Soldier System Market Report

Published Date: 03 February 2026 | Report Code: soldier-system

Soldier System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Soldier System market from 2023 to 2033, focusing on market size, trends, regional dynamics, technology advancements, key players, and future forecasts, offering valuable insights for stakeholders and decision-makers.

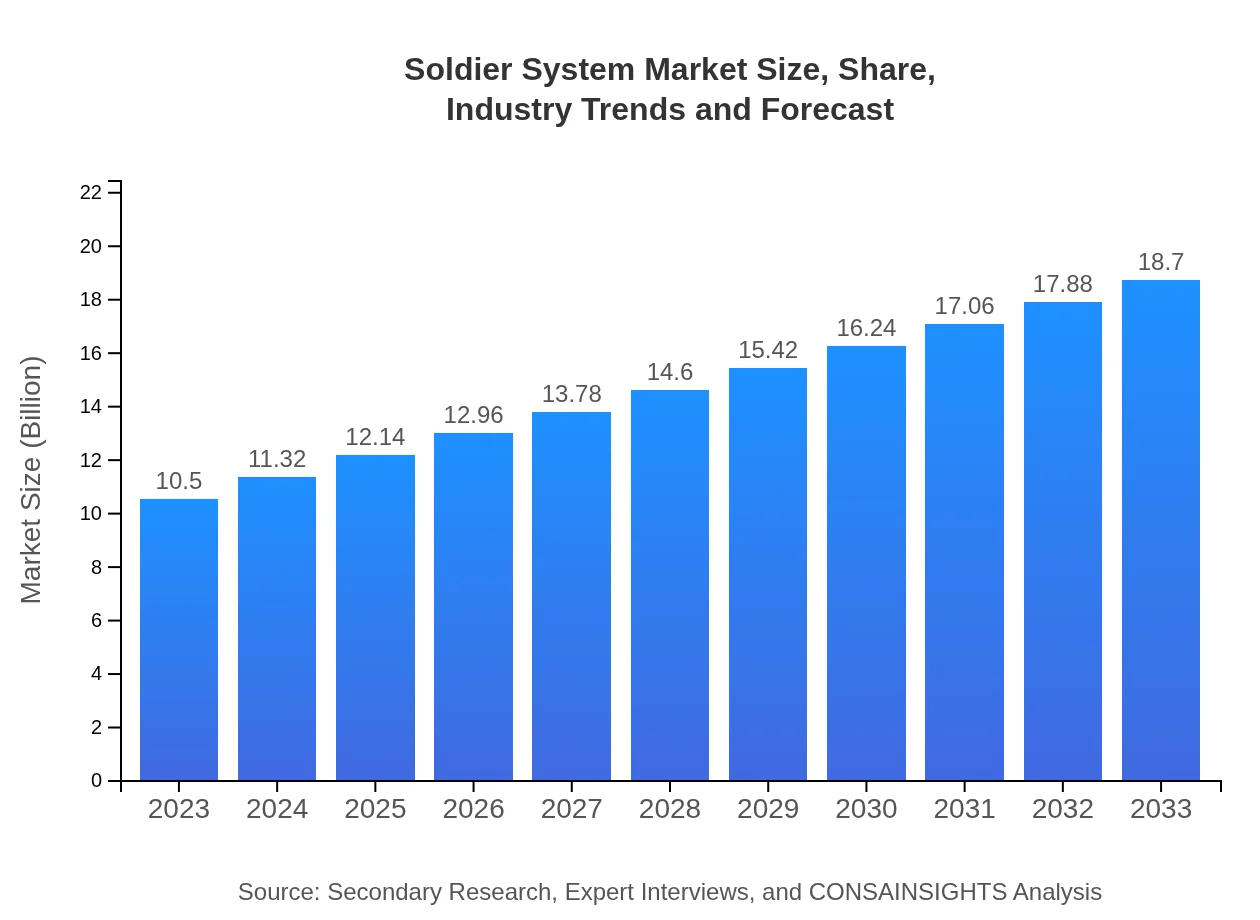

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Lockheed Martin, Northrop Grumman, BAE Systems, Thales Group, Raytheon Technologies |

| Last Modified Date | 03 February 2026 |

Soldier System Market Overview

Customize Soldier System Market Report market research report

- ✔ Get in-depth analysis of Soldier System market size, growth, and forecasts.

- ✔ Understand Soldier System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Soldier System

What is the Market Size & CAGR of Soldier System market in 2023?

Soldier System Industry Analysis

Soldier System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Soldier System Market Analysis Report by Region

Europe Soldier System Market Report:

In Europe, the Soldier System market is anticipated to increase from $2.78 billion in 2023 to approximately $4.94 billion by 2033. Countries like the UK, Germany, and France are investing heavily in next-generation soldier systems as part of NATO initiatives to enhance collective defense capabilities and respond to emergent threats.Asia Pacific Soldier System Market Report:

In the Asia Pacific region, the Soldier System market is valued at $2.09 billion in 2023, projected to grow to $3.73 billion by 2033. This growth is driven primarily by increasing military expenditures from nations like China and India that are enhancing their defense capabilities amid rising regional tensions and geopolitical uncertainties.North America Soldier System Market Report:

North America represents the largest segment of the Soldier System market, valued at $3.69 billion in 2023, forecast to escalate to $6.57 billion by 2033. The U.S. military’s focus on technological advancements and increased funding for soldier modernization initiatives significantly fuels this growth, alongside partnerships with private defense contractors.South America Soldier System Market Report:

The South American Soldier System market is estimated to be at $0.70 billion in 2023, with a growth expectation to $1.25 billion by 2033. This region is seeing a gradual increase in defense budgets, particularly in Brazil and Colombia, to address internal security challenges and modernize their military forces.Middle East & Africa Soldier System Market Report:

The Middle East and Africa Soldier System market is projected to grow from $1.24 billion in 2023 to $2.21 billion by 2033. Increasing conflicts, border tensions, and regional stability concerns are prompting nations such as Israel, Saudi Arabia, and South Africa to invest in advanced soldier systems to bolster their military capabilities.Tell us your focus area and get a customized research report.

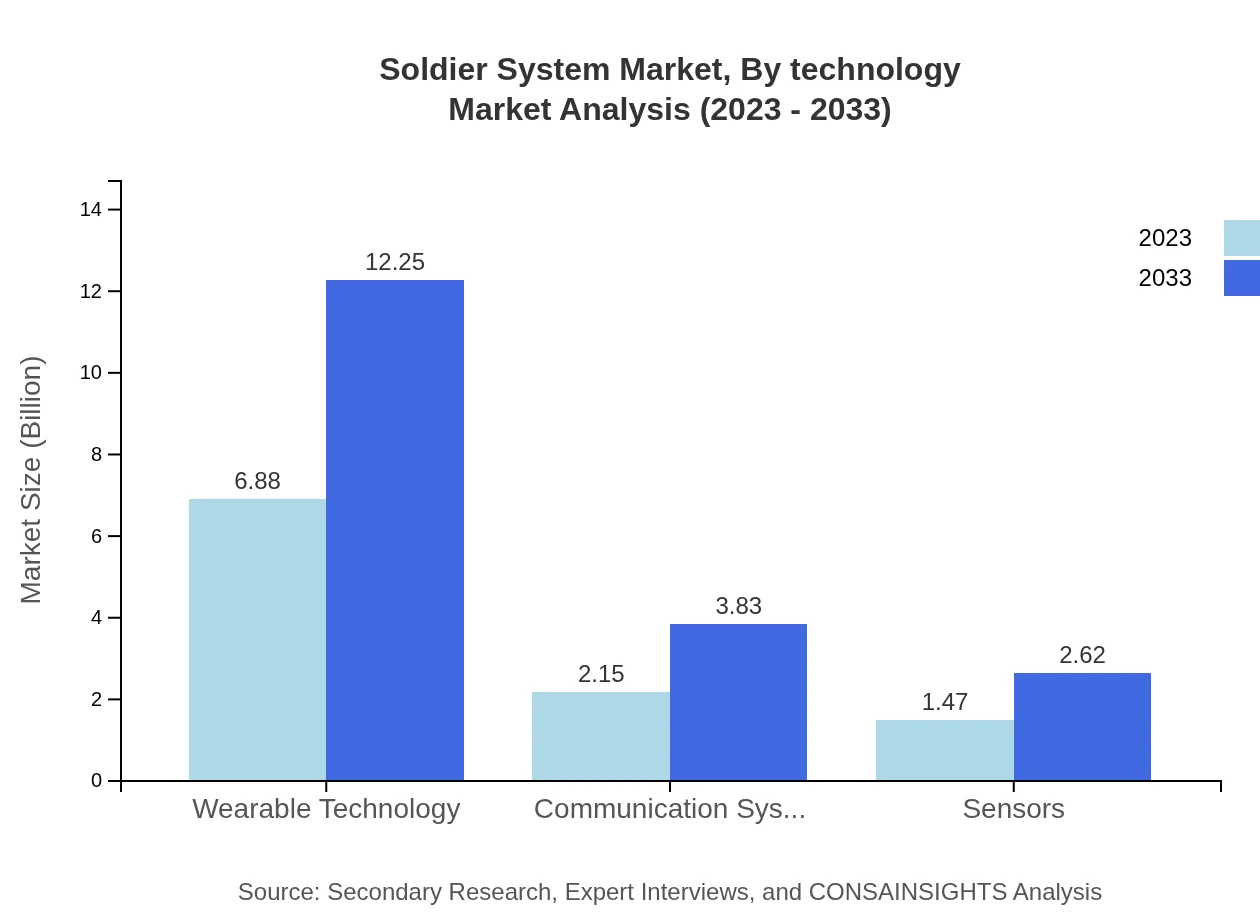

Soldier System Market Analysis By Technology

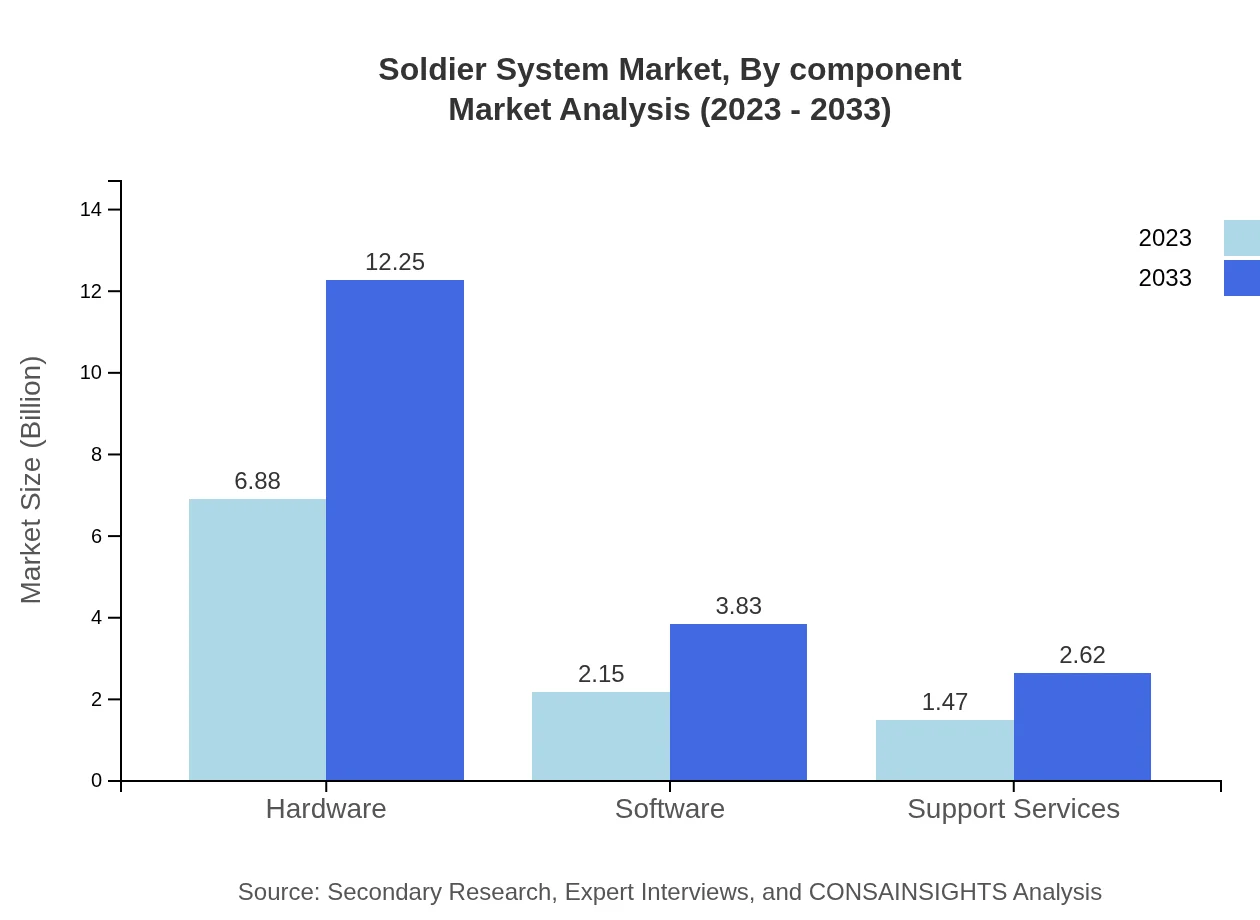

The Soldier System market is primarily segmented into Hardware and Software technologies. Hardware accounted for $6.88 billion in 2023 and is expected to grow to $12.25 billion by 2033, holding a dominant market share due to the foundational role of tangible systems and equipment. Software systems are also expanding, projected to grow from $2.15 billion in 2023 to $3.83 billion, critical for operational support and real-time data processing.

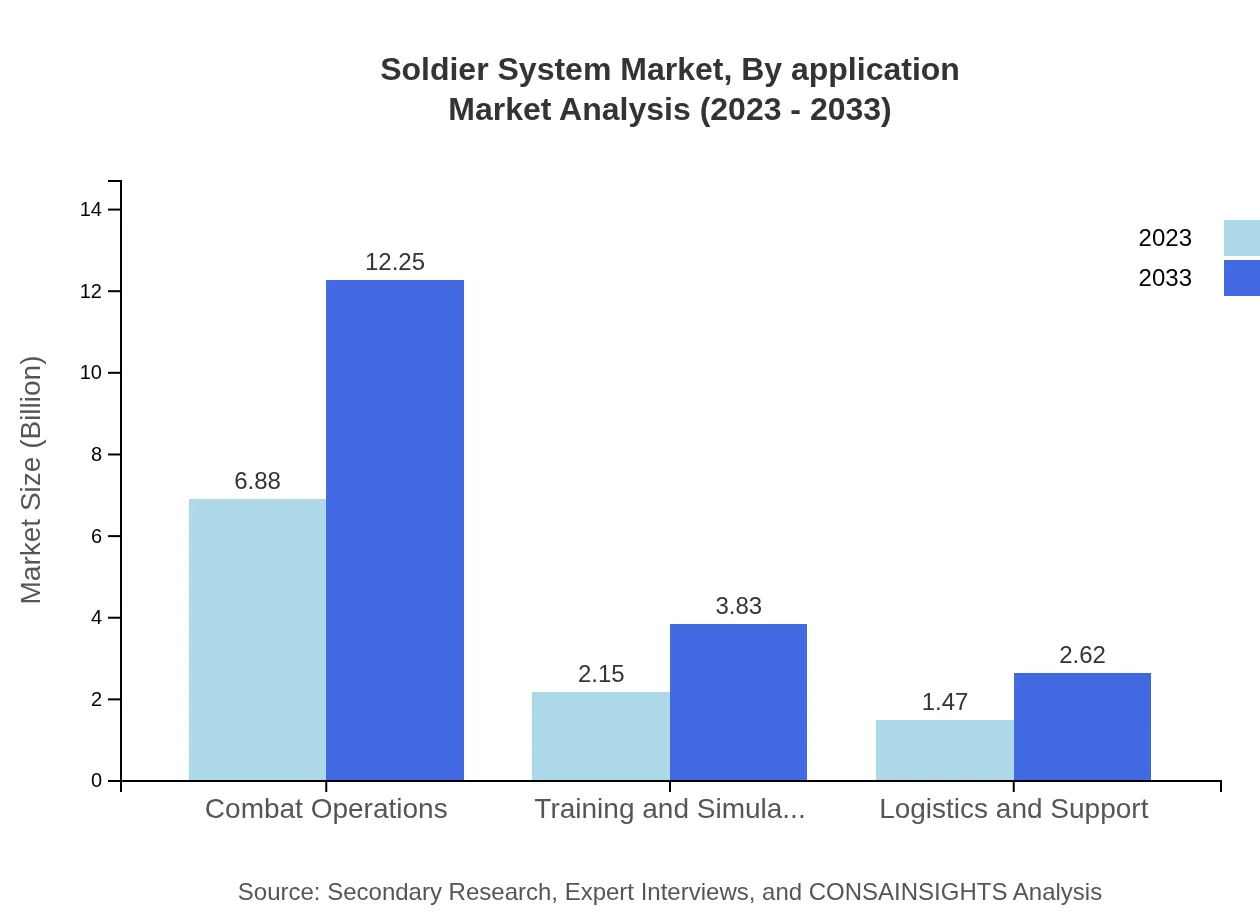

Soldier System Market Analysis By Application

The application segment of the Soldier System market includes combat operations, training simulations, logistics support, and more. Combat operations represent the bulk of market activity with $6.88 billion in 2023, maintaining a steady share due to ongoing demand for effective operational procedures in the field, while training and simulation technologies are expected to expand from $2.15 billion to $3.83 billion.

Soldier System Market Analysis By Component

Components of the Soldier System market include wearable technology, communication systems, and sensors. Wearable technology, integral to enhancing soldier mobility and connectivity, leads the market share at $6.88 billion in 2023, anticipated to reach $12.25 billion by 2033. Communication systems and sensors, valued at $2.15 billion and $1.47 billion in 2023 respectively, are crucial for situational awareness in combat scenarios.

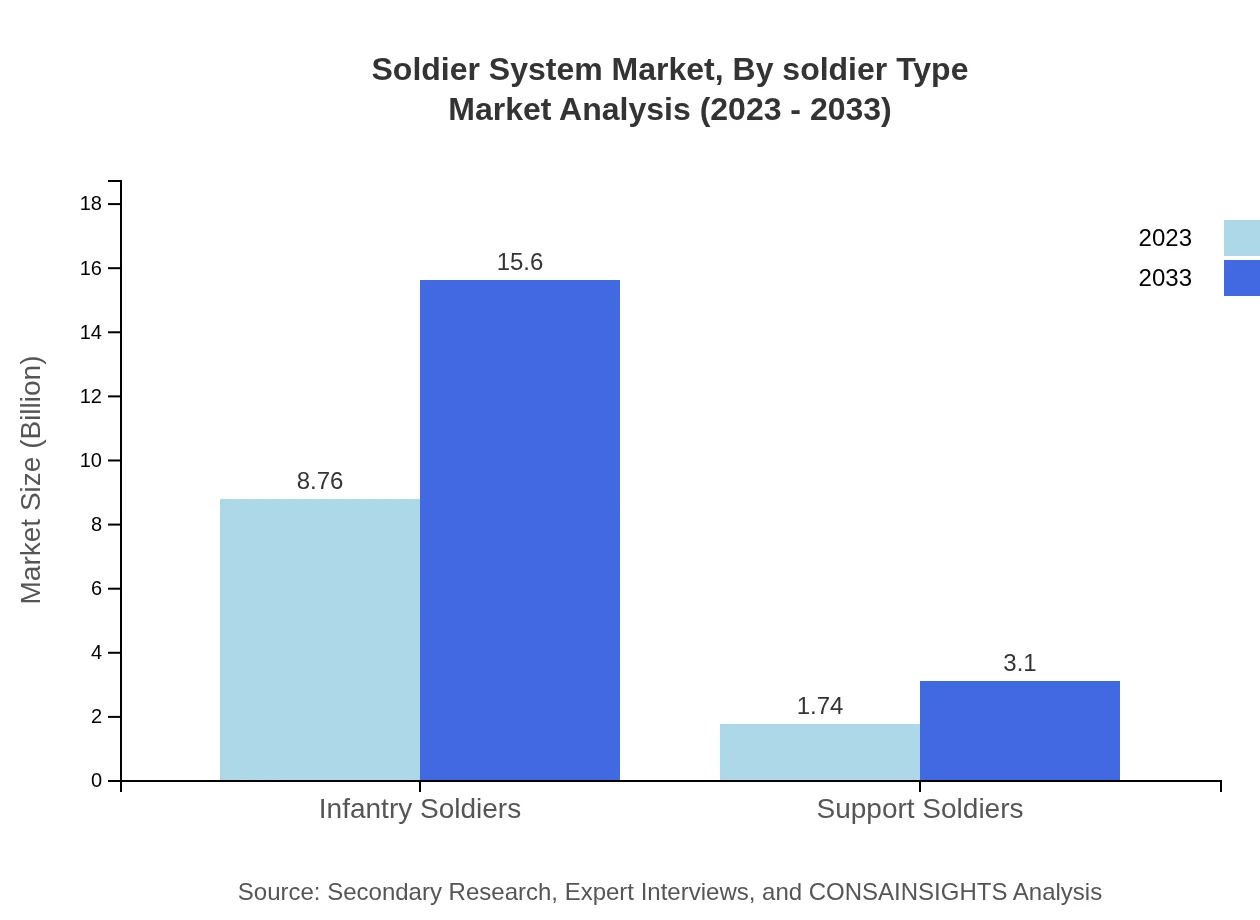

Soldier System Market Analysis By Soldier Type

The Soldier System market is classified by soldier type into Infantry and Support soldiers. Infantry soldiers account for a significant market presence, valued at $8.76 billion in 2023, projected to grow to $15.60 billion by 2033. Support soldiers, while smaller in proportion, are witnessing notable growth, from $1.74 billion to $3.10 billion.

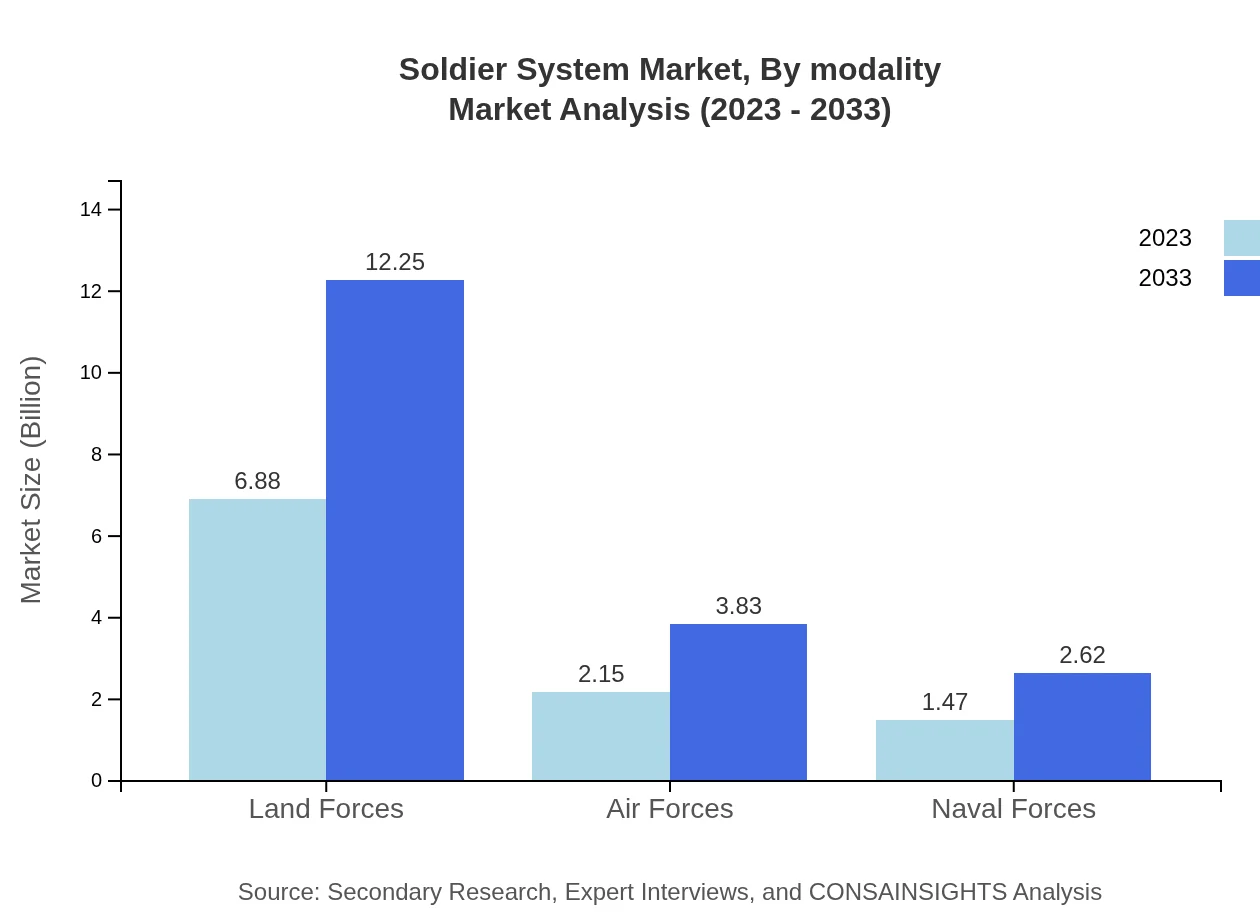

Soldier System Market Analysis By Modality

Market analysis by modality assesses the safety and efficacy of system components used in various operational contexts. Combat modes contribute substantially at $6.88 billion in 2023 with expected growth to $12.25 billion, emphasizing the importance of integrating systems that support multiple operational environments.

Soldier System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Soldier System Industry

Lockheed Martin:

Lockheed Martin is a global aerospace, defense, and security company, well-known for its advanced soldier systems integrated with cutting-edge technology aimed at enhancing soldier survivability and mission success.Northrop Grumman:

Northrop Grumman specializes in aerospace and defense technologies, providing innovative solutions in soldier systems focused on communication, sensor networks, and mission management systems.BAE Systems:

BAE Systems is recognized for its comprehensive defense solutions, including advanced soldier systems that integrate hardware and software for modern military applications.Thales Group:

Thales Group offers advanced technologies and services for military systems, focusing on enhancing operational capabilities and soldier safety through integrated solutions.Raytheon Technologies:

Raytheon Technologies is a top player in missile systems as well as soldiers’ support technologies, emphasizing the integration of next-generation technologies into soldier systems.We're grateful to work with incredible clients.

FAQs

What is the market size of soldier System?

The soldier-system market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 5.8% from 2023 to 2033, indicating consistent growth and expansion within the industry over the next decade.

What are the key market players or companies in this soldier System industry?

Key market players in the soldier-system industry include global defense companies such as Lockheed Martin, BAE Systems, Thales Group, Rheinmetall, and Northrop Grumman. These firms are instrumental in developing advanced technologies and solutions for modern military needs.

What are the primary factors driving the growth in the soldier System industry?

Growth in the soldier-system industry is driven by advancements in technology, increased military budgets globally, the need for enhanced soldier safety and efficiency, and the rising demand for integrated defense solutions that combine hardware and software capabilities.

Which region is the fastest Growing in the soldier System?

North America is currently the fastest-growing region in the soldier-system market, expanding from $3.69 billion in 2023 to $6.57 billion by 2033. This growth reflects heightened defense spending and ongoing military modernization efforts.

Does ConsaInsights provide customized market report data for the soldier System industry?

Yes, ConsaInsights offers customized market report data tailored to the soldier-system industry. Our bespoke reports cater to specific client needs, providing focused analysis and actionable insights tailored to unique market challenges and opportunities.

What deliverables can I expect from this soldier System market research project?

Deliverables from our soldier-system market research project include comprehensive market analysis, segmentation reports, regional studies, competitive landscape evaluations, and forecast models, ensuring stakeholders receive valuable intelligence for strategic decision-making.

What are the market trends of soldier System?

Current trends in the soldier-system market include the integration of wearable technology, increased focus on cybersecurity, enhanced communication systems, and the increasing utilization of simulations for training. Additionally, advancements in sensors are becoming essential for modern combat operations.