Soy Food Products Market Report

Published Date: 31 January 2026 | Report Code: soy-food-products

Soy Food Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Soy Food Products market from 2023 to 2033. Insights include market trends, segmentation, regional analysis, and future forecasts, focusing on growth opportunities and challenges within the industry.

| Metric | Value |

|---|---|

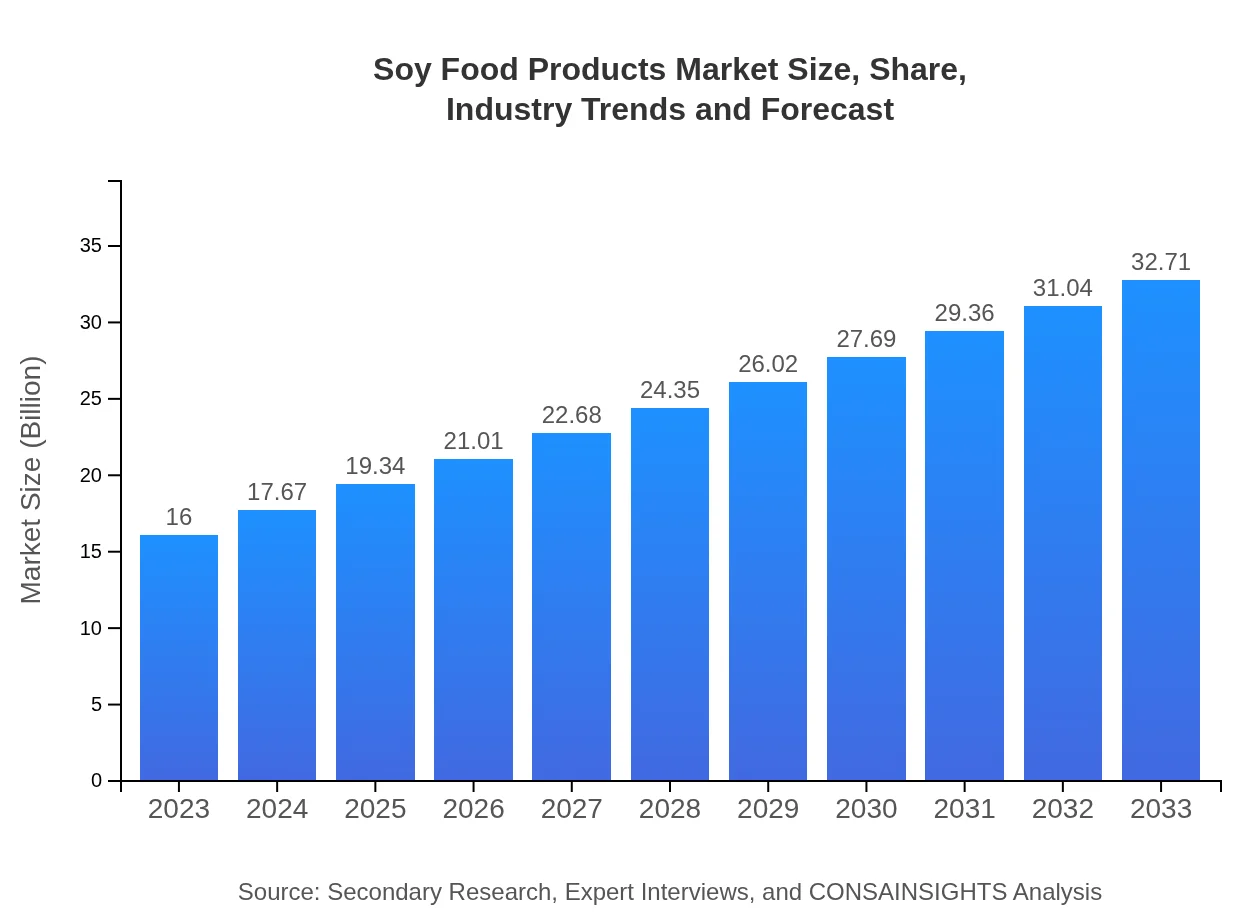

| Study Period | 2023 - 2033 |

| 2023 Market Size | $16.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $32.71 Billion |

| Top Companies | The Hain Celestial Group, Inc., WhiteWave Foods, Mizkan Holdings, Kikkoman Corporation |

| Last Modified Date | 31 January 2026 |

Soy Food Products Market Overview

Customize Soy Food Products Market Report market research report

- ✔ Get in-depth analysis of Soy Food Products market size, growth, and forecasts.

- ✔ Understand Soy Food Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Soy Food Products

What is the Market Size & CAGR of Soy Food Products market in 2023?

Soy Food Products Industry Analysis

Soy Food Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Soy Food Products Market Analysis Report by Region

Europe Soy Food Products Market Report:

The European Soy Food Products market is estimated to move from USD 4.42 billion in 2023 to USD 9.04 billion by 2033. Strong consumer demand for healthy alternatives and sustainability initiatives are expected to drive substantial growth in this region.Asia Pacific Soy Food Products Market Report:

In the Asia Pacific region, the Soy Food Products market size is estimated at USD 3.08 billion in 2023 and is anticipated to grow to USD 6.29 billion by 2033. The region's significant historical consumption of traditional soy products like tofu and soy milk underpins this growth, alongside increasing health awareness and western dietary influences.North America Soy Food Products Market Report:

In North America, the market is projected to grow from USD 5.33 billion in 2023 to USD 10.90 billion by 2033. The US and Canada are leading markets driven by an increase in vegan and vegetarian diets and significant investments in new product innovations among key players.South America Soy Food Products Market Report:

For South America, the market size is projected to rise from USD 1.01 billion in 2023 to USD 2.07 billion by 2033. The growing trend of vegetarianism and awareness of protein sources is driving demand in this region, particularly among younger consumers.Middle East & Africa Soy Food Products Market Report:

In the Middle East and Africa, the market is anticipated to expand from USD 2.15 billion in 2023 to USD 4.40 billion by 2033, influenced by increasing health awareness and growing acceptance of plant-based diets due to lifestyle changes.Tell us your focus area and get a customized research report.

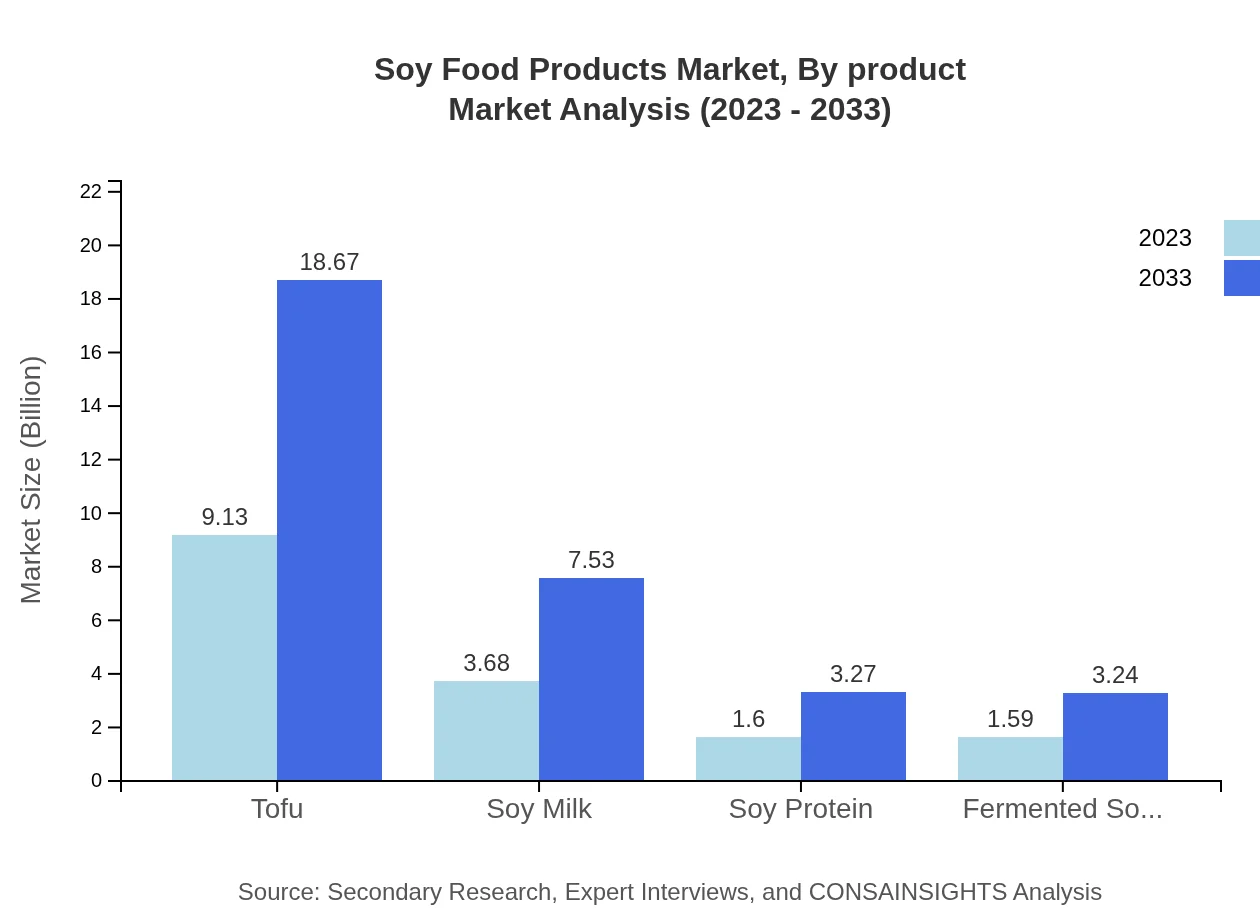

Soy Food Products Market Analysis By Product

In 2023, the liquid soy products segment is valued at USD 9.76 billion, expected to reach USD 19.96 billion by 2033. Tofu is another major product, with a market size of USD 9.13 billion projected to grow to USD 18.67 billion by 2033. Solid forms such as soy protein are also important, reflecting the diverse applications of soy in nutrition.

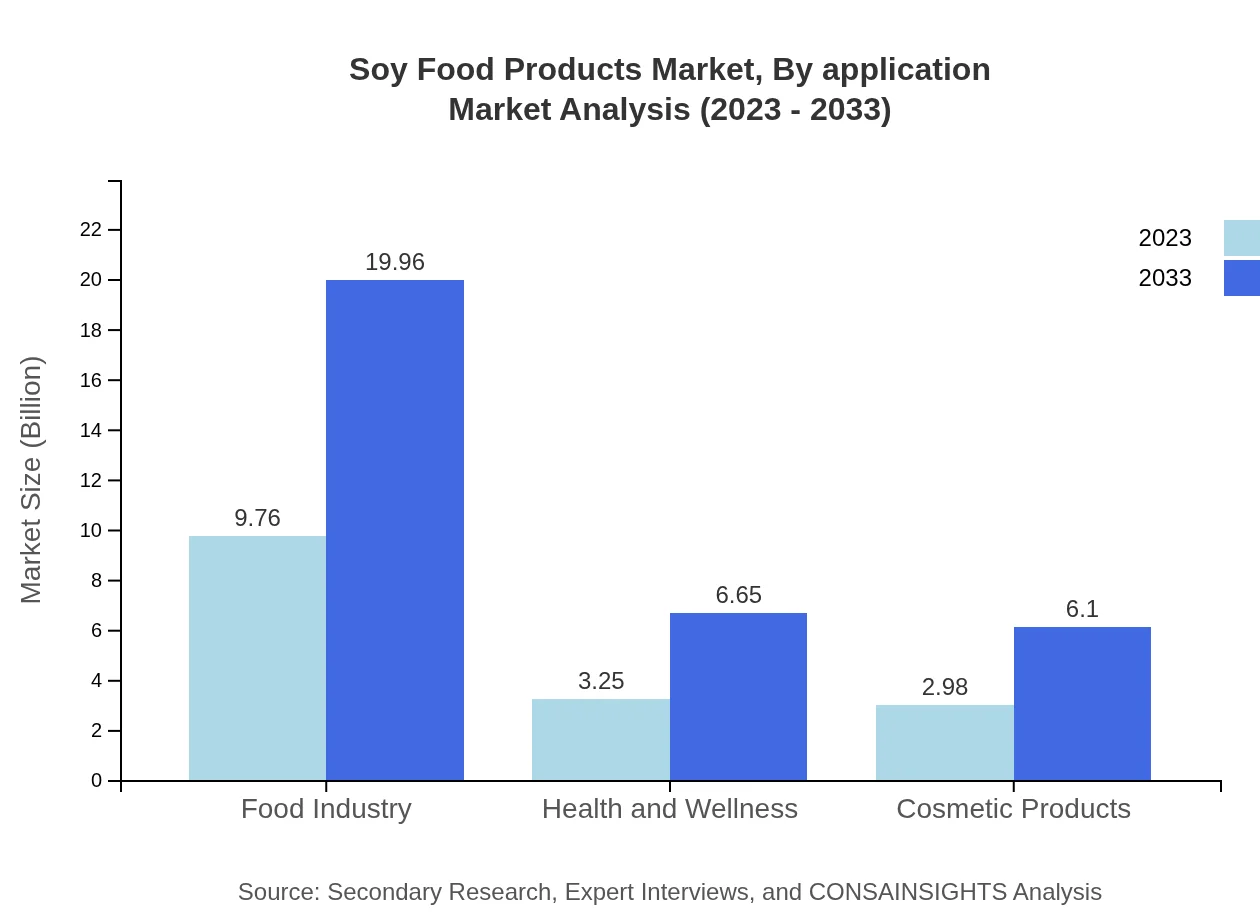

Soy Food Products Market Analysis By Application

The health and wellness application segment is valued at USD 3.25 billion in 2023, anticipated to grow to USD 6.65 billion by 2033, reflecting growing consumer interest in nutritional products. In the food industry category, the size in 2023 is USD 9.76 billion and is projected to reach USD 19.96 billion by 2033.

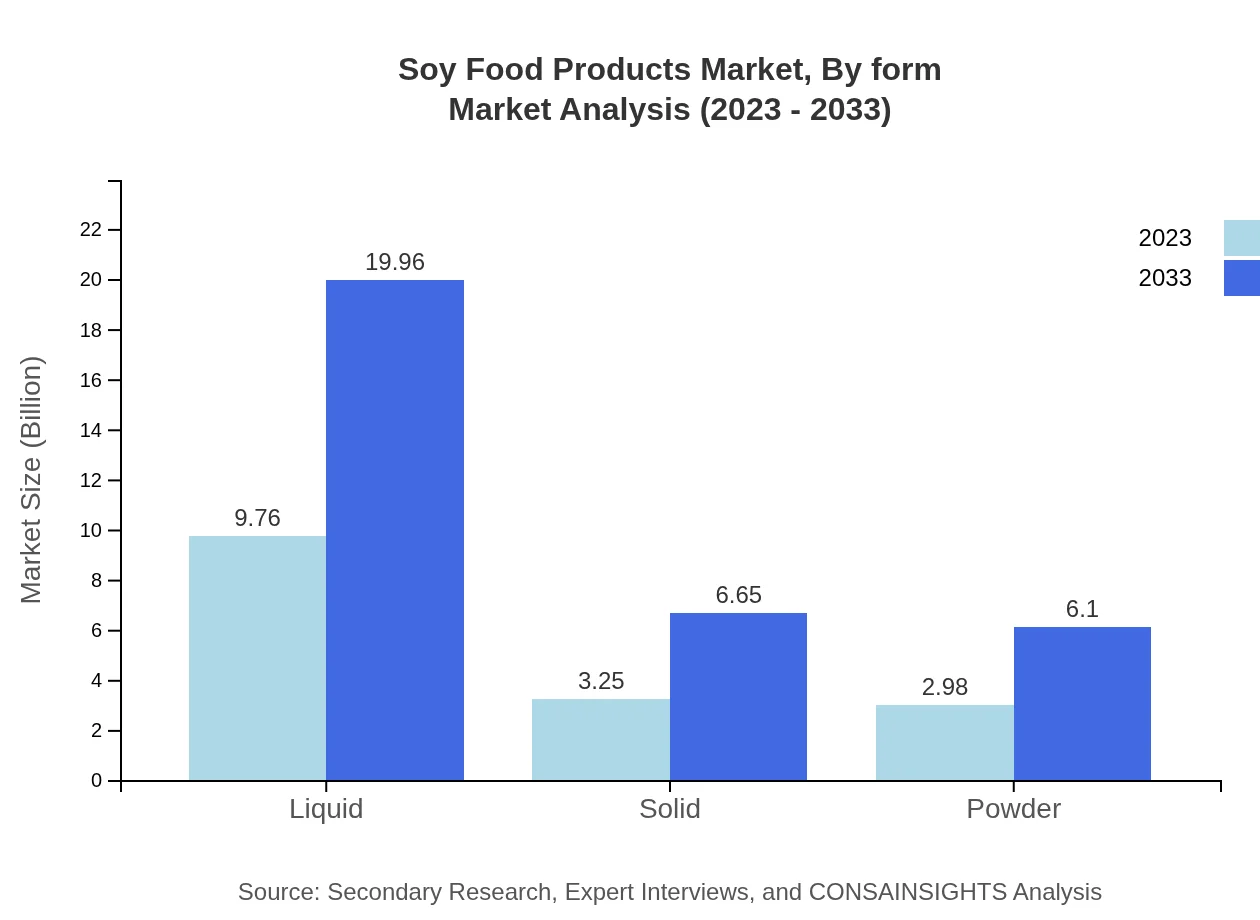

Soy Food Products Market Analysis By Form

The market is segmented into soy food products in liquid, solid, and powdered forms, with each showing promising growth. Liquid soy products command a 61.03% market share in 2023, while solid forms hold 20.32% and powdered forms account for 18.65%.

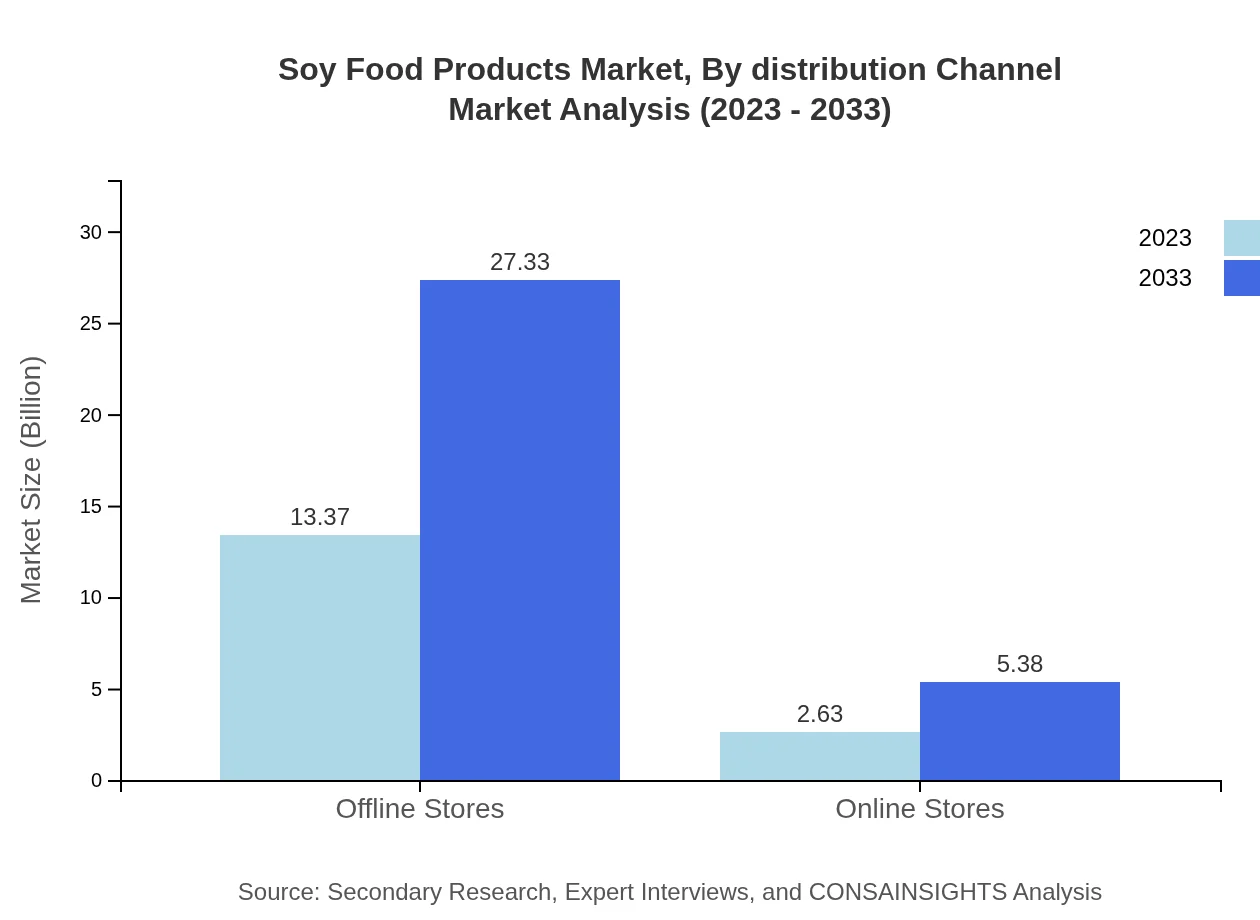

Soy Food Products Market Analysis By Distribution Channel

Offline stores dominate the distribution channels with a share of 83.55% in 2023. However, online stores are gradually increasing in relevance, anticipated to provide greater accessibility for consumers with increased market penetration expected from USD 2.63 billion in 2023 to USD 5.38 billion by 2033.

Soy Food Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Soy Food Products Industry

The Hain Celestial Group, Inc.:

A leading organic and natural products company known for its range of soy food products including tofu and soy milk, focusing on health and sustainability.WhiteWave Foods:

A key player in the dairy alternative segment with a strong portfolio of soy-based products, consistently innovating within the market to meet consumer demands.Mizkan Holdings:

A global organization with diversified soy product offerings, including sauces and marinades, focused on enhancing the culinary experience with quality ingredients.Kikkoman Corporation:

Renowned for their soy sauce, Kikkoman also ventures into the food products market, developing various soy-based offerings that resonate with health-oriented users.We're grateful to work with incredible clients.

FAQs

What is the market size of soy Food Products?

The global soy food products market is projected to reach approximately $16 billion by 2033, with a compound annual growth rate (CAGR) of 7.2%. This growth reflects increasing consumer demand for plant-based alternatives.

What are the key market players or companies in this soy Food Products industry?

Key players in the soy food products industry include major corporations such as Tofutti Brands, Inc., WhiteWave, and Pure Harvest. These companies are pivotal due to their innovative product offerings and extensive market reach.

What are the primary factors driving the growth in the soy food products industry?

The growth of the soy food products market is driven by rising health consciousness, increasing veganism, and the demand for protein-rich food alternatives. Moreover, environmental sustainability concerns also contribute to this rise.

Which region is the fastest Growing in the soy food products market?

The Asia Pacific region is the fastest-growing market for soy food products, expanding from $3.08 billion in 2023 to $6.29 billion by 2033, driven by increasing health awareness and the popularity of soy-based diets.

Does ConsaInsights provide customized market report data for the soy food products industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the soy food products industry, ensuring that stakeholders receive relevant insights for informed decision-making.

What deliverables can I expect from this soy food products market research project?

In this market research project, you can expect comprehensive deliverables including in-depth market analysis, trend forecasting, competitive landscape insights, and detailed segmentation data for strategic planning.

What are the market trends of soy food products?

Market trends indicate a growing preference for organic soy products, increased innovation in taste and variety, and expansion of online retail channels, reflecting shifts in consumer purchasing behaviors.