Sonar System Market Report

Published Date: 31 January 2026 | Report Code: sonar-system

Sonar System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Sonar System market, covering market size, trends, forecasts, and competitive landscape from 2023 to 2033. Insights into various segments, regional performance, and technological advancements are also included to guide stakeholders in decision-making.

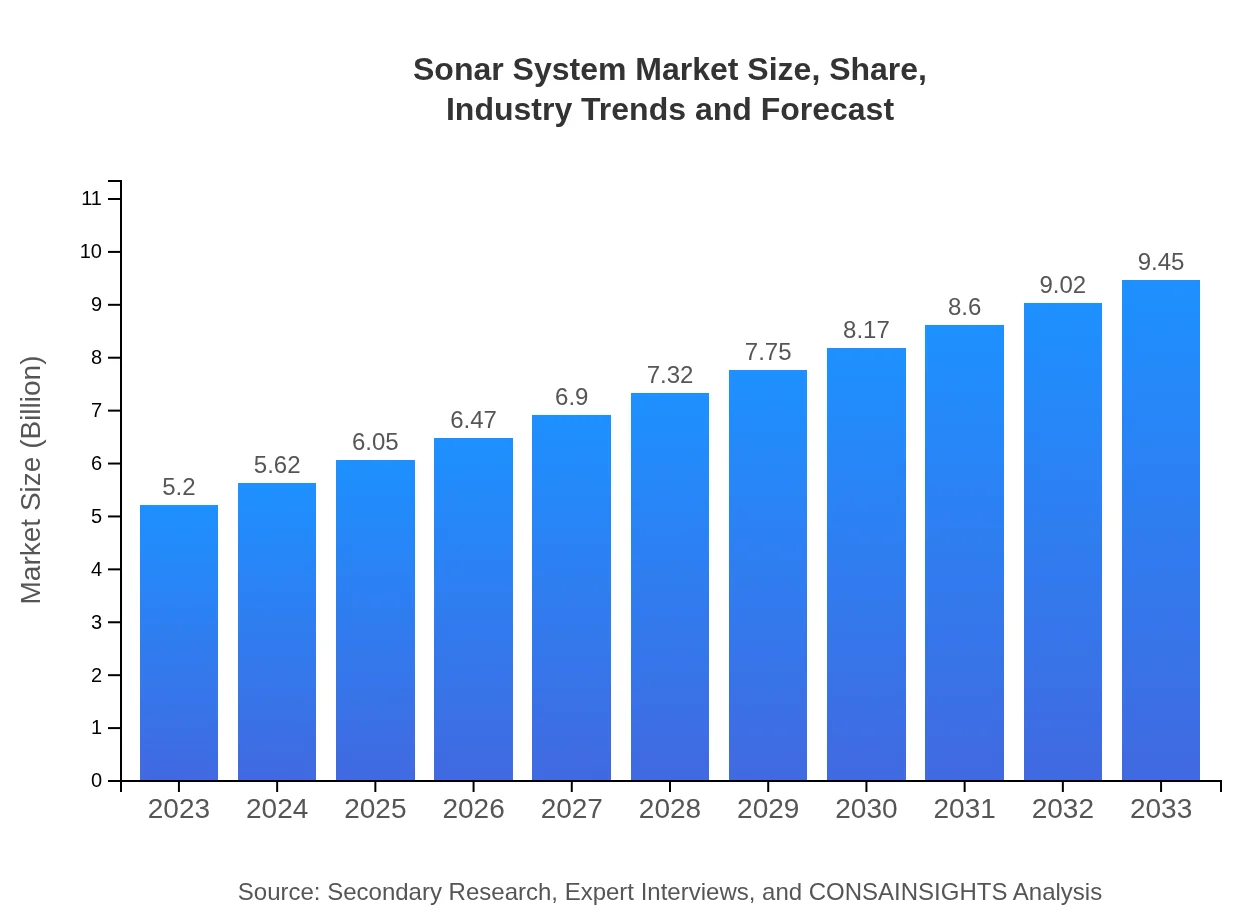

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $9.45 Billion |

| Top Companies | Raytheon Technologies, Thales Group, Kongsberg Gruppen, BAE Systems, Saab AB |

| Last Modified Date | 31 January 2026 |

Sonar System Market Overview

Customize Sonar System Market Report market research report

- ✔ Get in-depth analysis of Sonar System market size, growth, and forecasts.

- ✔ Understand Sonar System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sonar System

What is the Market Size & CAGR of Sonar System market in 2023?

Sonar System Industry Analysis

Sonar System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sonar System Market Analysis Report by Region

Europe Sonar System Market Report:

Europe's Sonar System market is set to grow from $1.48 billion in 2023 to $2.70 billion by 2033. The region is characterized by increased investment in maritime security and environmental monitoring initiatives, particularly in Northern European countries.Asia Pacific Sonar System Market Report:

In 2023, the Sonar System market in the Asia Pacific is valued at $0.94 billion, expected to grow to $1.71 billion by 2033, driven by increased maritime activities and investment in coastal security. Countries like China and Japan are leading this growth through advanced sonar technology deployments.North America Sonar System Market Report:

North America is a dominant player with a market value of $2.02 billion in 2023, expanding to $3.67 billion by 2033. The strong defense sector and extensive commercial shipping activities in the U.S. and Canada greatly contribute to this growth.South America Sonar System Market Report:

The South American market is projected to grow from $0.51 billion in 2023 to $0.92 billion in 2033. The region sees rising investments in marine research and fisheries management, bolstered by environmental monitoring requirements.Middle East & Africa Sonar System Market Report:

The Middle East and Africa market is currently valued at $0.24 billion in 2023 and is expected to reach $0.44 billion by 2033. The growth is supported by advancements in maritime security mechanisms and regional governmental investments in naval technologies.Tell us your focus area and get a customized research report.

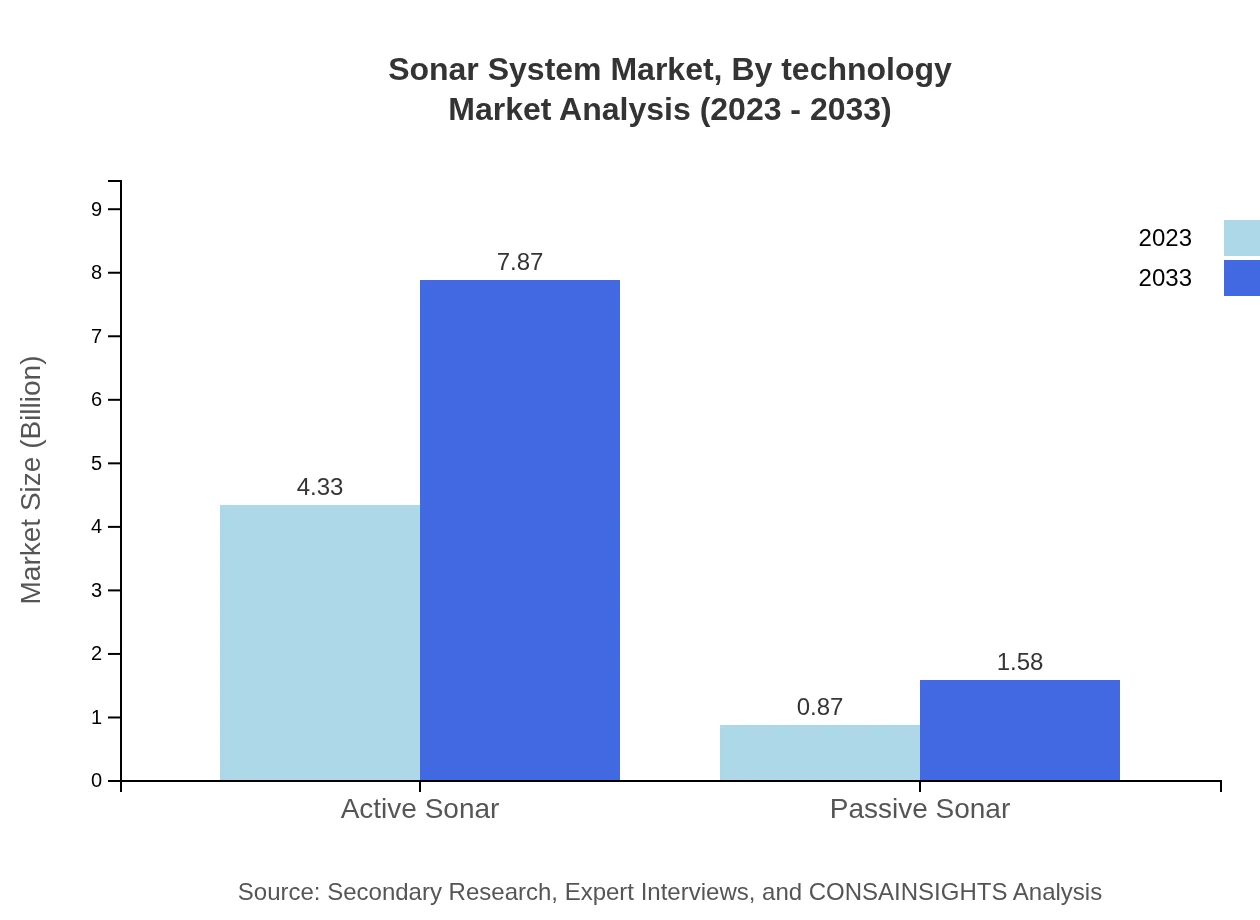

Sonar System Market Analysis By Technology

The Sonar System market is primarily divided into Active Sonar and Passive Sonar. Active Sonar systems accounted for $4.33 billion in 2023, representing 83.32% of the market share. These systems are favored for their ability to actively emit sound waves and detect reflections. In contrast, Passive Sonar systems, valued at $0.87 billion, hold a market share of 16.68%, utilized mainly for stealth operations in naval applications.

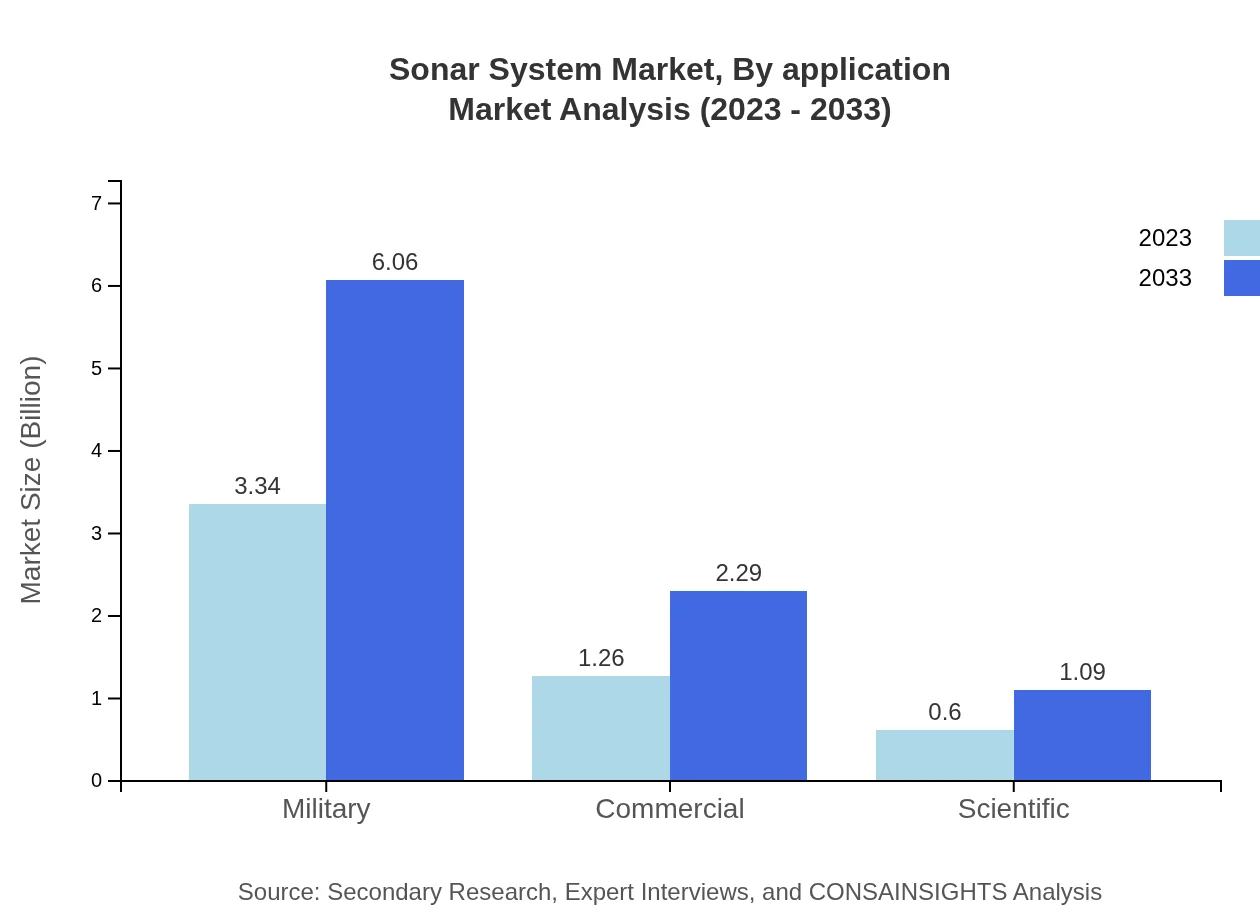

Sonar System Market Analysis By Application

Key applications of sonar systems include military, commercial shipping, and scientific research. The military segment holds the largest share at 64.16%, valued at $3.34 billion, reflecting its critical role in defense strategies. The commercial segment, valued at $1.26 billion (24.28%), benefits from demand for shipping and navigation technologies, while the scientific research segment is growing swiftly, valued at $0.60 billion (11.56%), driven by increased research activities.

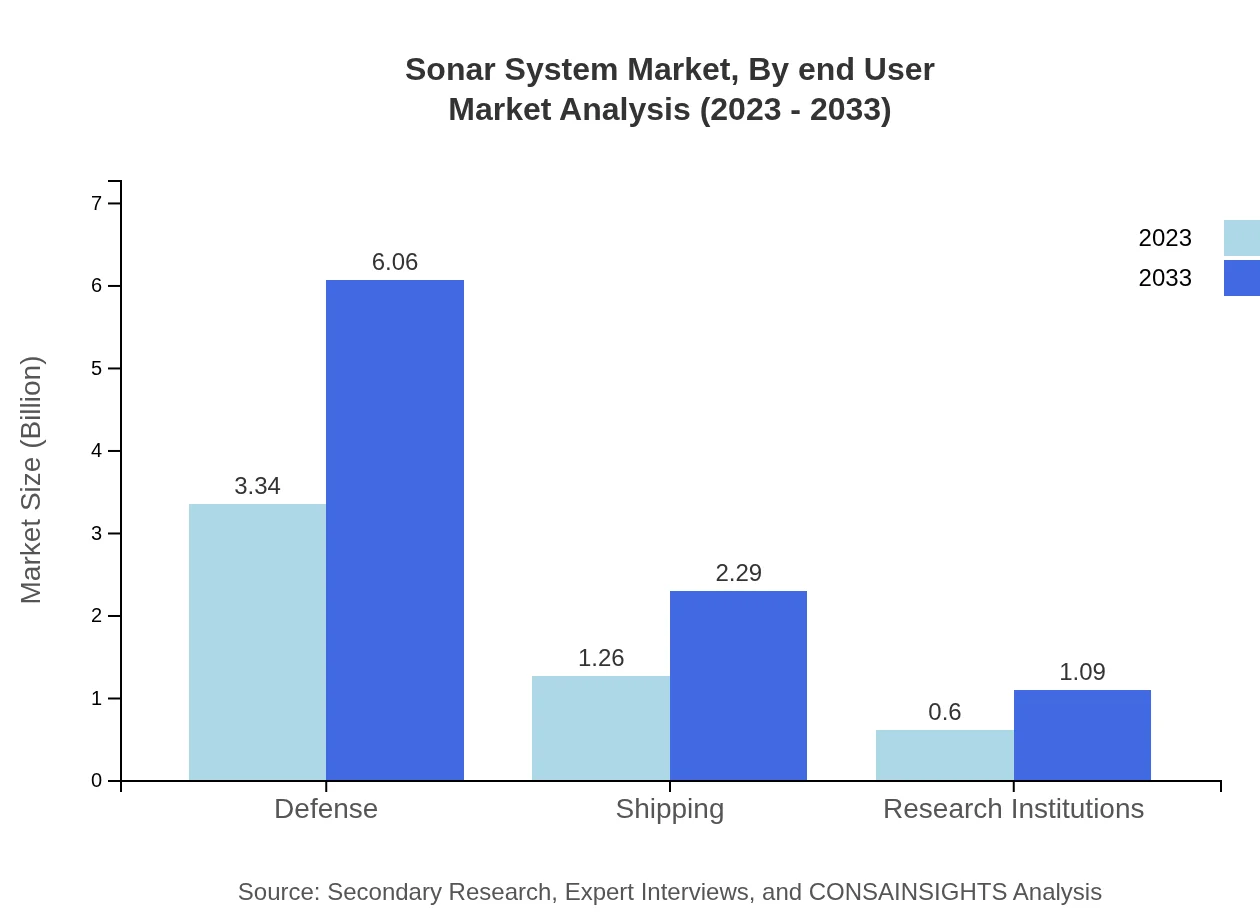

Sonar System Market Analysis By End User

End-users of sonar systems include defense forces, commercial shipping companies, and research institutions. The defense sector is the leading user, valued at $3.34 billion, making up 64.16% of the market. Commercial users, representing 24.28%, utilize sonar for navigation and safety, while research institutions account for 11.56%, focusing on environmental monitoring and underwater research.

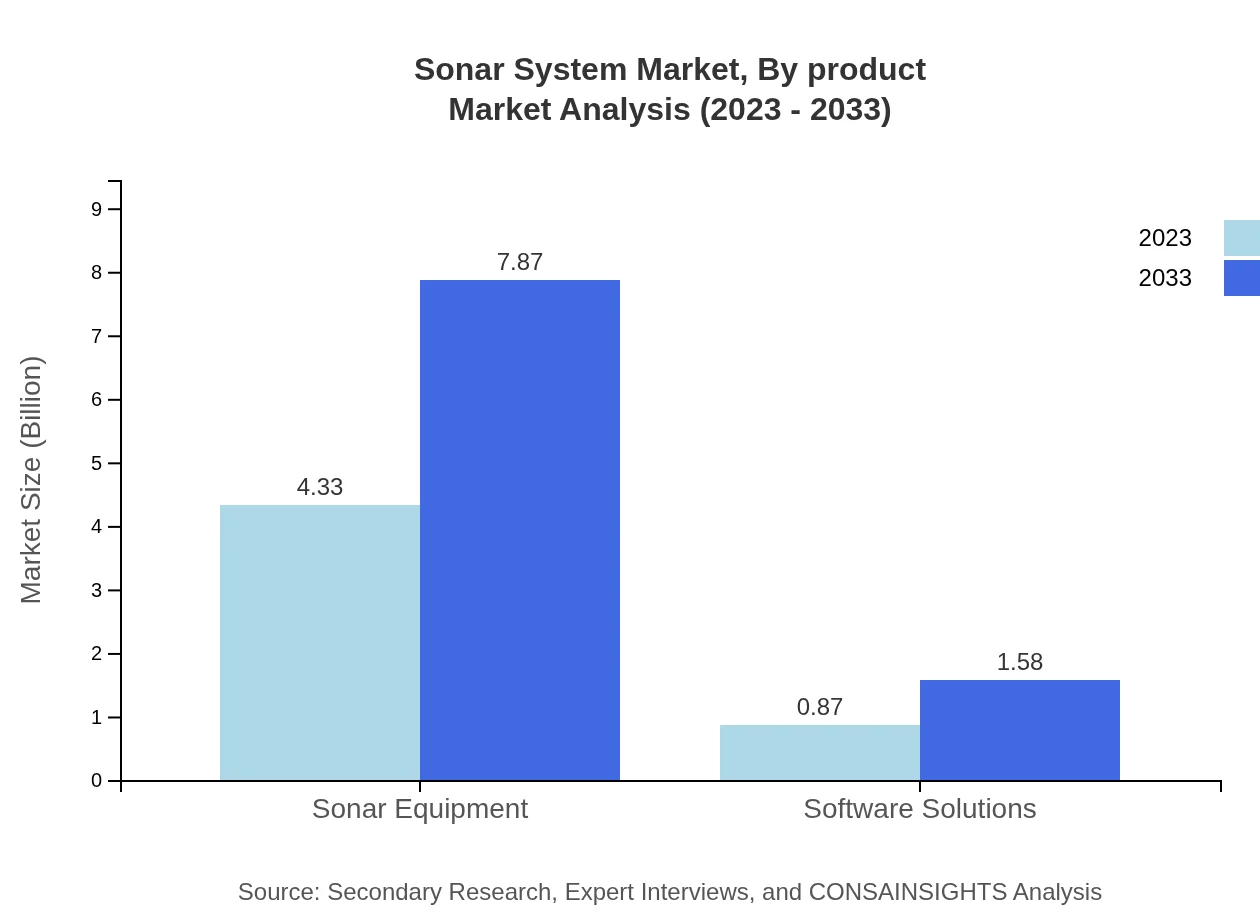

Sonar System Market Analysis By Product

The market features two main products: Sonar Equipment and Software Solutions. Sonar Equipment is projected to grow from $4.33 billion in 2023 to $7.87 billion by 2033, maintaining a market share of 83.32%. Software Solutions, although smaller, is expanding steadily from $0.87 billion to $1.58 billion, indicating growing reliance on analytical software in maritime applications.

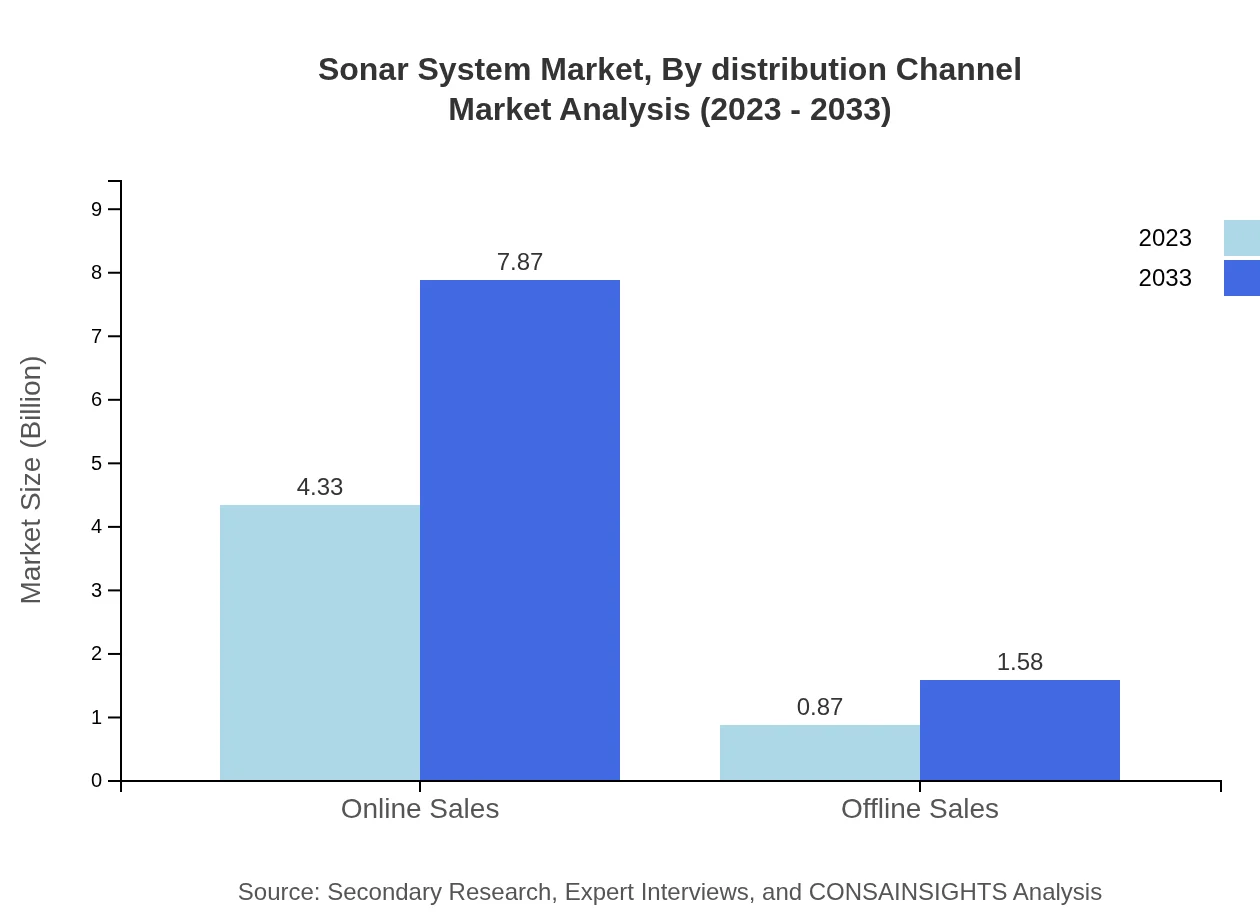

Sonar System Market Analysis By Distribution Channel

Distribution channels for sonar systems include online and offline sales. Online sales dominate with a market size of $4.33 billion (83.32% share) in 2023, driven by the ease of access and availability of products online. In comparison, offline sales make up 16.68%, sized at $0.87 billion, appealing to customers preferring direct engagement.

Sonar System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sonar System Industry

Raytheon Technologies:

A leading player in defense and aerospace technology; they specialize in advanced sonar systems for military applications.Thales Group:

A prominent global technology leader providing solutions in sonar technology, specifically for naval and underwater applications.Kongsberg Gruppen:

Notable for their maritime systems, they develop advanced sonar equipment for both military and commercial use.BAE Systems:

A major player in the defense sector, producing a variety of sonar systems designed for security and surveillance.Saab AB:

An innovation-driven company focusing on sonar technology mostly used in naval systems catering to various defense needs.We're grateful to work with incredible clients.

FAQs

What is the market size of sonar System?

The sonar system market is projected to reach a size of $5.2 billion by 2033, with a compound annual growth rate (CAGR) of 6% over the forecast period.

What are the key market players or companies in this sonar System industry?

Key players in the sonar system industry include renowned firms specializing in advanced marine technology solutions, defense contractors, and software development companies focused on sonar technology.

What are the primary factors driving the growth in the sonar system industry?

Growth in the sonar system industry is driven by increasing marine activities, advancements in sonar technology, demand for underwater exploration, and military applications enhancing defense capabilities.

Which region is the fastest Growing in the sonar system?

The fastest-growing region in the sonar system market is North America, projected to grow from $2.02 billion in 2023 to $3.67 billion by 2033, reflecting strong military and commercial demand.

Does ConsaInsights provide customized market report data for the sonar System industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the sonar system industry, ensuring clients receive relevant and actionable insights.

What deliverables can I expect from this sonar system market research project?

Expect comprehensive deliverables including detailed market analysis, regional insights, segment data, competitive landscape reports, and strategic recommendations based on industry trends.

What are the market trends of sonar system?

Key market trends in the sonar system industry include the rise of active sonar systems, increased investment in military applications, and technological advancements enhancing equipment efficiency.