Smart Contracts Market Report

Published Date: 31 January 2026 | Report Code: smart-contracts

Smart Contracts Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Smart Contracts market, providing insights into its forecast from 2023 to 2033. It covers current trends, market analysis, segmentation, regional insights, and future forecasts including growth potential and challenges.

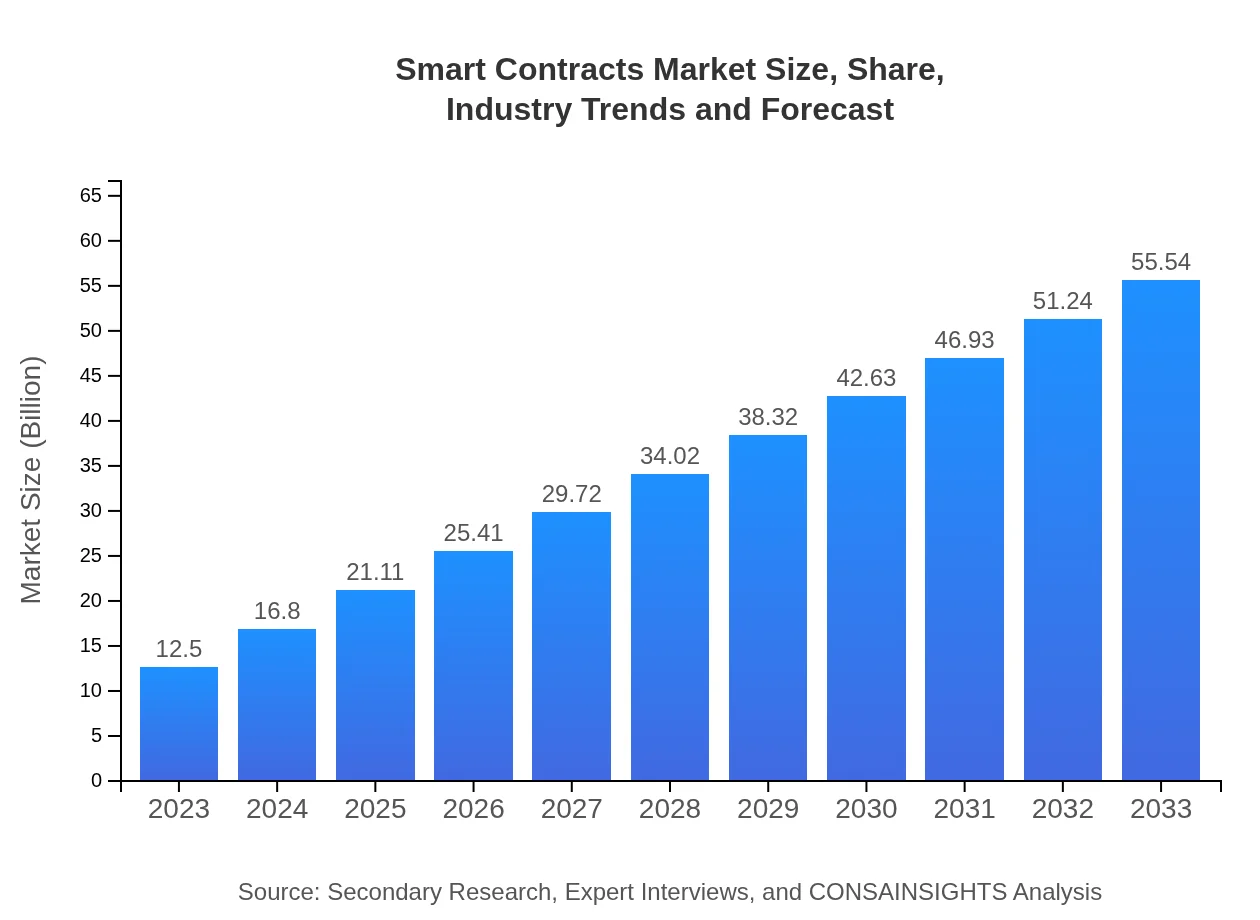

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 15.3% |

| 2033 Market Size | $55.54 Billion |

| Top Companies | Ethereum Foundation, IBM, Chainlink, R3 Corda |

| Last Modified Date | 31 January 2026 |

Smart Contracts Market Overview

Customize Smart Contracts Market Report market research report

- ✔ Get in-depth analysis of Smart Contracts market size, growth, and forecasts.

- ✔ Understand Smart Contracts's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Contracts

What is the Market Size & CAGR of Smart Contracts market in 2023?

Smart Contracts Industry Analysis

Smart Contracts Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Contracts Market Analysis Report by Region

Europe Smart Contracts Market Report:

The European market size is currently at $3.63 billion in 2023 and is predicted to grow to $16.14 billion by 2033. Europe’s regulatory framework supporting blockchain technologies is a significant growth catalyst.Asia Pacific Smart Contracts Market Report:

In Asia Pacific, the smart contracts market is projected to grow from approximately $2.48 billion in 2023 to $11.01 billion by 2033, driven by burgeoning fintech innovation and the rapid adoption of blockchain solutions across various sectors.North America Smart Contracts Market Report:

North America is currently leading the market with a size of $4.45 billion in 2023. By 2033, it is expected to expand to $19.76 billion as companies predominantly in finance and technology vigorously adopt smart contract solutions.South America Smart Contracts Market Report:

The South America region has a market size of about $1.20 billion in 2023, expected to reach $5.32 billion by 2033. The increased focus on digital transformation and regulatory advancements are pivotal in guiding market growth here.Middle East & Africa Smart Contracts Market Report:

The Middle East and Africa market is relatively smaller with a size of $0.74 billion in 2023, set to increase to $3.31 billion by 2033. The rise in blockchain initiatives and governmental support for innovation is key for growth in this region.Tell us your focus area and get a customized research report.

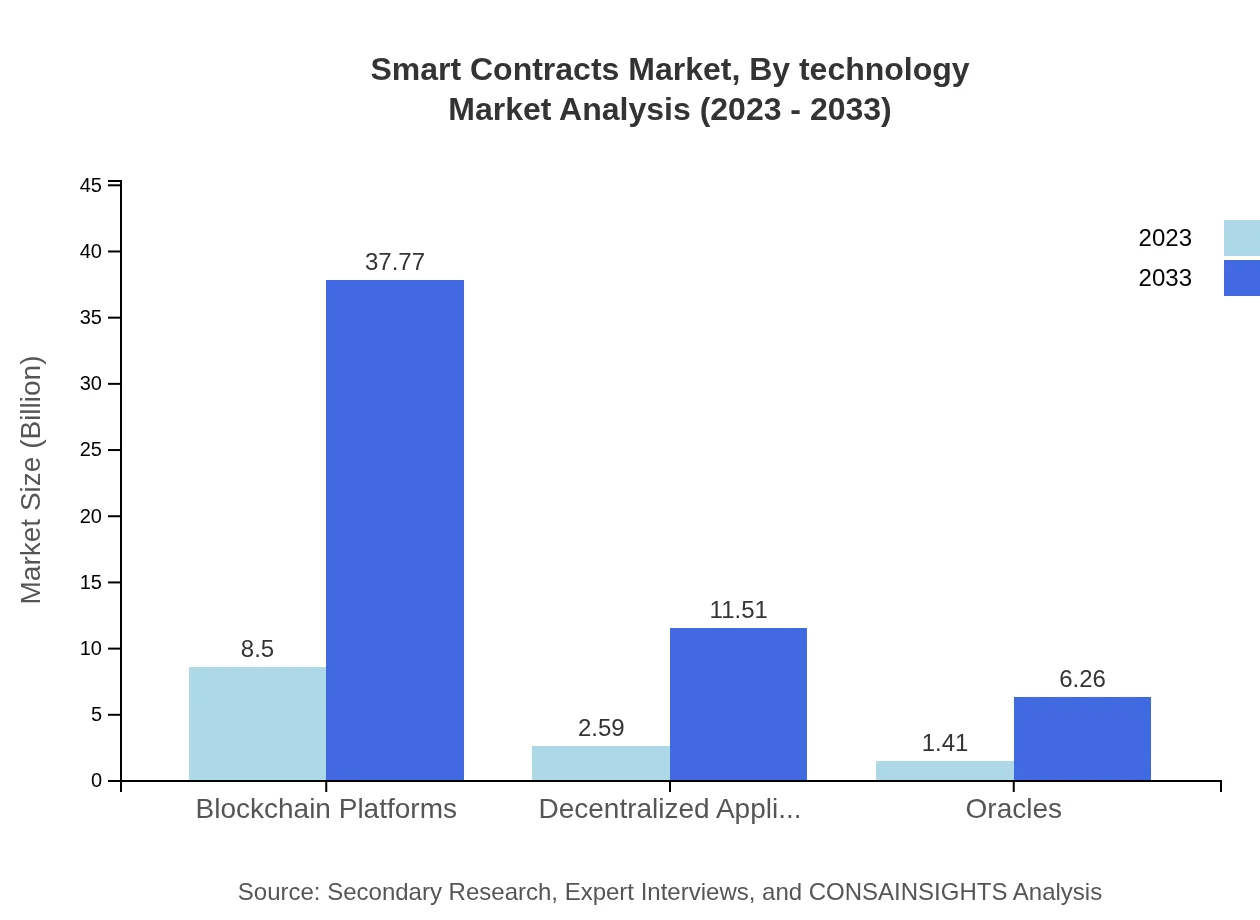

Smart Contracts Market Analysis By Technology

The Smart Contracts market can be analyzed through various technological frameworks, primarily focusing on public, private, and hybrid blockchains. The public blockchain segment, enabling transparent transactions, holds about 68% market share, showcasing its popularity due to its decentralized nature. In contrast, private blockchains, accounting for approximately 20.73%, are gaining traction in businesses requiring heightened security and privacy.

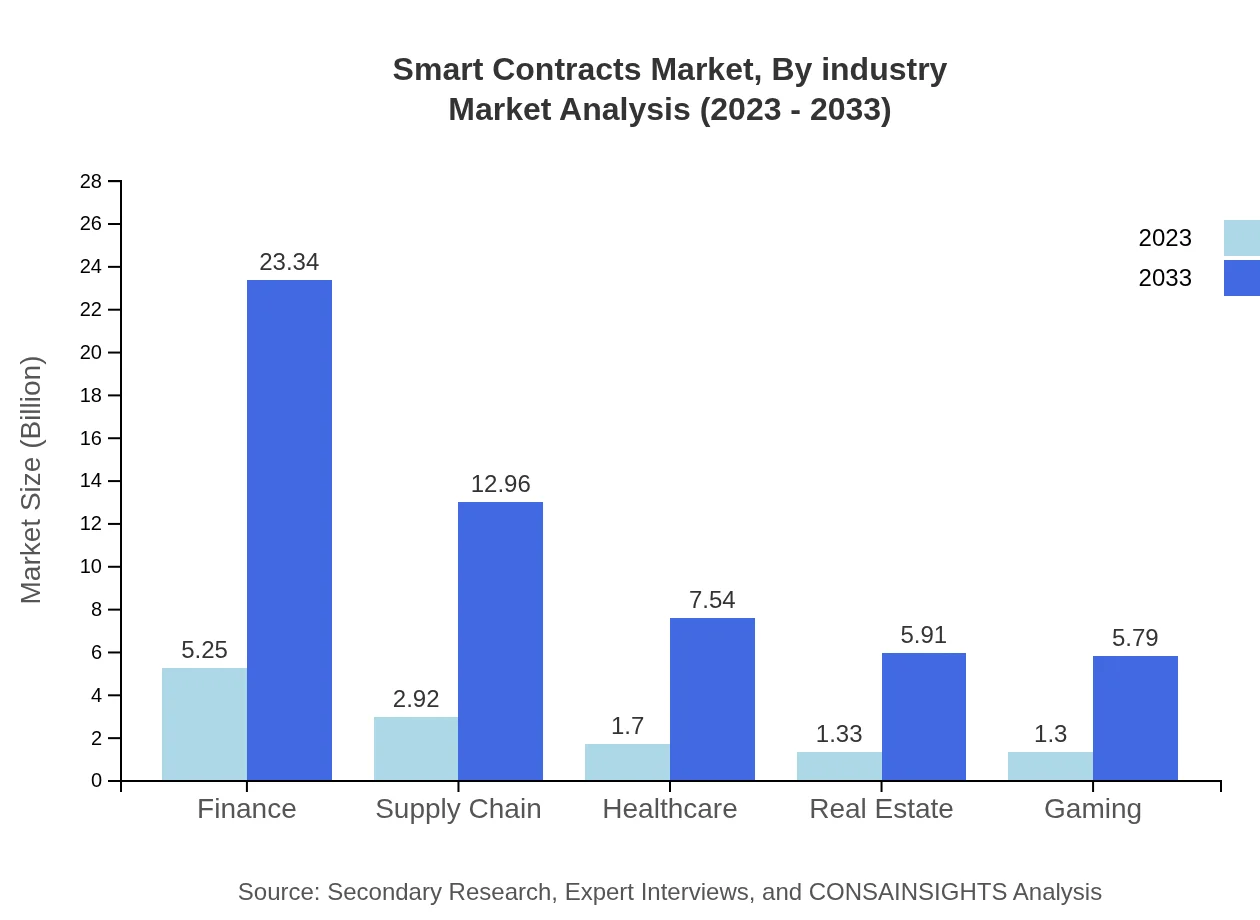

Smart Contracts Market Analysis By Industry

The finance sector emerges as the largest user of smart contracts, renting automation in transaction processing, currently valued at $5.25 billion in 2023 and projected to grow to $23.34 billion by 2033. Supply chain and healthcare also present significant market potential, with current market sizes of $2.92 billion and $1.70 billion respectively. Real estate and gaming sectors follow closely, indicating a broader trend of smart contract adoption across diverse industries.

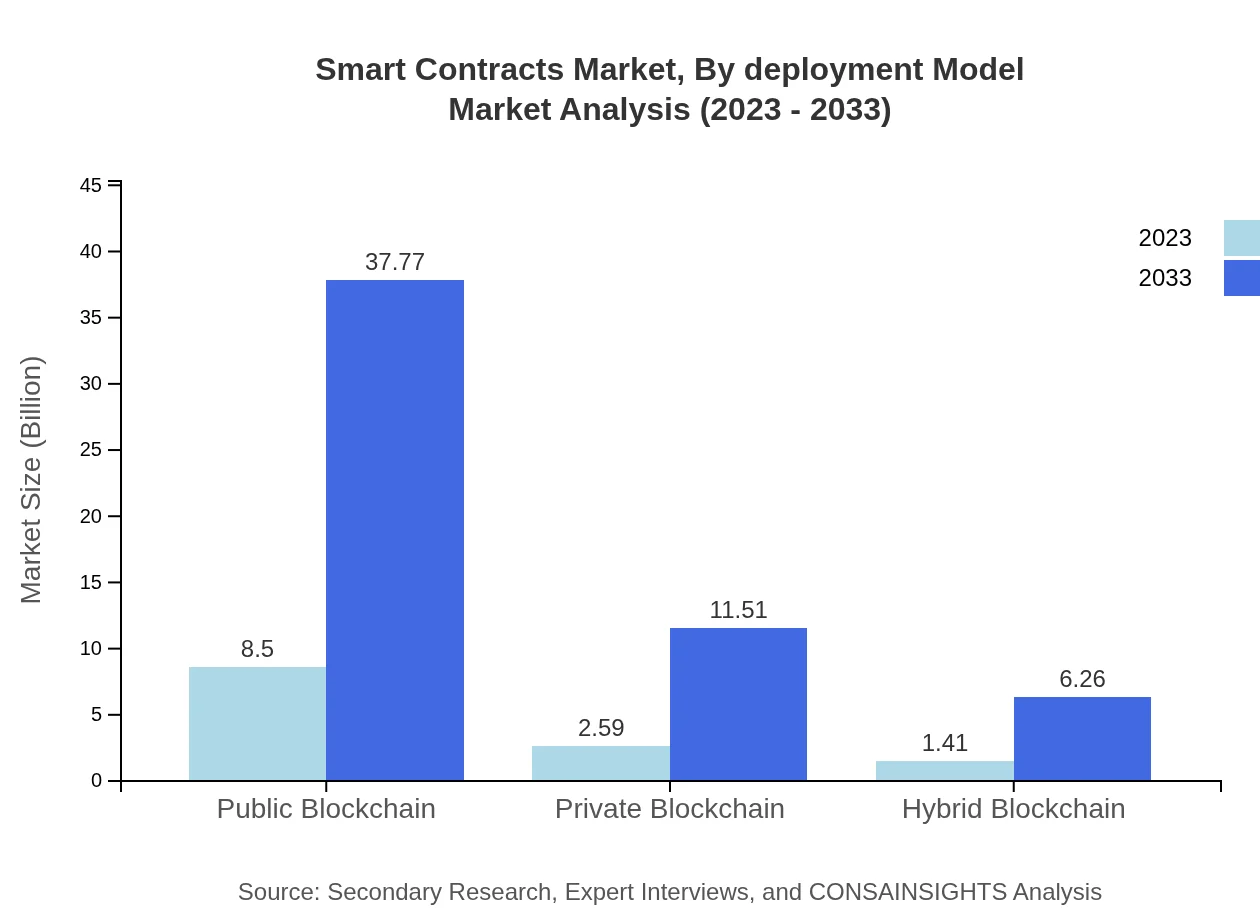

Smart Contracts Market Analysis By Deployment Model

Deployment models for smart contracts generally segment into cloud and on-premises solutions, with cloud services witnessing robust growth due to operational efficiencies and scalability, appealing to startups and established firms. This technological adaptability drives innovation, enabling businesses to optimize their smart contract frameworks according to specific industry needs.

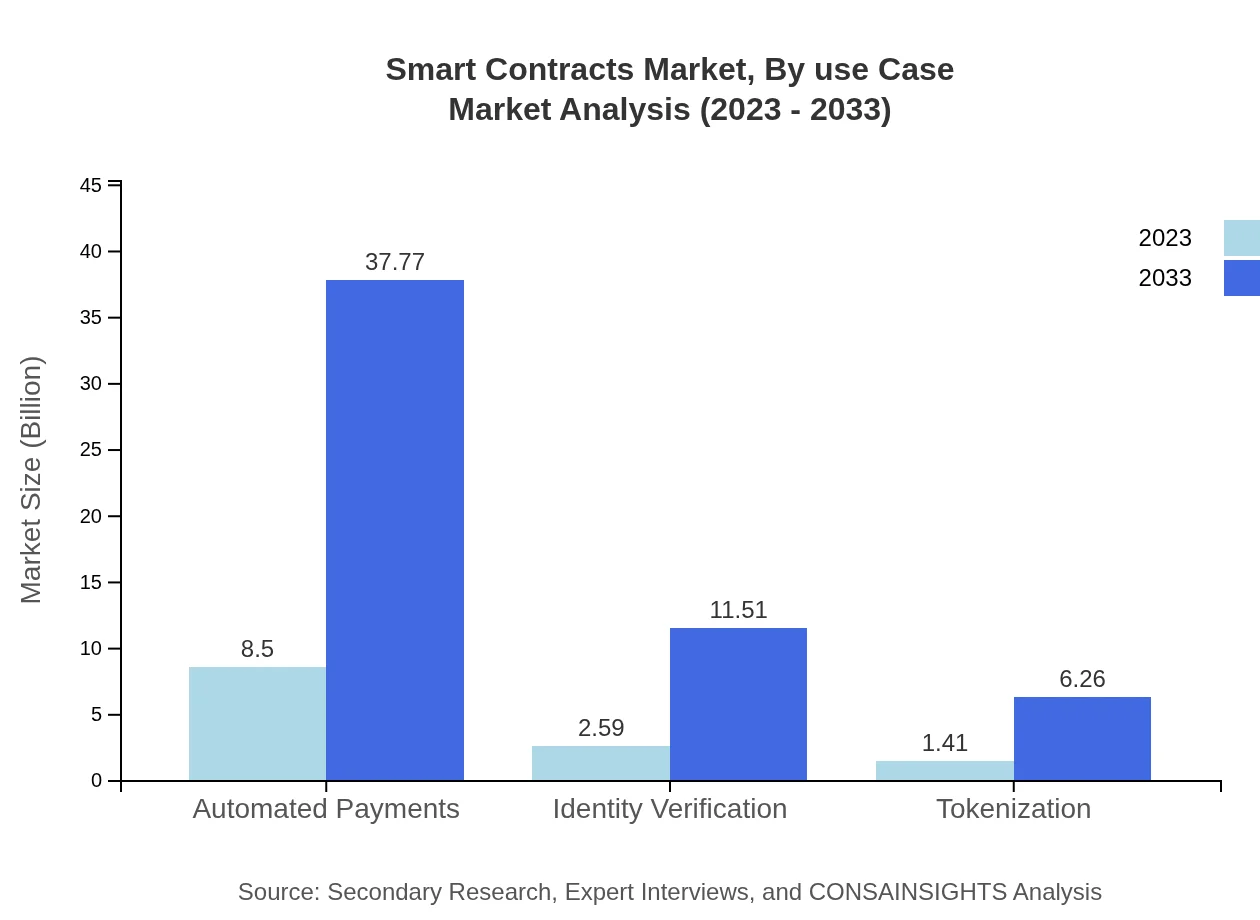

Smart Contracts Market Analysis By Use Case

Various use cases are driving the adoption of smart contracts including automated payments, identity verification, and tokenization. Automated payments generate substantial market activity, valued at $8.50 billion in 2023, expected to reach $37.77 billion by 2033. Identity verification applications reflect a growing market necessity in ensuring secure digital identities, showcasing its market size growth from $2.59 billion to $11.51 billion in the same period.

Smart Contracts Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Contracts Industry

Ethereum Foundation:

The Ethereum Foundation is a key player in promoting blockchain technology and smart contracts through its Ethereum platform, enabling developers to build decentralized applications.IBM:

IBM has been at the forefront of integrating smart contracts into enterprise solutions, enhancing operational efficiencies across sectors like supply chain and finance.Chainlink:

Chainlink focuses on enhancing smart contracts by providing reliable real-world data through decentralized oracles, thus improving their usability and reliability.R3 Corda:

R3 is a consortium that leads Corda, a blockchain platform specifically designed for business, which allows for the deployment of smart contracts in finance.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Contracts?

The smart contracts market is projected to reach a size of approximately 12.5 billion by 2033, growing at a CAGR of 15.3% from 2023. This growth reflects increasing adoption across various industries and the widespread integration of blockchain technologies.

What are the key market players or companies in the smart Contracts industry?

Key players in the smart contracts industry include significant blockchain technology firms, fintech companies, and startups specializing in decentralized applications. Their innovative solutions drive market dynamics and facilitate advancements in smart contract functionality.

What are the primary factors driving the growth in the smart Contracts industry?

Major growth factors in the smart contracts industry include the rise of cryptocurrency transactions, demand for automated contract management, and the need for greater transparency and security in transactions across sectors like finance and supply chain.

Which region is the fastest Growing in the smart Contracts industry?

The fastest-growing region in the smart contracts market is North America, projected to grow from 4.45 billion in 2023 to 19.76 billion by 2033. This expansion is driven by advancements in technology and high adoption rates across various sectors.

Does Consainsights provide customized market report data for the smart Contracts industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the smart contracts industry. This personalized analysis ensures stakeholders receive relevant and actionable insights for strategic decision-making.

What deliverables can I expect from this smart Contracts market research project?

Deliverables from the smart contracts market research project typically include comprehensive market analysis reports, regional and segment-specific insights, trend forecasts, and actionable recommendations to guide business strategies in the emerging blockchain landscape.

What are the market trends of smart Contracts?

Market trends in the smart contracts sector include increasing adoption of decentralized finance, integration with artificial intelligence for enhanced functionalities, and a growing emphasis on regulatory compliance as industries leverage blockchain technologies.