Soil Wetting Agents Market Report

Published Date: 02 February 2026 | Report Code: soil-wetting-agents

Soil Wetting Agents Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Soil Wetting Agents market, providing insights and data on market size, trends, and forecasts from 2023 to 2033, along with a detailed regional analysis and industry dynamics.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $2.81 Billion |

| Top Companies | BASF SE, SABIC, Humboldt Professional Grade, Nufarm |

| Last Modified Date | 02 February 2026 |

Soil Wetting Agents Market Overview

Customize Soil Wetting Agents Market Report market research report

- ✔ Get in-depth analysis of Soil Wetting Agents market size, growth, and forecasts.

- ✔ Understand Soil Wetting Agents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Soil Wetting Agents

What is the Market Size & CAGR of Soil Wetting Agents market in 2023?

Soil Wetting Agents Industry Analysis

Soil Wetting Agents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Soil Wetting Agents Market Analysis Report by Region

Europe Soil Wetting Agents Market Report:

Europe's market for Soil Wetting Agents is projected to increase from $0.49 billion in 2023 to $0.91 billion by 2033, supported by stringent regulations focusing on sustainable farming practices.Asia Pacific Soil Wetting Agents Market Report:

The Asia Pacific region showcases robust growth in the Soil Wetting Agents market, projected to increase from $0.25 billion in 2023 to $0.47 billion by 2033. This growth is being driven by increasing agricultural activities, especially in countries like India and China, where soil conservation methods are increasingly deployed.North America Soil Wetting Agents Market Report:

North America is forecasted to witness significant growth, escalating from $0.54 billion in 2023 to $1.01 billion in 2033. Enhanced agricultural practices and strong demand for effective crop production technologies are key contributors to this growth.South America Soil Wetting Agents Market Report:

In South America, the market for Soil Wetting Agents is expected to grow from $0.13 billion in 2023 to $0.24 billion by 2033. The region's agricultural sector is focusing on sustainability, leading to heightened investments in soil management products.Middle East & Africa Soil Wetting Agents Market Report:

The Middle East and Africa region show moderate growth prospects, with the market size increasing from $0.09 billion in 2023 to $0.17 billion by 2033, driven by water scarcity issues necessitating improved soil moisture management.Tell us your focus area and get a customized research report.

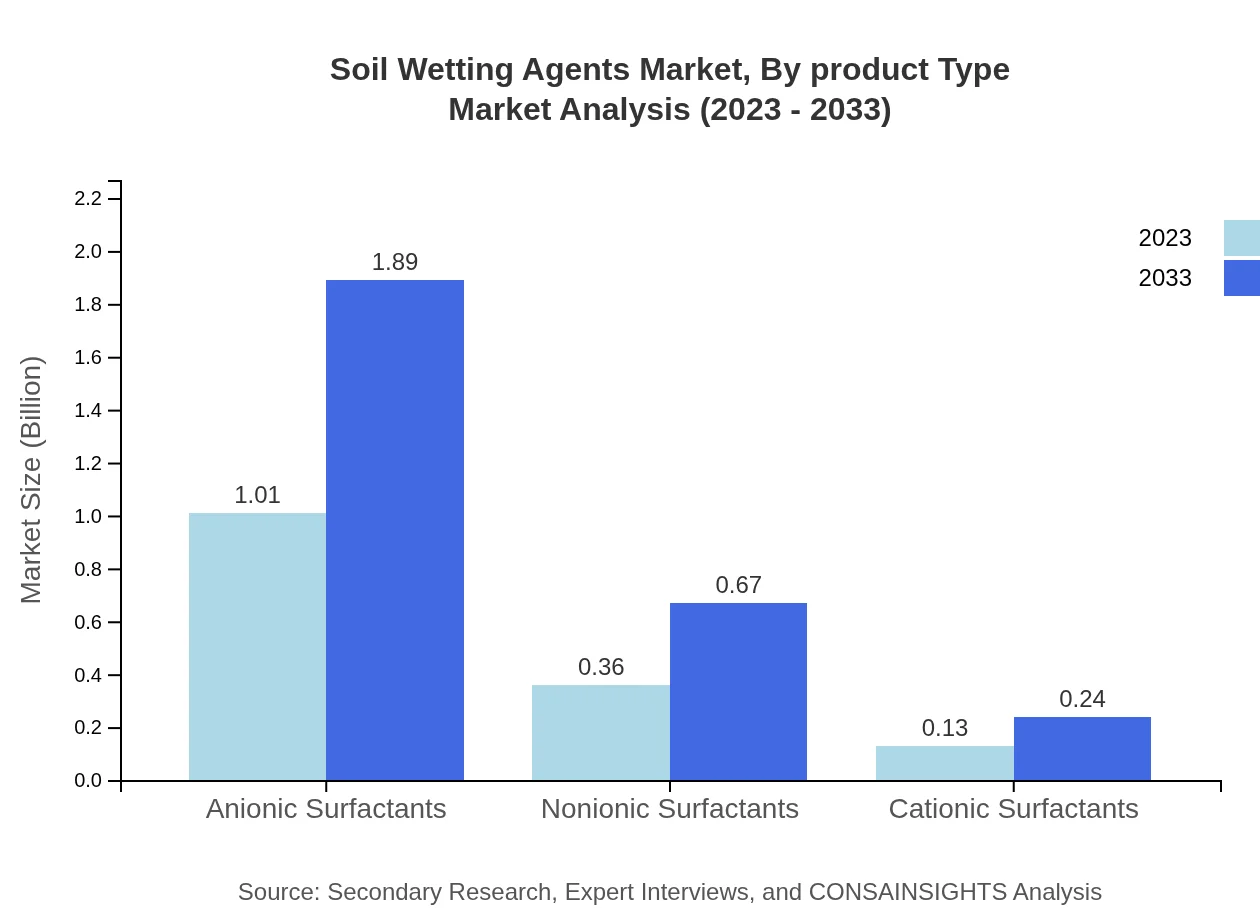

Soil Wetting Agents Market Analysis By Product Type

The analysis indicates that Liquid Soil Wetting Agents account for the majority share, achieving a market size of $1.01 billion in 2023 and expected to reach $1.89 billion by 2033, holding a consistent market share of 67.39%. Powder and Emulsion types are also significant but command smaller portions with projected growth indicative of increasing usage across applications.

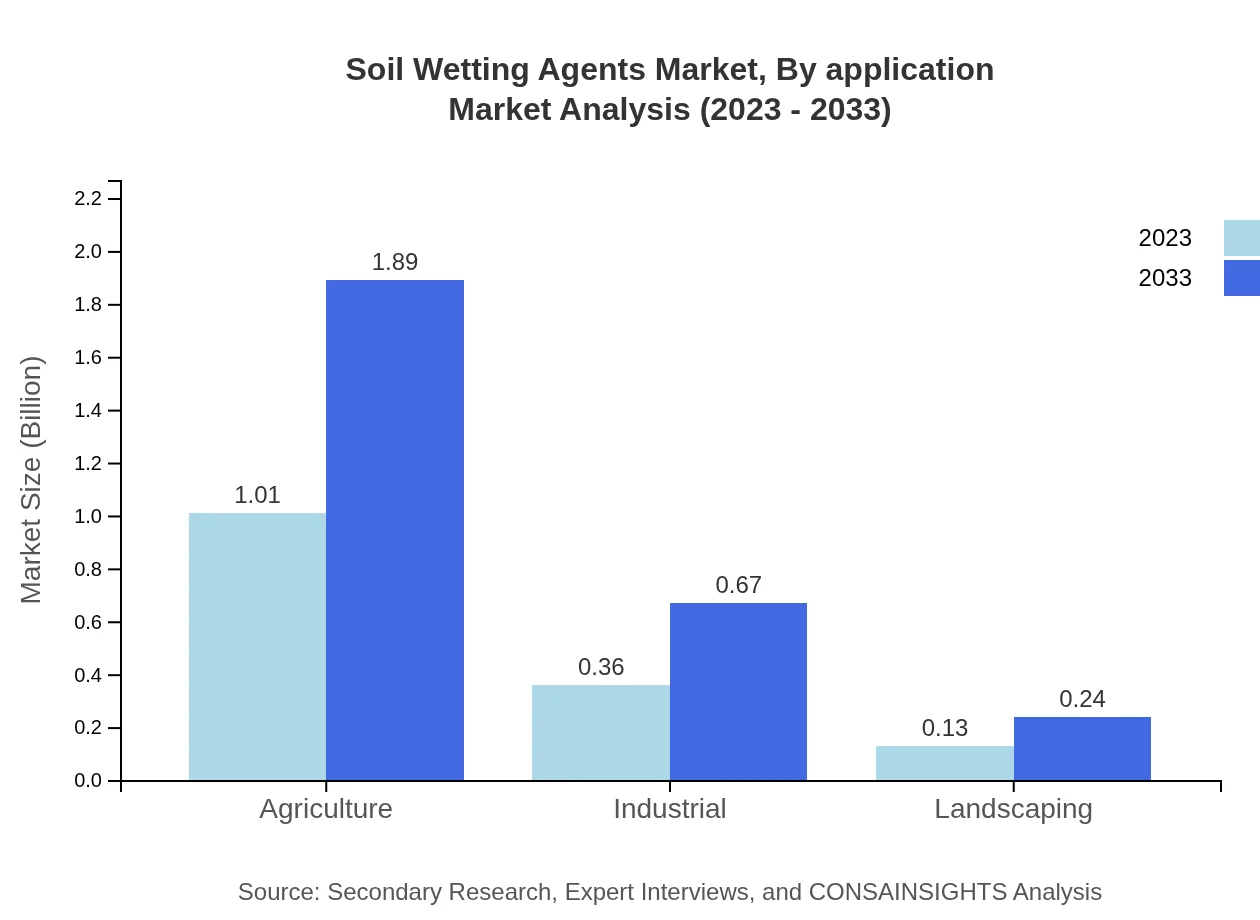

Soil Wetting Agents Market Analysis By Application

In terms of applications, the agricultural sector leads significantly, with a market size of $1.01 billion in 2023 and forecasting to reach $1.89 billion by 2033. The industrial sector contributes $0.36 billion, projected to grow to $0.67 billion, representing 24.02% of market share, while landscaping applications command a smaller yet impactful segment.

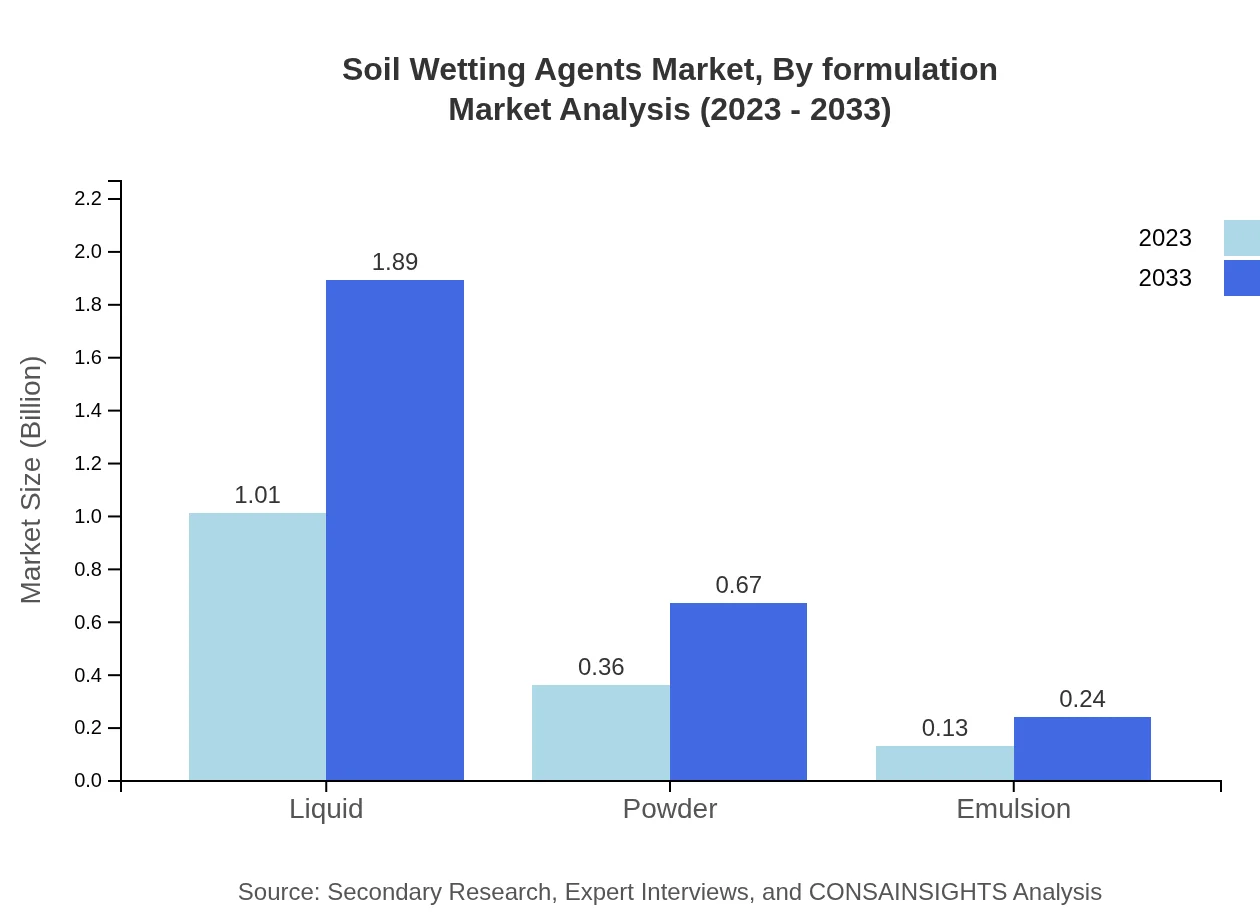

Soil Wetting Agents Market Analysis By Formulation

The formulation segment reflects a similar trend with Liquid formulations dominating, showing extensive applicability in various sectors, scaling from $1.01 billion in 2023 to $1.89 billion in 2033. Other forms like Powder and Emulsion follow with respective growth trajectories, aiding diverse application requirements.

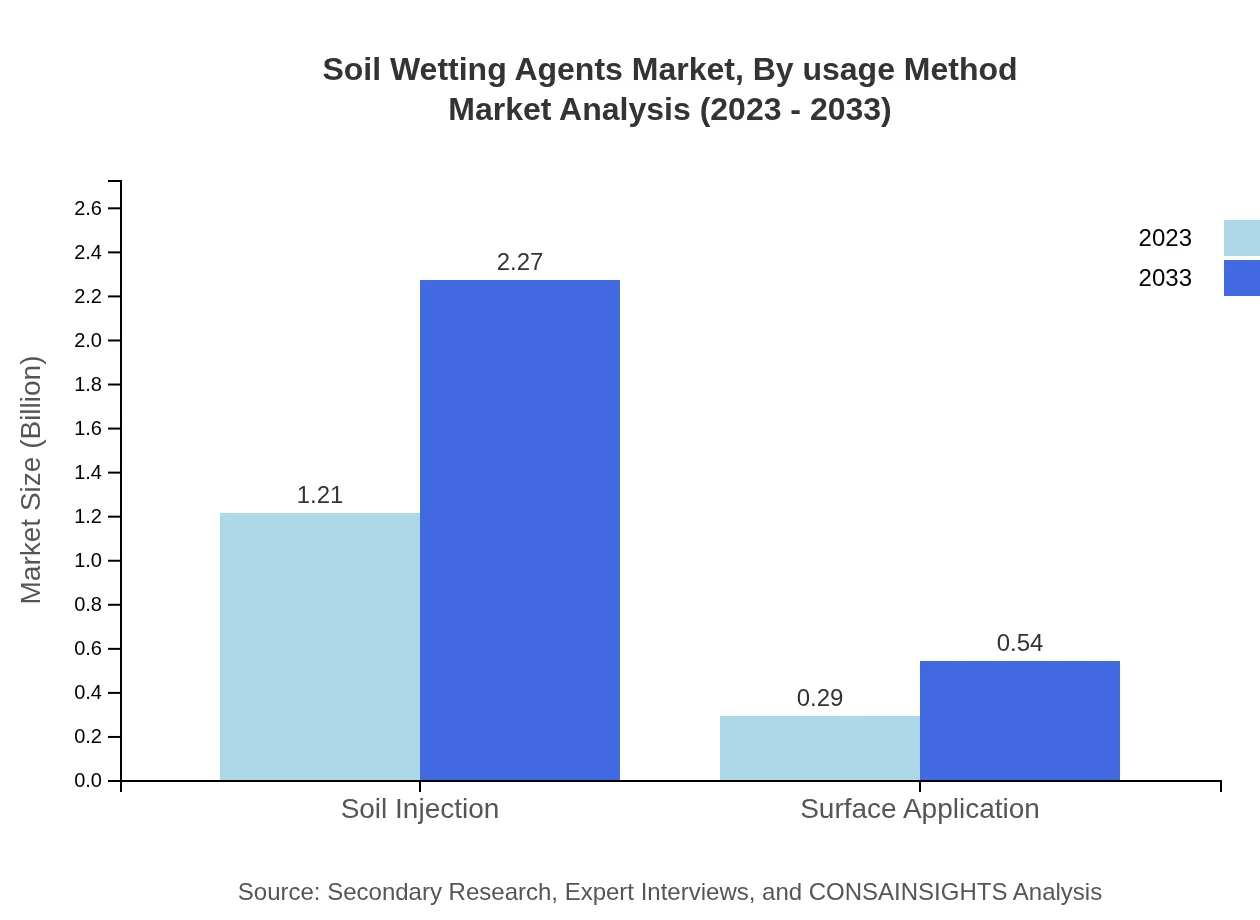

Soil Wetting Agents Market Analysis By Usage Method

Usage method analysis highlights Soil Injection methods as primary, with a size increase from $1.21 billion in 2023 to $2.27 billion by 2033, making up 80.79% of the market share. Surface Application occupies the remainder, enhancing efficiency in water usage significantly.

Soil Wetting Agents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Soil Wetting Agents Industry

BASF SE:

A global leader in chemical production, BASF SE has developed a range of innovative soil wetting agents aimed at enhancing agricultural productivity while minimizing environmental impacts.SABIC:

SABIC offers advanced solutions in soil wetting agents designed for agricultural practices, focusing on sustainability and improved crop yields through innovative technology.Humboldt Professional Grade:

Known for its expertise in agricultural products, Humboldt Pro provides a range of premium soil wetting agents targeting the landscaping and commercial agriculture sectors.Nufarm:

Nufarm specializes in crop protection products among which soil wetting agents are formulated to optimize water retention.We're grateful to work with incredible clients.

FAQs

What is the market size of soil Wetting Agents?

The global soil wetting agents market is valued at approximately $1.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.3%, reaching around $2.7 billion by 2033.

What are the key market players or companies in the soil Wetting Agents industry?

Key players in the soil wetting agents market include leading agricultural and chemical companies. Their contributions are vital in innovation, product development, and expanding market reach, significantly influencing market dynamics.

What are the primary factors driving the growth in the soil Wetting Agents industry?

The growth of the soil wetting agents industry is driven by increasing agricultural demand, advancements in technology, environmental concerns, and the rising need for efficient water management practices in farming and landscaping.

Which region is the fastest Growing in the soil Wetting Agents market?

The Asia Pacific region is the fastest-growing market for soil wetting agents, expected to grow from $0.25 billion in 2023 to $0.47 billion by 2033, benefiting from agricultural expansions and increased awareness of soil management.

Does ConsaInsights provide customized market report data for the soil Wetting Agents industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients in the soil wetting agents industry, providing insights specific to trends, forecasts, and market opportunities.

What deliverables can I expect from this soil Wetting Agents market research project?

Deliverables from the soil wetting agents market research include detailed reports, market analysis, trend identification, competitive landscape evaluations, and actionable insights to inform strategic decision-making.

What are the market trends of soil Wetting Agents?

Current trends in the soil wetting agents market reflect a shift towards sustainable agriculture, with increased use in crop production, emerging formulations, and a focus on water conservation practices in various regions.