Solvent Pressure Sensitive Adhesives Market Report

Published Date: 02 February 2026 | Report Code: solvent-pressure-sensitive-adhesives

Solvent Pressure Sensitive Adhesives Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report covers the Solvent Pressure Sensitive Adhesives market, providing in-depth insights on market size, growth trends, regional analyses, and industry dynamics, along with forecasts spanning from 2023 to 2033.

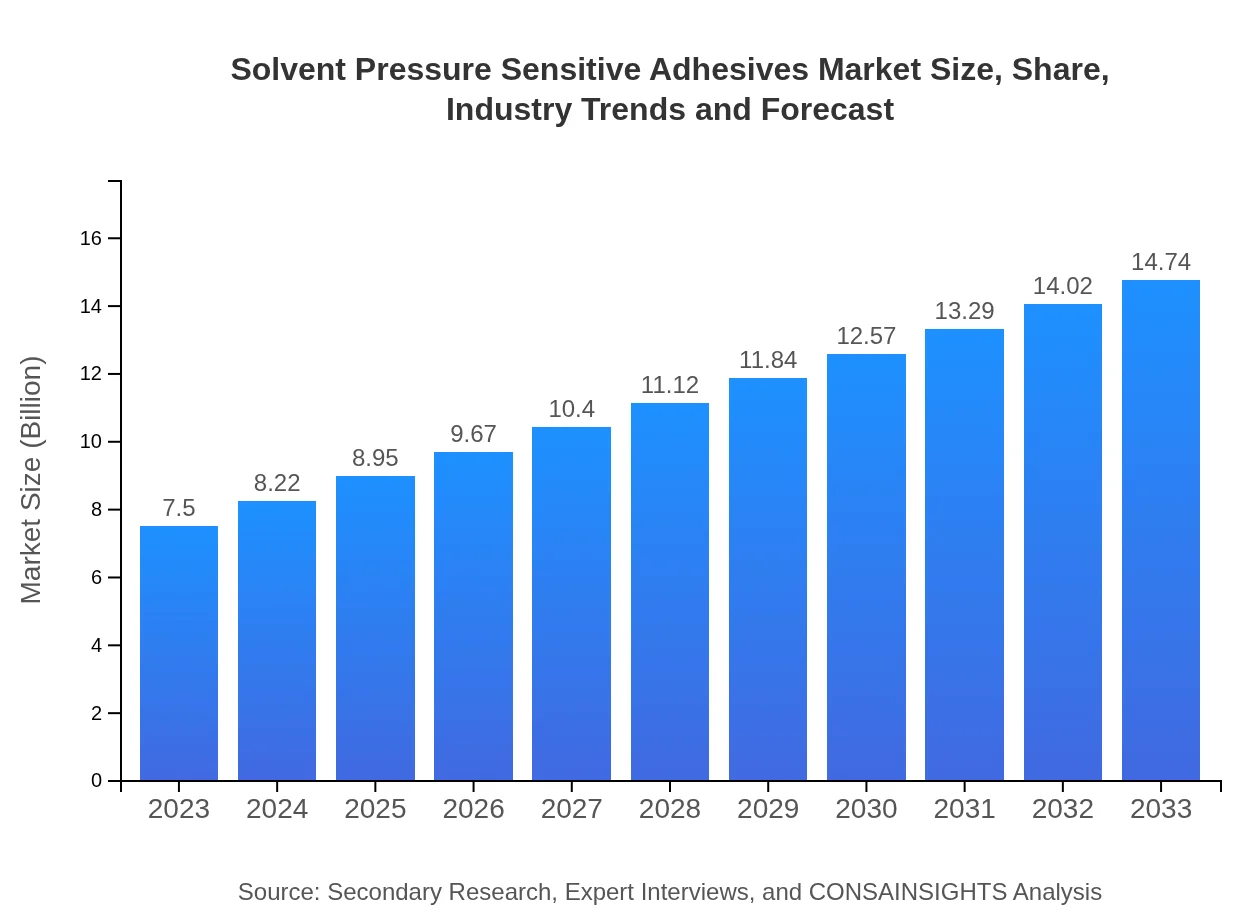

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $14.74 Billion |

| Top Companies | 3M, Henkel AG, Sika AG, BASF SE, Avery Dennison |

| Last Modified Date | 02 February 2026 |

Solvent Pressure Sensitive Adhesives Market Overview

Customize Solvent Pressure Sensitive Adhesives Market Report market research report

- ✔ Get in-depth analysis of Solvent Pressure Sensitive Adhesives market size, growth, and forecasts.

- ✔ Understand Solvent Pressure Sensitive Adhesives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Solvent Pressure Sensitive Adhesives

What is the Market Size & CAGR of Solvent Pressure Sensitive Adhesives market in 2023?

Solvent Pressure Sensitive Adhesives Industry Analysis

Solvent Pressure Sensitive Adhesives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Solvent Pressure Sensitive Adhesives Market Analysis Report by Region

Europe Solvent Pressure Sensitive Adhesives Market Report:

The European market is valued at $2.45 billion in 2023, expected to reach $4.81 billion by 2033. The region's growth is fueled by stringent regulations on VOCs encouraging the production and use of sustainable adhesive solutions.Asia Pacific Solvent Pressure Sensitive Adhesives Market Report:

The Asia Pacific region is experiencing rapid growth, valued at approximately $1.41 billion in 2023 and projected to reach $2.76 billion by 2033, driven by rising manufacturing activities in countries like China and India. The increased production of consumer goods and packaging is a key factor in this growth.North America Solvent Pressure Sensitive Adhesives Market Report:

North America holds a significant share of the market, estimated at $2.79 billion in 2023, and is expected to grow to $5.48 billion by 2033. The expansion is attributed to technological innovations, regulatory support for eco-friendly adhesives, and a strong manufacturing base.South America Solvent Pressure Sensitive Adhesives Market Report:

The South America market is valued at $0.65 billion in 2023, expected to grow to $1.27 billion by 2033. This growth is propelled by the expansion in industries such as packaging and automotive manufacturing, alongside increasing consumer demand.Middle East & Africa Solvent Pressure Sensitive Adhesives Market Report:

The Middle East and Africa market is currently valued at $0.22 billion in 2023, with projections showing an increase to $0.43 billion by 2033. The growth is driven by expanding construction and automotive sectors in the region.Tell us your focus area and get a customized research report.

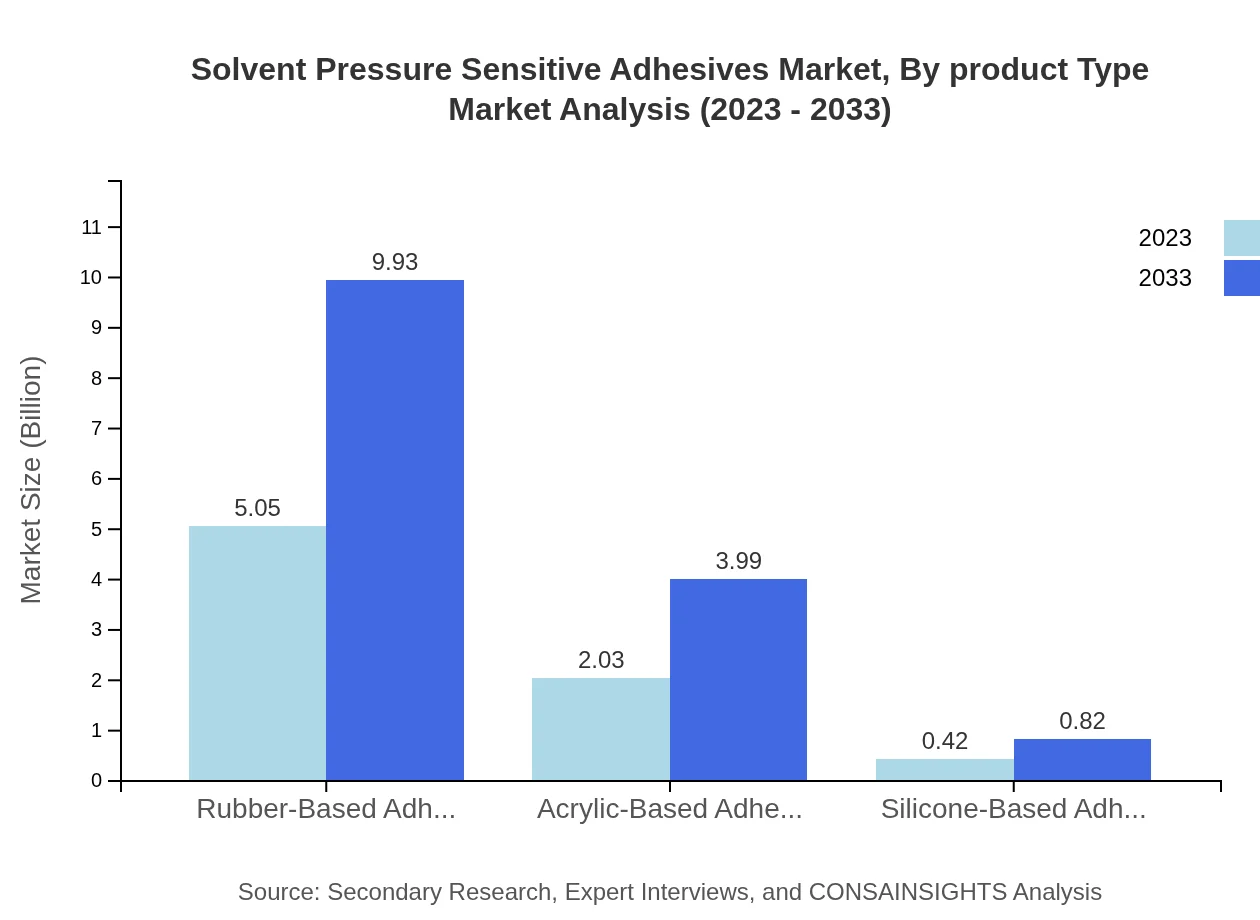

Solvent Pressure Sensitive Adhesives Market Analysis By Product Type

The market is dominated by rubber-based adhesives, accounting for a size of $5.05 billion (67.37% share) in 2023, increasing to $9.93 billion by 2033. Acrylic-based adhesives follow with a value of $2.03 billion and a 27.06% share. Silicone-based adhesives represent a smaller segment with $0.42 billion (5.57% share) in 2023, expected to grow steadily. Permanent and removable adhesive segments also reveal substantial performances, with permanent adhesives leading the segment due to their widespread use in industrial applications.

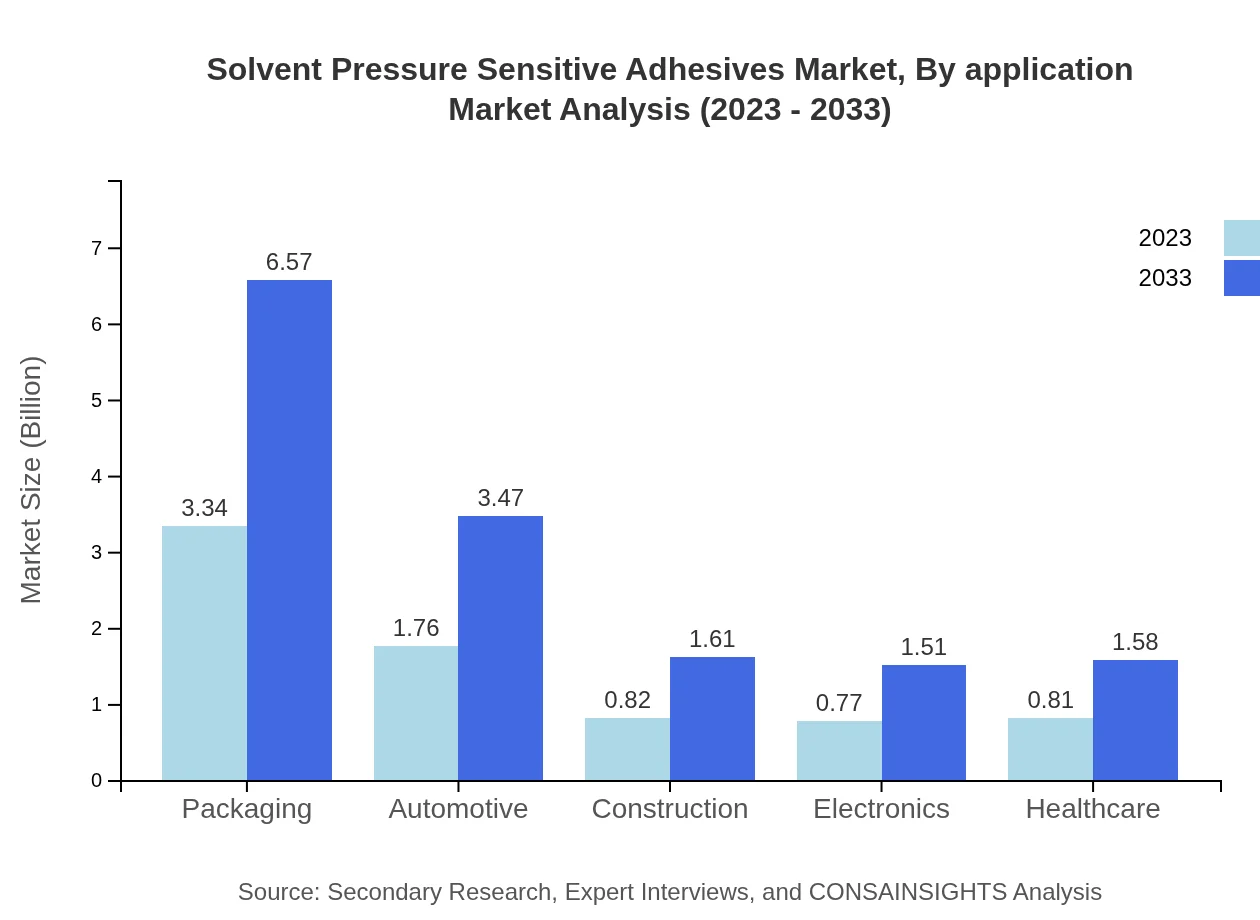

Solvent Pressure Sensitive Adhesives Market Analysis By Application

The packaging segment leads the market with a size of $3.34 billion (44.55% share) in 2023, projected to grow to $6.57 billion by 2033. The automotive application stands at $1.76 billion (23.53% share), reflecting increased use in automotive assembly and interiors. Other notable segments include electronics and healthcare, each with 10-11% market shares, stressing the versatility of PSAs in various high-tech and medical applications.

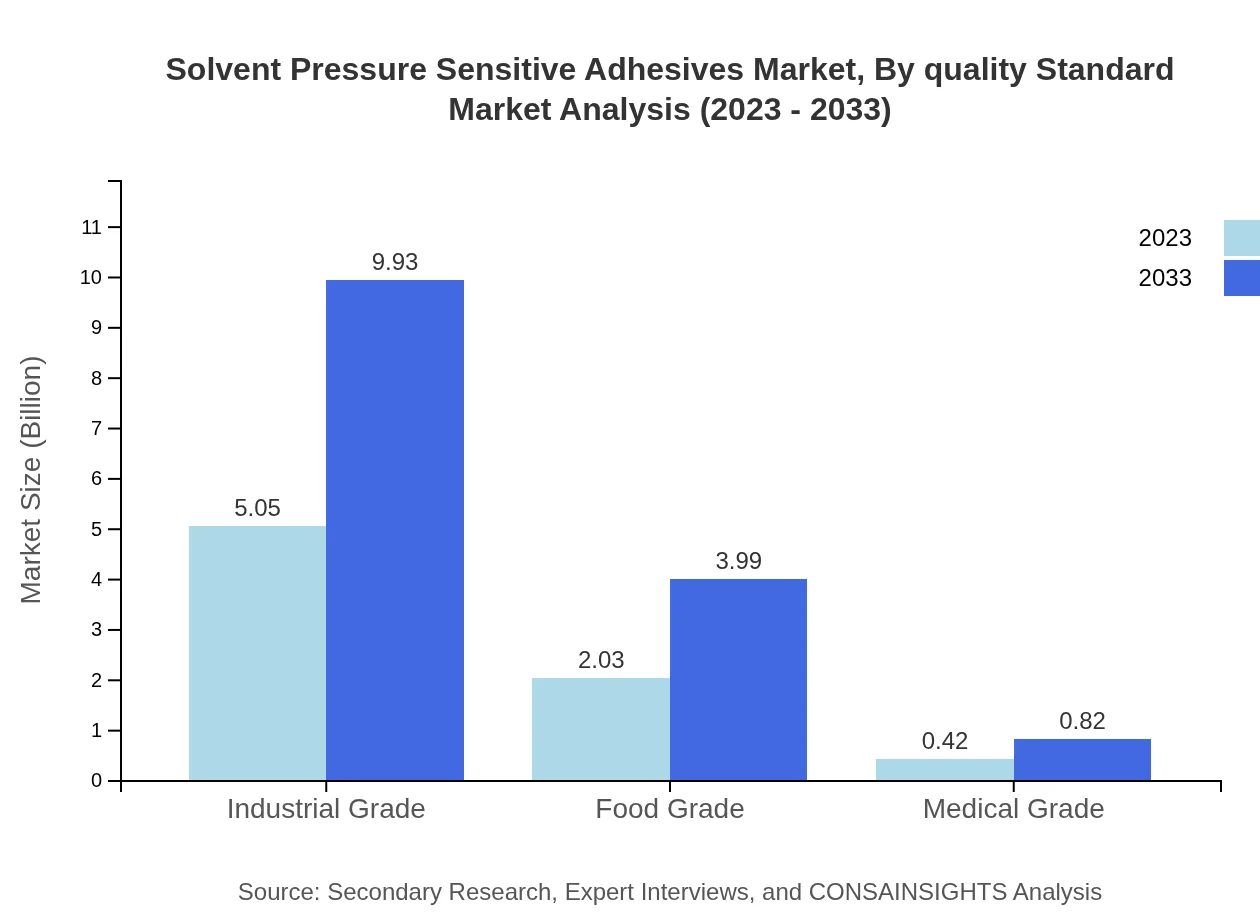

Solvent Pressure Sensitive Adhesives Market Analysis By Quality Standard

The market segmentation includes industrial grade PSAs leading with a size of $5.05 billion, while food grade and medical grade adhesives represent significant sub-segments, valued at $2.03 billion and $0.42 billion, respectively, in 2023. The emphasis on compliance with industry regulations is critical, and products are increasingly being designed to meet high safety and quality standards.

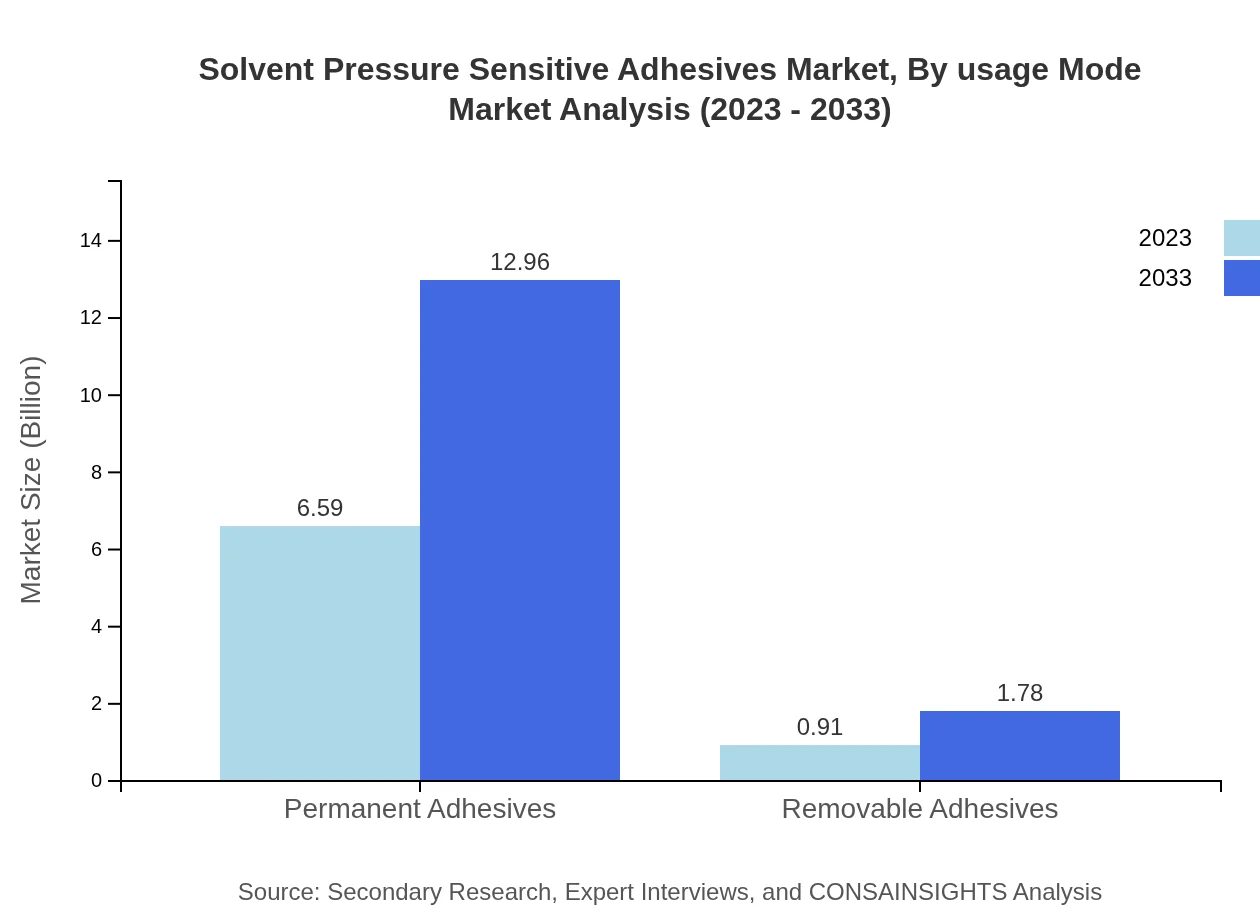

Solvent Pressure Sensitive Adhesives Market Analysis By Usage Mode

The market showcases permanent adhesives with a significant share of 87.91% in 2023, valued at $6.59 billion. In contrast, removable adhesives, while much smaller, show growth potential, valued at $0.91 billion (12.09% share). This segmentation underscores the important distinction between adhesives designed for long-term use versus those intended for temporary applications.

Solvent Pressure Sensitive Adhesives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Solvent Pressure Sensitive Adhesives Industry

3M:

A leading innovator in adhesives and tapes, 3M offers a range of solvent PSAs for various industrial applications, contributing significantly to market advancements.Henkel AG:

Henkel is renowned for its high-performance adhesives, including solvent-based solutions designed for tough conditions across numerous industries.Sika AG:

Sika specializes in construction adhesives and sealants, providing durable solvent-based products tailored to meet specific building standards.BASF SE:

BASF is one of the top manufacturers, focusing on sustainable adhesive solutions that meet modern environmental regulations and client demands.Avery Dennison:

This company provides pressure-sensitive adhesive solutions and is a pioneer in the development of eco-friendly adhesive technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of solvent Pressure Sensitive Adhesives?

The global solvent pressure sensitive adhesives market is projected to reach approximately $7.5 billion by 2033, with a compound annual growth rate (CAGR) of 6.8%. This indicates strong and sustained growth in the industry over the next decade.

What are the key market players or companies in this solvent Pressure Sensitive Adhesives industry?

Key players in the solvent pressure sensitive adhesives market include established companies like 3M, Henkel AG, Avery Dennison, and Bostik. These firms lead in innovation and market share, catering to diverse applications across sectors such as automotive, packaging, and healthcare.

What are the primary factors driving the growth in the solvent Pressure Sensitive Adhesives industry?

Growth in the solvent pressure sensitive adhesives market is driven by increased demand in the packaging and automotive sectors, advancements in adhesive formulations, and rising R&D investments. Additionally, trends toward lighter materials in products are bolstering market expansion.

Which region is the fastest Growing in the solvent Pressure Sensitive Adhesives?

North America currently holds a significant market share, projected to grow from $2.79 billion in 2023 to $5.48 billion by 2033, marking it as the fastest-growing region. Europe and the Asia Pacific are also experiencing robust growth rates, supporting overall market expansion.

Does ConsaInsights provide customized market report data for the solvent Pressure Sensitive Adhesives industry?

Yes, ConsaInsights offers customized market research reports tailored to specific client needs. This includes detailed analysis and forecasts of the solvent pressure sensitive adhesives market, allowing businesses to make informed strategic decisions.

What deliverables can I expect from this solvent Pressure Sensitive Adhesives market research project?

Deliverables include comprehensive market analysis reports, segmentation data, growth forecasts, competitive landscape insights, and trend identification, providing actionable intelligence for businesses operating within the solvent pressure sensitive adhesives sector.

What are the market trends of solvent Pressure Sensitive Adhesives?

Current trends in the solvent pressure sensitive adhesives market include an emphasis on eco-friendly formulations, increased automation in manufacturing processes, and the rise of advanced adhesive technologies. These trends reflect changing consumer preferences and technological advancements in the industry.