Smart Fleet On Board Devices Market Report

Published Date: 31 January 2026 | Report Code: smart-fleet-on-board-devices

Smart Fleet On Board Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Smart Fleet On Board Devices market covering growth projections, current trends, and industry insights from 2023 to 2033. It includes detailed regional analyses, competitive landscapes, and identifies key growth drivers shaping the market.

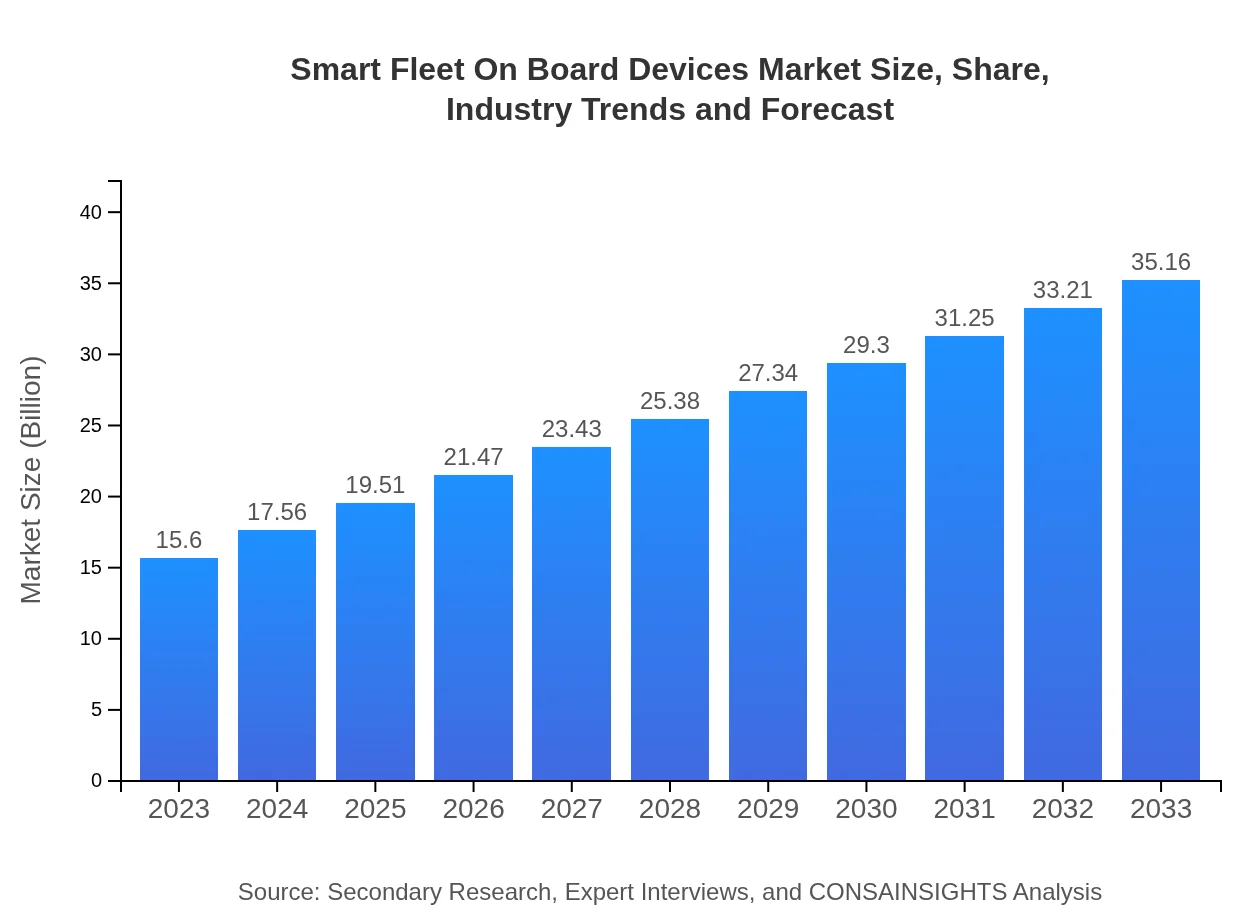

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $35.16 Billion |

| Top Companies | Teletrac Navman, Verizon Connect, Geotab, Omnicomm, Samsara |

| Last Modified Date | 31 January 2026 |

Smart Fleet On Board Devices Market Overview

Customize Smart Fleet On Board Devices Market Report market research report

- ✔ Get in-depth analysis of Smart Fleet On Board Devices market size, growth, and forecasts.

- ✔ Understand Smart Fleet On Board Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Fleet On Board Devices

What is the Market Size & CAGR of Smart Fleet On Board Devices market in 2023?

Smart Fleet On Board Devices Industry Analysis

Smart Fleet On Board Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Fleet On Board Devices Market Analysis Report by Region

Europe Smart Fleet On Board Devices Market Report:

Europe's market stands at $4.02 billion in 2023 and is set to increase to $9.07 billion by 2033. The stringent regulations regarding vehicle emissions and safety are catalyzing the rapid adoption of smart fleet technologies.Asia Pacific Smart Fleet On Board Devices Market Report:

In 2023, the Asia Pacific region holds a market size of $3.20 billion, expected to grow to $7.22 billion by 2033. The rise in industrial activity and urbanization, coupled with government initiatives promoting smart transportation, are key growth drivers.North America Smart Fleet On Board Devices Market Report:

North America represents the largest market segment at $5.91 billion in 2023, anticipated to grow to $13.31 billion by 2033. The region is a leader in technology adoption, with heavy investments in logistics and safety-focused initiatives.South America Smart Fleet On Board Devices Market Report:

South America’s Smart Fleet On Board Devices market is valued at $0.92 billion in 2023 and projected to reach $2.08 billion by 2033. Challenges such as infrastructure limitations are being countered with investments in fleet management solutions.Middle East & Africa Smart Fleet On Board Devices Market Report:

The Middle East and Africa market is valued at $1.55 billion in 2023, with expectations of growth to $3.49 billion by 2033. Increasing investments in transportation infrastructure are vital for market expansion in this region.Tell us your focus area and get a customized research report.

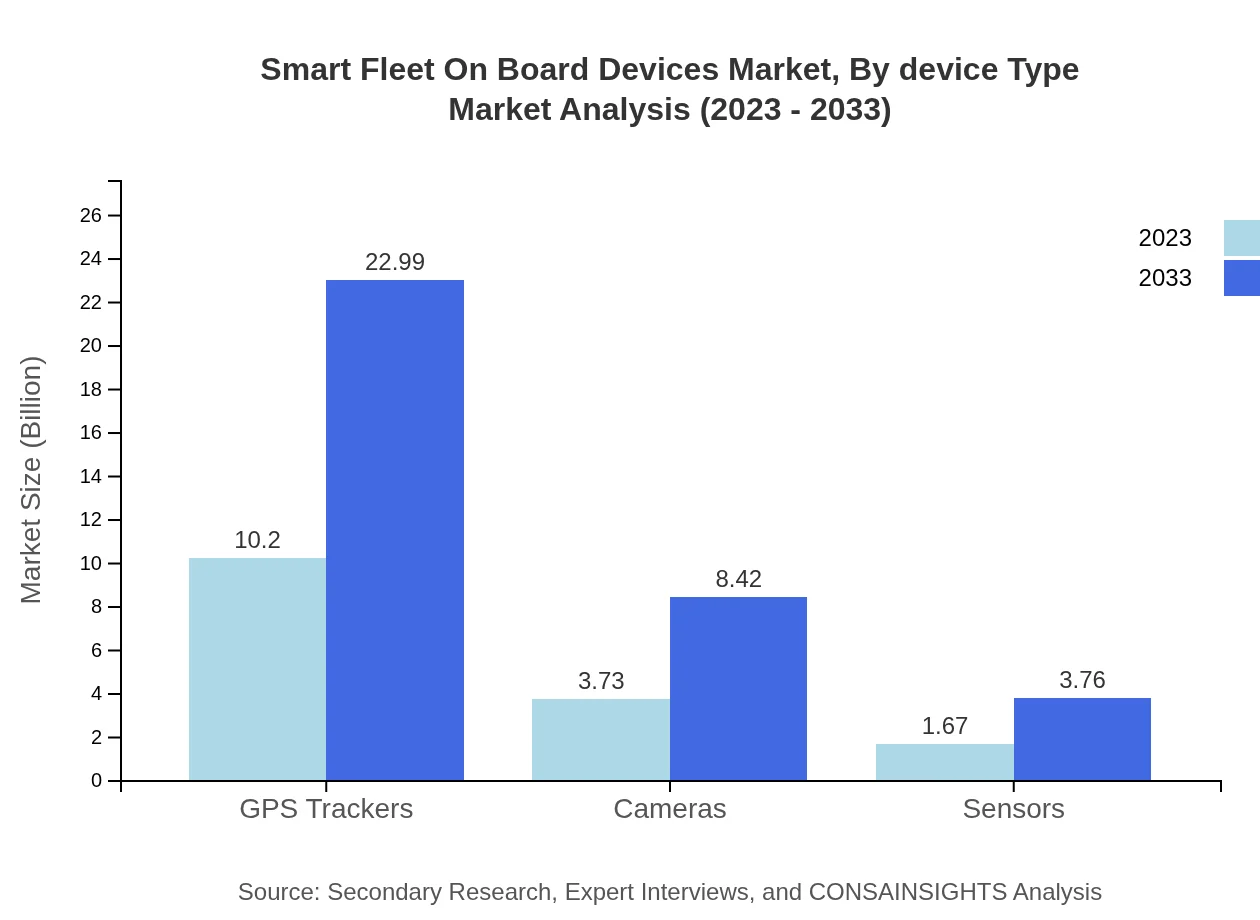

Smart Fleet On Board Devices Market Analysis By Device Type

The Smart Fleet On Board Devices market by device type shows extensive usage of GPS tracking systems, which account for $10.20 billion in 2023, expected to grow to $22.99 billion by 2033. Cameras, sensors, and fleet management systems also set exhibit considerable growth, emphasizing the need for comprehensive monitoring and safety systems across fleets.

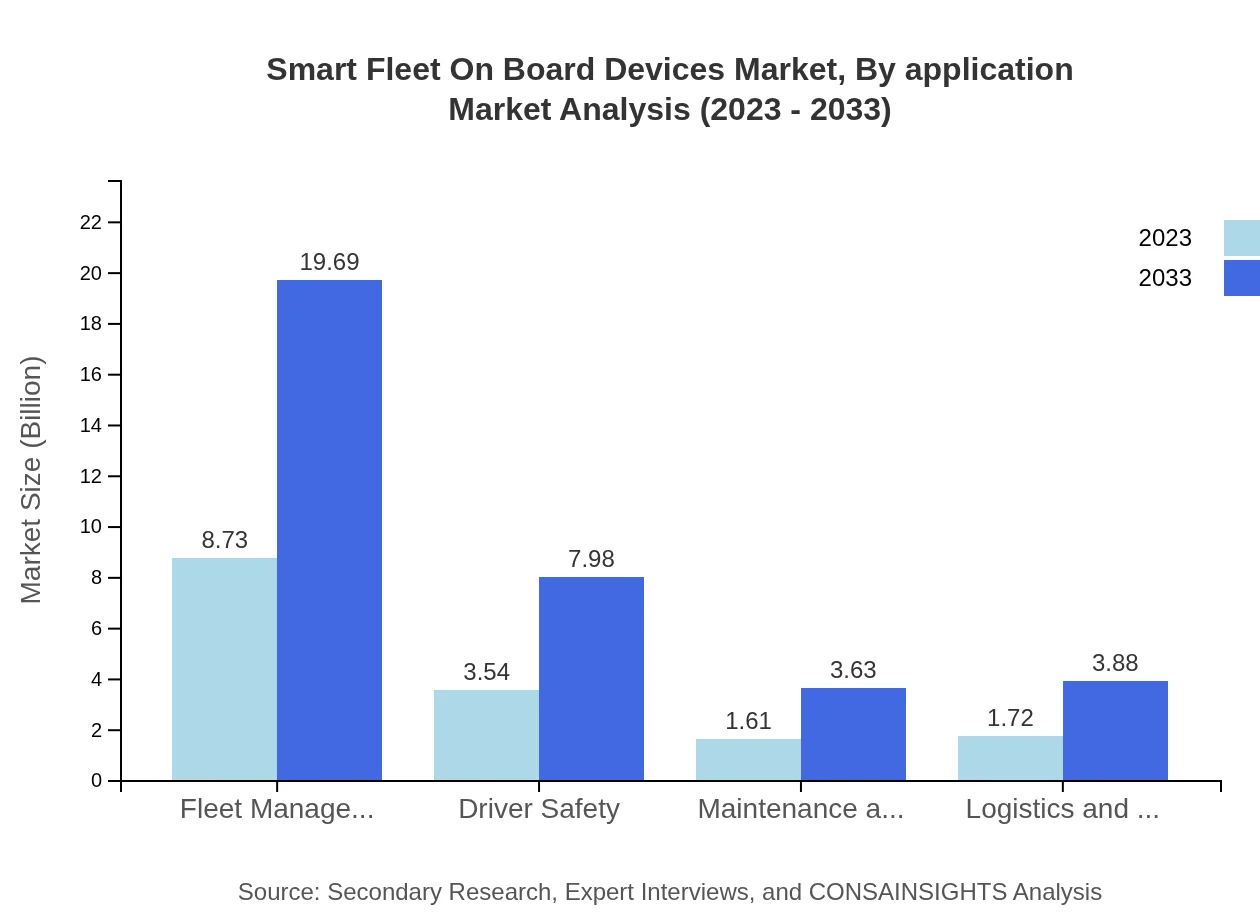

Smart Fleet On Board Devices Market Analysis By Application

Major applications of smart fleet devices include logistics, where it is valued at $8.73 billion in 2023 and projected to reach $19.69 billion by 2033, alongside growing applications in public transport and construction sectors driven by increased focus on efficiency and safety.

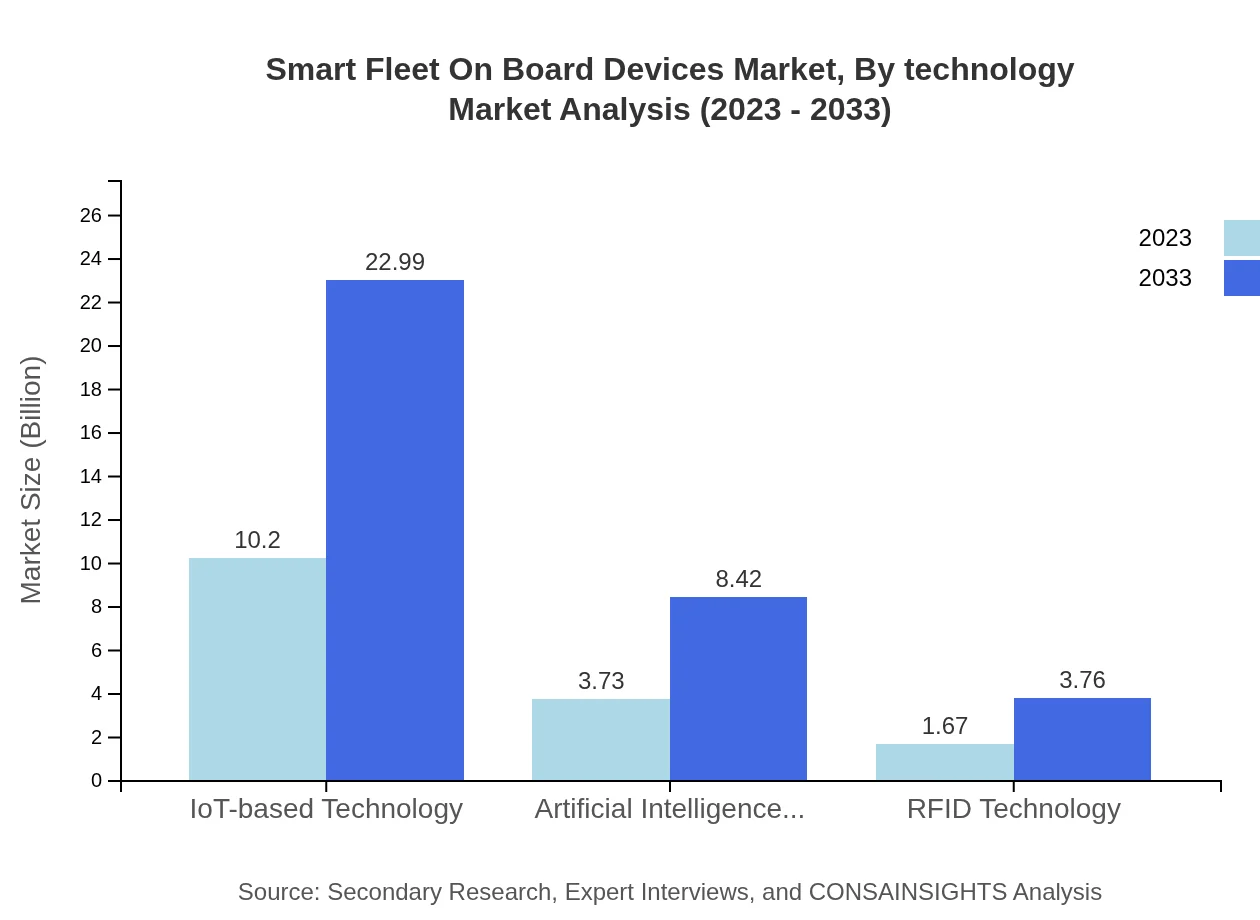

Smart Fleet On Board Devices Market Analysis By Technology

The market is increasingly adopting IoT-based technologies with a size of $10.20 billion in 2023 projected to double to $22.99 billion by 2033. This rapid integration is coupled with advancements in AI, RFID, and sensor technologies enhancing data acquisition and processing capabilities.

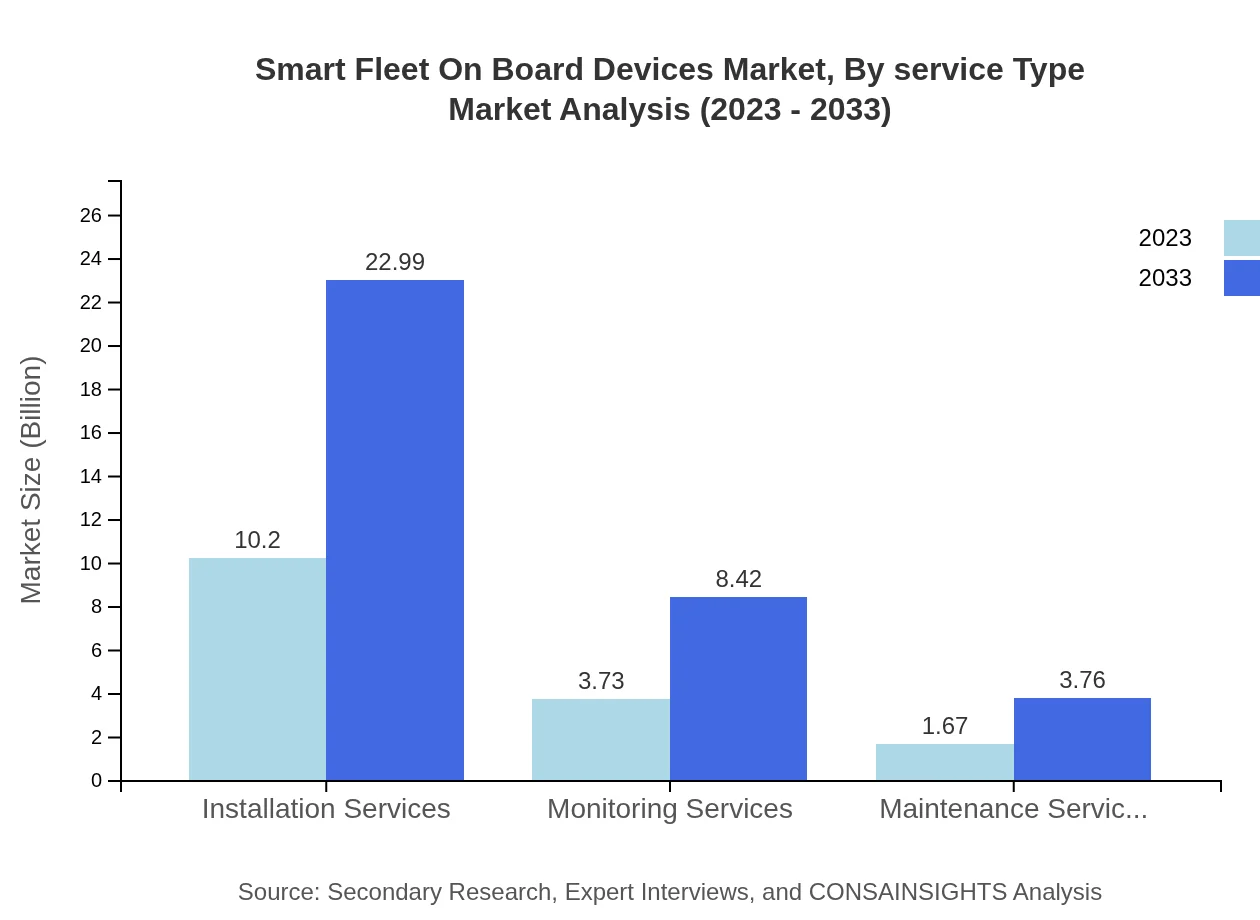

Smart Fleet On Board Devices Market Analysis By Service Type

Service types, comprising installation, monitoring, and maintenance services, indicate a growing market with installation services conservatively estimated at $10.20 billion in 2023, expanding to $22.99 billion by 2033, reflecting the need for professional setup to maximize device utility.

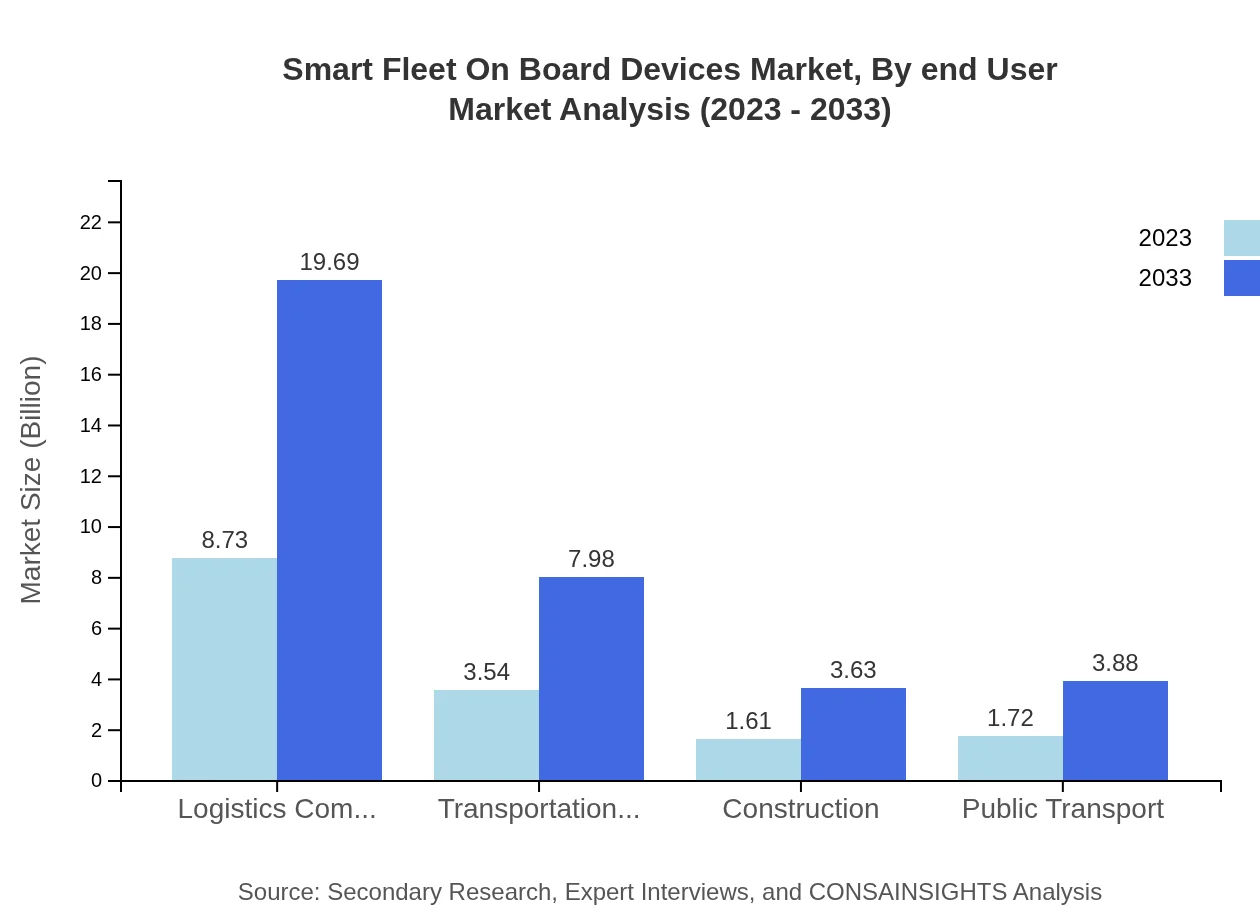

Smart Fleet On Board Devices Market Analysis By End User

Logistics companies are the primary end-users of smart fleet technologies, contributing significantly at $8.73 billion in 2023 and expected to grow to $19.69 billion by 2033. Transportation firms and public transport providers are also crucial segments, driven by the demand for improved operational safety and efficiency.

Smart Fleet On Board Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Fleet On Board Devices Industry

Teletrac Navman:

Known for its leading fleet management software and GPS tracking solutions, Teletrac Navman enhances operational efficiency for fleet operators through innovative technologies.Verizon Connect:

A prominent player offering a comprehensive suite of fleet telematics solutions, focusing on safety and performance optimization for various industries.Geotab:

Geotab specializes in advanced telematics and fleet management solutions to improve vehicle and driver performance, utilizing big data analytics.Omnicomm:

Renowned for fuel monitoring solutions, Omnicomm provides insights to optimize fleet performance and reduce operational costs.Samsara :

Samsara uses IoT technology for real-time GPS tracking and analytics, focusing on providing solutions to enhance the reliability and safety of fleet operations.We're grateful to work with incredible clients.

FAQs

What is the market size of Smart Fleet On Board Devices?

The Smart Fleet On Board Devices market is projected to reach a size of approximately $15.6 billion by 2033, growing at a CAGR of 8.2% from its current valuation. This indicates a significant trend towards enhanced fleet management solutions.

What are the key market players or companies in the Smart Fleet On Board Devices industry?

Key players in the Smart Fleet On Board Devices industry include technology firms specializing in IoT solutions, GPS tracking systems, and fleet management software. Major companies focus on innovative solutions to enhance operational efficiency and driver safety.

What are the primary factors driving the growth in the Smart Fleet On Board Devices industry?

The growth drivers in the Smart Fleet On Board Devices market include increasing efficiencies in logistics, demand for real-time tracking, innovations in IoT technology, and the rising importance of driver safety. These factors collectively push the adoption of smart fleet technologies.

Which region is the fastest Growing in the Smart Fleet On Board Devices?

North America is currently the fastest-growing region in the Smart Fleet On Board Devices market, expected to grow from $5.91 billion in 2023 to $13.31 billion by 2033, representing significant advancements in smart fleet technology and widespread adoption.

Does ConsaInsights provide customized market report data for the Smart Fleet On Board Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Smart Fleet On Board Devices industry, enabling clients to gain insightful analysis and strategic recommendations to stay competitive.

What deliverables can I expect from this Smart Fleet On Board Devices market research project?

Deliverables from the Smart Fleet On Board Devices market research project include comprehensive market analysis reports, segment insights, regional trends, competitive landscape overview, and forecasts that assist in informed decision-making.

What are the market trends of Smart Fleet On Board Devices?

Current market trends in Smart Fleet On Board Devices include a growing reliance on IoT-based technologies, enhanced driver safety measures, increased use of GPS tracking, and a shift towards electric vehicles, all contributing to efficient fleet operations.