Smart Card Market Report

Published Date: 31 January 2026 | Report Code: smart-card

Smart Card Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Smart Card market, focusing on market trends, technology innovations, regional dynamics, and forecasts from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

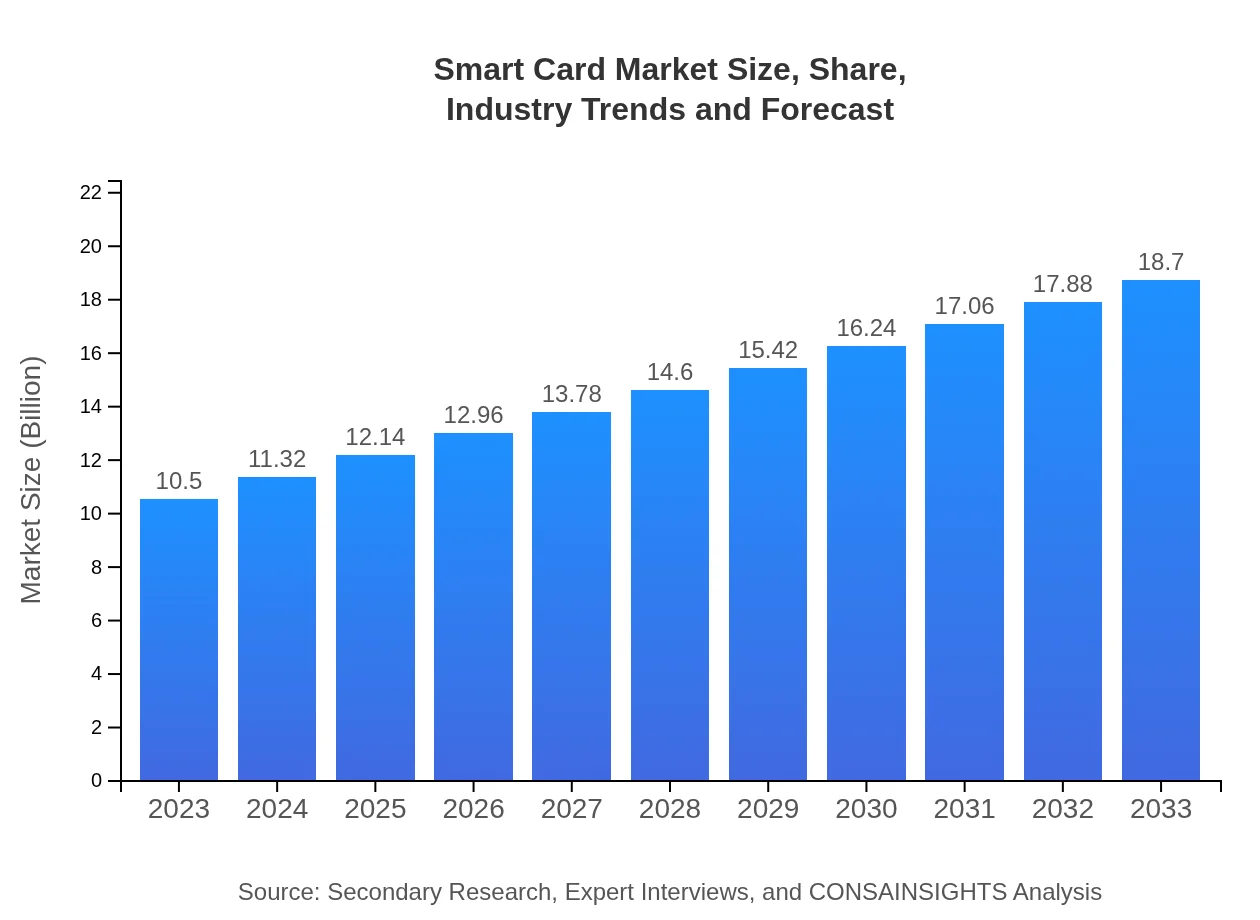

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Gemalto (Thales Group), NXP Semiconductors, Identiv, Morpheus, CardLogix |

| Last Modified Date | 31 January 2026 |

Smart Card Market Overview

Customize Smart Card Market Report market research report

- ✔ Get in-depth analysis of Smart Card market size, growth, and forecasts.

- ✔ Understand Smart Card's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Card

What is the Market Size & CAGR of Smart Card market in 2023?

Smart Card Industry Analysis

Smart Card Market Segmentation and Scope

Tell us your focus area and get a customized research report.

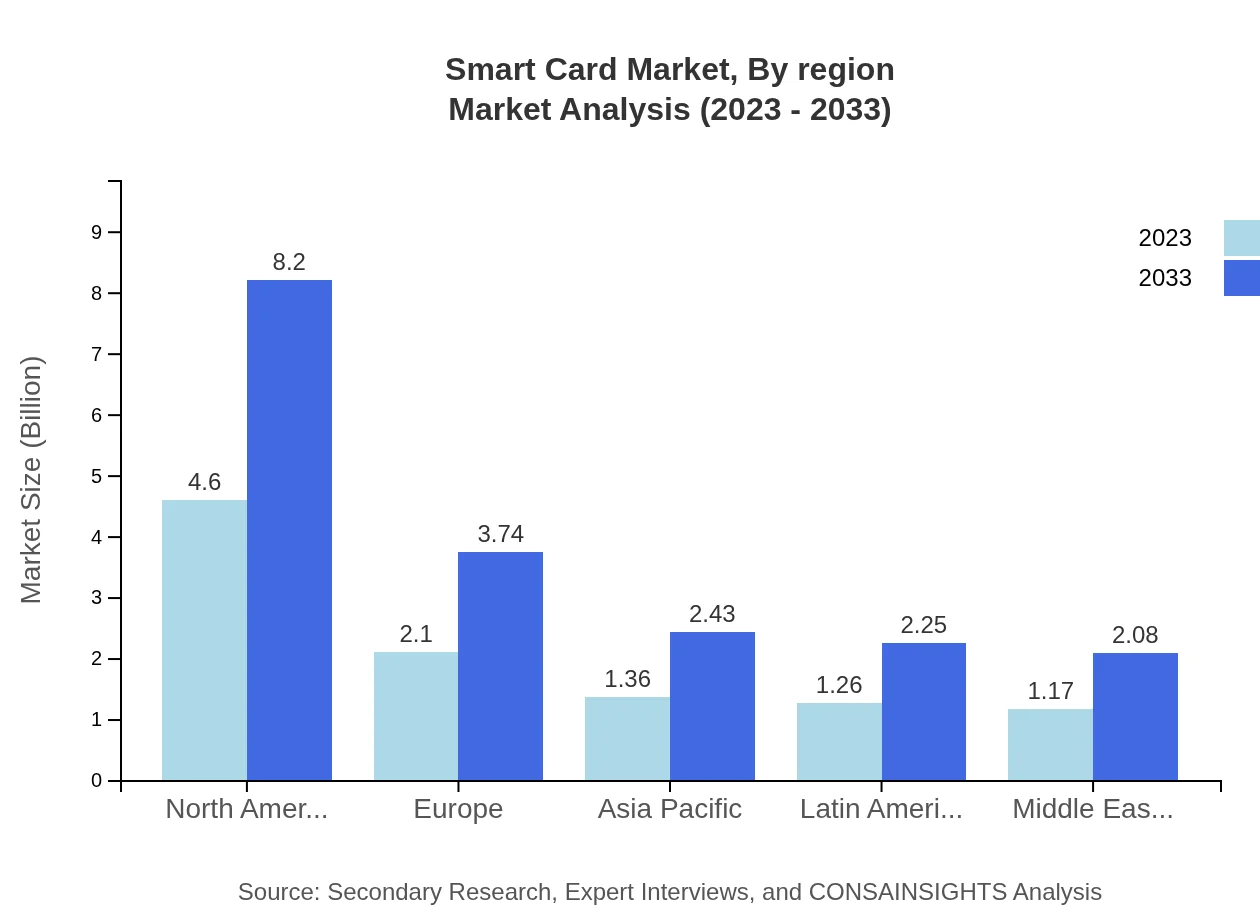

Smart Card Market Analysis Report by Region

Europe Smart Card Market Report:

The European Smart Card market is anticipated to expand from $3.14 billion in 2023 to $5.60 billion by 2033, with a focus on compliance with data protection regulations and the increasing use of contactless payment systems.Asia Pacific Smart Card Market Report:

In the Asia Pacific region, the Smart Card market is projected to grow from $1.99 billion in 2023 to $3.55 billion by 2033, driven by increasing investments in digital payment infrastructure and the growing adoption of mobile wallets.North America Smart Card Market Report:

North America holds a substantial share of the Smart Card market, valued at $3.82 billion in 2023 and expected to reach $6.81 billion by 2033. The region benefits from innovations in financial technologies and a strong emphasis on data security.South America Smart Card Market Report:

South America is expected to experience moderate growth, from $0.17 billion in 2023 to $0.30 billion in 2033. The adoption of Smart Cards for secure identification in government and healthcare sectors is anticipated to boost market demand.Middle East & Africa Smart Card Market Report:

In the Middle East and Africa, the market is forecasted to rise from $1.37 billion in 2023 to $2.45 billion by 2033. Enhanced security measures in e-governance and telecom sectors are driving Smart Card adoption.Tell us your focus area and get a customized research report.

Smart Card Market Analysis By Technology

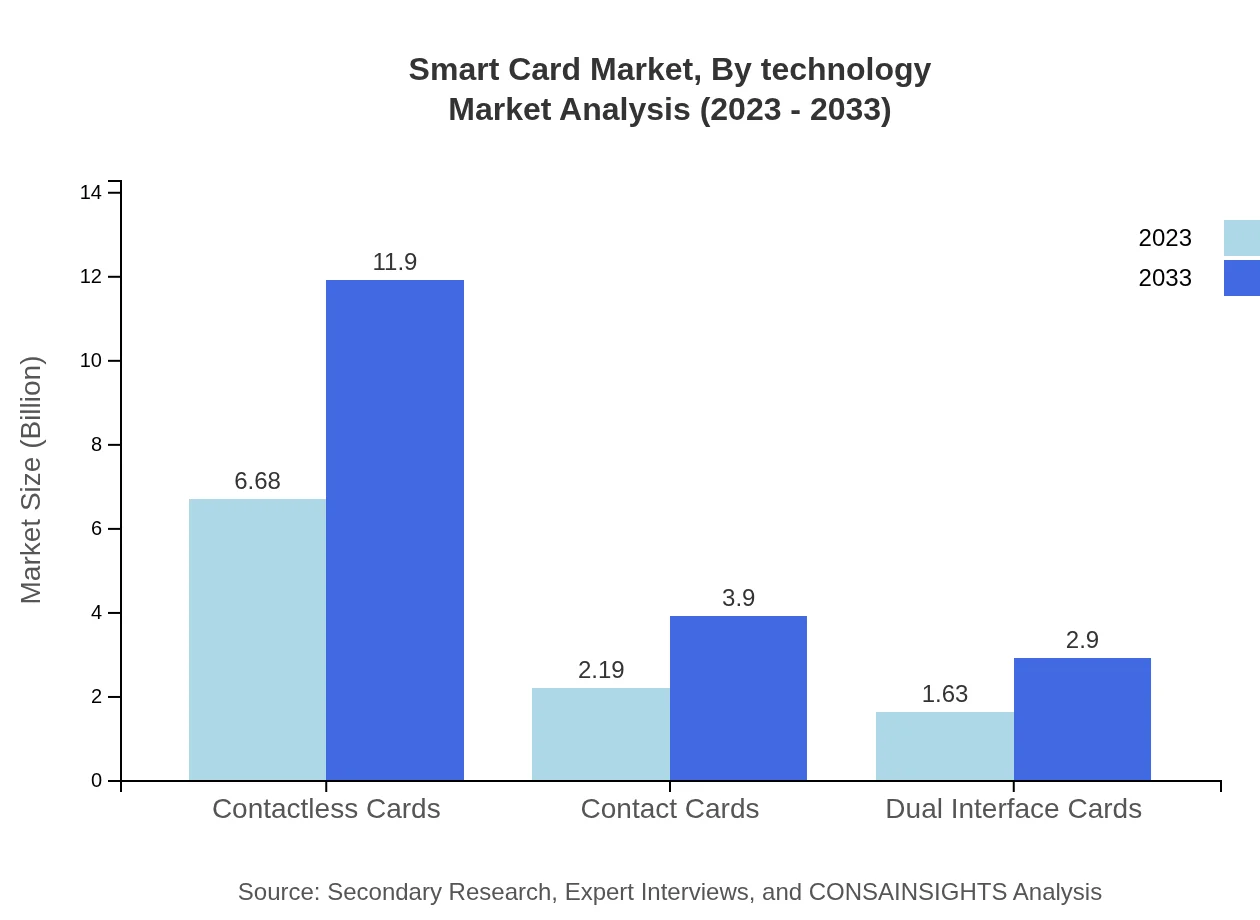

The Smart Card market can be segmented based on technology into contact cards, contactless cards, and dual-interface cards. Contactless cards are leading in market share, expected to grow from $6.68 billion in 2023 to $11.90 billion by 2033, driven by increasing consumer preference for contactless transactions. Dual-interface and contact cards are also showing significant growth, with respective increases from $1.63 billion to $2.90 billion and $2.19 billion to $3.90 billion.

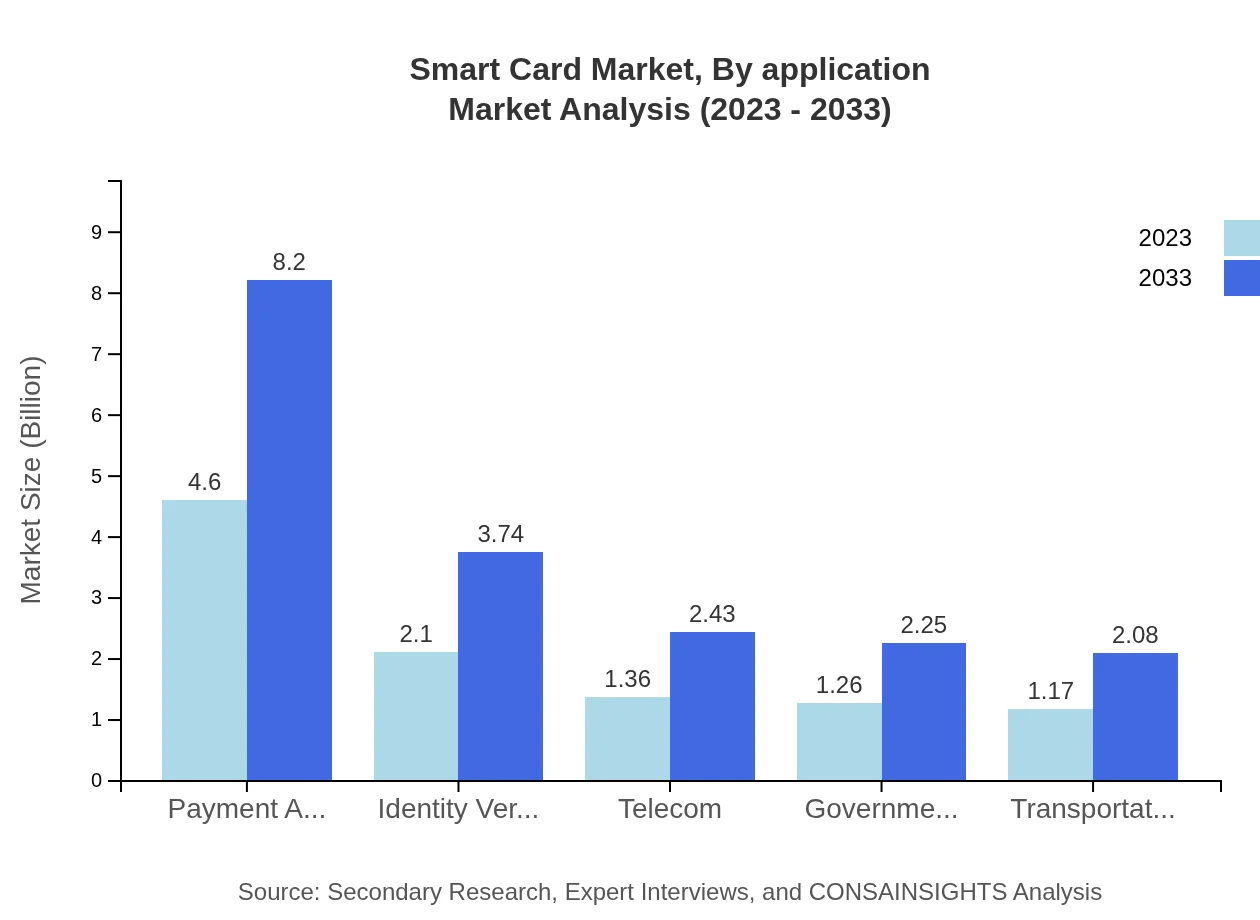

Smart Card Market Analysis By Application

Application-wise, the Smart Card market includes sectors such as banking and financial services, healthcare, government, and retail. The banking sector leads with a market size of $4.60 billion in 2023, projected to reach $8.20 billion by 2033. Healthcare applications are also expanding, particularly in patient identification and record management, moving from $1.26 billion to $2.25 billion during the forecast period.

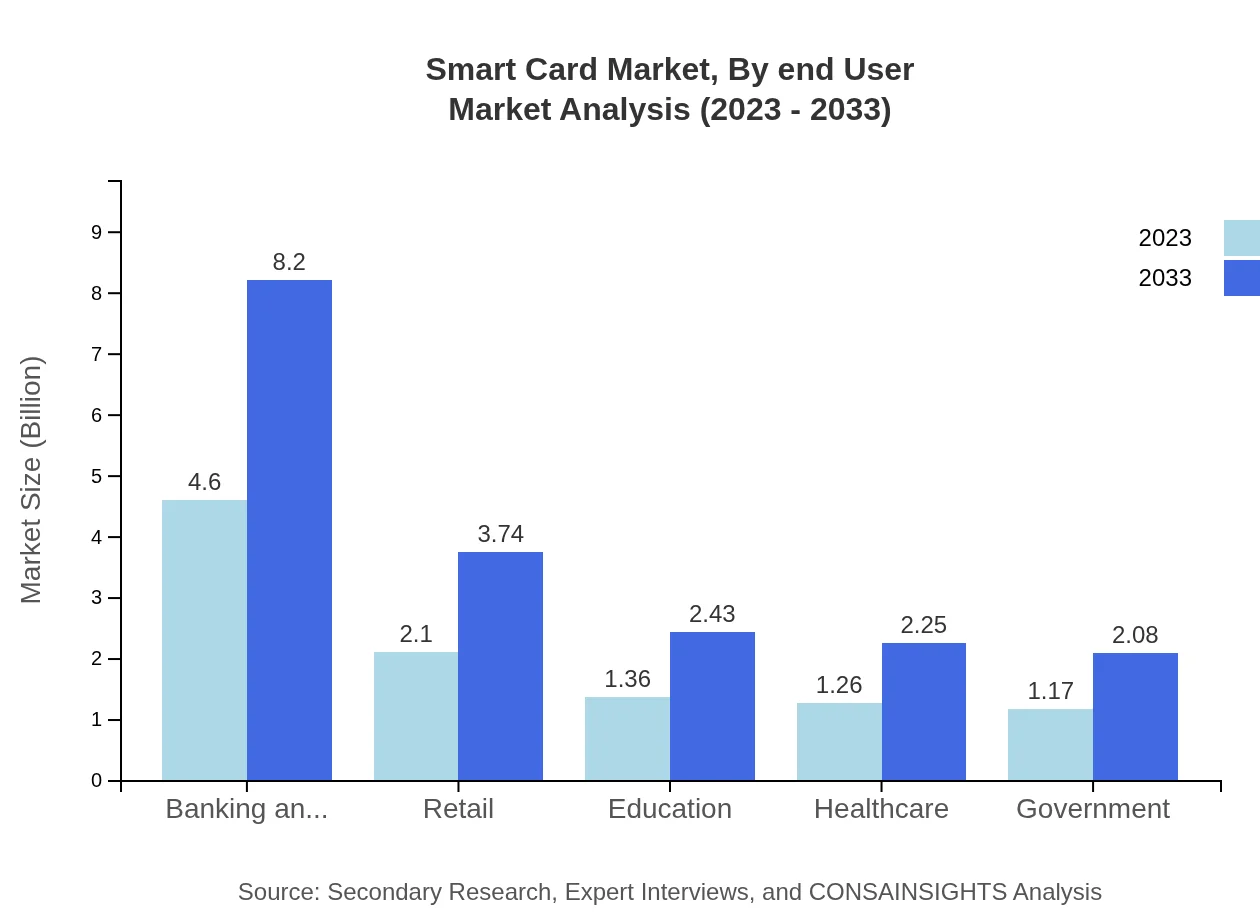

Smart Card Market Analysis By End User

End-user segments for the Smart Card market encompass industries such as retail, healthcare, government, and telecom. The retail sector represents a significant share, growing from $2.10 billion in 2023 to $3.74 billion by 2033, aligning with increasing digital transactions. Identity verification applications in the government sector are also gaining momentum, enhancing security measures from $1.17 billion to $2.08 billion.

Smart Card Market Analysis By Region

Regional segmentation of the Smart Card market reveals diverse growth patterns. North America leads with a market share of 43.85% in 2023, while regions like Asia Pacific and Europe follow with shares of 12.97% and 20.02%, respectively. The Middle East and Africa present unique opportunities, characterized by rapid urbanization and security concerns, projected to maintain a share of 11.13% throughout the forecast period.

Smart Card Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Card Industry

Gemalto (Thales Group):

A leader in digital security solutions, known for providing advanced Smart Card technologies utilized in banking and public services.NXP Semiconductors:

Specializes in high-performance semiconductors and is a key player in developing NFC-enabled Smart Cards for payments.Identiv:

Focuses on identity verification and security technology; offers a wide range of Smart Card products for various industries.Morpheus:

A pioneer in Smart Card manufacturing with a robust range of products catering to the telecommunications sector.CardLogix:

Provides Smart Card solutions for secure access control systems, government applications, and enterprise solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Card?

The global smart card market is projected to reach approximately USD 10.5 billion by 2023, with a compound annual growth rate (CAGR) of 5.8% expected through 2033.

What are the key market players or companies in this smart Card industry?

Key players in the smart card industry include major companies such as Gemalto, IDEMIA, NXP Semiconductors, and Infineon Technologies, which are renowned for their innovations and significant market shares.

What are the primary factors driving the growth in the smart card industry?

Growth in the smart card industry is primarily driven by increased demand for secure transactions across various sectors, technological advancements in card design, and rising adoption of contactless payment systems.

Which region is the fastest Growing in the smart card market?

The fastest-growing region in the smart card market is North America, expected to expand from USD 3.82 billion in 2023 to USD 6.81 billion by 2033, boosted by advancements in payment technologies.

Does ConsaInsights provide customized market report data for the smart card industry?

Yes, ConsaInsights specializes in providing tailored market report data, allowing clients to access customized insights and analyses specific to their niche within the smart card industry.

What deliverables can I expect from this smart card market research project?

Deliverables from the smart card market research project typically include comprehensive reports, trend analyses, segmentation data, forecasts, and recommendations to aid strategic decision-making.

What are the market trends of smart card?

Current trends in the smart card market include a growing shift towards contactless technology, increased integration of biometric features, and heightened interest in secure transaction solutions across diverse sectors.