Sodium Silicate Market Report

Published Date: 02 February 2026 | Report Code: sodium-silicate

Sodium Silicate Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Sodium Silicate market from 2023 to 2033, including market size, growth rates, key trends, industry insights, and regional performance. Data-driven insights will assist stakeholders in making informed decisions and strategies for future growth.

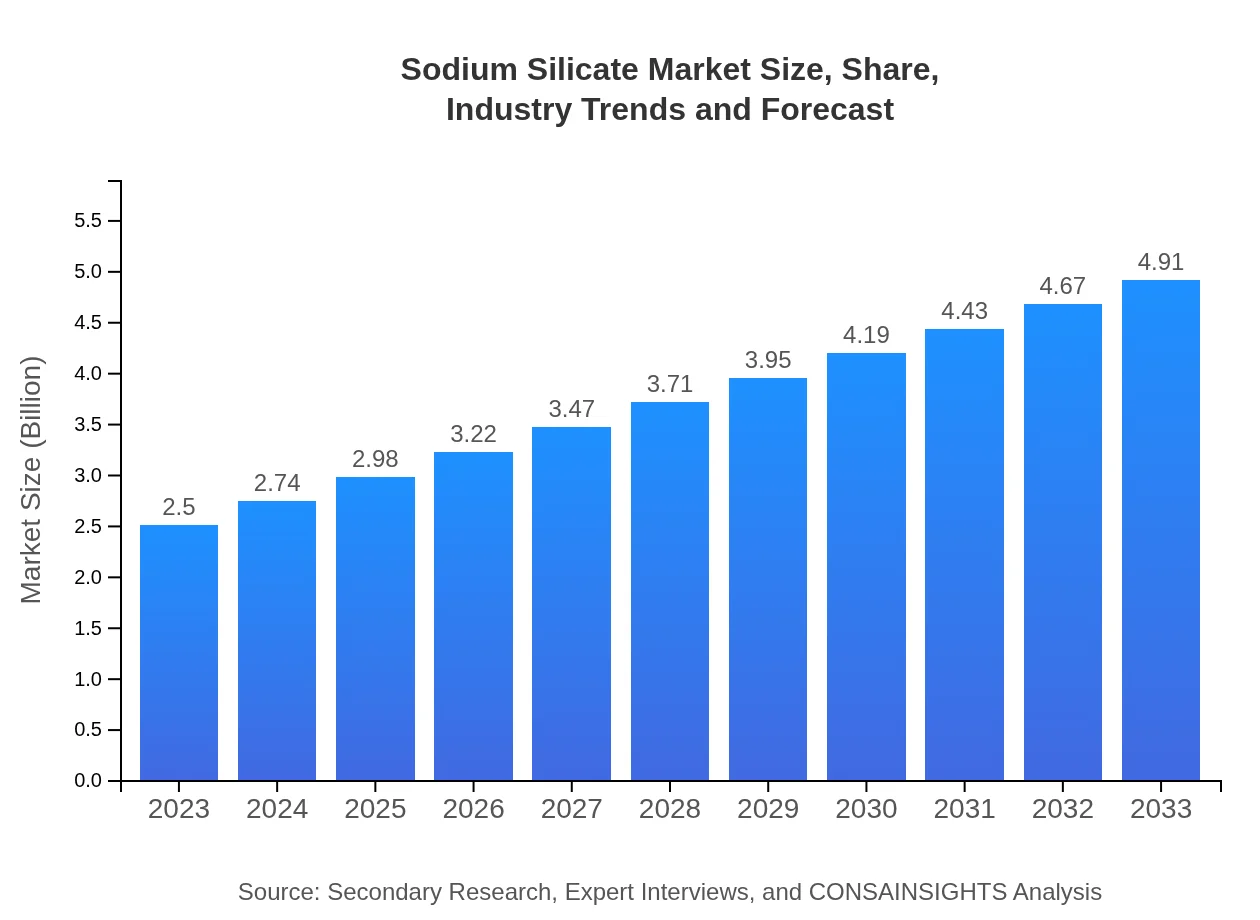

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | PQ Corporation, Evonik Industries AG, BASF SE, Hubei Yihua Chemical Industry Co. Ltd. |

| Last Modified Date | 02 February 2026 |

Sodium Silicate Market Overview

Customize Sodium Silicate Market Report market research report

- ✔ Get in-depth analysis of Sodium Silicate market size, growth, and forecasts.

- ✔ Understand Sodium Silicate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sodium Silicate

What is the Market Size & CAGR of Sodium Silicate market in 2023?

Sodium Silicate Industry Analysis

Sodium Silicate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sodium Silicate Market Analysis Report by Region

Europe Sodium Silicate Market Report:

Europe's sodium silicate market, valued at 0.80 billion USD in 2023, is set to reach 1.58 billion USD by 2033. The increasing adoption of environmentally safe materials in industries such as construction and automotive manufacturing is propelling market growth, alongside stringent regulations promoting sustainable practices.Asia Pacific Sodium Silicate Market Report:

In the Asia Pacific region, the sodium silicate market is projected to grow from 0.44 billion USD in 2023 to 0.86 billion USD in 2033. The rise in industrial activities, particularly in China and India, is a key driver of this growth. The increasing demand for detergents and construction materials in developing economies stands to benefit from advancements in sodium silicate production.North America Sodium Silicate Market Report:

North America represents a significant market for sodium silicate, expected to increase from 0.90 billion USD in 2023 to 1.77 billion USD in 2033. The region benefits from strong demand in the chemical and textile industries, as well as a substantial focus on eco-friendly products, driving the need for sustainable sodium silicate solutions.South America Sodium Silicate Market Report:

The South American sodium silicate market shows modest growth, with estimates rising from 0.01 billion USD in 2023 to 0.02 billion USD by 2033. This market growth is primarily fueled by the food processing industry, which increasingly utilizes sodium silicate as a preservative and clarifying agent.Middle East & Africa Sodium Silicate Market Report:

In the Middle East and Africa, the sodium silicate market is projected to increase from 0.35 billion USD in 2023 to 0.68 billion USD by 2033. The burgeoning construction sector in Gulf Cooperation Council (GCC) countries is a significant contributor, as sodium silicate finds extensive use in concrete and sealants.Tell us your focus area and get a customized research report.

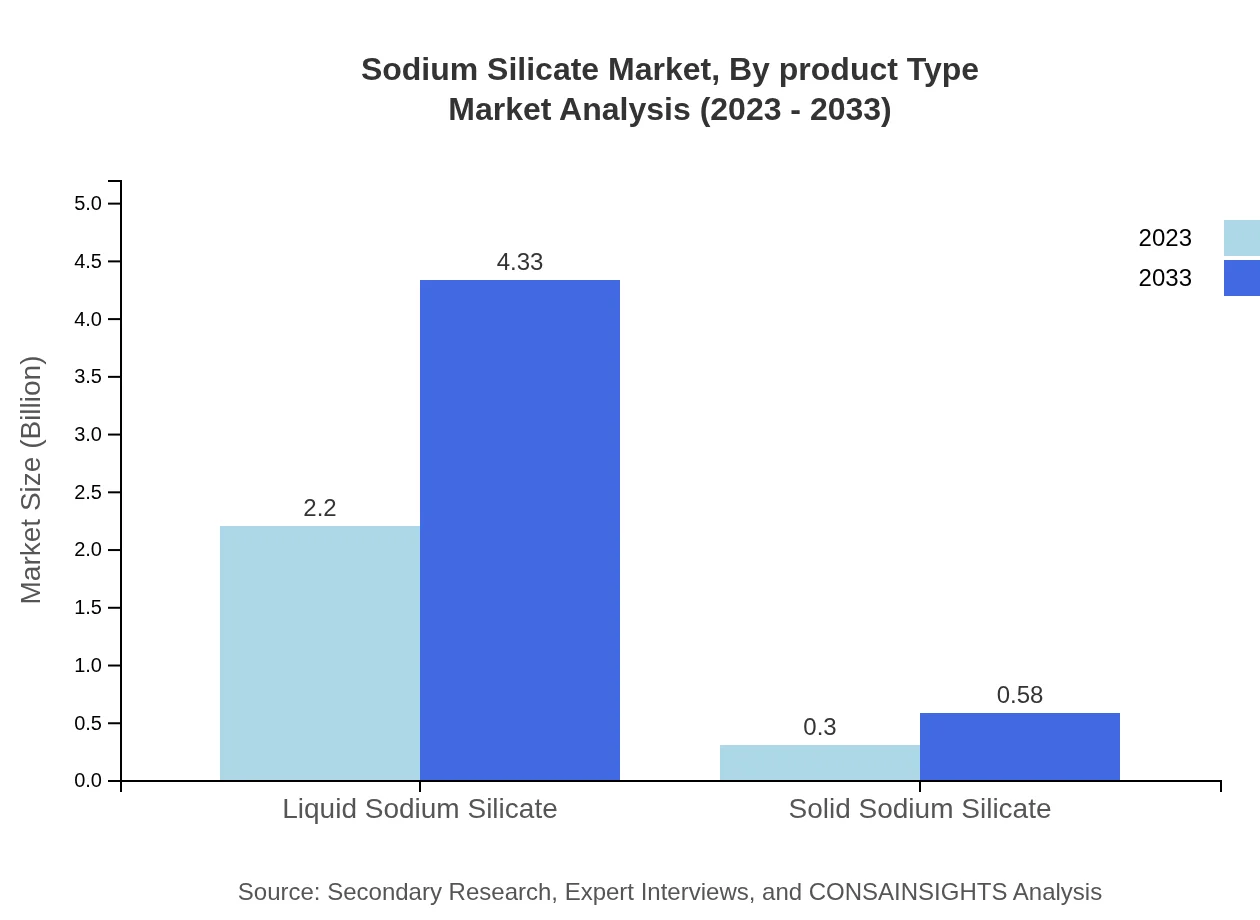

Sodium Silicate Market Analysis By Product Type

The sodium silicate market is categorized into liquid and solid types, with liquid sodium silicate being the dominant segment, holding an 88.18% share in 2023, up from 88.18% in 2033, and a projected growth from a market size of 2.20 billion USD in 2023 to 4.33 billion USD by 2033. Solid sodium silicate captures an 11.82% market share, growing from 0.30 billion USD in 2023 to 0.58 billion USD by 2033.

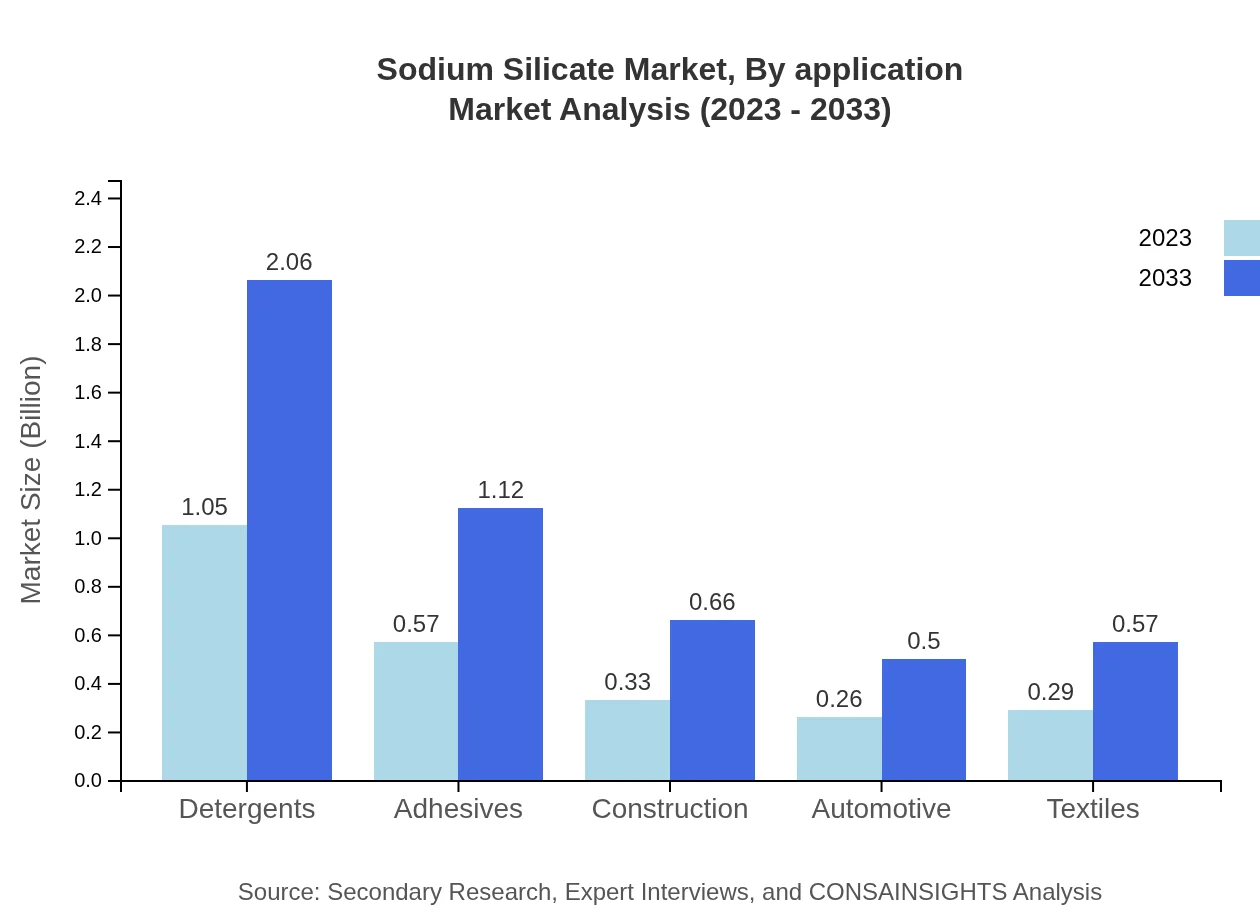

Sodium Silicate Market Analysis By Application

The applications of sodium silicate are expansive, with key segments including detergents, food processing, and pharmaceuticals. In 2023, detergents accounted for a significant share of the market at 1.05 billion USD, expected to double to 2.06 billion USD by 2033. The food processing segment also shows promising growth, from 0.57 billion USD to 1.12 billion USD over the same period.

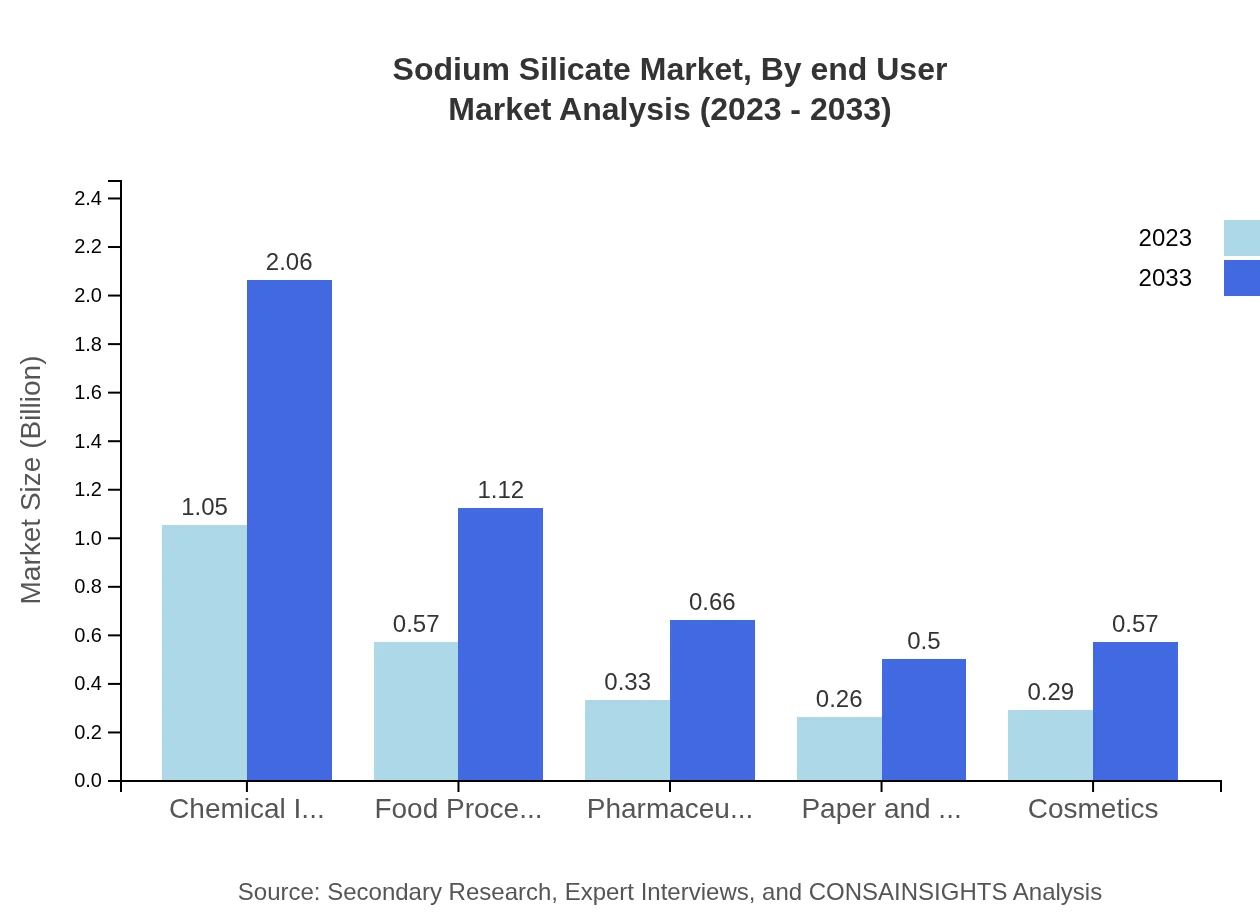

Sodium Silicate Market Analysis By End User

The chemical industry remains the largest end-user of sodium silicate, with a market size of 1.05 billion USD in 2023, forecasted to reach 2.06 billion USD by 2033. The automotive and construction sectors are also noteworthy users, leveraging sodium silicate for various applications including adhesives and sealants.

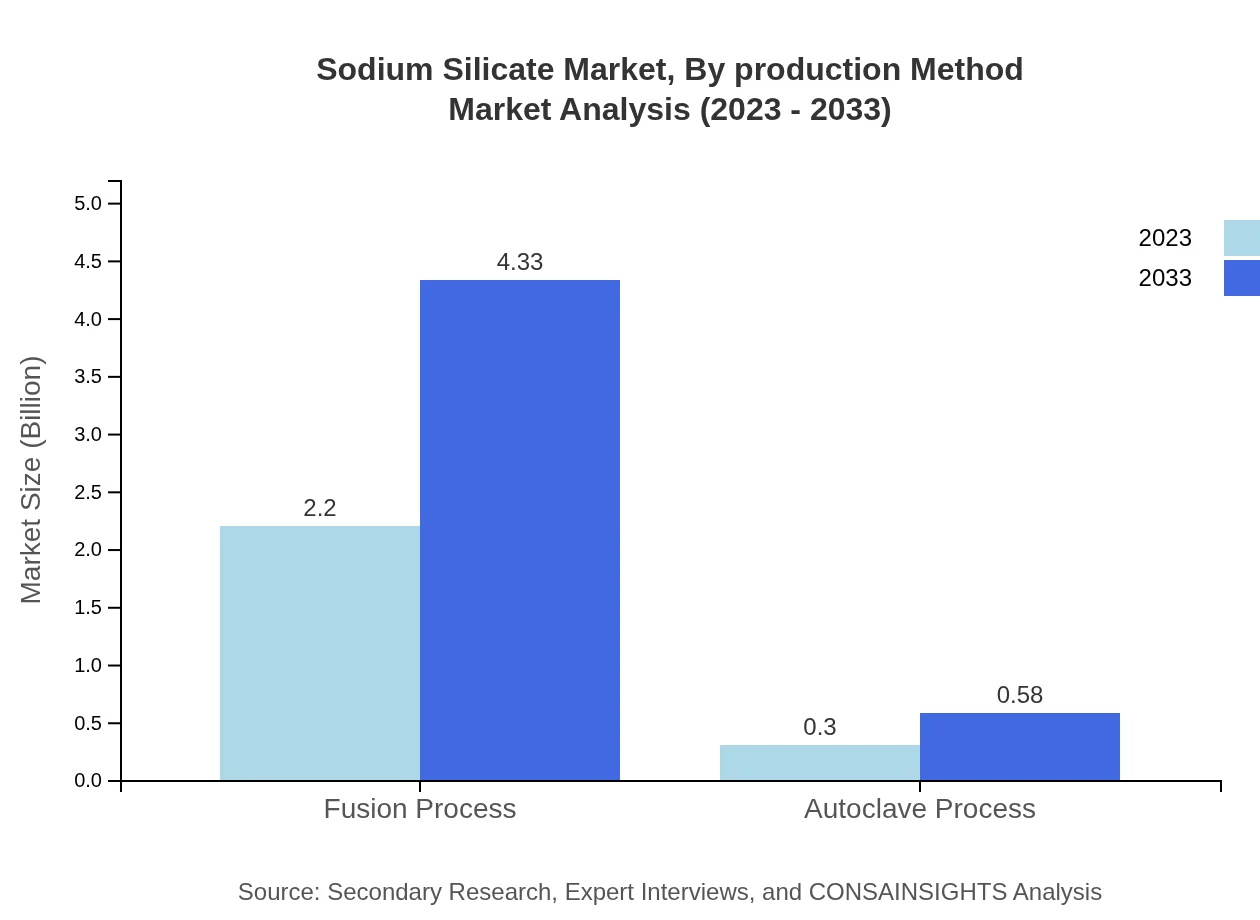

Sodium Silicate Market Analysis By Production Method

The primary methods of sodium silicate production include fusion and autoclave processes. The fusion process dominates the market, holding an 88.18% share with a market size of 2.20 billion USD in 2023, anticipated to grow to 4.33 billion USD by 2033. The autoclave process, while smaller, is projected to grow steadily, from 0.30 billion USD to 0.58 billion USD.

Sodium Silicate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sodium Silicate Industry

PQ Corporation:

PQ Corporation is a leading global supplier of sodium silicate and silica products, known for its commitment to innovation and sustainable practices in the manufacturing of silicate products.Evonik Industries AG:

Evonik, a specialty chemicals company, provides a broad range of sodium silicate solutions that cater to a diverse set of applications, emphasizing safety and performance.BASF SE:

BASF is one of the world’s largest chemical producers, offering advanced sodium silicate solutions that target the construction and automotive sectors, focusing on sustainability.Hubei Yihua Chemical Industry Co. Ltd.:

Hubei Yihua specializes in silicate production processes, leveraging the Chinese market to enhance global distribution and innovation in sodium silicate applications.We're grateful to work with incredible clients.

FAQs

What is the market size of sodium silicate?

The global sodium silicate market was valued at approximately $2.5 billion in 2023, with a projected CAGR of 6.8%. This growth is driven by increasing demand from various applications like detergents, paper, and the construction industry.

What are the key market players or companies in this sodium silicate industry?

Key players in the sodium silicate industry include PQ Corporation, BASF SE, and W.R. Grace & Co. These companies lead in production capacity and technological innovation, significantly impacting market dynamics and trends.

What are the primary factors driving the growth in the sodium silicate industry?

Growth in the sodium silicate industry is primarily driven by increasing applications in the detergent and construction sectors, technological advancements in production processes, and rising global demand for environmentally friendly products.

Which region is the fastest Growing in the sodium silicate market?

The Asia Pacific region is the fastest-growing market for sodium silicate, expected to grow from $0.44 billion in 2023 to $0.86 billion by 2033 due to expanding industrialization and urbanization.

Does ConsaInsights provide customized market report data for the sodium silicate industry?

Yes, ConsaInsights offers customized market report data for the sodium silicate industry, enabling stakeholders to obtain insights tailored to their specific needs and strategic objectives.

What deliverables can I expect from this sodium silicate market research project?

Deliverables from the sodium silicate market research project include comprehensive market analysis reports, segment-wise data, competitive landscape assessments, and future growth forecasts, ensuring informed decision-making.

What are the market trends of sodium silicate?

Trends in the sodium silicate market include increasing demand for eco-friendly products, technological advancements in production, the rise of multifunctional applications, and expanding usage in emerging economies.