Smart Lighting Market Report

Published Date: 31 January 2026 | Report Code: smart-lighting

Smart Lighting Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Smart Lighting market from 2023 to 2033, offering insights into market size, growth trends, technological advancements, and regional dynamics. It aims to provide a comprehensive understanding of the industry's current landscape and future trajectory.

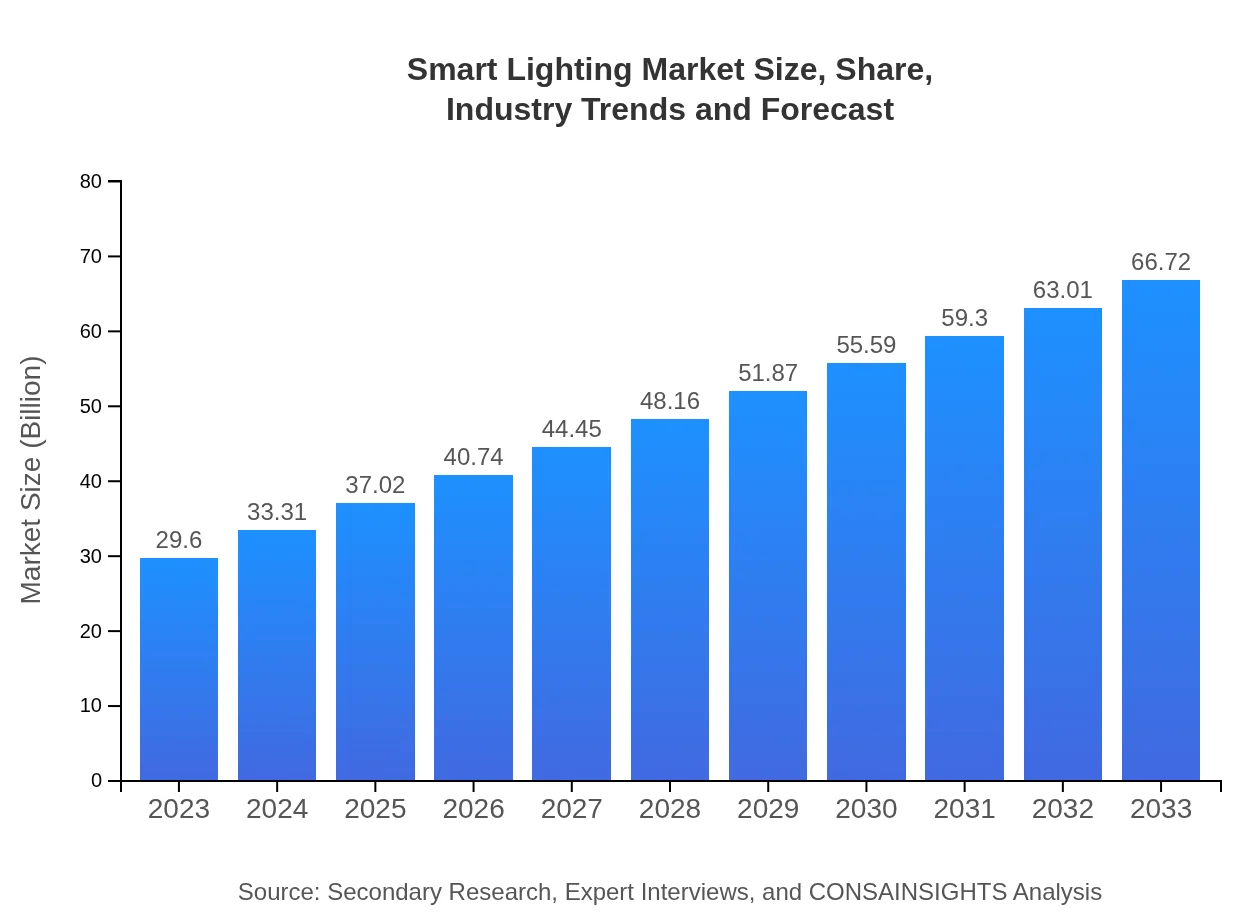

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $29.60 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $66.72 Billion |

| Top Companies | Philips Lighting (Signify), Osram Licht AG, General Electric Company, Acuity Brands, Inc., Honeywell International Inc. |

| Last Modified Date | 31 January 2026 |

Smart Lighting Market Overview

Customize Smart Lighting Market Report market research report

- ✔ Get in-depth analysis of Smart Lighting market size, growth, and forecasts.

- ✔ Understand Smart Lighting's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Lighting

What is the Market Size & CAGR of Smart Lighting in 2023?

Smart Lighting Industry Analysis

Smart Lighting Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Lighting Market Analysis Report by Region

Europe Smart Lighting Market Report:

The European Smart Lighting market is anticipated to grow from $7.22 billion in 2023 to $16.28 billion in 2033, supported by strict energy efficiency policies within the EU and growing demand for smart city initiatives. Countries such as Germany, the UK, and France are expected to lead the market, focusing on integrating smart solutions across various sectors.Asia Pacific Smart Lighting Market Report:

The Asia-Pacific region is projected to grow from a market size of $6.36 billion in 2023 to $14.34 billion by 2033, driven by increased urbanization and investment in smart city projects. The demand for energy-efficient solutions is also fostering growth as countries focus on sustainability. China and India are expected to be the forefront in adoption due to their vast population and rapid economic development.North America Smart Lighting Market Report:

North America holds a significant market share in the Smart Lighting industry, growing from $10.64 billion in 2023 to $23.99 billion by 2033. The United States, in particular, is at the forefront of adopting smart technologies, driven by innovations from technology firms and regulatory incentives promoting energy efficiency. The considerable focus on retrofitting existing infrastructure further propels market expansion.South America Smart Lighting Market Report:

In South America, the market size is expected to rise from $2.58 billion in 2023 to $5.82 billion by 2033. Brazil and Argentina lead this growth due to rising disposable incomes and urban expansion. Growing awareness regarding energy savings and government initiatives supporting sustainable development are likely to drive the adoption of smart lighting solutions.Middle East & Africa Smart Lighting Market Report:

The Middle East and Africa (MEA) market is projected to witness growth from $2.79 billion in 2023 to $6.29 billion by 2033. Rapid urbanization and a growing trend towards smart cities in countries like the UAE and South Africa are significant drivers. Government policies aimed at improving energy efficiency are also contributing to the rising adoption of smart lighting technologies.Tell us your focus area and get a customized research report.

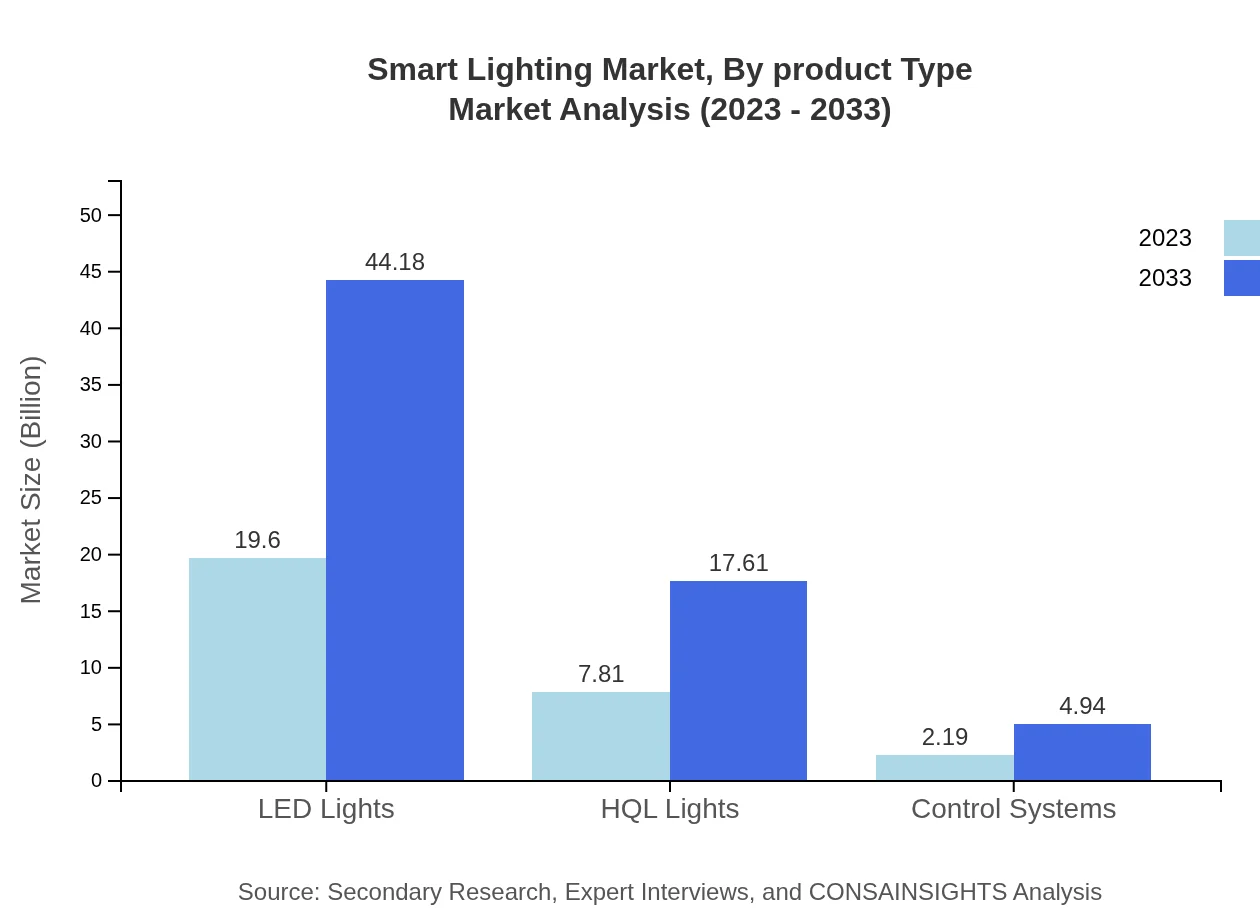

Smart Lighting Market Analysis By Product Type

The Smart Lighting market by product type includes LEDs, HQL lights, control systems, and more. LED lights dominate the market, with a size increasing from $19.60 billion in 2023 to $44.18 billion by 2033, accounting for 66.21% market share in both years. HQL lights are growing in significance, projected to move from $7.81 billion to $17.61 billion during the same period, holding 26.39% market share.

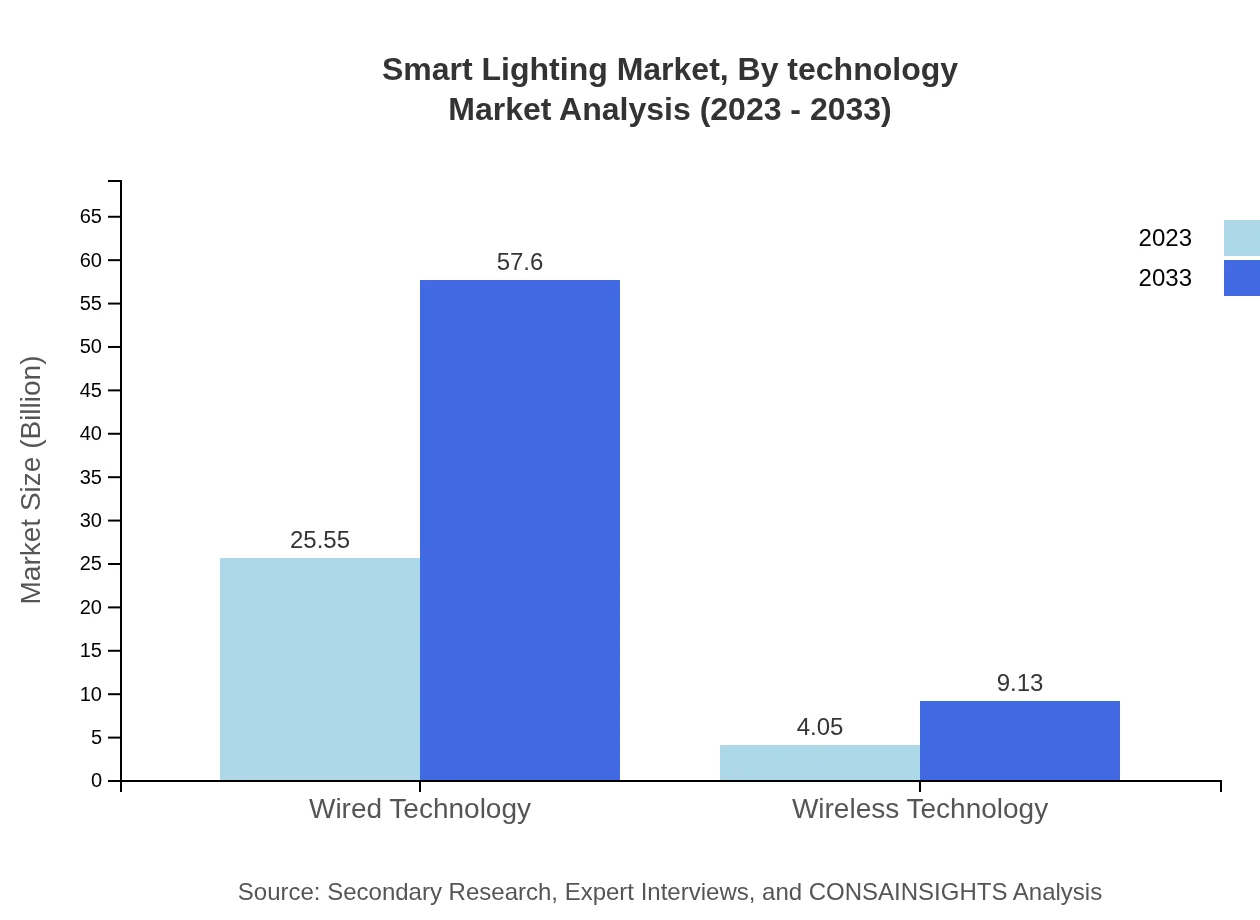

Smart Lighting Market Analysis By Technology

In terms of technology, the Smart Lighting market is segmented into wired and wireless technology. Wired technology is expected to expand from $25.55 billion in 2023 to $57.60 billion by 2033, commanding an 86.32% market share. Wireless technology, while smaller, will grow from $4.05 billion to $9.13 billion, maintaining a 13.68% share, driven by the growing demand for IoT-enabled lighting.

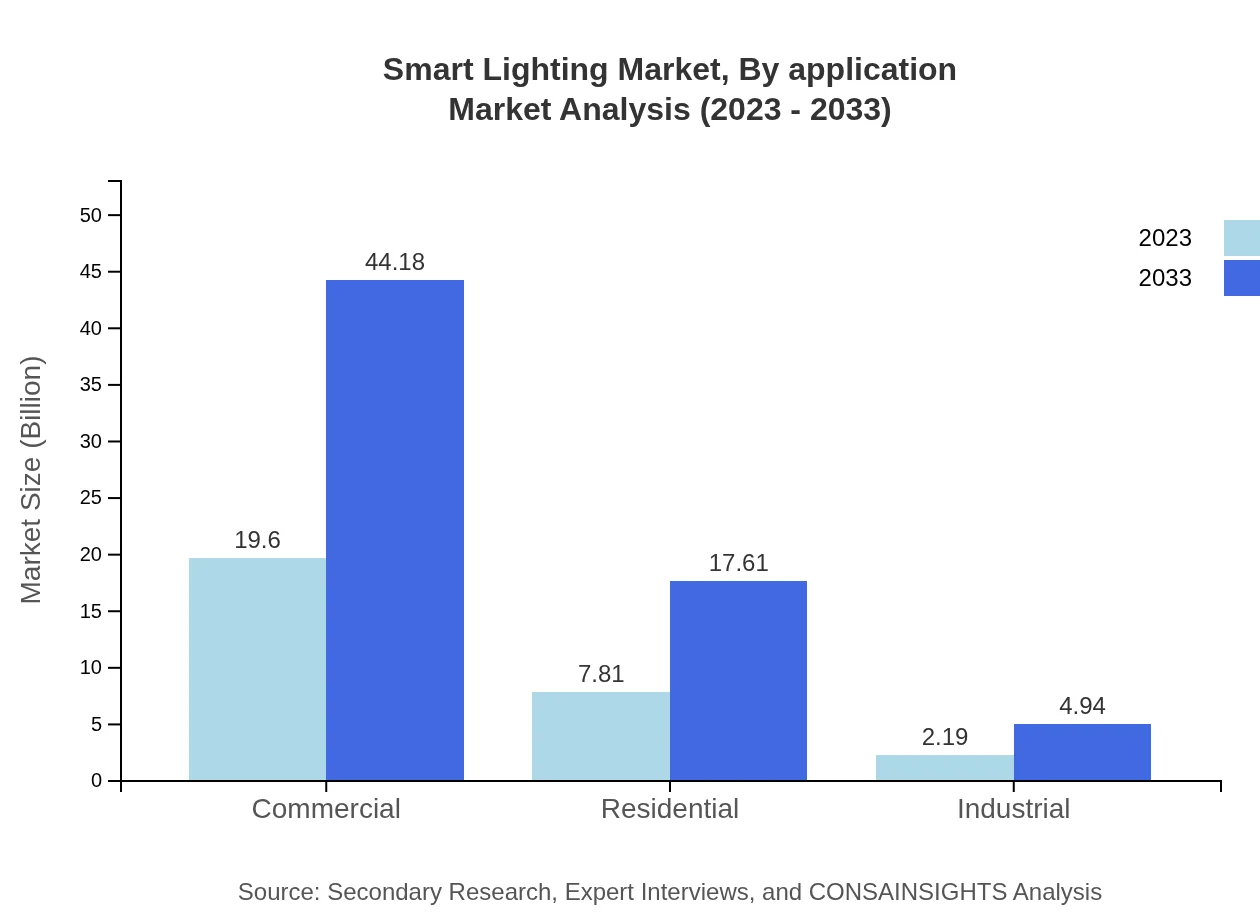

Smart Lighting Market Analysis By Application

Application-wise, the Smart Lighting market features various segments including residential, commercial, industrial, retail, and hospitality. The commercial segment continues to lead, projected to grow significantly from $19.60 billion to $44.18 billion, accounting for 66.21% market share. Residential applications are also notable, advancing from $7.81 billion to $17.61 billion.

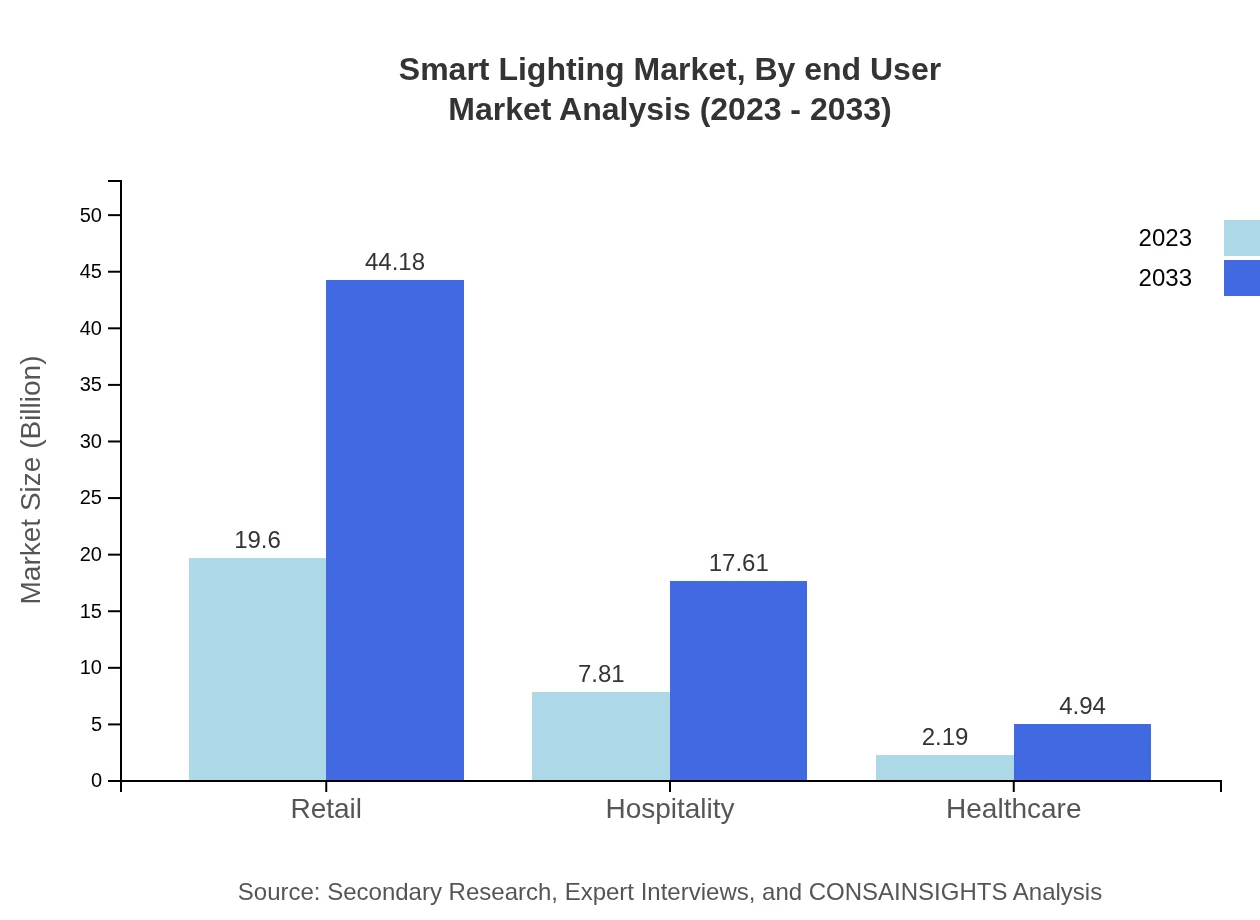

Smart Lighting Market Analysis By End User

Different end-user categories such as healthcare, hospitality, commercial, and residential shape the Smart Lighting market. The commercial sector accounts for a large part of the market, aligning with trends toward smart buildings and energy efficiency. The healthcare segment also shows potential, growing from $2.19 billion to $4.94 billion.

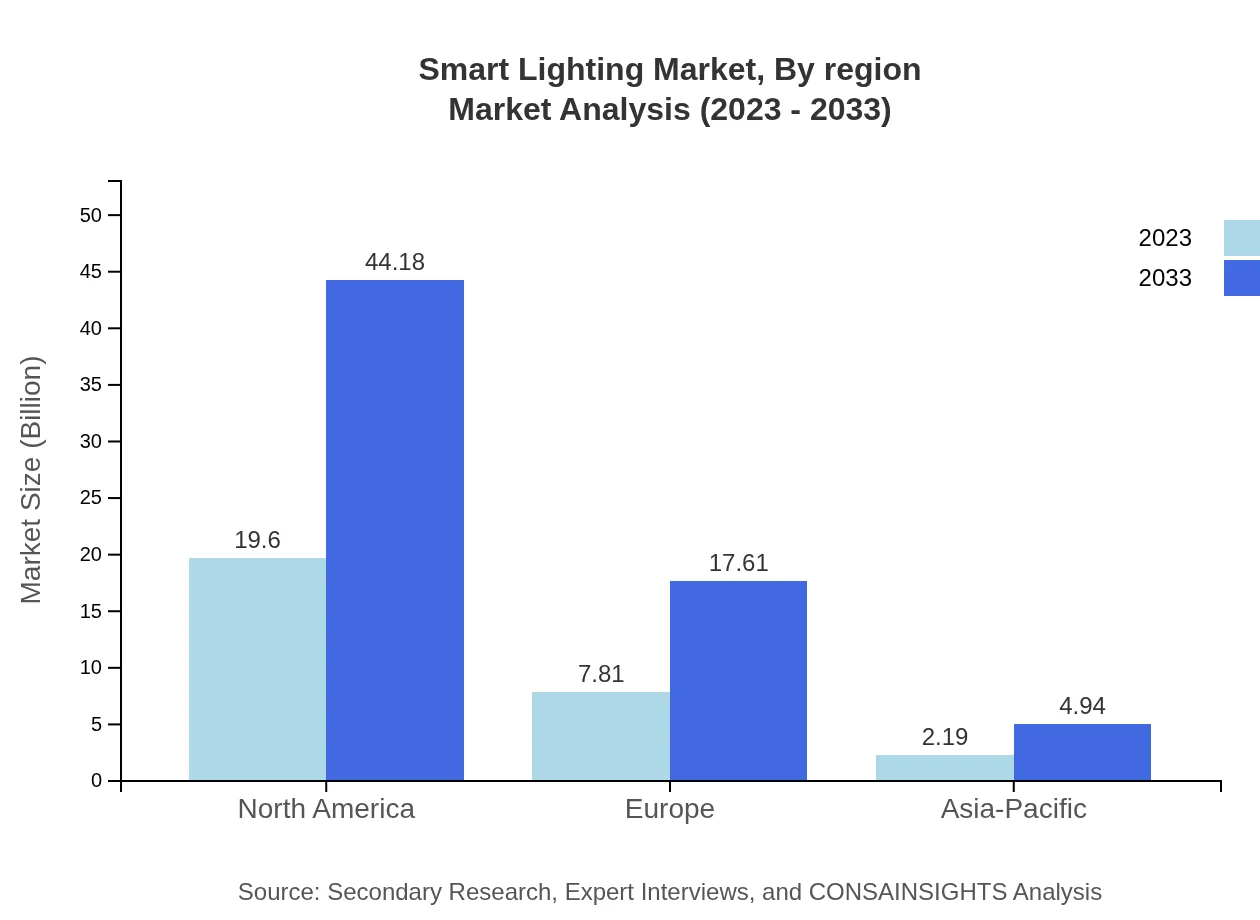

Smart Lighting Market Analysis By Region

Regional dynamics significantly influence the Smart Lighting market, with North America leading in market share. Each region presents unique growth drivers, such as government initiatives, urbanization efforts, and technological advancements affecting adoption rates and trends.

Smart Lighting Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Lighting Industry

Philips Lighting (Signify):

A global leader in lighting products, Philips Lighting focuses on innovative smart lighting solutions that enhance user experiences while promoting energy efficiency.Osram Licht AG:

Osram is known for its advanced technologies in the lighting industry, providing smart integrated lighting solutions tailored to both commercial and residential applications.General Electric Company:

GE Wiring focuses on advanced lighting solutions that leverage IoT and automated controls to enhance energy efficiency and promote sustainability.Acuity Brands, Inc.:

Acuity Brands specializes in smart and sustainable lighting solutions for commercial spaces, leading innovations in integrated controls and energy efficiency.Honeywell International Inc.:

Honeywell offers smart building solutions, including integrations for smart lighting, promoting energy efficiency and optimizing building operations.We're grateful to work with incredible clients.

FAQs

What is the market size of smart lighting?

The smart lighting market is expected to reach a size of approximately $29.6 billion by 2033, growing at a remarkable CAGR of 8.2% from its current status. This growth reflects the rising demand for energy-efficient lighting solutions worldwide.

What are the key market players or companies in the smart lighting industry?

Key players in the smart lighting market include major companies like Philips Lighting, GE Lighting, Acuity Brands, Osram, and Signify. These companies lead with innovative product offerings, technological advancements, and significant market shares.

What are the primary factors driving the growth in the smart lighting industry?

Growth in the smart lighting industry is primarily driven by increased energy efficiency, rising demand for smart home solutions, technological innovations, and supportive government regulations for smart infrastructure, encouraging sustainability and reduced energy consumption.

Which region is the fastest Growing in the smart lighting market?

North America is the fastest-growing region in the smart lighting market, projected to increase from $10.64 billion in 2023 to $23.99 billion by 2033. Europe and Asia-Pacific are also witnessing substantial growth, highlighting the global demand for smart lighting.

Does ConsaInsights provide customized market report data for the smart lighting industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the smart lighting industry. Clients can request insights based on particular segments, regions, or market dynamics for more focused strategic planning.

What deliverables can I expect from this smart lighting market research project?

Clients can expect detailed reports, data analytics, market forecasts, segment analysis, and competitive landscape evaluations as part of the smart lighting market research project. These deliverables support informed decision-making and strategic initiatives.

What are the market trends of smart lighting?

Current trends in the smart lighting market include an increase in the adoption of IoT-enabled technologies, the transition towards LED lighting, integration of smart controls, and a surge in eco-friendly initiatives, which are shaping the industry's future direction.