Software Defined Data Center Market Report

Published Date: 31 January 2026 | Report Code: software-defined-data-center

Software Defined Data Center Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Software Defined Data Center (SDDC) market, focusing on market trends, regional insights, segment performance, and forecasts from 2023 to 2033. It aims to deliver strategic insights for stakeholders and business decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

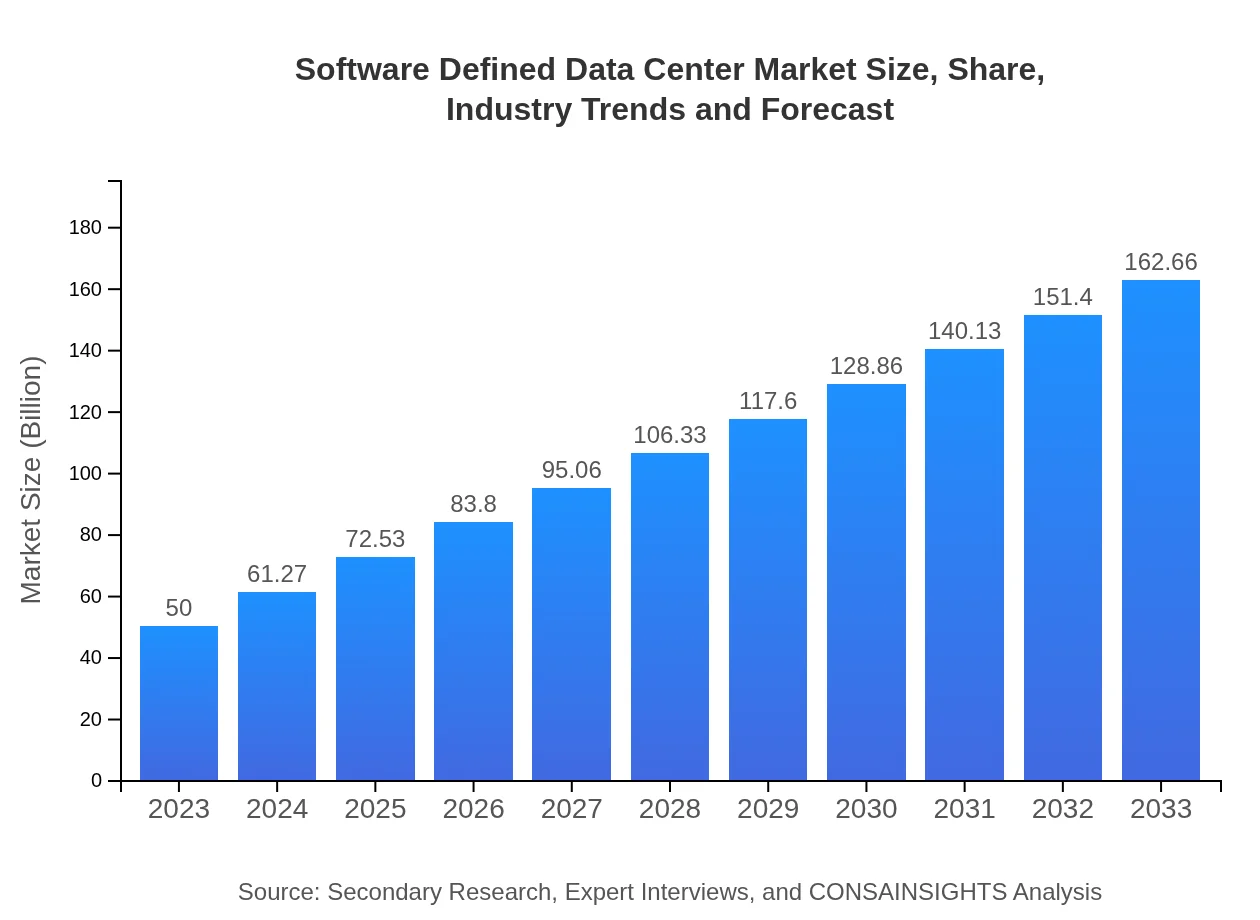

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $162.66 Billion |

| Top Companies | VMware, Cisco Systems, Hewlett Packard Enterprise, Dell Technologies, Microsoft Azure |

| Last Modified Date | 31 January 2026 |

Software Defined Data Center Market Overview

Customize Software Defined Data Center Market Report market research report

- ✔ Get in-depth analysis of Software Defined Data Center market size, growth, and forecasts.

- ✔ Understand Software Defined Data Center's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Software Defined Data Center

What is the Market Size & CAGR of Software Defined Data Center market in 2023 and 2033?

Software Defined Data Center Industry Analysis

Software Defined Data Center Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Software Defined Data Center Market Analysis Report by Region

Europe Software Defined Data Center Market Report:

Europe is projected to grow from $14.52 billion in 2023 to $47.24 billion in 2033. The region’s emphasis on data privacy and security, alongside stringent regulatory frameworks, is bolstering the demand for SDDC solutions.Asia Pacific Software Defined Data Center Market Report:

The Asia Pacific region is expected to witness significant growth in the SDDC market, projected to reach $28.63 billion by 2033 from $8.80 billion in 2023. Countries like China and India are leading the charge due to rapid digital transformation and investment in IT infrastructure.North America Software Defined Data Center Market Report:

North America remains the largest market for Software Defined Data Centers, with an expected growth from $19.32 billion in 2023 to $62.84 billion by 2033. The United States is at the forefront of SDDC adoption, fueled by major investments in cloud technologies and GDPR compliance.South America Software Defined Data Center Market Report:

The South American market is relatively nascent but is on a growth trajectory, expected to rise from $1.68 billion in 2023 to $5.47 billion by 2033. Increased internet penetration and a shift towards cloud computing are driving this growth.Middle East & Africa Software Defined Data Center Market Report:

In the Middle East and Africa, the SDDC market is expected to increase from $5.68 billion in 2023 to $18.49 billion by 2033, driven by growing investments in digital transformation and smart city initiatives.Tell us your focus area and get a customized research report.

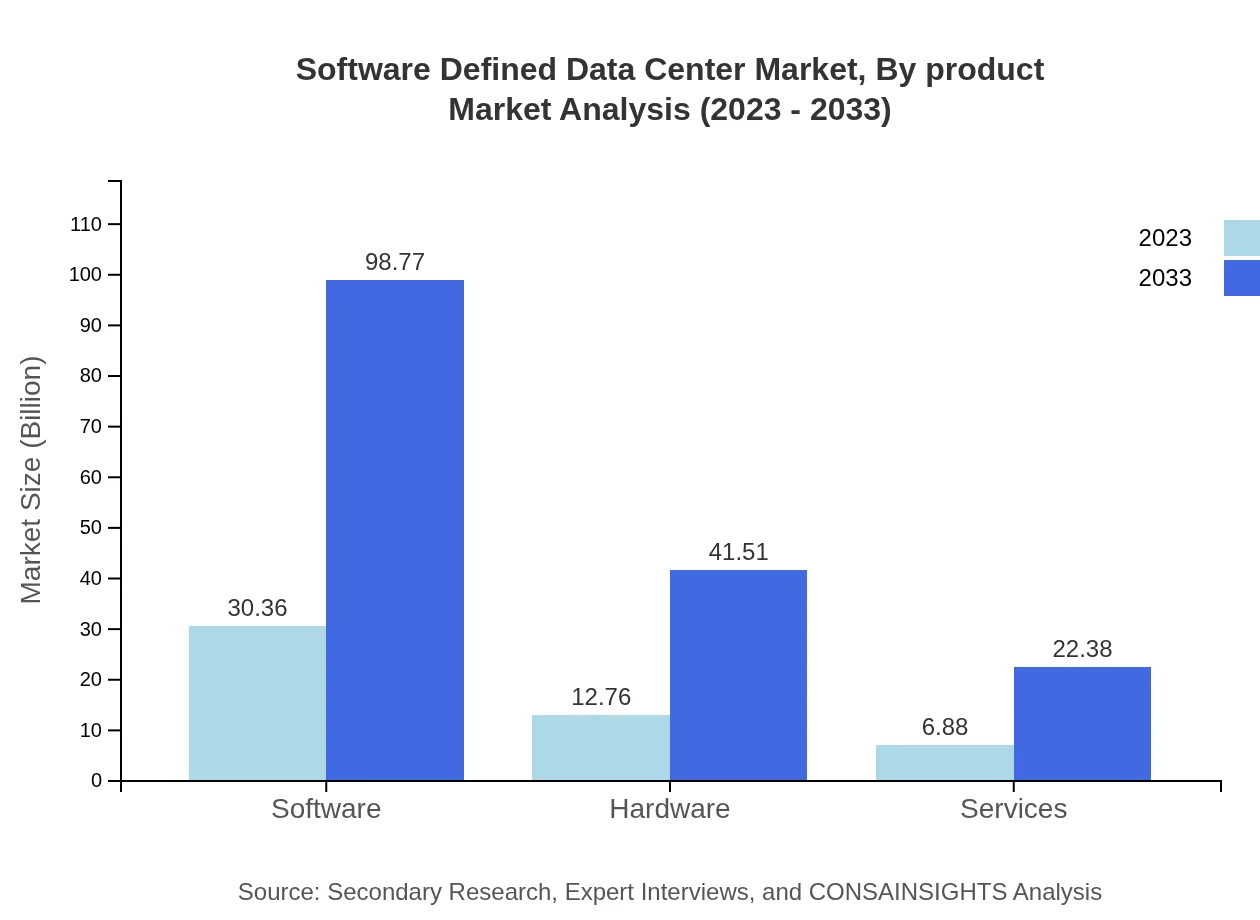

Software Defined Data Center Market Analysis By Product

In 2023, the Software segment is valued at $30.36 billion, growing to $98.77 billion by 2033. Hardware accounts for $12.76 billion and is projected to grow to $41.51 billion, while Services are expected to grow from $6.88 billion to $22.38 billion over the same period.

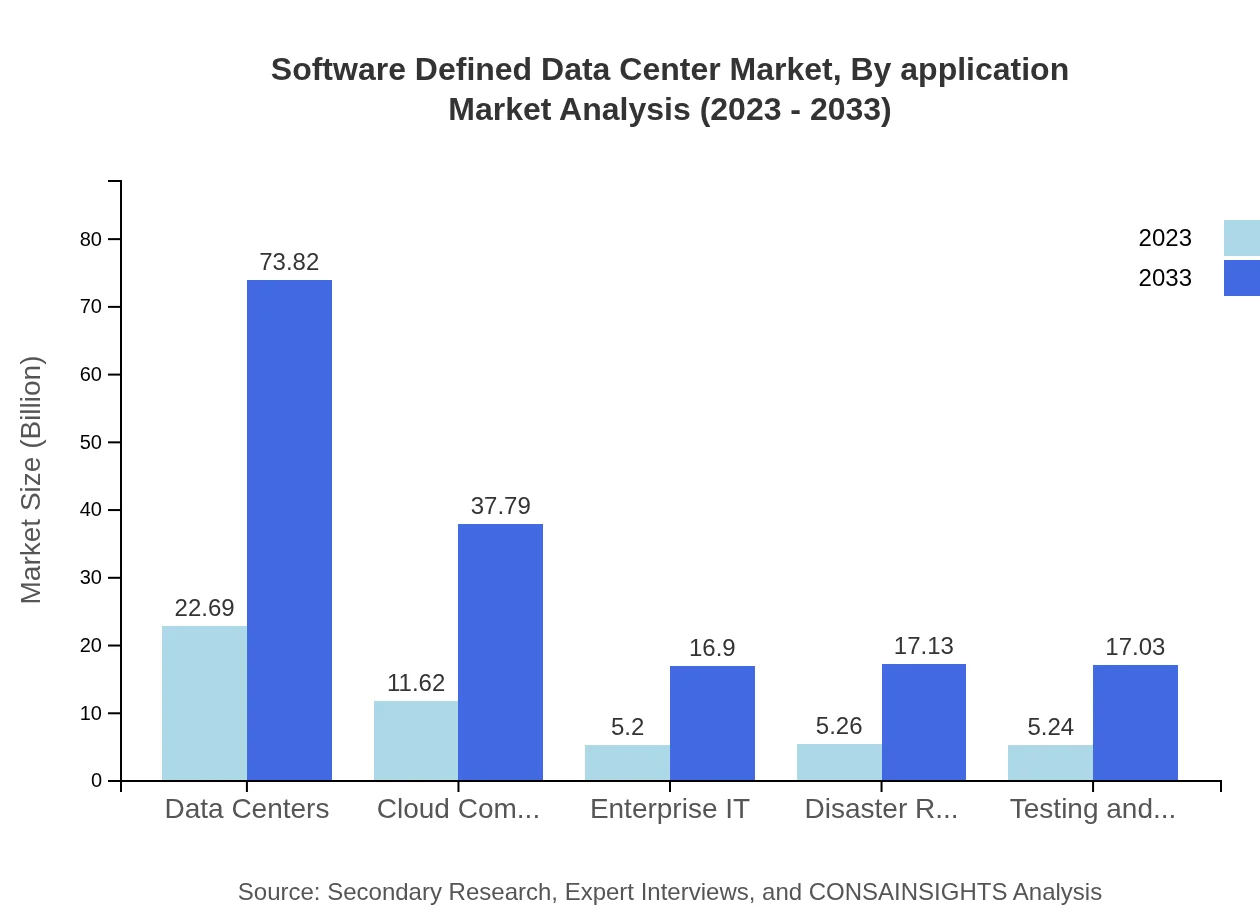

Software Defined Data Center Market Analysis By Application

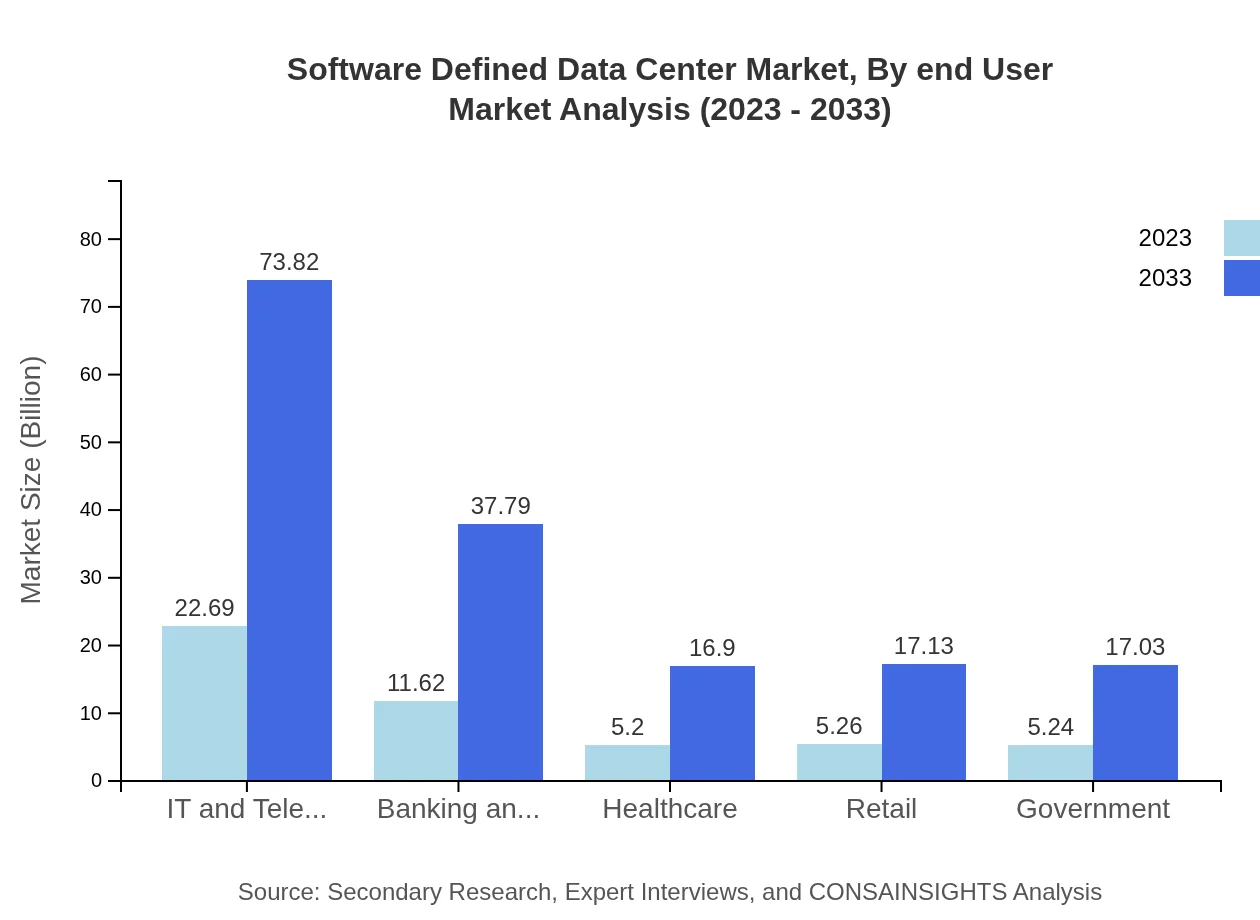

Key applications include IT and Telecom which is valued at $22.69 billion in 2023, expected to reach $73.82 billion by 2033. Other crucial sectors include Banking and Finance ($11.62 billion to $37.79 billion), and Healthcare ($5.20 billion to $16.90 billion).

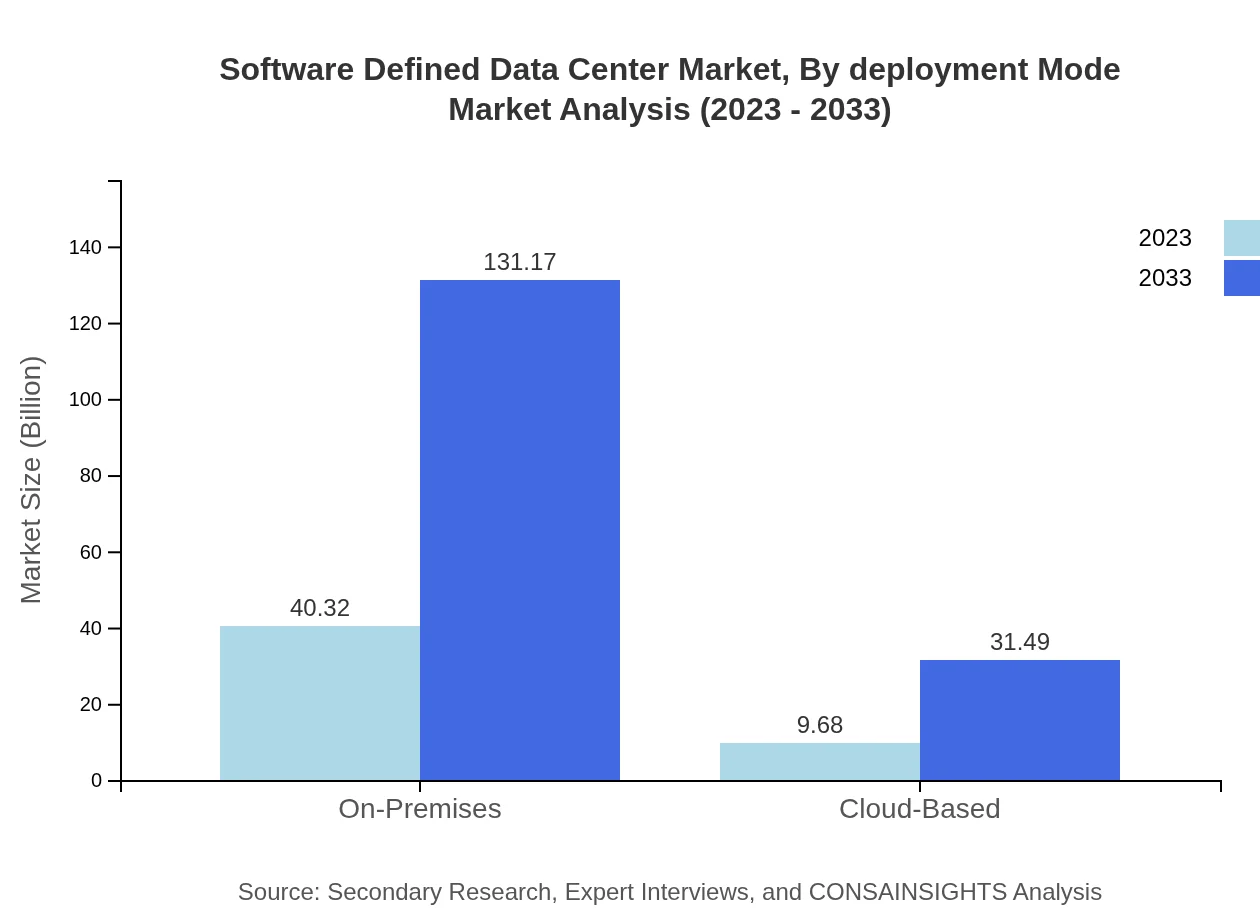

Software Defined Data Center Market Analysis By Deployment Mode

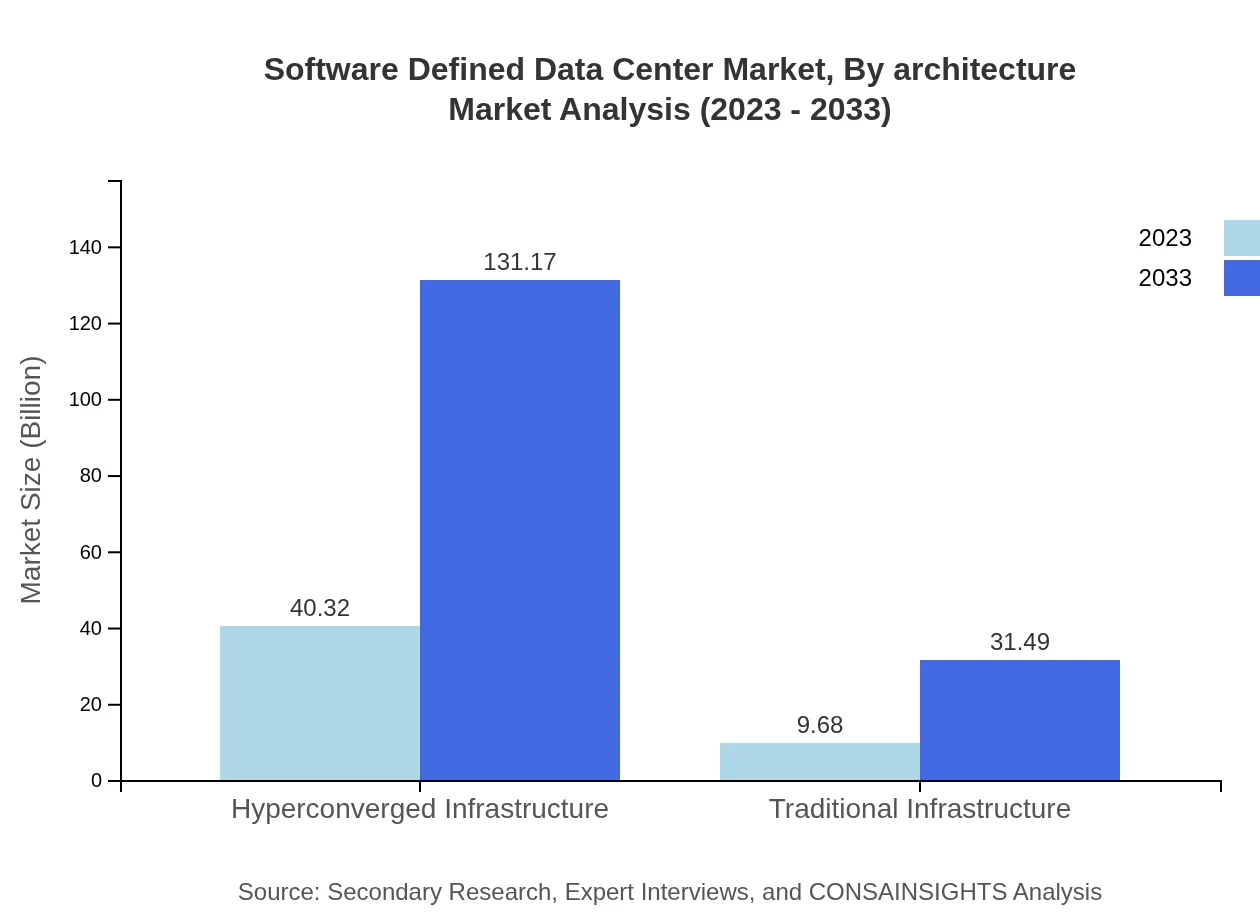

The On-Premises model is valued at $40.32 billion in 2023, forecasted to rise to $131.17 billion, while the Cloud-Based model moves from $9.68 billion to $31.49 billion. The hybrid approach is creating new opportunities across various industries.

Software Defined Data Center Market Analysis By End User

Data Centers account for major growth within SDDC, moving from $22.69 billion in 2023 to $73.82 billion in 2033, with significant contributions from sectors like Cloud Computing, Healthcare, and Government.

Software Defined Data Center Market Analysis By Architecture

Hyperconverged Infrastructure dominates with an expected growth from $40.32 billion to $131.17 billion. Traditional Infrastructure will see growth from $9.68 billion to $31.49 billion, reflecting shifts in architectural preferences among enterprises.

Software Defined Data Center Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Software Defined Data Center Industry

VMware:

A leader in virtualization and cloud infrastructure technologies, VMware offers SDDC solutions that enhance data center performance and efficiency.Cisco Systems:

Cisco provides innovative networking solutions that enable organizations to build robust Software Defined Data Centers, integrating hardware and software for seamless operations.Hewlett Packard Enterprise:

An enterprise-focused technology company, HPE provides SDDC solutions that help organizations manage resources effectively while driving digital transformation.Dell Technologies:

Dell Technologies offers a range of SDDC and hyper-converged solutions designed for flexibility, scaling deeply integrated hardware and software.Microsoft Azure:

Microsoft Azure provides cloud-based SDDC solutions that empower businesses to scale infrastructure on-demand while maintaining high security and compliance.We're grateful to work with incredible clients.

FAQs

What is the market size of Software-Defined Data Center?

The Software-Defined Data Center market is projected to expand from a market size of $50 billion in 2023, with a CAGR of 12%, reaching substantial growth by 2033.

What are the key market players or companies in this Software-Defined Data Center industry?

Key players in the Software-Defined Data Center industry include VMware, Cisco, HPE, IBM, and Microsoft, leading innovations and providing advanced solutions in this rapidly growing market.

What are the primary factors driving the growth in the Software-Defined Data Center industry?

Factors driving growth include increased demand for cloud computing, the necessity for efficient IT resource management, digitization across sectors, and the need for scalability in enterprise operations.

Which region is the fastest Growing in the Software-Defined Data Center?

North America is the fastest-growing region, with projections for 2023 at $19.32 billion and expected to grow to $62.84 billion by 2033, driven by technological advancements and adoption rates.

Does ConsaInsights provide customized market report data for the Software-Defined Data Center industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements, enabling clients to gain deeper insights into the Software-Defined Data Center industry.

What deliverables can I expect from this Software-Defined Data Center market research project?

Expect comprehensive reports including market size, analysis of key players, trends, regional breakdowns, and detailed segmentation insights to guide strategic decisions.

What are the market trends of Software-Defined Data Center?

Market trends include the rise of hyper-converged infrastructures, increased adoption of AI and machine learning in data centers, along with a shift towards hybrid cloud models.