Software Defined Storage Market Report

Published Date: 31 January 2026 | Report Code: software-defined-storage

Software Defined Storage Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Software Defined Storage (SDS) market, offering insights on market size, growth trends, segmentation, and forecasts from 2023 to 2033.

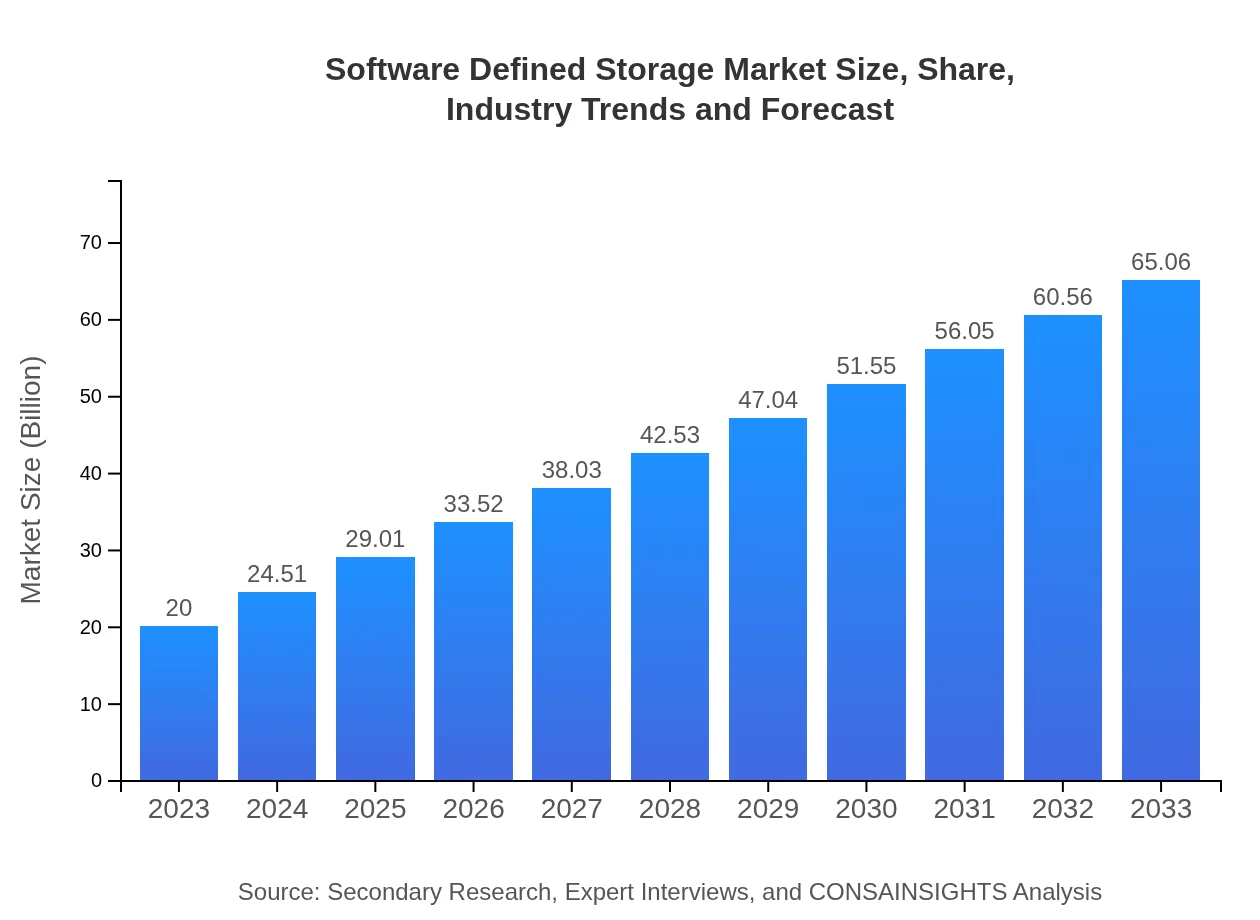

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $65.06 Billion |

| Top Companies | Dell Technologies, IBM Corporation, Hewlett Packard Enterprise (HPE), NetApp, Inc., VMware, Inc. |

| Last Modified Date | 31 January 2026 |

Software Defined Storage Market Overview

Customize Software Defined Storage Market Report market research report

- ✔ Get in-depth analysis of Software Defined Storage market size, growth, and forecasts.

- ✔ Understand Software Defined Storage's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Software Defined Storage

What is the Market Size & CAGR of Software Defined Storage market in 2023?

Software Defined Storage Industry Analysis

Software Defined Storage Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Software Defined Storage Market Analysis Report by Region

Europe Software Defined Storage Market Report:

In Europe, the Software Defined Storage market is forecasted to expand from $6.09 billion in 2023 to $19.83 billion by 2033. The growth is fueled by increasing investments in cloud technologies, data protection regulations, and a focus on digital innovation.Asia Pacific Software Defined Storage Market Report:

The Asia Pacific Software Defined Storage market is projected to grow from $3.58 billion in 2023 to $11.66 billion by 2033, reflecting a CAGR of 12.5%. Factors contributing to this growth include increasing digital transformation initiatives, cloud adoption, and a growing e-commerce sector, all of which create substantial demands for scalable storage solutions.North America Software Defined Storage Market Report:

North America holds a significant market share, with an expected growth from $7.41 billion in 2023 to $24.11 billion by 2033. This impressive growth is driven by the presence of key technology players and the high adoption rate of advanced IT solutions among enterprises in the region.South America Software Defined Storage Market Report:

In South America, the market size is anticipated to rise from $1.19 billion in 2023 to $3.86 billion by 2033. The region is experiencing growth due to increasing awareness about the benefits of cloud computing and the need for efficient data management solutions amidst expanding digital infrastructures.Middle East & Africa Software Defined Storage Market Report:

The Middle East and Africa region is projected to grow from $1.72 billion in 2023 to $5.61 billion by 2033. Increased digitalization efforts, particularly among businesses looking to optimize their operations and enhance customer experience, are key drivers of this growth.Tell us your focus area and get a customized research report.

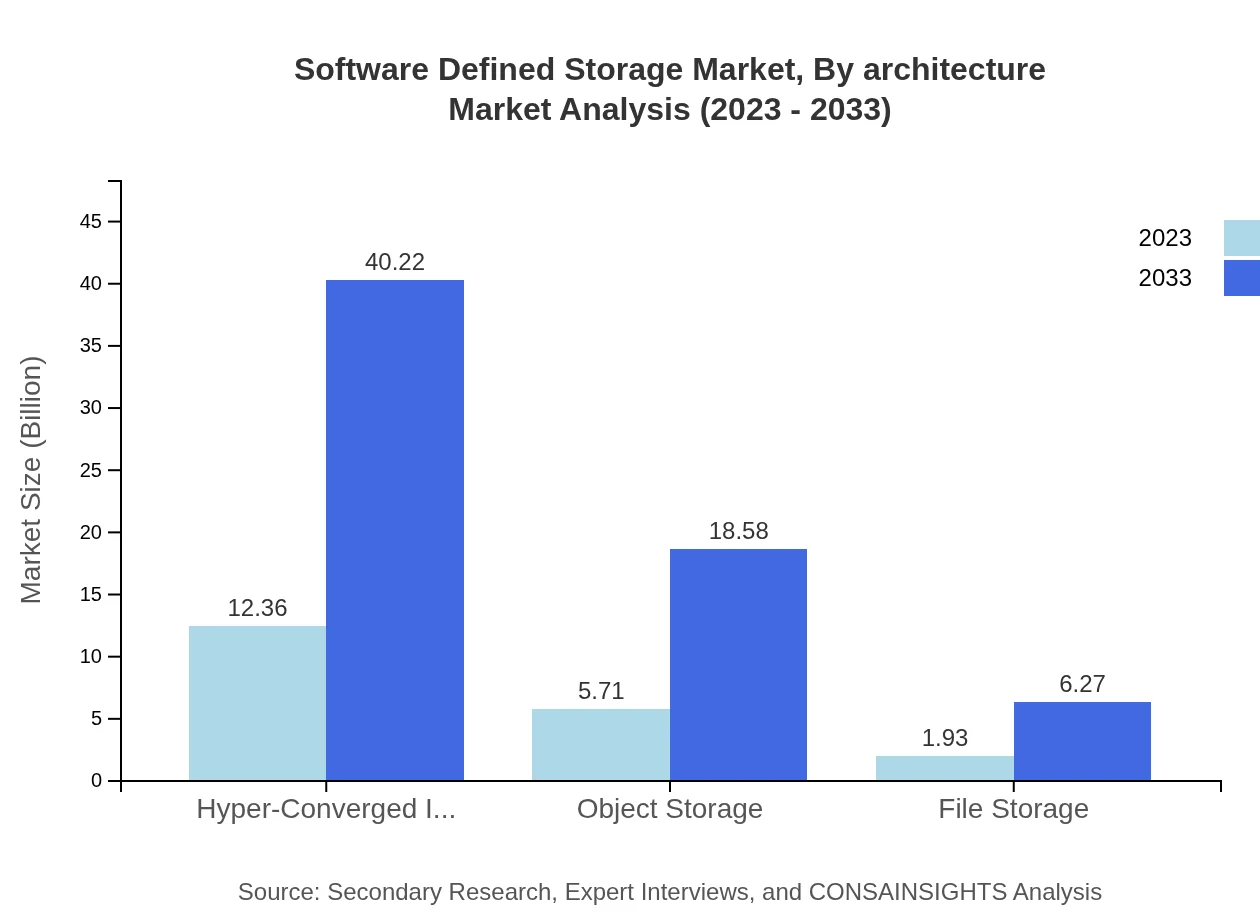

Software Defined Storage Market Analysis By Architecture

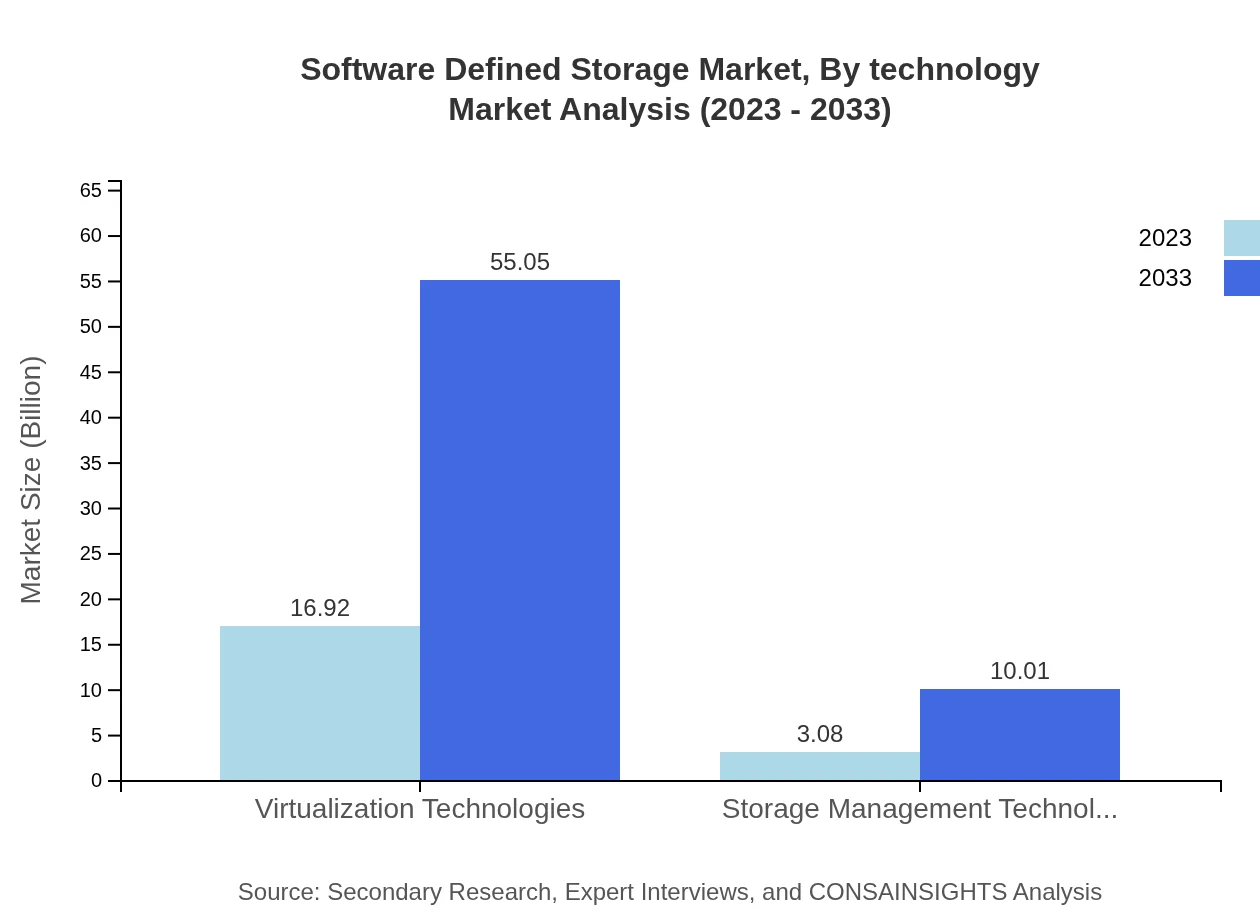

The Software Defined Storage market by architecture is dominated by Virtualization Technologies, projected to rise from $16.92 billion in 2023 to $55.05 billion by 2033, showcasing the importance of virtualization in maximizing resource utilization and flexibility. Object Storage and Hyper-Converged Infrastructure are also emerging as critical components driving solutions alongside conventional storage models.

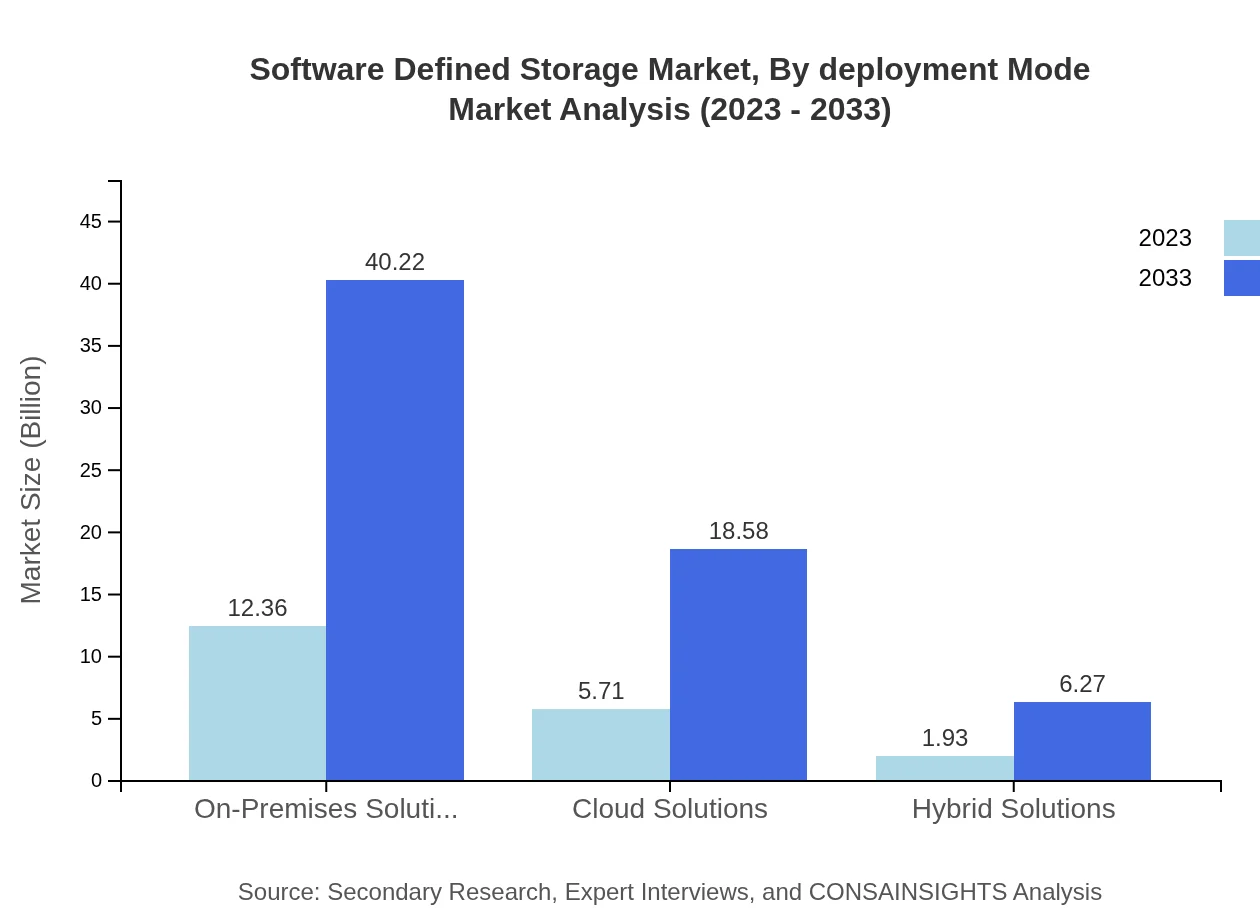

Software Defined Storage Market Analysis By Deployment Mode

Deployment modes in the Software Defined Storage market reveal a strong inclination towards Hybrid Solutions, expected to grow from $1.93 billion in 2023 to $6.27 billion by 2033. This trend highlights the need for businesses to integrate existing on-premises infrastructure with scalable cloud solutions, ensuring better manageability and lower costs.

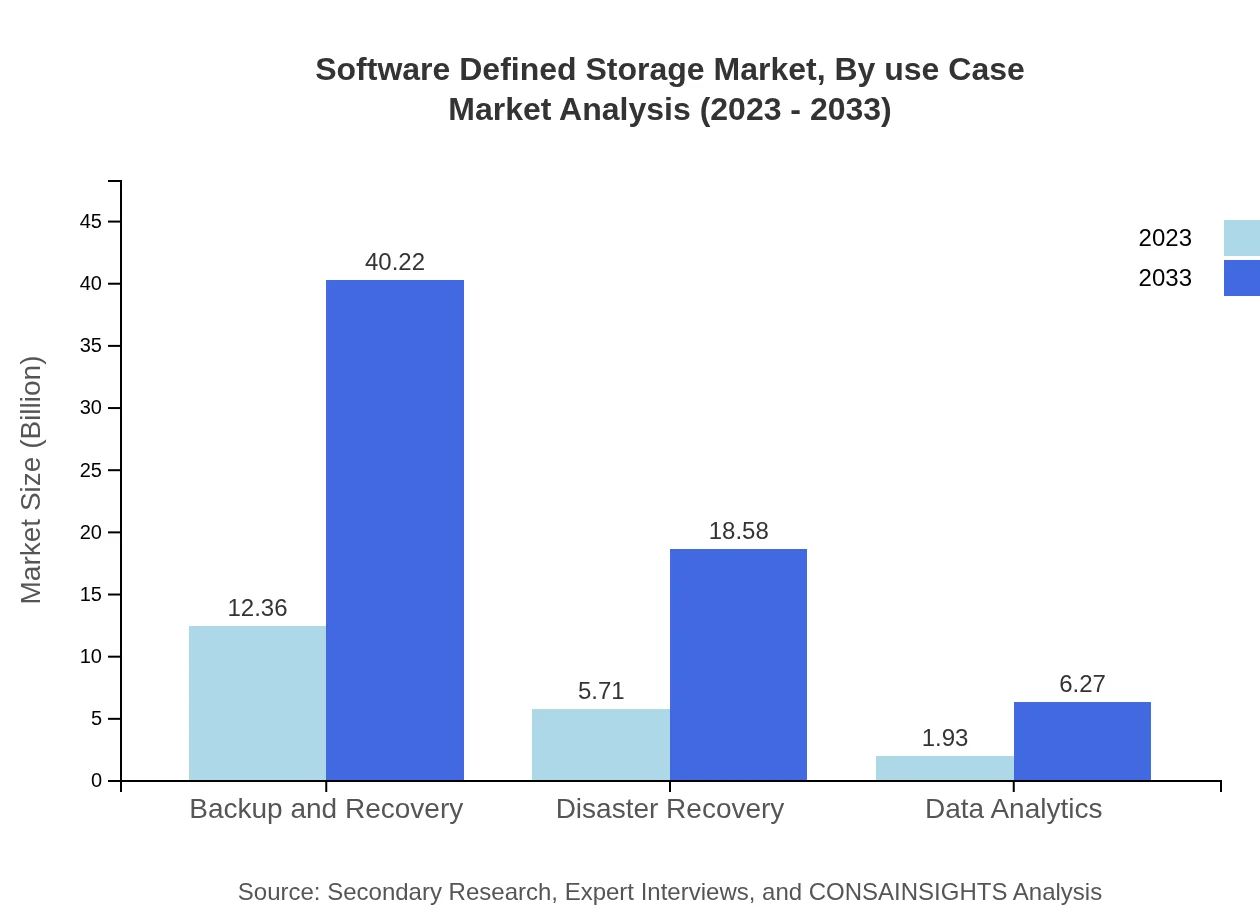

Software Defined Storage Market Analysis By Use Case

In the use case segment, Backup and Recovery solutions dominate, projected to grow from $12.36 billion in 2023 to $40.22 billion by 2033. Organizations increasingly prioritize data protection mechanisms to mitigate risks associated with data loss or corruption, making backup and recovery an essential focus area.

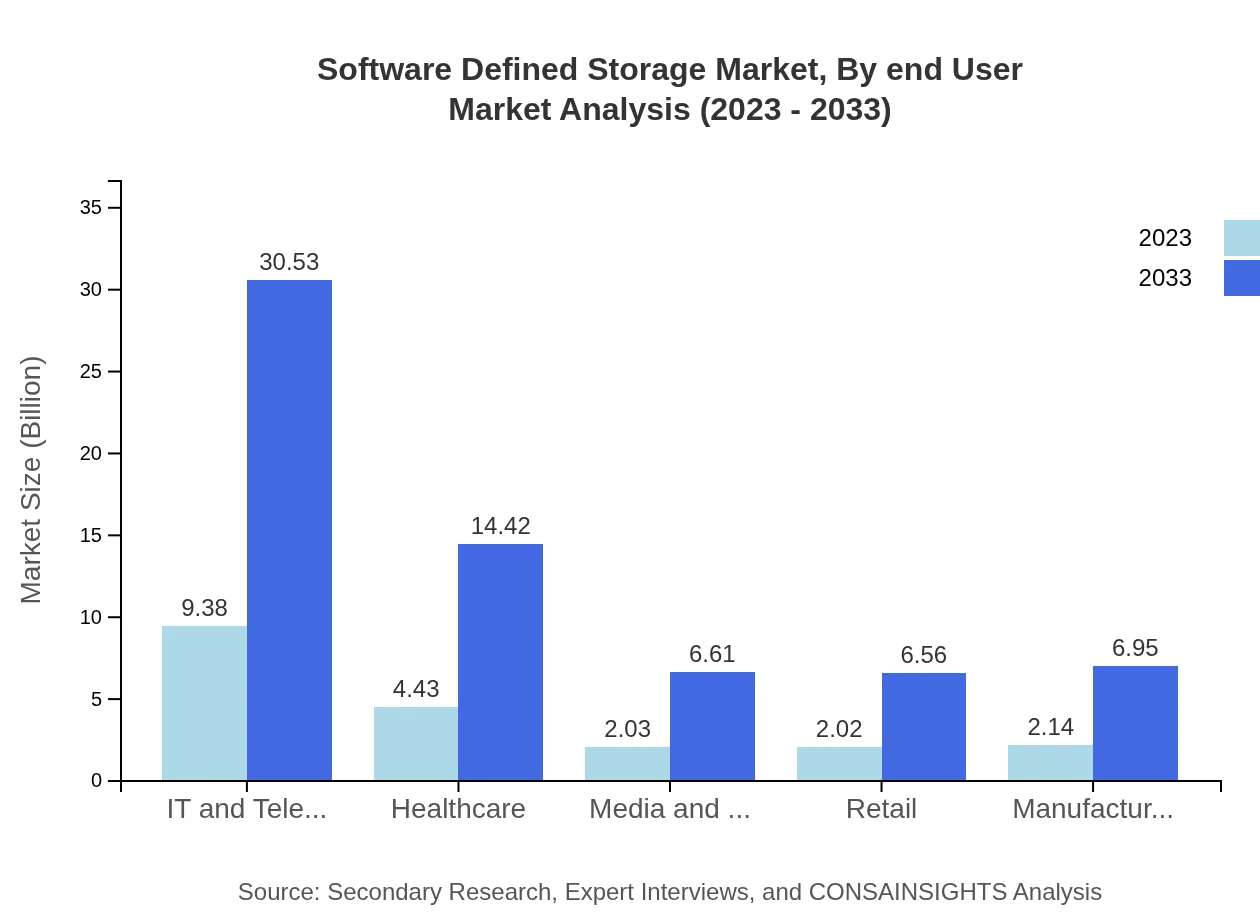

Software Defined Storage Market Analysis By End User

The IT and Telecom sector exhibits significant growth, expanding from $9.38 billion in 2023 to $30.53 billion by 2033. The need for robust and scalable storage solutions to manage extensive data operations is driving demand in this sector, alongside other industries such as Healthcare and Media and Entertainment.

Software Defined Storage Market Analysis By Technology

In terms of technology, Hyper-Converged Infrastructure leads the market with a substantial growth trajectory, expected to rise from $12.36 billion in 2023 to $40.22 billion by 2033. Innovations in storage management technologies are also supporting the market's overall expansion, enhancing efficiency and operational resilience.

Software Defined Storage Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Software Defined Storage Industry

Dell Technologies:

Dell Technologies is a leading player in the SDS space, offering a robust range of storage solutions designed to meet diverse business requirements while ensuring high performance and scalability.IBM Corporation:

IBM Corporation provides advanced SDS solutions, including extensive data analytics capabilities, supporting enterprises in managing their data more effectively.Hewlett Packard Enterprise (HPE):

HPE is renowned for its innovative storage solutions, focusing on flexibility and efficiency in data management through its Software Defined Storage portfolio.NetApp, Inc.:

NetApp is a key player in the SDS market, known for its data-centric approach and integrated solutions that optimize data management across the enterprise.VMware, Inc.:

VMware leads in virtualization technology, offering SDS solutions that leverage virtualization to enhance storage efficiency and reduce costs.We're grateful to work with incredible clients.

FAQs

What is the market size of software Defined Storage?

The software-defined storage market is valued at approximately $20 billion in 2023, with a robust CAGR of 12% projected until 2033, indicating strong growth and expanding opportunities in this segment over the next decade.

What are the key market players or companies in the software Defined Storage industry?

Key players in the software-defined storage industry include major technology firms and startups that specialize in cloud storage solutions, virtualization technologies, and data management systems, contributing to innovations and competitive advancements.

What are the primary factors driving the growth in the software Defined Storage industry?

Growth in the software-defined storage industry is driven by increasing data storage demands, adoption of cloud solutions, advancements in technology, and the need for scalable storage infrastructure, enabling organizations to enhance their data management capabilities.

Which region is the fastest Growing in the software Defined Storage market?

North America is the fastest-growing region in the software-defined storage market, projected to rise from $7.41 billion in 2023 to $24.11 billion by 2033, driven by technological innovations and strong demand for data storage solutions.

Does ConsaInsights provide customized market report data for the software Defined Storage industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the software-defined storage industry, ensuring that businesses receive the most relevant insights for their strategic decisions.

What deliverables can I expect from this software Defined Storage market research project?

Deliverables from a software-defined storage market research project include comprehensive market analysis, growth forecasts, competitive landscape assessments, and insights into regional and segment-specific trends for informed decision-making.

What are the market trends of software Defined Storage?

Current market trends in software-defined storage include a shift towards virtualization technologies, increased adoption of cloud and hybrid storage solutions, and rising investments in backup and recovery systems, reflecting evolving storage needs.