Soft Drink Concentrate Market Report

Published Date: 31 January 2026 | Report Code: soft-drink-concentrate

Soft Drink Concentrate Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the global soft drink concentrate market, covering market dynamics from 2023 to 2033. It provides insights into market size, growth trends, regional performance, key players, and future forecasts, positioning stakeholders to make informed decisions.

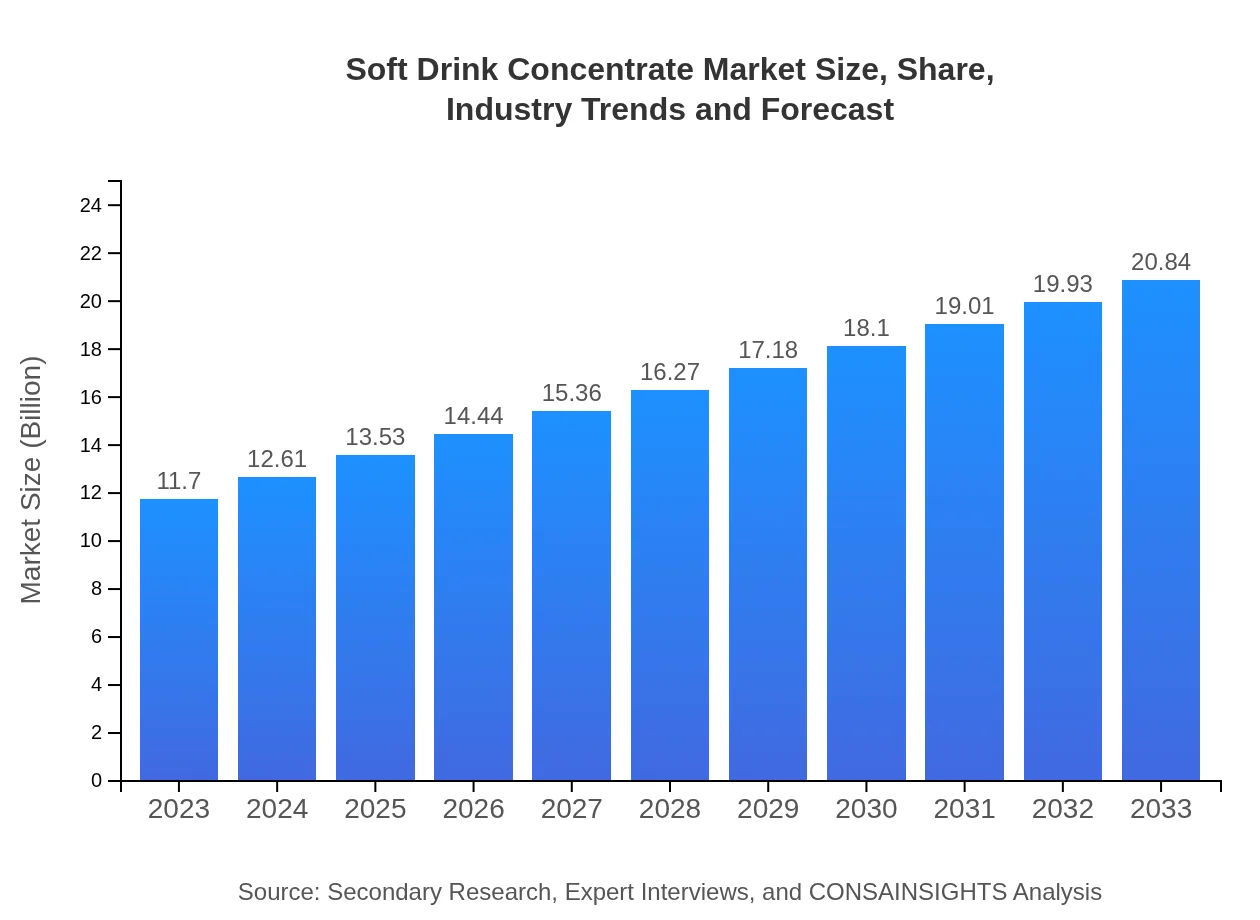

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.70 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $20.84 Billion |

| Top Companies | Coca-Cola Company, PepsiCo, Monin, Nestlé, Givaudan |

| Last Modified Date | 31 January 2026 |

Soft Drink Concentrate Market Overview

Customize Soft Drink Concentrate Market Report market research report

- ✔ Get in-depth analysis of Soft Drink Concentrate market size, growth, and forecasts.

- ✔ Understand Soft Drink Concentrate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Soft Drink Concentrate

What is the Market Size & CAGR of the Soft Drink Concentrate market in 2023?

Soft Drink Concentrate Industry Analysis

Soft Drink Concentrate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Soft Drink Concentrate Market Analysis Report by Region

Europe Soft Drink Concentrate Market Report:

The European market for soft drink concentrates is expected to grow from USD 3.12 billion in 2023 to USD 5.56 billion by 2033. This growth is fueled by a robust demand for functional beverages and environmental awareness steering consumers toward sustainable practices.Asia Pacific Soft Drink Concentrate Market Report:

The Asia Pacific soft drink concentrate market is poised for significant growth, expanding from USD 2.32 billion in 2023 to USD 4.12 billion in 2033. The growing youth population, along with a surge in disposable incomes, fuels demand for soft drinks, particularly in countries like China and India, where globalization fosters a diverse flavor palate.North America Soft Drink Concentrate Market Report:

North America is anticipated to dominate the market with a growth from USD 4.20 billion in 2023 to USD 7.49 billion by 2033. The region exhibits high demand for innovation in flavors and organic products as health-conscious consumers continue to steer market trends.South America Soft Drink Concentrate Market Report:

In the South American market, the size of soft drink concentrates is projected to grow from USD 1.08 billion in 2023 to USD 1.93 billion by 2033. This growth is driven by an increasing consumer shift towards flavored beverages, partly influenced by cultural eating habits and increasing urbanization.Middle East & Africa Soft Drink Concentrate Market Report:

The Middle East and Africa market, although smaller, is on an upward trajectory, expanding from USD 0.98 billion in 2023 to USD 1.74 billion by 2033. Rapid urbanization and an emerging middle class in African countries are critical drivers of this growth.Tell us your focus area and get a customized research report.

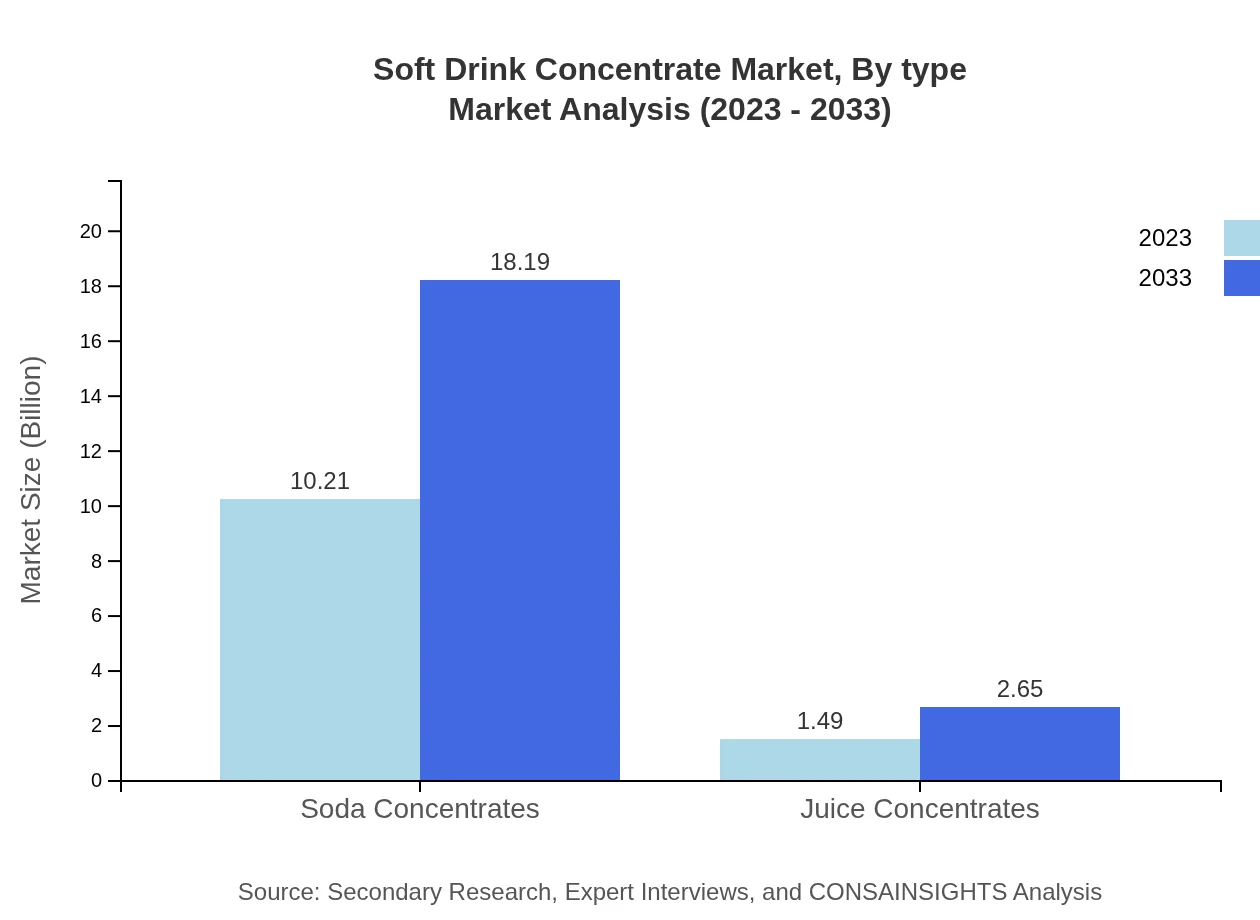

Soft Drink Concentrate Market Analysis By Type

Soda concentrates dominate the market, expected to increase from USD 10.21 billion in 2023 to USD 18.19 billion by 2033, holding an 87.3% share. Juice concentrates maintain a small but growing presence, projected to rise from USD 1.49 billion to USD 2.65 billion.

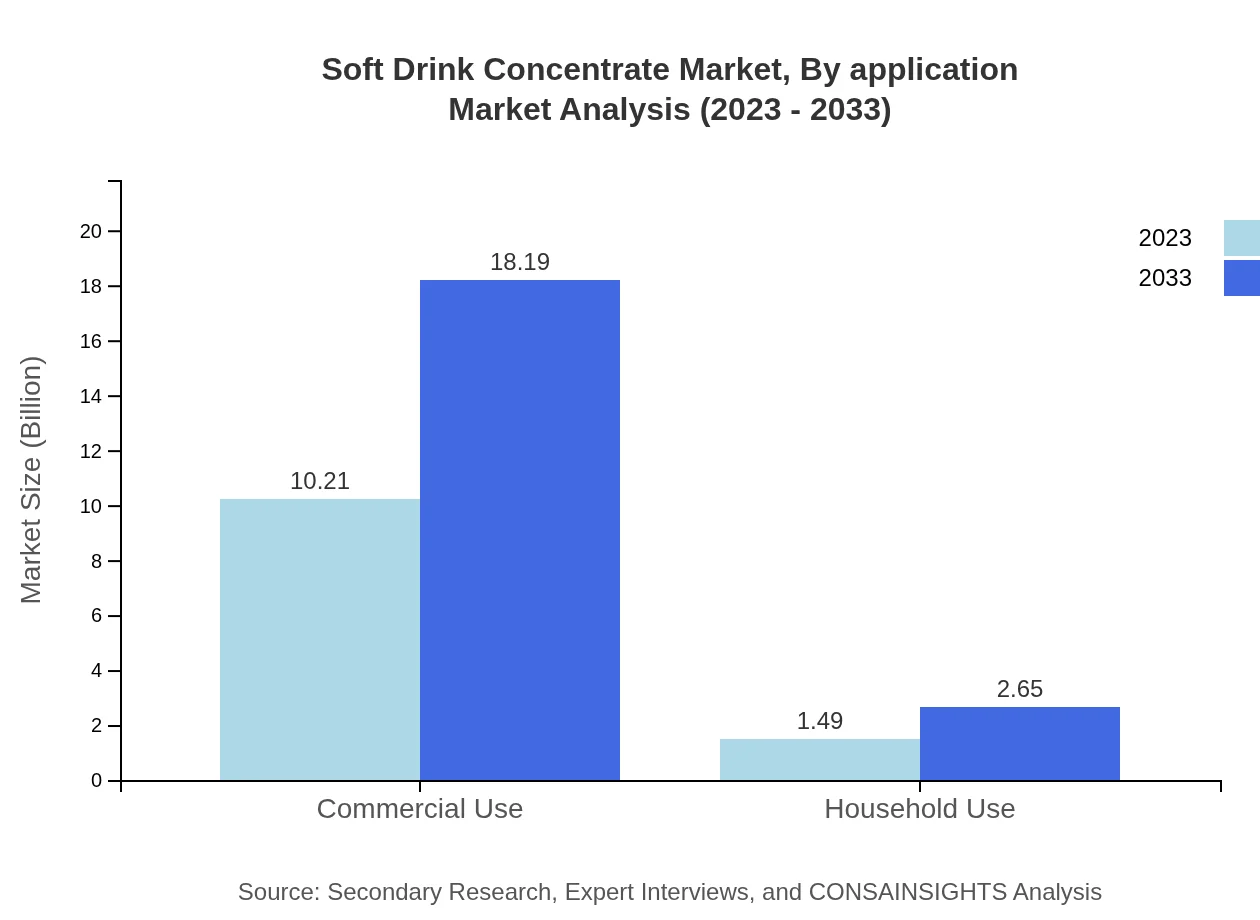

Soft Drink Concentrate Market Analysis By Application

Commercial use represents most demand for soft drink concentrates, from USD 10.21 billion to USD 18.19 billion by 2033, whereas household use lags behind but shows growth potential from USD 1.49 billion to USD 2.65 billion.

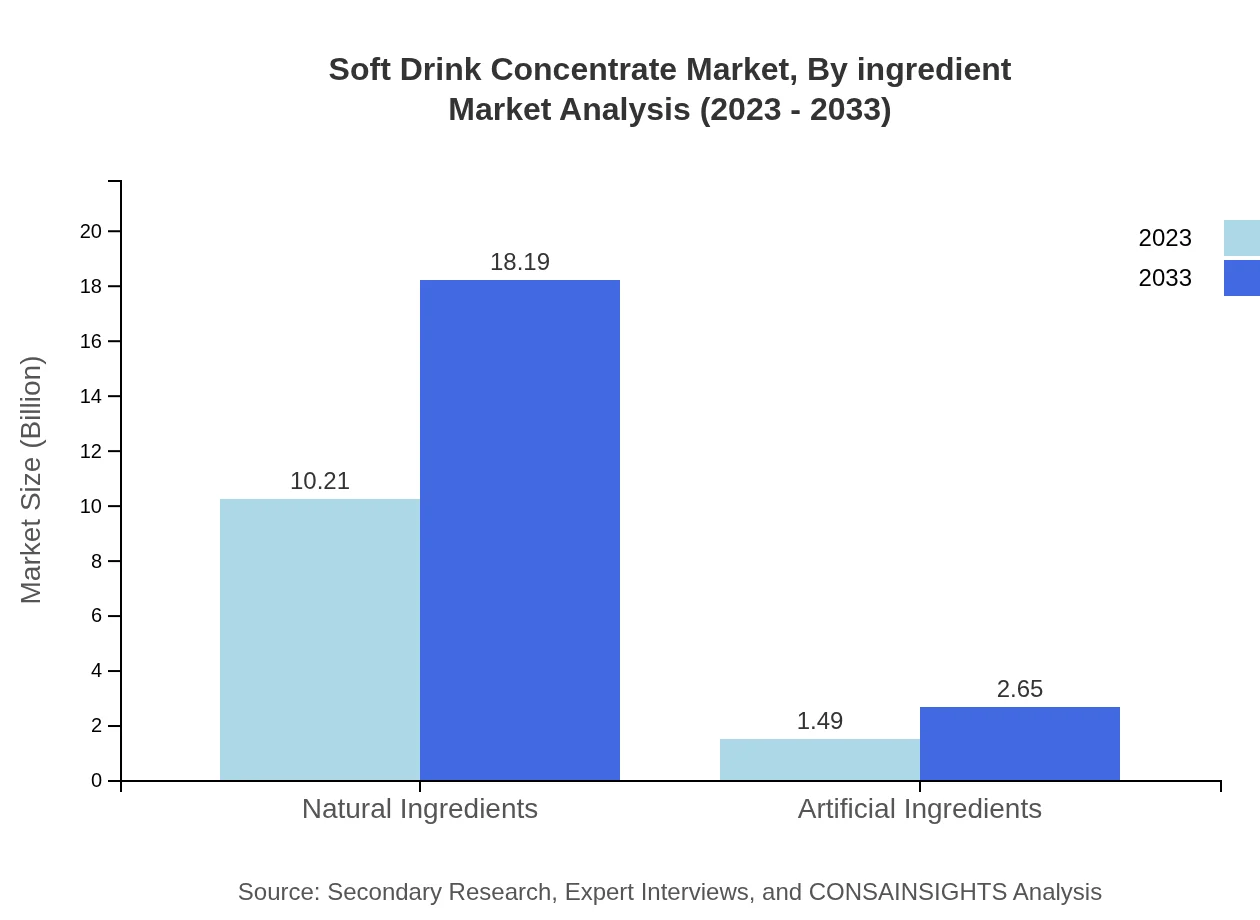

Soft Drink Concentrate Market Analysis By Ingredient

Natural ingredients are favored, accounting for a significant market weight. In 2023, market earnings from natural ingredients is USD 10.21 billion, expected to rise to USD 18.19 billion by 2033, maintaining 87.3% share against artificial ingredients.

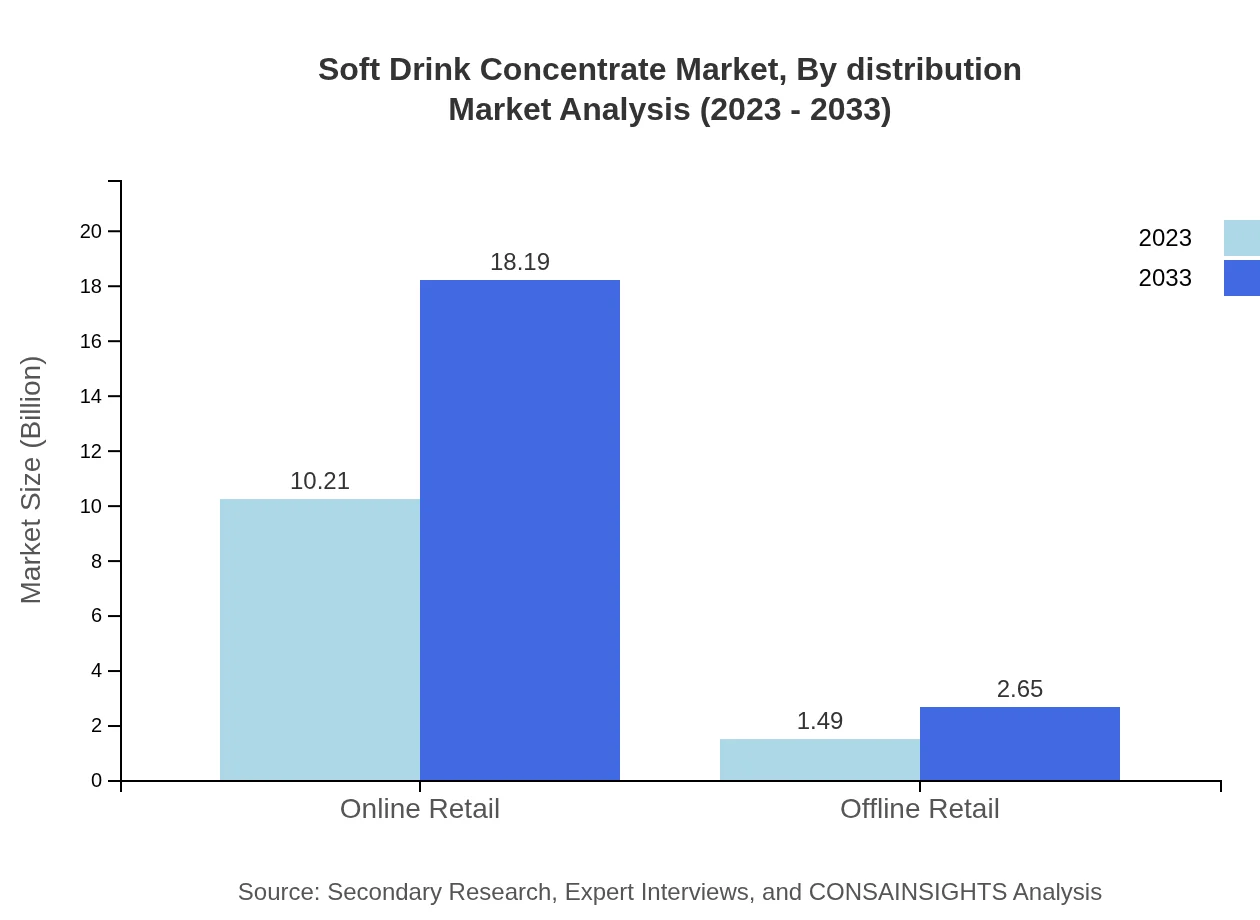

Soft Drink Concentrate Market Analysis By Distribution

Online retailing is expected to robustly increase from USD 10.21 billion to USD 18.19 billion until 2033, indicating the swift shift of consumers toward e-commerce, while offline retail remains at USD 1.49 billion growing to USD 2.65 billion.

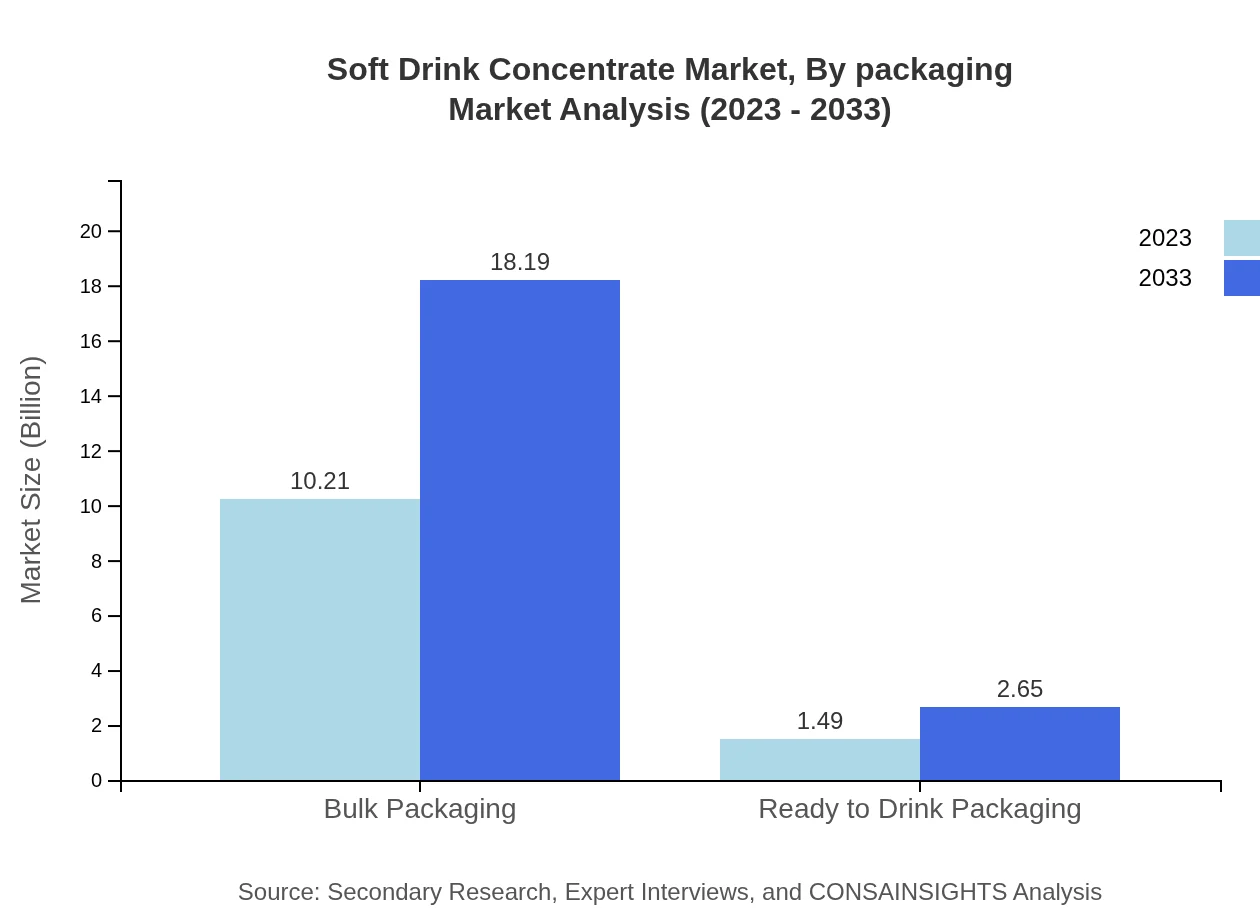

Soft Drink Concentrate Market Analysis By Packaging

Bulk packaging holds a substantial market value, expanding from USD 10.21 billion to USD 18.19 billion, while ready-to-drink packaging, although smaller, is increasingly preferred at a rise from USD 1.49 billion to USD 2.65 billion.

Soft Drink Concentrate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Soft Drink Concentrate Industry

Coca-Cola Company:

A leading player offering a diverse range of beverage concentrates, the Coca-Cola Company continues to dominate the market with its extensive distribution network.PepsiCo:

Known for its significant market presence, PepsiCo develops innovative soft drink concentrates focusing on flavors that cater to global consumer palate.Monin:

Specializing in flavor concentrates, Monin targets high-end applications in coffee and cocktail markets, capitalizing on the trend towards premium beverages.Nestlé:

Nestlé participates actively in the soft drink concentrate market, emphasizing on health-oriented products and ready-to-drink solutions.Givaudan:

As a flavoring company, Givaudan innovates in the soft drink sector, focusing on natural flavors to meet changing consumer preferences.We're grateful to work with incredible clients.

FAQs

What is the market size of soft Drink Concentrate?

The global soft drink concentrate market is valued at approximately $11.7 billion in 2023, with a projected CAGR of 5.8% leading to significant growth by 2033.

What are the key market players or companies in this soft Drink Concentrate industry?

Key players in the soft drink concentrate industry include major companies like Coca-Cola, PepsiCo, Nestlé, and Dr Pepper Snapple Group, each contributing significantly to market dynamics and product innovation.

What are the primary factors driving the growth in the soft Drink Concentrate industry?

Growth in the soft-drink-concentrate industry is driven by rising consumer demand for flavored beverages, increasing popularity of low-calorie options, and innovation in packaging and distribution channels.

Which region is the fastest Growing in the soft Drink Concentrate?

The fastest-growing region in the soft drink concentrate market is Europe, projected to grow from $3.12 billion in 2023 to $5.56 billion by 2033, demonstrating strong demand in flavored beverages across the continent.

Does ConsaInsights provide customized market report data for the soft Drink Concentrate industry?

Yes, ConsaInsights offers customized market report data for the soft drink concentrate industry, tailored to specific client needs and market conditions for better decision-making.

What deliverables can I expect from this soft Drink Concentrate market research project?

Expected deliverables from the soft drink concentrate market research project include comprehensive market analysis reports, segmentation data, growth forecasts, competitive landscape evaluations, and regional insights.

What are the market trends of soft Drink Concentrate?

Key market trends in the soft drink concentrate sector include a shift towards healthier ingredients, enhanced online retail experiences, and sustainable packaging solutions catering to environmentally-conscious consumers.