Software Defined Security Market Report

Published Date: 31 January 2026 | Report Code: software-defined-security

Software Defined Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Software Defined Security market, covering insights from 2023 to 2033. It includes market size, growth rates, regional analysis, industry trends, and forecasts, offering stakeholders valuable data for strategic decision-making.

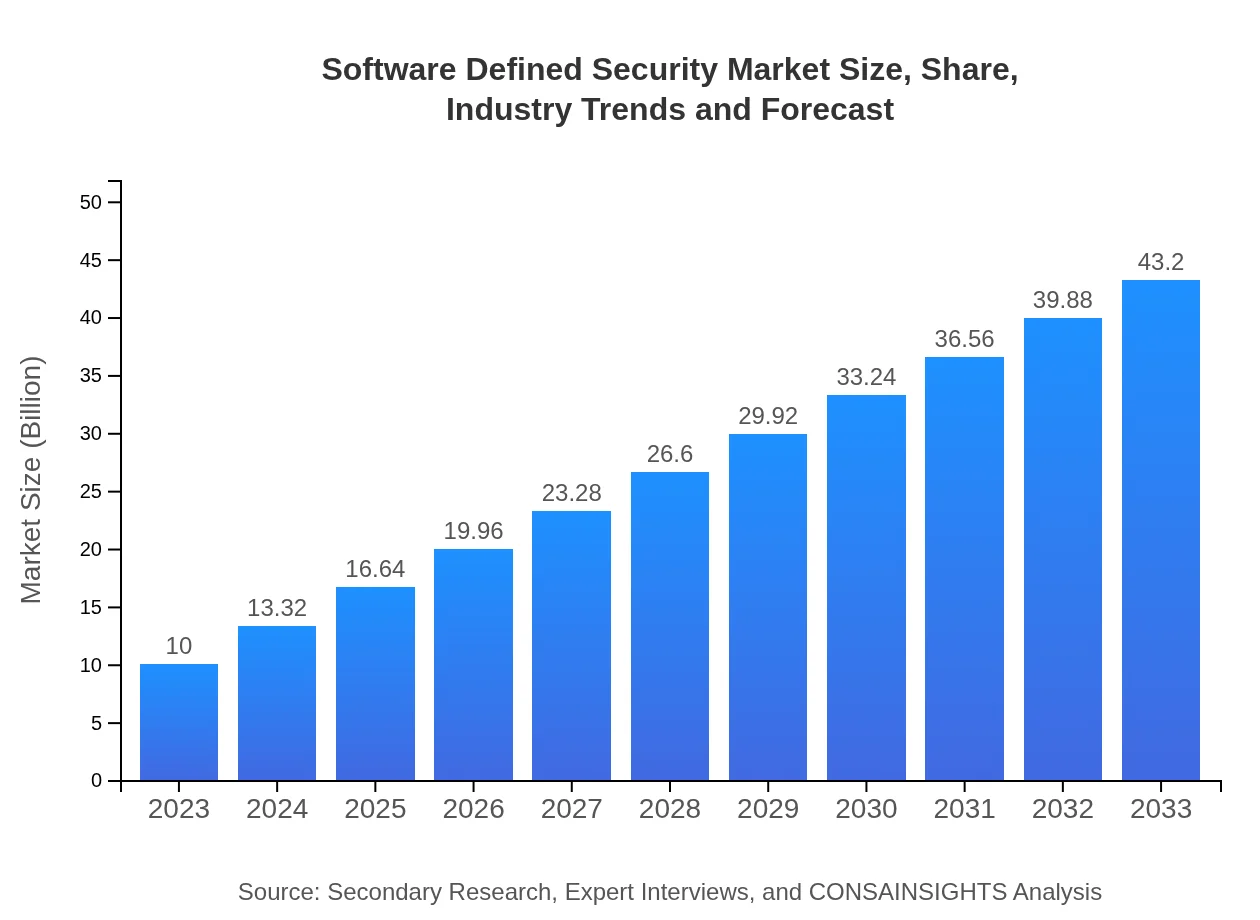

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $43.20 Billion |

| Top Companies | Cisco Systems, Inc., VMware, Inc., Zscaler, Inc., Palo Alto Networks, Inc., Check Point Software Technologies Ltd. |

| Last Modified Date | 31 January 2026 |

Software Defined Security Market Overview

Customize Software Defined Security Market Report market research report

- ✔ Get in-depth analysis of Software Defined Security market size, growth, and forecasts.

- ✔ Understand Software Defined Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Software Defined Security

What is the Market Size & CAGR of Software Defined Security market in 2023?

Software Defined Security Industry Analysis

Software Defined Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Software Defined Security Market Analysis Report by Region

Europe Software Defined Security Market Report:

The European Software Defined Security market is predicted to rise from $3.28 billion in 2023 to $14.19 billion by 2033. European businesses are under significant pressure to comply with GDPR and other regulations, leading to a heightened focus on comprehensive security solutions.Asia Pacific Software Defined Security Market Report:

In the Asia Pacific region, the Software Defined Security market was valued at $1.74 billion in 2023 and is projected to reach $7.51 billion by 2033, reflecting a growing trend of digitalization and the increasing dependency on mobile and cloud-based services. Countries like China, India, and Japan showcase significant investment in cybersecurity solutions, further driving market growth.North America Software Defined Security Market Report:

North America is anticipated to dominate the Software Defined Security market, with an estimated value of $3.68 billion in 2023 growing to $15.90 billion by 2033. The United States is the primary contributor due to pronounced investments in security infrastructure driven by stringent government regulations and a high incidence of cyberattacks.South America Software Defined Security Market Report:

South America’s Software Defined Security market is expected to grow from $0.67 billion in 2023 to $2.90 billion by 2033. The rising concern over cybercrime and increasing internet penetration are key factors contributing to market expansion in this region, particularly in Brazil and Argentina.Middle East & Africa Software Defined Security Market Report:

In the Middle East and Africa, the Software Defined Security market is forecasted to grow from $0.63 billion in 2023 to $2.70 billion by 2033. This growth can be attributed to increasing government initiatives for enhancing cybersecurity and rising investments in critical infrastructure protection.Tell us your focus area and get a customized research report.

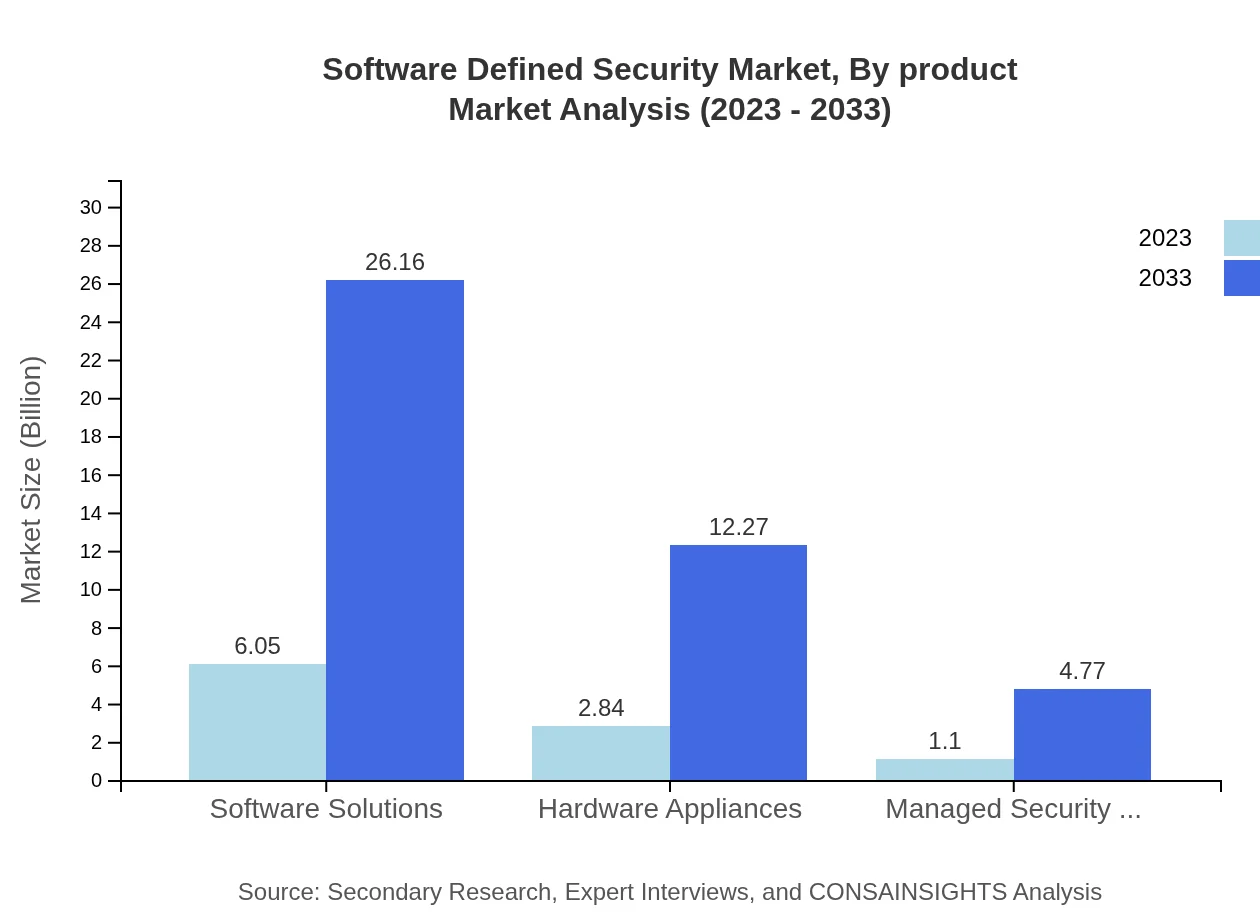

Software Defined Security Market Analysis By Product

The Software Defined Security market segmented by product reveals substantial differences in performance. Software Solutions, leading the market, accounted for $6.05 billion in 2023, projected to grow to $26.16 billion by 2033, highlighting an increased reliance on software-driven security measures. Hardware Appliances represent a smaller but significant segment, expected to rise from $2.84 billion to $12.27 billion in the same period. Managed Security Services, crucial for organizations lacking in-house expertise, are also anticipated to grow from $1.10 billion to $4.77 billion.

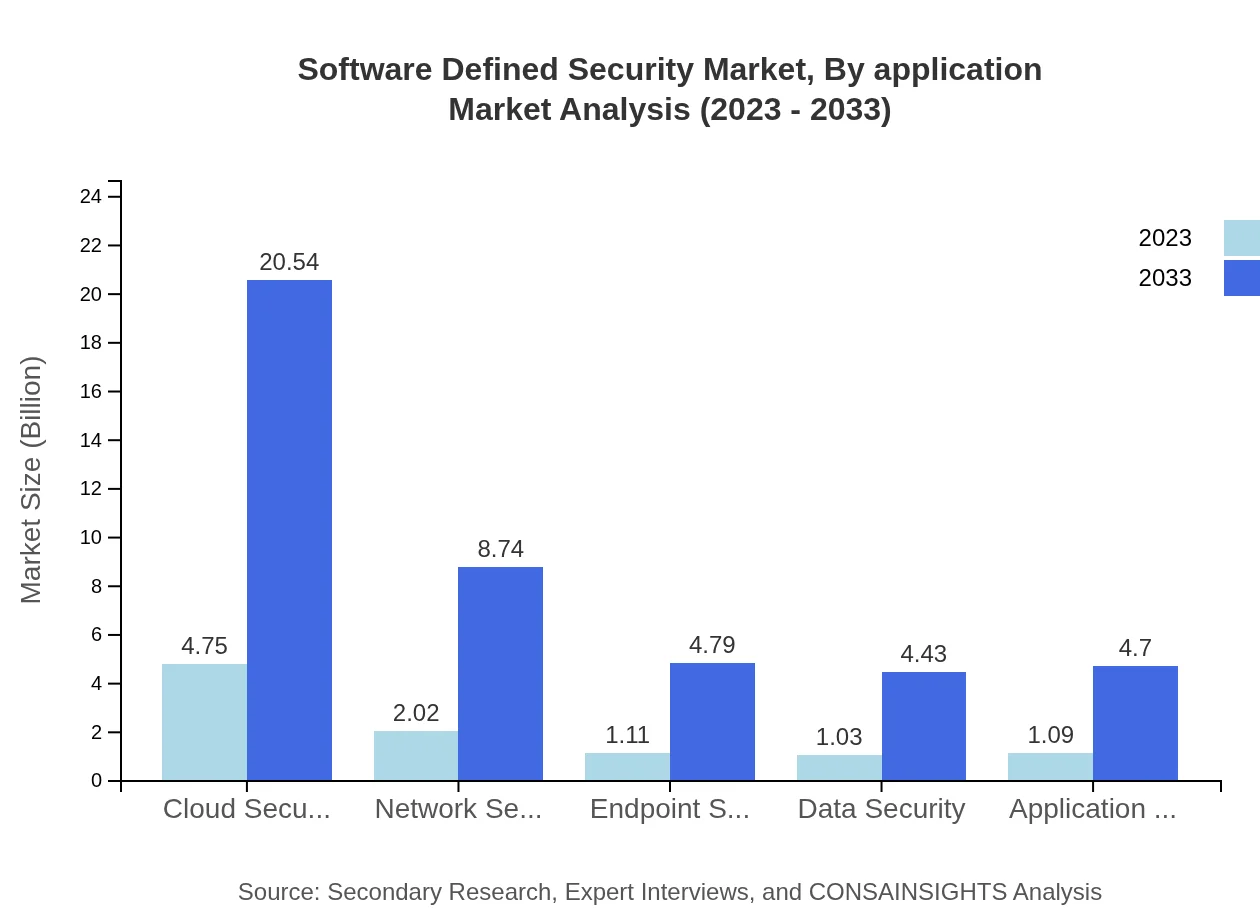

Software Defined Security Market Analysis By Application

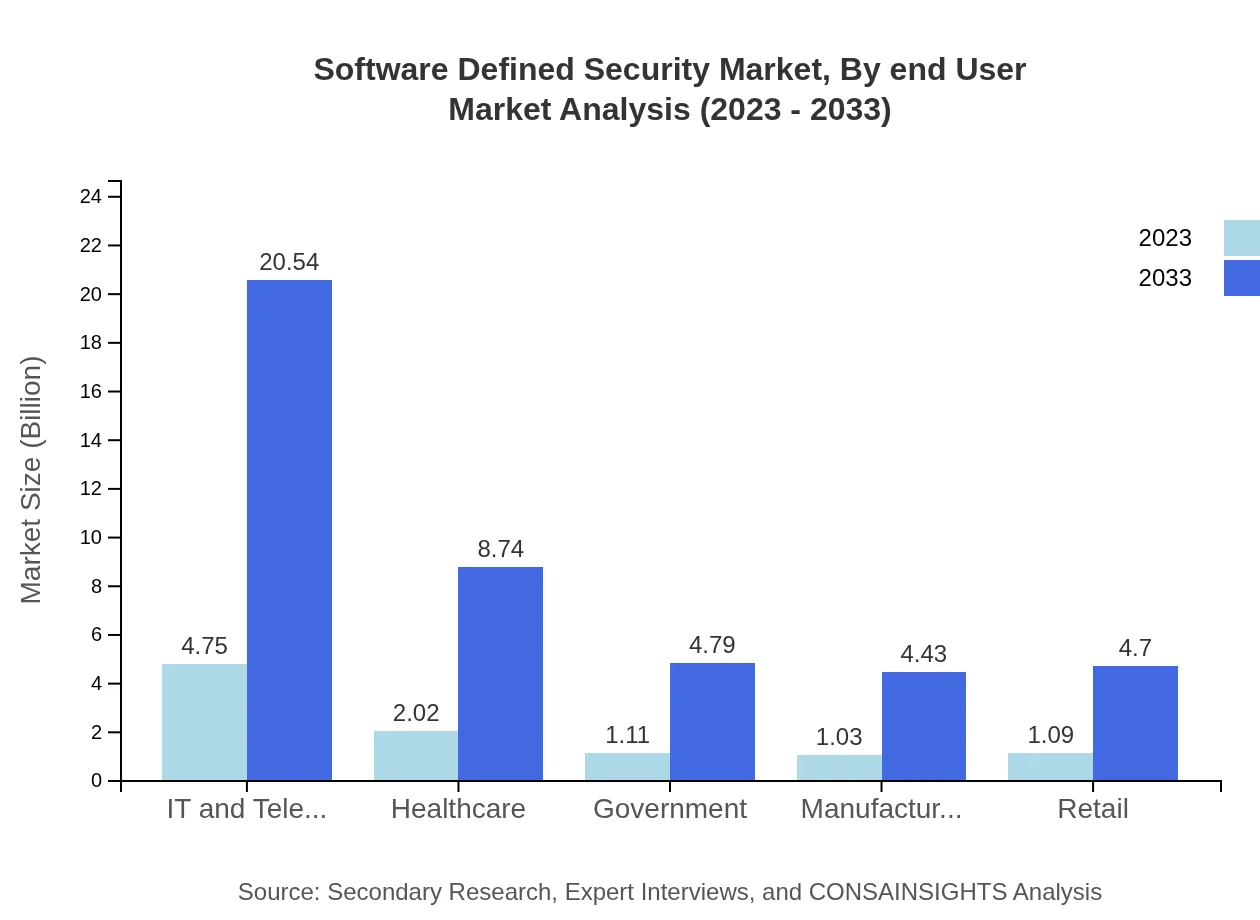

The market is extensively categorized by applications including IT and Telecom, Healthcare, Government, Manufacturing, and Retail. The IT and Telecom applications dominate the market with a size of $4.75 billion in 2023 and are projected to reach $20.54 billion by 2033, driven by the rise of cloud services and mobile security. The Healthcare sector is also significant, primarily due to compliance needs, expected to grow from $2.02 billion to $8.74 billion.

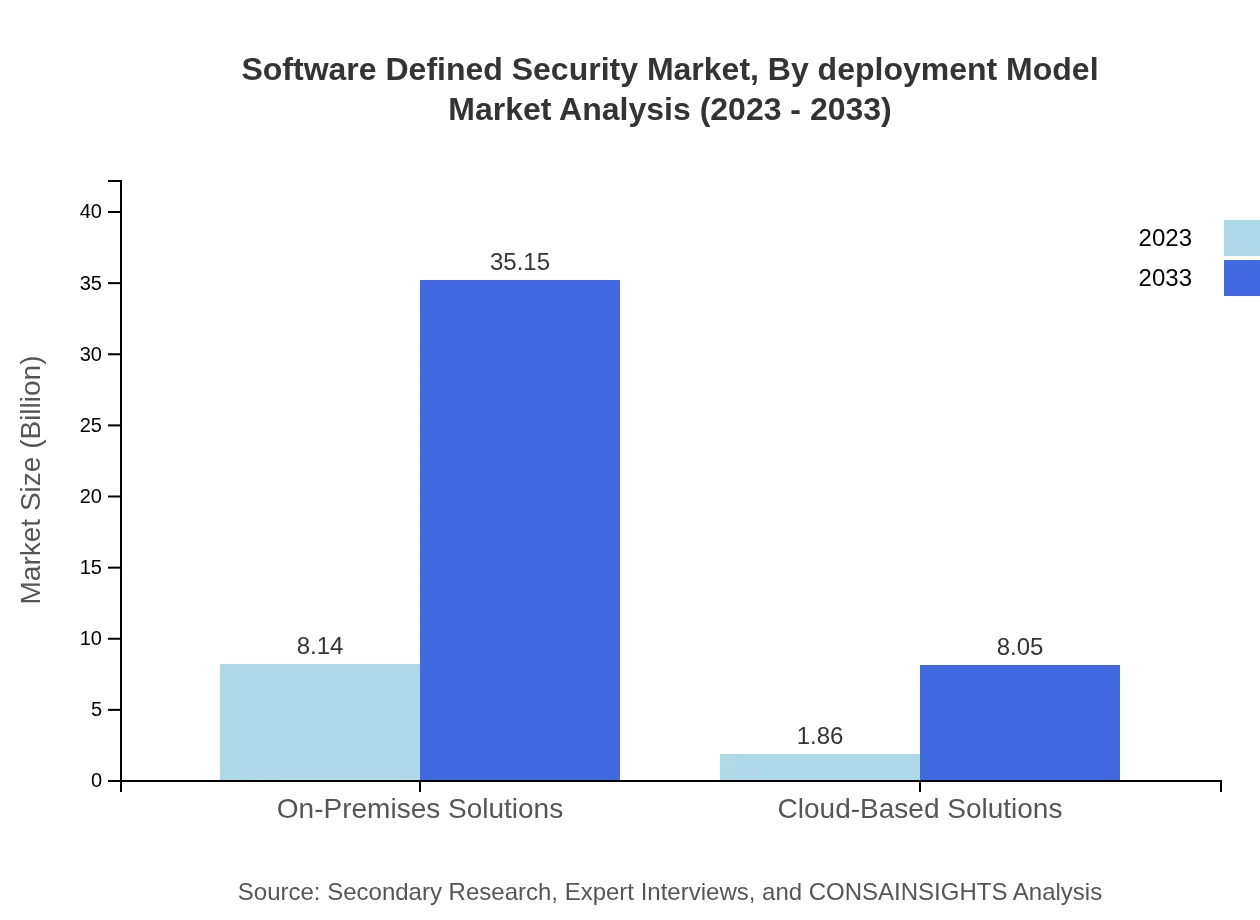

Software Defined Security Market Analysis By Deployment Model

Deployment models are pivotal in understanding the Software Defined Security market dynamics. On-Premises Solutions dominate the sector, representing an estimated $8.14 billion in 2023, growing to $35.15 billion by 2033. This showcases organizations' preference for control over sensitive information. Conversely, Cloud-Based Solutions are gradually increasing from $1.86 billion to $8.05 billion, symbolizing the shift towards cloud environments.

Software Defined Security Market Analysis By End User

Key industries such as Finance, Retail, and Healthcare are crucial end-users of Software Defined Security solutions. The Finance sector, requiring stringent security protocols, is a major market player. The Government sector is also a significant contributor due to rising threats to national security, projected to grow from $1.11 billion in 2023 to $4.79 billion by 2033.

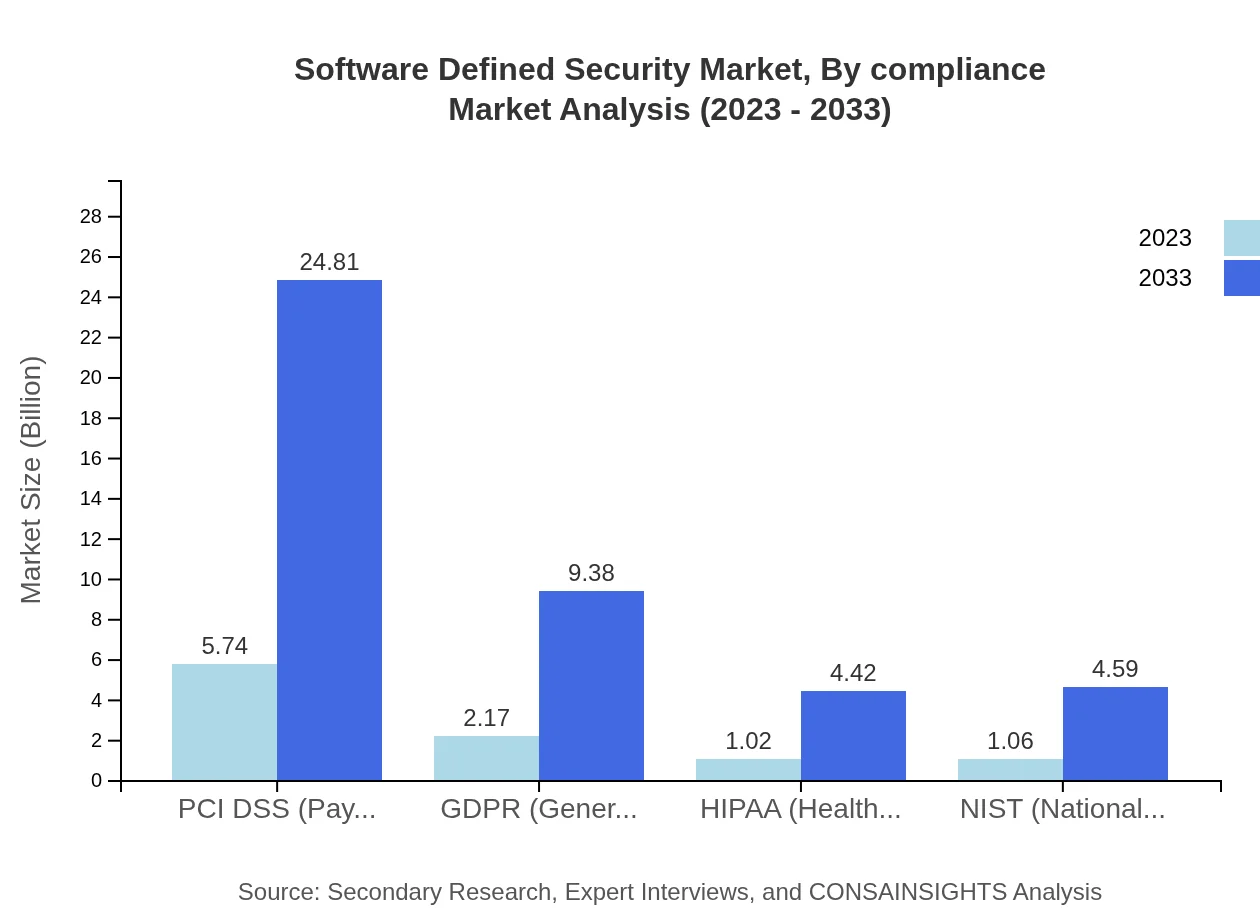

Software Defined Security Market Analysis By Compliance

Compliance standards drive adoption across different sectors. The PCI DSS market segment, worth $5.74 billion in 2023, is estimated to reach $24.81 billion by 2033 due to mandatory compliance for organizations handling credit card transactions. GDPR compliance is also significant, growing from $2.17 billion to $9.38 billion as organizations strive to meet European regulatory requirements.

Software Defined Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Software Defined Security Industry

Cisco Systems, Inc.:

Cisco is a leading player offering a range of cybersecurity solutions focused on network security and software-defined security, helping organizations safeguard their assets and comply with regulations.VMware, Inc.:

VMware specializes in virtualization and cloud computing technologies, providing various security solutions that integrate well with existing IT infrastructures, enhancing security for cloud and on-premises environments.Zscaler, Inc.:

Zscaler specializes in cloud security solutions that enable secure internet access for organizations, ensuring no compromise on user experience while protecting data in transit.Palo Alto Networks, Inc.:

Palo Alto Networks offers a wide array of solutions, emphasizing next-generation firewalls and cloud-based security, catering to various industry sectors.Check Point Software Technologies Ltd.:

Check Point provides comprehensive enterprise security solutions, protecting networks, endpoints, cloud data, and mobile devices.We're grateful to work with incredible clients.

FAQs

What is the market size of software Defined Security?

The software-defined security market is projected to grow from $10 billion in 2023 to significant heights by 2033, with a robust compound annual growth rate (CAGR) of 15%. This growth reflects the increasing demand for versatile security measures in an evolving digital landscape.

What are the key market players or companies in this software Defined Security industry?

Key market players include industry leaders such as Palo Alto Networks, Fortinet, Cisco, Check Point, and IBM. These companies focus on innovating security technologies, driving both competitive positioning and industry transformation.

What are the primary factors driving the growth in the software Defined Security industry?

Key growth drivers include the rising frequency of cyberattacks, increased regulatory compliance needs, and the transition to cloud-based infrastructures, which necessitate advanced, scalable security solutions to protect sensitive information.

Which region is the fastest Growing in the software Defined Security market?

North America is identified as the fastest-growing region in the software-defined security market, with its market projected to expand from $3.68 billion in 2023 to $15.90 billion in 2033, supported by a strong technological innovation landscape.

Does ConsaInsights provide customized market report data for the software Defined Security industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the software-defined security industry, allowing clients to obtain precise insights for strategic decision-making.

What deliverables can I expect from this software Defined Security market research project?

Expect deliverables such as comprehensive reports, segmentation analysis, trend forecasts, competitive landscape evaluations, and strategic recommendations regarding market entry or expansion in the software-defined security landscape.

What are the market trends of software Defined Security?

Emerging trends include the growing adoption of AI-driven security solutions, a shift toward integrated security frameworks, and an emphasis on cloud-native protections, demonstrating the need to adapt to evolving cyber threats.