Sme Insurance Market Report

Published Date: 31 January 2026 | Report Code: sme-insurance

Sme Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the SME insurance market from 2023 to 2033, focusing on market size, growth trends, regional dynamics, and key industry players, along with insights into technology and product segments.

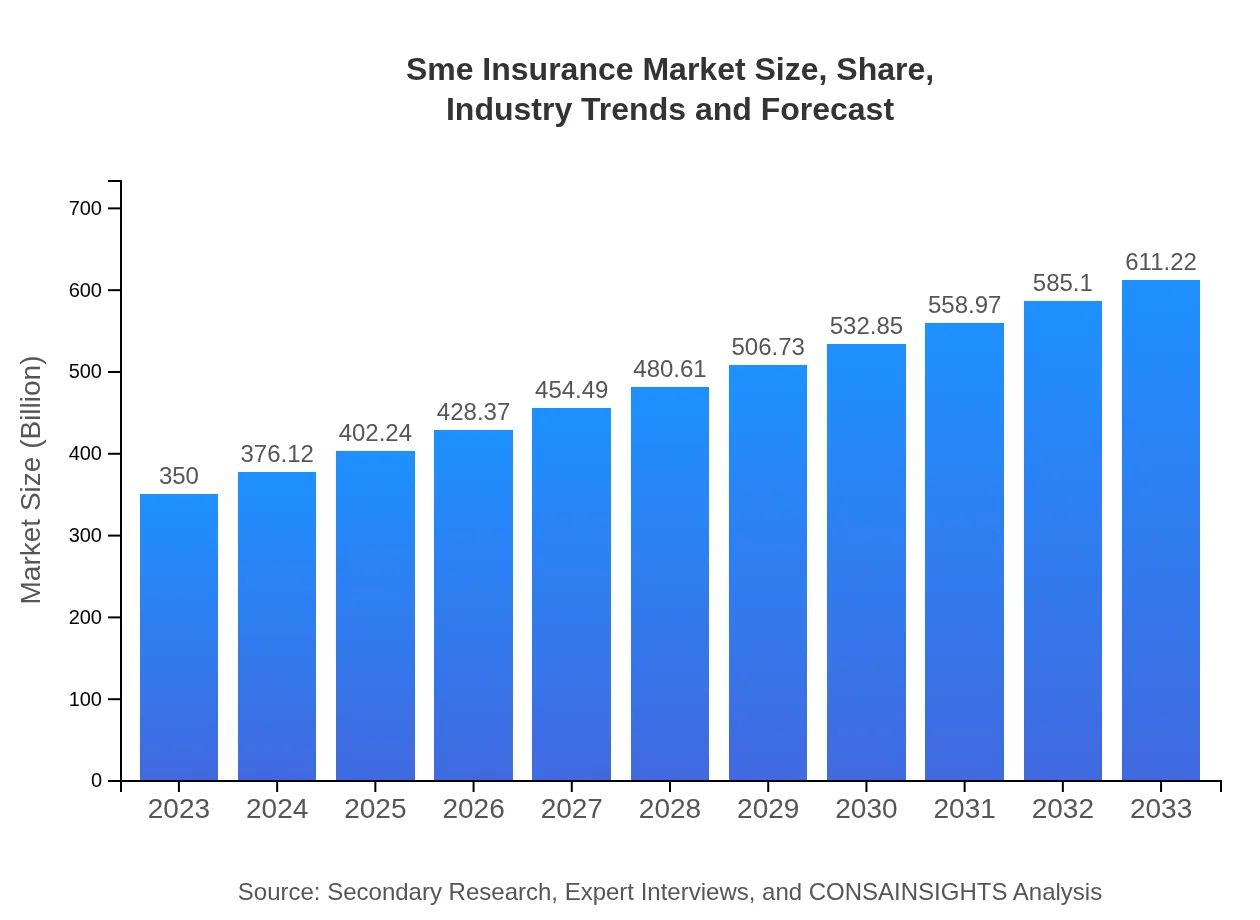

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $350.00 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $611.22 Billion |

| Top Companies | Allianz, AXA, Zurich, Chubb |

| Last Modified Date | 31 January 2026 |

SME Insurance Market Overview

Customize Sme Insurance Market Report market research report

- ✔ Get in-depth analysis of Sme Insurance market size, growth, and forecasts.

- ✔ Understand Sme Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sme Insurance

What is the Market Size & CAGR of SME Insurance market in 2023?

SME Insurance Industry Analysis

SME Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

SME Insurance Market Analysis Report by Region

Europe Sme Insurance Market Report:

Europe's SME insurance market is anticipated to grow from $114.76 billion in 2023 to $200.42 billion by 2033. The increasing sophistication of SME needs and rising regulatory requirements are major contributors to this upward trend.Asia Pacific Sme Insurance Market Report:

The Asia Pacific SME insurance market is estimated at $66.19 billion in 2023 and is projected to grow to $115.58 billion by 2033, propelled by the rapid growth of SMEs in countries like India and China. Increased digitalization in insurance offerings is also contributing to this expansion.North America Sme Insurance Market Report:

The North American SME insurance market has a current valuation of $126.74 billion in 2023, with forecasts estimating it to rise to $221.32 billion by 2033. The presence of numerous established insurance providers and the rise of innovative insurtech firms are key factors for this growth.South America Sme Insurance Market Report:

In South America, the SME insurance market is valued at $7.91 billion in 2023 and expected to reach $13.81 billion by 2033. Growing economic conditions and SMEs' increasing awareness of risk management are driving this growth.Middle East & Africa Sme Insurance Market Report:

The Middle East and Africa SME insurance market is projected to grow from $34.41 billion in 2023 to $60.08 billion by 2033. Growing economic diversification in these regions has increased the demand for SME insurance products.Tell us your focus area and get a customized research report.

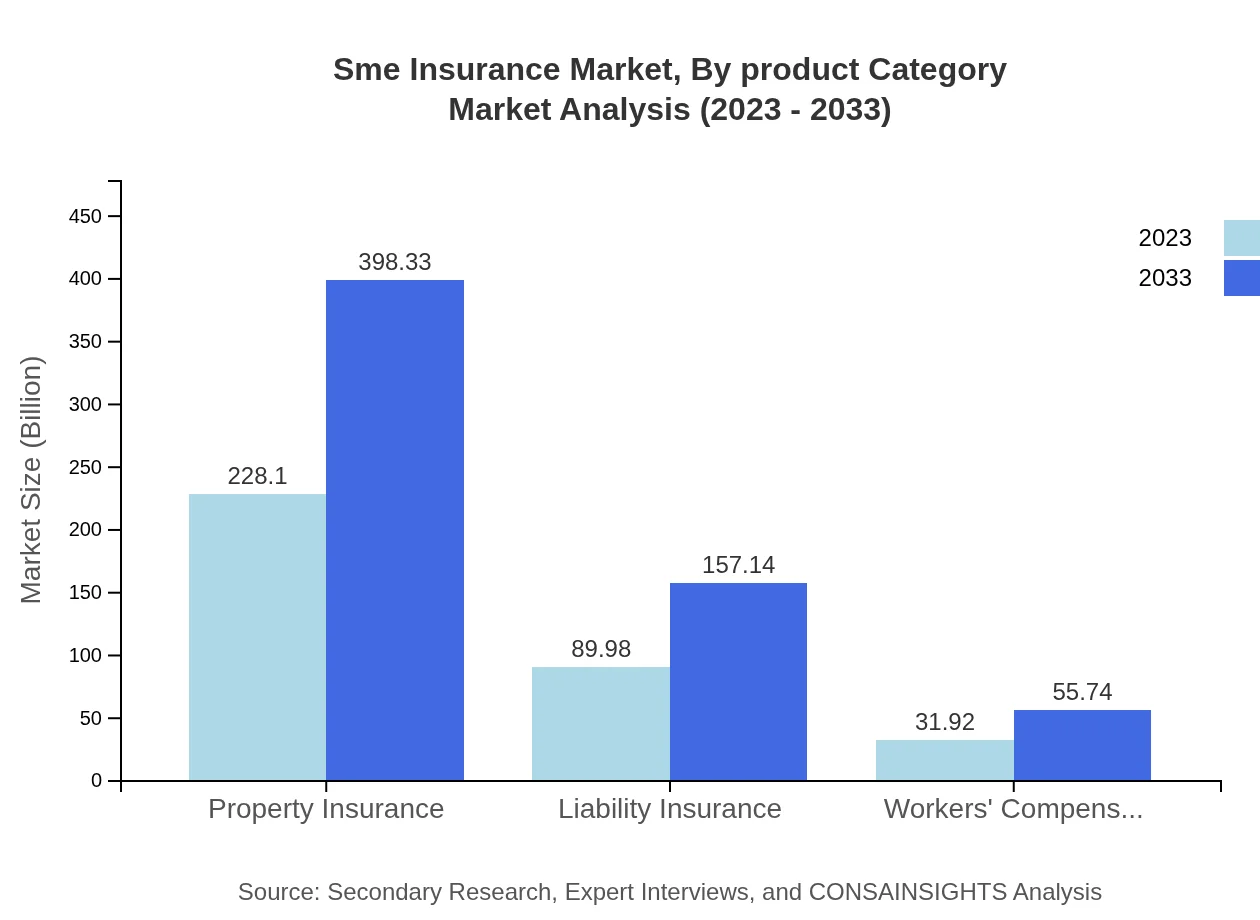

Sme Insurance Market Analysis By Product Category

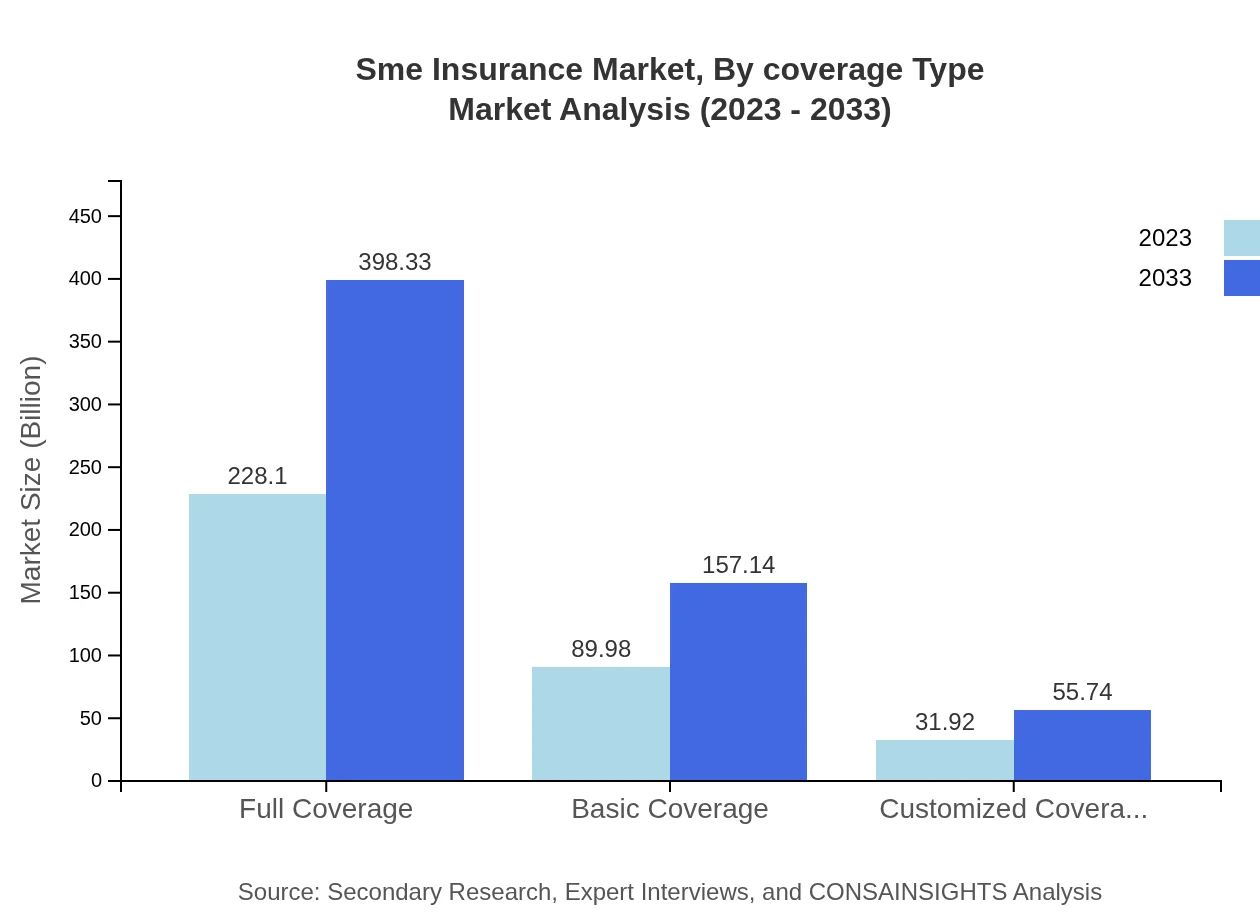

Full Coverage remains the dominant product category in the SME insurance market, valued at $228.10 billion in 2023 and expected to grow to $398.33 billion by 2033. Basic and customized coverage categories are also significant, with basic coverage at $89.98 billion (2023) and customized coverage at $31.92 billion. This diversity in coverage types highlights the tailored needs of various SMEs.

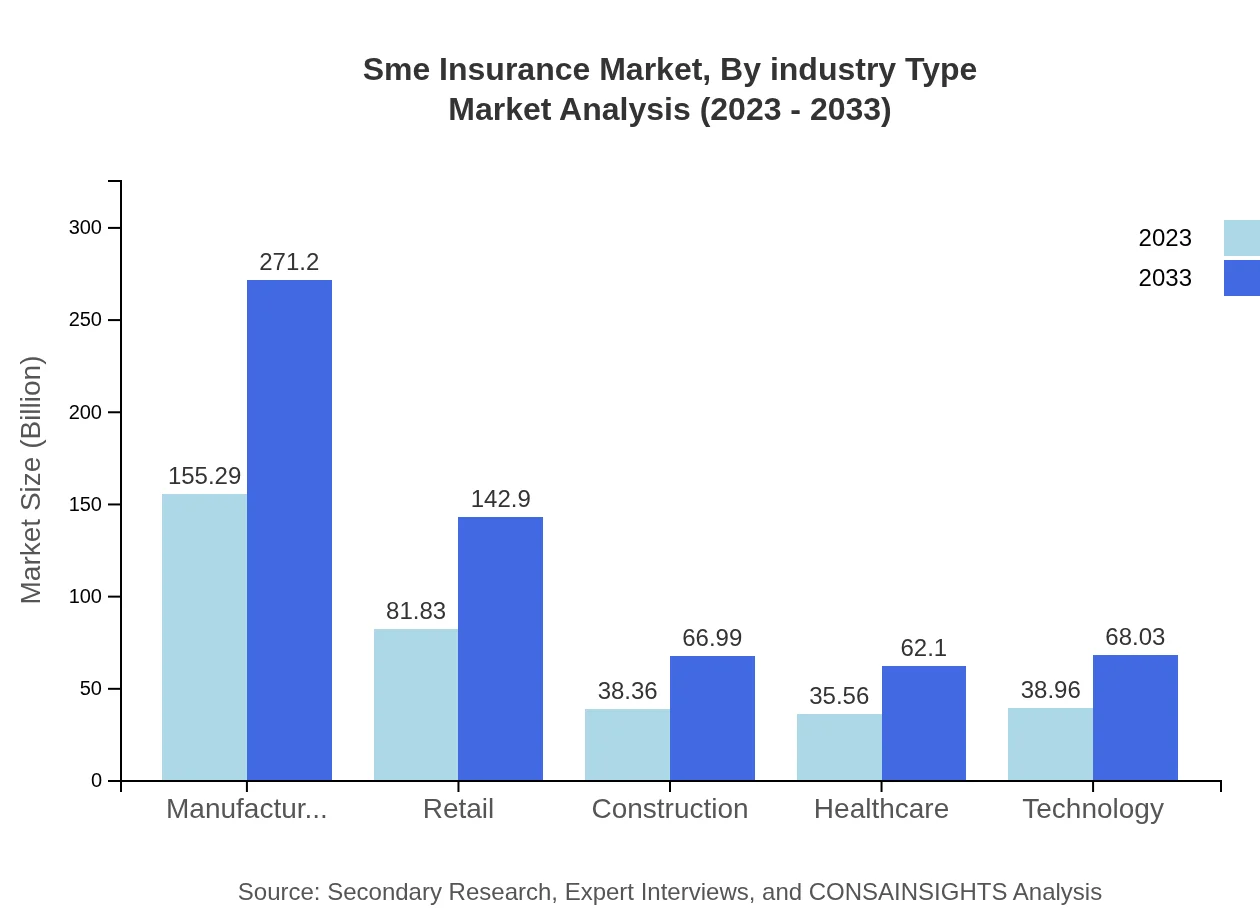

Sme Insurance Market Analysis By Industry Type

The manufacturing sector leads the SME insurance market, with a current valuation of $155.29 billion in 2023, expected to reach $271.20 billion by 2033. This is followed by retail and healthcare sectors, with values of $81.83 billion and $35.56 billion respectively in 2023. The diverse needs across sectors illustrate the necessity of specialized insurance solutions for SMEs.

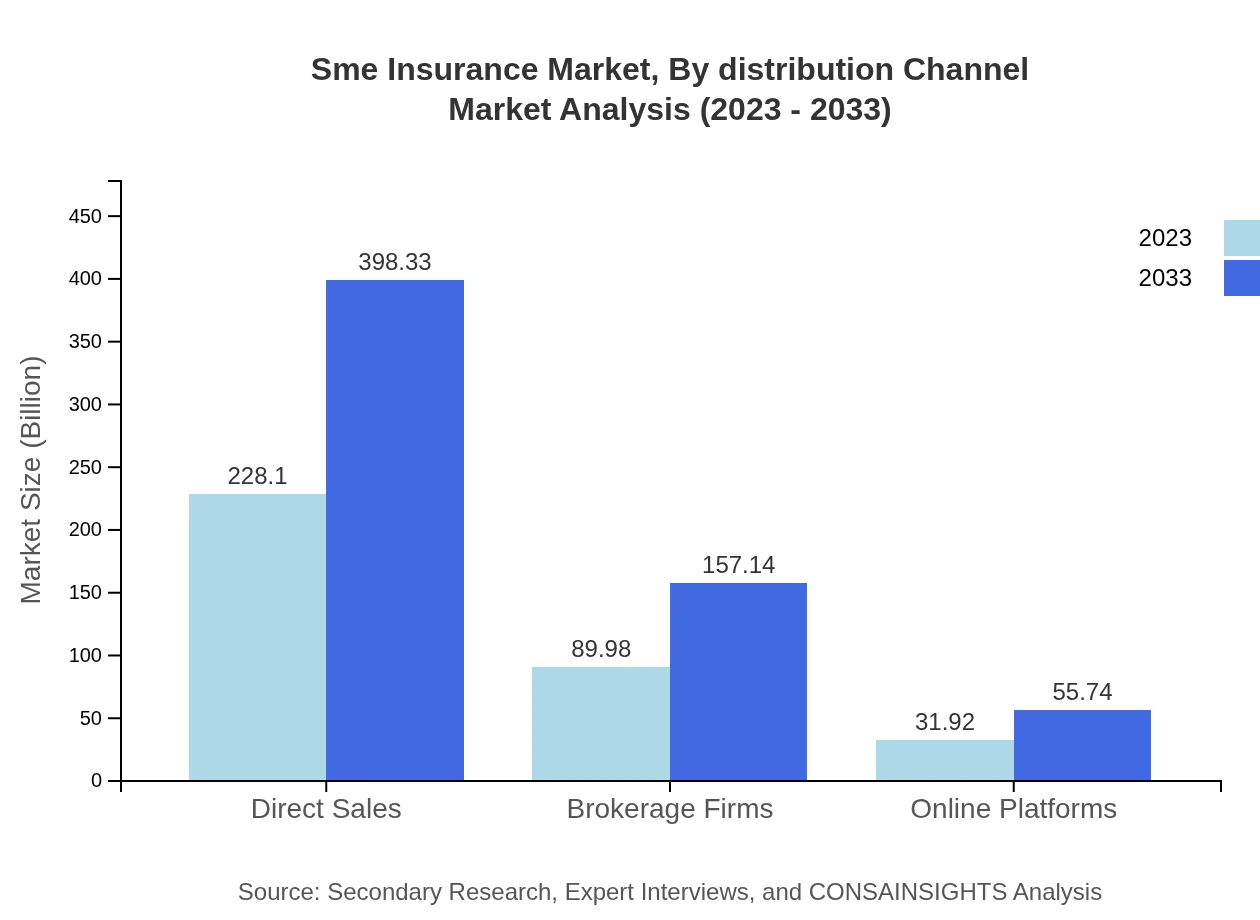

Sme Insurance Market Analysis By Distribution Channel

Direct sales account for a significant share of the SME insurance market, valued at $228.10 billion in 2023. Brokerage firms and online platforms follow, reflecting the shift towards digitalization and customer preference for convenient purchasing methods.

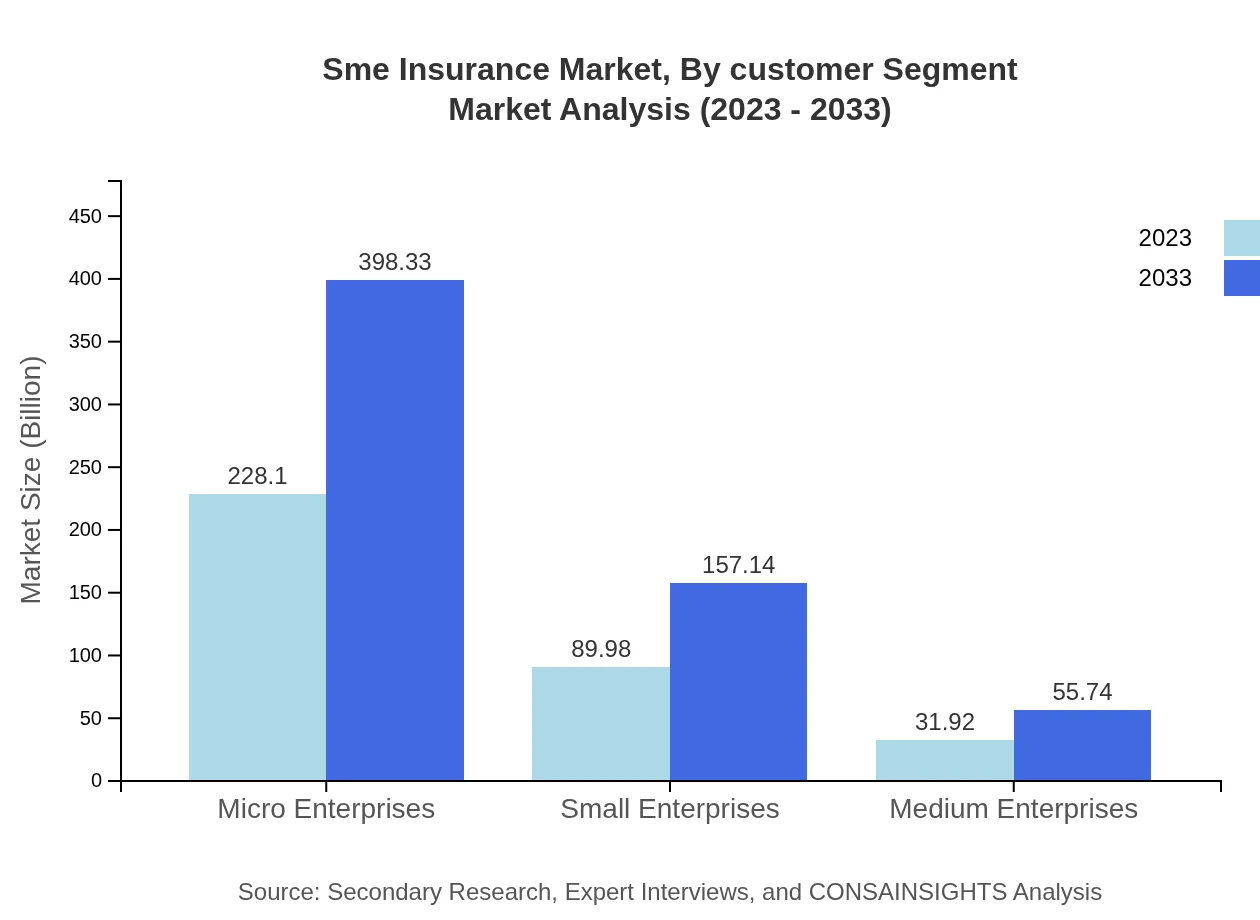

Sme Insurance Market Analysis By Customer Segment

The micro enterprises segment has the highest market share, currently valued at $228.10 billion for 2023, highlighting the vast number of small startups in need of insurance. Small and medium enterprises also contribute significantly, with values of $89.98 billion and $31.92 billion respectively, showcasing the well-rounded market opportunities.

Sme Insurance Market Analysis By Coverage Type

In coverage types, full coverage dominates with a valuation of $228.10 billion, showcasing a strong demand for comprehensive insurance solutions among SMEs. The basic and liability coverage types remain essential, valued at $89.98 billion and $31.92 billion respectively, indicating varied risk mitigation strategies.

SME Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in SME Insurance Industry

Allianz:

Allianz is a leading global insurer and asset manager, offering extensive SME insurance solutions tailored to meet the diverse needs of small businesses globally.AXA:

AXA provides a comprehensive range of insurance products for SMEs, focusing on innovative solutions and excellent customer service to enhance risk management.Zurich:

Zurich is known for its robust SME insurance offerings, providing customized coverage options and a notable focus on digital transformation within the insurance sector.Chubb:

Chubb is a prominent player in the SME insurance market, delivering a variety of property and casualty insurance solutions among other tailored offerings.We're grateful to work with incredible clients.

FAQs

What is the market size of SME Insurance?

The SME Insurance market is valued at approximately $350 billion in 2023, with a projected compound annual growth rate (CAGR) of 5.6% through 2033.

What are the key market players or companies in the SME Insurance industry?

Key players in the SME Insurance industry include major insurance firms and brokers that cater specifically to the needs of small and medium enterprises, focusing on tailored insurance solutions and competitive pricing.

What are the primary factors driving the growth in the SME Insurance industry?

Key growth drivers include increasing awareness of insurance benefits among SMEs, regulatory changes requiring coverage, economic growth enhancing business activities, and the rise of digital platforms easing access to insurance.

Which region is the fastest Growing in the SME Insurance?

The fastest-growing region in the SME Insurance market is Europe, where the market is projected to grow from approximately $114.76 billion in 2023 to $200.42 billion by 2033, driven by regulatory support and increased coverage awareness.

Does ConsaInsights provide customized market report data for the SME Insurance industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, including detailed analysis of trends, forecasts, competitive landscapes, and regional insights in the SME Insurance industry.

What deliverables can I expect from this SME Insurance market research project?

From the SME Insurance market research project, expect deliverables that include comprehensive reports with market sizing, growth forecasts, competitive analysis, regional data insights, and trends specific to the insurance landscape.

What are the market trends of SME Insurance?

Market trends in SME Insurance include a shift towards digital platforms for policy management, increased focus on customized coverage solutions, and a greater understanding among SMEs of the value of comprehensive protective insurance.