Smart Elevator Market Report

Published Date: 22 January 2026 | Report Code: smart-elevator

Smart Elevator Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Smart Elevator market from 2023 to 2033, including insights on market size, trends, regional dynamics, and industry players. It aims to equip stakeholders with data-driven forecasts and strategic recommendations.

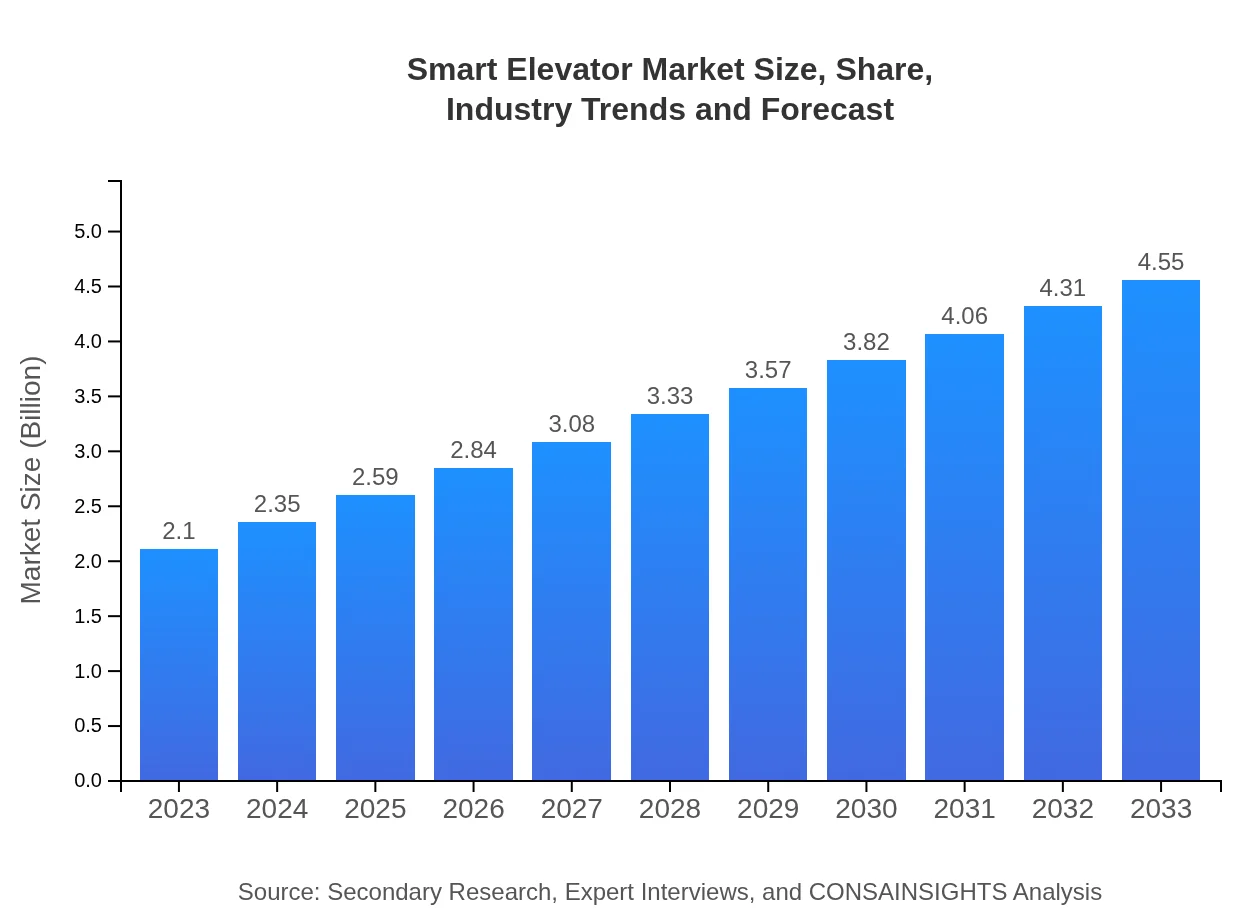

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.10 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $4.55 Billion |

| Top Companies | Otis Elevator Company, Schindler Group, ThyssenKrupp AG, KONE Corporation, Mitsubishi Electric |

| Last Modified Date | 22 January 2026 |

Smart Elevator Market Overview

Customize Smart Elevator Market Report market research report

- ✔ Get in-depth analysis of Smart Elevator market size, growth, and forecasts.

- ✔ Understand Smart Elevator's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Elevator

What is the Market Size & CAGR of Smart Elevator market in 2023?

Smart Elevator Industry Analysis

Smart Elevator Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Elevator Market Analysis Report by Region

Europe Smart Elevator Market Report:

Europe's Smart Elevator market is anticipated to grow from USD 0.64 billion in 2023 to USD 1.39 billion by 2033. Strict regulations concerning safety and energy efficiency, combined with growing investment in smart buildings, significantly impact market trends. The European Union's commitment to net-zero emissions provides an additional impetus for investments in smart elevator technologies.Asia Pacific Smart Elevator Market Report:

In 2023, the Smart Elevator market in the Asia Pacific region is valued at USD 0.35 billion and is projected to grow to USD 0.76 billion by 2033. Rapid urbanization, particularly in countries like China and India, coupled with increased infrastructure development, drives significant demand for smart elevators. Moreover, government initiatives promoting smart city projects are expected to further boost market growth in this region.North America Smart Elevator Market Report:

North America is projected to showcase robust growth, with the Smart Elevator market growing from USD 0.81 billion in 2023 to USD 1.77 billion by 2033. Advances in building technologies, alongside a strong emphasis on energy efficiency and safety, reflect the region's pioneering status in the smart elevator sector. The U.S. maintains a strong demand, driven by retrofitting initiatives in established infrastructures.South America Smart Elevator Market Report:

The South American market for Smart Elevators is expected to rise from USD 0.18 billion in 2023 to USD 0.39 billion by 2033. This growth is attributed to increasing construction activities and urban development projects aimed at enhancing public transportation systems and residential complexes. Promotion of energy-efficient technologies is also fostering a favorable investment landscape in countries like Brazil and Argentina.Middle East & Africa Smart Elevator Market Report:

The Smart Elevator market in the Middle East and Africa is set to evolve from USD 0.11 billion in 2023 to USD 0.24 billion by 2033. With a burgeoning real estate sector driven by infrastructural growth, especially in the UAE and Saudi Arabia, there’s a rising gap for smart elevator solutions that promise efficiency and modern safety features.Tell us your focus area and get a customized research report.

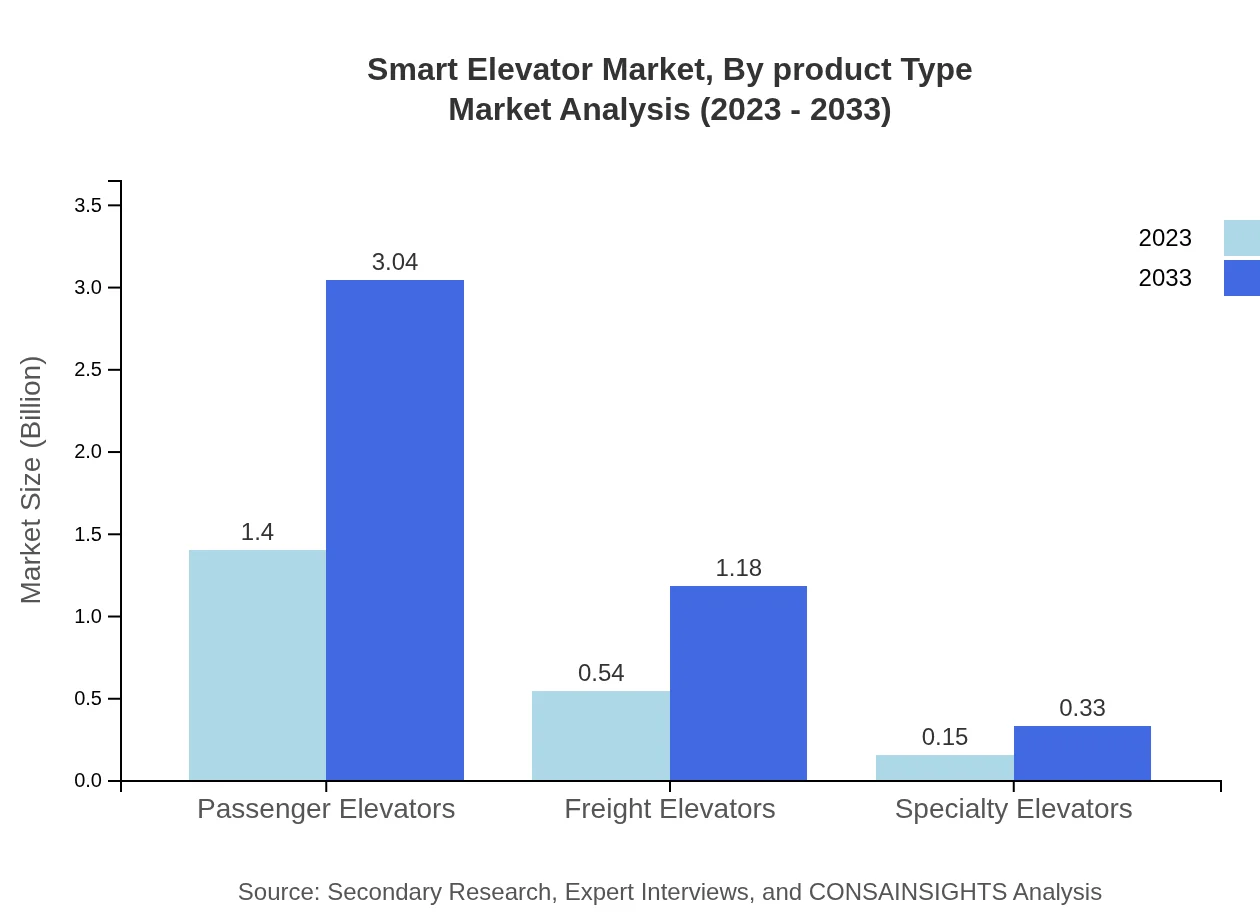

Smart Elevator Market Analysis By Product Type

The Smart Elevator market by product type includes passenger elevators, freight elevators, and specialty elevators. By 2033, the passenger elevator segment is expected to dominate the market with a size of USD 3.04 billion, capturing approximately 66.86% of the total market share. Freight elevators are expected to follow, reaching USD 1.18 billion, while specialty elevators will account for USD 0.33 billion.

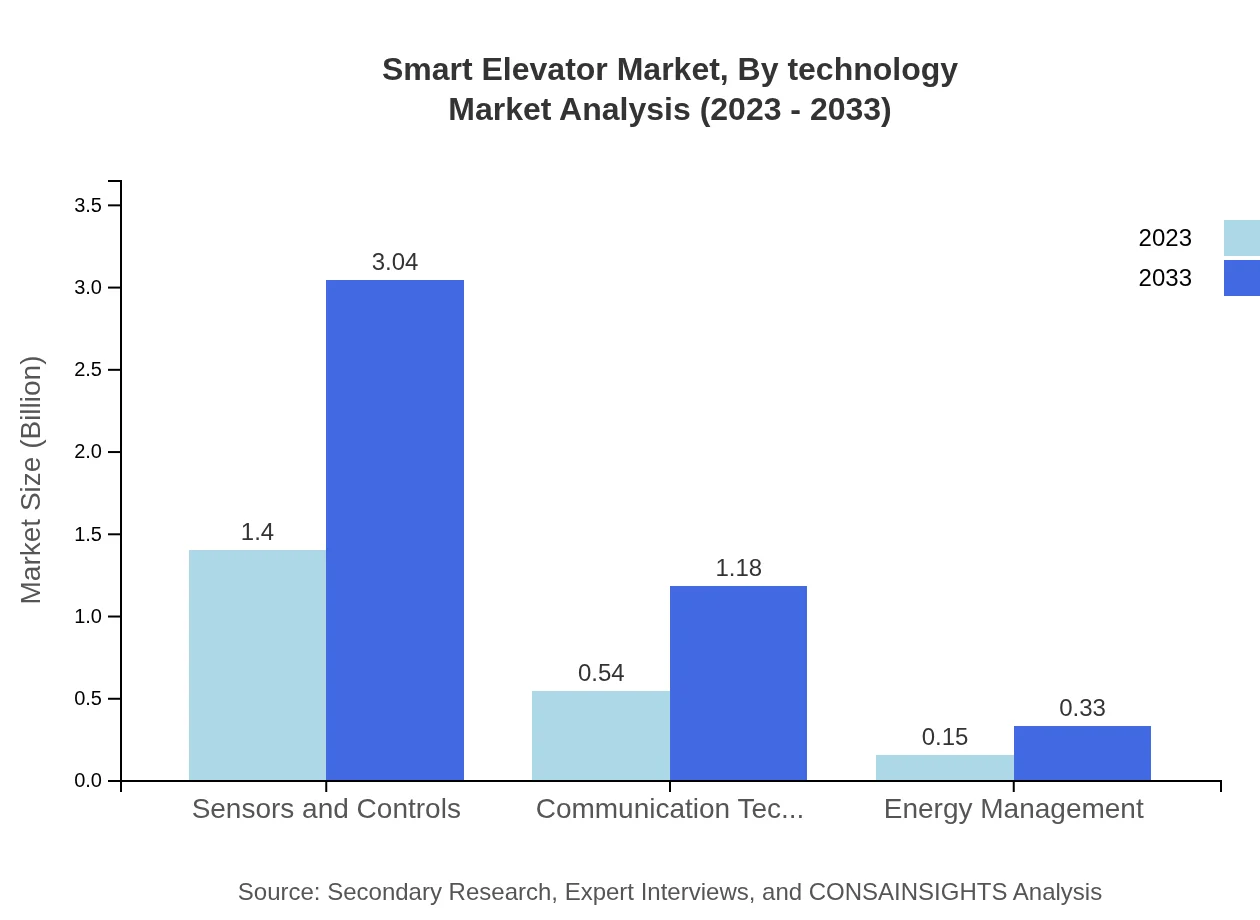

Smart Elevator Market Analysis By Technology

This market segment encompasses essential technologies such as sensors and controls, communication technologies, energy management systems, and safety regulations. Sensors and controls are anticipated to hold the largest share, valued at USD 3.04 billion by 2033. The integration of IoT into communication technologies is also expected to evolve, offering more sophisticated solutions for operational efficiencies.

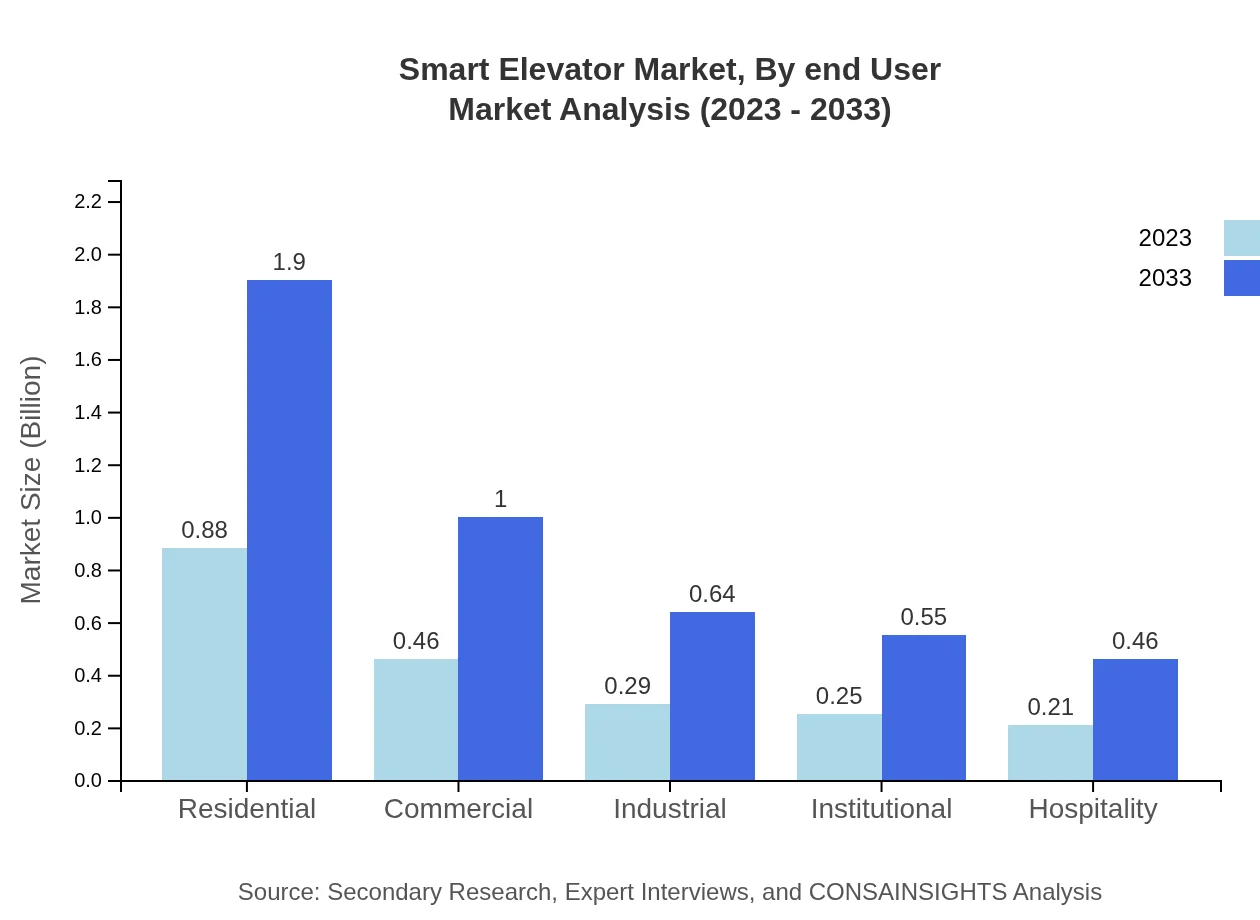

Smart Elevator Market Analysis By End User

The market segmentation by end-user includes residential, commercial, industrial, institutional, and hospitality sectors. The residential segment is projected to be significant, growing to USD 1.90 billion by 2033, while commercial elevators are expected to reach USD 1.00 billion, indicating a growing emphasis on smart living and working environments.

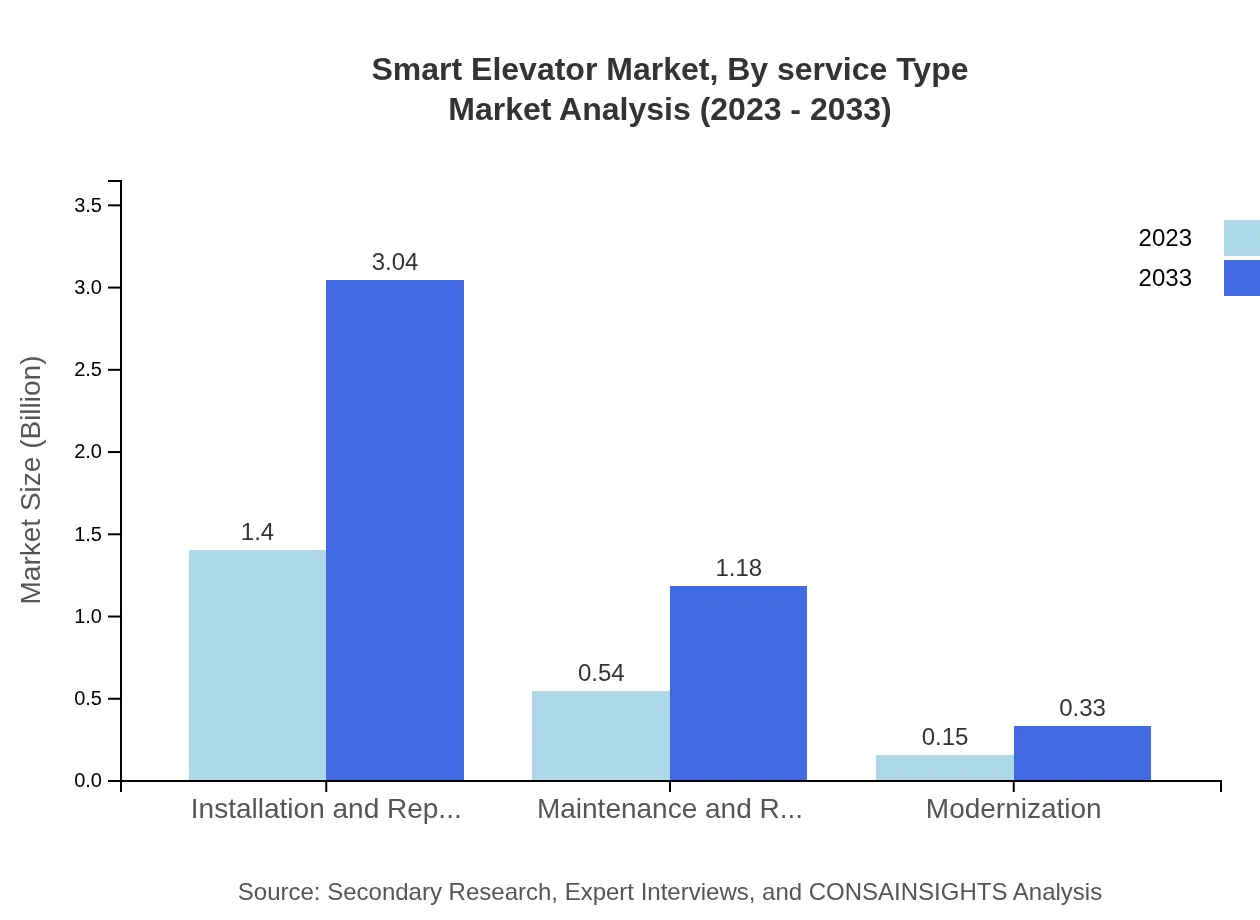

Smart Elevator Market Analysis By Service Type

Service types include installation and replacement, maintenance and repair, and modernization services. The installation and replacement segment is forecasted to experience the most growth, reaching USD 3.04 billion by 2033. Maintenance and repair services will also remain important as building codes and safety regulations increase the demand for ongoing service well after installation.

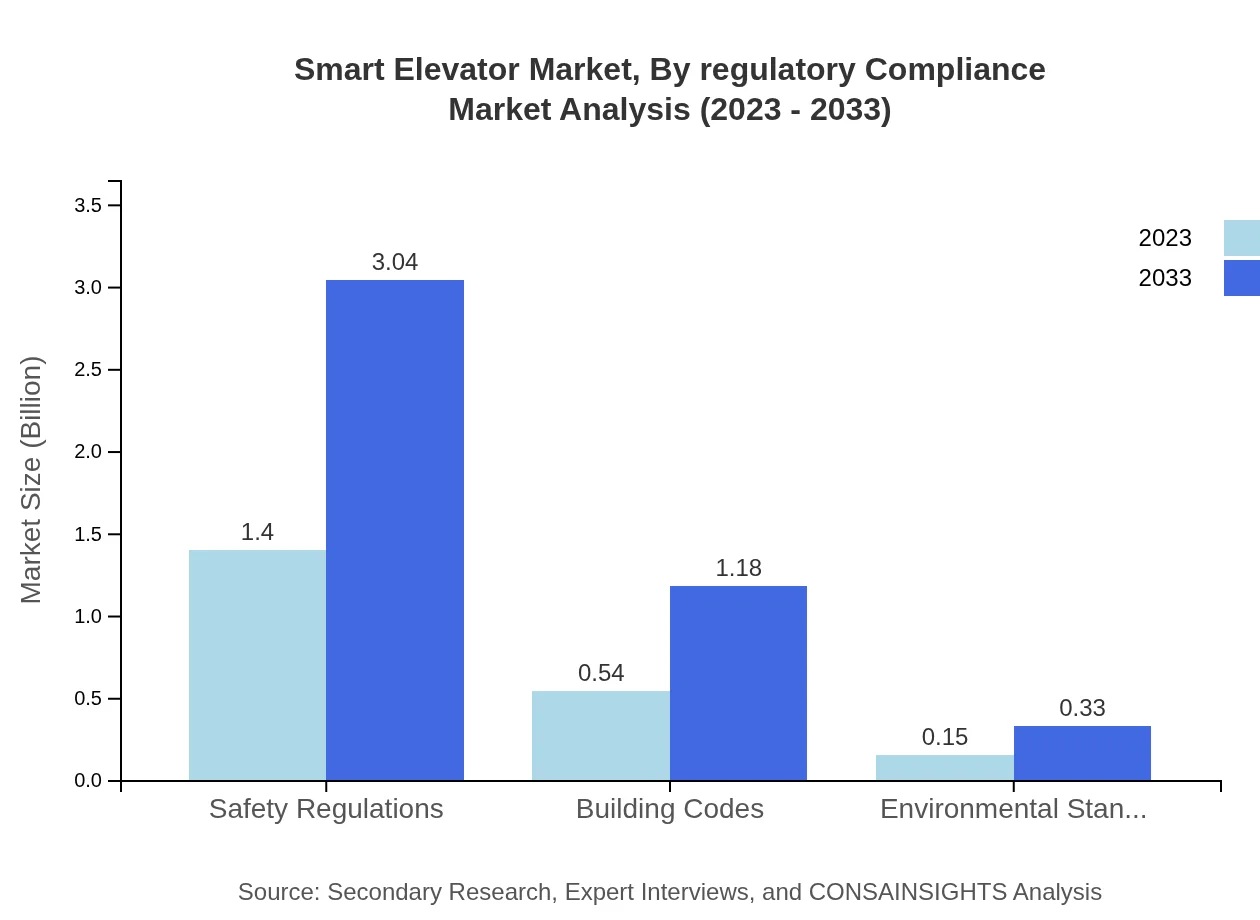

Smart Elevator Market Analysis By Regulatory Compliance

This segment analyzes the compliance with safety regulations, building codes, and environmental standards. As governments impose stricter guidelines, adherence to these standards will shape the market dynamics. By 2033, the market for safety regulations is expected to be valued at USD 3.04 billion, accounting for a significant share of operational costs among elevator management systems.

Smart Elevator Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Elevator Industry

Otis Elevator Company:

A leader in the elevator and escalator industry, Otis focuses on innovation and sustainability, providing advanced smart technologies in vertical transportation.Schindler Group:

Known for its cutting-edge technology and eco-friendly designs, Schindler specializes in providing smart and efficient elevator solutions globally.ThyssenKrupp AG:

With a strong focus on engineering and innovation, ThyssenKrupp provides a wide range of smart elevators and offers modernization solutions to enhance operational efficiency.KONE Corporation:

KONE is recognized for its sustainable and intelligent elevator solutions that integrate seamless connectivity for improved user experiences and energy management.Mitsubishi Electric:

A global player in elevator manufacturing, Mitsubishi Electric is known for its high-quality products and innovative smart technologies enhancing vertical transport efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Elevator?

The global smart elevator market is valued at approximately $2.1 billion in 2023, with an expected CAGR of 7.8% over the next decade. This growth trajectory signals rising demand in technology-enhanced vertical transportation systems.

What are the key market players or companies in the smart Elevator industry?

Key players in the smart elevator industry include Otis Elevator Company, Schindler Group, Kone Corporation, Thyssenkrupp AG, and Mitsubishi Electric Corporation. These companies are at the forefront of technological advancement and market innovation.

What are the primary factors driving the growth in the smart Elevator industry?

Growth in the smart elevator industry is driven by urbanization, increased infrastructure investments, and technological advancements in IoT. Enhanced safety features and energy efficiency also contribute to market momentum, making smart solutions increasingly attractive.

Which region is the fastest Growing in the smart Elevator industry?

North America is currently the fastest-growing region in the smart elevator market, projected to expand from $0.81 billion in 2023 to approximately $1.77 billion by 2033. Europe and Asia Pacific follow closely, indicating substantial regional growth.

Does ConsaInsights provide customized market report data for the smart Elevator industry?

Yes, ConsaInsights offers customized market report data tailored to specific client requirements within the smart elevator industry. This service provides specific insights on trends, forecasts, and competitive analysis for informed decision-making.

What deliverables can I expect from this smart Elevator market research project?

Deliverables from the smart elevator market research project include comprehensive market analysis reports, detailed segmentation data, competitive insights, and regional forecasts, all customized to fit strategic business needs and decision-making.

What are the market trends of smart elevators?

Current trends in the smart elevator market include the integration of advanced IoT technologies, focusing on energy efficiency, and adopting AI for predictive maintenance. The demand for passenger elevators is predominant, with significant market shares observed across various segments.