Sourcing Software Market Report

Published Date: 31 January 2026 | Report Code: sourcing-software

Sourcing Software Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Sourcing Software market, providing insights on current trends, segment analysis, and comprehensive data spanning from 2023 to 2033. It presents a thorough examination of market conditions, growth expectations, and regional performances.

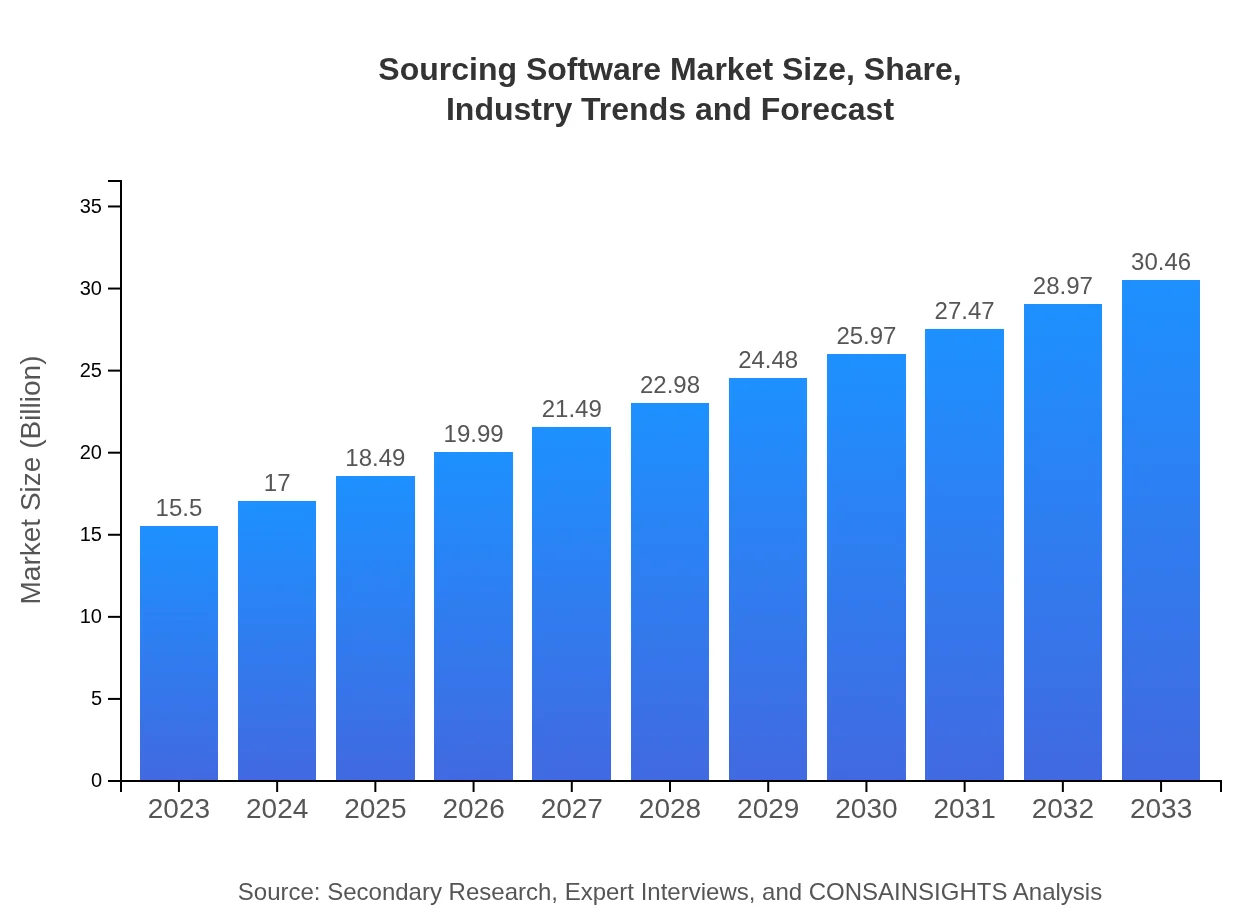

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.46 Billion |

| Top Companies | SAP Ariba, Jaggaer, Coupa, Ivalua, Oracle Procurement Cloud |

| Last Modified Date | 31 January 2026 |

Sourcing Software Market Overview

Customize Sourcing Software Market Report market research report

- ✔ Get in-depth analysis of Sourcing Software market size, growth, and forecasts.

- ✔ Understand Sourcing Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Sourcing Software

What is the Market Size & CAGR of Sourcing Software market in 2023?

Sourcing Software Industry Analysis

Sourcing Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Sourcing Software Market Analysis Report by Region

Europe Sourcing Software Market Report:

The European Sourcing Software market is projected to grow from $4.22 billion in 2023 to $8.30 billion by 2033, fueled by stringent compliance regulations and a focus on sustainability in supply chain practices.Asia Pacific Sourcing Software Market Report:

The Asia Pacific region is experiencing rapid growth in the Sourcing Software market, with an estimated market size of $3.05 billion in 2023, projected to reach $6.00 billion by 2033. The growth is driven by increasing digitization, a booming e-commerce sector, and greater investments in supply chain technologies.North America Sourcing Software Market Report:

North America leads the Sourcing Software market with a valuation of $5.20 billion in 2023, growing to $10.23 billion by 2033. This growth can be attributed to the advanced technological landscape, high demand for automation, and strong investment in software solutions across various sectors.South America Sourcing Software Market Report:

In South America, the market is valued at $1.07 billion in 2023, with an expected growth to $2.11 billion by 2033. The adoption of cloud solutions and the need for efficient resource management are key factors contributing to this growth.Middle East & Africa Sourcing Software Market Report:

In the Middle East and Africa, the market is set to grow from $1.95 billion in 2023 to $3.84 billion by 2033, driven primarily by an increasing focus on digital transformation and a push towards operational efficiency in various industries.Tell us your focus area and get a customized research report.

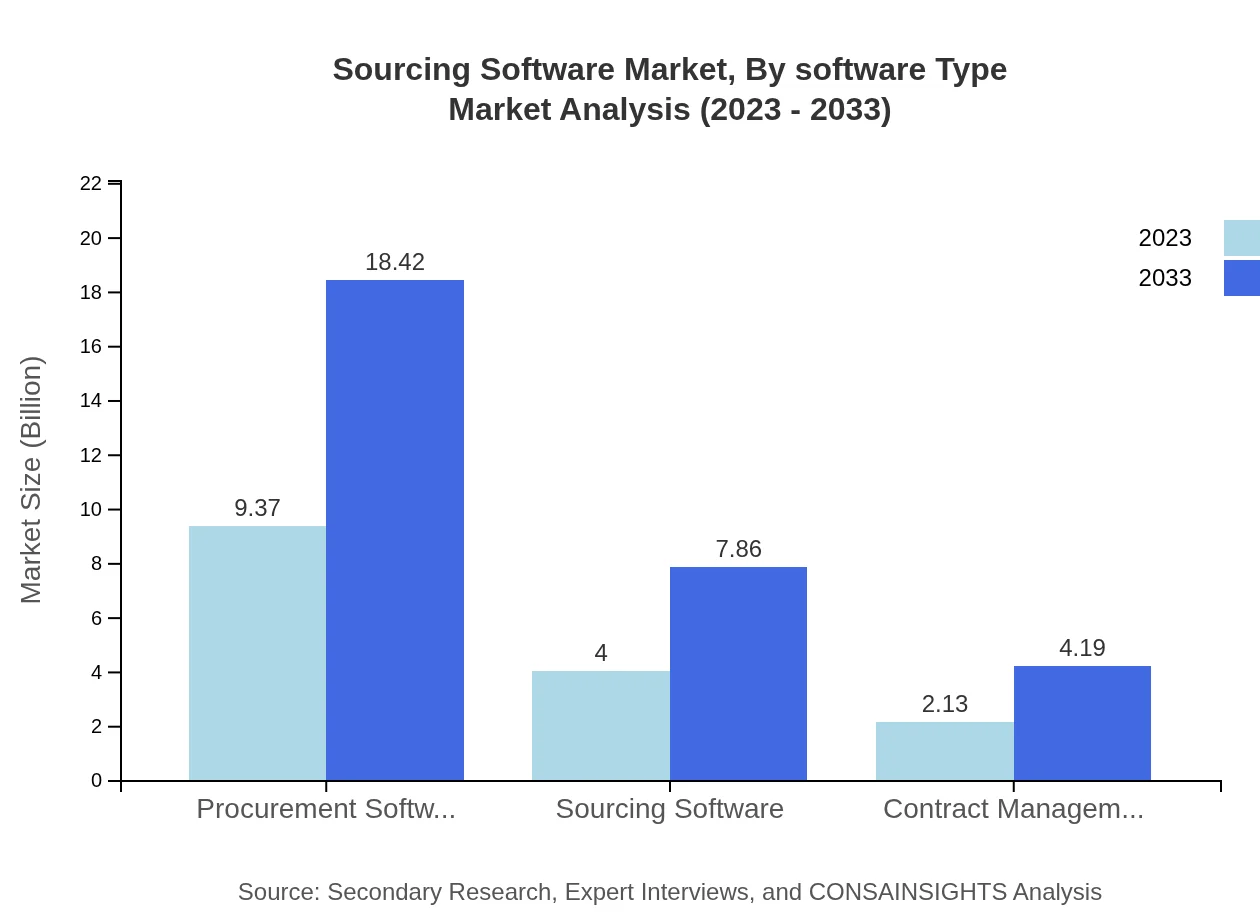

Sourcing Software Market Analysis By Software Type

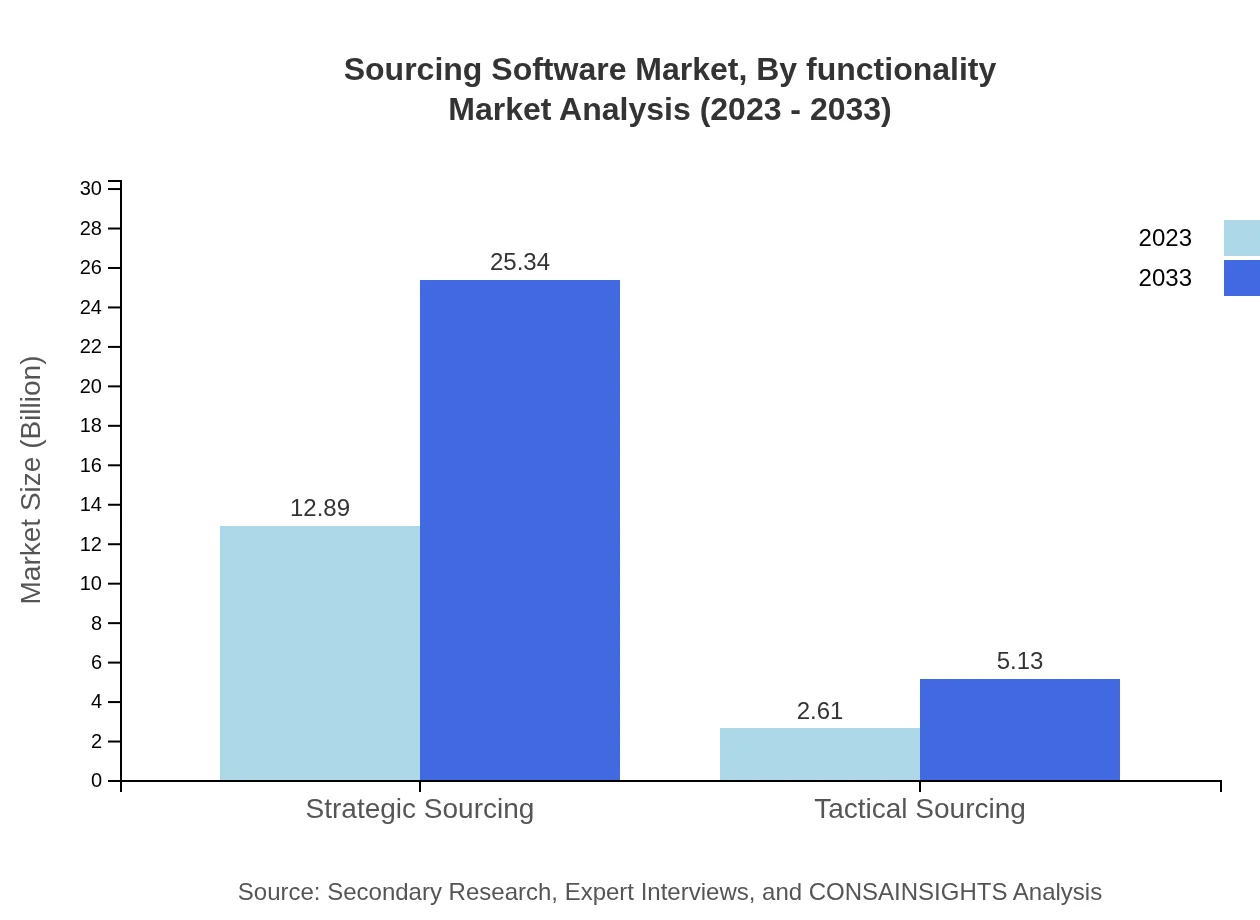

The Sourcing Software market, segmented by software type, shows that Strategic Sourcing holds a significant share, with a market size of $12.89 billion in 2023, expected to reach $25.34 billion by 2033. Tactical Sourcing, although smaller, is growing rapidly with a current size of $2.61 billion projected to double to $5.13 billion. Procurement Software commands a market value of $9.37 billion in 2023, expected to rise to $18.42 billion, while Contract Management Software is projected to grow from $2.13 billion to $4.19 billion within the same timeframe.

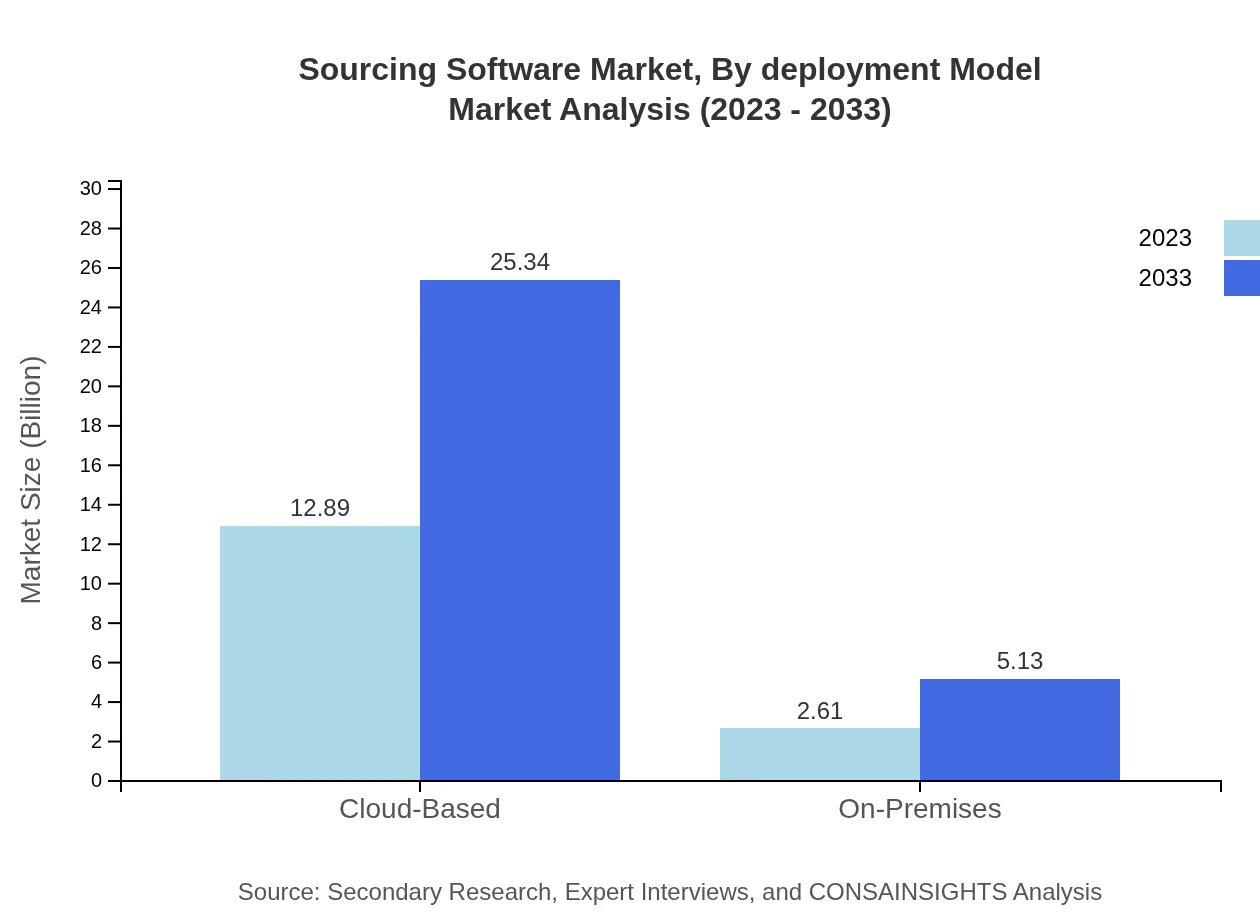

Sourcing Software Market Analysis By Deployment Model

In terms of deployment models, Cloud-Based solutions dominate the market with a size of $12.89 billion in 2023, anticipated to rise to $25.34 billion by 2033. On-Premises solutions account for a smaller segment, currently valued at $2.61 billion and expecting to grow to $5.13 billion. The preference for cloud-based solutions is driven by their flexibility, scalability, and cost-effectiveness, which align with current business needs.

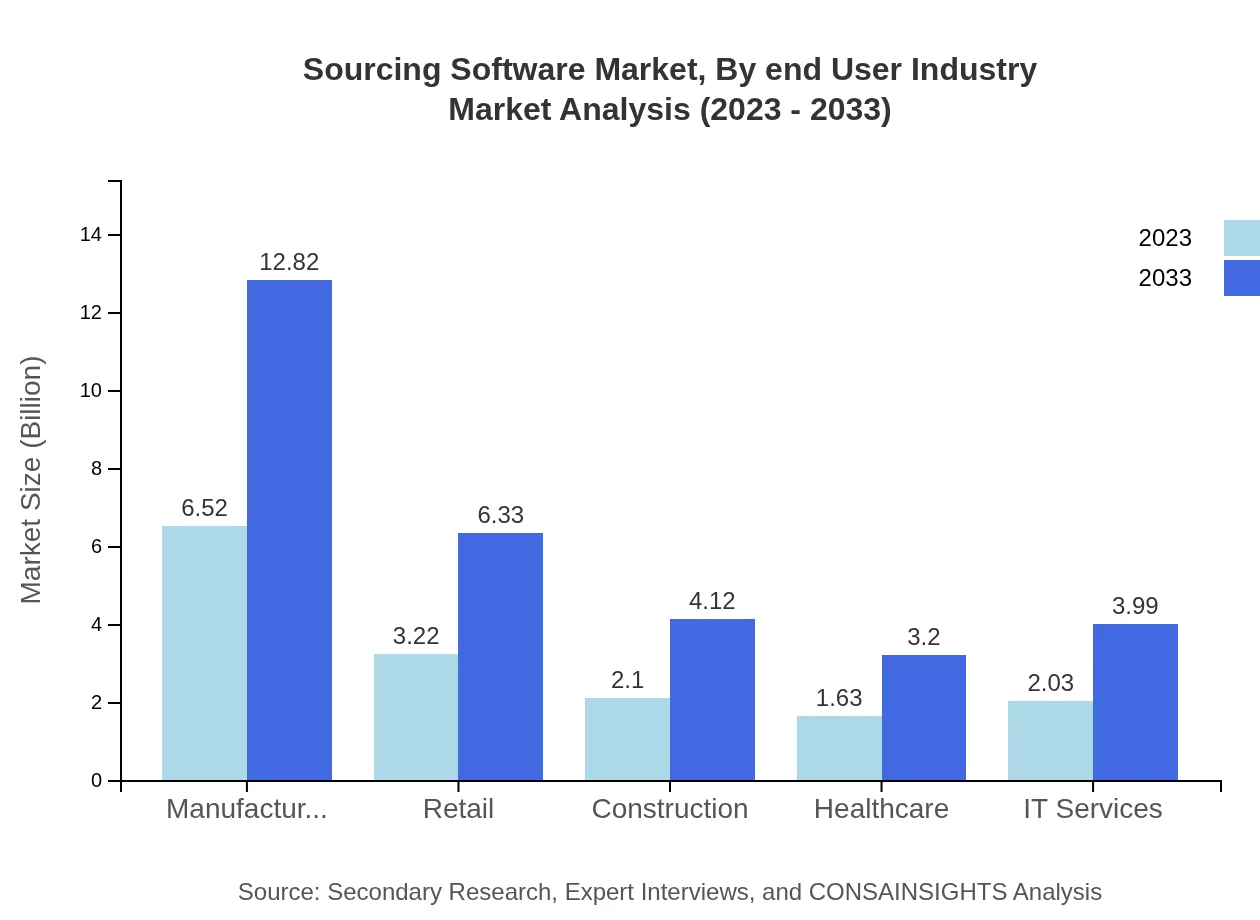

Sourcing Software Market Analysis By End User Industry

The market by end-user industry indicates that Manufacturing leads with a size of $6.52 billion in 2023, projected to escalate to $12.82 billion by 2033. The Retail sector follows with a current value of $3.22 billion, expected to grow to $6.33 billion. Other notable segments include Healthcare and IT Services, valued at $1.63 billion and $2.03 billion in 2023, respectively.

Sourcing Software Market Analysis By Functionality

Functionality wise, Spend Analysis is critical, helping organizations analyze spending habits for improved sourcing decisions. Supplier Management and Contract Management also play substantial roles in ensuring effective sourcing, with functionalities continually evolving to meet the demands of modern procurement processes.

Sourcing Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Sourcing Software Industry

SAP Ariba:

SAP Ariba is a leading provider of procurement and sourcing solutions, offering a comprehensive platform for managing the entire source-to-pay lifecycle, enabling organizations to collaborate with suppliers effectively.Jaggaer:

Jaggaer delivers a unified spend management solution, equipped with advanced sourcing capabilities designed to enhance procurement efficiency and supplier collaboration across various industries.Coupa:

Coupa's innovative sourcing and procurement solutions empower organizations to maximize savings, improve compliance, and streamline supplier management by leveraging spend analytics.Ivalua:

Ivalua provides a robust platform that integrates sourcing, procurement, and supplier management functionalities, empowering enterprises to drive efficiency and effectiveness in their purchasing processes.Oracle Procurement Cloud:

Oracle offers an integrated suite of procurement tools that enable organizations to manage their sourcing strategies and supplier relationships effectively through a cloud-based environment.We're grateful to work with incredible clients.

FAQs

What is the market size of sourcing Software?

The global sourcing software market is projected to reach approximately $15.5 billion by 2033, with a compound annual growth rate (CAGR) of 6.8% from 2023. This notable growth reflects increasing demand for efficient sourcing solutions.

What are the key market players or companies in this sourcing Software industry?

Key players in the sourcing software industry include major companies like SAP, Oracle, Coupa Software, Jaggaer, and Ivalua, which contribute significantly to market innovations, product enhancements, and competitive strategies.

What are the primary factors driving the growth in the sourcing Software industry?

The growth in the sourcing software industry is driven by factors such as digital transformation, increasing automation in procurement processes, demand for analytics, and the need for cost optimization among businesses seeking competitive advantages.

Which region is the fastest Growing in the sourcing Software?

North America is currently the fastest-growing region in the sourcing software market, projected to increase from $5.20 billion in 2023 to $10.23 billion by 2033, reflecting a strong growth trajectory driven by technological advancements.

Does ConsaInsights provide customized market report data for the sourcing Software industry?

Yes, ConsaInsights offers customized market report data for the sourcing software industry, catering to specific client requirements and providing tailored insights that align with unique business needs.

What deliverables can I expect from this sourcing Software market research project?

Expect comprehensive deliverables including an in-depth market analysis report, segmentation data, competitive landscape overviews, regional insights, and forecasts detailing market dynamics over the next decade.

What are the market trends of sourcing Software?

Current market trends in sourcing software include a shift towards cloud-based solutions, increased focus on strategic sourcing practices, and the integration of AI technologies to enhance decision-making processes within procurement.