Smart Hospital Market Report

Published Date: 31 January 2026 | Report Code: smart-hospital

Smart Hospital Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Smart Hospital market, including current trends, market size, segmentation, and regional insights covering the forecast period from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

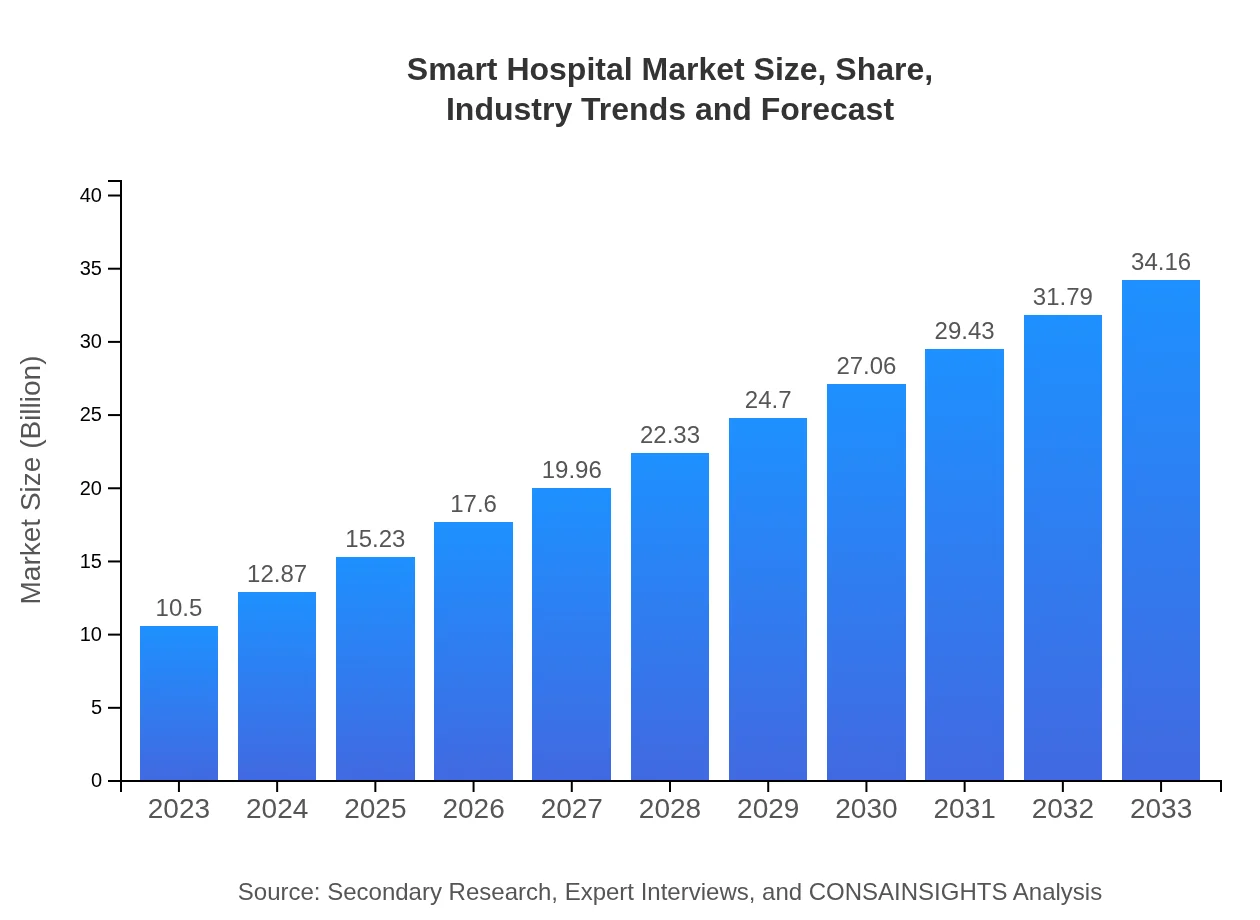

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $34.16 Billion |

| Top Companies | Siemens Healthineers, Philips Healthcare, Medtronic , GE Healthcare, IBM Watson Health |

| Last Modified Date | 31 January 2026 |

Smart Hospital Market Overview

Customize Smart Hospital Market Report market research report

- ✔ Get in-depth analysis of Smart Hospital market size, growth, and forecasts.

- ✔ Understand Smart Hospital's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Hospital

What is the Market Size & CAGR of Smart Hospital market in 2023?

Smart Hospital Industry Analysis

Smart Hospital Market Segmentation and Scope

Tell us your focus area and get a customized research report.

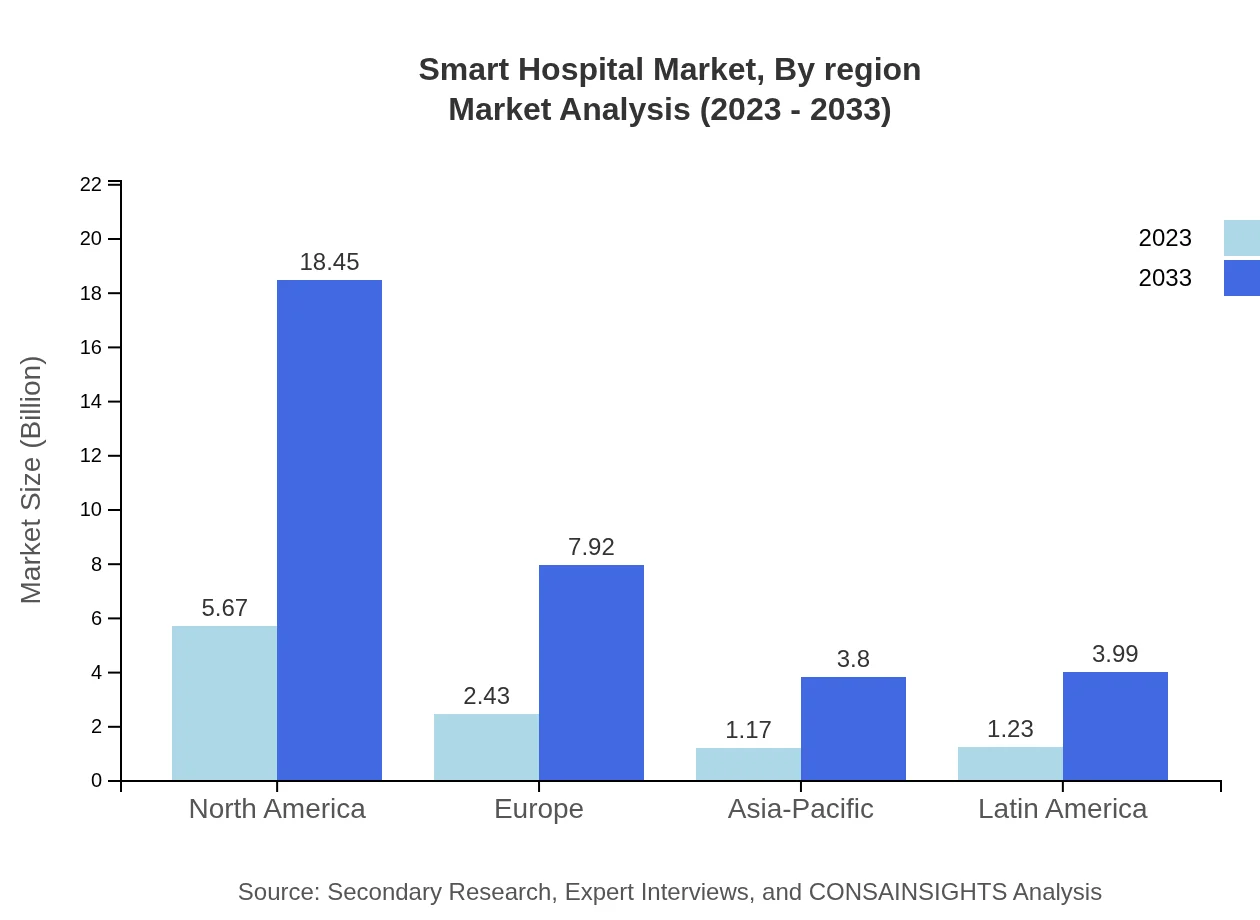

Smart Hospital Market Analysis Report by Region

Europe Smart Hospital Market Report:

Europe's Smart Hospital market is set to grow from $3.18 billion in 2023 to $10.36 billion by 2033, encouraged by stringent regulations aimed at improving patient care quality. The focus on nurse and patient safety and operational efficiency is driving technology adoption.Asia Pacific Smart Hospital Market Report:

In the Asia Pacific region, the Smart Hospital market is projected to grow from $1.99 billion in 2023 to $6.47 billion by 2033. The rise in healthcare expenditure, coupled with technological advancements, is driving this growth. Countries like China and India are leading the integration of smart technologies in healthcare settings.North America Smart Hospital Market Report:

North America is dominant in the Smart Hospital market, with a projected market size of $4.05 billion in 2023, increasing to approximately $13.18 billion by 2033. The region's advanced healthcare infrastructure, coupled with a high prevalence of chronic diseases, necessitates innovative healthcare solutions.South America Smart Hospital Market Report:

South America is witnessing gradual adoption of Smart Hospital technology, with the market size expected to increase from $0.64 billion in 2023 to $2.09 billion by 2033. Governments are promoting healthcare IT solutions to enhance service quality and accessibility.Middle East & Africa Smart Hospital Market Report:

In the Middle East and Africa, the Smart Hospital market is projected to grow from $0.64 billion in 2023 to $2.07 billion by 2033. The increasing investment in healthcare infrastructure and technology is propelling market growth, with several governments implementing digitization strategies in healthcare systems.Tell us your focus area and get a customized research report.

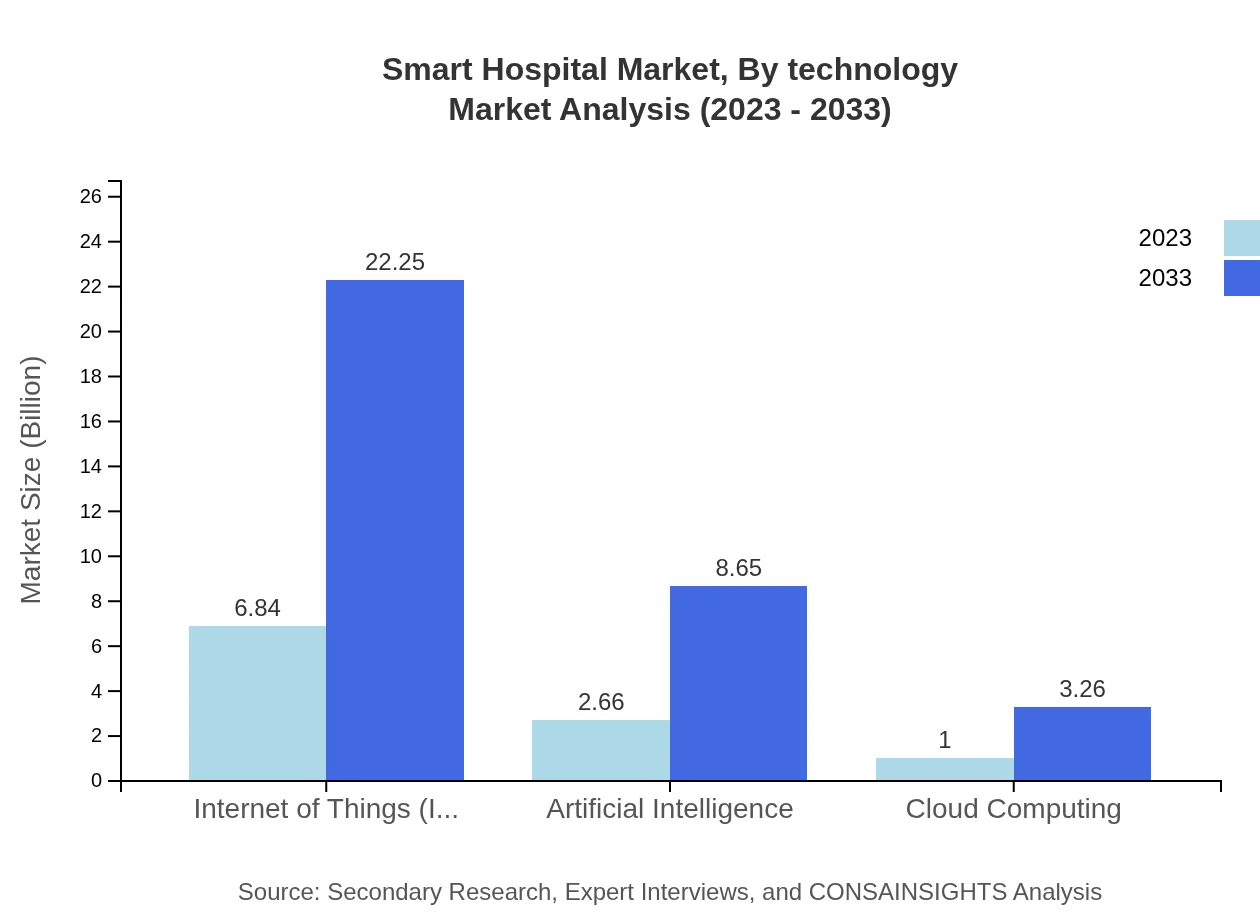

Smart Hospital Market Analysis By Technology

The Smart Hospital market is characterized by technologies such as IoT, AI, Cloud Computing, and Digital Imaging. In 2023, IoT leads the market with a size of $6.84 billion and is expected to grow significantly, representing 65.14% of the market share. AI also shows robust growth, projected at $2.66 billion in 2023, capturing 25.32% of the market.

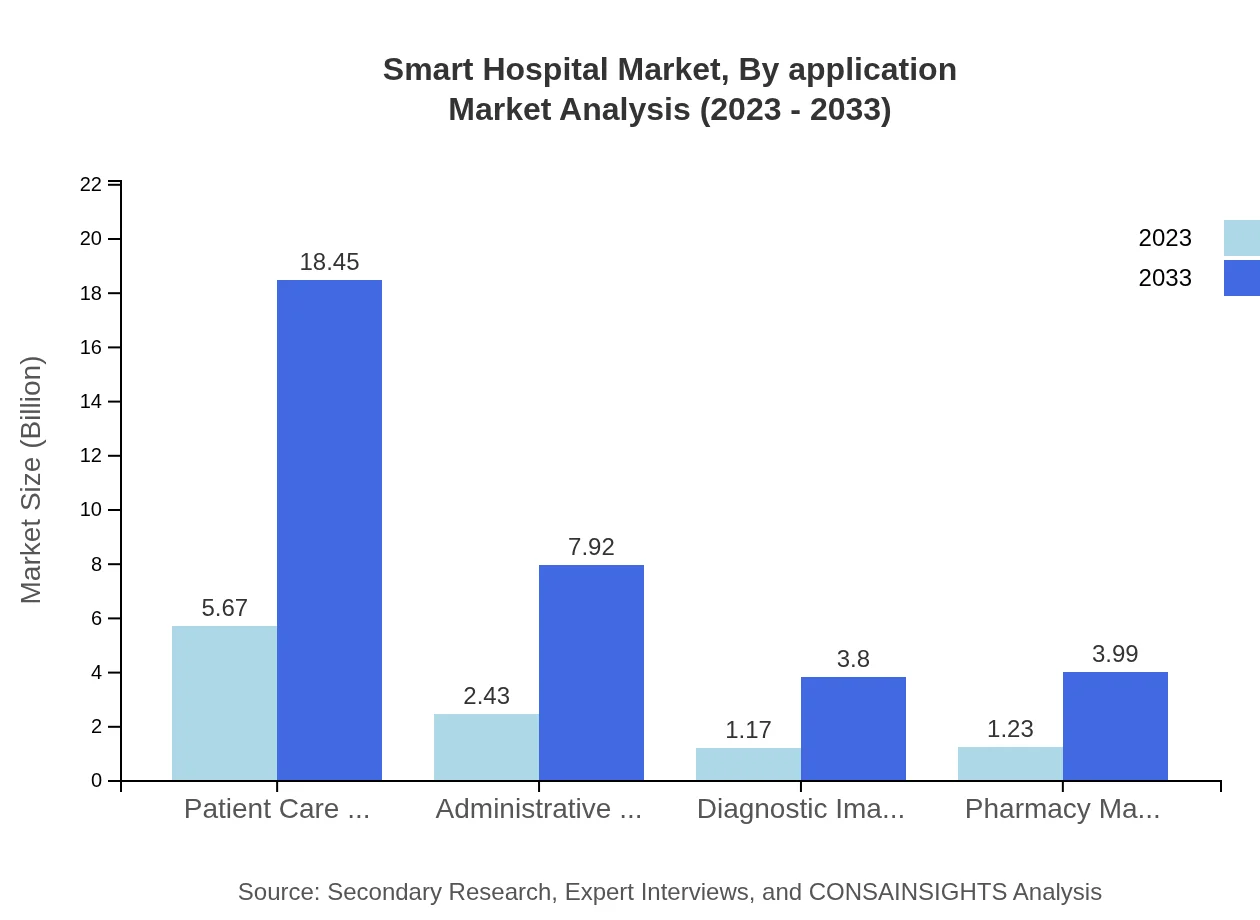

Smart Hospital Market Analysis By Application

Applications in the Smart Hospital market include Patient Care Management, Administrative Management, and Diagnostic Imaging. Patient Care Management holds a significant share with a market size of $5.67 billion in 2023 (54.02%). The trend indicates a shift towards enhanced administration through technology, which is expected to evolve by 2033.

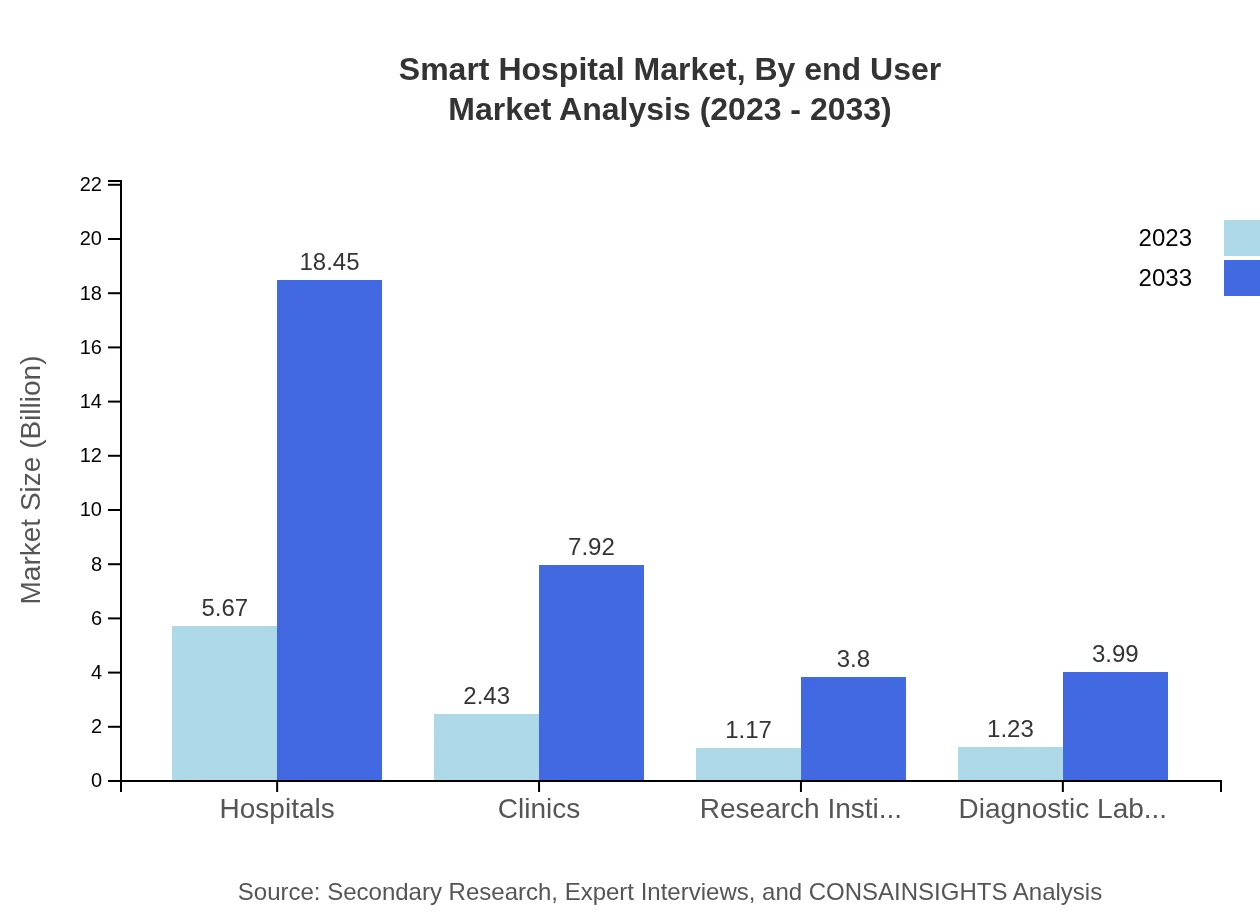

Smart Hospital Market Analysis By End User

End-users of smart hospital solutions include hospitals, clinics, research institutes, and diagnostic labs. Hospitals are projected to continue leading this segment with a market share of 54.02% as of 2023. The demand for smart technologies in clinical environments facilitates improved patient outcomes and workflow efficiency.

Smart Hospital Market Analysis By Region

The regional analysis indicates North America as the major contributor, followed by Europe and Asia Pacific. As noted, North America is expected to dominate the market size at $4.05 billion by 2023, supported by advanced technologies and increased healthcare spending.

Smart Hospital Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Hospital Industry

Siemens Healthineers:

A leader in medical technology, Siemens Healthineers focuses on digitalization in healthcare, offering solutions that enhance imaging and laboratory diagnostics in smart hospitals.Philips Healthcare:

Philips is at the forefront of health technology, providing innovative medical devices and solutions aimed at improving hospital efficiency and patient care through smart infrastructure.Medtronic :

Medtronic specializes in medical technologies and devices that are critical for delivering advanced patient care within smart hospitals, facilitating the adoption of digital transformation.GE Healthcare:

A prominent global player, GE Healthcare promotes digital health transformation through smart hospital solutions that improve clinical efficiency and healthcare delivery.IBM Watson Health:

IBM Watson Health utilizes AI to analyze healthcare data, enabling smart hospitals to offer personalized patient care and enhance the overall healthcare experience.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Hospital?

The smart hospital market is valued at approximately $10.5 billion in 2023, with a projected growth at a CAGR of 12%, indicating significant expansion leading to numerous advancements in healthcare technology by 2033.

What are the key market players or companies in this smart hospital industry?

Key players in the smart hospital industry include established technology firms and healthcare providers who are integrating IoT, AI, and cloud computing into their services to enhance patient care and optimize hospital operations.

What are the primary factors driving the growth in the smart hospital industry?

The growth of the smart hospital industry is driven by advancements in technology, the need for improved patient management systems, rising demand for telehealth services, and government initiatives promoting healthcare digitization.

Which region is the fastest Growing in the smart hospital?

North America is the fastest-growing region in the smart hospital market, expected to increase from $4.05 billion in 2023 to $13.18 billion in 2033, followed closely by Europe and Asia-Pacific with substantial growth projections.

Does ConsaInsights provide customized market report data for the smart hospital industry?

Yes, ConsaInsights offers customized market report data for the smart hospital industry, allowing clients to tailor reports according to their specific needs and insights on various market segments.

What deliverables can I expect from this smart hospital market research project?

From this smart hospital market research project, you can expect comprehensive reports that include market size, growth forecasts, competitive analysis, segment insights, and regional overviews to facilitate informed decision-making.

What are the market trends of smart hospital?

Current trends in the smart hospital market include increased adoption of IoT devices, enhancement of AI applications in diagnostics, growth of cloud computing, and a shift toward patient-centric care management strategies.