Source Measure Unit Market Report

Published Date: 22 January 2026 | Report Code: source-measure-unit

Source Measure Unit Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on the Source Measure Unit market provides essential insights and data covering the years 2023 to 2033. It outlines market size, growth trends, segmentation, regional analysis, and forecasts to assist stakeholders in making informed decisions.

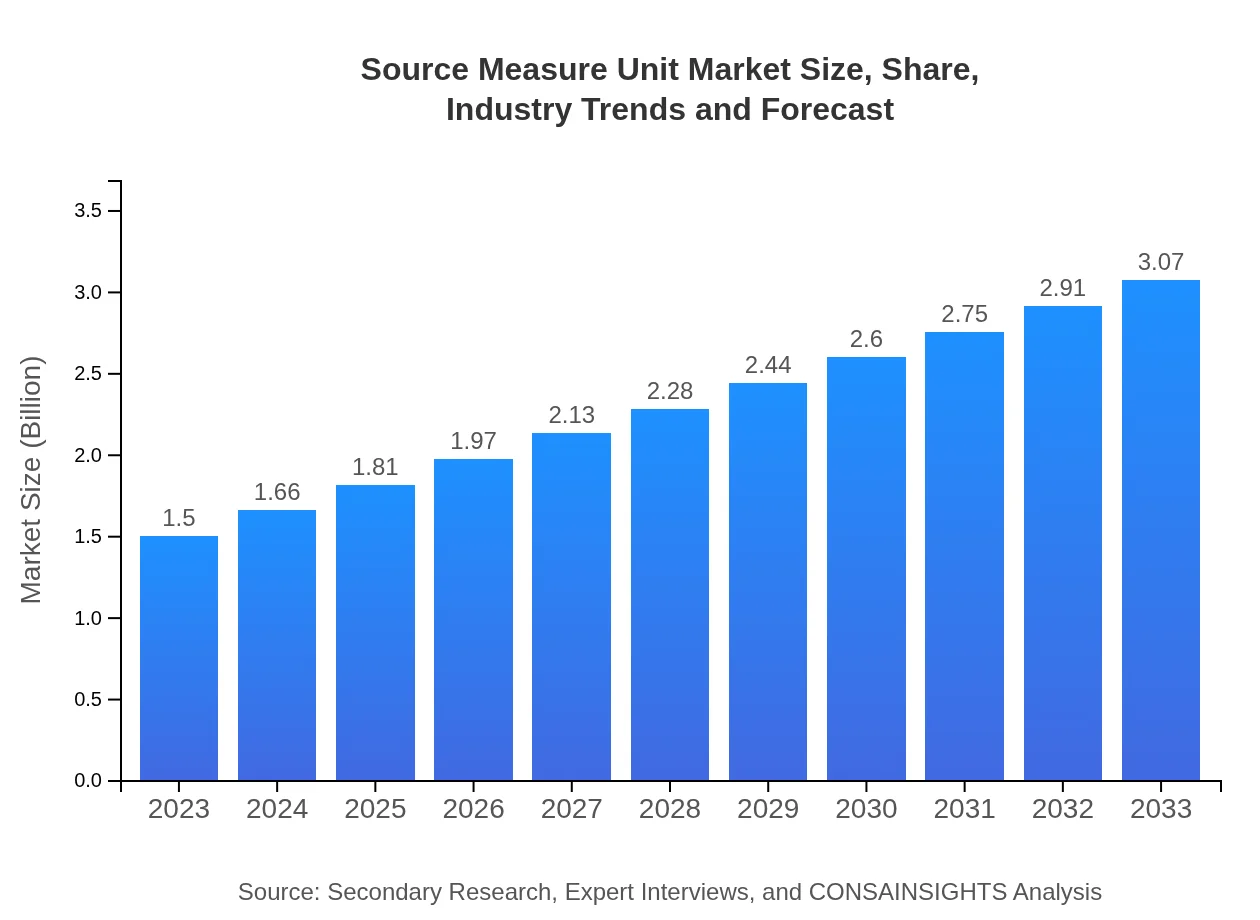

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $3.07 Billion |

| Top Companies | Keysight Technologies, Tektronix, National Instruments, Rigol Technologies |

| Last Modified Date | 22 January 2026 |

Source Measure Unit Market Overview

Customize Source Measure Unit Market Report market research report

- ✔ Get in-depth analysis of Source Measure Unit market size, growth, and forecasts.

- ✔ Understand Source Measure Unit's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Source Measure Unit

What is the Market Size & CAGR of Source Measure Unit market in 2023?

Source Measure Unit Industry Analysis

Source Measure Unit Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Source Measure Unit Market Analysis Report by Region

Europe Source Measure Unit Market Report:

The European market is set to more than double in size, from USD 0.54 billion in 2023 to USD 1.10 billion by 2033, influenced by regulatory standards and safety requirements driving technological updates in measurement instruments.Asia Pacific Source Measure Unit Market Report:

In the Asia Pacific region, the Source Measure Unit market is expanding rapidly, projected to reach USD 0.52 billion by 2033 from approximately USD 0.26 billion in 2023. The surge is attributed to technological surges in countries like China and Japan, with major investments in semiconductor and electronics manufacturing driving demand for advanced measurement tools.North America Source Measure Unit Market Report:

North America holds a significant market share, anticipated to grow from USD 0.50 billion in 2023 to USD 1.03 billion by 2033. This growth is spurred by strong R&D spending and the presence of leading technology firms, coupled with an increasing demand for high-precision measurement solutions in various sectors.South America Source Measure Unit Market Report:

The Latin American market is witnessing moderate growth, forecasted to grow from USD 0.11 billion in 2023 to USD 0.22 billion by 2033. This growth is driven by the increasing adoption of electronic devices and the growth of the automotive sector, despite economic fluctuations.Middle East & Africa Source Measure Unit Market Report:

In the Middle East and Africa, the market is projected to increase from USD 0.09 billion in 2023 to USD 0.19 billion by 2033. The growth is prompted by infrastructural developments and increased investments in telecommunications and energy sectors.Tell us your focus area and get a customized research report.

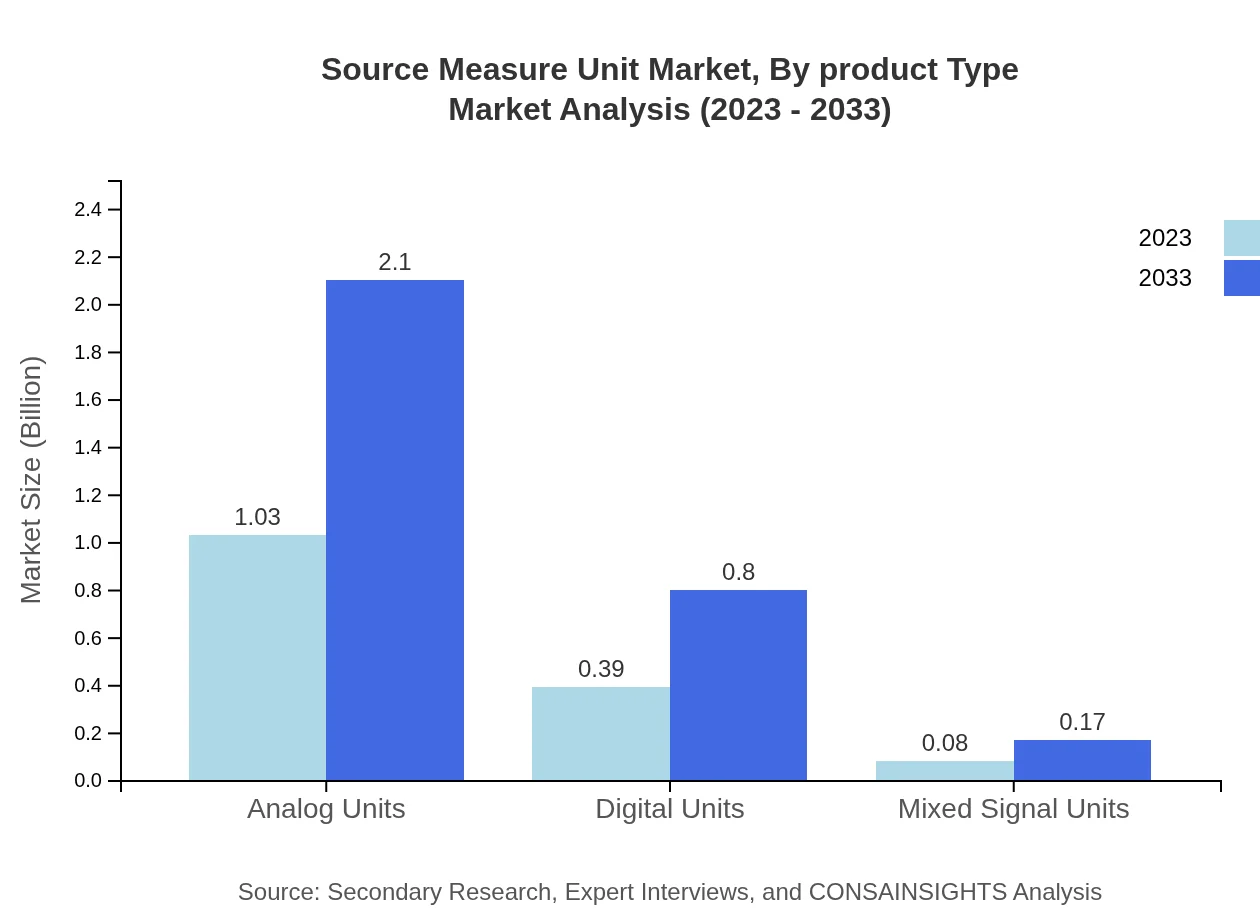

Source Measure Unit Market Analysis By Product Type

The Source Measure Unit market is strategically segmented into analog, digital, and mixed signal units. Analog units are currently dominating the market with a size of USD 1.03 billion in 2023, accounting for approximately 68.39% of the total market share. Digital units, worth USD 0.39 billion, represent 26.1% while mixed signal units contribute minorly with USD 0.08 billion and 5.51% share. The growth of the digital segment emphasizes the transition towards advanced functionalities that modern applications increasingly demand.

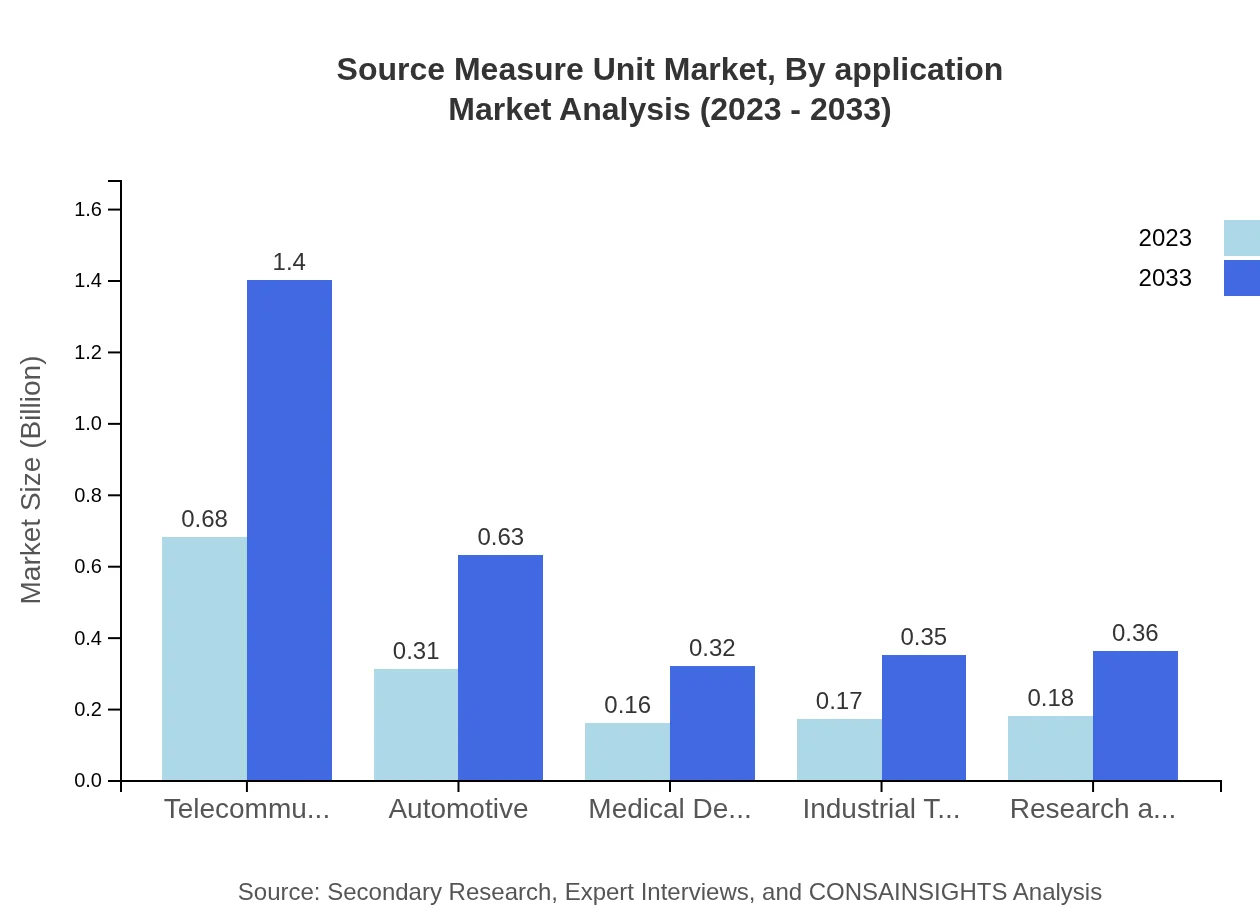

Source Measure Unit Market Analysis By Application

Applications of Source Measure Units span across various fields, including electronics, medical devices, automotive, telecommunications, education, and industrial testing. The electronics sector commands a market size of USD 0.68 billion in 2023, while the medical application segment stands at USD 0.31 billion. Each segment is experiencing growth due to heightened demand for precision measurement in these industries.

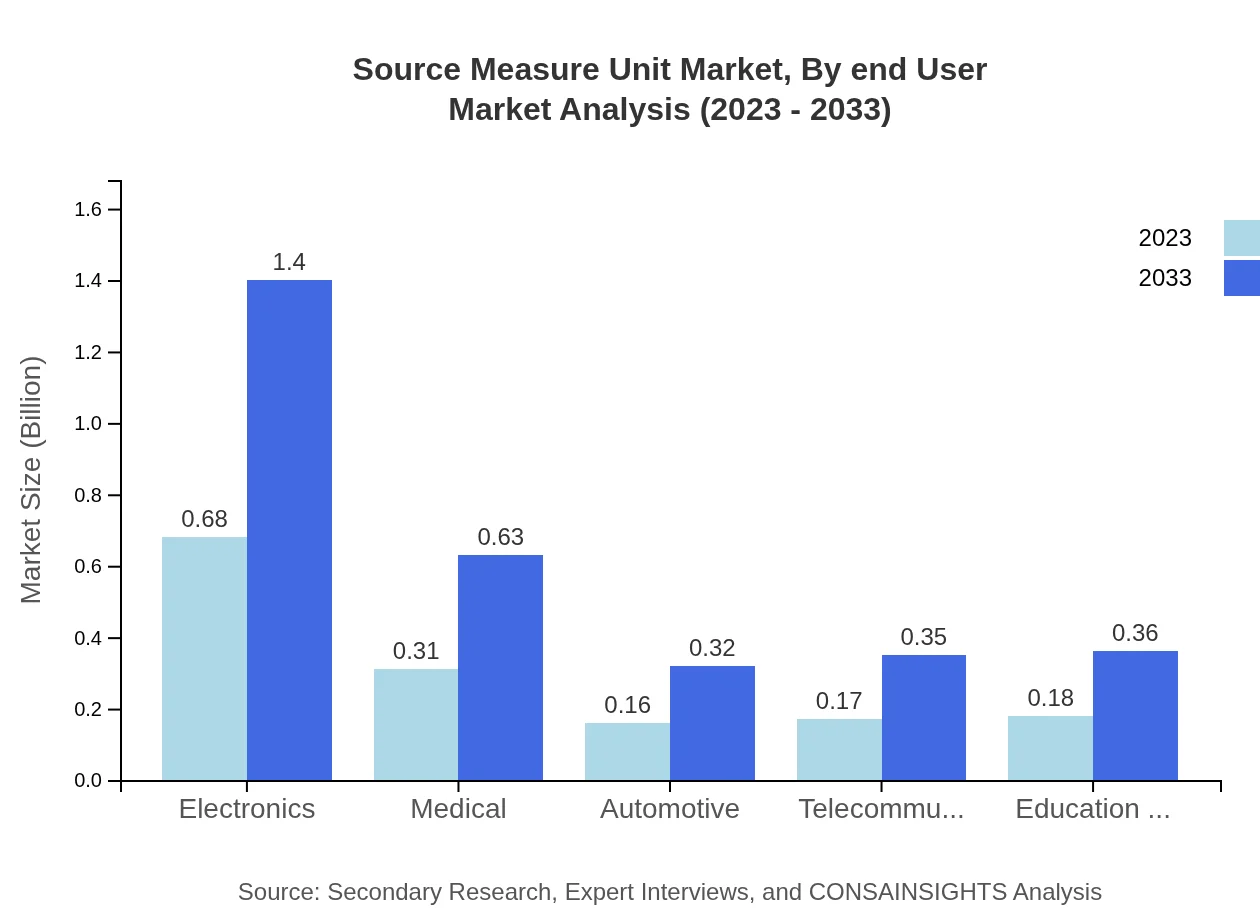

Source Measure Unit Market Analysis By End User

End-user industry segmentation includes electronics manufacturers, healthcare providers, automotive companies, and educational institutions. The electronics segment leads with extensive applications solidifying its stronghold, followed closely by automotive and telecommunications—both critical sectors embracing new technologies.

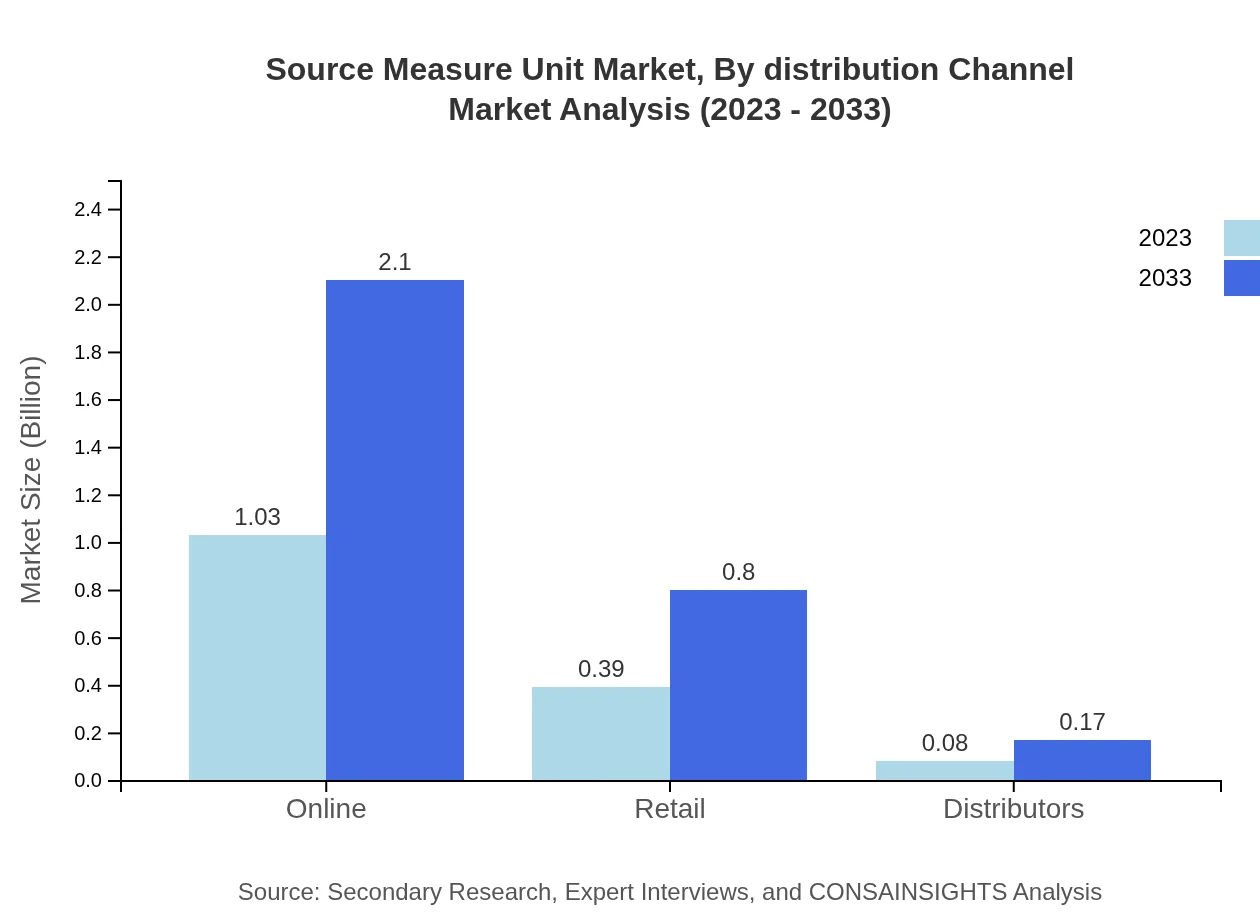

Source Measure Unit Market Analysis By Distribution Channel

Distribution channels include online sales, retail outlets, and direct distribution. Online sales are rapidly growing, propelled by increasing e-commerce trends allowing customers direct access to products, while retail and distributors play significant roles in localized market penetration.

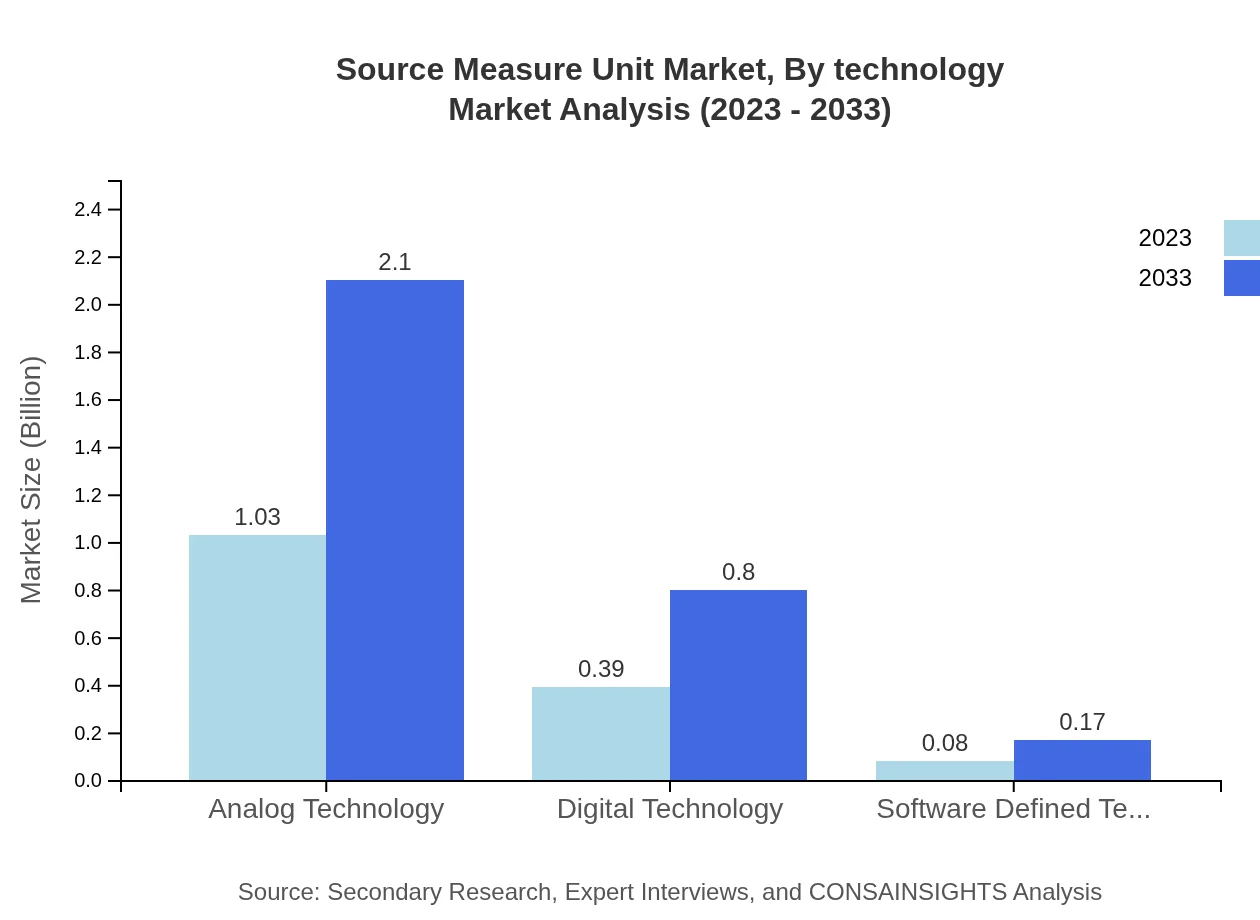

Source Measure Unit Market Analysis By Technology

Technologies influencing the Source Measure Unit market include software-defined solutions alongside traditional analog and digital technologies. The rise of software-defined applications highlights the shift toward integrated solutions enhancing measurement capabilities, reflecting a crucial trend in market development.

Source Measure Unit Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Source Measure Unit Industry

Keysight Technologies:

A market leader renowned for its innovative test and measurement solutions, providing high-performance Source Measure Units across various sectors.Tektronix:

A subsidiary of Fortive, Tektronix specializes in electronic test and measurement equipment, including advanced SMUs that cater to a range of applications from research to industry standards.National Instruments:

National Instruments provides integrated hardware and software solutions that include Source Measure Units, greatly aiding in automated test environments and complex system measurement.Rigol Technologies:

Known for affordable yet high-quality measurement instruments, Rigol Technologies focuses on accessibility and efficiency, serving the growing demands of establish end-users.We're grateful to work with incredible clients.

FAQs

What is the market size of Source Measure Unit?

The Source Measure Unit market is projected to reach $1.5 billion by 2033, growing at a CAGR of 7.2% from 2023. This growth reflects the increasing adoption of advanced measurement technologies across several industries.

What are the key market players or companies in this Source Measure Unit industry?

Key players in the Source Measure Unit industry include major electronics manufacturers, tech innovators, and firms specializing in medical and automotive testing technologies. These companies are crucial as they drive advancements and expand market reach.

What are the primary factors driving the growth in the Source Measure Unit industry?

Growth in the Source Measure Unit industry is driven by increased demand for precise testing and measurement solutions, advancements in semiconductor technologies, and the growing need for efficient testing in electronics and medical applications.

Which region is the fastest Growing in the Source Measure Unit?

The fastest-growing region for Source Measure Units is Europe, projected to expand from $0.54 billion in 2023 to $1.1 billion by 2033, indicating a strong adoption rate of innovative measurement technologies.

Does ConsaInsights provide customized market report data for the Source Measure Unit industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Source Measure Unit industry, ensuring clients receive relevant insights to support their strategic decisions.

What deliverables can I expect from this Source Measure Unit market research project?

Deliverables from the Source Measure Unit market research project include comprehensive market analysis, segmented data by region and application, competitive landscape evaluation, and trend analysis to inform strategic planning.

What are the market trends of Source Measure Unit?

Market trends for Source Measure Units include a shift towards digital technologies, increased investment in R&D across sectors, and the integration of more advanced measurement solutions to enhance efficiency and accuracy.