Smart Pills Market Report

Published Date: 31 January 2026 | Report Code: smart-pills

Smart Pills Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Smart Pills market, detailing market trends, segmentation, and a forecast from 2023 to 2033. It offers insights into regional dynamics, market leaders, and technological advancements shaping the industry.

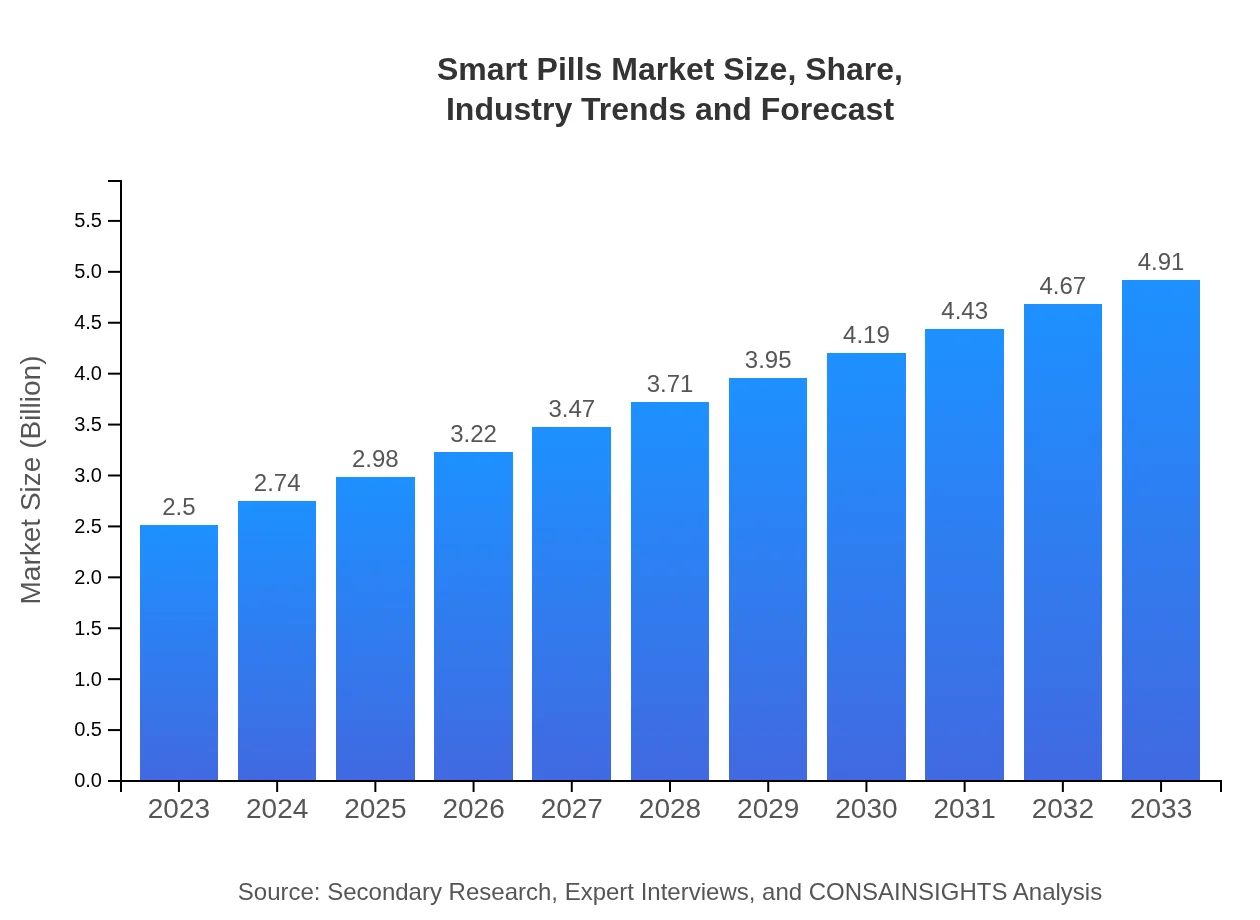

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Proteus Digital Health, Otsuka Pharmaceutical, Philips Healthcare, Medtronic |

| Last Modified Date | 31 January 2026 |

Smart Pills Market Overview

Customize Smart Pills Market Report market research report

- ✔ Get in-depth analysis of Smart Pills market size, growth, and forecasts.

- ✔ Understand Smart Pills's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Pills

What is the Market Size & CAGR of Smart Pills market in 2023?

Smart Pills Industry Analysis

Smart Pills Market Segmentation and Scope

Tell us your focus area and get a customized research report.

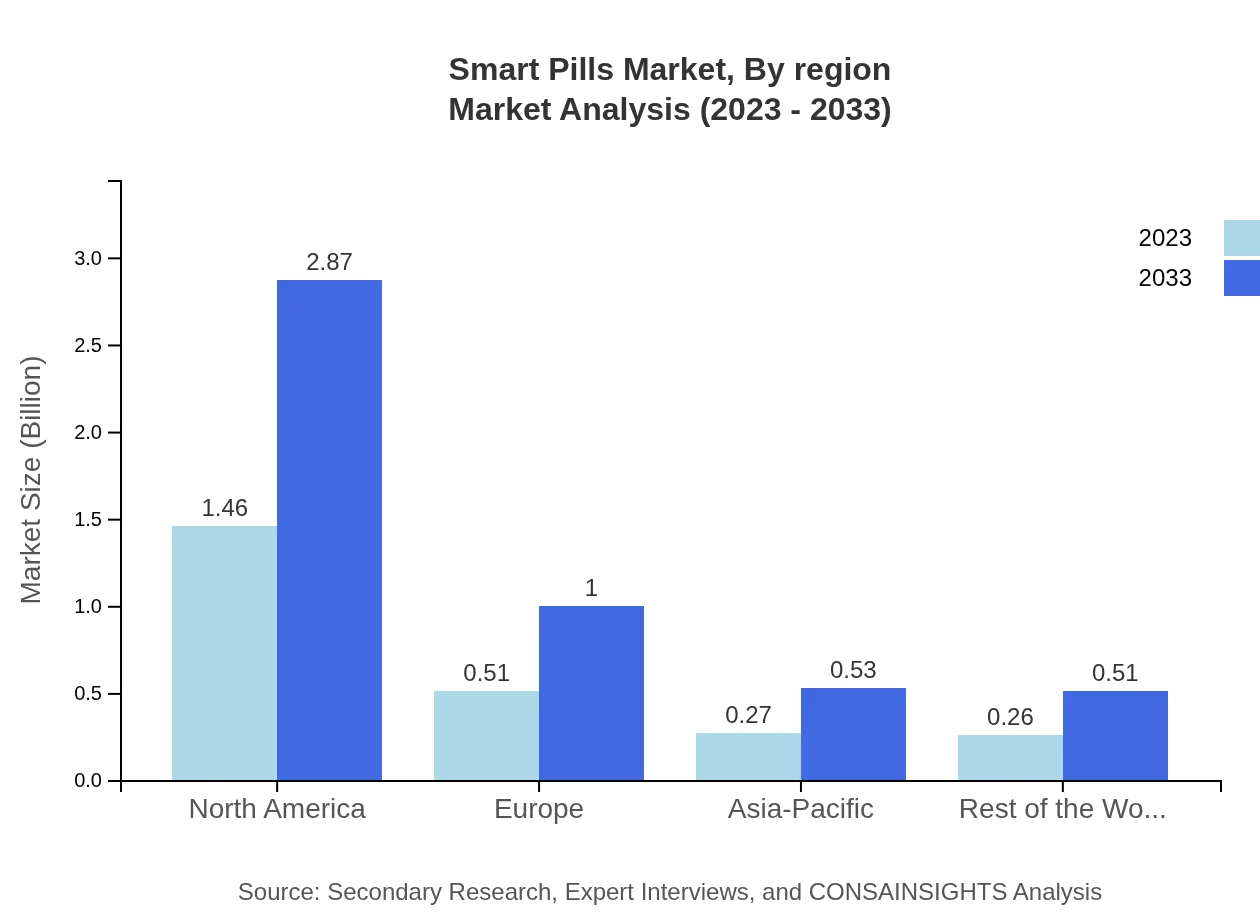

Smart Pills Market Analysis Report by Region

Europe Smart Pills Market Report:

Europe's market is expected to increase from USD 0.73 billion in 2023 to USD 1.44 billion by 2033. The focus on innovative health solutions and regulatory frameworks that support new medical technologies underpin market growth.Asia Pacific Smart Pills Market Report:

The Asia-Pacific region's Smart Pills market is poised to grow significantly from USD 0.49 billion in 2023 to USD 0.96 billion by 2033. This growth is driven by an increase in healthcare investments, rising chronic disease prevalence, and growing awareness regarding advanced drug delivery solutions.North America Smart Pills Market Report:

North America holds one of the largest shares of the Smart Pills market, forecasted to grow from USD 0.90 billion in 2023 to USD 1.77 billion by 2033. The region's strong healthcare infrastructure and investment in health technology drive this growth.South America Smart Pills Market Report:

In South America, the Smart Pills market is projected to grow from USD 0.16 billion in 2023 to USD 0.32 billion by 2033. The market is benefiting from technological advancements and a growing awareness of digital healthcare solutions.Middle East & Africa Smart Pills Market Report:

The Middle East and Africa are projected to grow from USD 0.22 billion in 2023 to USD 0.42 billion by 2033. Increasing healthcare expenditures and growing interest in digital health solutions will stimulate this market.Tell us your focus area and get a customized research report.

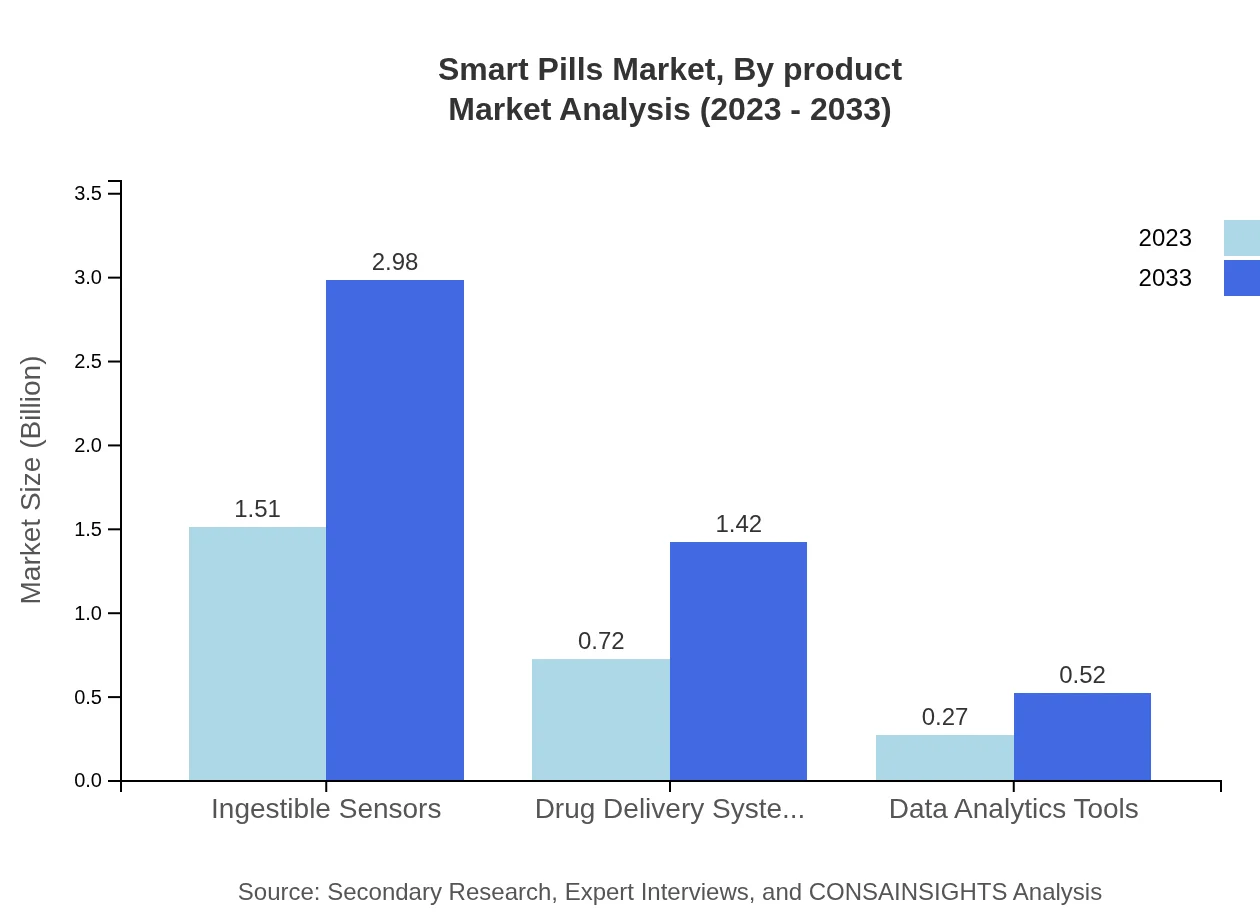

Smart Pills Market Analysis By Product

The Smart Pills market segmented by product comprises Ingestible Sensors, Drug Delivery Systems, and Data Analytics Tools. Ingestible Sensors represent the largest share, contributing significantly to market growth due to their innovative usage in monitoring medication adherence and efficacy. Drug Delivery Systems follow, showcasing efficient drug administration methods. Data Analytics Tools are rising in prominence, enhancing predictive analytics capabilities for healthcare providers.

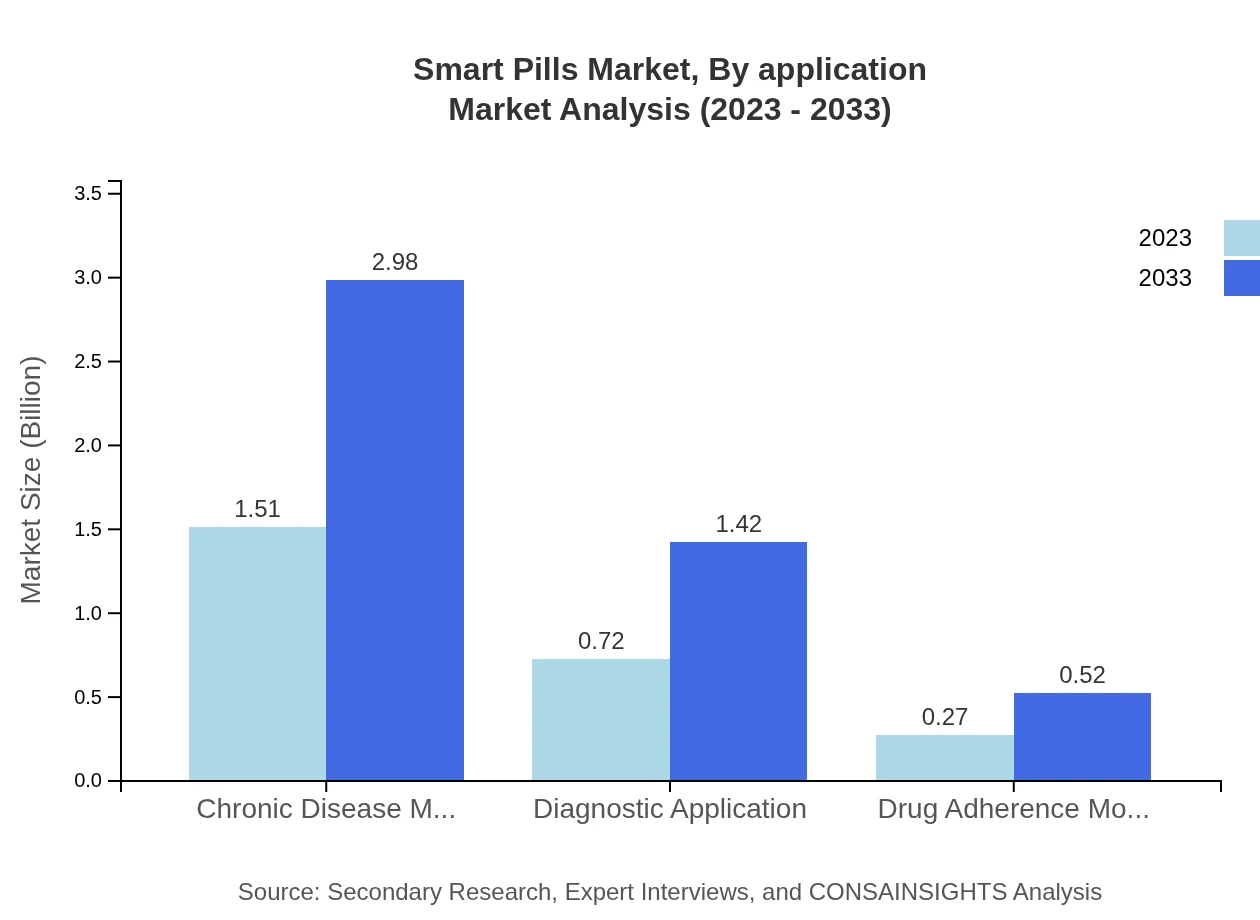

Smart Pills Market Analysis By Application

The applications of Smart Pills are predominantly found in Chronic Disease Management, Diagnostic Applications, and Drug Adherence Monitoring. The highest contribution comes from Chronic Disease Management, as healthcare providers focus on improving patient outcomes and adherence to long-term treatment protocols. Diagnostic Applications and Drug Adherence Monitoring are also essential, providing insights that facilitate treatment adjustments based on real-time data.

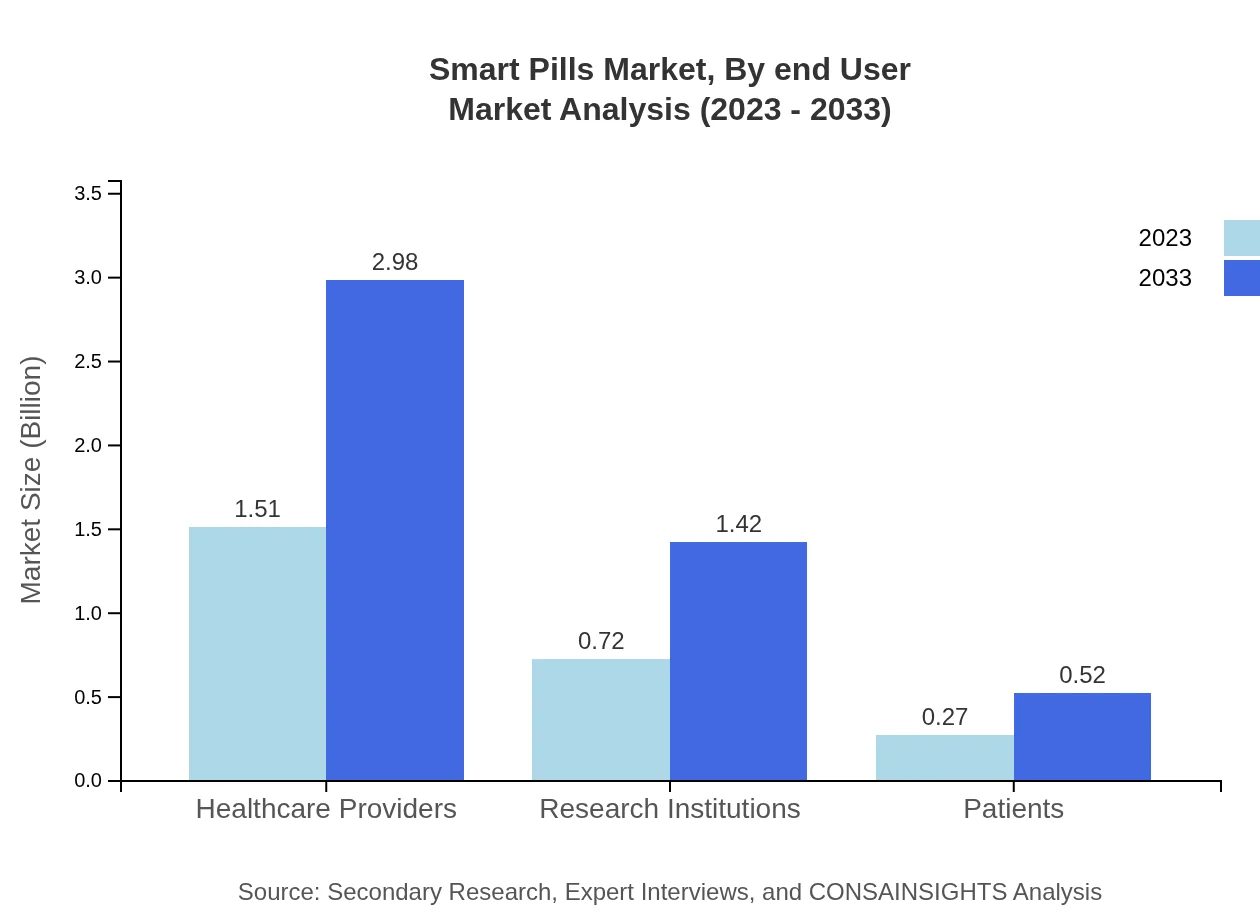

Smart Pills Market Analysis By End User

The market is segmented by end-user into Healthcare Providers, Research Institutions, and Patients. Healthcare Providers dominate the market, leveraging Smart Pills for enhanced patient management and monitoring. Research Institutions contribute significantly, focusing on innovation and development. Patient adoption is gradually increasing, as awareness about the benefits of Smart Pills grows.

Smart Pills Market Analysis By Region

The regional analysis of the Smart Pills market indicates distinct growth trajectories across regions. North America continues to lead in innovation and market size, followed closely by Europe. The Asia-Pacific region shows promising growth due to increasing investments and healthcare access. South America and Middle Eastern markets are poised for future expansions as healthcare technology adoption grows.

Smart Pills Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Pills Industry

Proteus Digital Health:

A pioneer in the development of digital health products, known for its innovative ingestible sensor technology that tracks medication adherence.Otsuka Pharmaceutical:

This company has made significant strides in the healthcare sector, partnering with Proteus to introduce smart pill products to enhance patient treatment regimes.Philips Healthcare:

Philips is renowned for integrating advanced technologies in its product offerings, contributing to the smart pill technology landscape through innovative health solutions.Medtronic :

A leader in medical devices, Medtronic focuses on developing smart technologies that facilitate better drug delivery and treatment compliance.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Pills?

The global smart pills market in 2023 is valued at approximately $2.5 billion, with a projected CAGR of 6.8% leading up to 2033. This growth signifies the increasing adoption and innovation in ingestible technologies.

What are the key market players or companies in the smart Pills industry?

Key players in the smart pills industry include major pharmaceutical and technology companies focused on drug delivery and healthcare innovations. This market is characterized by collaborations and research from biomedical firms and healthcare institutions.

What are the primary factors driving the growth in the smart Pills industry?

Driving factors include the rising chronic disease prevalence, advancements in technology, increased healthcare expenditure, and a growing demand for patient-centric drug delivery systems innovative solutions.

Which region is the fastest Growing in the smart pills market?

North America is currently the fastest-growing region in the smart pills market, with its market size projected to rise from $0.90 billion in 2023 to $1.77 billion by 2033, driven by healthcare advancements and technology investments.

Does ConsaInsights provide customized market report data for the smart pills industry?

Yes, ConsaInsights offers customized market report data tailored to the smart pills industry, catering to specific client needs such as market trends, regional analysis, and competitive landscapes for optimized decision-making.

What deliverables can I expect from this smart Pills market research project?

Deliverables will include comprehensive reports detailing market size, growth projections, competitive analysis, and insights into regional variations, segmented data, and key market trends influencing the smart pills landscape.

What are the market trends of smart pills?

Current trends include the increased integration of data analytics in healthcare, expansion of ingestible sensors, and a focus on personalized medicine, driving greater enhancements in drug adherence and management of chronic diseases.