Smart Label Market Report

Published Date: 02 February 2026 | Report Code: smart-label

Smart Label Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Smart Label market, including key insights into market size, growth projections, segment analysis, and emerging trends from 2023 to 2033.

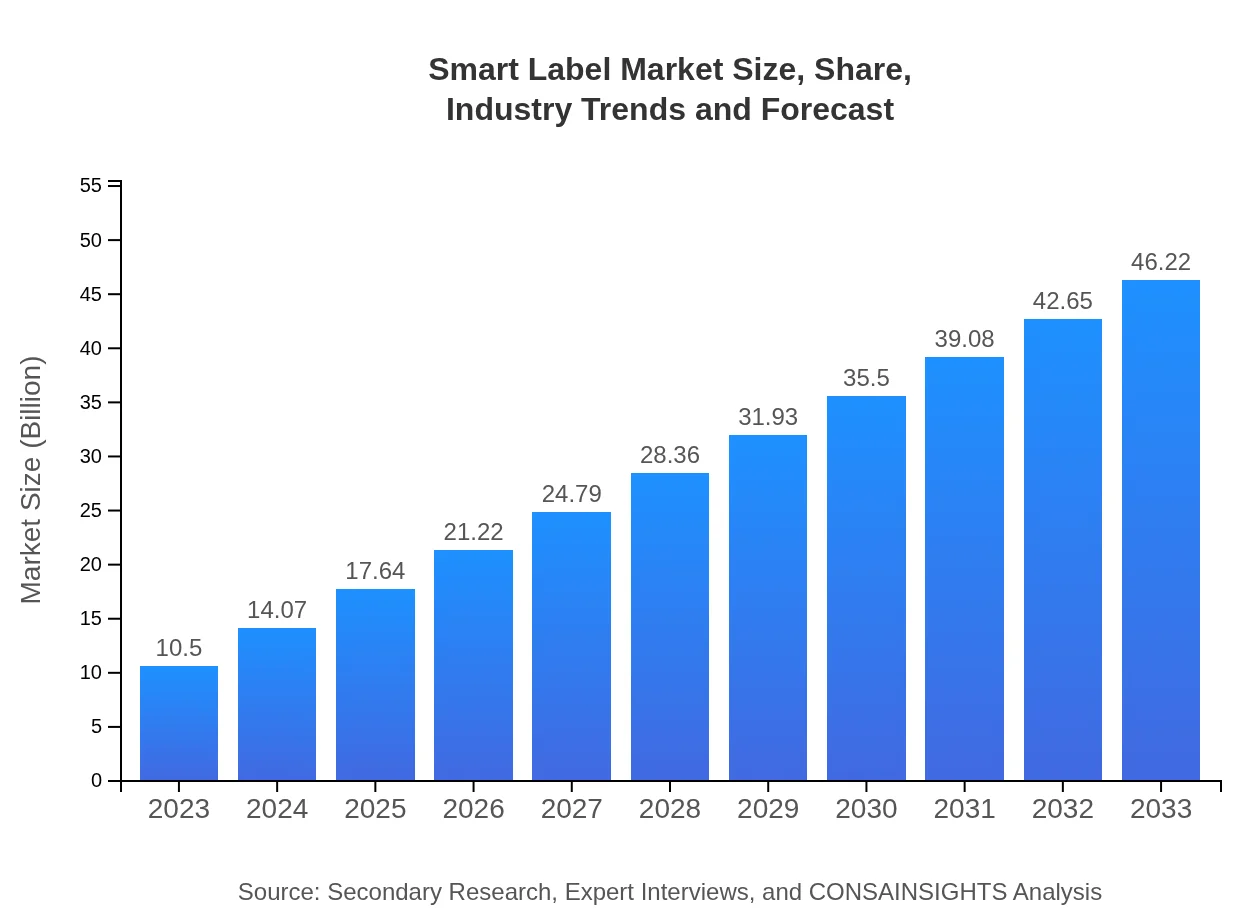

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $46.22 Billion |

| Top Companies | Zebra Technologies, Avery Dennison, Sato Holdings, Impinj |

| Last Modified Date | 02 February 2026 |

Smart Label Market Overview

Customize Smart Label Market Report market research report

- ✔ Get in-depth analysis of Smart Label market size, growth, and forecasts.

- ✔ Understand Smart Label's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Label

What is the Market Size & CAGR of Smart Label market in 2023?

Smart Label Industry Analysis

Smart Label Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Label Market Analysis Report by Region

Europe Smart Label Market Report:

The Smart Label market in Europe is poised for significant growth, moving from a value of USD 2.87 billion in 2023 to USD 12.64 billion by 2033. Regulatory advancements and increasing end-user demands for consistent product information drive market expansion.Asia Pacific Smart Label Market Report:

The Asia Pacific region is witnessing substantial growth in the Smart Label market, with an estimated market size of USD 2.01 billion in 2023, projected to reach USD 8.84 billion by 2033. This growth is driven by increasing manufacturing activities, advancements in technology, and an expanding retail sector.North America Smart Label Market Report:

North America is one of the leading regions in the Smart Label market, holding a size of USD 3.44 billion in 2023 and expected to grow to USD 15.13 billion by 2033. The region benefits from technological advancements and the presence of major players intensifying competition.South America Smart Label Market Report:

In South America, the Smart Label market is emerging steadily, with a market size of USD 0.94 billion in 2023, estimated to reach USD 4.13 billion by 2033. The rise of logistic infrastructures and enhanced supply chains are key drivers for this market.Middle East & Africa Smart Label Market Report:

The market size for Smart Label in the Middle East and Africa is estimated at USD 1.25 billion in 2023 and is expected to reach USD 5.49 billion by 2033. Growth factors include enhanced logistics frameworks and government investments in technology.Tell us your focus area and get a customized research report.

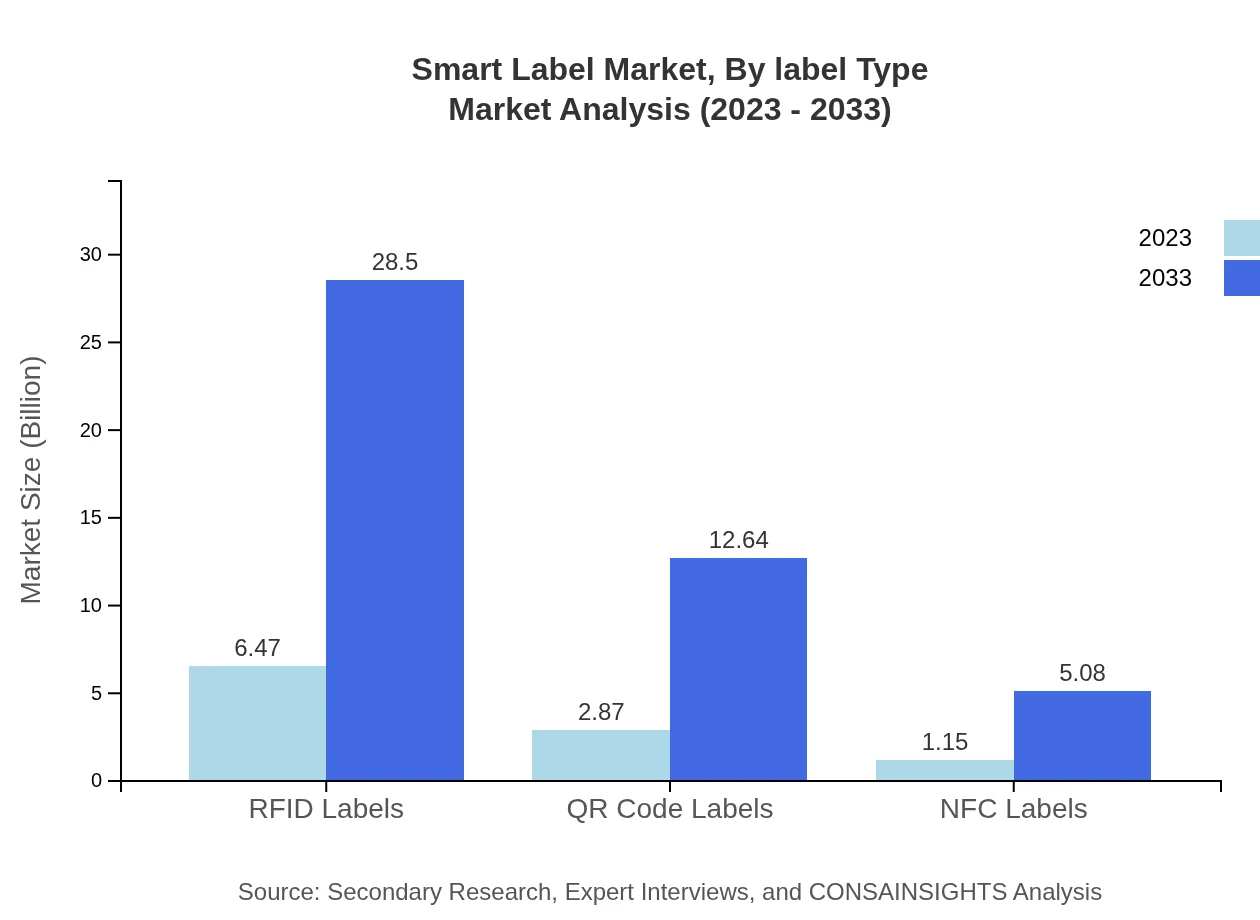

Smart Label Market Analysis By Label Type

The Smart Label market, segmented by label type, shows that RFID labels dominate this segment, with a size of USD 6.47 billion in 2023, projected to reach USD 28.50 billion by 2033. QR Code labels and NFC labels also report significant market shares of USD 2.87 billion (2023) and USD 1.15 billion (2023), respectively.

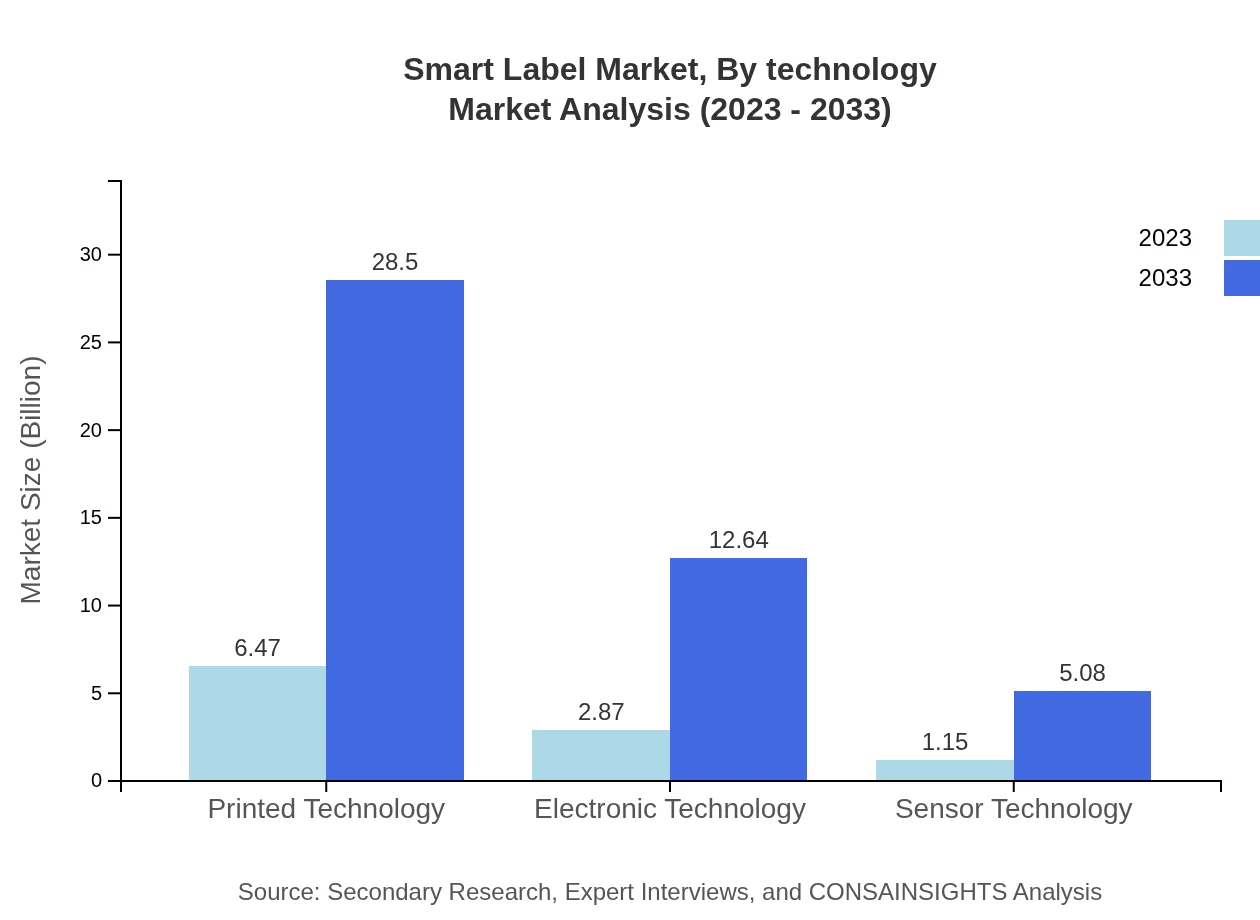

Smart Label Market Analysis By Technology

Technologically, printed labels account for a substantial share valued at USD 6.47 billion in 2023, anticipated to grow to USD 28.50 billion by 2033. Electronic and sensor technologies, while smaller in market share, show promising growth with increasing applications in various sectors.

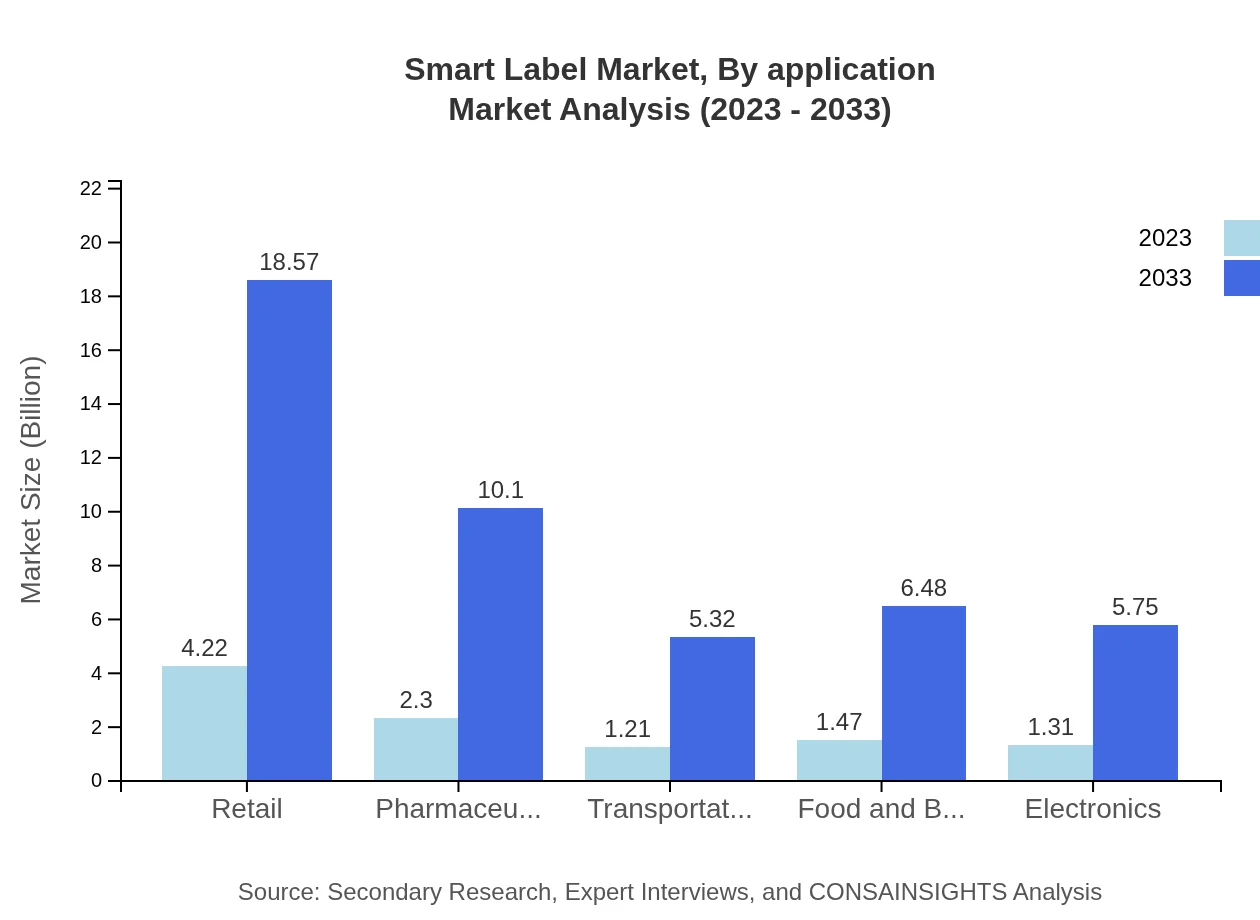

Smart Label Market Analysis By Application

Applications in the retail sector account for USD 4.22 billion in 2023, expecting to rise to USD 18.57 billion by 2033, showcasing the increasing implementation of smart labels for brand protection and personalization.

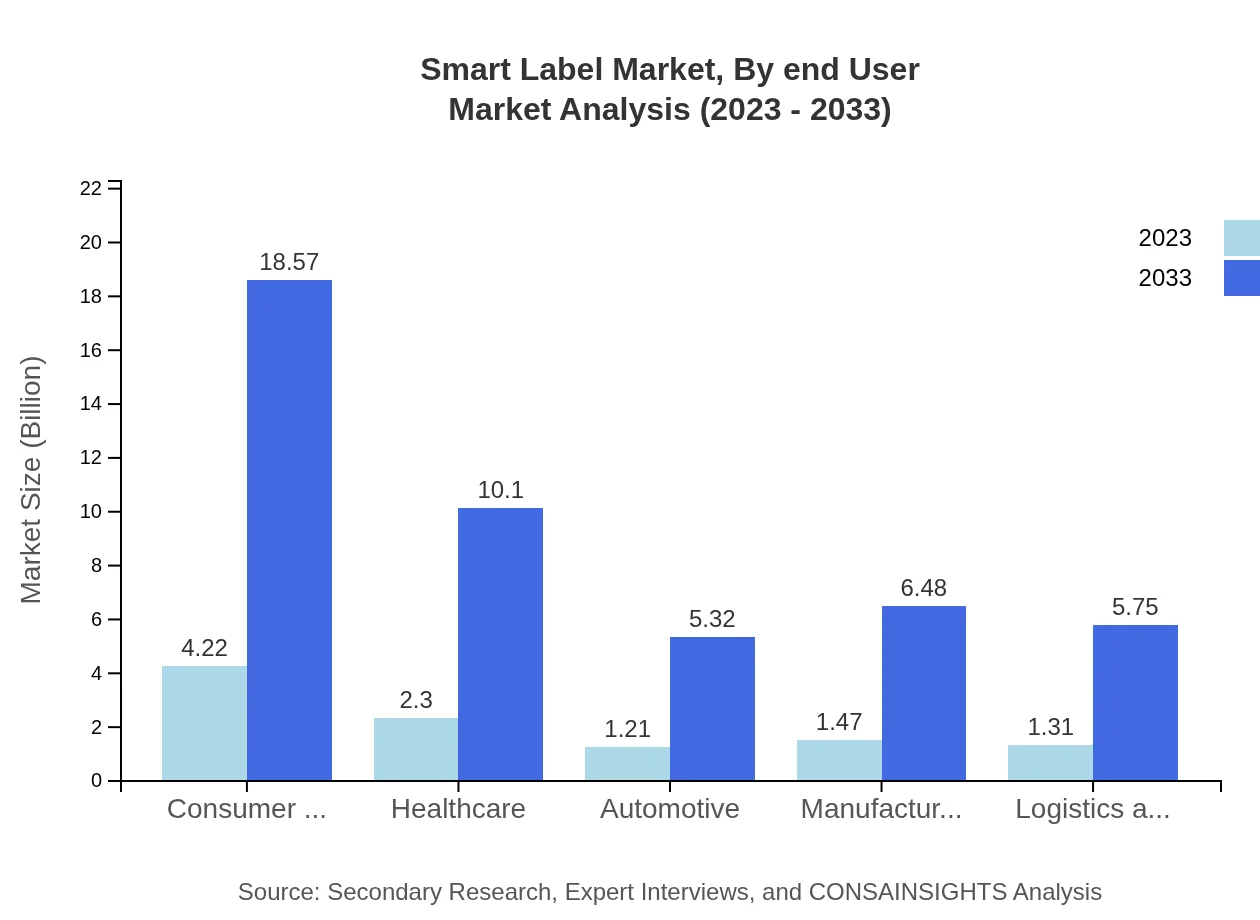

Smart Label Market Analysis By End User

End-user segmentation reveals that consumer goods lead with a value of USD 4.22 billion in 2023, expected to reach USD 18.57 billion by 2033. The healthcare sector also plays a significant role with anticipated growth in tracking and compliance.

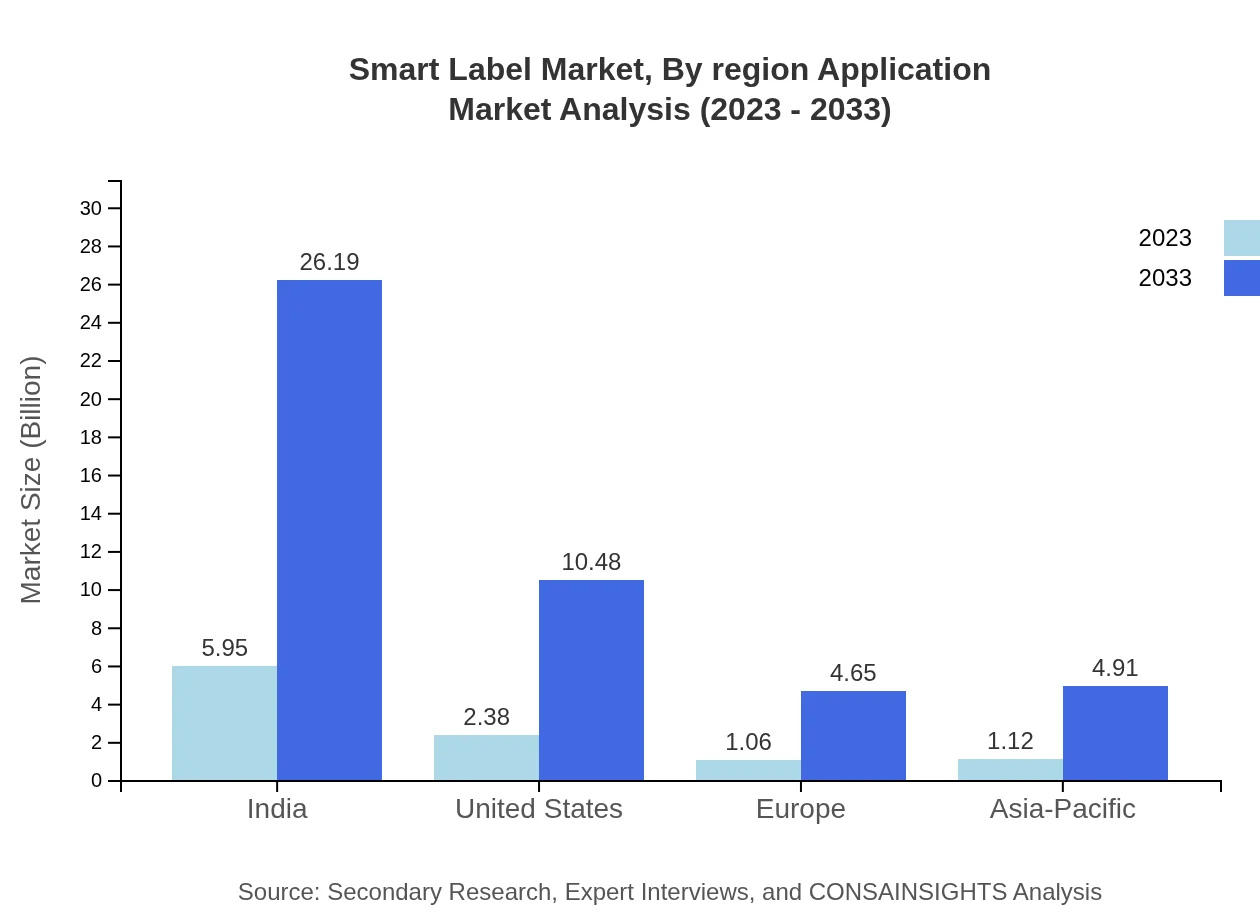

Smart Label Market Analysis By Region Application

Analysis by region shows North America leading both in size and growth potential, followed closely by Europe and Asia Pacific, indicating regional adoption trends aligned with technological advancements and consumer demand.

Smart Label Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Label Industry

Zebra Technologies:

A leader in mobile computing and printing technologies, Zebra offers comprehensive smart labeling solutions that empower businesses to enhance operational productivity.Avery Dennison:

Avery Dennison is a global leader in labeling and packaging materials, providing innovative smart labeling solutions tailored to diverse industries.Sato Holdings:

Sato Holdings specializes in barcode and labeling solutions, focusing on enhancing visibility and traceability within supply chains.Impinj:

Impinj delivers leading-edge RFID solutions, enhancing supply chain operations and consumer engagement for businesses across various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Label?

The global smart label market is projected to reach approximately $10.5 billion by 2033, growing at a robust CAGR of 15.2%. The market size for 2023 is also expected to show significant growth from its initial value.

What are the key market players or companies in this smart Label industry?

Key players in the smart label market include major companies involved in technology and manufacturing sectors, focusing on RFID, NFC, and electronic labels. Their innovations and partnerships significantly influence market dynamics.

What are the primary factors driving the growth in the smart label industry?

Growth in the smart label industry is driven by increasing demand for enhanced logistical efficiency, technological advancements in labeling technologies, and significant investments in supply chain management solutions.

Which region is the fastest Growing in the smart label market?

The Asia Pacific region is experiencing the fastest growth in the smart label market, expected to expand from $2.01 billion in 2023 to $8.84 billion by 2033, reflecting a substantial rise in demand.

Does ConsaInsights provide customized market report data for the smart Label industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the smart label industry, allowing for deeper insights and focused market analysis.

What deliverables can I expect from this smart label market research project?

Deliverables typically include a comprehensive report containing market analysis, forecasts, competitive landscape, segmented data, and insights into regional trends in the smart label market.

What are the market trends of smart label?

Current trends in the smart label market highlight a shift towards digital solutions, increased adoption of NFC and RFID technologies, and growth in sectors like healthcare and retail, indicating evolving use cases and consumer demand.