Smart Implantable Pumps Market Report

Published Date: 31 January 2026 | Report Code: smart-implantable-pumps

Smart Implantable Pumps Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Smart Implantable Pumps market, analyzing current trends, growth prospects, and forecast data from 2023 to 2033. It covers market size, segmentation, regional analysis, and key players in the industry.

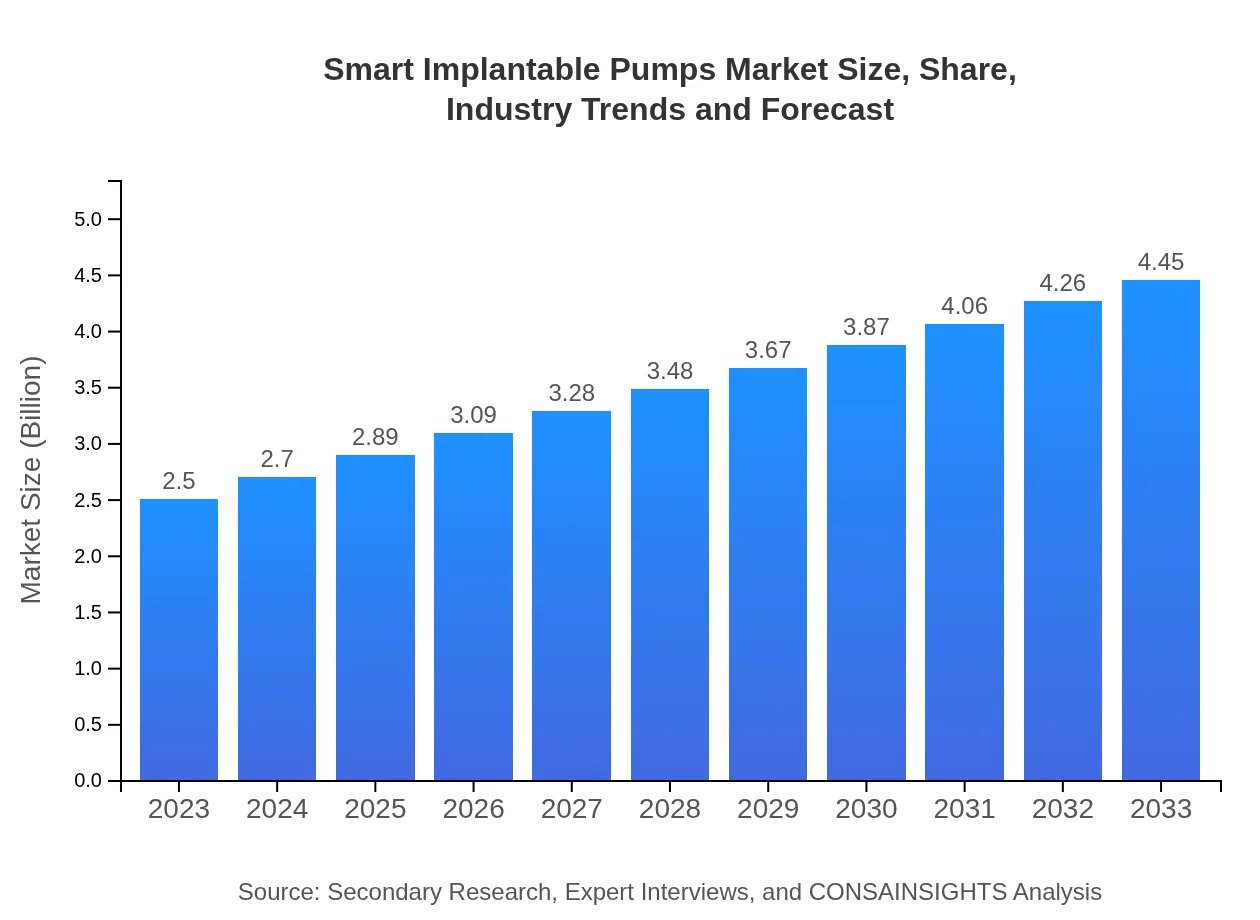

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $4.45 Billion |

| Top Companies | Medtronic , Boston Scientific, Abbott Laboratories, Bayer Healthcare |

| Last Modified Date | 31 January 2026 |

Smart Implantable Pumps Market Overview

Customize Smart Implantable Pumps Market Report market research report

- ✔ Get in-depth analysis of Smart Implantable Pumps market size, growth, and forecasts.

- ✔ Understand Smart Implantable Pumps's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Implantable Pumps

What is the Market Size & CAGR of Smart Implantable Pumps market in 2023?

Smart Implantable Pumps Industry Analysis

Smart Implantable Pumps Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Implantable Pumps Market Analysis Report by Region

Europe Smart Implantable Pumps Market Report:

The European market for Smart Implantable Pumps is projected to grow from $0.81 billion in 2023 to about $1.44 billion by 2033. This growth is fueled by the increasing prevalence of diabetes and chronic illnesses, alongside supportive government regulations and technological advancements in medical devices.Asia Pacific Smart Implantable Pumps Market Report:

The Asia Pacific region is expected to witness significant growth in the Smart Implantable Pumps market, with an estimated market size of $0.85 billion by 2033, up from $0.47 billion in 2023. The expansion is driven by increasing healthcare investments, rising chronic disease rates, and growing awareness of advanced medical technologies. Countries like China and India are leading the market due to high population density and a rising number of healthcare facilities.North America Smart Implantable Pumps Market Report:

The North American market is projected to increase from $0.92 billion in 2023 to approximately $1.63 billion by 2033. The United States holds the largest market share due to its advanced healthcare infrastructure, high adoption of innovative medical technologies, and significant investments in research and development. The presence of major market players further strengthens the region's market position.South America Smart Implantable Pumps Market Report:

In South America, the market is anticipated to grow from $0.09 billion in 2023 to $0.16 billion by 2033. The growth is attributed to the rising healthcare expenditure and increasing adoption of technologically advanced medical devices. However, economic challenges and regulatory barriers may restrain growth in certain countries within the region.Middle East & Africa Smart Implantable Pumps Market Report:

In the Middle East and Africa, the Smart Implantable Pumps market is expected to rise from $0.21 billion in 2023 to $0.37 billion by 2033, driven by improving healthcare access and rising consumer awareness about advanced healthcare technologies. Key markets in this region include South Africa and the UAE.Tell us your focus area and get a customized research report.

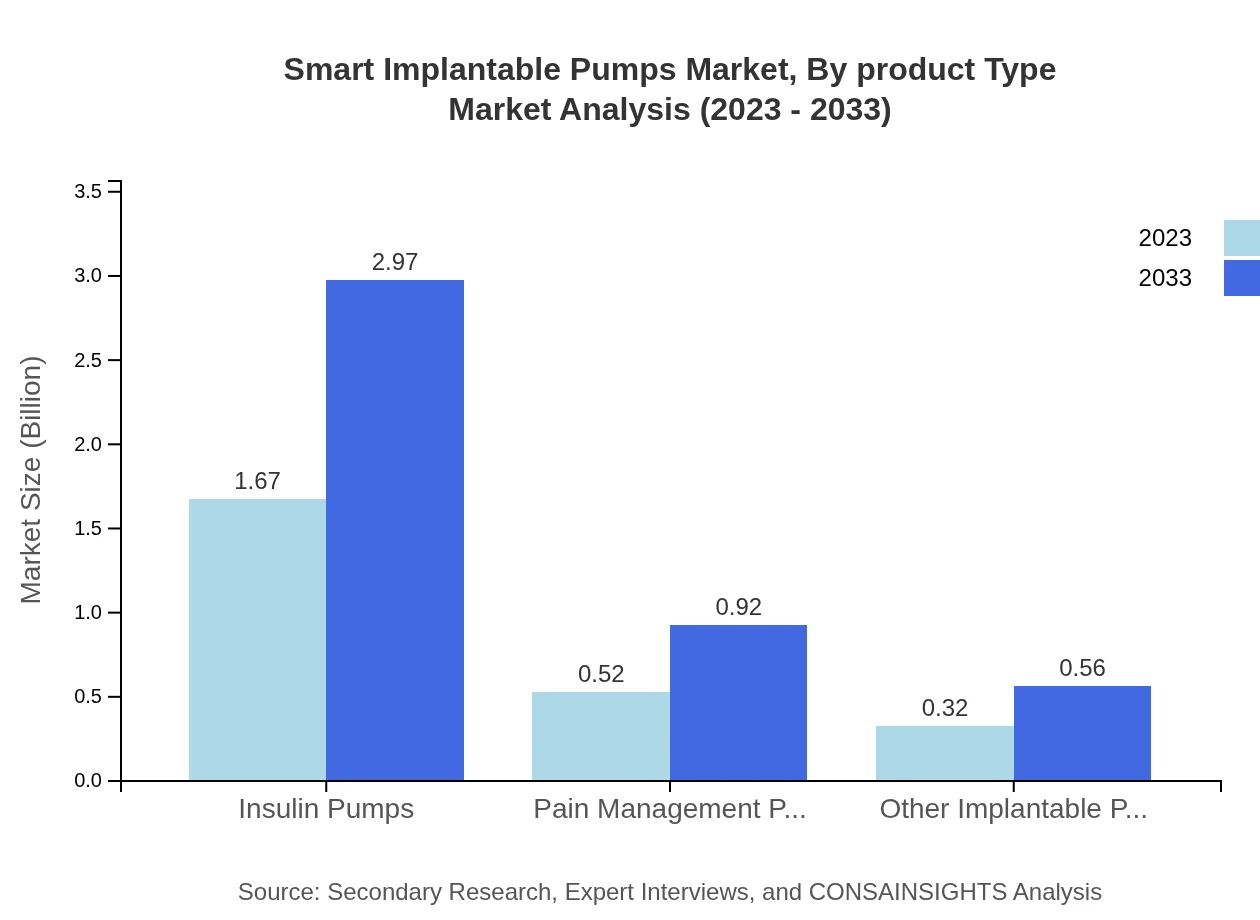

Smart Implantable Pumps Market Analysis By Product Type

The analysis by product type reveals that insulin pumps are leading, with a market size of $1.67 billion in 2023, growing to $2.97 billion in 2033, maintaining a market share of 66.77%. Pain management pumps follow, showing promising growth from $0.52 billion to $0.92 billion, accounting for 20.63% of the market share. Other types, including microelectronics and wireless technology, are also diversifying the product offerings in the market.

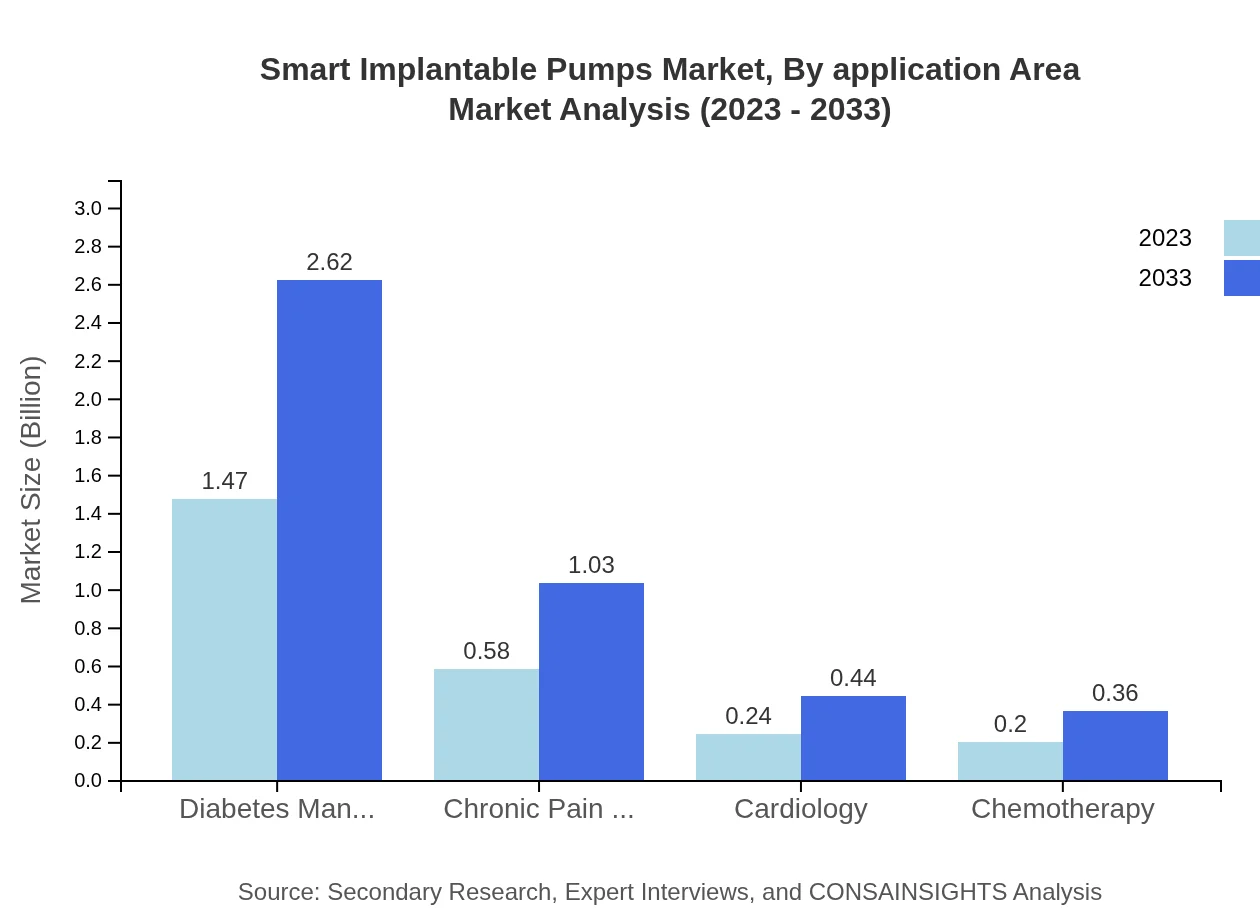

Smart Implantable Pumps Market Analysis By Application Area

In terms of application, diabetes management remains at the forefront, with a size of $1.47 billion in 2023 and set to grow to $2.62 billion by 2033, capturing 58.84% of the market share. Chronic pain management is also a significant segment, growing from $0.58 billion to $1.03 billion, holding 23.23% of the market share. The cardiology and chemotherapy segments are smaller yet crucial, reflecting diverse medical approaches to treatment.

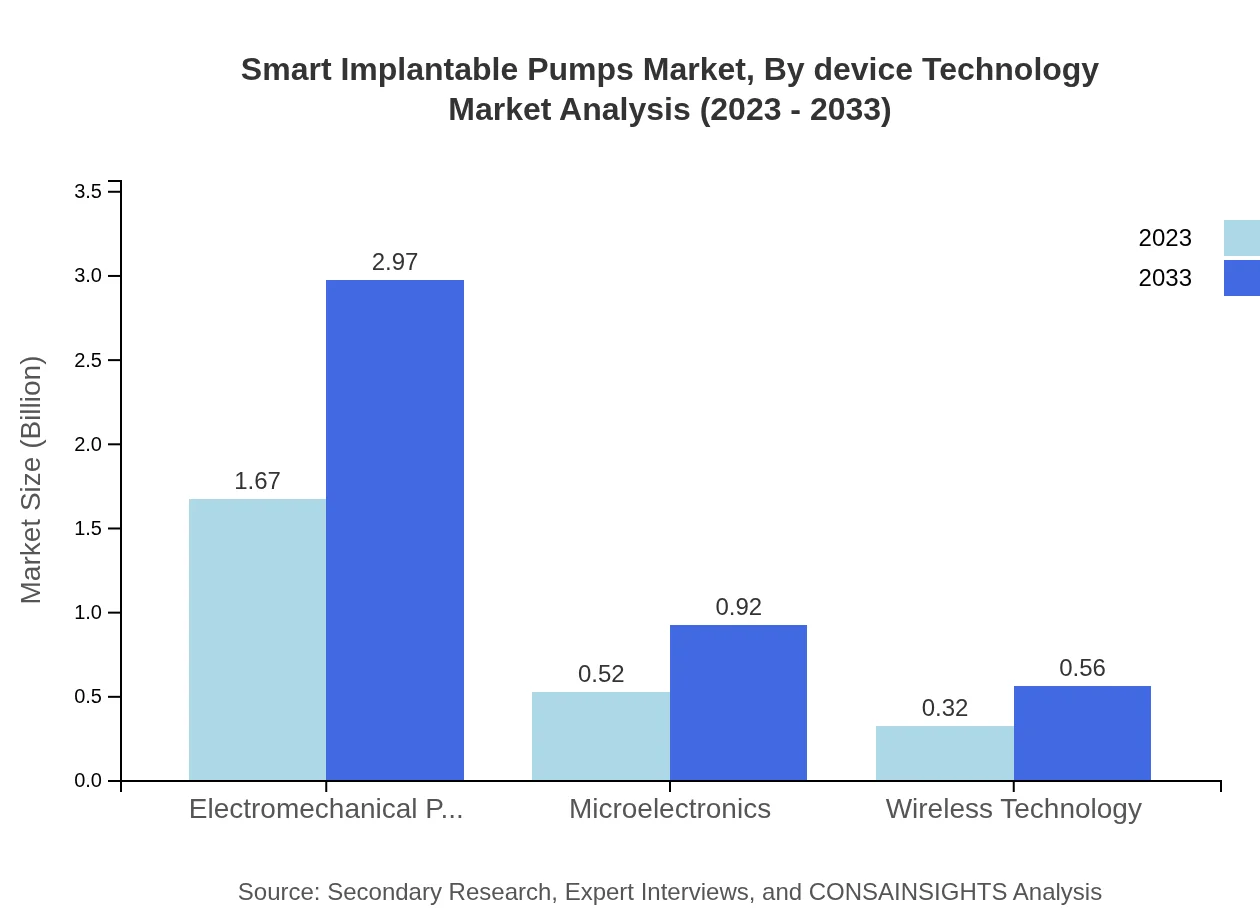

Smart Implantable Pumps Market Analysis By Device Technology

In the device technology segment, electromechanical pumps dominate with a size estimated at $1.67 billion in 2023, expected to reach $2.97 billion by 2033, maintaining a strong share of 66.77%. Microelectronics are growing in importance, moving from $0.52 billion to $0.92 billion, with a share of 20.63%, as manufacturers innovate towards more compact and efficient devices.

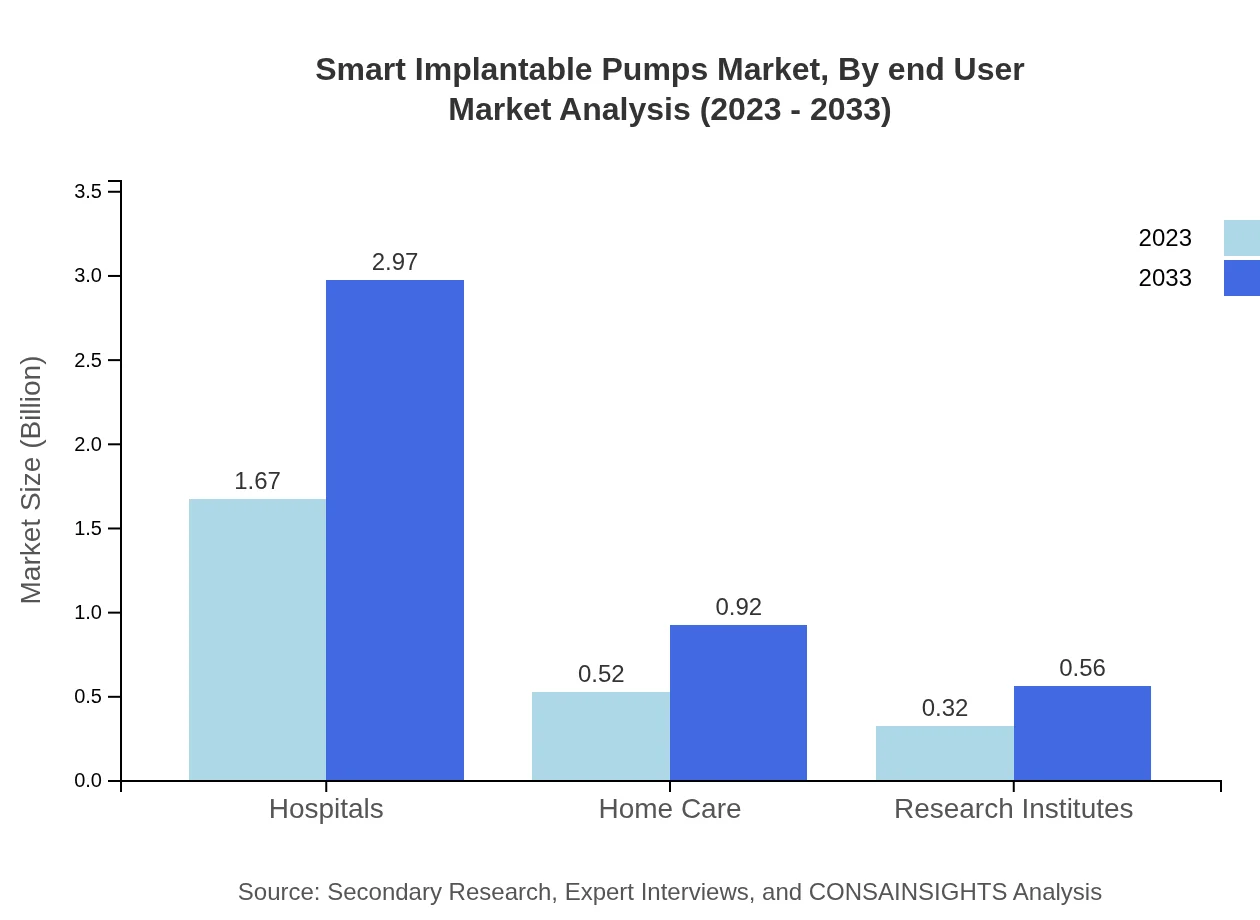

Smart Implantable Pumps Market Analysis By End User

Hospitals are the largest end-users of Smart Implantable Pumps, reflecting a market size of $1.67 billion in 2023, increasing to $2.97 billion by 2033, with a stable share of 66.77%. Home care settings are also important, growing from $0.52 billion to $0.92 billion, indicating increased patient preference for home-based healthcare solutions.

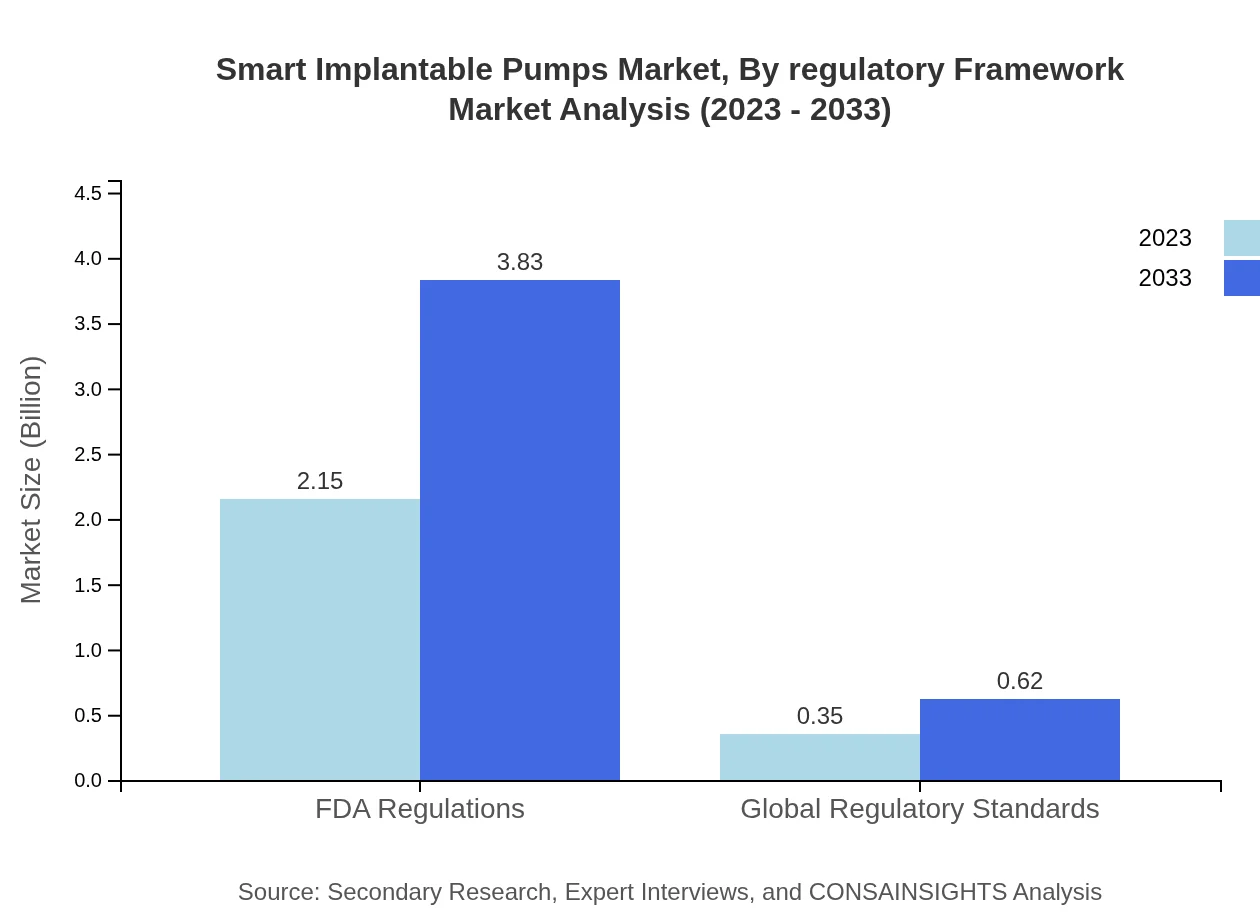

Smart Implantable Pumps Market Analysis By Regulatory Framework

The market under regulatory frameworks indicates the influence of FDA regulations, projected to grow from $2.15 billion in 2023 to $3.83 billion in 2033, with an 86.02% market share. Global regulatory standards are also notable, growing from $0.35 billion to $0.62 billion, accounting for 13.98% of the market, emphasizing the importance of compliance in the industry.

Smart Implantable Pumps Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Implantable Pumps Industry

Medtronic :

Medtronic is a pioneering leader in medical technology, specializing in the development of advanced, reliable insulin pumps and implantable devices to improve patient outcomes.Boston Scientific:

Boston Scientific focuses on innovative implantable pumps for cardiology and pain management, emphasizing cutting-edge technology to enhance medical device efficacy.Abbott Laboratories:

Abbott provides a range of implantable pumps, particularly for diabetes care, harnessing technology to deliver integrated solutions for patient management.Bayer Healthcare:

Bayer is involved in developing advanced implantable drug delivery systems, focusing on innovations to aid chemotherapy and chronic disease management.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Implantable Pumps?

The global smart implantable pumps market is currently valued at approximately $2.5 billion and is expected to grow at a CAGR of 5.8% from 2023 to 2033. This growth is indicative of the increasing demand for advanced medical solutions.

What are the key market players or companies in this smart Implantable Pumps industry?

Key market players in the smart implantable pumps industry include major medical device manufacturers and biotechnology firms that are innovating in pump technology, drug delivery systems, and patient care solutions, contributing significantly to market dynamics.

What are the primary factors driving the growth in the smart implantable pumps industry?

The growth in the smart implantable pumps industry is driven by technological advancements, increasing prevalence of chronic diseases, rising demand for minimally invasive procedures, and growing adoption of home healthcare services.

Which region is the fastest Growing in the smart implantable pumps?

The fastest-growing region in the smart implantable pumps market is North America, projected to increase from $0.92 billion in 2023 to $1.63 billion in 2033, driven by high healthcare expenditure and advanced healthcare infrastructure.

Does ConsaInsights provide customized market report data for the smart implantable pumps industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, providing in-depth insights and analyses for stakeholders in the smart implantable pumps industry to make informed decisions.

What deliverables can I expect from this smart implantable pumps market research project?

From the smart implantable pumps market research project, clients can expect comprehensive market analysis, segmented data, growth forecasts, competitive landscape evaluations, and actionable business recommendations based on current trends.

What are the market trends of smart implantable pumps?

Current market trends for smart implantable pumps include increased integration of digital technologies, a focus on patient-centric designs, growth in telehealth services, and enhanced regulatory compliance standards within the medical device sector.