Software Defined Radio Market Report

Published Date: 31 January 2026 | Report Code: software-defined-radio

Software Defined Radio Market Size, Share, Industry Trends and Forecast to 2033

This market report provides insights into the Software Defined Radio (SDR) sector, focusing on market size, growth rates, segmentation, regional analysis, and future trends from 2023 to 2033. Comprehensive data are presented to support strategic decision-making.

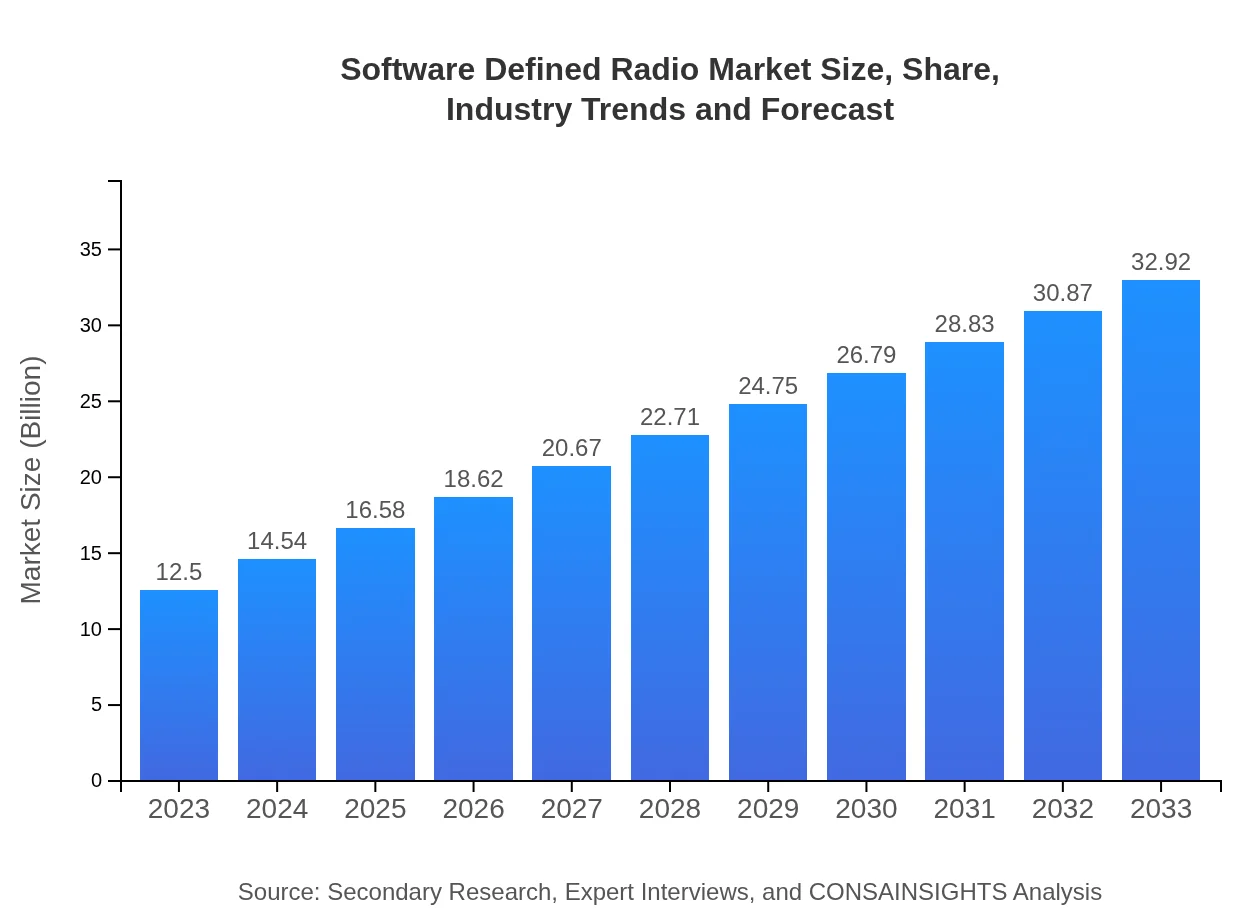

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $32.92 Billion |

| Top Companies | Raytheon Technologies, Thales Group, General Dynamics, Harris Corporation, Northrop Grumman |

| Last Modified Date | 31 January 2026 |

Software Defined Radio Market Overview

Customize Software Defined Radio Market Report market research report

- ✔ Get in-depth analysis of Software Defined Radio market size, growth, and forecasts.

- ✔ Understand Software Defined Radio's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Software Defined Radio

What is the Market Size & CAGR of Software Defined Radio market in 2023?

Software Defined Radio Industry Analysis

Software Defined Radio Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Software Defined Radio Market Analysis Report by Region

Europe Software Defined Radio Market Report:

Europe's SDR market is expected to rise from $3.58 billion in 2023 to $9.41 billion by 2033, influenced by the increasing demand for sophisticated communication channels and the integration of advanced mobile communication technologies.Asia Pacific Software Defined Radio Market Report:

In the Asia Pacific region, the Software Defined Radio market is projected to grow from $2.55 billion in 2023 to $6.71 billion by 2033, driven by rising investments in communication technologies and increasing military modernization programs.North America Software Defined Radio Market Report:

North America holds a significant share of the SDR market, anticipated to grow from $4.50 billion in 2023 to $11.84 billion by 2033. This expansion is fueled by advanced defense technology expenditure and rapid technological innovations in the telecommunications sector.South America Software Defined Radio Market Report:

The South American market for Software Defined Radio is expected to expand from $0.25 billion in 2023 to $0.65 billion by 2033. Growth in this region is largely attributed to greater focus on digital communication networks and public safety initiatives.Middle East & Africa Software Defined Radio Market Report:

The Middle East and Africa SDR market is projected to increase from $1.64 billion in 2023 to $4.31 billion by 2033. The growth is driven by military modernization efforts and the escalating need for reliable communication systems in emergency situations.Tell us your focus area and get a customized research report.

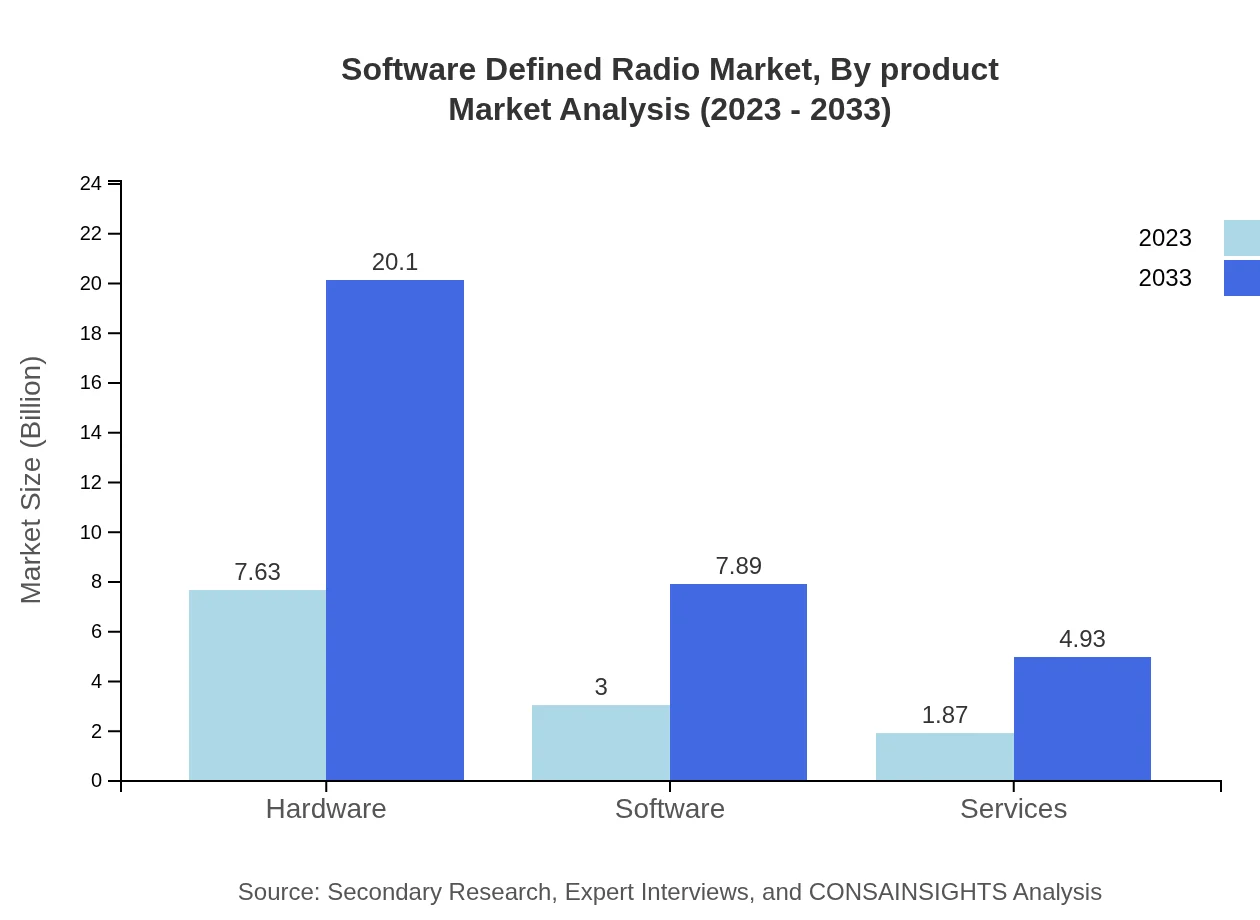

Software Defined Radio Market Analysis By Product

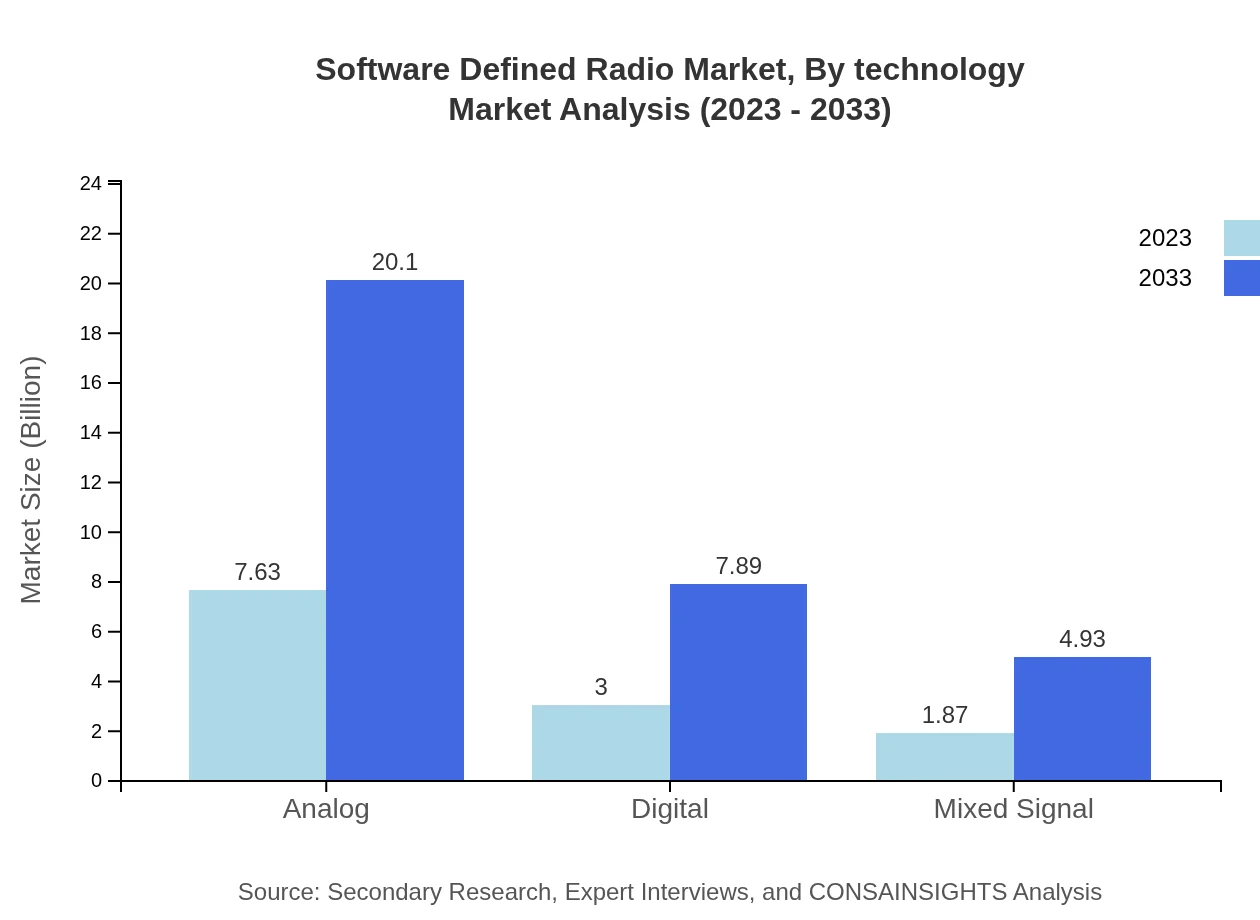

In 2023, the hardware segment commands a market size of $7.63 billion, with projections reaching $20.10 billion by 2033, maintaining a market share of 61.07%. The software segment is valued at $3.00 billion in 2023, expected to grow to $7.89 billion by 2033. Services constitute a smaller share at $1.87 billion, projected to rise to $4.93 billion.

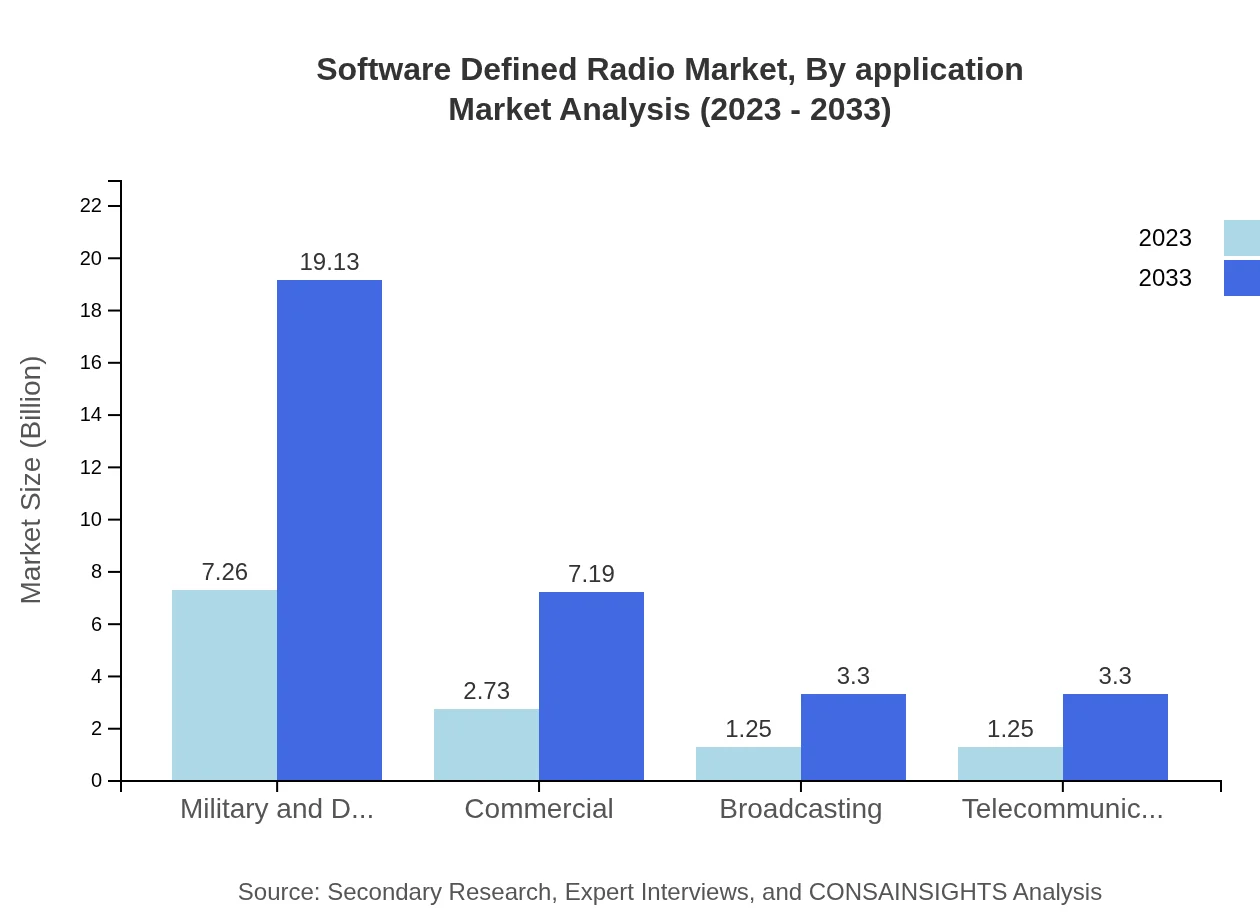

Software Defined Radio Market Analysis By Application

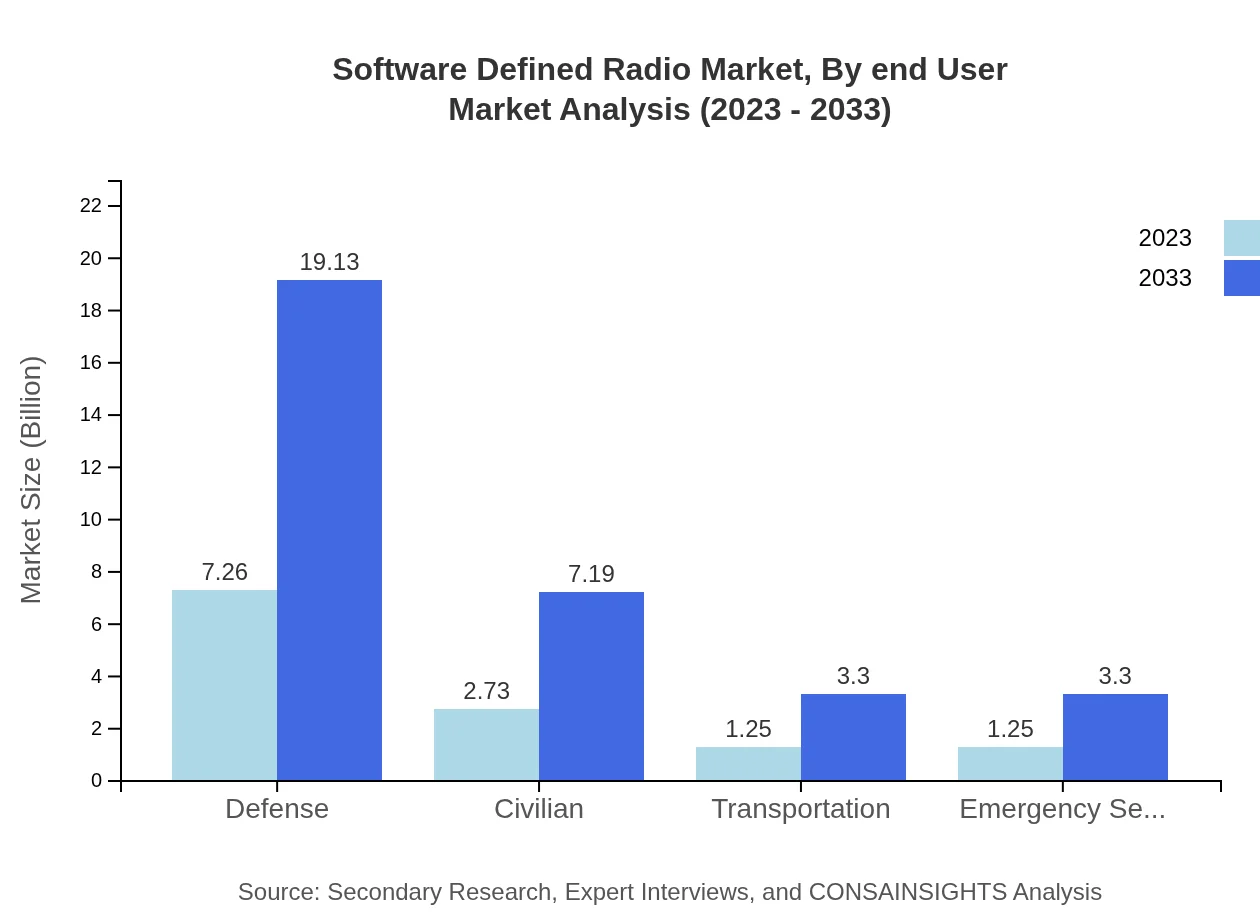

The defense segment dominates the SDR market with a size of $7.26 billion in 2023, projected to reach $19.13 billion by 2033, representing 58.11% of the share. Civilian applications are estimated to grow from $2.73 billion to $7.19 billion, while transportation and emergency services each represent a market size of $1.25 billion, expected to grow similarly.

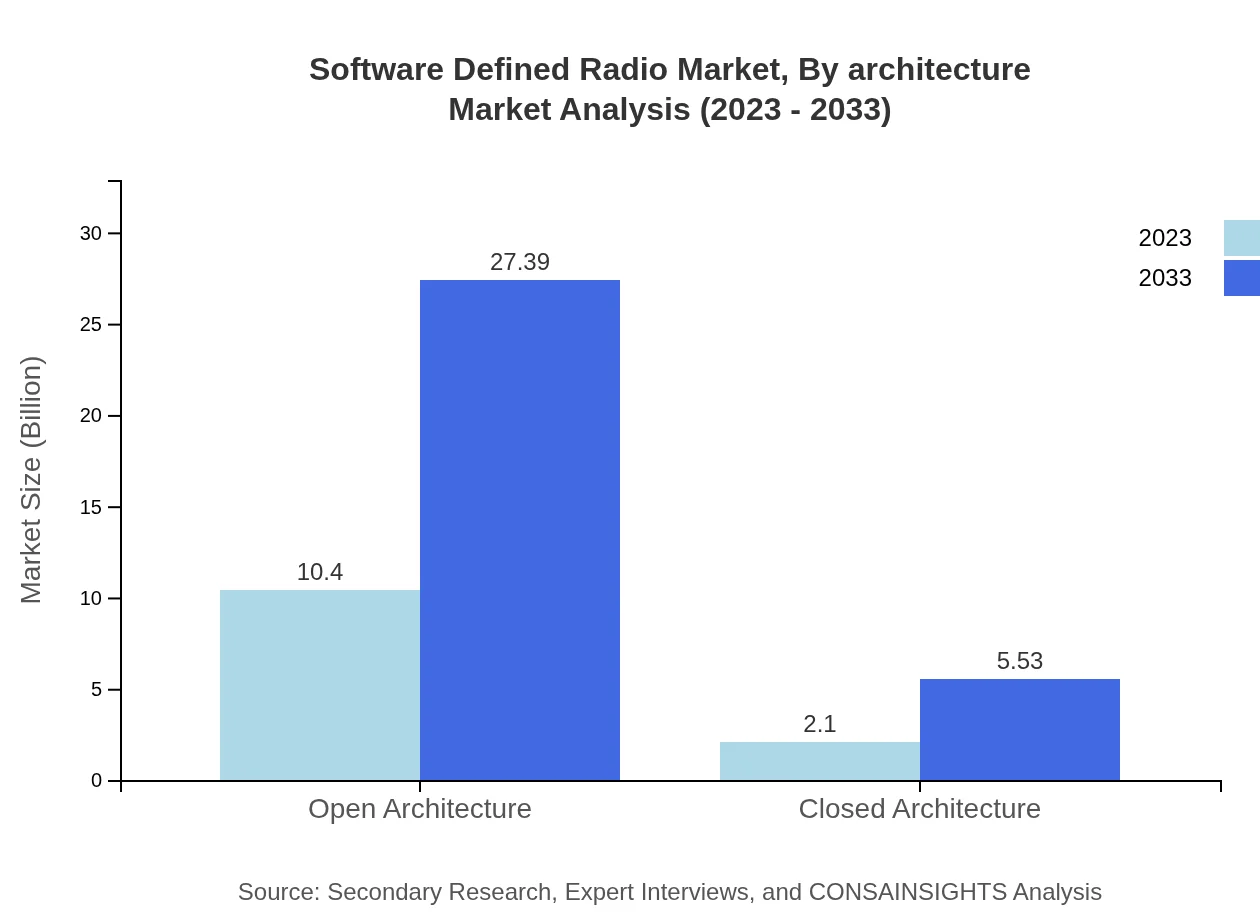

Software Defined Radio Market Analysis By Architecture

The SDR market's architecture is led by open architecture systems valued at $10.40 billion in 2023 and projected to grow to $27.39 billion by 2033, holding 83.2% of the market share. Closed architecture systems are comparatively smaller, growing from $2.10 billion to $5.53 billion at a share of 16.8%.

Software Defined Radio Market Analysis By End User

In the military and defense sector, the market size is $7.26 billion in 2023, expanding to $19.13 billion by 2033. The commercial segment reflects growth from $2.73 billion to $7.19 billion, showcased by increasing investments in commercial aviation and maritime operations.

Software Defined Radio Market Analysis By Technology

The market segmented by technology shows analog systems with a size of $7.63 billion in 2023, increasing to $20.10 billion by 2033, dominating the market share at 61.07%. Digital systems stand at $3.00 billion and are expected to grow to $7.89 billion, representing 23.96%.

Software Defined Radio Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Software Defined Radio Industry

Raytheon Technologies:

A leader in defense and aerospace systems, Raytheon develops SDR technology for military applications, focusing on enhancing communication reliability and interoperability.Thales Group:

Thales provides advanced communication solutions leveraging SDR technology. The company is recognized for its defense and security applications across various regions.General Dynamics:

General Dynamics is a major provider of SDR for military applications, offering robust and secure communication systems to enhance operational capabilities.Harris Corporation:

Harris specializes in communication and electronic systems, providing innovative SDR solutions that support both civilian and defense market needs.Northrop Grumman:

Northrop Grumman is a key player in advanced technology, focusing on SDR solutions for defense applications, highlighting their commitment to innovation and technological leadership.We're grateful to work with incredible clients.

FAQs

What is the market size of Software-Defined Radio?

The global Software-Defined Radio (SDR) market size was estimated at $12.5 billion in 2023, with a projected CAGR of 9.8%, reaching significant growth in various segments by 2033.

What are the key market players or companies in the Software-Defined Radio industry?

Key players in the Software-Defined Radio industry include major companies such as Thales Group, Raytheon Technologies, BAE Systems, and Harris Corporation, driving innovations and market expansion through cutting-edge technology and strategic partnerships.

What are the primary factors driving the growth in the Software-Defined Radio industry?

The growth in the Software-Defined Radio industry is driven primarily by increasing demand for advanced communication systems, technological advancements in radio architecture, and a growing need for adaptable and efficient defense communication solutions.

Which region is the fastest Growing in the Software-Defined Radio market?

North America is anticipated to be the fastest-growing region for Software-Defined Radio, expanding from $4.50 billion in 2023 to $11.84 billion by 2033, fueled by government investments and technological innovation in defense sectors.

Does ConsaInsights provide customized market report data for the Software-Defined Radio industry?

Yes, ConsaInsights does offer customized market report data tailored to the Software-Defined Radio industry, ensuring that clients receive detailed insights specific to their strategic needs and market focus.

What deliverables can I expect from this Software-Defined Radio market research project?

From the Software-Defined Radio market research project, clients can expect comprehensive reports detailing market analysis, competitive landscape evaluations, trends, forecasts, and segmentation data relevant to their business objectives.

What are the market trends of Software-Defined Radio?

Current market trends in Software-Defined Radio include a shift towards open architectures, increased integration of AI and machine learning for enhanced processing capabilities, and growing applications across military and civilian segments.