Solvent Borne Adhesives Market Report

Published Date: 02 February 2026 | Report Code: solvent-borne-adhesives

Solvent Borne Adhesives Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Solvent Borne Adhesives market, covering market size, trends, segmentation, and regional insights from 2023 to 2033, along with a competitive landscape of key players in the industry.

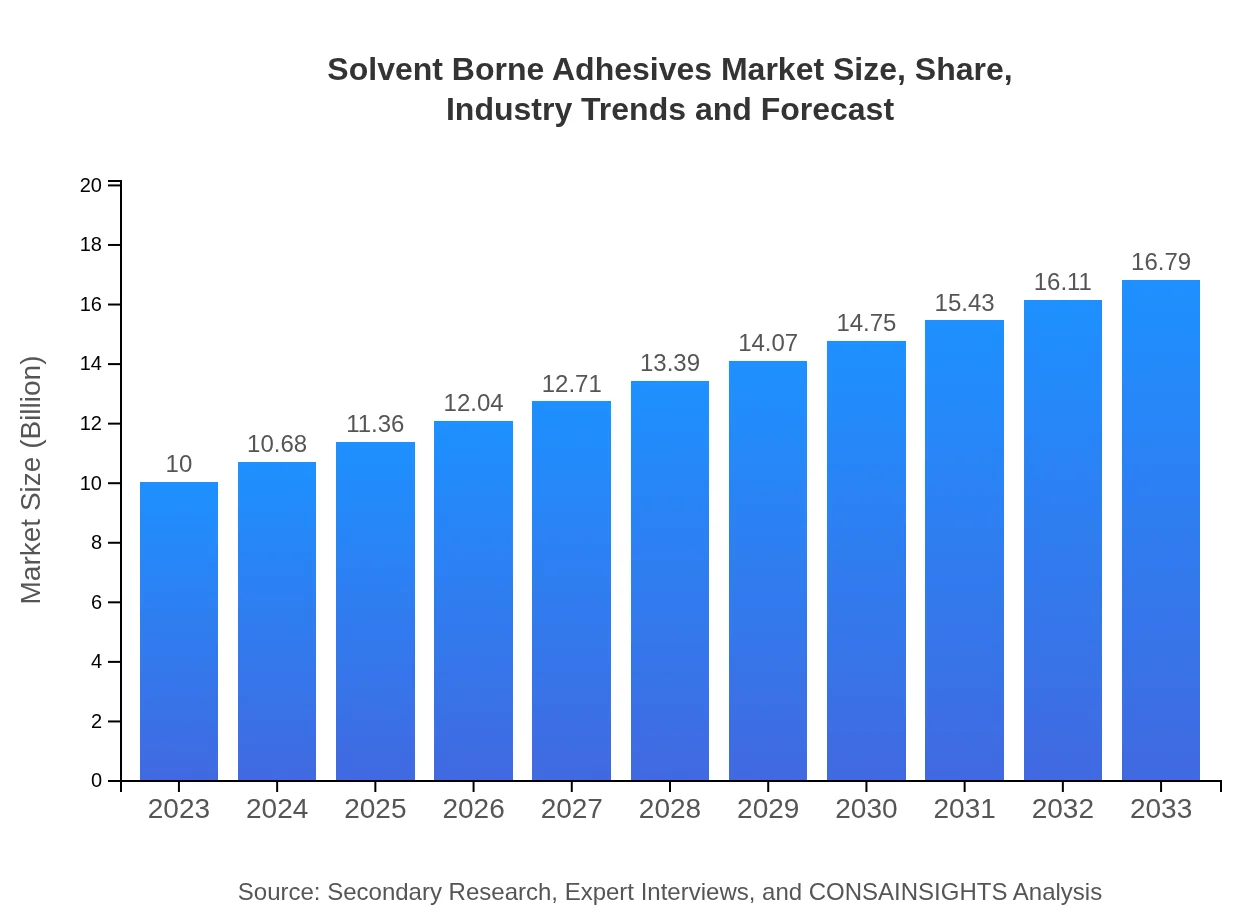

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $16.79 Billion |

| Top Companies | Henkel AG & Co. KGaA, 3M Company, BASF SE, Sika AG, ITW (Illinois Tool Works) |

| Last Modified Date | 02 February 2026 |

Solvent Borne Adhesives Market Overview

Customize Solvent Borne Adhesives Market Report market research report

- ✔ Get in-depth analysis of Solvent Borne Adhesives market size, growth, and forecasts.

- ✔ Understand Solvent Borne Adhesives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Solvent Borne Adhesives

What is the Market Size & CAGR of Solvent Borne Adhesives market in 2023?

Solvent Borne Adhesives Industry Analysis

Solvent Borne Adhesives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Solvent Borne Adhesives Market Analysis Report by Region

Europe Solvent Borne Adhesives Market Report:

Europe holds a significant share in the Solvent Borne Adhesives market, with a current market size of USD 2.85 billion in 2023, projected to grow to USD 4.79 billion by 2033. The European market is influenced by rigorous environmental regulations, pushing innovation towards low-VOC adhesives while sustaining demand from the automotive and packaging industries.Asia Pacific Solvent Borne Adhesives Market Report:

The Asia Pacific region is experiencing significant growth in the Solvent Borne Adhesives market, with a market size of USD 1.98 billion in 2023, expected to reach USD 3.32 billion by 2033. The burgeoning construction and automotive industries, particularly in countries like China, India, and Japan, are driving this growth, along with increased infrastructure developments and urbanization.North America Solvent Borne Adhesives Market Report:

The North American Solvent Borne Adhesives market size is anticipated to grow from USD 3.59 billion in 2023 to USD 6.03 billion by 2033. The region's strong automotive and construction sectors, paired with stringent regulations that push manufacturers towards advanced adhesive technologies, contribute to the market's expansion.South America Solvent Borne Adhesives Market Report:

In South America, the market size for Solvent Borne Adhesives is projected to grow from USD 0.58 billion in 2023 to USD 0.98 billion by 2033. Growth in this region is attributed to increasing manufacturing activities and the expanding furniture sector, bolstered by rising consumer demand for durable and efficient adhesive solutions.Middle East & Africa Solvent Borne Adhesives Market Report:

In the Middle East and Africa, the market for Solvent Borne Adhesives is expected to increase from USD 1.00 billion in 2023 to USD 1.67 billion by 2033. Growth is driven by developing economies investing in infrastructure and construction projects, along with the rising demand for adhesives in emerging markets.Tell us your focus area and get a customized research report.

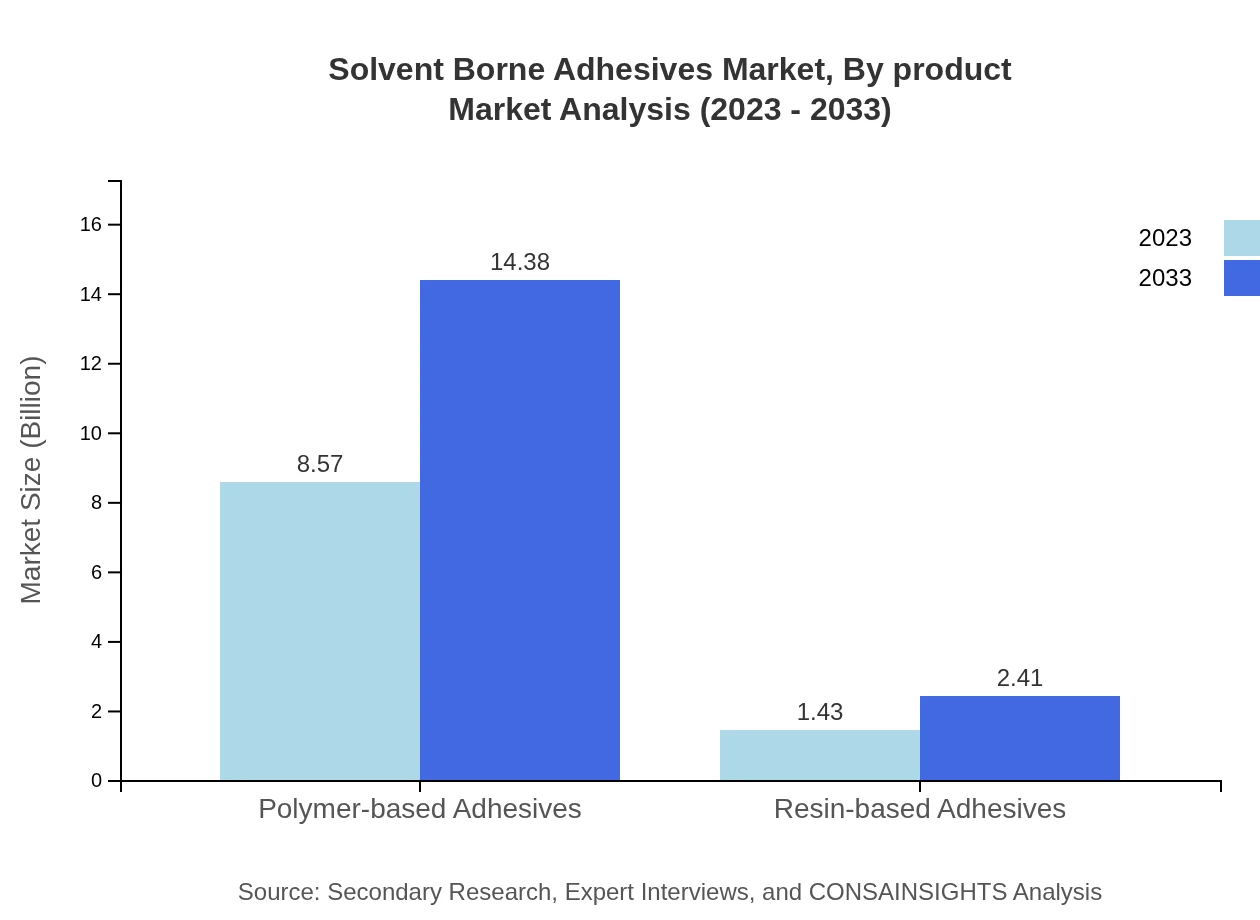

Solvent Borne Adhesives Market Analysis By Product

In the Solvent-Borne Adhesives market, polymer-based adhesives dominate, with a size of USD 8.57 billion in 2023, growing to USD 14.38 billion by 2033. They hold a significant market share of 85.66%. Conversely, resin-based adhesives showcase a smaller presence, with a market size of USD 1.43 billion in 2023, increasing to USD 2.41 billion in 2033 and capturing 14.34% market share.

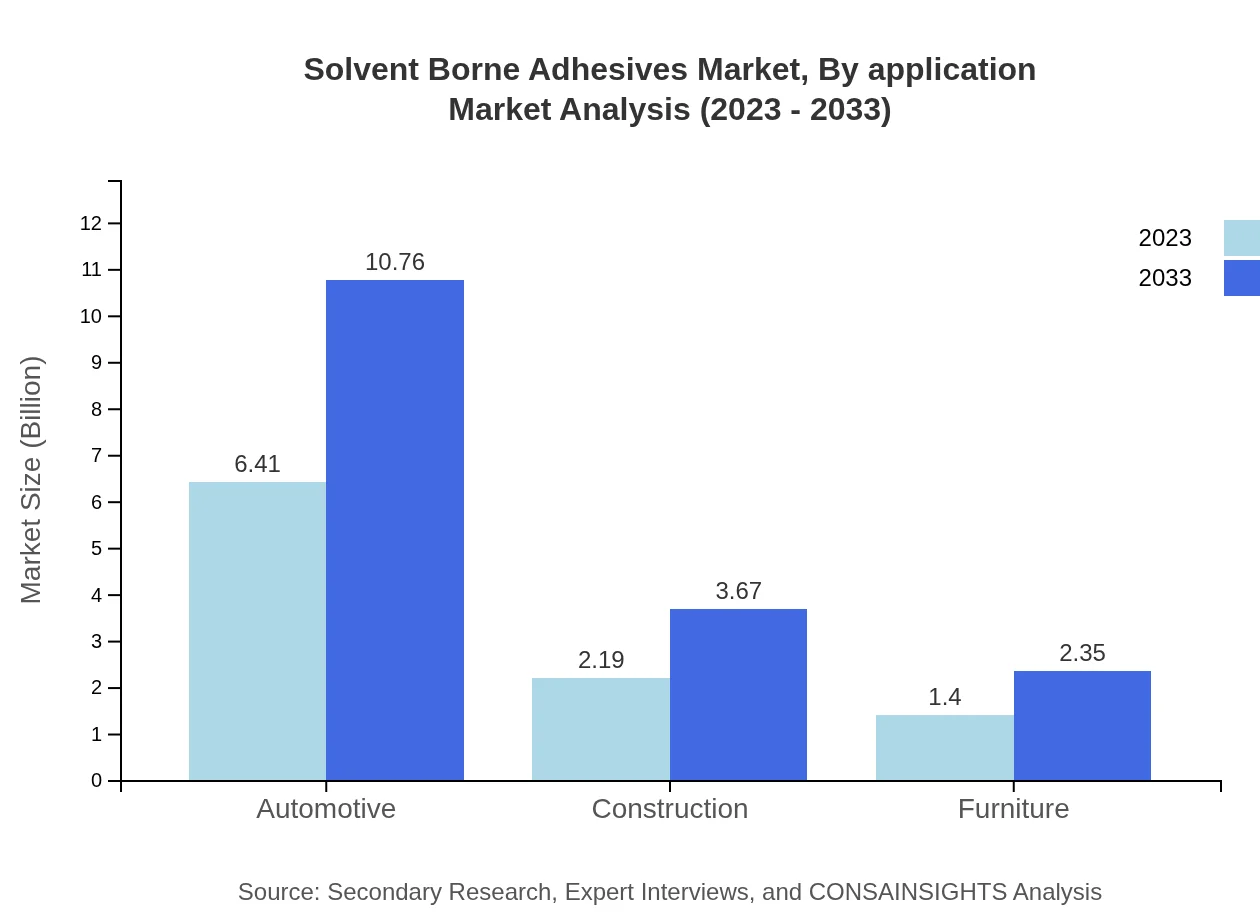

Solvent Borne Adhesives Market Analysis By Application

Applications in the construction sector show a size of USD 6.41 billion in 2023, projected to reach USD 10.76 billion by 2033, maintaining a substantial 64.12% market share. Automotive applications also contribute significantly with a size of USD 2.19 billion in 2023 and reaching USD 3.67 billion by 2033 (21.89% share). Packaging applications generated USD 1.40 billion in 2023, expected to rise to USD 2.35 billion by 2033, holding 13.99% share.

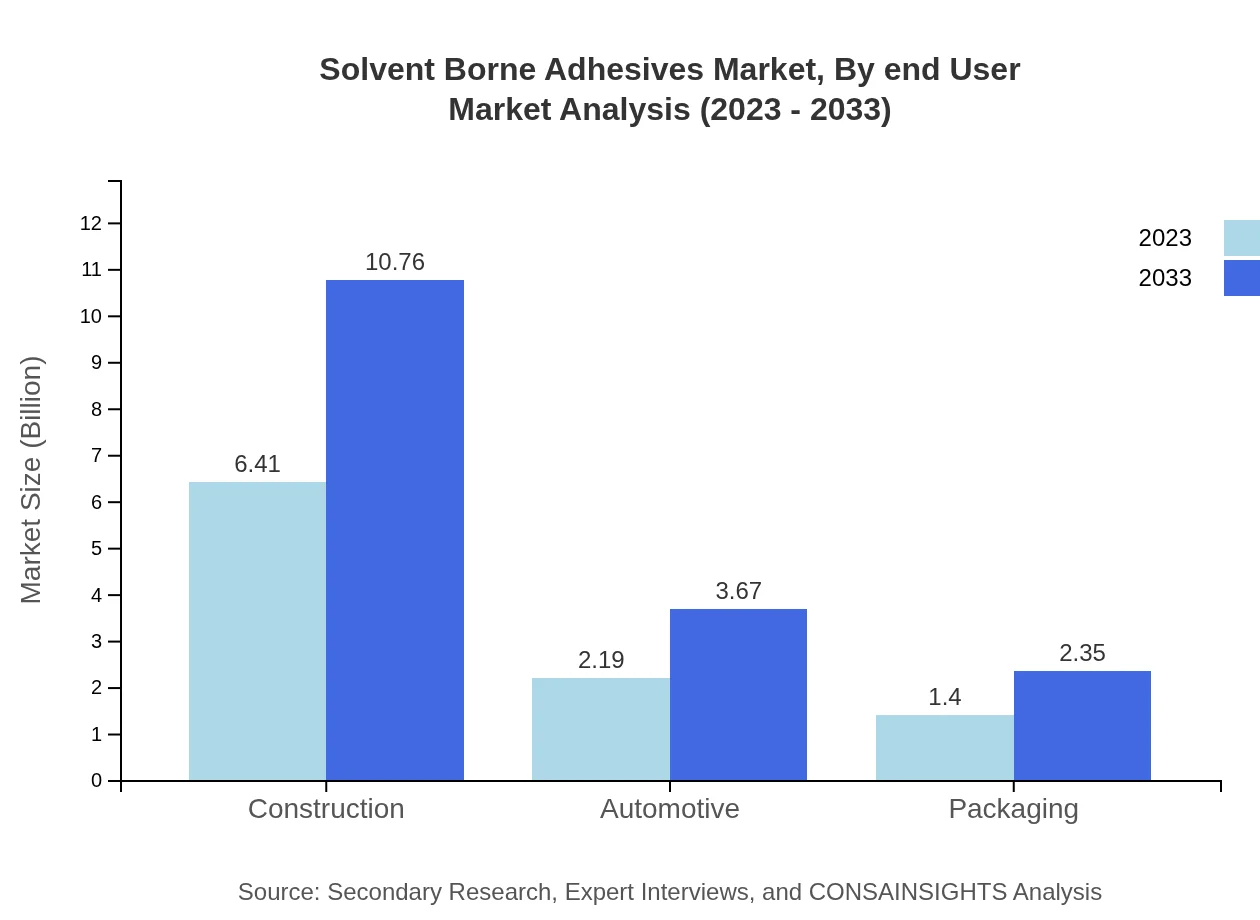

Solvent Borne Adhesives Market Analysis By End User

The construction sector continues to lead as the primary end-user with a market size of USD 6.41 billion in 2023, expanding to USD 10.76 billion in 2033 (64.12% share). Other significant industries include automotive and packaging, where their contributions reflect growing trends in durable, high-performance adhesive solutions.

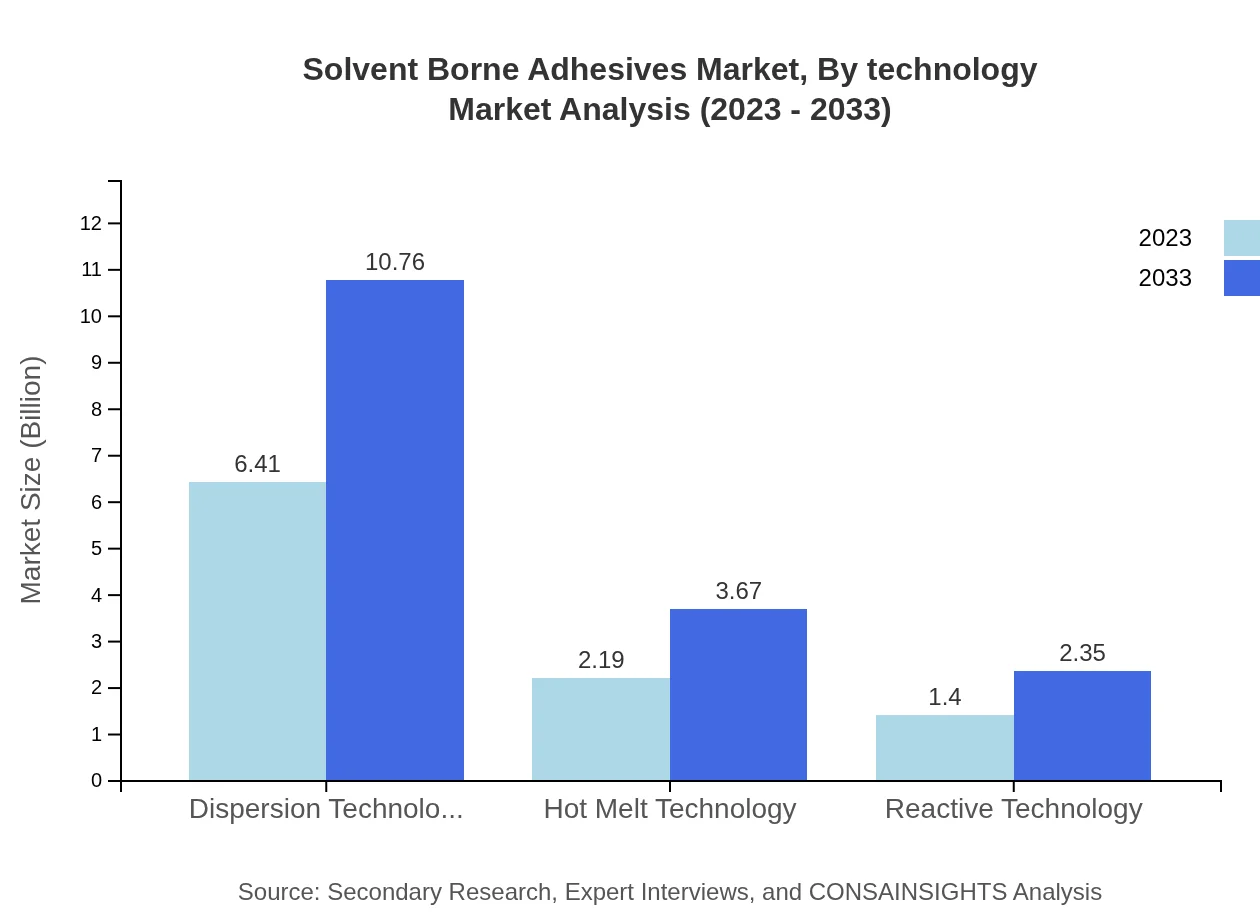

Solvent Borne Adhesives Market Analysis By Technology

Major technology segments include Dispersion Technology, which commands a size of USD 6.41 billion in 2023, growing to USD 10.76 billion by 2033, occupying a 64.12% market share. Hot Melt Technology and Reactive Technology also hold substantial shares, contributing USD 2.19 billion and USD 1.40 billion respectively in 2023, with expected growth trajectories to 2033.

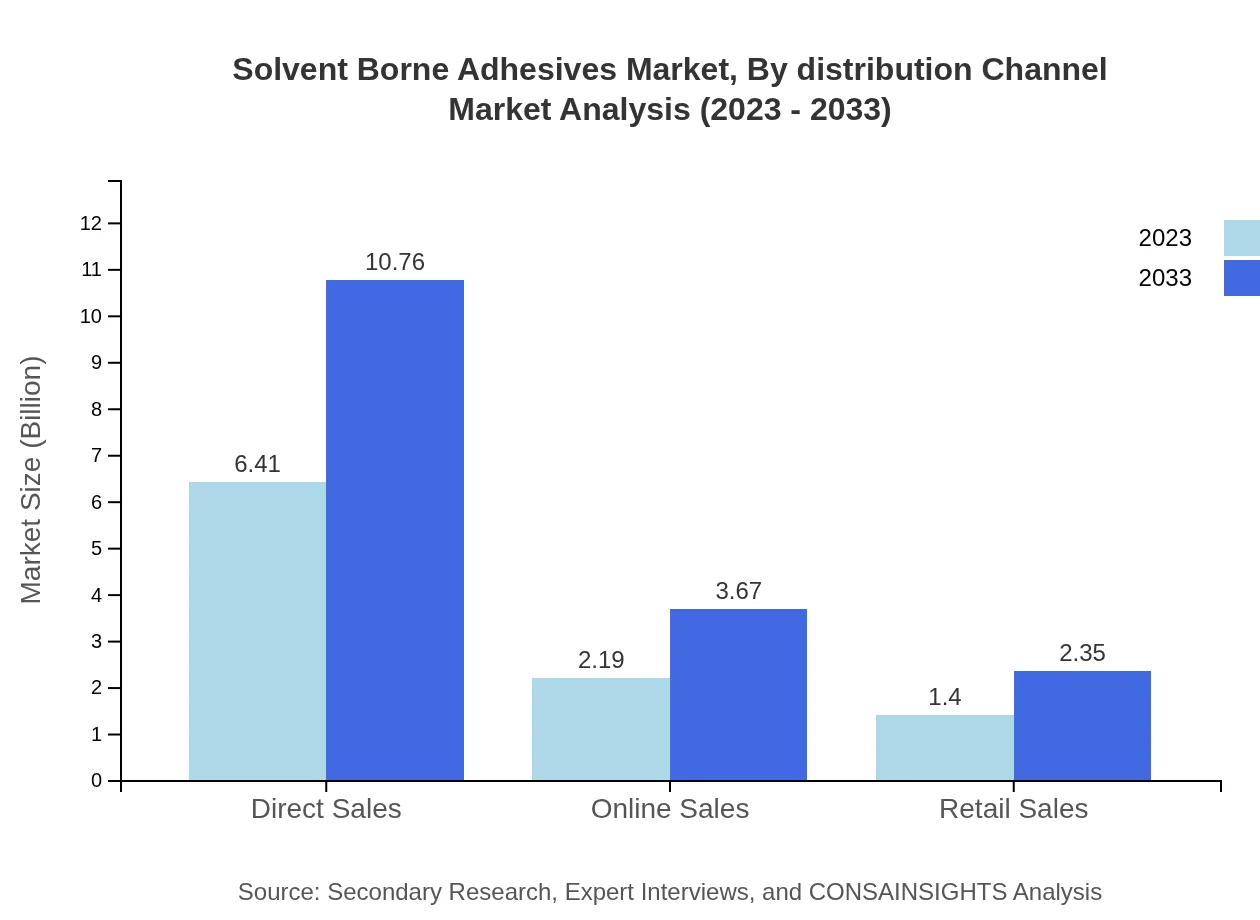

Solvent Borne Adhesives Market Analysis By Distribution Channel

Distribution primarily occurs through Direct Sales (USD 6.41 billion in 2023, growing to USD 10.76 billion by 2033) and Online Sales (USD 2.19 billion in 2023, projected at USD 3.67 billion by 2033). Retail Sales reveal a size of USD 1.40 billion in 2023, increasing to USD 2.35 billion by 2033.

Solvent Borne Adhesives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Solvent Borne Adhesives Industry

Henkel AG & Co. KGaA:

A global leader in adhesives, Henkel offers innovative and high-performance solvent borne adhesives for various applications across industries.3M Company:

Known for its diversified product lines, 3M manufactures advanced adhesives that cater to automotive, construction, and consumer markets.BASF SE:

As a leading chemical producer, BASF develops eco-friendly solvent borne adhesives that improve operational efficiencies in various sectors.Sika AG:

Sika specializes in construction solutions, providing high-quality adhesive products for both industrial and commercial applications.ITW (Illinois Tool Works):

ITW offers a comprehensive portfolio of adhesive brands, focusing on customer satisfaction and innovative packaging solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of solvent Borne adhesives?

The global solvent-borne adhesives market is projected to reach approximately $10 billion by 2033, growing at a CAGR of 5.2% from 2023. This growth is driven by rising demand across various sectors including construction and automotive.

What are the key market players or companies in the solvent Borne adhesives industry?

Key players in the solvent-borne adhesives market include companies like Henkel AG, 3M Company, and H.B. Fuller. These companies are pivotal in driving innovations and expanding their market presence through strategic partnerships and product development.

What are the primary factors driving the growth in the solvent Borne adhesives industry?

Growth in the solvent-borne adhesives market is propelled by rising construction activities, increasing automotive production, and the demand for sustainable packaging solutions. Additionally, advancements in adhesive technologies enhance product performance and drive adoption.

Which region is the fastest Growing in the solvent Borne adhesives market?

The Asia Pacific region is the fastest-growing market for solvent-borne adhesives, projected to grow from $1.98 billion in 2023 to $3.32 billion by 2033. Factors include rapid industrialization and increased demand in packaging and automotive segments.

Does Consainsights provide customized market report data for the solvent Borne adhesives industry?

Yes, Consainsights offers customized market report data for the solvent-borne adhesives industry. Clients can tailor research reports according to specific requirements, focusing on aspects such as geographic segmentation and market trends.

What deliverables can I expect from this solvent Borne adhesives market research project?

From this market research project on solvent-borne adhesives, you can expect comprehensive reports, market analysis with insights on region-specific data, segment performance, competitive landscape, and future market forecasts.

What are the market trends of solvent Borne adhesives?

Current market trends for solvent-borne adhesives include the increased use of bio-based adhesives, a shift towards eco-friendly products, and the growing importance of online sales channels for distribution.