Smart Mining Market Report

Published Date: 22 January 2026 | Report Code: smart-mining

Smart Mining Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Smart Mining market from 2023 to 2033, focusing on market trends, size, segmentation, regional insights, and key players, along with future forecasts.

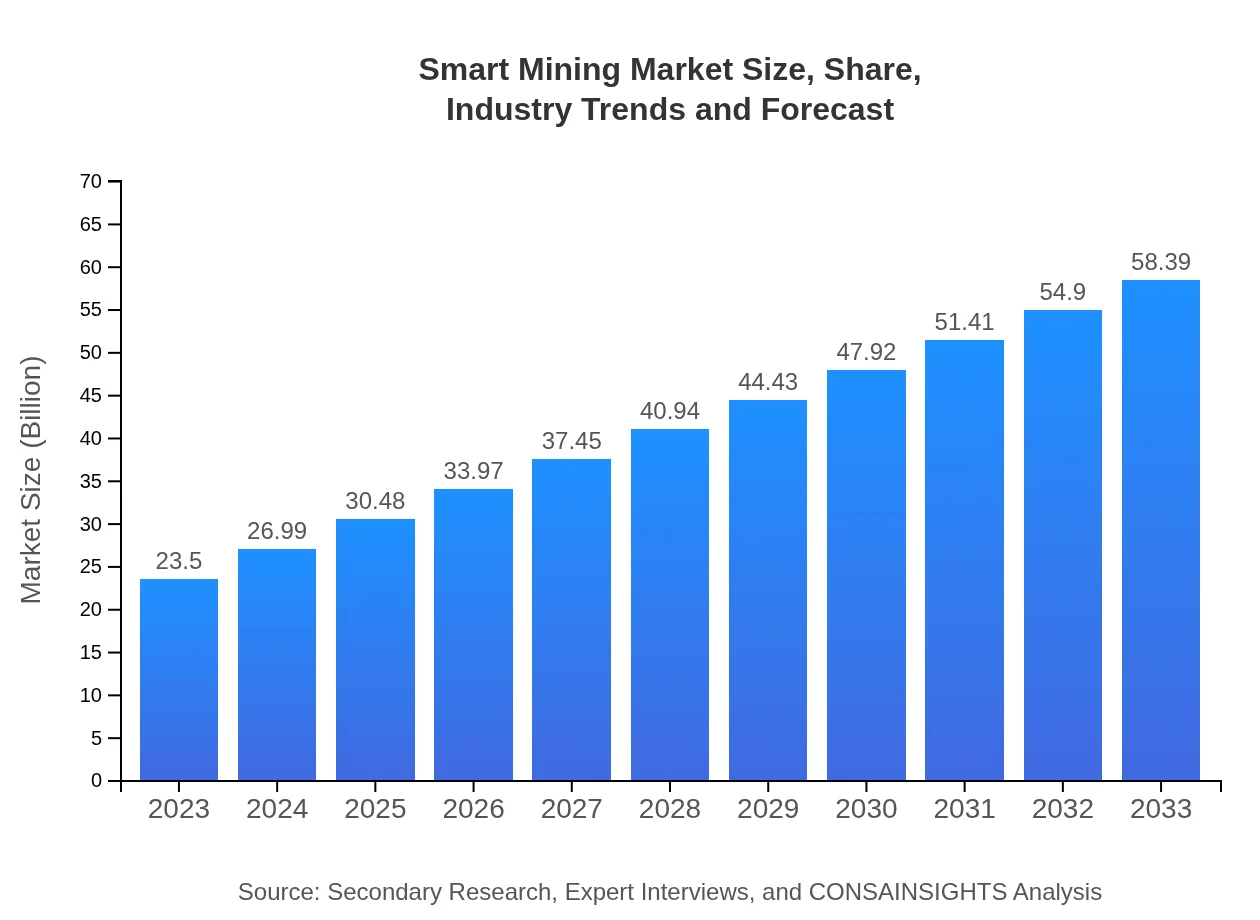

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $58.39 Billion |

| Top Companies | Caterpillar Inc., Komatsu Mining Corporation, Siemens AG, ABB Ltd., Hitachi Construction Machinery |

| Last Modified Date | 22 January 2026 |

Smart Mining Market Overview

Customize Smart Mining Market Report market research report

- ✔ Get in-depth analysis of Smart Mining market size, growth, and forecasts.

- ✔ Understand Smart Mining's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Mining

What is the Market Size & CAGR of Smart Mining market in 2023?

Smart Mining Industry Analysis

Smart Mining Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Mining Market Analysis Report by Region

Europe Smart Mining Market Report:

In Europe, the Smart Mining market is forecasted to grow from $6.06 billion in 2023 to $15.06 billion in 2033. The European Union's green initiatives and investment in digital technologies are significant motivators of growth, promoting sustainable mining practices.Asia Pacific Smart Mining Market Report:

The Asia Pacific region is expected to experience substantial growth, with the market size projected to increase from $4.55 billion in 2023 to $11.30 billion in 2033. Countries like China and Australia are at the forefront of adopting smart mining technologies, driven by increased mining activity and a focus on modernization.North America Smart Mining Market Report:

North America remains a critical market for Smart Mining, with expected growth from $8.23 billion in 2023 to $20.45 billion by 2033. Factors contributing to this expansion include advancements in mining technologies, a push for sustainability, and increased regulatory compliance.South America Smart Mining Market Report:

The South American market for Smart Mining is anticipated to grow from $2.29 billion in 2023 to $5.70 billion by 2033. The region's rich mineral reserves and ongoing investment in innovative technologies are encouraging growth, particularly in countries like Brazil and Chile.Middle East & Africa Smart Mining Market Report:

The Middle East and Africa are projected to increase from $2.36 billion in 2023 to $5.87 billion by 2033, fueled by rising demand for minerals and mining infrastructure developments in countries like South Africa and the UAE. The focus on improving operational efficiencies in this region is leading to increased adoption of smart mining technologies.Tell us your focus area and get a customized research report.

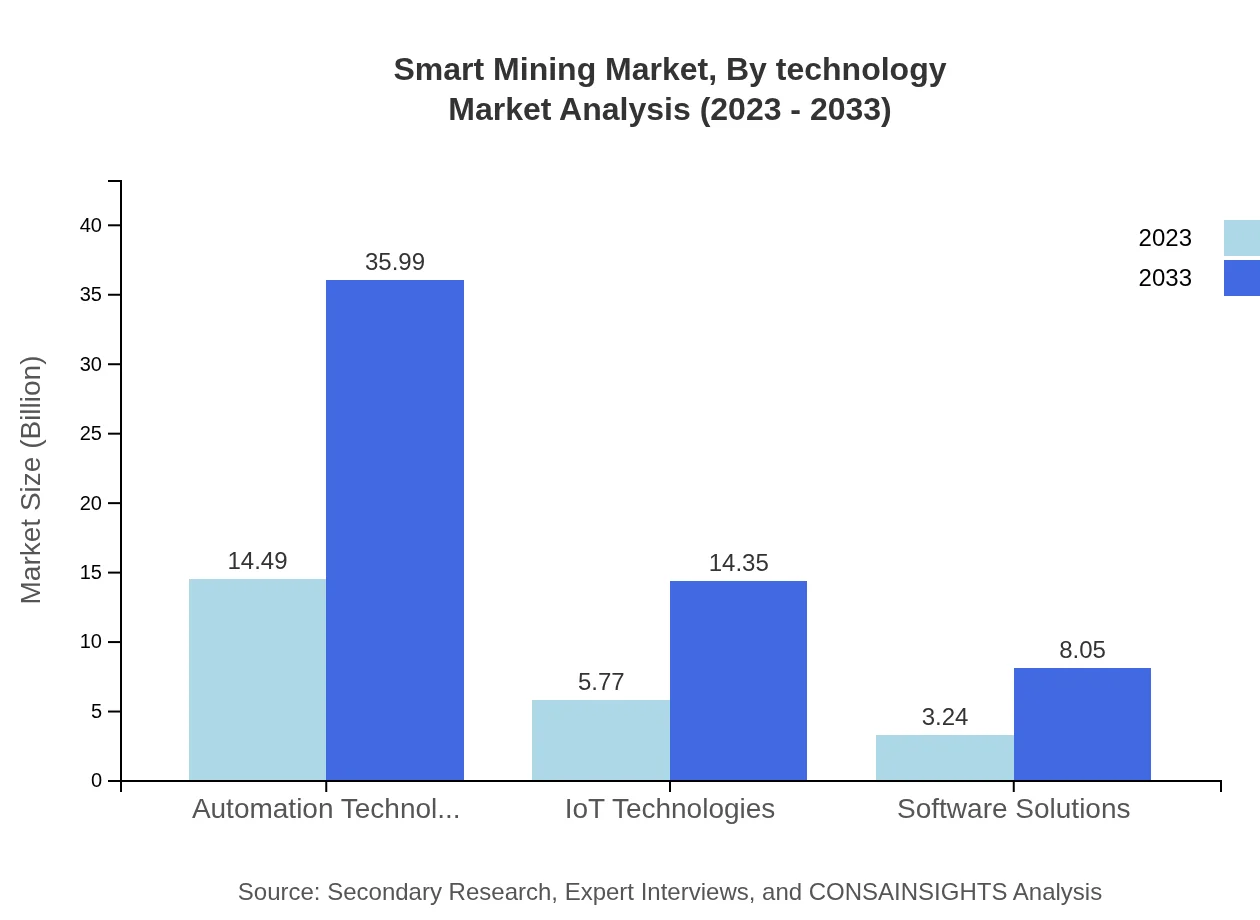

Smart Mining Market Analysis By Technology

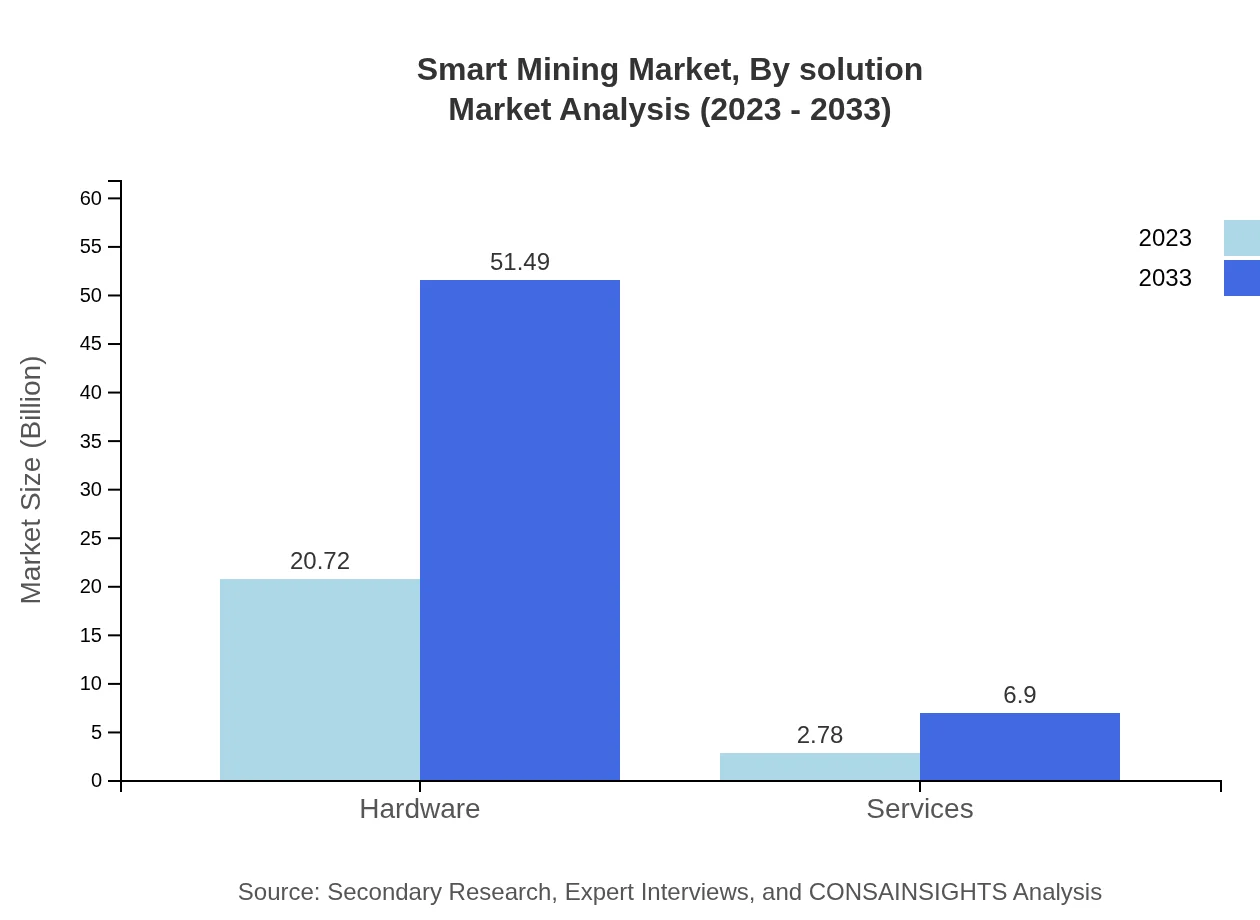

The Smart Mining market, categorized by technology, shows hardware dominating the sector with a projected market size of $20.72 billion in 2023, increasing to $51.49 billion by 2033, capturing 88.19% market share. Automation technologies and IoT solutions follow suit, emphasizing the trend of digital transformation within the mining industry.

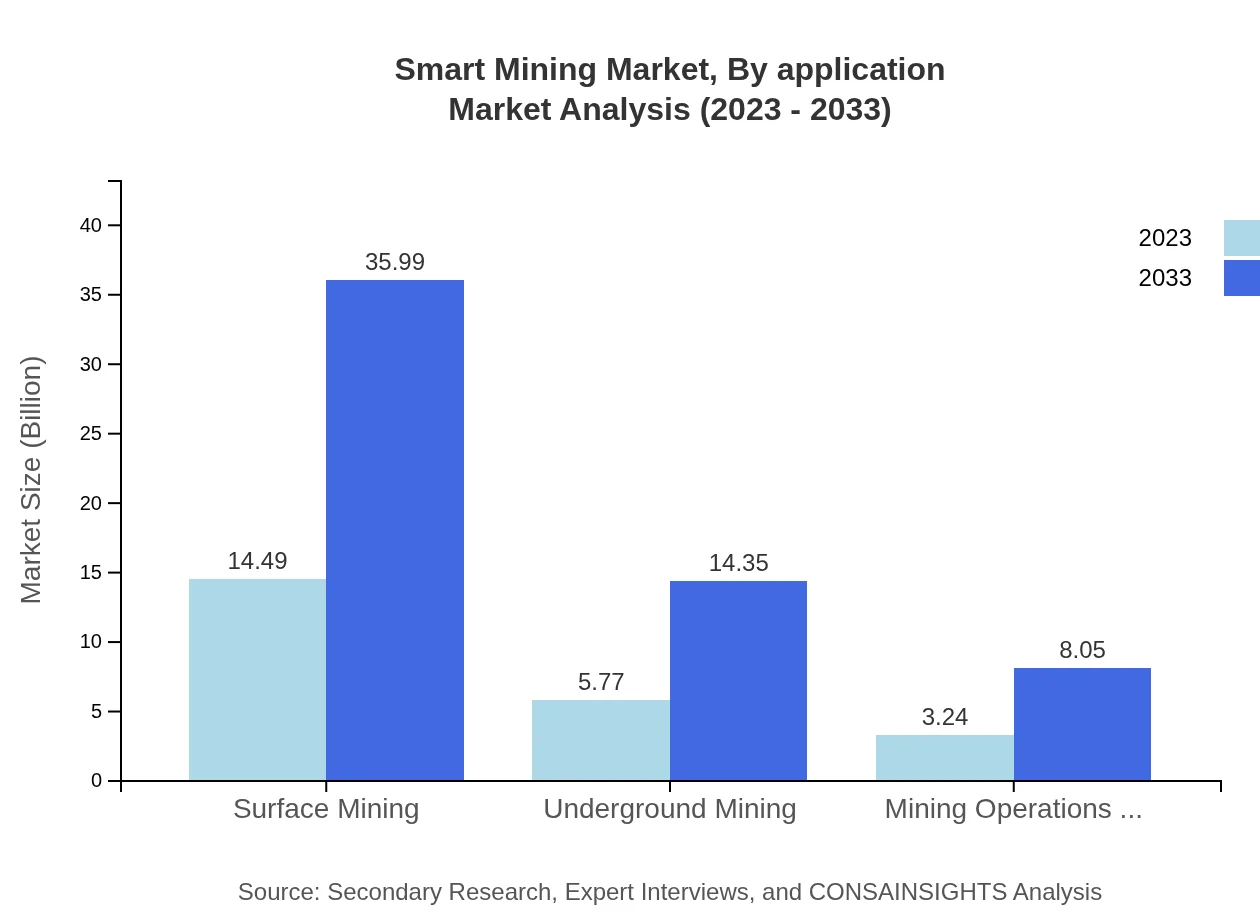

Smart Mining Market Analysis By Application

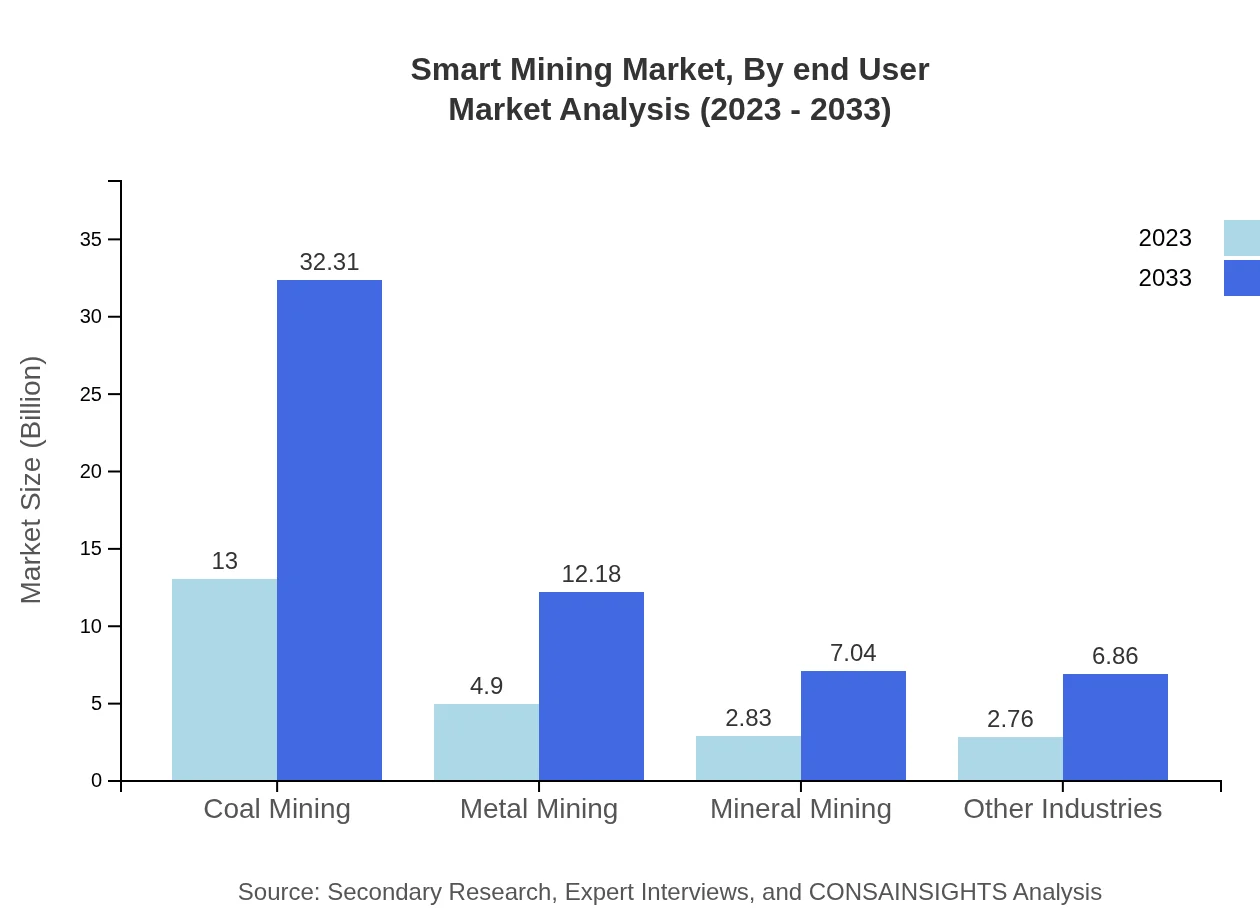

In terms of application, coal mining leads with a market size of $13.00 billion in 2023, projected to soar to $32.31 billion by 2033. With a share of 55.33%, coal remains pivotal in energy production, although metal and mineral mining are gaining ground as technology adoption grows.

Smart Mining Market Analysis By End User

The end-user segmentation reveals a comprehensive market, with large-scale mining companies being the primary consumers of smart mining solutions. The focus is shifting towards optimizing operations, leading to a projected increase in expenditure on technology-driven solutions across all minerals.

Smart Mining Market Analysis By Solution

In the solution segment, mining optimization technologies play a critical role with a market size of $3.24 billion in 2023 climbing to $8.05 billion by 2033. Services related to smart mining are also gaining attention, urging solution providers to innovate continuously to meet diverse client needs.

Smart Mining Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Mining Industry

Caterpillar Inc.:

Caterpillar is a global leader in construction and mining equipment, known for its innovative products that enhance efficiency in the mining sector through advanced technology solutions.Komatsu Mining Corporation:

Komatsu Mining specializes in mining solutions, providing pioneering technologies that significantly improve productivity and safety in various mining operations.Siemens AG:

Siemens provides automated and digital solutions that boost mining efficiency and safety, playing a vital role in the digital transformation of the industry.ABB Ltd.:

ABB is recognized for its cutting-edge automation and electrical equipment, enhancing operational efficiency and safety measures in smart mining.Hitachi Construction Machinery:

Hitachi offers innovative machinery and solutions designed for modern mining challenges, focusing on efficiency and sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Mining?

The smart-mining market is expected to reach $23.5 billion by 2033, growing at a CAGR of 9.2% from its current size. The increasing adoption of digital solutions and automation in mining drives this growth.

What are the key market players or companies in the smart Mining industry?

Key players in the smart-mining industry include major companies such as Siemens AG, Rockwell Automation, ABB, and Caterpillar Inc., which lead in developing innovative technologies and strategic partnerships to enhance mining efficiency.

What are the primary factors driving the growth in the smart Mining industry?

Growth in the smart-mining industry is primarily driven by technological advancements, increasing operational efficiency, investment in IoT and automation technologies, and the rising necessity for sustainable mining practices that reduce environmental impact.

Which region is the fastest Growing in the smart Mining market?

North America is the fastest-growing region in the smart-mining market, expected to grow from $8.23 billion in 2023 to $20.45 billion by 2033. This growth is fueled by rapid technological advancements and significant investments in mining automation.

Does ConsaInsights provide customized market report data for the smart Mining industry?

Yes, ConsaInsights provides customized market report data tailored to client needs in the smart-mining industry. Clients can expect detailed reports with insights on specific segments, regional analysis, and market trends.

What deliverables can I expect from this smart Mining market research project?

Deliverables from the smart-mining market research project typically include comprehensive market analysis reports, regional market insights, competitive landscape overviews, and projections for future growth within specific segments.

What are the market trends of smart Mining?

Market trends in smart-mining include the growing adoption of automation technologies, increased integration of IoT solutions, and a shift towards data-driven decision-making for optimizing mining operations while reducing costs and enhancing safety.