Smart Fleet Management Market Report

Published Date: 02 February 2026 | Report Code: smart-fleet-management

Smart Fleet Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Smart Fleet Management market from 2023 to 2033, highlighting market trends, size, segmentation, regional insights, and key players to guide stakeholders in informed decision-making and strategic planning.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

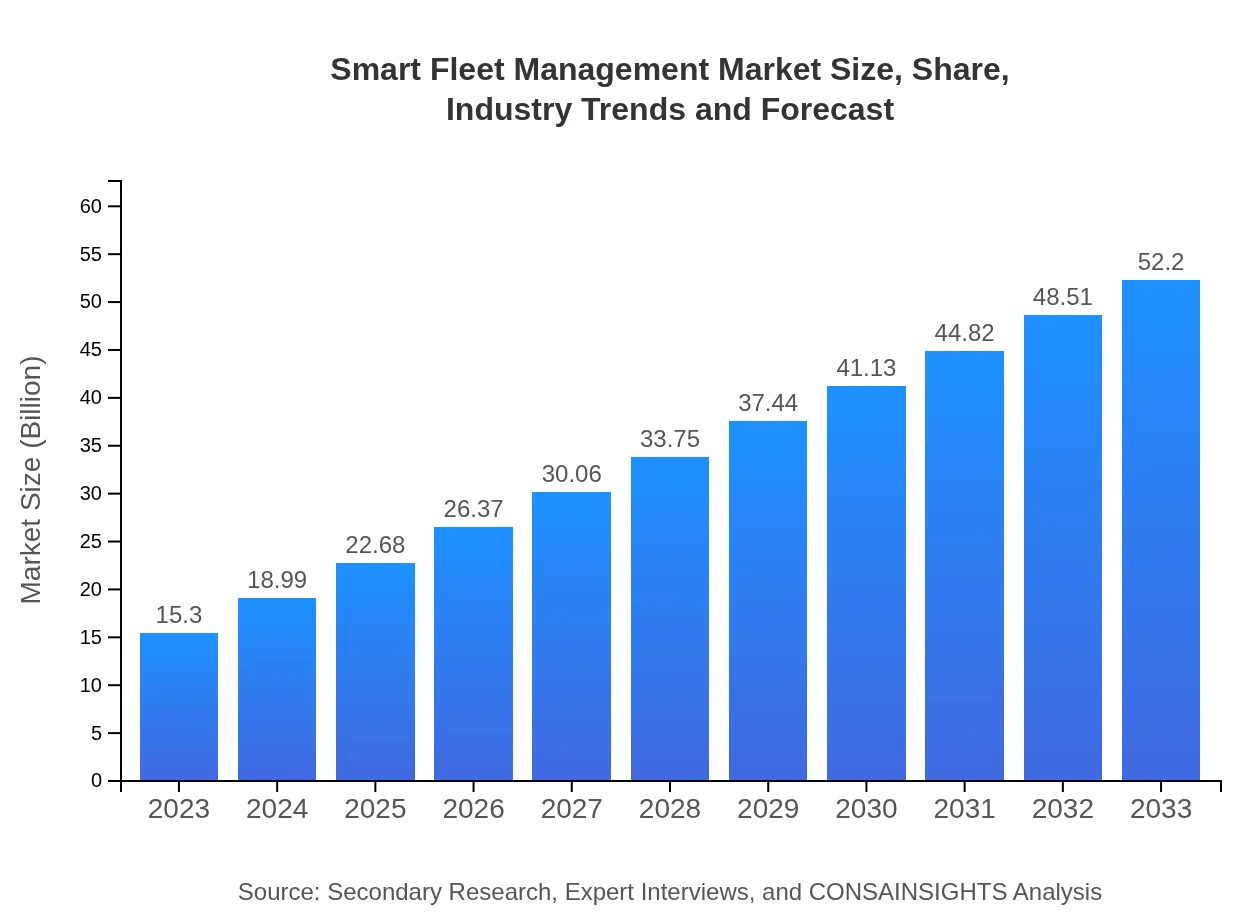

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $52.20 Billion |

| Top Companies | Teletrac Navman, Geotab Inc., Samsara , Verizon Connect |

| Last Modified Date | 02 February 2026 |

Smart Fleet Management Market Overview

Customize Smart Fleet Management Market Report market research report

- ✔ Get in-depth analysis of Smart Fleet Management market size, growth, and forecasts.

- ✔ Understand Smart Fleet Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Fleet Management

What is the Market Size & CAGR of Smart Fleet Management market in 2023?

Smart Fleet Management Industry Analysis

Smart Fleet Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Fleet Management Market Analysis Report by Region

Europe Smart Fleet Management Market Report:

The European market is set to grow from $4.38 billion in 2023 to $14.93 billion in 2033. Innovations in transportation and rising demand for energy-efficient vehicles drive this expansion. European countries are prioritizing sustainable transport solutions, which increases investments in smart fleet technologies.Asia Pacific Smart Fleet Management Market Report:

The Asia Pacific region is expected to witness significant growth in the Smart Fleet Management market, increasing from $3.17 billion in 2023 to $10.83 billion in 2033. The region's growth is attributed to the rising e-commerce sector and increasing investments in transportation infrastructure, particularly in developing countries like India and China, where rapid urbanization demands smarter logistics solutions.North America Smart Fleet Management Market Report:

North America is the largest market for Smart Fleet Management, anticipated to expand from $5.01 billion in 2023 to $17.09 billion by 2033. The presence of major logistics companies and the high adoption rate of telematics technologies contribute to this growth, alongside governmental regulations mandating fleet safety and environmental practices.South America Smart Fleet Management Market Report:

In South America, the market is projected to grow from $0.81 billion in 2023 to $2.77 billion in 2033. The region's growth is driven by the need for improved logistics efficiency and the adoption of technology in fleet operations, especially in Brazil and Argentina, which are focusing on modernization of their fleet management systems.Middle East & Africa Smart Fleet Management Market Report:

In the Middle East and Africa, the market is projected to increase from $1.93 billion in 2023 to $6.59 billion in 2033. The region is witnessing a transition towards smart city initiatives which include improved fleet management solutions to enhance urban mobility, efficiency, and sustainability.Tell us your focus area and get a customized research report.

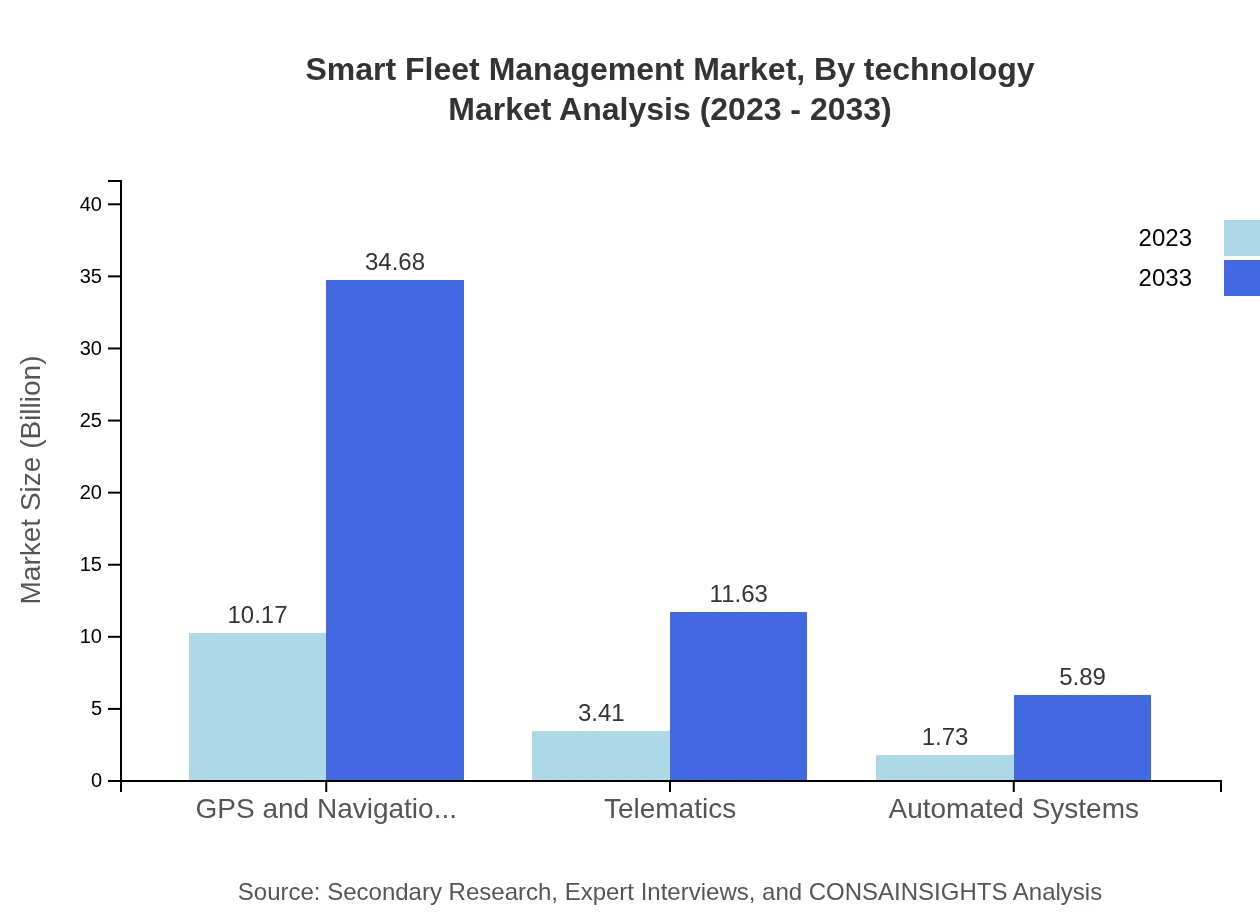

Smart Fleet Management Market Analysis By Technology

Key technologies include GPS and navigation systems, which dominate the market size, projected to grow from $10.17 billion in 2023 to $34.68 billion in 2033. Other technologies such as telematics and automated systems are also gaining traction due to their ability to provide data-driven insights into fleet performance.

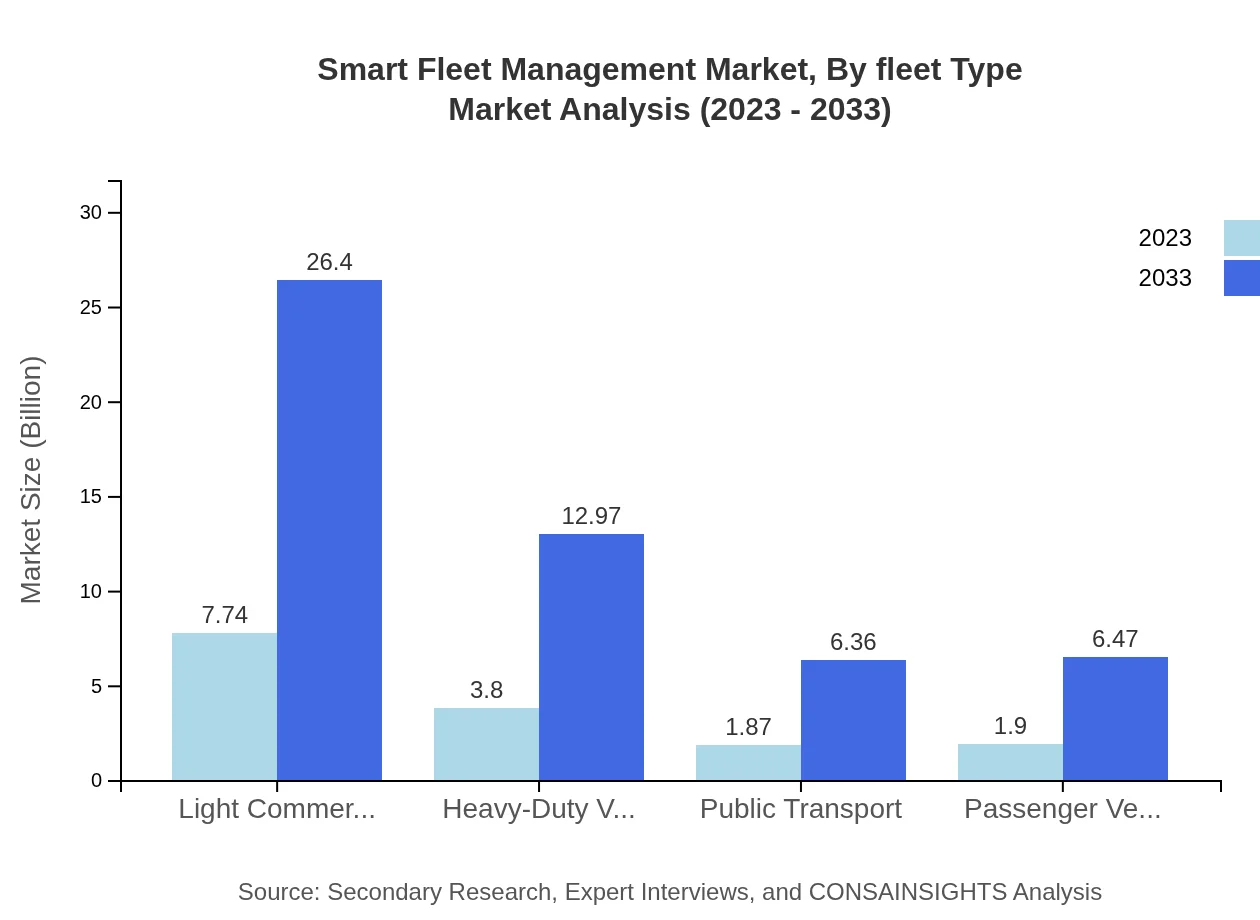

Smart Fleet Management Market Analysis By Fleet Type

Heavy-duty vehicles and light commercial vehicles dominate the fleet type segment, with heavy-duty vehicles expected to grow from $3.80 billion in 2023 to $12.97 billion by 2033. The logistics and transportation sector remains the largest end-user segment, reflecting the industry's reliance on efficient fleet management solutions.

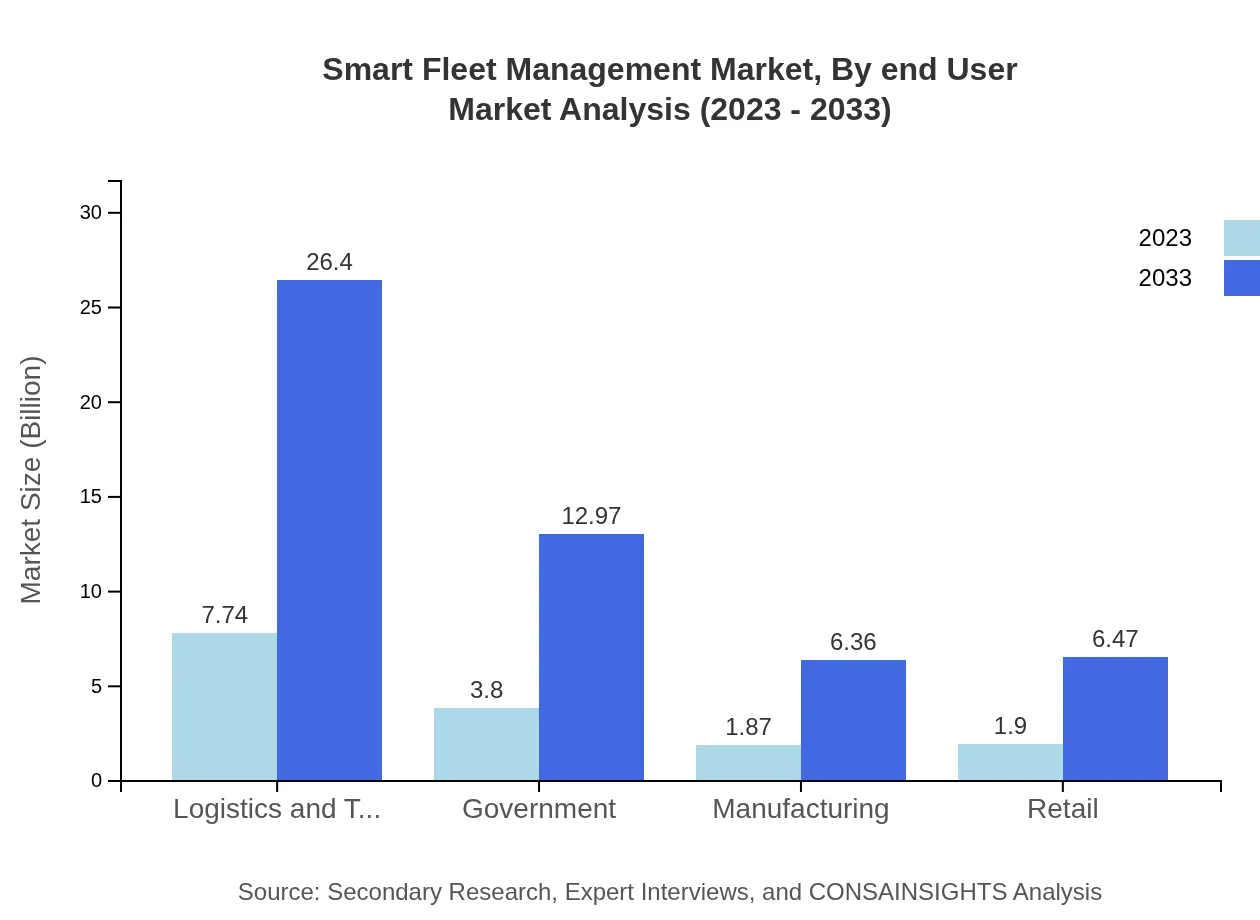

Smart Fleet Management Market Analysis By End User

The logistics and transportation sector is the largest contributor to the Smart Fleet Management market, representing 50.57% market share in 2023. Other significant end-user segments include government, manufacturing, and retail industries, all focusing on operational efficiencies and cost reduction.

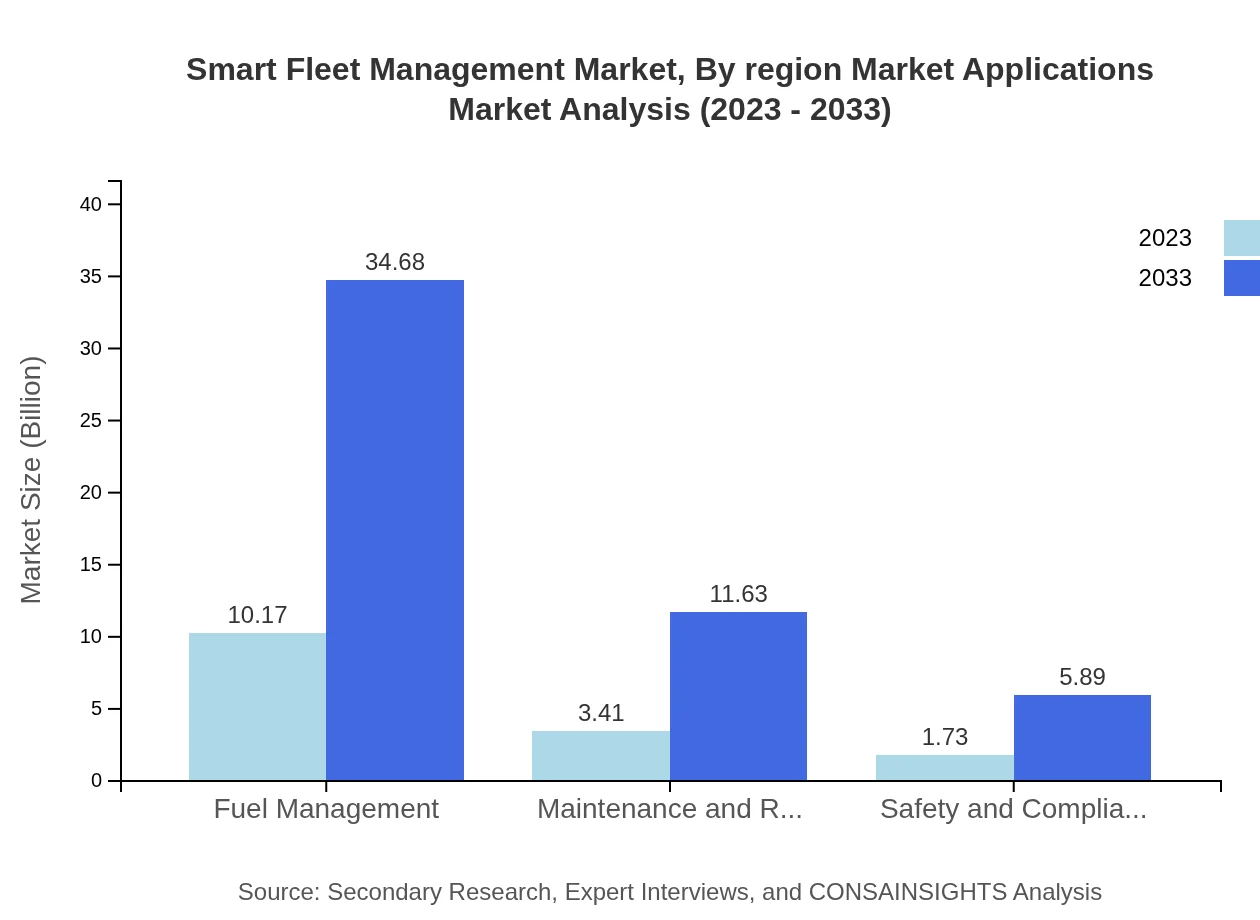

Smart Fleet Management Market Analysis By Region Market Applications

The primary applications of smart fleet management include fuel management, maintenance and repair, and safety and compliance solutions. These applications are critical for optimizing operations and enhancing productivity across multiple fleet types.

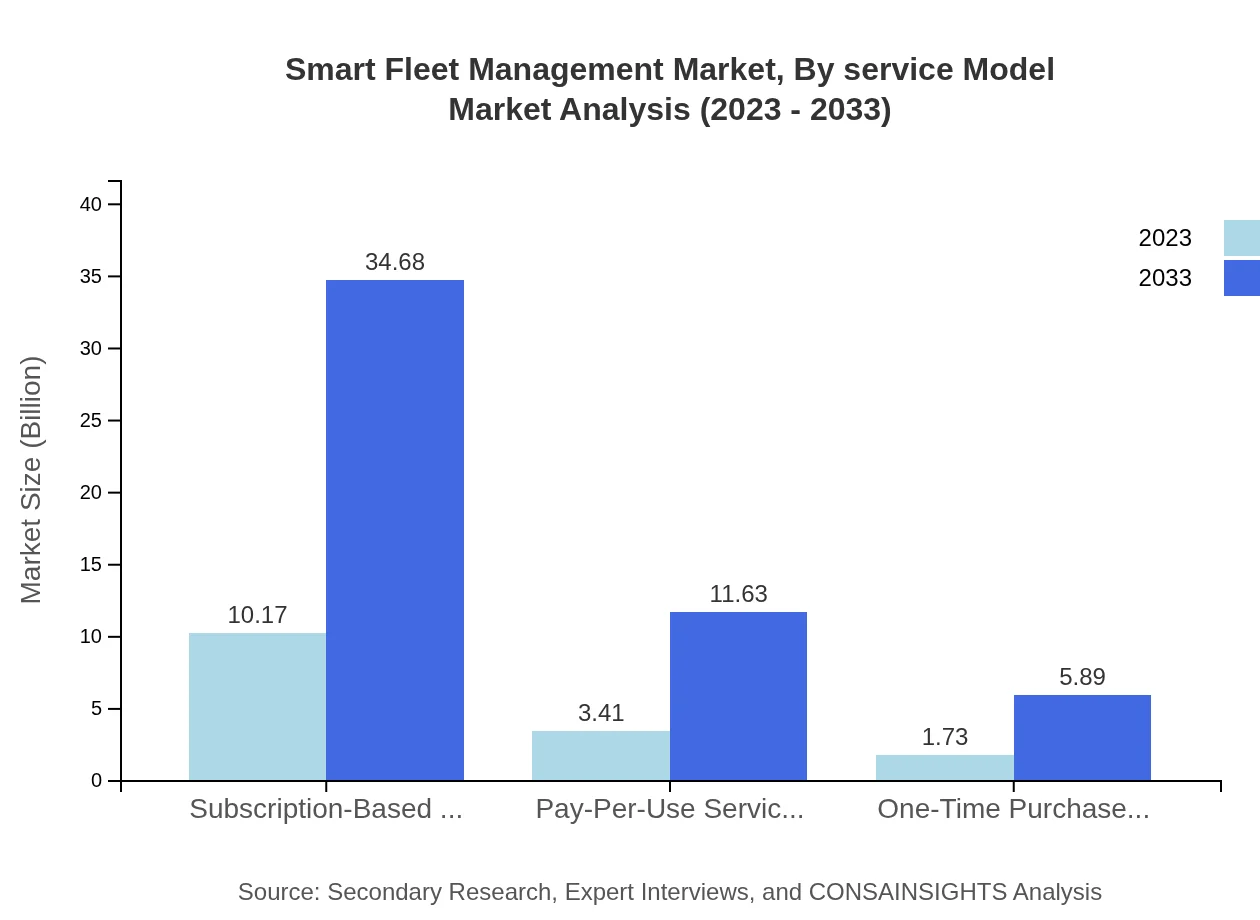

Smart Fleet Management Market Analysis By Service Model

Service models include subscription-based services, pay-per-use services, and one-time purchase services, with subscription-based services expected to dominate the market, growing significantly due to continuous service delivery and support.

Smart Fleet Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Fleet Management Industry

Teletrac Navman:

A leading provider of fleet management and telematics solutions, offering software and hardware products that enhance fleet operations and driver safety.Geotab Inc.:

Provides robust telematics solutions and analytics platforms, empowering fleet managers with real-time insights and data-driven decisions.Samsara :

A technology company providing IoT solutions to help businesses optimize their fleet operations through advanced software platforms and GPS tracking.Verizon Connect:

Offers fleet management solutions focusing on mobility and logistics, improving efficiency, productivity, and asset utilization for businesses.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Fleet Management?

The global smart fleet management market is currently valued at approximately $15.3 billion in 2023, with a projected CAGR of 12.5% from 2023 to 2033, indicating substantial growth opportunities in this sector.

What are the key market players or companies in the smart Fleet Management industry?

Key players in the smart fleet management market include Verizon, Geotab, Fleet Complete, Fleetmatics, and Omnicom, known for their innovative solutions and technologies that drive efficiency and sustainability in fleet operations.

What are the primary factors driving the growth in the smart Fleet Management industry?

Growth in the smart fleet management industry is primarily driven by the increasing demand for operational efficiency, advancements in telematics, regulatory compliance requirements, and a growing focus on reducing operational costs and enhancing safety.

Which region is the fastest Growing in the smart Fleet Management?

The North American region is expected to witness the fastest growth in the smart fleet management market, with a projected market increase from $5.01 billion in 2023 to $17.09 billion by 2033, fueled by technological advancements.

Does ConsaInsights provide customized market report data for the smart Fleet Management industry?

Yes, ConsaInsights offers tailored market report data for the smart fleet management industry, accommodating the specific analytical needs and strategic interests of companies and stakeholders in this sector.

What deliverables can I expect from this smart Fleet Management market research project?

Deliverables from this market research project typically include detailed market analysis reports, trend assessments, competitive landscape evaluations, and customized insights to guide strategic decision-making.

What are the market trends of smart Fleet Management?

Current market trends in smart fleet management include increasing adoption of AI and IoT technologies, a shift towards subscription-based models, heightened focus on sustainability, and the integration of advanced analytics for enhanced decision-making.