Sorghum Market Report

Published Date: 02 February 2026 | Report Code: sorghum

Sorghum Market Size, Share, Industry Trends and Forecast to 2033

This report provides detailed insights into the sorghum market, analyzing growth trends, market size, and industry dynamics from 2023 to 2033. It covers aspects such as regional performances, technological advancements, and key players influencing the market landscape.

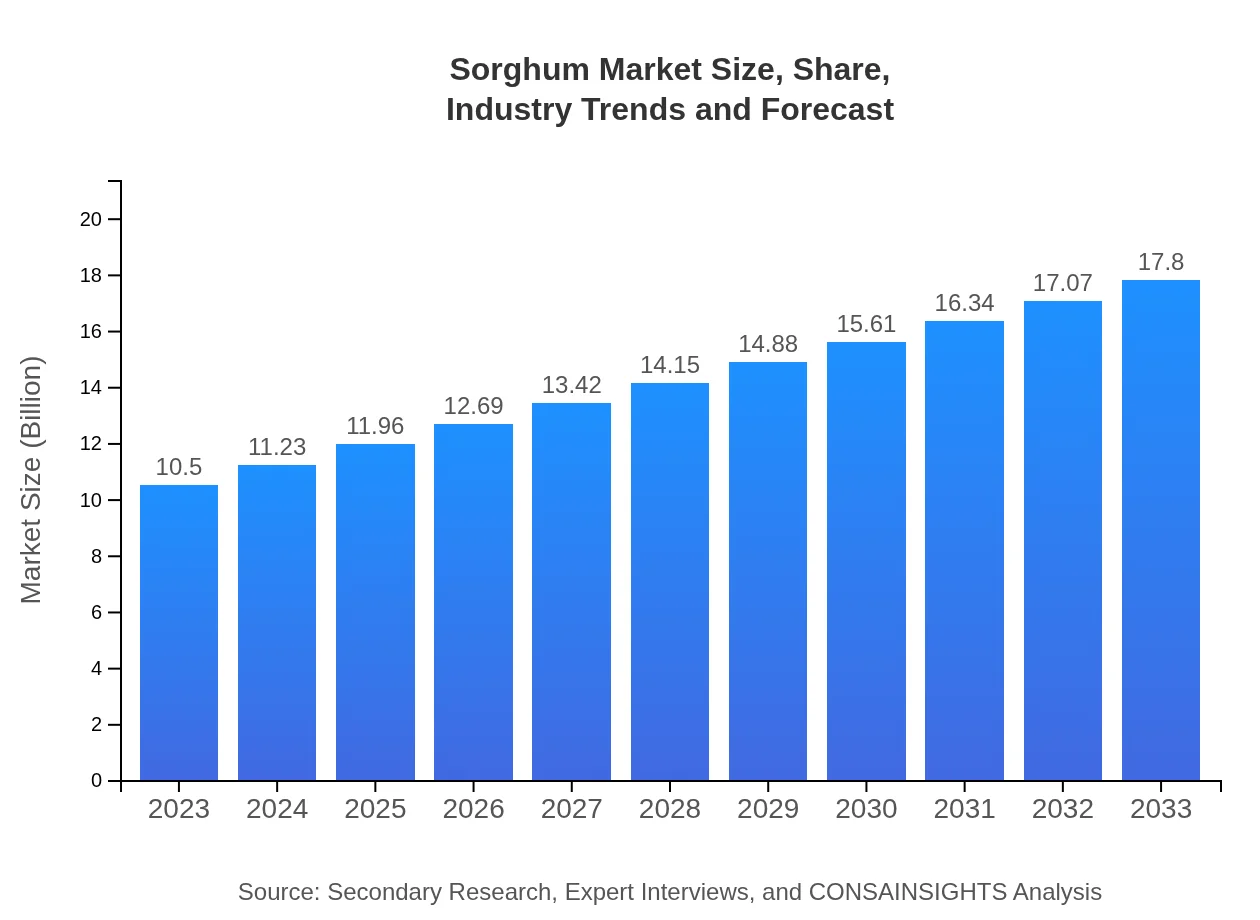

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.3% |

| 2033 Market Size | $17.80 Billion |

| Top Companies | Cargill Inc., BASF SE, DuPont de Nemours, Inc., GrainCorp, Syngenta AG |

| Last Modified Date | 02 February 2026 |

Sorghum Market Overview

Customize Sorghum Market Report market research report

- ✔ Get in-depth analysis of Sorghum market size, growth, and forecasts.

- ✔ Understand Sorghum's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sorghum

What is the Market Size & CAGR of Sorghum market in 2023?

Sorghum Industry Analysis

Sorghum Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sorghum Market Analysis Report by Region

Europe Sorghum Market Report:

In Europe, the sorghum market size is set to rise from $3.03 billion in 2023 to $5.13 billion by 2033. The increasing trend for gluten-free products and sustainable agriculture practices are essential growth drivers.Asia Pacific Sorghum Market Report:

In the Asia Pacific region, the sorghum market is expected to grow from $1.88 billion in 2023 to $3.19 billion by 2033, driven by increased production and export potential. Countries like China and India are investing in sorghum cultivation due to its nutritional benefits and adaptability to arid climates.North America Sorghum Market Report:

North America will see substantial growth, with the market size projected to reach $6.87 billion by 2033 from $4.05 billion in 2023. The region's emphasis on bioethanol production and livestock feed is driving this growth, along with innovative farming techniques.South America Sorghum Market Report:

The South American sorghum market is estimated to grow from $0.75 billion in 2023 to $1.27 billion in 2033. Brazil and Argentina are leading producers, focusing on both domestic consumption and international exports amid rising demands for ethanol and animal feed.Middle East & Africa Sorghum Market Report:

The Middle East and Africa's sorghum market is projected to expand from $0.79 billion in 2023 to $1.34 billion by 2033. The region is focusing on enhancing food security, driving the growth of sorghum as a staple crop.Tell us your focus area and get a customized research report.

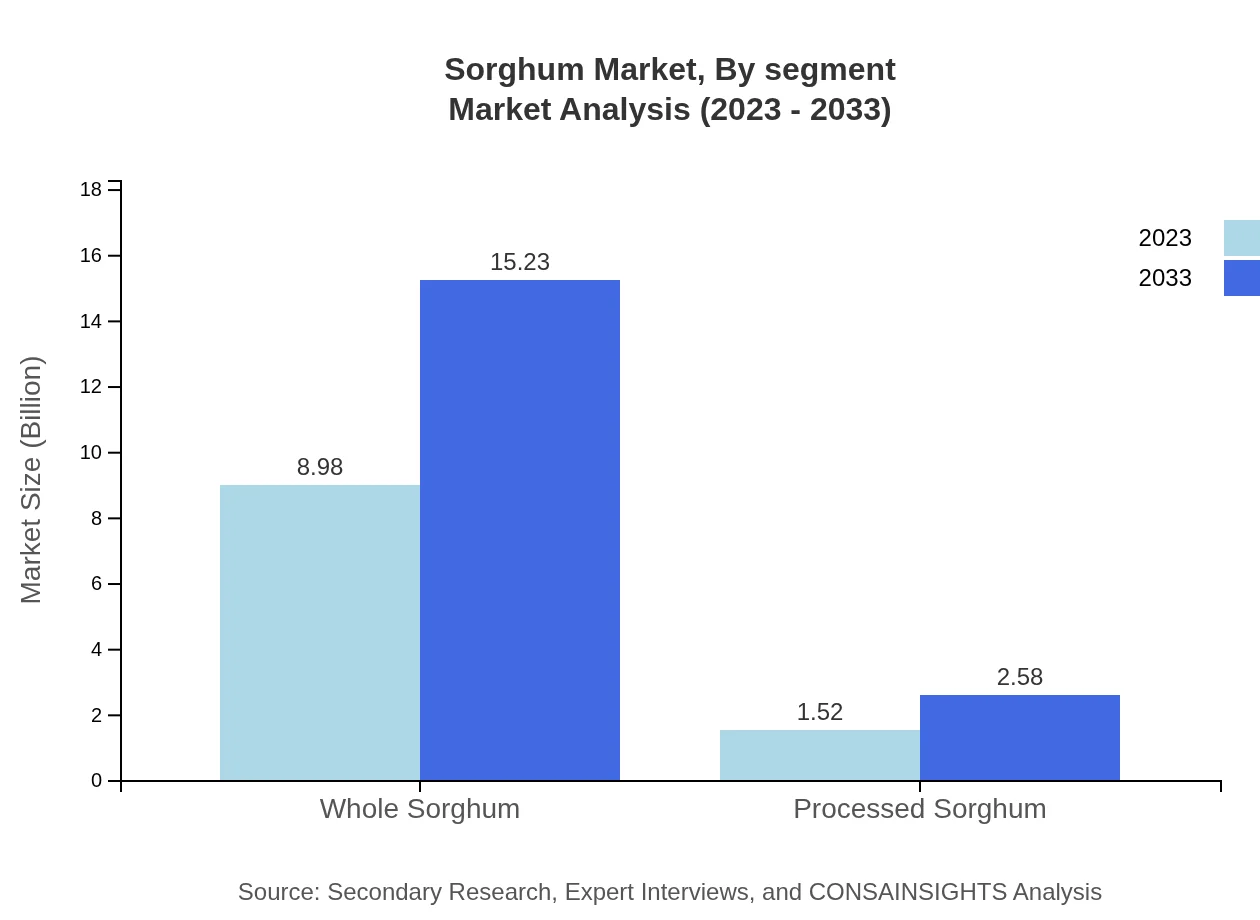

Sorghum Market Analysis By Segment

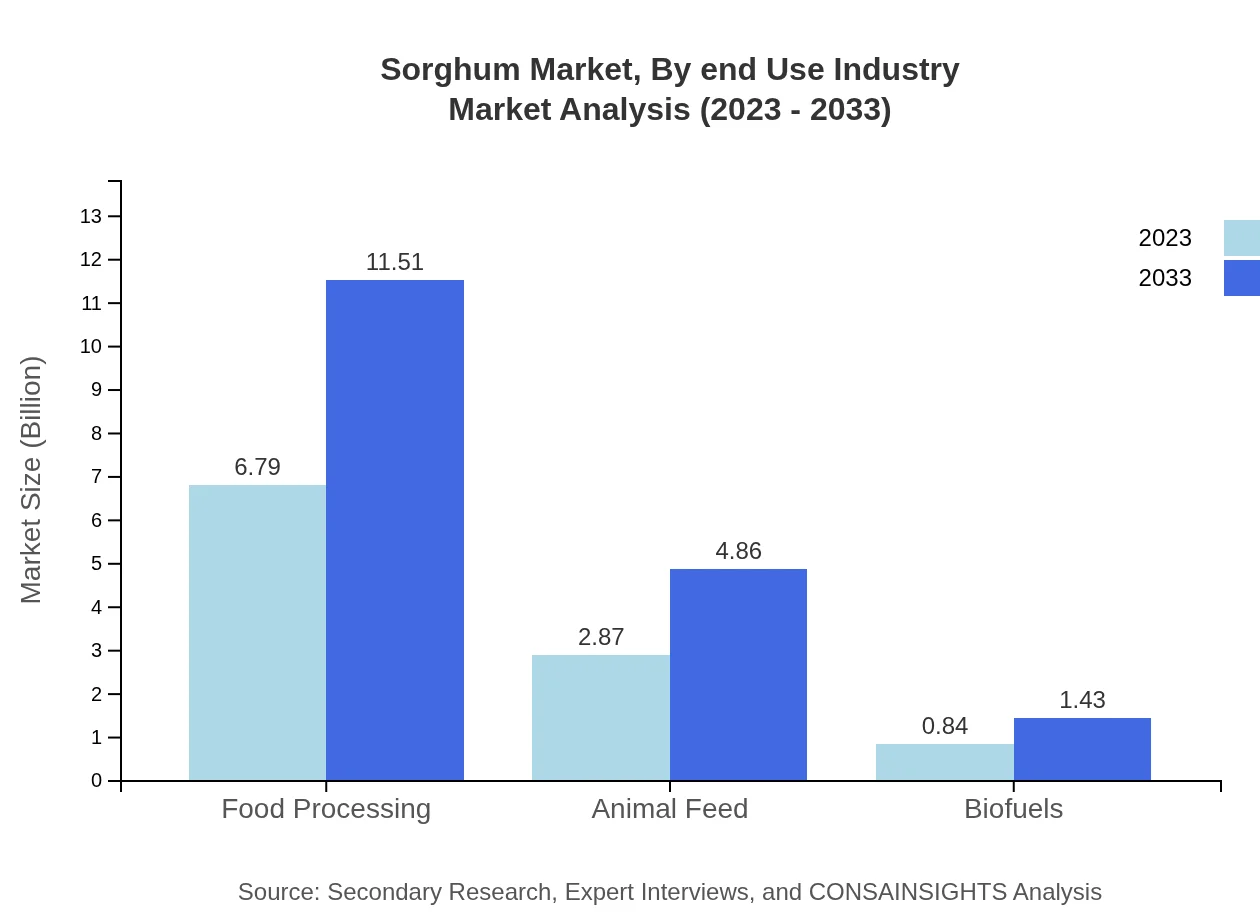

In 2023, the Sorghum Market, by segment, achieved a market size of $6.79 billion, projected to rise to $11.51 billion by 2033. The major segments include food processing, animal feed, and biofuel production. Each segment is expected to witness substantial growth owing to increasing consumer demand for healthy foods and sustainable practices.

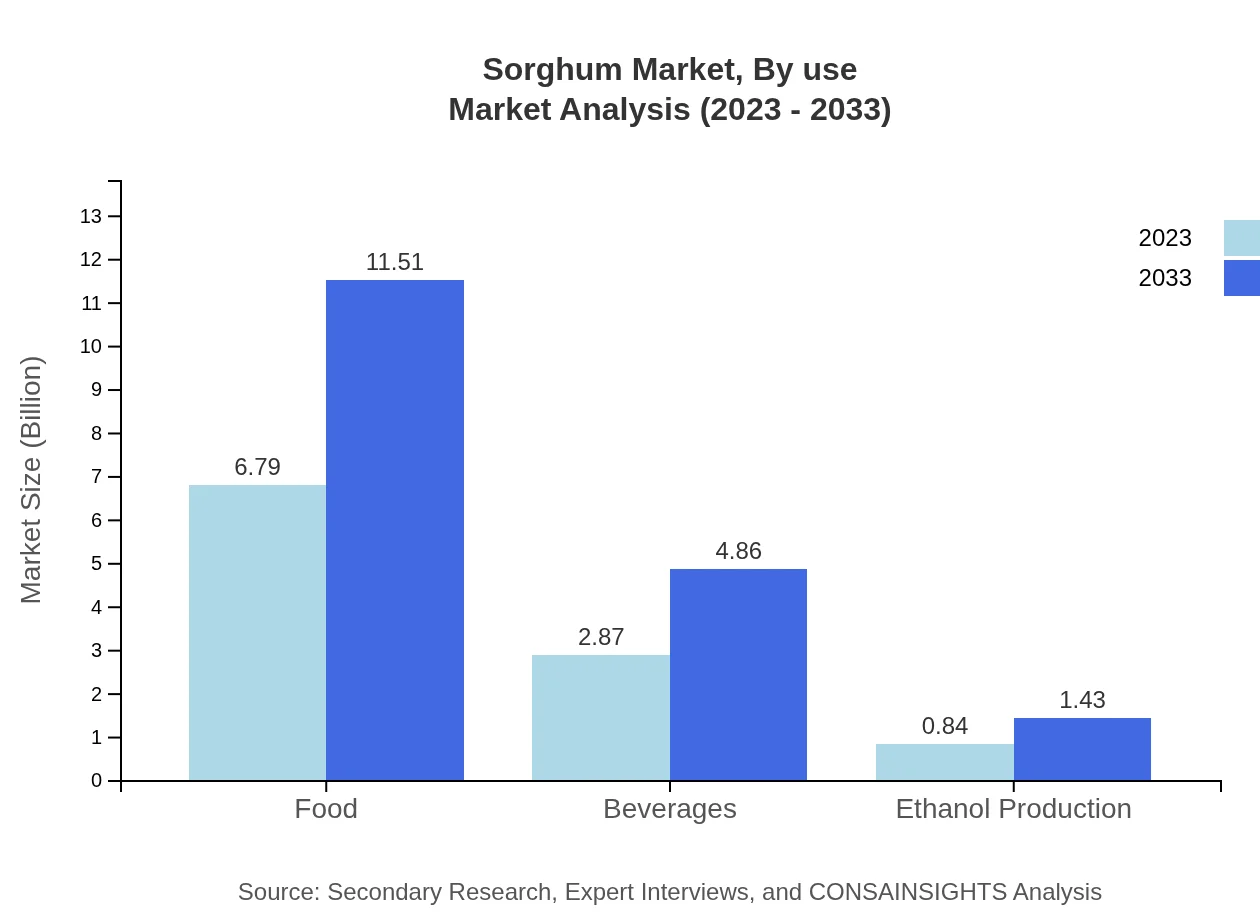

Sorghum Market Analysis By Use

The sorghum market, by use, indicates significant segments with food processing estimating $6.79 billion in 2023, increasing to $11.51 billion by 2033. Consumed as whole grains and ingredients in gluten-free products, sorghum's popularity is on the rise in the health-conscious market.

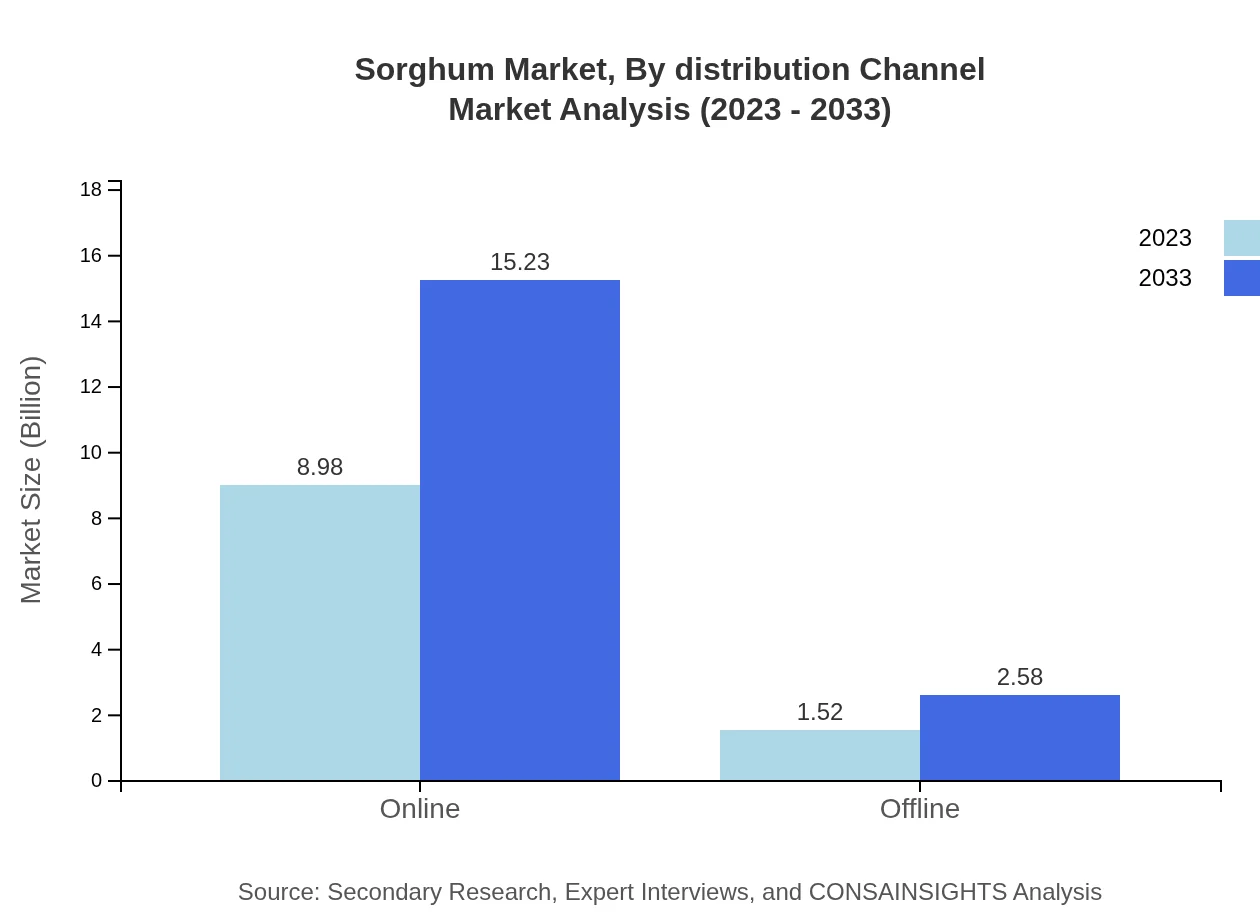

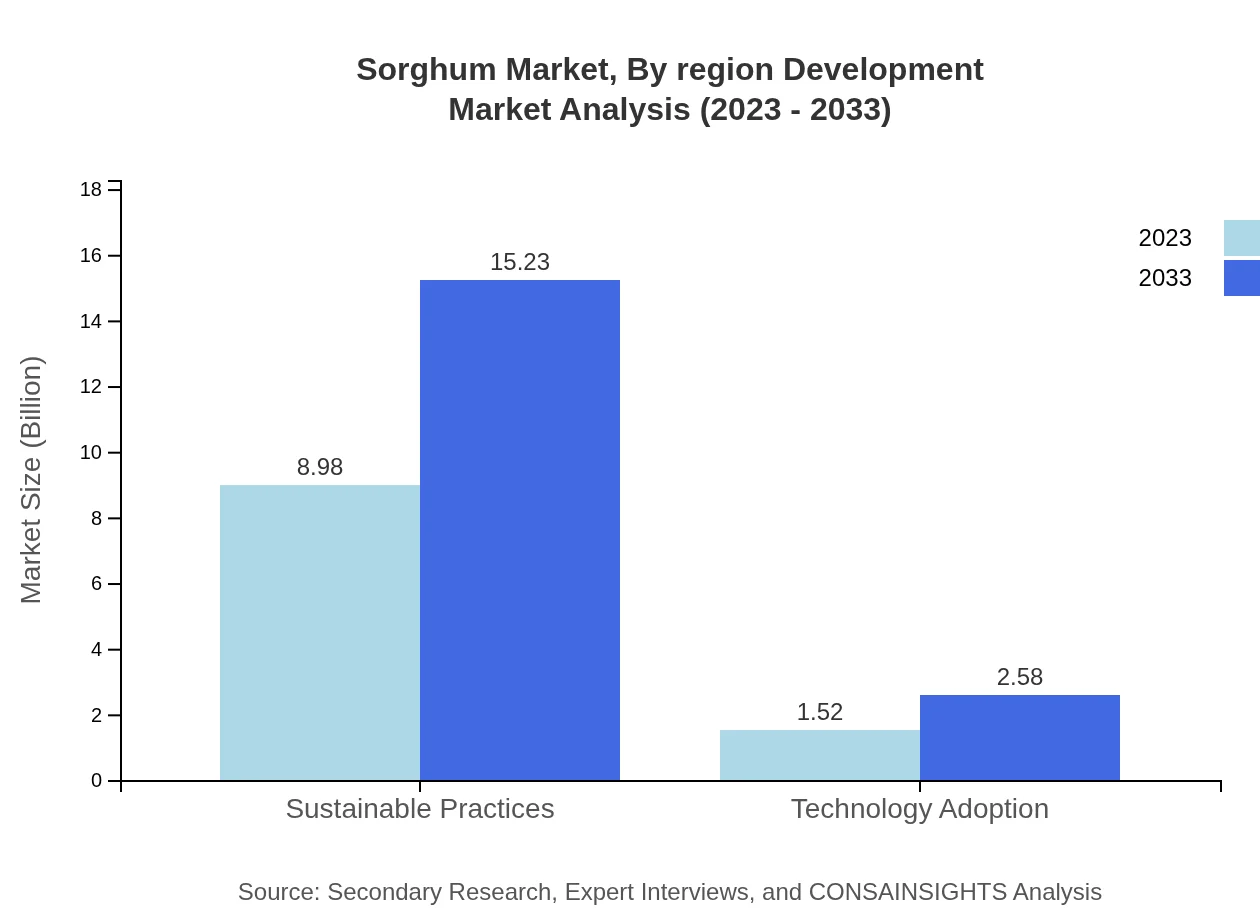

Sorghum Market Analysis By Distribution Channel

The distribution channel analysis shows that the offline channels accounted for the majority share, but online channels are projected to grow significantly from $8.98 billion in 2023 to $15.23 billion by 2033. This indicates a shift in shopping behaviors influenced by digital transformation.

Sorghum Market Analysis By End Use Industry

The analysis demonstrates that food processing remains a significant end-use industry in sorghum, with a size of $6.79 billion in 2023, expected to reach $11.51 billion in 2033. The trend towards healthy eating is predicted to bolster its demand.

Sorghum Market Analysis By Region Development

Development opportunities in the sorghum market vary by region, with the Asia Pacific and North America exhibiting the highest growth potential because of favorable agricultural policies and increasing investment in sustainable farming practices.

Sorghum Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sorghum Industry

Cargill Inc.:

A global leader in food and agriculture, Cargill is involved in sorghum production and processing, focusing on sustainability and innovative agricultural practices.BASF SE:

BASF operates in the biosolutions sector, enhancing sorghum varieties through biotechnology, targeting higher yields and better disease resistance.DuPont de Nemours, Inc.:

DuPont contributes to developing high-quality sorghum seeds and fertilizers, pushing for sustainable practices and efficient agriculture.GrainCorp:

An Australian agribusiness, GrainCorp plays a vital role in sourcing and exporting sorghum products, contributing to the global market supply.Syngenta AG:

Syngenta focuses on innovative seed development for sorghum, aiming to improve crop resilience and environmental sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of sorghum?

The global sorghum market is projected to reach a market size of $10.5 billion by 2033, with a compound annual growth rate (CAGR) of 5.3% from 2023. This growth reflects the increasing demand for sorghum in various sectors.

What are the key market players or companies in the sorghum industry?

Key players in the sorghum industry include global agricultural firms focusing on seed production, food processing companies, and biofuel producers. Partnerships and collaborations among these players enhance innovation and market growth.

What are the primary factors driving the growth in the sorghum industry?

Primary growth drivers for the sorghum industry encompass rising consumer interest in gluten-free products, increasing animal feed requirements, and the growing emphasis on biofuel production due to sustainability initiatives which boost market expansion.

Which region is the fastest Growing in the sorghum market?

The fastest-growing region in the sorghum market is North America, where the market size is expected to grow from $4.05 billion in 2023 to $6.87 billion by 2033, driven by an increase in demand for animal feed and health-conscious food options.

Does ConsaInsights provide customized market report data for the sorghum industry?

Yes, ConsaInsights offers customized market report data tailored to meet clients' specific needs in the sorghum industry. This includes comprehensive analysis, forecasting, and segmentation data for informed decision-making.

What deliverables can I expect from this sorghum market research project?

Deliverables from the sorghum market research project will include detailed market analysis reports, regional size evaluations, segment-wise performance insights, growth forecasts, and key player assessments for strategic planning.

What are the market trends of sorghum?

Current trends in the sorghum market highlight a rising focus on sustainability and organic practices, increased usage in animal feed, and a shift towards processed sorghum products, fostering broader market applications and consumer awareness.