South Africa Ip Video Surveillance And Vsaas Market Report

Published Date: 31 January 2026 | Report Code: south-africa-ip-video-surveillance-and-vsaas

South Africa Ip Video Surveillance And Vsaas Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the South Africa IP Video Surveillance and VSaaS market, focusing on market dynamics, segmentation, and regional insights, along with forecasts for 2023 to 2033.

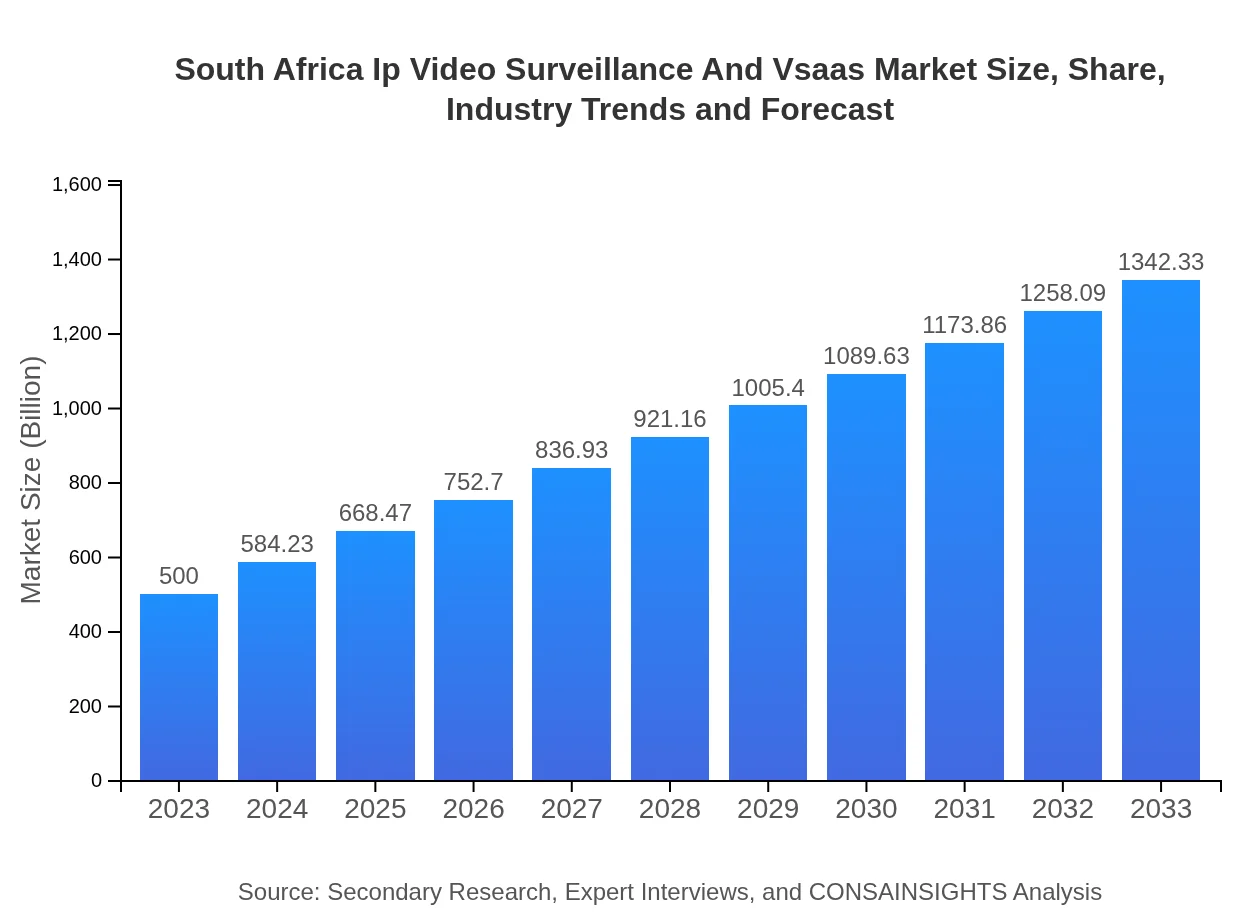

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $1342.33 Million |

| Top Companies | Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems |

| Last Modified Date | 31 January 2026 |

South Africa Ip Video Surveillance And Vsaas Market Overview

Customize South Africa Ip Video Surveillance And Vsaas Market Report market research report

- ✔ Get in-depth analysis of South Africa Ip Video Surveillance And Vsaas market size, growth, and forecasts.

- ✔ Understand South Africa Ip Video Surveillance And Vsaas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in South Africa Ip Video Surveillance And Vsaas

What is the Market Size & CAGR of South Africa Ip Video Surveillance And Vsaas market in 2023?

South Africa Ip Video Surveillance And Vsaas Industry Analysis

South Africa Ip Video Surveillance And Vsaas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

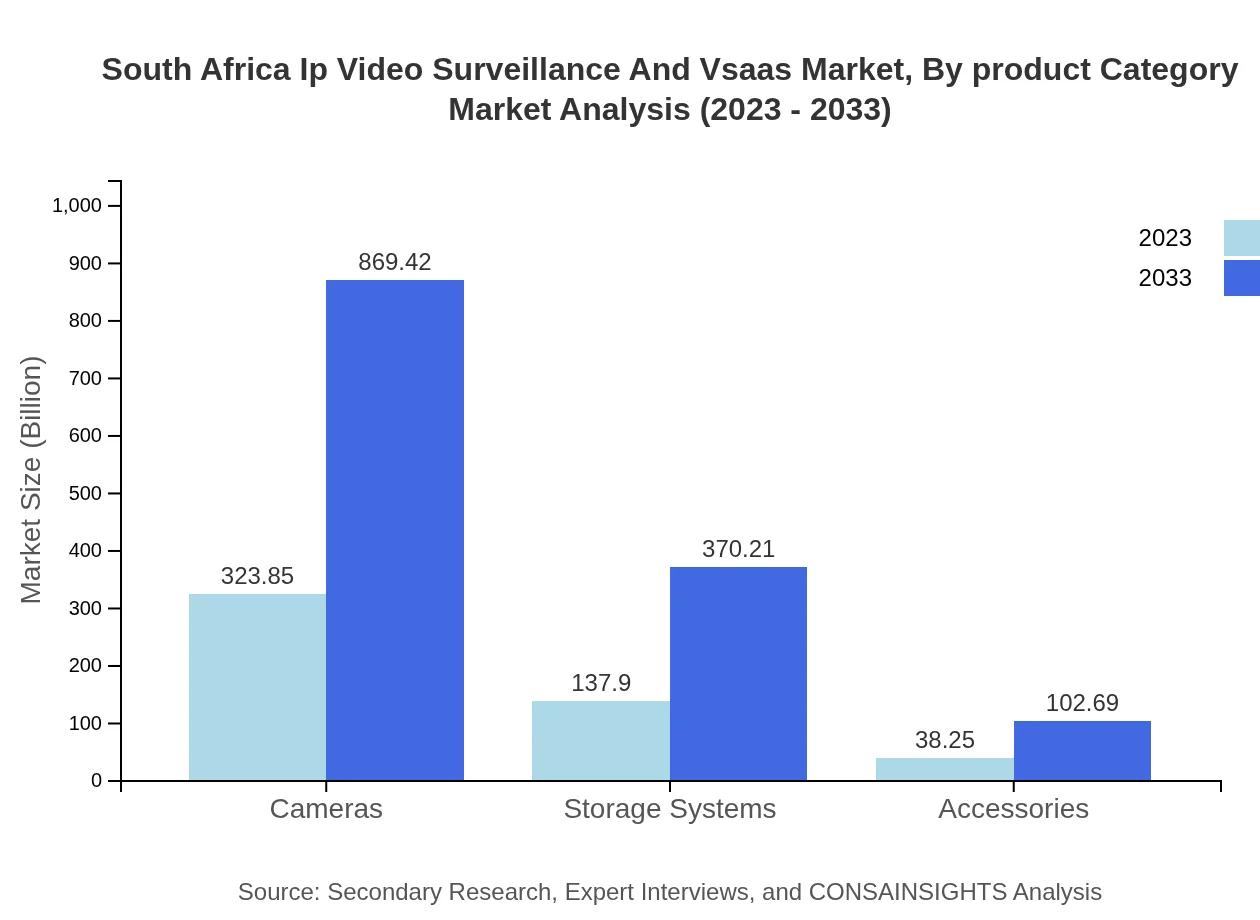

South Africa Ip Video Surveillance And Vsaas Market Analysis By Product Category

The market is further categorized by product types such as Wired Surveillance Systems (USD 323.85 million in 2023, USD 869.42 million in 2033), Wireless Surveillance Systems, and Cloud-Based Systems. Wired categories dominate in terms of market share, while wireless options are progressively becoming popular for their installation flexibility.

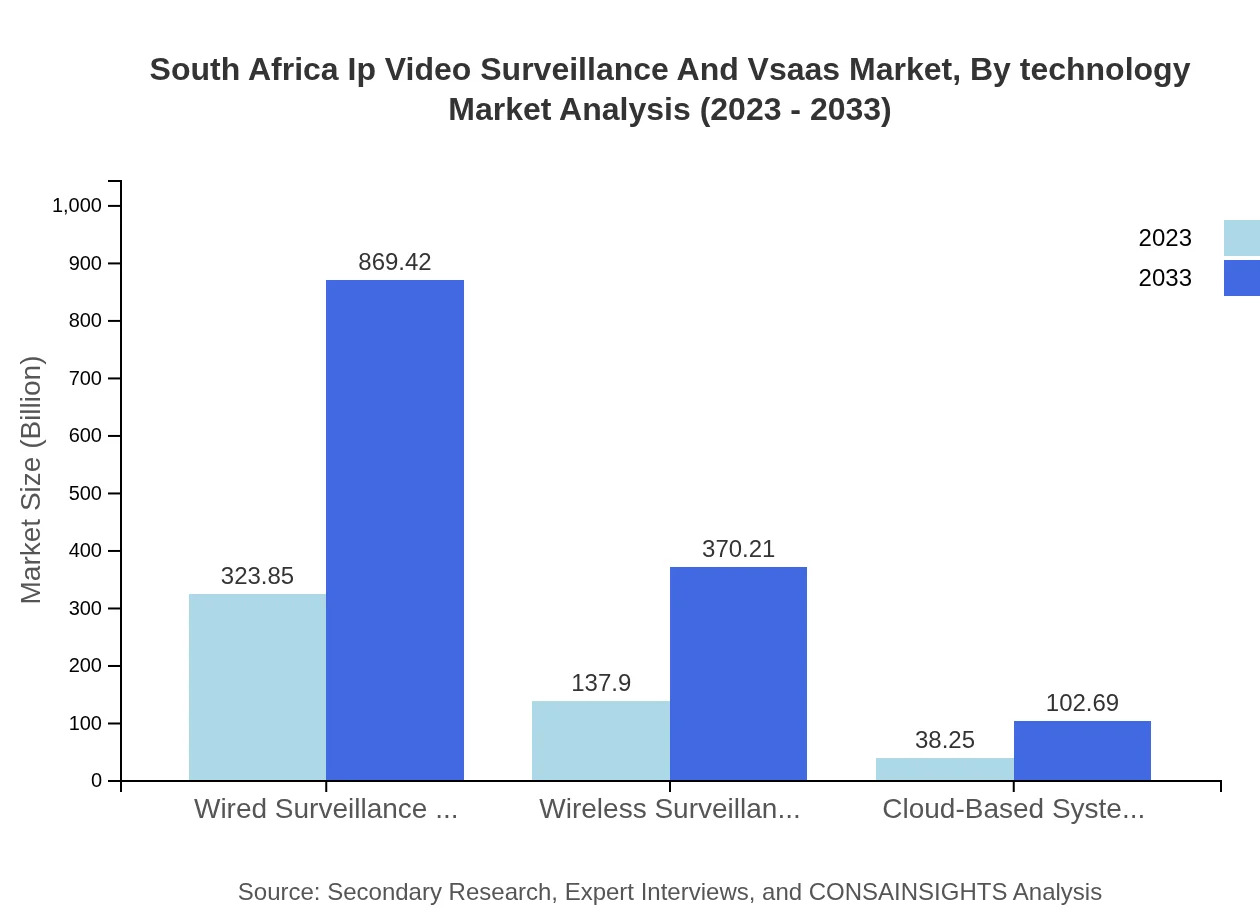

South Africa Ip Video Surveillance And Vsaas Market Analysis By Technology

In terms of technology, the market is segmented into traditional IP cameras and modern enhanced solutions like AI-driven cameras. AI developments are critical in shifting the paradigm towards smart surveillance, enabling better event detection and analysis.

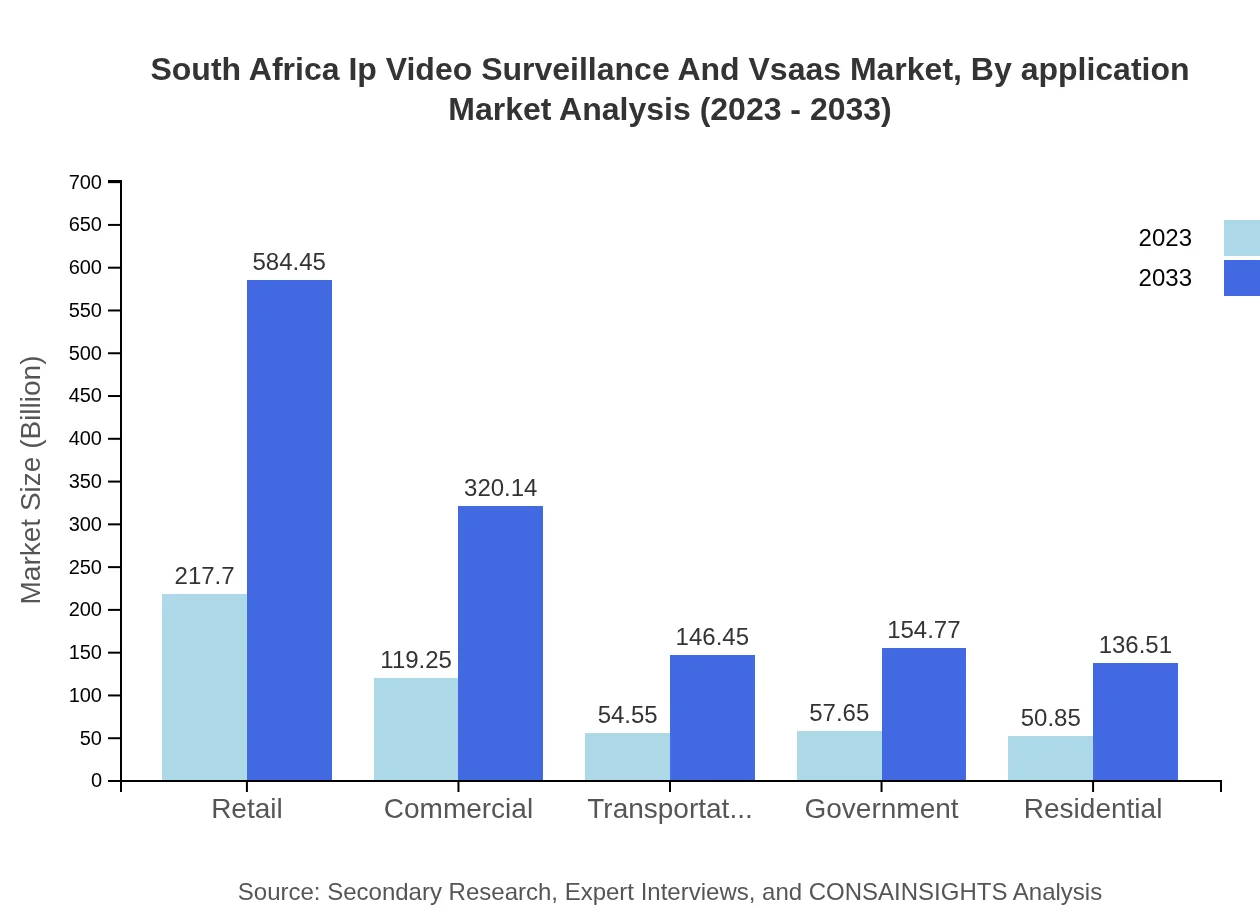

South Africa Ip Video Surveillance And Vsaas Market Analysis By Application

Key applications of IP Video Surveillance include Retail, Commercial, Transportation, Government, and Residential sectors. Retail applications account for the largest share due to the need for theft mitigation and asset protection.

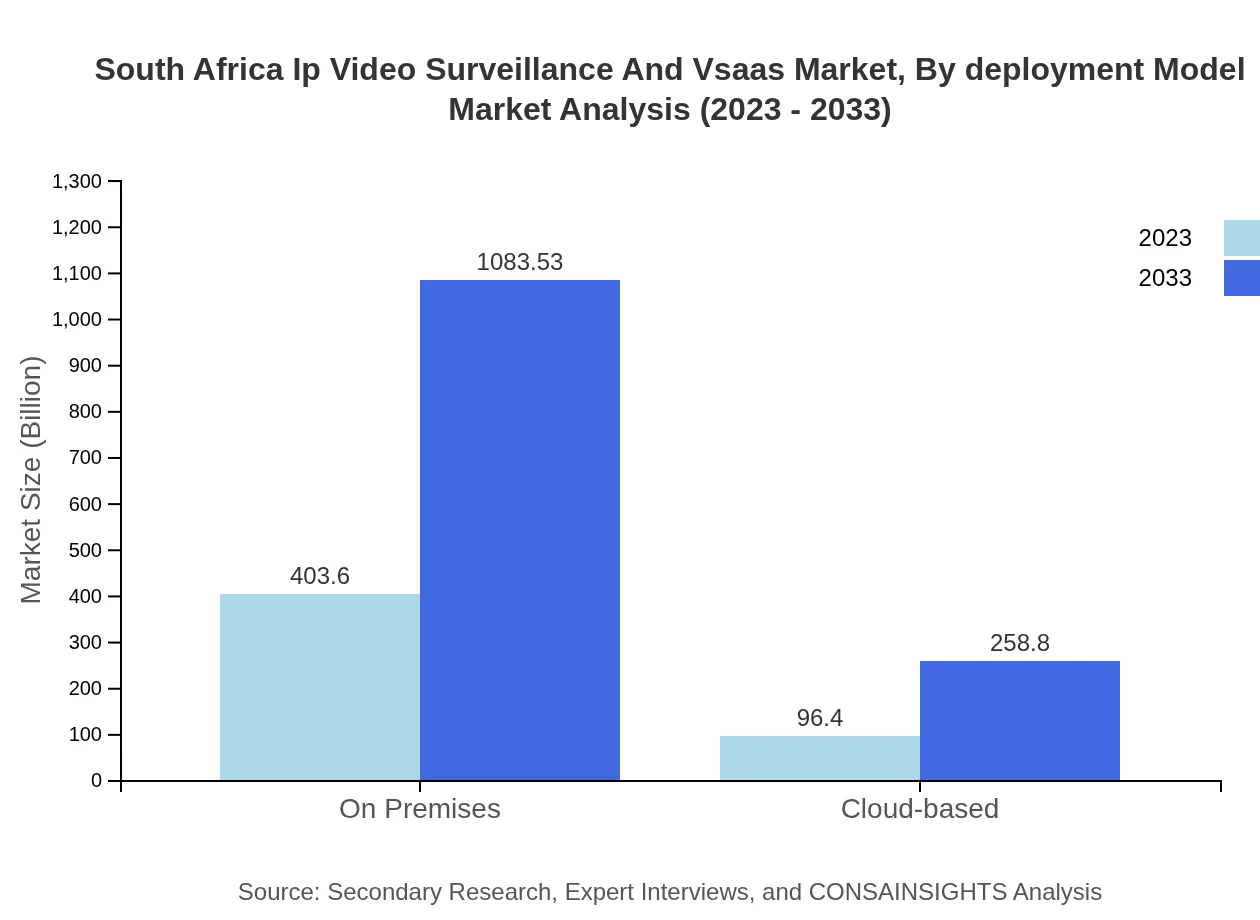

South Africa Ip Video Surveillance And Vsaas Market Analysis By Deployment Model

Deployment models include on-premises and cloud-based systems. On-premises solutions, valued at USD 403.60 million in 2023, dominate the market, while cloud-based systems capture a significant share due to their scalability and ease of management.

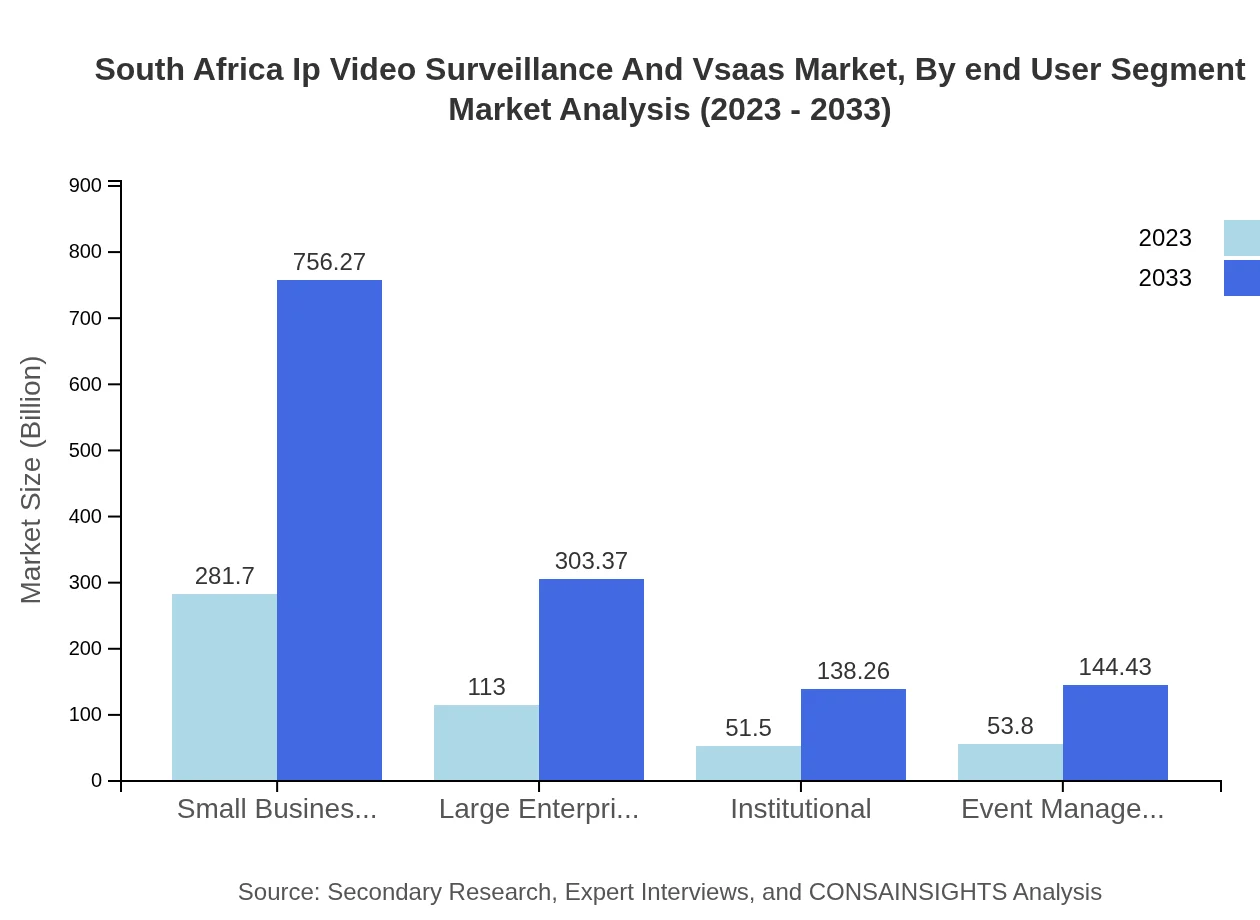

South Africa Ip Video Surveillance And Vsaas Market Analysis By End User Segment

End-user segments encompass Small Businesses, Large Enterprises, Institutional, and Government sectors. Small Businesses represent USD 281.70 million in 2023, highlighting this group as a major target for affordable VSaaS solutions.

South Africa Ip Video Surveillance And Vsaas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in South Africa Ip Video Surveillance And Vsaas Industry

Hikvision:

Hikvision is a globally recognized leader in video surveillance products and solutions, offering a range of innovative IP cameras and advanced analytics.Dahua Technology:

Dahua Technology specializes in video surveillance solutions, renowned for its cutting-edge technology and comprehensive product lines that cater to various security needs.Axis Communications:

Axis Communications is known for pioneering network video technology and continues to lead the market with innovative products in the IP surveillance segments.Bosch Security Systems:

Bosch provides advanced surveillance solutions focusing on cybersecurity and data integrity while ensuring user-friendliness and compliance with regulations.We're grateful to work with incredible clients.

FAQs

What is the market size of South Africa IP Video Surveillance and VSaaS?

The market size for South Africa IP Video Surveillance and VSaaS is projected to reach $500 million in 2023, with a CAGR of 10% anticipated through 2033, indicating robust growth in demand for surveillance technologies.

What are the key market players or companies in this industry?

Key players in the South Africa IP Video Surveillance and VSaaS industry typically include leading technology firms specializing in security solutions such as Cisco, Hikvision, Dahua, Axis Communications, and Genetec. These companies are instrumental in shaping technological advancements.

What are the primary factors driving the growth in the industry?

Growth drivers in South Africa's IP Video Surveillance and VSaaS market encompass heightened security concerns, rapid urbanization, technological advancements, and government investments in smart city initiatives. Increasing availability of cloud technologies also enables accessibility and scalability of services.

Which region is the fastest Growing in the industry?

Among various regions, South Africa is anticipated to experience notable growth in the IP Video Surveillance and VSaaS market, reflecting a trend seen across the Middle East and Africa, where demand for sophisticated surveillance systems is significantly increasing.

Does ConsaInsights provide customized market report data for the industry?

Yes, ConsaInsights offers the flexibility to create customized market reports tailored to specific client needs, ensuring that the data fits particular sectors or regional variations within the South Africa IP Video Surveillance and VSaaS landscape.

What deliverables can I expect from this market research project?

Deliverables from the South Africa IP Video Surveillance and VSaaS market research include comprehensive reports, market forecasts, competitive analysis, segmentation insights, and tailored recommendations for strategic decision-making in investments and market entry strategies.

What are the market trends of South Africa IP Video Surveillance and VSaaS?

Current trends in the market include the adoption of cloud-based surveillance solutions, enhanced integration of AI technologies for better analytics, and a shift towards wireless surveillance systems, reflecting changing consumer needs and technological advancements.