Smart Water Meter Market Report

Published Date: 22 January 2026 | Report Code: smart-water-meter

Smart Water Meter Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Smart Water Meter market from 2023 to 2033, including market size, trends, segmentation, and key players, providing valuable insights for stakeholders.

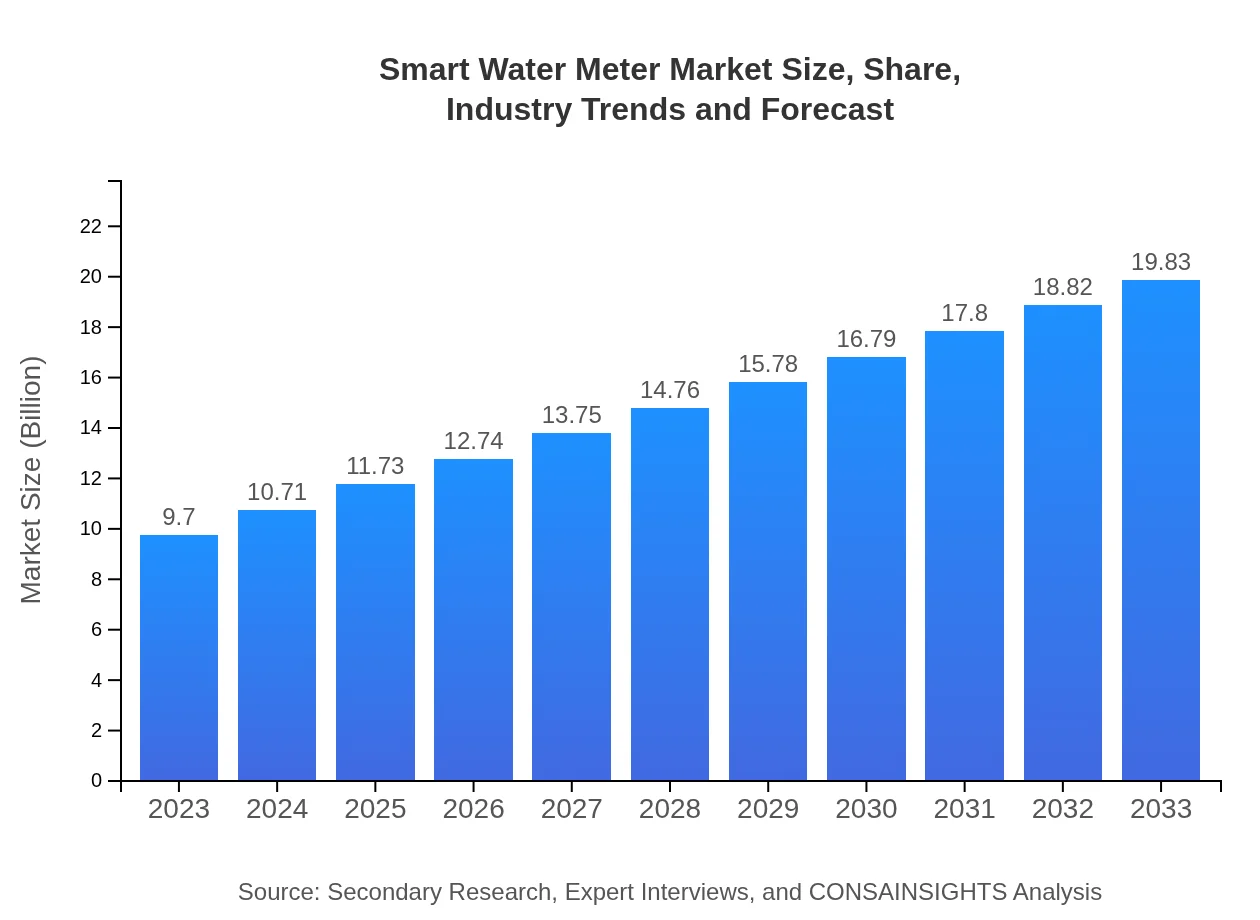

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $9.70 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $19.83 Billion |

| Top Companies | Itron, Inc., Sensus (a Xylem brand), Kamstrup A/S, Diehl Metering |

| Last Modified Date | 22 January 2026 |

Smart Water Meter Market Overview

Customize Smart Water Meter Market Report market research report

- ✔ Get in-depth analysis of Smart Water Meter market size, growth, and forecasts.

- ✔ Understand Smart Water Meter's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Smart Water Meter

What is the Market Size & CAGR of Smart Water Meter market in 2023?

Smart Water Meter Industry Analysis

Smart Water Meter Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Smart Water Meter Market Analysis Report by Region

Europe Smart Water Meter Market Report:

Europe's market is forecasted to grow from $2.96 billion in 2023 to $6.05 billion in 2033. Stringent regulations regarding water management and sustainability drive this region's focus on smart technology deployment.Asia Pacific Smart Water Meter Market Report:

The Asia Pacific region is poised for substantial growth, with a market size increase from $1.67 billion in 2023 to $3.42 billion in 2033. Growing urbanization and government initiatives focused on smart city projects are major drivers.North America Smart Water Meter Market Report:

North America leads the market with a projected increase in size from $3.78 billion in 2023 to $7.73 billion in 2033. Rising investments in smart water infrastructure and a strong demand for innovative metering solutions are key factors.South America Smart Water Meter Market Report:

In South America, the Smart Water Meter market is expected to grow from $0.41 billion in 2023 to $0.83 billion by 2033. Increasing water scarcity and the need for improved metering solutions present opportunities for market expansion.Middle East & Africa Smart Water Meter Market Report:

The Middle East and Africa market is expected to increase from $0.88 billion in 2023 to $1.80 billion by 2033. The region's focus on water conservation and infrastructure development will enhance market prospects.Tell us your focus area and get a customized research report.

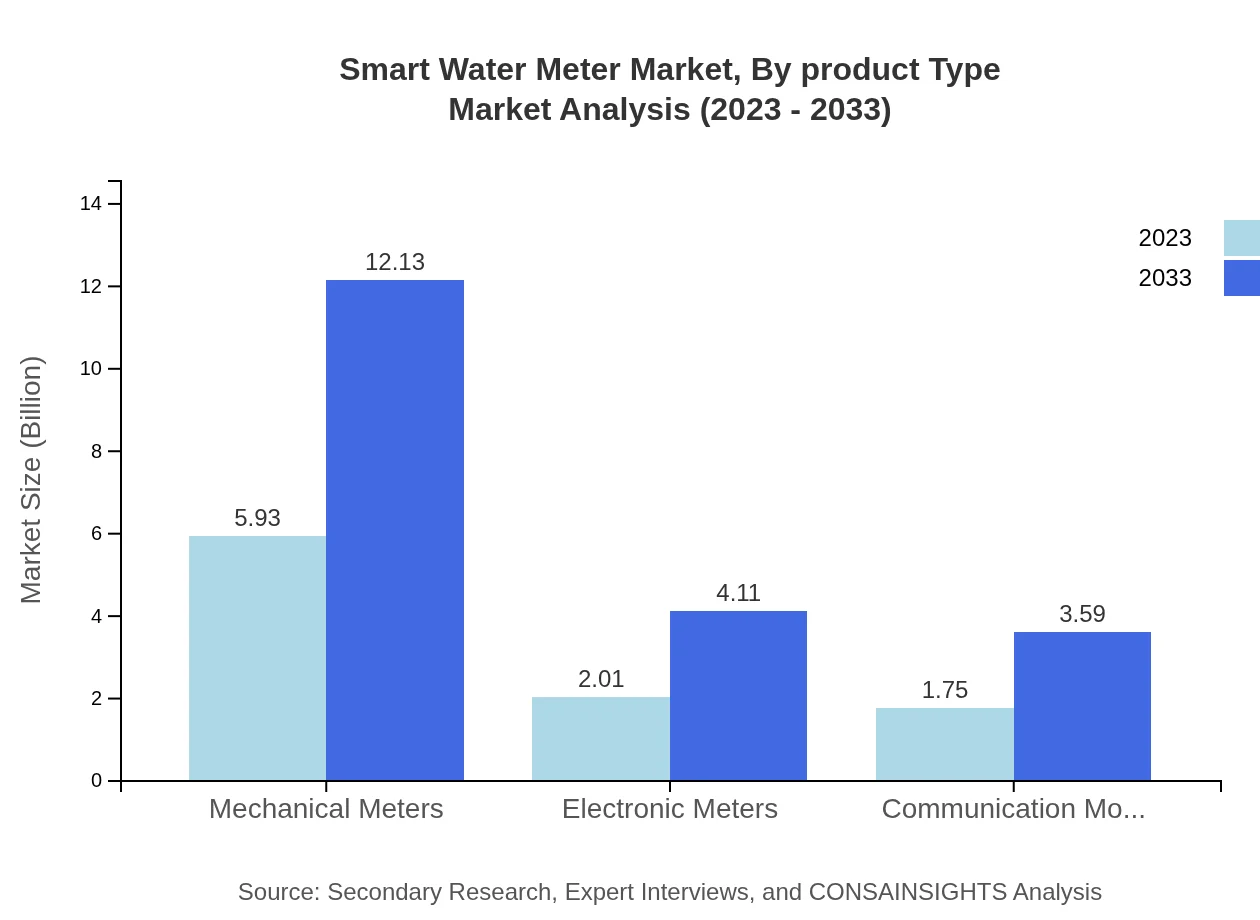

Smart Water Meter Market Analysis By Product Type

The Smart Water Meter market by product type sees a significant share in mechanical and electronic meters. Mechanical meters, although traditional, still dominate the market with a share of around 61.18% in 2023 and a projected growth to 61.18% by 2033. Electronic meters, holding about 20.73% share, are gaining popularity as they offer advanced features like real-time data collection. New product innovations in communication modules are also emerging as key segments boosting efficiency.

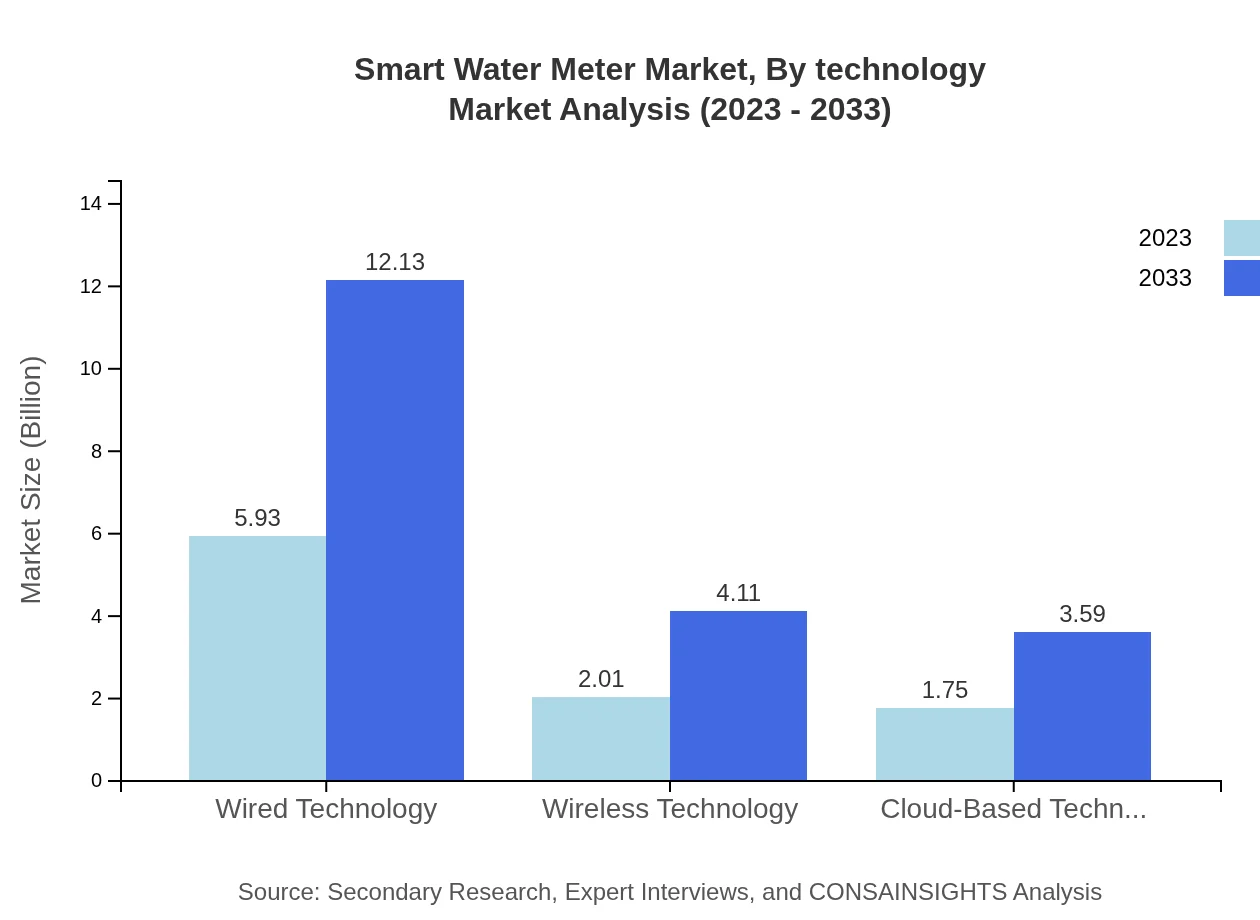

Smart Water Meter Market Analysis By Technology

In the Smart Water Meter market, wired technology continues to capture the largest share, approximately 61.18% in 2023, maintaining this share through 2033. Wireless technology, although smaller with a 20.73% share, is expected to show robust growth due to its advantages in deployment speed and flexibility. Cloud-based technology is also emerging, with increasing recognition for its ability to facilitate data analytics and remote monitoring.

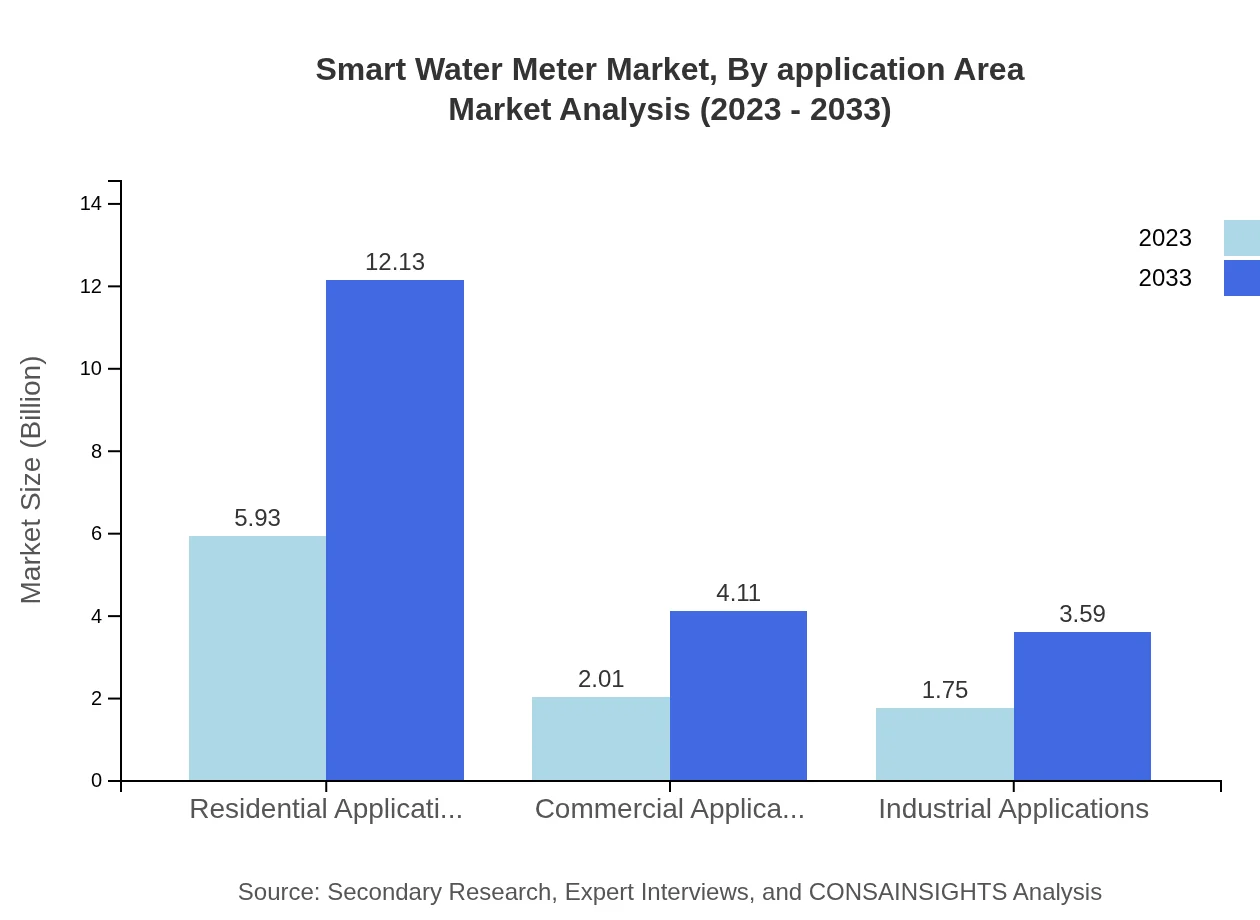

Smart Water Meter Market Analysis By Application Area

The application area segments highlight significant growth opportunities, especially within residential applications, which hold a commanding share of 61.18% in 2023 and maintain this share through 2033. Commercial and industrial applications together represent a growing area of interest, highlighting the adaptability of smart meters in various scenarios.

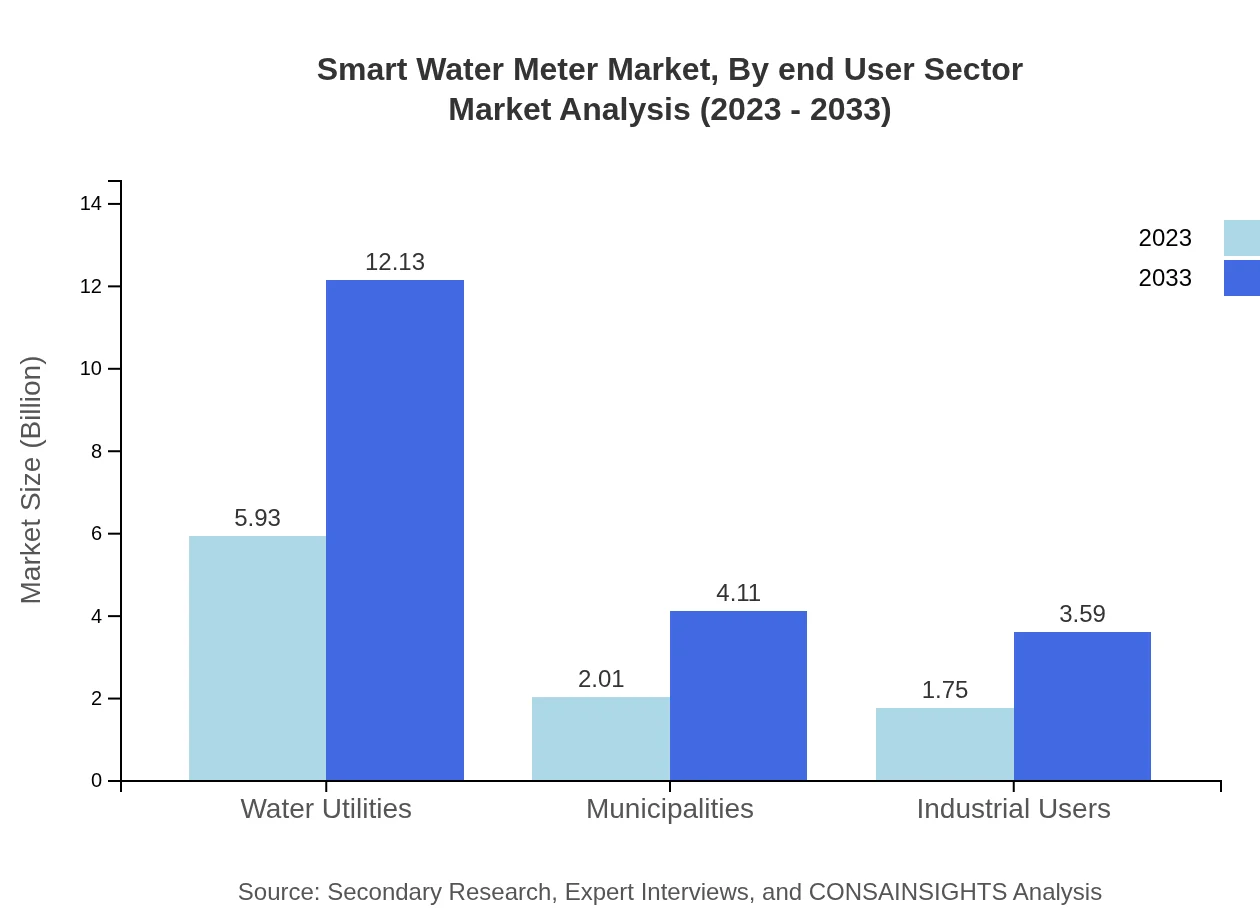

Smart Water Meter Market Analysis By End User Sector

Water utilities remain the dominant end-user sector, holding a significant market share of 61.18% in 2023 with similar expectations for 2033. Municipal applications also contribute significantly, currently holding 20.73% market share, reflecting the importance of managing urban water supply efficiently.

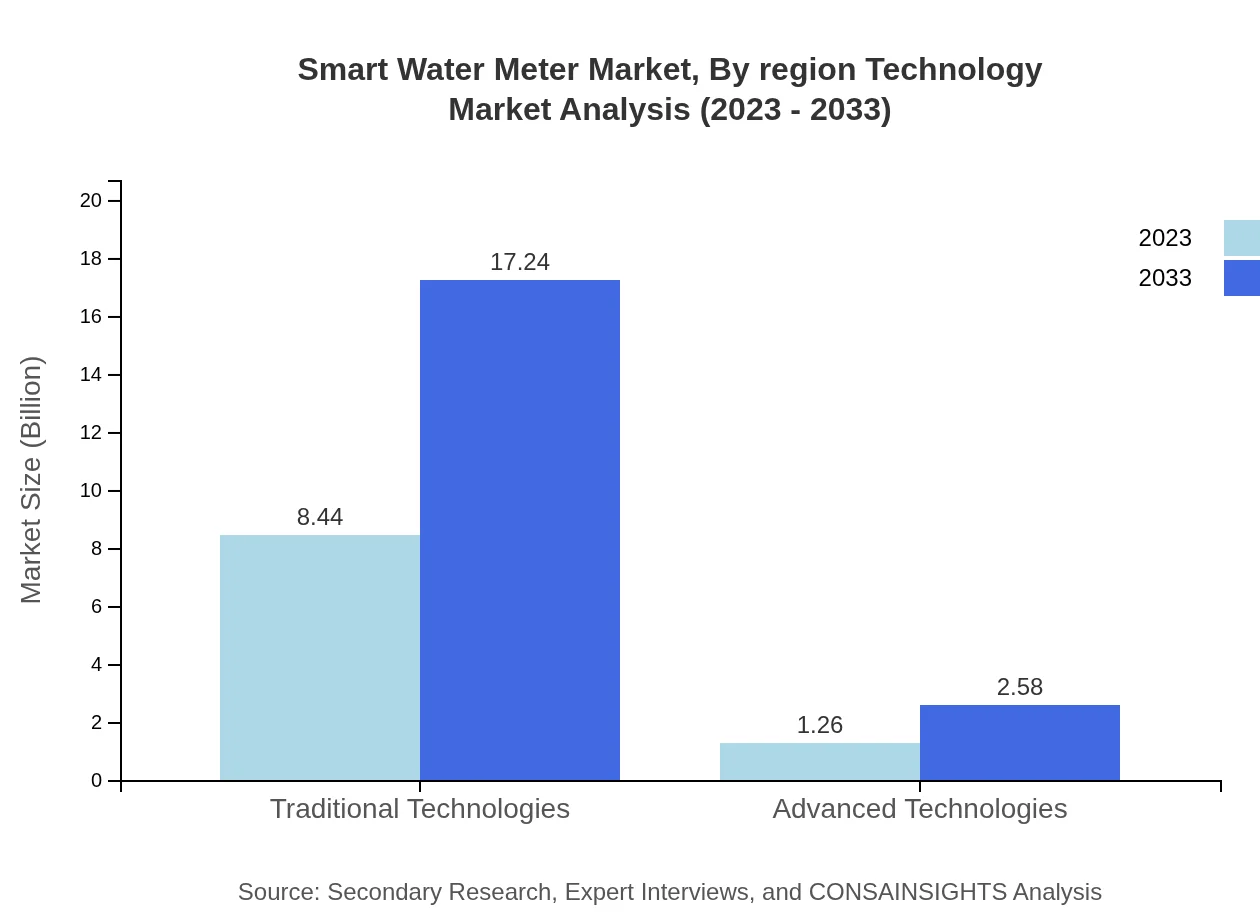

Smart Water Meter Market Analysis By Region Technology

The Smart Water Meter market segmentation by technology indicates a robust inclination toward advanced technologies, with traditional technologies accounting for 86.97% of the market in 2023 but expected to decline gradually as advanced technology rises, achieving a share of 13.03% by 2033, driven by ongoing innovation and user demand.

Smart Water Meter Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Smart Water Meter Industry

Itron, Inc.:

Itron designs and develops technologies that help utilities manage energy and water resources. With innovative smart water meters, Itron leads the industry by providing advanced communication and analytics solutions.Sensus (a Xylem brand):

Sensus focuses on smart water metering solutions and is recognized for its wireless technology. Their products facilitate improved water management and billing efficiency for utility providers.Kamstrup A/S:

Kamstrup specializes in energy and water metering solutions, combining advanced technology with efficient software to offer holistic solutions for water utilities.Diehl Metering:

Diehl Metering provides comprehensive metering solutions for water utilities, emphasizing sustainability and smart technology integration.We're grateful to work with incredible clients.

FAQs

What is the market size of smart Water Meter?

The global market size for smart water meters is projected to reach $9.7 billion by 2033, growing at a CAGR of 7.2% from 2023. This growth reflects increasing demand for efficient water management technologies worldwide.

What are the key market players or companies in this smart Water Meter industry?

Key players in the smart water meter market include companies such as Diehl Metering, Itron, Sensus, and Aclara. These companies are leading the development of advanced water metering solutions.

What are the primary factors driving the growth in the smart water meter industry?

The growth of the smart water meter industry is primarily driven by increasing water scarcity, demand for efficient water management, technological advancements, and government initiatives promoting water conservation and digitalization.

Which region is the fastest Growing in the smart water meter market?

North America is the fastest-growing region in the smart water meter market, expected to grow from $3.78 billion in 2023 to $7.73 billion by 2033, driven by strong technological adoption and urbanization trends.

Does ConsaInsights provide customized market report data for the smart water meter industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the smart water meter sector, allowing insights into specific market dynamics and regional trends as requested.

What deliverables can I expect from this smart water meter market research project?

From our smart water meter market research project, you can expect detailed reports covering market size, growth forecasts, competitive analysis, segmentation details, and regional insights tailored to your needs.

What are the market trends of smart water meter?

Key market trends in smart water meters include increased adoption of IoT technology, a shift towards wireless metering solutions, and enhanced analytics capabilities, as utilities seek more effective management.