Software Asset Management Market Report

Published Date: 31 January 2026 | Report Code: software-asset-management

Software Asset Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Software Asset Management market from 2023 to 2033, focusing on market size, growth forecasts, industry trends, regional insights, and competitive landscape.

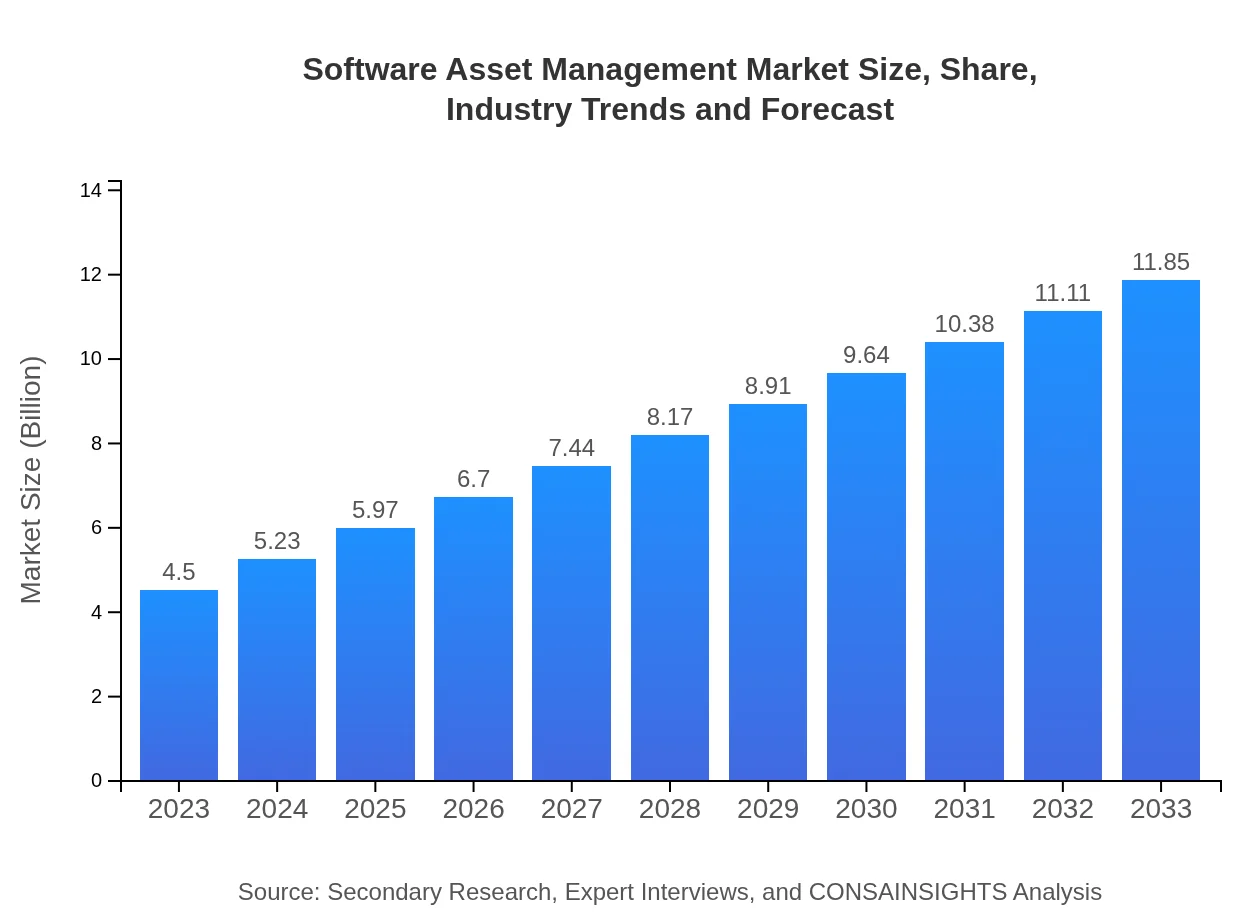

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $11.85 Billion |

| Top Companies | ServiceNow, Flexera, IBM, Microsoft |

| Last Modified Date | 31 January 2026 |

Software Asset Management Market Overview

Customize Software Asset Management Market Report market research report

- ✔ Get in-depth analysis of Software Asset Management market size, growth, and forecasts.

- ✔ Understand Software Asset Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Software Asset Management

What is the Market Size & CAGR of Software Asset Management market in 2023?

Software Asset Management Industry Analysis

Software Asset Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Software Asset Management Market Analysis Report by Region

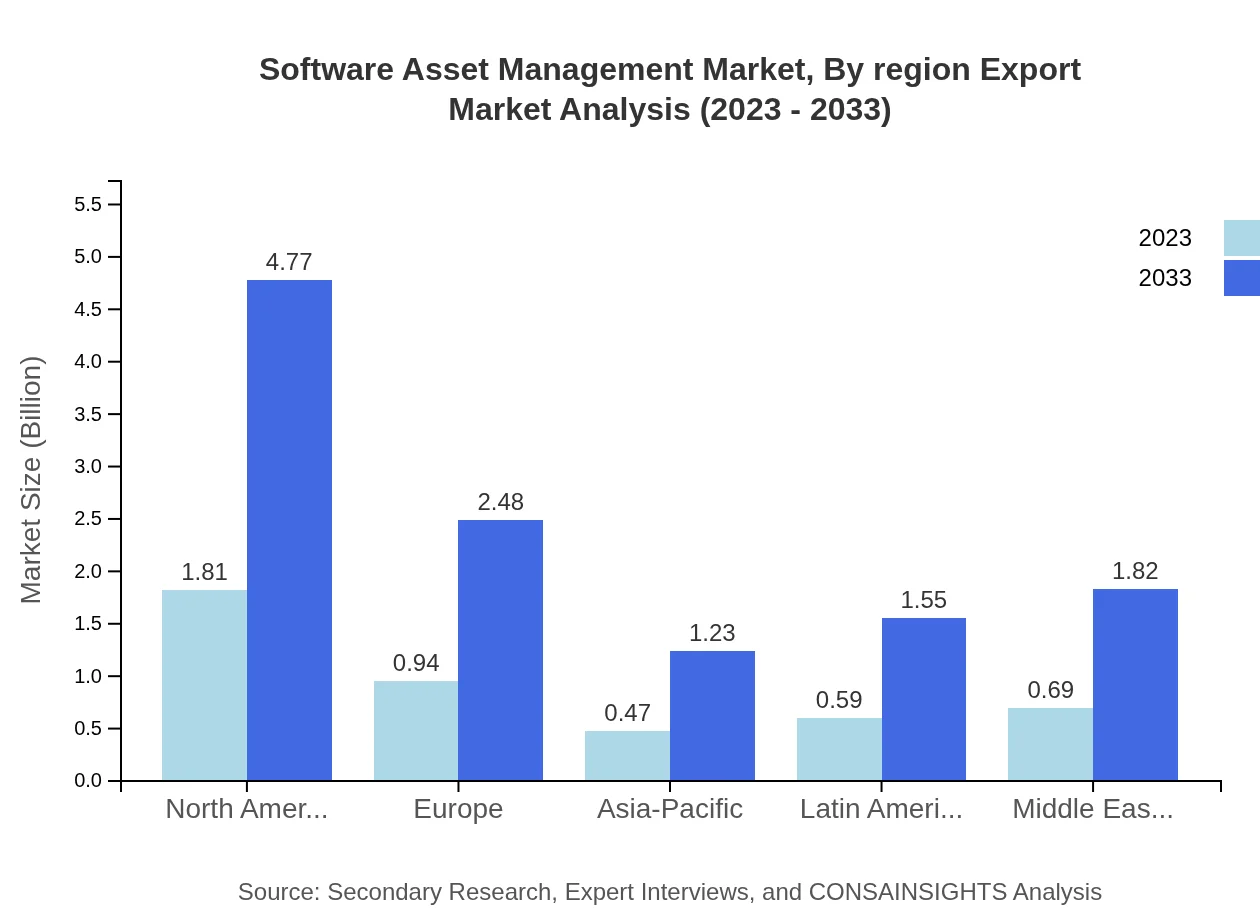

Europe Software Asset Management Market Report:

Europe's SAM market was valued at $1.59 billion in 2023, projected to reach $4.19 billion by 2033. The growing emphasis on IT governance and security across Europe is a key driver of this growth.Asia Pacific Software Asset Management Market Report:

In the Asia Pacific region, the SAM market was valued at approximately $0.81 billion in 2023 and is expected to grow to $2.13 billion by 2033. The rapid digitization and a growing base of IT services in emerging markets contribute to this expansion.North America Software Asset Management Market Report:

North America holds a significant share of the SAM market, valued at approximately $1.46 billion in 2023, with a projection of $3.85 billion by 2033. The region’s dominance is led by advanced technology adoption, high software expenditures, and a focus on regulatory compliance.South America Software Asset Management Market Report:

The South American market for Software Asset Management reached around $0.28 billion in 2023, with projections indicating it will grow to $0.74 billion by 2033. The growth is fueled by an increasing number of enterprises adopting SAM solutions for legal compliance and cost optimization.Middle East & Africa Software Asset Management Market Report:

The Software Asset Management market in the Middle East and Africa was valued at $0.35 billion in 2023, expected to grow to $0.93 billion by 2033. The rising adoption of digital solutions in various sectors will contribute to this growth.Tell us your focus area and get a customized research report.

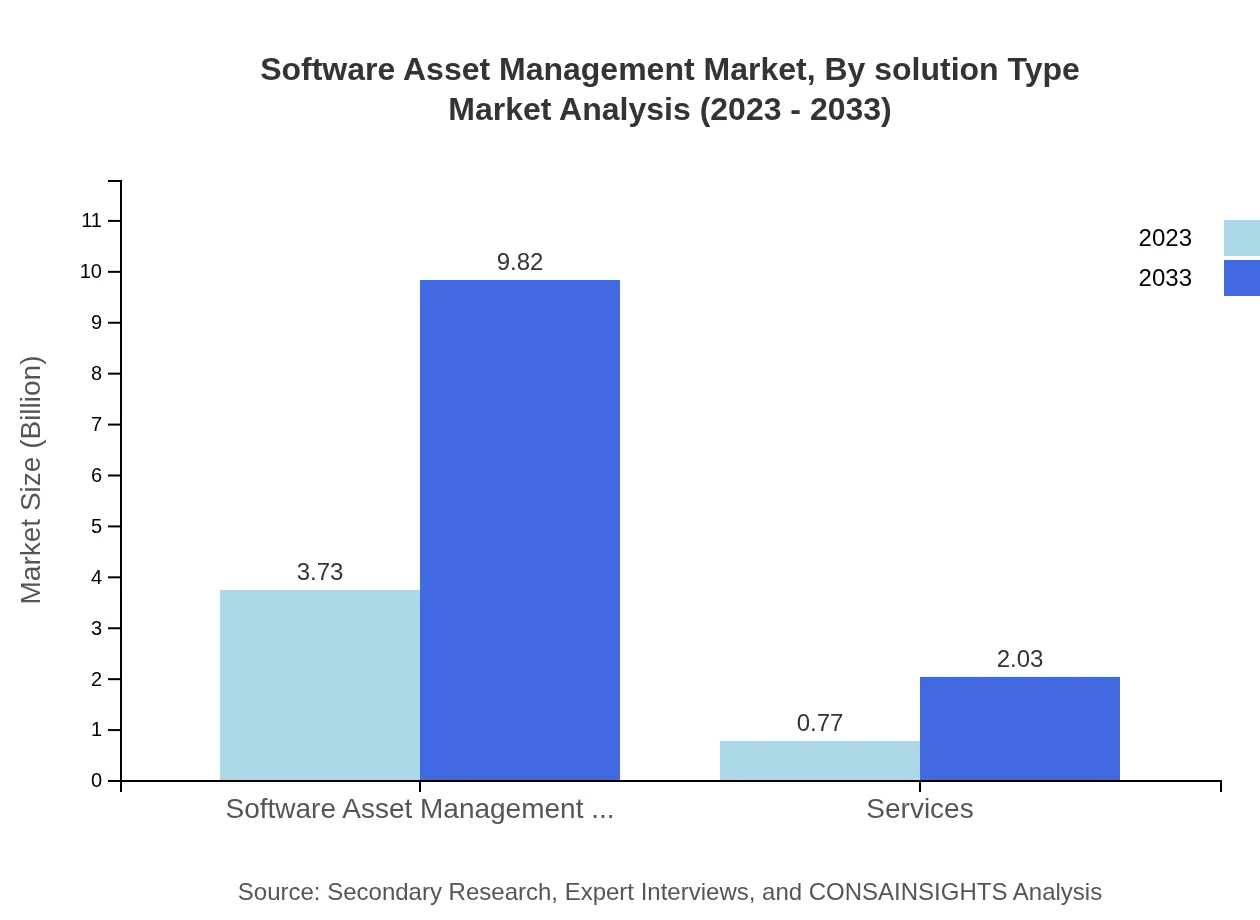

Software Asset Management Market Analysis By Solution Type

The SAM market, by solution type comprises software management solutions and services. In 2023, the SAM Solutions segment accounted for 82.89% of the market share, valued at $3.73 billion. It is expected to enlarge to $9.82 billion by 2033, reflecting the critical need for optimized licensing management.

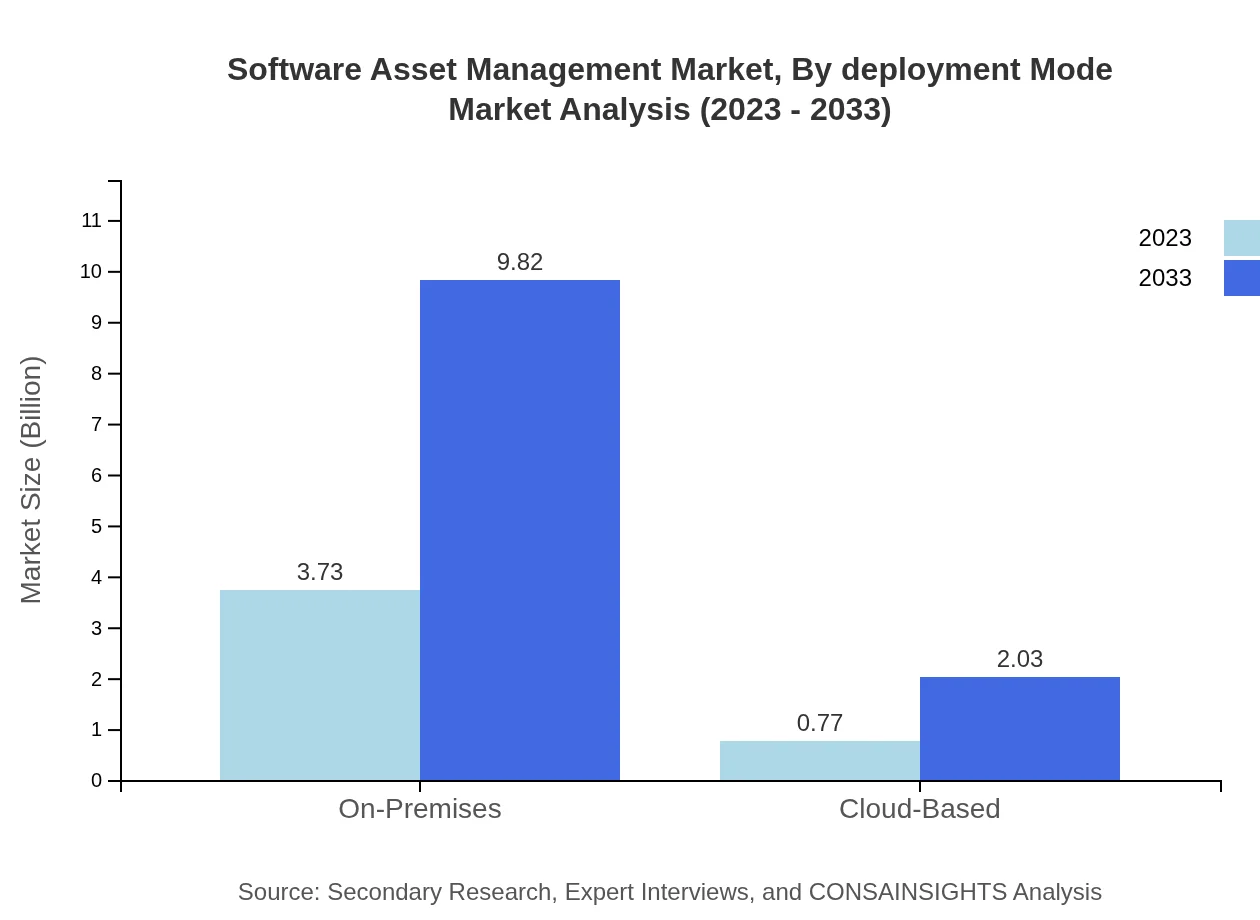

Software Asset Management Market Analysis By Deployment Mode

On-premises solutions currently dominate the deployment mode segment, holding 82.89% of the market share in 2023 with a valuation of $3.73 billion. This segment is expected to grow to $9.82 billion by 2033. Conversely, the cloud-based market is projected to witness significant growth due to flexibility and scalability.

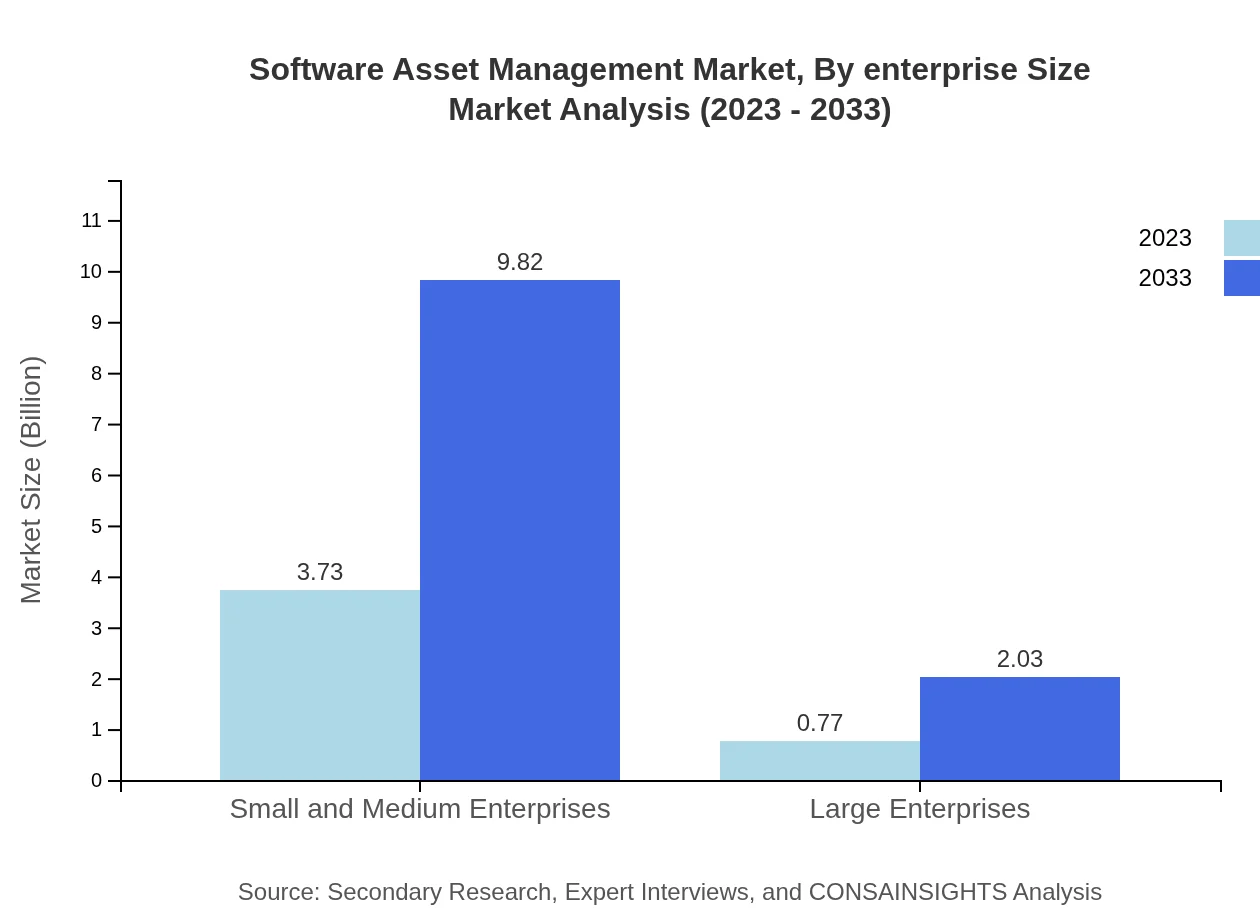

Software Asset Management Market Analysis By Enterprise Size

Small and Medium Enterprises (SMEs) constitute the majority, accounting for 82.89% of the market share in 2023 with a revenue of $3.73 billion. This segment is projected to grow to $9.82 billion by 2033 as SMEs increasingly seek solutions to enhance software efficiency and compliance.

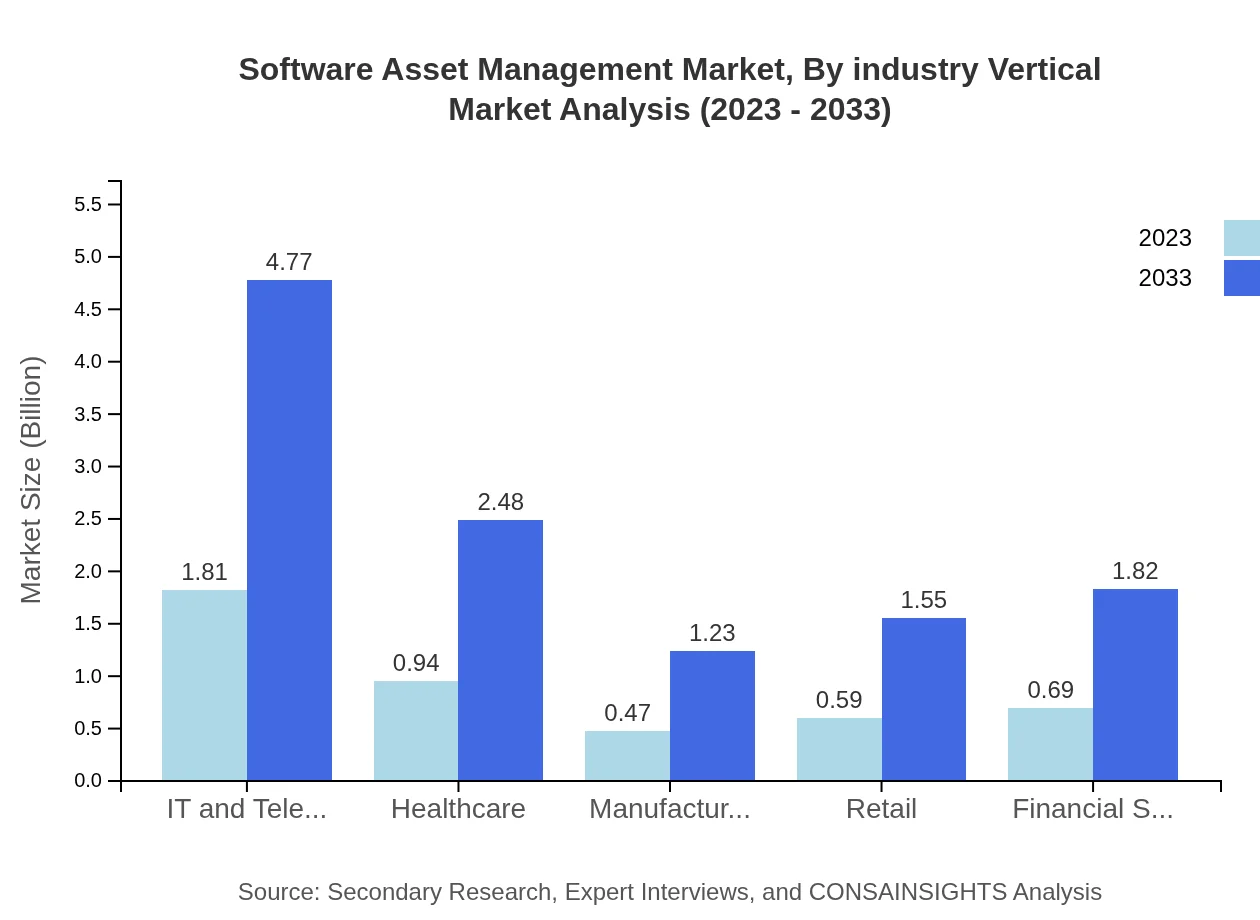

Software Asset Management Market Analysis By Industry Vertical

IT and Telecom sectors present the largest demand for SAM solutions, valued at $1.81 billion in 2023 and expected to rise to $4.77 billion by 2033. Healthcare and Financial Services sectors are also experiencing notable growth in demand for SAM tools for compliance and cost management.

Software Asset Management Market Analysis By Region Export

North America leads the region export, accounting for a market share of 40.26% in 2023. This trend is expected to continue, propelled by innovations and technology advancements in SAM, providing regional players with significant export opportunities.

Software Asset Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Software Asset Management Industry

ServiceNow:

ServiceNow offers a robust SAM solution focusing on improving software compliance and reducing costs through automation and streamlined IT operations.Flexera:

Flexera provides comprehensive software asset management software that enables enterprises to improve compliance and optimize software costs.IBM:

IBM's SAM solutions emphasize automated lifecycle management and robust governance processes to meet regulatory compliance and reduce software spending.Microsoft:

Microsoft enhances its SAM offerings through cloud-based solutions that allow organizations to track licenses effectively and ensure compliance.We're grateful to work with incredible clients.

FAQs

What is the market size of software Asset Management?

The global software asset management market is valued at $4.5 billion in 2023, with a projected CAGR of 9.8% leading up to 2033. This growth reflects the increasing need for effective software management solutions across industries.

What are the key market players or companies in this software Asset Management industry?

Key players in the software asset management industry include major companies like Microsoft, ServiceNow, IBM, Flexera, and Snow Software, all driving innovation and competitive strategies to capture market share and meet the evolving needs of businesses.

What are the primary factors driving the growth in the software Asset Management industry?

Primary factors driving growth include increased software complexity, the rise of cloud computing, regulatory compliance requirements, and the need for organizations to optimize software spending and mitigate licensing risks across multiple platforms.

Which region is the fastest Growing in the software Asset Management?

The fastest-growing region for software asset management is Asia-Pacific, expected to increase from $0.81 billion in 2023 to $2.13 billion by 2033 due to rapid digital transformation and rising adoption of software solutions in the region.

Does ConsaInsights provide customized market report data for the software Asset Management industry?

Yes, ConsaInsights offers customized market report data tailored specifically to the software asset management industry, enabling clients to receive insights that match their unique strategic needs and market interests.

What deliverables can I expect from this software Asset Management market research project?

Deliverables from the software asset management market research include comprehensive market size analysis, growth forecasts, competitive landscape, regional insights, and detailed segmentation data to support informed decision-making.

What are the market trends of software Asset Management?

Current trends in software asset management include a shift towards cloud-based solutions, increased automation in asset monitoring, a focus on compliance and reporting, and the growing use of analytics for optimizing software utilization across enterprises.