Solid State Lighting Source Market Report

Published Date: 31 January 2026 | Report Code: solid-state-lighting-source

Solid State Lighting Source Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Solid State Lighting Source market, covering market dynamics, size, segmentation, and future trends from 2023 to 2033, alongside key insights into regional performance and competitive landscape.

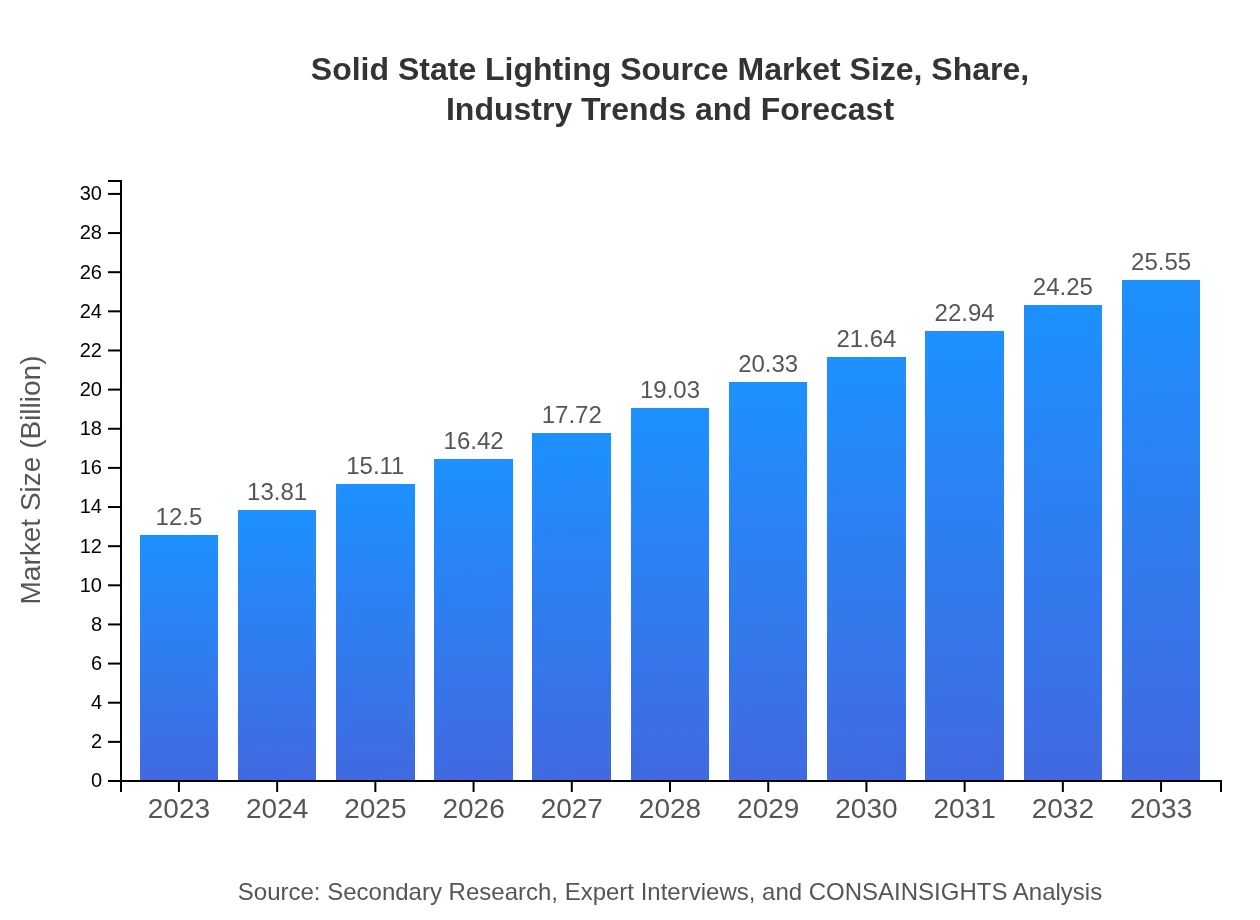

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $25.55 Billion |

| Top Companies | Philips Lighting, Osram Licht AG, Cree, Inc., GE Lighting, Samsung Electronics |

| Last Modified Date | 31 January 2026 |

Solid State Lighting Source Market Overview

Customize Solid State Lighting Source Market Report market research report

- ✔ Get in-depth analysis of Solid State Lighting Source market size, growth, and forecasts.

- ✔ Understand Solid State Lighting Source's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Solid State Lighting Source

What is the Market Size & CAGR of Solid State Lighting Source market in {Year}?

Solid State Lighting Source Industry Analysis

Solid State Lighting Source Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Solid State Lighting Source Market Analysis Report by Region

Europe Solid State Lighting Source Market Report:

Europe is estimated to grow from $3.82 billion in 2023 to $7.82 billion by 2033, fueled by strict regulatory frameworks focused on sustainability and energy efficiency. The EU’s commitment to reducing carbon footprints propels investments in advanced lighting technologies, including LED and OLED options, thus enhancing market viability.Asia Pacific Solid State Lighting Source Market Report:

The Asia Pacific region is anticipated to witness significant growth, with the market expected to expand from $2.40 billion in 2023 to $4.90 billion by 2033. Increased urbanization and government initiatives promoting energy-efficient lighting are key contributors to this growth. Furthermore, the growing adoption of LED technology in emerging economies enhances market potential in this region.North America Solid State Lighting Source Market Report:

North America leads the global market, with a projected increase from $4.16 billion in 2023 to $8.50 billion by 2033. The region has established itself as a technological innovator, with significant investments in smart lighting solutions, further boosting the adoption of solid state lighting. Energy efficiency regulations and consumer awareness drive this expansion.South America Solid State Lighting Source Market Report:

In South America, the Solid State Lighting Source market is projected to grow from $0.81 billion in 2023 to $1.66 billion by 2033. The expansion is driven by increasing demand for energy-efficient lighting solutions and collaborative efforts by governments to minimize carbon emissions. Additionally, growing awareness about sustainability among consumers aids market dynamics.Middle East & Africa Solid State Lighting Source Market Report:

The market in the Middle East and Africa is projected to increase from $1.31 billion in 2023 to $2.67 billion by 2033. The growth is driven by infrastructural developments and investments in sustainable urban lighting, as well as governmental efforts promoting energy-efficient technologies to combat rising energy costs.Tell us your focus area and get a customized research report.

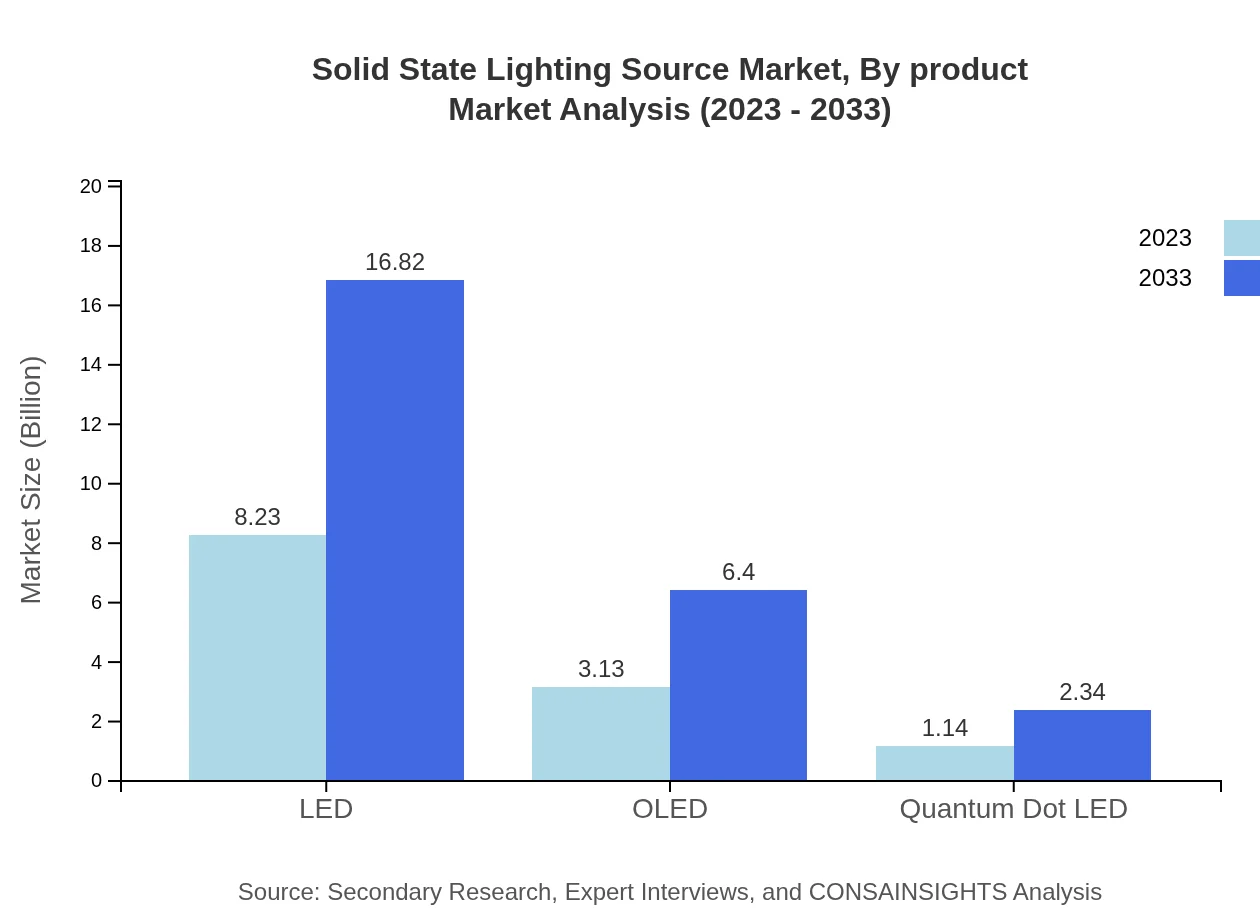

Solid State Lighting Source Market Analysis By Product

In 2023, the market for LED products stands at $8.23 billion, expected to reach $16.82 billion by 2033, representing sustained dominance in the sector. OLEDs also show potential, increasing from $3.13 billion to $6.40 billion. Quantum Dot LEDs, while smaller at $1.14 billion, are slated to grow to $2.34 billion, reflecting a trend towards innovative lighting technologies.

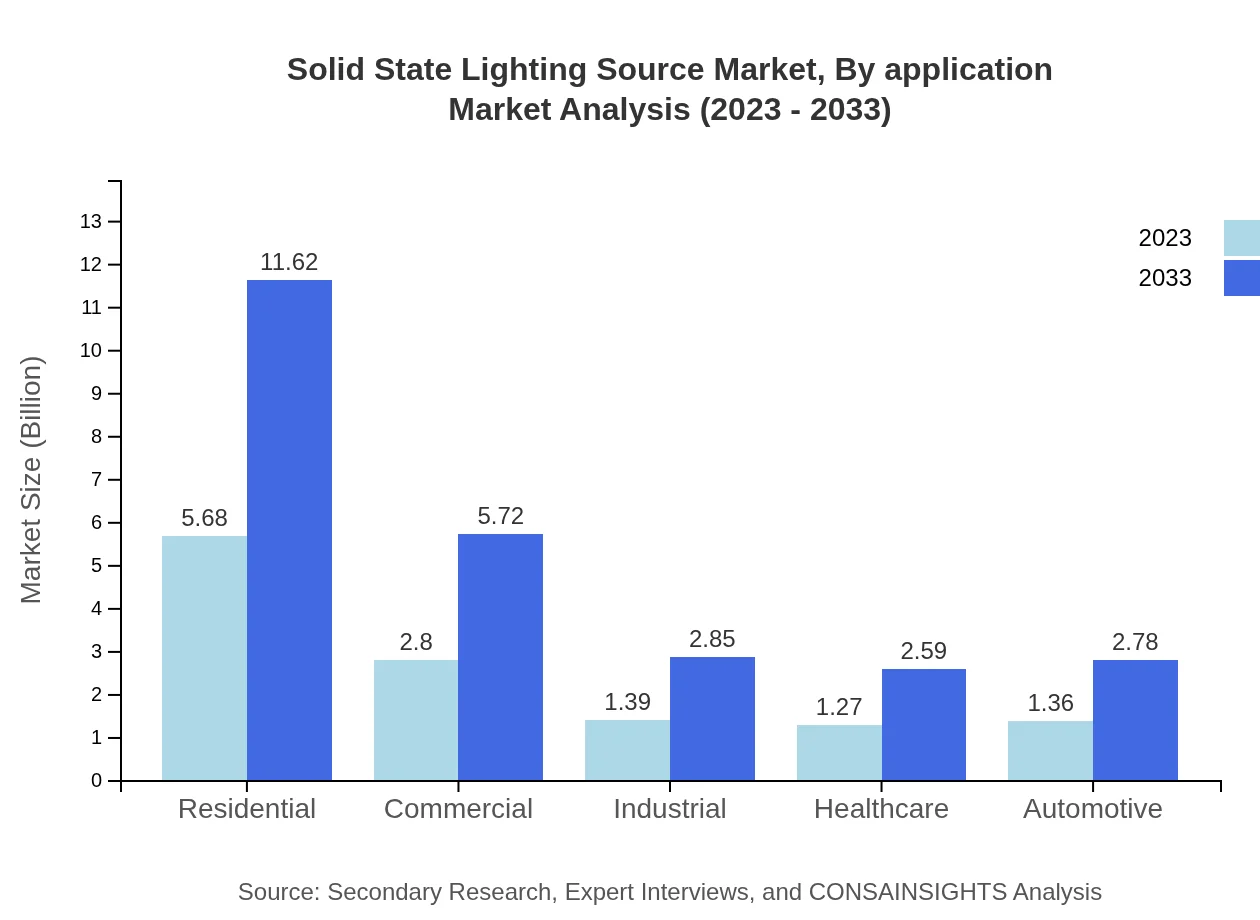

Solid State Lighting Source Market Analysis By Application

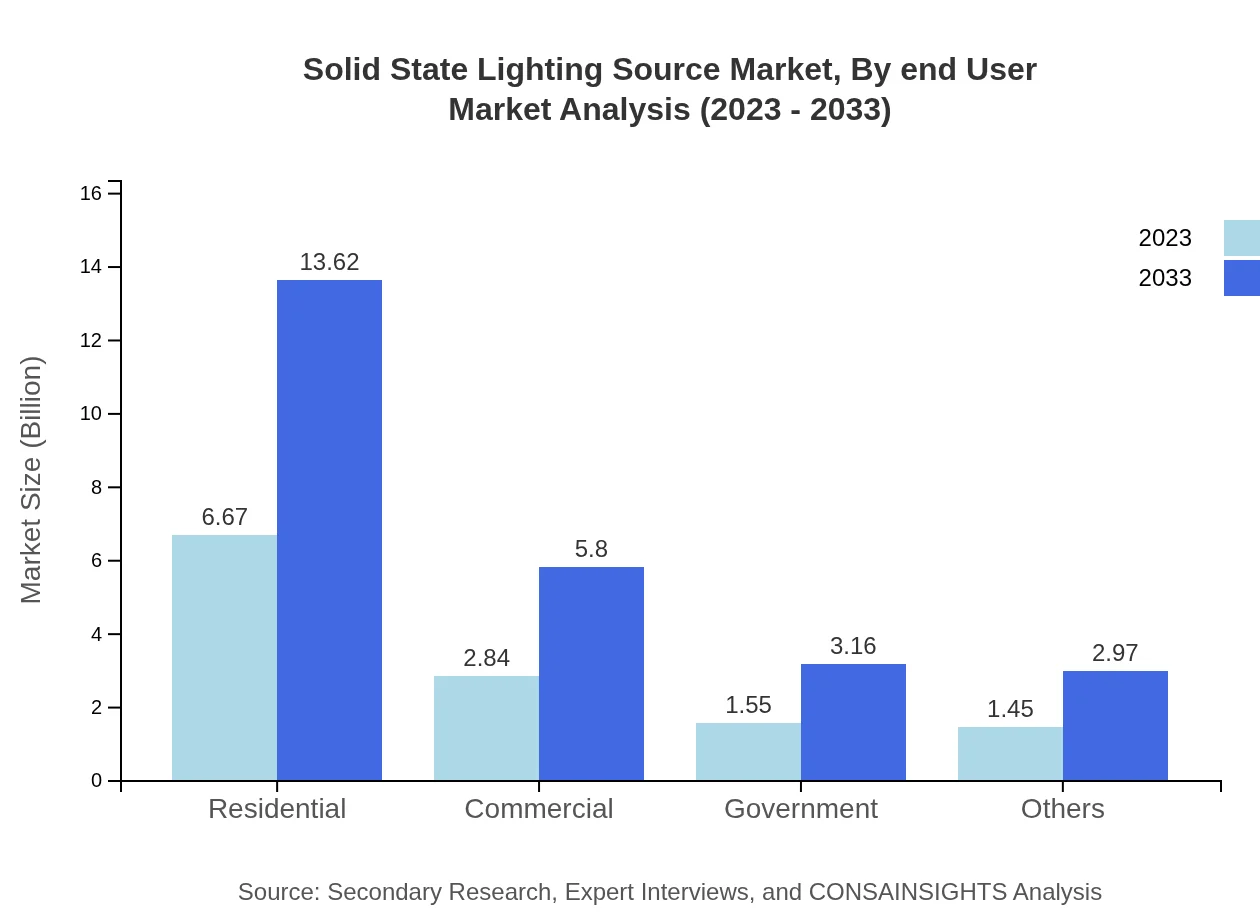

The residential market segment, valued at $6.67 billion in 2023, will witness growth to $13.62 billion by 2033. Commercial and government applications are also significant, with projected growth rates reflecting the surge in demand for energy-efficient lighting solutions. The industrial and healthcare sectors will contribute incrementally, highlighting the need for improved lighting technologies across various applications.

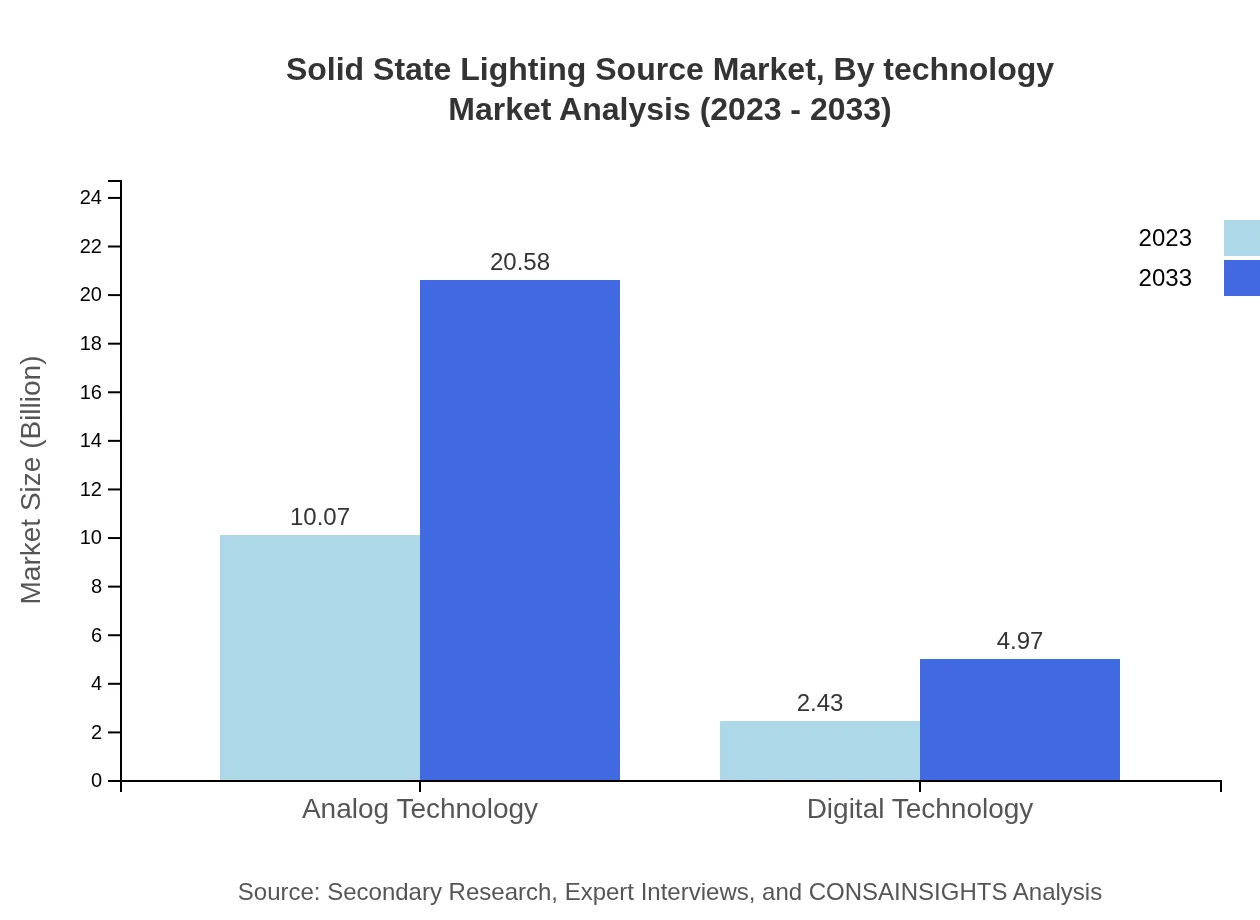

Solid State Lighting Source Market Analysis By Technology

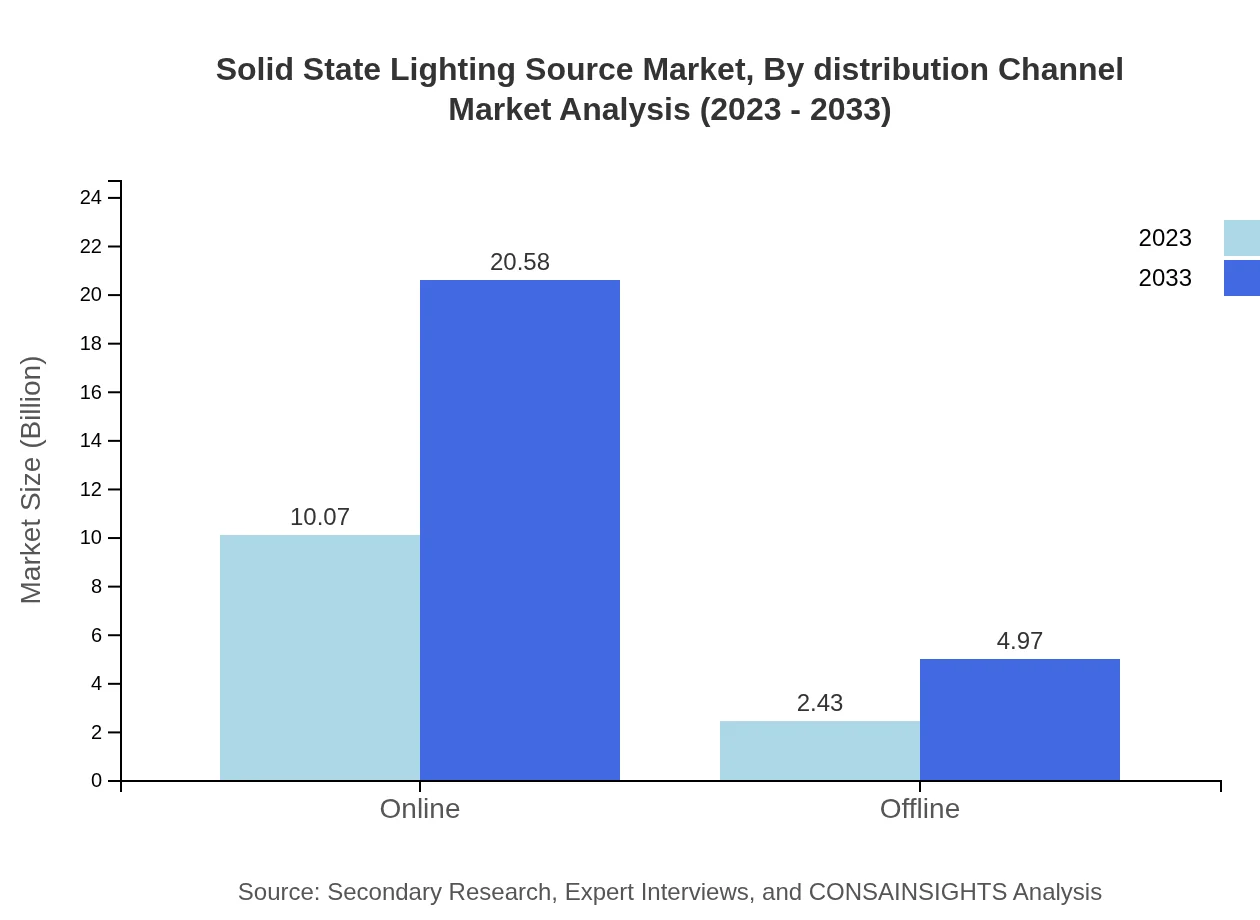

The technology landscape is dominated by Analog Technology, which has a market size of $10.07 billion in 2023, expected to amplify to $20.58 billion by 2033. Digital Technology, though smaller, illustrates a potential increase from $2.43 billion to $4.97 billion as smart lighting solutions gain traction.

Solid State Lighting Source Market Analysis By End User

The end-user analysis reveals the residential sector commanding a significant share, currently at $5.68 billion and anticipated to reach $11.62 billion by 2033. Commercial and industrial sectors also showcase robust markets, with healthcare and automotive applications emerging steadily.

Solid State Lighting Source Market Analysis By Distribution Channel

The online distribution channel dominates, with a market value of $10.07 billion in 2023, expected to expand to $20.58 billion. Offline channels, although smaller, are projected to see growth from $2.43 billion to $4.97 billion as consumers continue to value in-person shopping experiences.

Solid State Lighting Source Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Solid State Lighting Source Industry

Philips Lighting:

Philips Lighting is a leader in lighting products, specializing in innovative designs and sustainable solutions, playing a vital role in advancing solid-state lighting technologies.Osram Licht AG:

Osram has a longstanding history in lighting technology, focusing on producing high-efficiency lighting solutions, including LEDs, that cater to a wide range of applications.Cree, Inc.:

Cree is recognized for its cutting-edge LED technology, focusing on performance and innovation to establish a strong foothold in the solid-state lighting market.GE Lighting:

General Electric Lighting provides diverse lighting solutions, combining traditional technologies with innovative LED applications to meet consumer and industrial needs.Samsung Electronics:

Samsung is a technology leader developing integrated lighting solutions that leverage advanced technologies, contributing significantly to the LED market.We're grateful to work with incredible clients.

FAQs

What is the market size of solid State Lighting Source?

The solid-state lighting source market is valued at $12.5 billion in 2023, with a projected CAGR of 7.2% over the next ten years, indicating robust growth in this sector.

What are the key market players or companies in the solid State Lighting Source industry?

Key players in the solid-state lighting source industry include major companies engaged in LED, OLED, and Quantum Dot technologies, delivering innovative products globally and contributing significantly to market growth efforts.

What are the primary factors driving the growth in the solid State Lighting Source industry?

Major growth drivers in the solid-state lighting source industry include advancements in technology, the increasing demand for energy-efficient solutions, and government regulations promoting sustainability and reduced energy consumption.

Which region is the fastest Growing in the solid State Lighting Source?

The fastest-growing region in the solid-state lighting source market is expected to be North America, with a market size projected to grow from $4.16 billion in 2023 to $8.50 billion by 2033.

Does ConsaInsights provide customized market report data for the solid State Lighting Source industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the solid-state lighting source industry, enabling businesses to gain insights relevant to their strategies and objectives.

What deliverables can I expect from this solid State Lighting Source market research project?

Deliverables from the solid-state lighting source market research project typically include detailed reports, market forecasts, competitive analysis, and actionable insights tailored to your business requirements.

What are the market trends of solid State Lighting Source?

Current market trends in solid-state lighting include a growing preference for LED technologies, increasing investments in smart lighting solutions, and a notable shift towards sustainable lighting practices across various sectors.