Smart Container Market Report

Published Date: 31 January 2026 | Report Code: smart-container

Smart Container Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Smart Container market, covering market size, industry insights, technology advancements, and regional dynamics. The insights provided will help stakeholders make informed decisions for the forecast period of 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

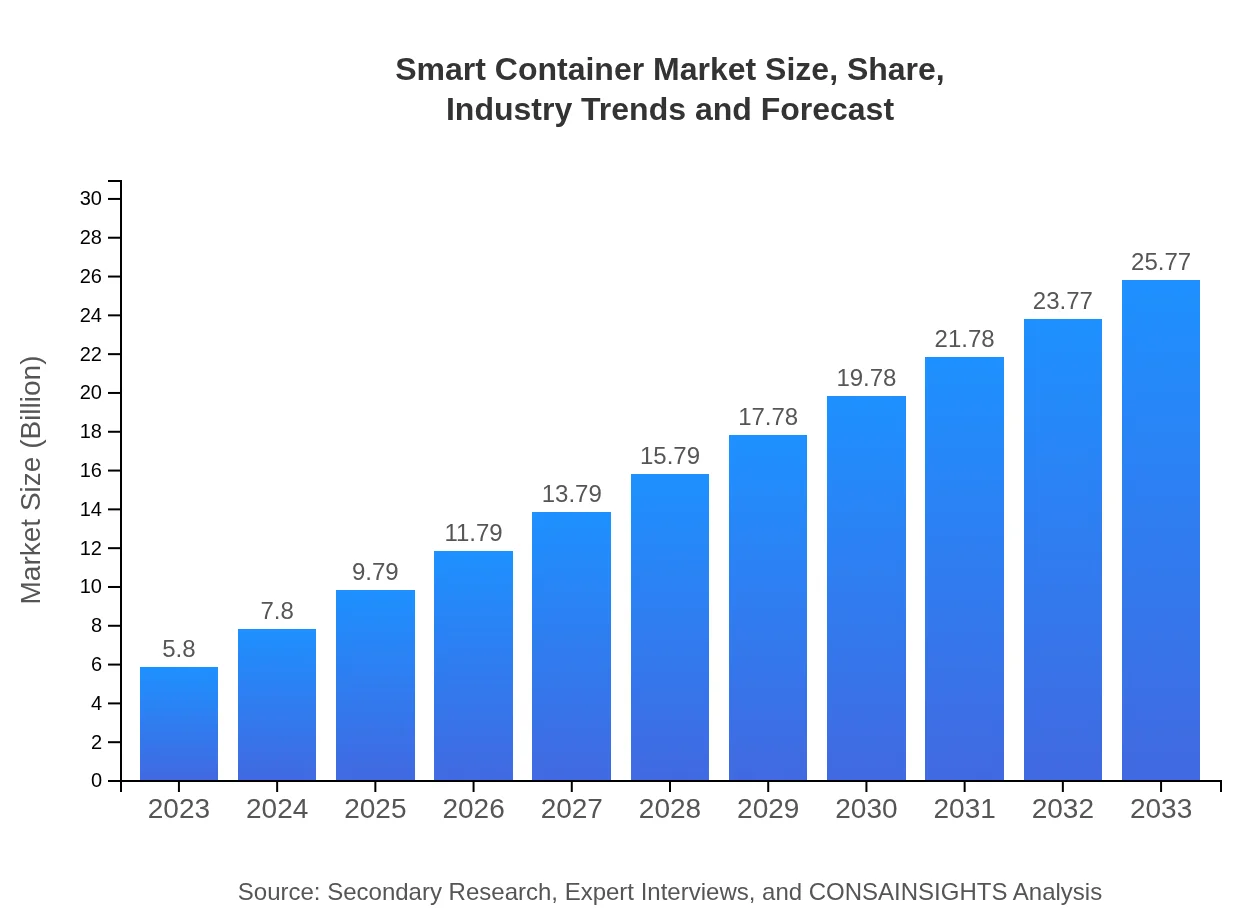

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 15.3% |

| 2033 Market Size | $25.77 Billion |

| Top Companies | Maersk, DHL, Carrier Global Corporation, CMA CGM, ZIM Integrated Shipping Services |

| Last Modified Date | 31 January 2026 |

Smart Container Market Overview

Customize Smart Container Market Report market research report

- ✔ Get in-depth analysis of Smart Container market size, growth, and forecasts.

- ✔ Understand Smart Container's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Container

What is the Market Size & CAGR of Smart Container market in 2023?

Smart Container Industry Analysis

Smart Container Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Container Market Analysis Report by Region

Europe Smart Container Market Report:

Europe stands as a formidable market for Smart Containers, aiming to grow from $1.64 billion in 2023 to $7.28 billion by 2033. The regulation of freight operations in the region and the stringent compliance requirements for product transportation are significant drivers, alongside the increasing emphasis on sustainability in logistics.Asia Pacific Smart Container Market Report:

By 2033, the Asia Pacific region is expected to see a significant increase in the Smart Container market, projected to reach $4.91 billion, up from $1.10 billion in 2023. Growing logistics activities, rapid urbanization, and thriving e-commerce are key factors driving this growth. Countries such as China and India are leading the adoption due to their expansive manufacturing and export operations.North America Smart Container Market Report:

North America is anticipated to maintain a leading share in the Smart Container market, with projected growth from $2.16 billion in 2023 to $9.58 billion in 2033. This region benefits from advanced logistics technologies, high standards for operational efficiency, and a strong focus on supply chain optimization among enterprises.South America Smart Container Market Report:

The South American market for Smart Containers is forecasted to grow from $0.43 billion in 2023 to approximately $1.92 billion by 2033. Rising investments in infrastructure development, alongside increasing trade and logistics needs, are likely to boost this region's adoption of smart shipping solutions.Middle East & Africa Smart Container Market Report:

In the Middle East and Africa, the Smart Container market is expected to grow from $0.47 billion in 2023 to $2.08 billion by 2033. This growth is supported by advancements in logistics infrastructure and the rising demand for temperature-controlled containers, driven particularly by oil and gas logistics operations.Tell us your focus area and get a customized research report.

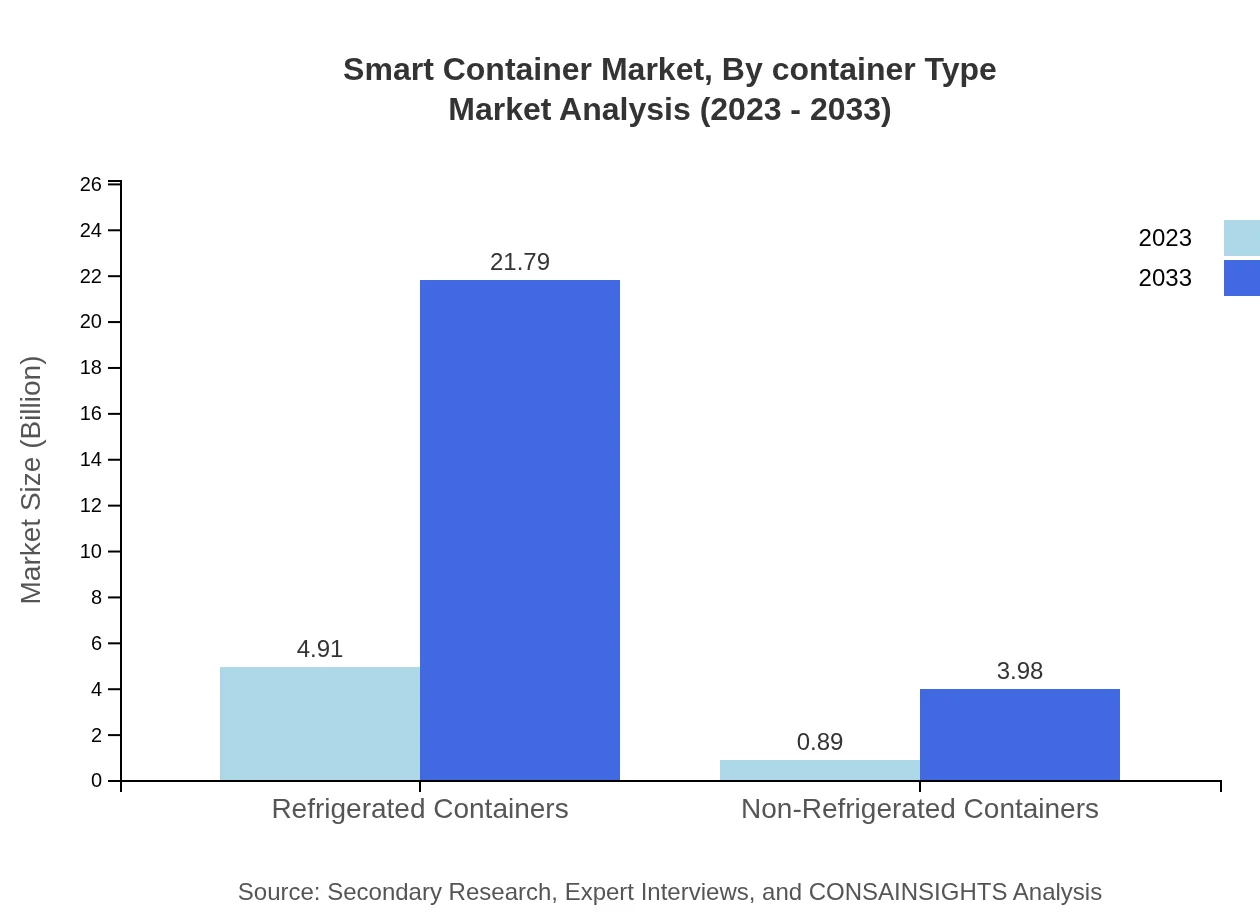

Smart Container Market Analysis By Container Type

Smart containers are categorized into refrigerated and non-refrigerated types. Refrigerated containers dominate, demonstrating a market size of $4.91 billion in 2023, projected to reach $21.79 billion by 2033, catering primarily to food and pharmaceutical logistics. Non-refrigerated containers, while smaller in size at $0.89 billion, are also set for growth, expected to reach $3.98 billion by 2033 as they accommodate various non-perishable goods.

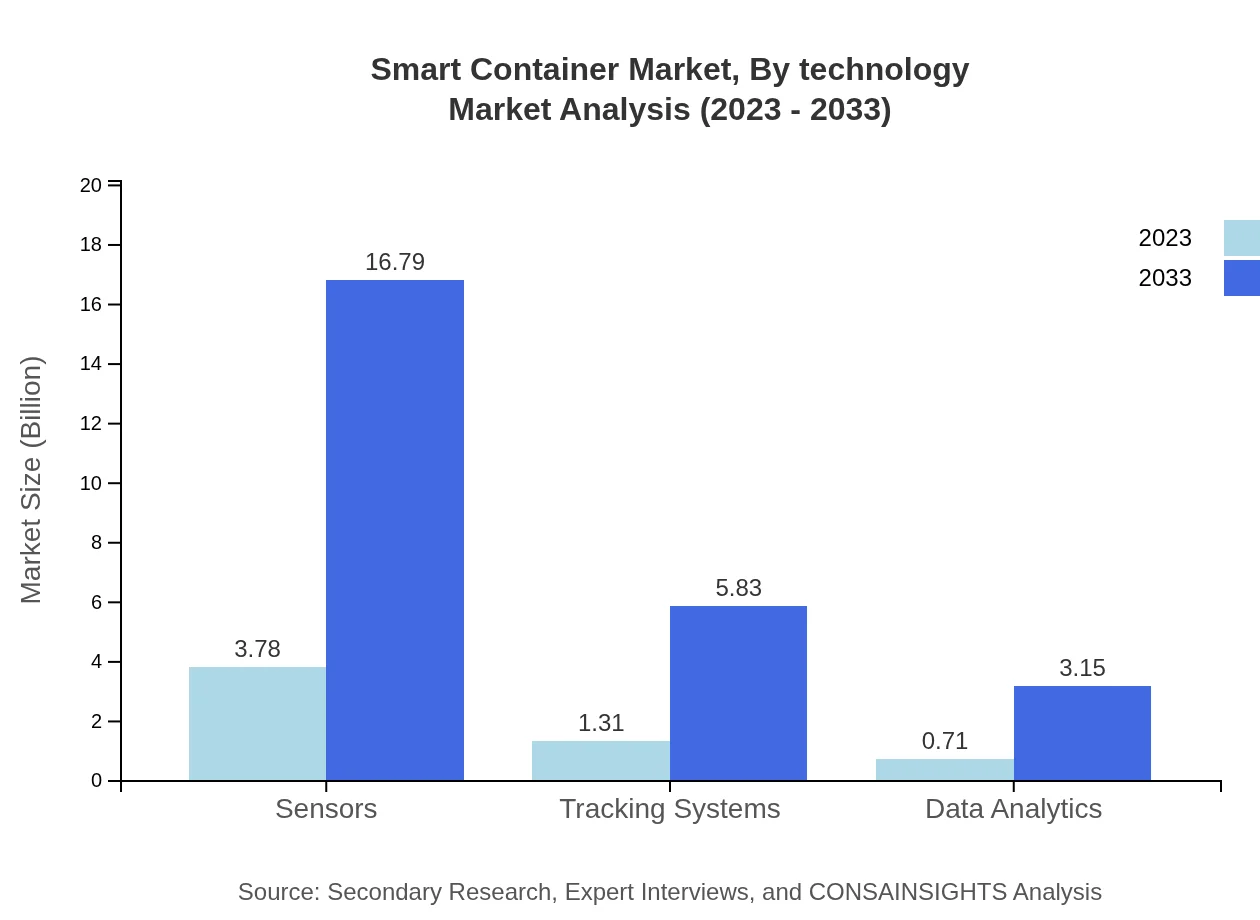

Smart Container Market Analysis By Technology

The technology segment of smart containers primarily encompasses sensors, tracking systems, and data analytics. Sensors are the leading technology, with a size of $3.78 billion in 2023, likely to expand to $16.79 billion by 2033 due to increased monitoring needs. Tracking systems and data analytics also show significant potential, with respective sizes projected to reach $5.83 billion and $3.15 billion by 2033, reflecting the growing reliance on data-driven shipping solutions.

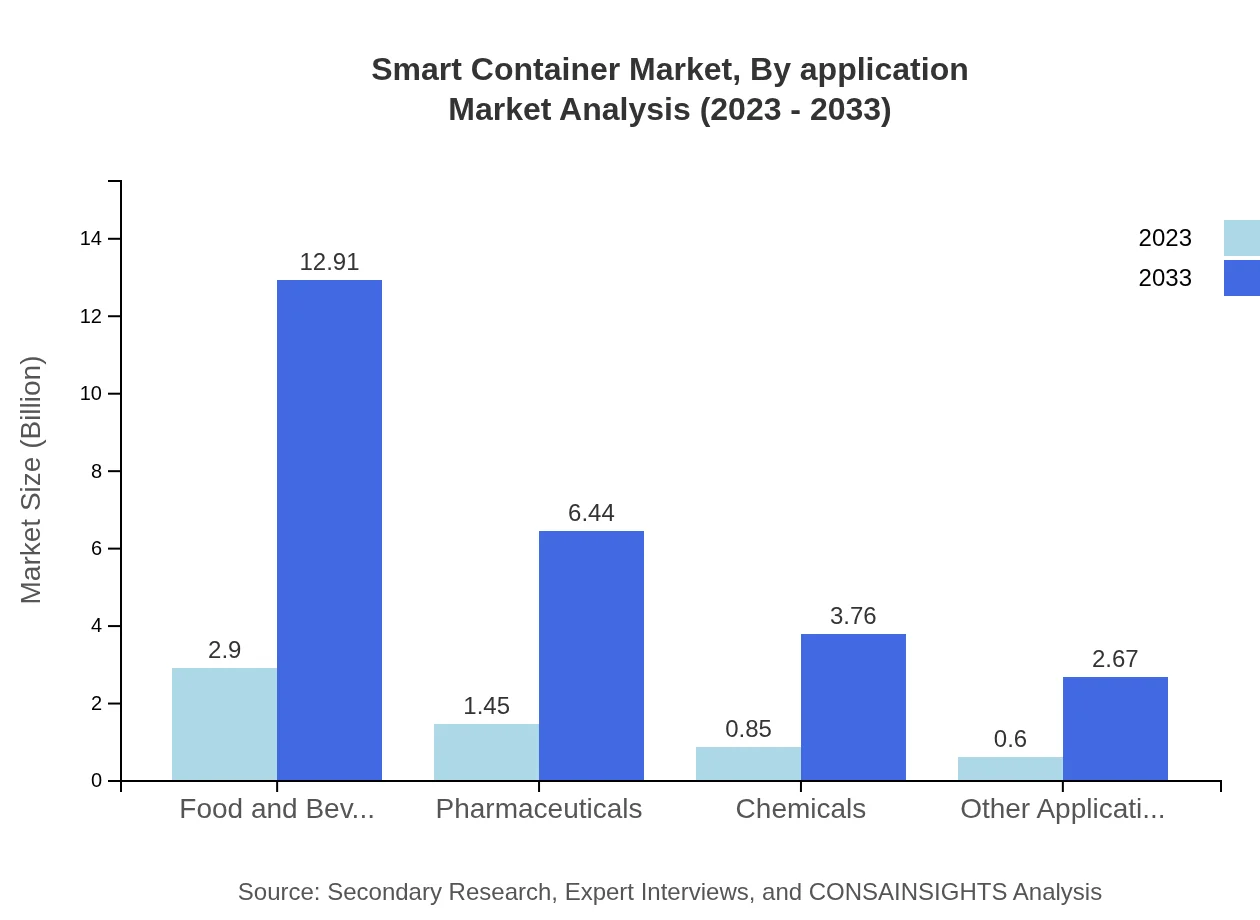

Smart Container Market Analysis By Application

Applications of smart containers include logistics and transportation, healthcare, manufacturing, and food & beverage. The logistics segment takes a substantial share, with a market size of $2.81 billion in 2023, estimated to expand to $12.49 billion by 2033. Other significant applications include food and beverage, expected to grow from $2.90 billion to $12.91 billion, showcasing the escalating demand for temperature-controlled transport.

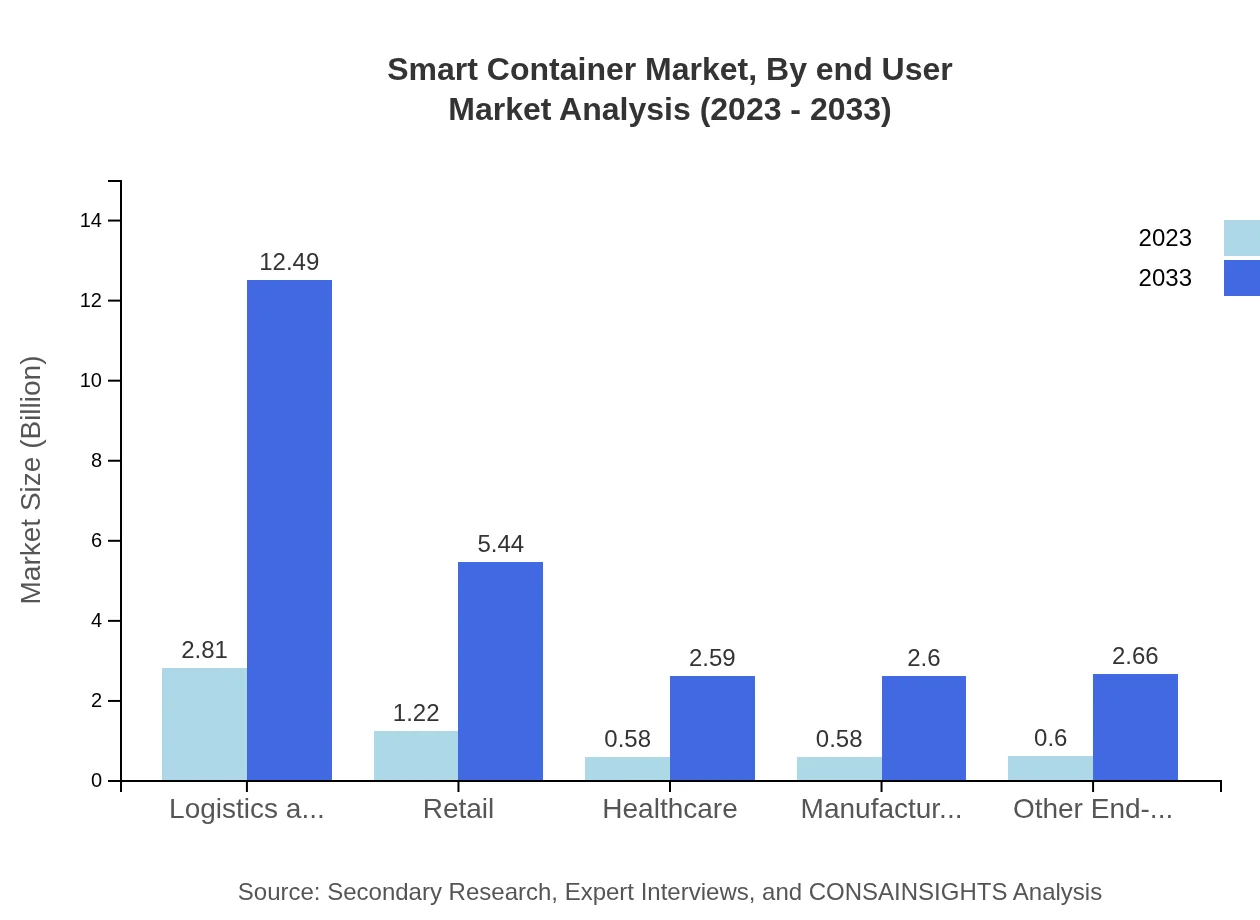

Smart Container Market Analysis By End User

End-user segmentation highlights logistics and transportation, healthcare, retail, and manufacturing sectors. The logistics sector is currently leading with $2.81 billion in size for 2023 and projected to increase to $12.49 billion by 2033. The healthcare segment shows particular potential for growth, moving from $0.58 billion to $2.59 billion, due to rising demand for secure shipment solutions.

Smart Container Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Container Industry

Maersk:

A global leader in container shipping and logistics, providing advanced smart container solutions to optimize shipping operations and compliance.DHL:

A prominent logistics player that offers smart container technologies to ensure traceability and reliable delivery of goods worldwide.Carrier Global Corporation:

This company specializes in innovative temperature management solutions, playing a significant role in the refrigerated container market.CMA CGM:

A key player in shipping, continuously advancing its smart container technologies for better operational efficiencies and customer satisfaction.ZIM Integrated Shipping Services:

A pioneering shipping company emphasizing digital solutions and smart technology integrations for enhanced maritime operations.We're grateful to work with incredible clients.

FAQs

What is the market size of Smart Container?

The global smart container market is projected to grow from $5.8 billion in 2023 to significant figures by 2033, with a compound annual growth rate (CAGR) of 15.3%. This growth is fueled by innovations and increased demand in logistics and retail sectors.

What are the key market players or companies in the Smart Container industry?

Key players in the smart container market include leading logistics companies, technology firms specializing in IoT solutions, and manufacturers of advanced tracking systems. These companies drive innovation and competitive dynamics in the market.

What are the primary factors driving the growth in the Smart Container industry?

The primary factors driving growth include increasing demand for real-time tracking, globalization of supply chains, and advancements in IoT technology. Sustainability concerns and regulatory pressures further encourage adoption of smart containers.

Which region is the fastest Growing in the Smart Container market?

The fastest-growing region in the smart container market is North America, expected to increase from $2.16 billion in 2023 to $9.58 billion by 2033. Other significant growth can be seen in Europe and Asia-Pacific over the same period.

Does Consainsights provide customized market report data for the Smart Container industry?

Yes, Consainsights offers customized market report data tailored to specific needs in the smart container industry. This includes detailed insights into market size, growth trends, and competitor analysis based on individual client requirements.

What deliverables can I expect from this Smart Container market research project?

Deliverables from a smart container market research project typically include comprehensive market analysis, segmentation data by region and application, competitive landscape insights, and actionable recommendations to enhance business strategies.

What are the market trends of Smart Container?

Market trends in the smart container industry include a rise in automation and digitization, increased emphasis on sustainability, and the growing integration of AI and machine learning for predictive analytics and improved supply chain efficiency.