Software Composition Analysis Market Report

Published Date: 31 January 2026 | Report Code: software-composition-analysis

Software Composition Analysis Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Software Composition Analysis market, covering insights into current trends, market size, growth forecasts, and key players from 2023 to 2033. It aims to provide stakeholders with a comprehensive understanding of market dynamics and future opportunities.

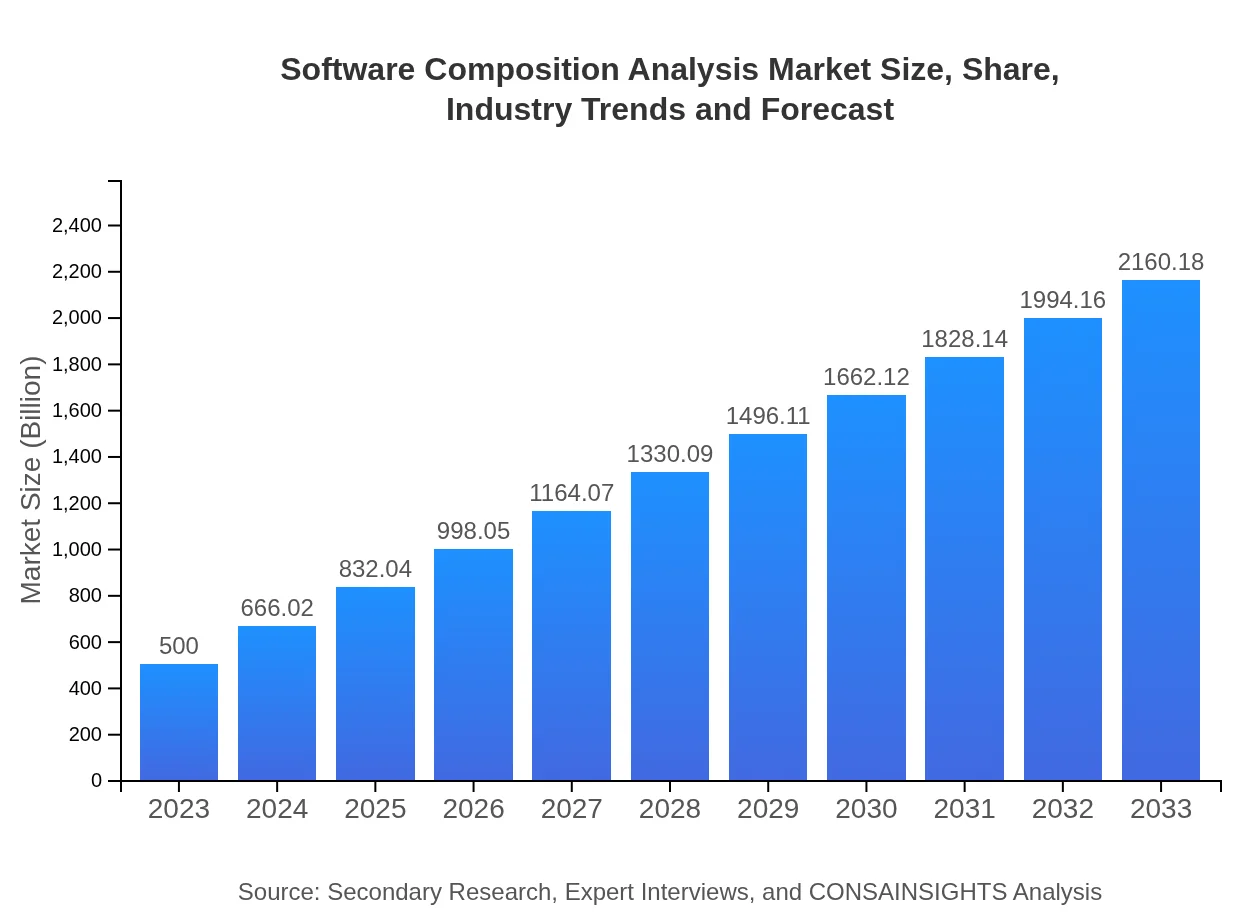

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $2160.18 Million |

| Top Companies | Sonatype, Synopsys, Veracode, WhiteSource, Checkmarx |

| Last Modified Date | 31 January 2026 |

Software Composition Analysis Market Overview

Customize Software Composition Analysis Market Report market research report

- ✔ Get in-depth analysis of Software Composition Analysis market size, growth, and forecasts.

- ✔ Understand Software Composition Analysis's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Software Composition Analysis

What is the Market Size & CAGR of Software Composition Analysis market in 2023?

Software Composition Analysis Industry Analysis

Software Composition Analysis Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Software Composition Analysis Market Analysis Report by Region

Europe Software Composition Analysis Market Report:

Europe's market is expected to evolve from $161.60 million in 2023 to a notable $698.17 million by 2033. Factors driving this growth include a higher infrastructural investment in cybersecurity tools and a growing focus on data protection regulations like GDPR, alongside initiatives promoting the use of open-source software.Asia Pacific Software Composition Analysis Market Report:

The Asia Pacific region accounted for approximately $99.35 million in 2023, with expectations to reach $429.23 million by 2033. The rise of digital transformation initiatives and regulatory compliance in countries like India and China are driving this growth. Additionally, increasing cyber threats and a burgeoning tech startup ecosystem are catalyzing the demand for SCA solutions.North America Software Composition Analysis Market Report:

North America, valued at $160.40 million in 2023, is predicted to escalate to $692.99 million by 2033, driven by stringent regulations and a robust cybersecurity framework. The presence of major technology corporations and increasing adoption of DevSecOps practices are particularly fostering growth in this region.South America Software Composition Analysis Market Report:

South America is projected to grow from $35.80 million in 2023 to $154.67 million by 2033. Governments are emphasizing cybersecurity measures amidst rising digital threats. The burgeoning technology sector in Brazil and Argentina is also expected to fuel market growth, alongside increased awareness about software security.Middle East & Africa Software Composition Analysis Market Report:

The Middle East and Africa market is anticipated to grow from $42.85 million in 2023 to $185.13 million by 2033. With a growing awareness of digital security among enterprises and government regulations calling for improved cybersecurity, the demand for SCA tools is rapidly increasing in this region.Tell us your focus area and get a customized research report.

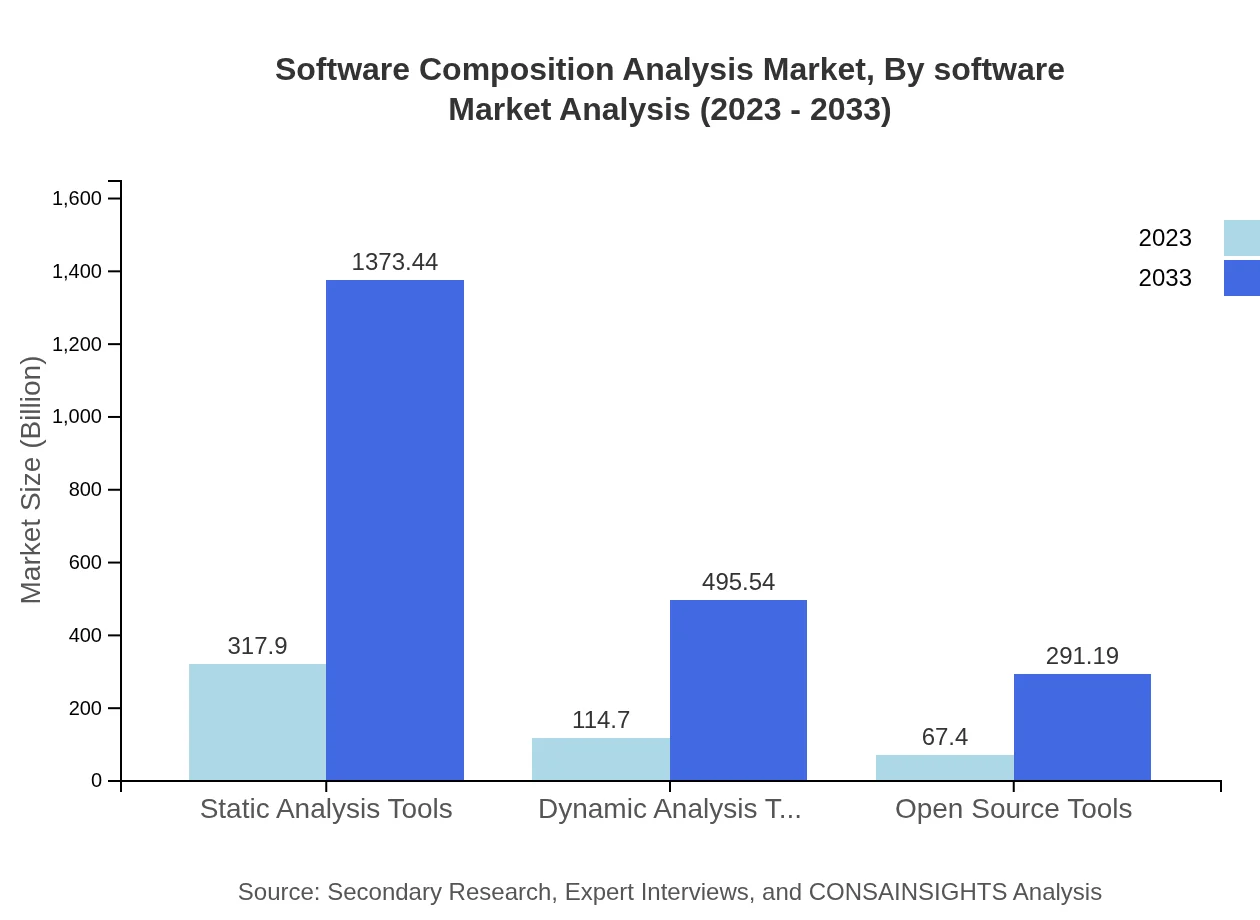

Software Composition Analysis Market Analysis By Software

The market is significantly influenced by various software types, including Static Analysis Tools, Dynamic Analysis Tools, and Open Source Tools. Static Analysis Tools dominate the sector, accounting for $317.90 million in 2023 and projected to reach $1,373.44 million by 2033, due to their proactive vulnerability detection capabilities. Dynamic Analysis Tools and Open Source Tools also present considerable growth opportunities, driven by their increasing adoption and efficacy in modern software development.

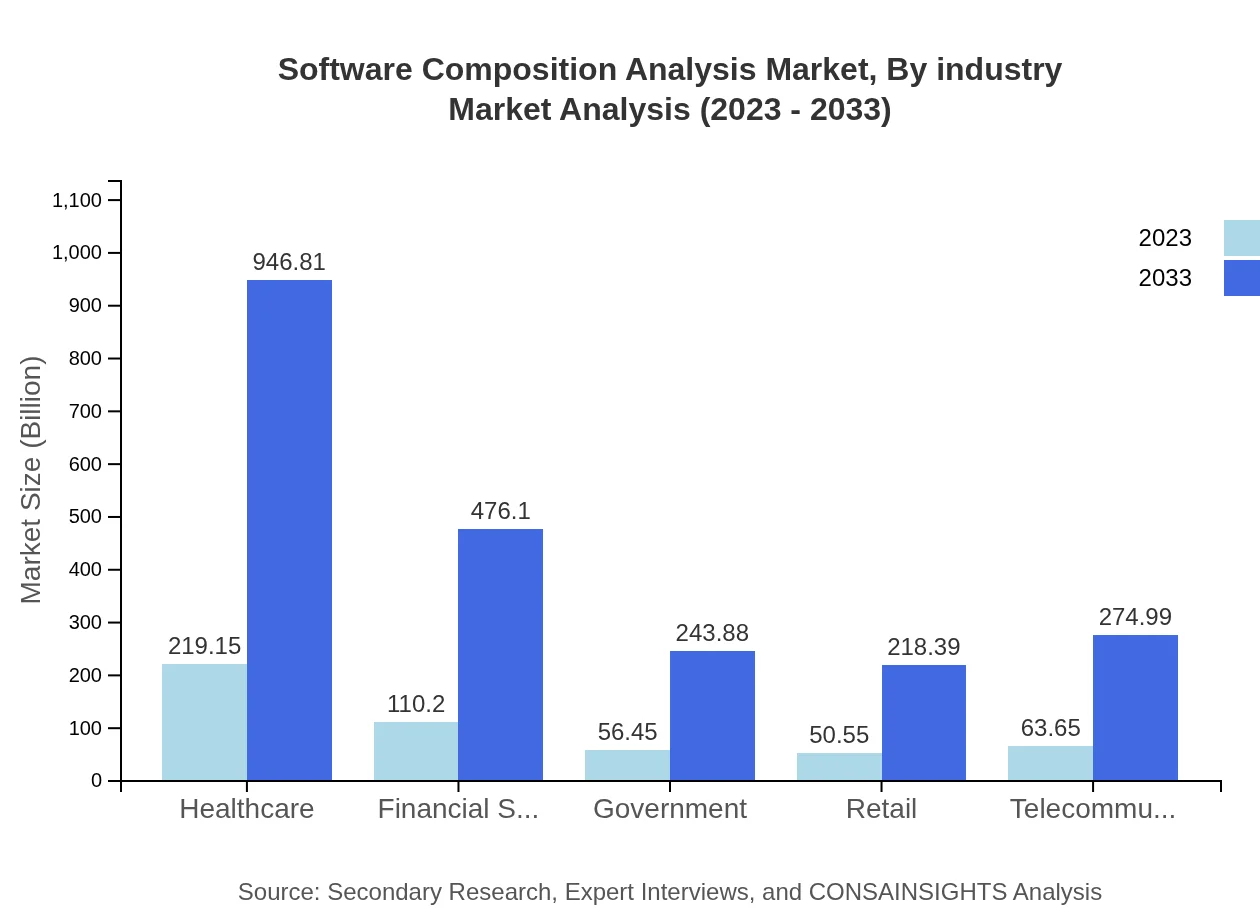

Software Composition Analysis Market Analysis By Industry

The industry segmentation shows substantial growth across various sectors. The Healthcare sector alone is expected to rise from $219.15 million in 2023 to $946.81 million by 2033, emphasizing the critical need for compliance and security in managing health data. The Financial Services sector also sees significant growth, driven by stringent regulations, expanding from $110.20 million to $476.10 million within the same period.

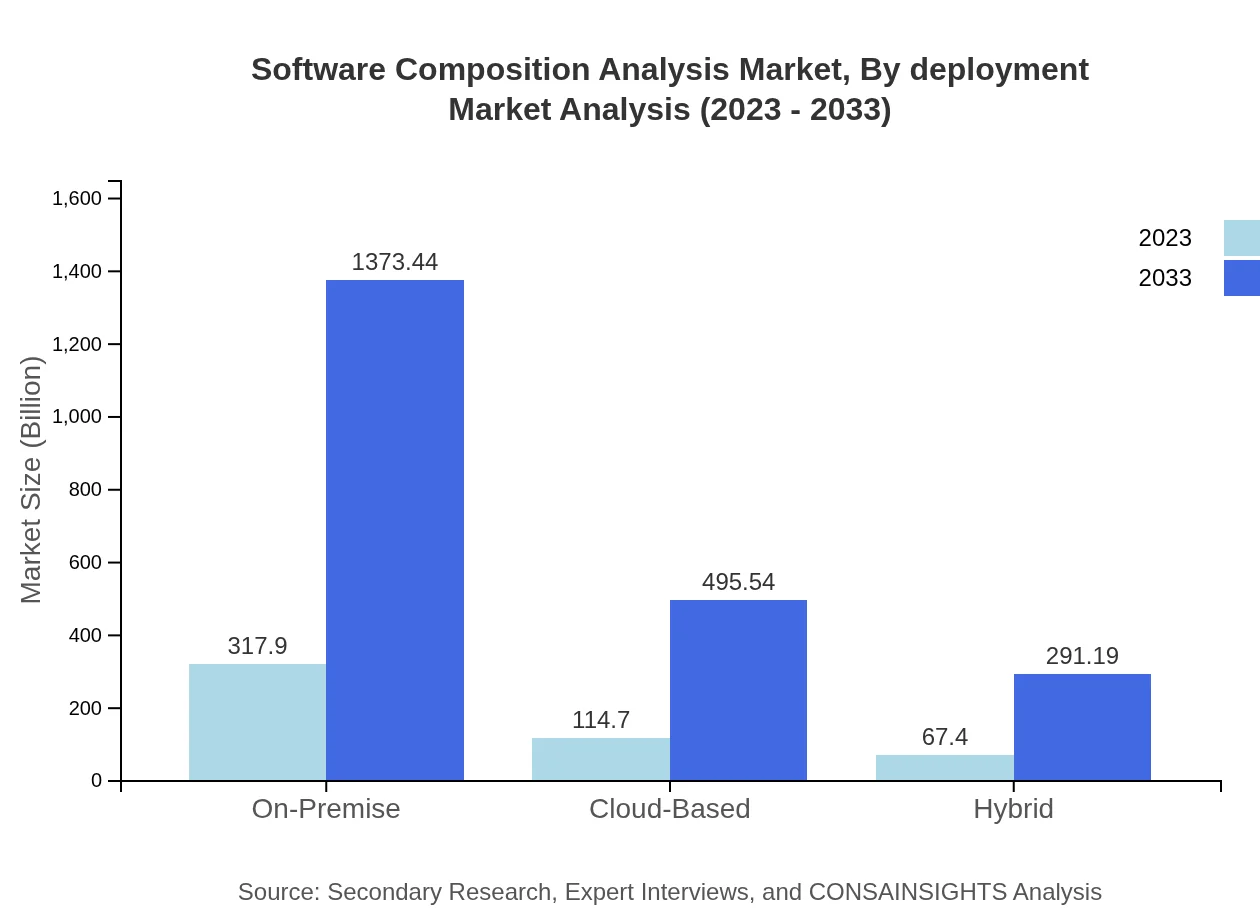

Software Composition Analysis Market Analysis By Deployment

Deployment models are also pivotal in shaping the SCA market, with On-Premise solutions dominating at $317.90 million in 2023 and poised to grow to $1,373.44 million by 2033. At the same time, Cloud-Based and Hybrid solutions are gaining traction, with their market sizes increasing as companies move towards flexibility and scalability without compromising on security.

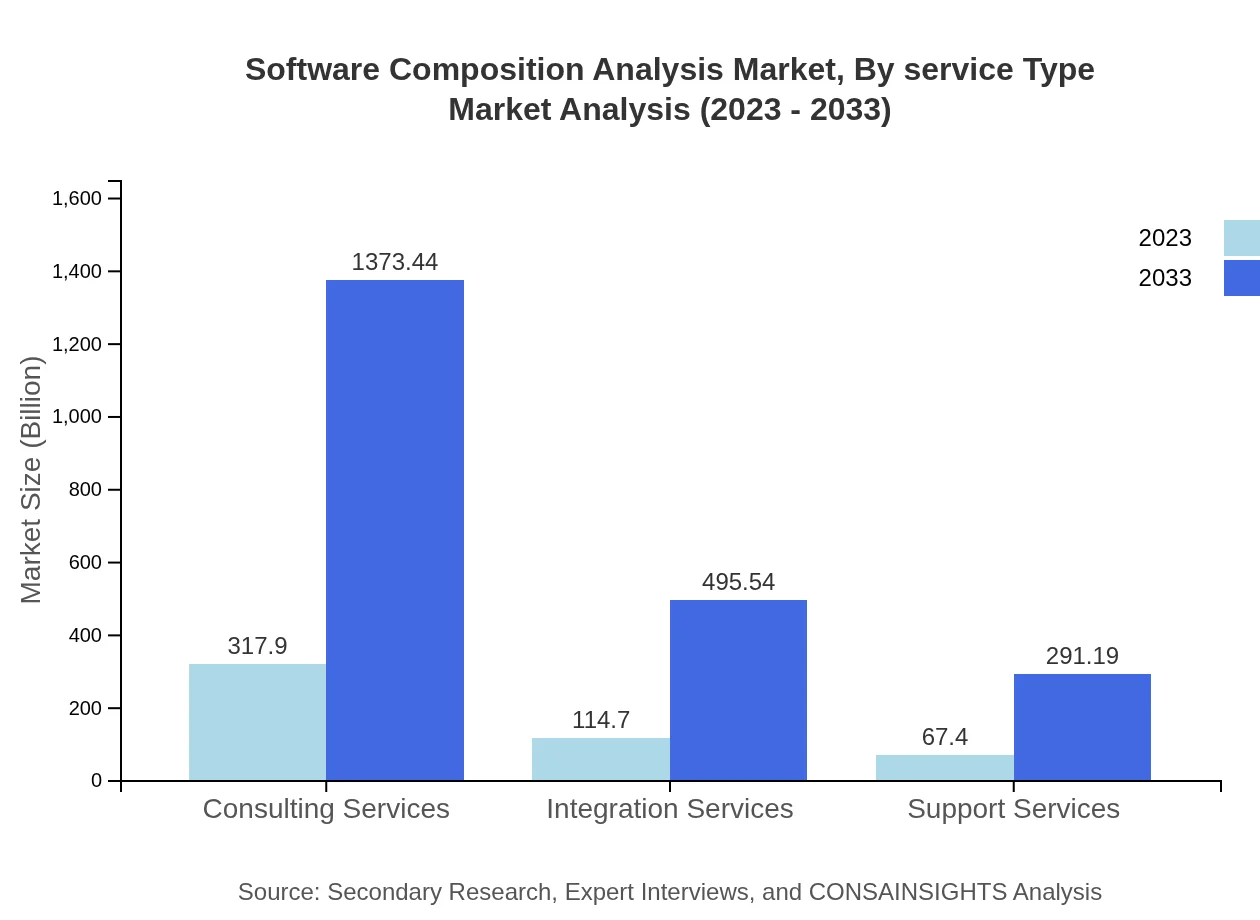

Software Composition Analysis Market Analysis By Service Type

The market reveals significant potential in different service types. Consulting Services lead with $317.90 million in 2023, moving to $1,373.44 million by 2033 as firms seek expert guidance in implementing SCA tools. Integration and Support Services are also growing, reflecting the industry's need for tailored solutions and ongoing maintenance.

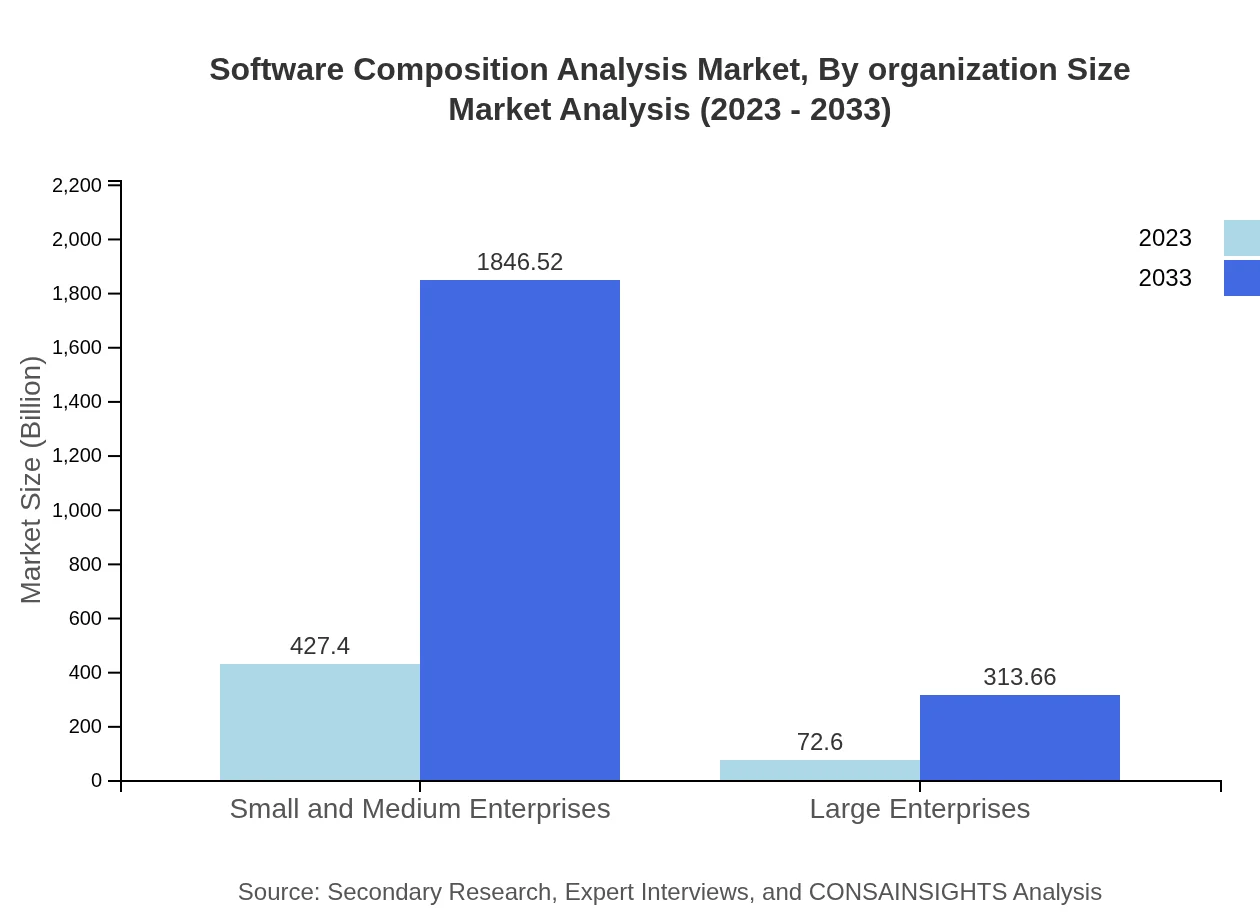

Software Composition Analysis Market Analysis By Organization Size

SMEs represent a substantial portion of the SCA market with a size of $427.40 million in 2023, projected to reach $1,846.52 million by 2033. Large Enterprises also show growth tendencies, although they occupy a smaller share compared to SMEs, highlighting the widespread need for robust security solutions across various organizational scales.

Software Composition Analysis Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Software Composition Analysis Industry

Sonatype:

Sonatype provides advanced SCA tools focusing on DevOps environments and secure software development lifecycles, which prevent vulnerabilities in open-source software.Synopsys:

A leader in application security, Synopsys offers comprehensive SCA solutions that integrate seamlessly into development workflows, facilitating code analysis and security management.Veracode:

Veracode streamlines the SCA process with its cloud-based security solutions, making it accessible and effective for both small businesses and large enterprises.WhiteSource:

WhiteSource specializes in tracking open-source components, providing automated security and compliance management solutions tailored for organizations globally.Checkmarx:

Checkmarx emphasizes static code analysis and offers features that support the detection of vulnerabilities in the compositional software.We're grateful to work with incredible clients.

FAQs

What is the market size of software Composition Analysis?

The software composition analysis market is valued at approximately $500 million in 2023, with a robust compound annual growth rate (CAGR) of 15% projected through 2033, indicating strong growth and increased adoption across various sectors.

What are the key market players or companies in the software Composition Analysis industry?

Key players in the software composition analysis industry include established tech companies providing innovative solutions and tools to enhance software security, compliance, and performance. Their contributions are crucial in driving the market forward.

What are the primary factors driving the growth in the software composition Analysis industry?

The growth in the software composition analysis industry is driven by increasing cybersecurity threats, the growing adoption of open-source software, and regulatory compliance pressures. Organizations prioritize software security and risk management, fueling demand.

Which region is the fastest Growing in the software Composition Analysis?

The fastest-growing region in the software composition analysis market is North America, projected to grow from $160.40 million in 2023 to $692.99 million by 2033, demonstrating significant market expansion in response to heightened cyber threats.

Does ConsaInsights provide customized market report data for the software Composition Analysis industry?

Yes, ConsaInsights offers customized market reports tailored to client needs in the software composition analysis industry, ensuring comprehensive analysis and up-to-date insights for strategic decision-making.

What deliverables can I expect from this software Composition Analysis market research project?

Deliverables from the software composition analysis market research project typically include comprehensive reports, market trend analyses, segment data, and forecasts, coupled with actionable insights for stakeholders in various sectors.

What are the market trends of software composition analysis?

Market trends in software composition analysis include an increasing emphasis on automated tools, the rise of cloud-based solutions, and the growing importance of cybersecurity in software development, influencing investment and strategic focus across industries.