Space Launch Services Market Report

Published Date: 03 February 2026 | Report Code: space-launch-services

Space Launch Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Space Launch Services market, analyzing key dynamics, trends, and forecasts for the period from 2023 to 2033, offering insights on regional performance, segmental breakdown, and competitive landscape.

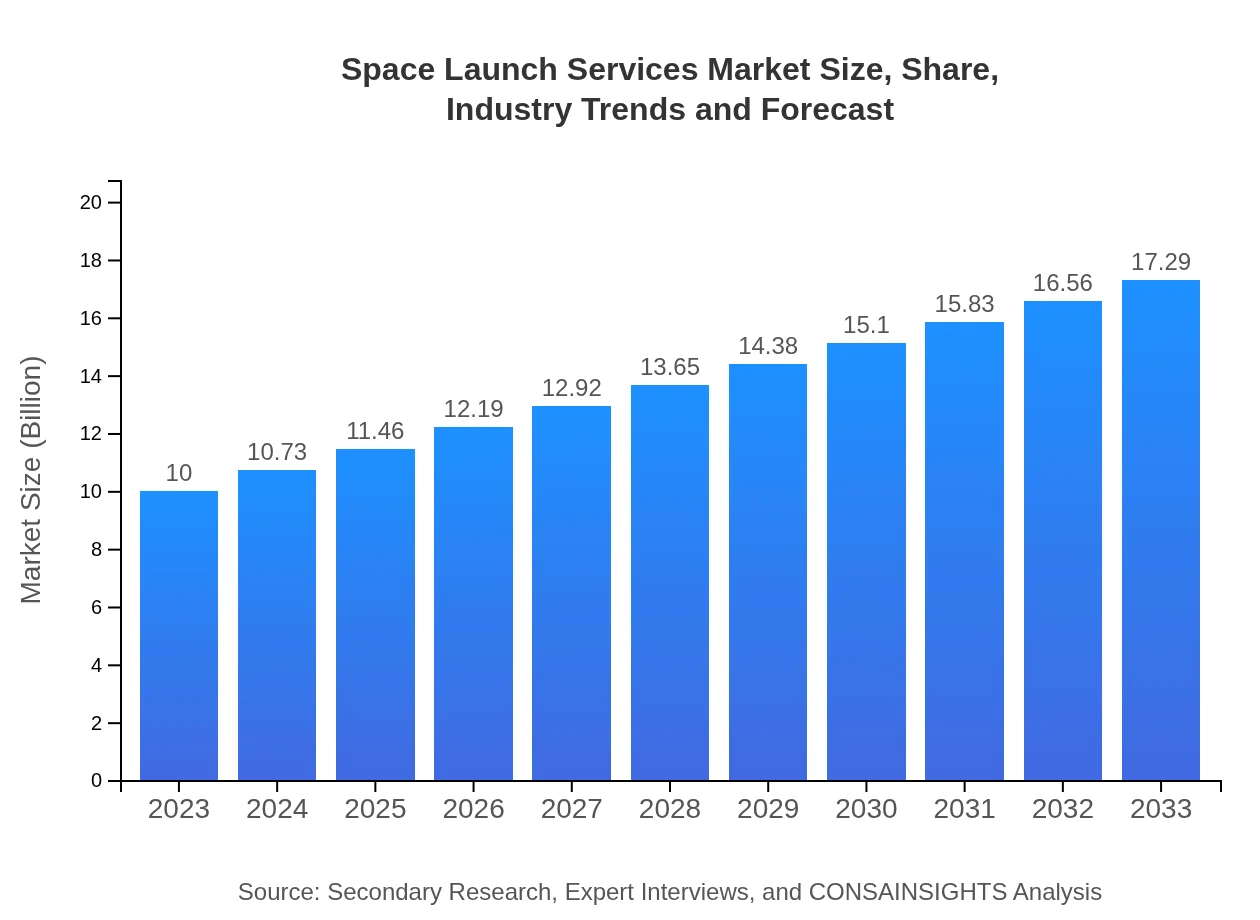

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.5% |

| 2033 Market Size | $17.29 Billion |

| Top Companies | SpaceX, Arianespace, Rocket Lab, Blue Origin, Northrop Grumman |

| Last Modified Date | 03 February 2026 |

Space Launch Services Market Overview

Customize Space Launch Services Market Report market research report

- ✔ Get in-depth analysis of Space Launch Services market size, growth, and forecasts.

- ✔ Understand Space Launch Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Space Launch Services

What is the Market Size & CAGR of Space Launch Services market in 2033?

Space Launch Services Industry Analysis

Space Launch Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Space Launch Services Market Analysis Report by Region

Europe Space Launch Services Market Report:

Europe's market is valued at $3.11 billion in 2023 and is anticipated to grow to $5.38 billion by 2033. European countries emphasize collaborative projects, such as the Arianespace, and the development of the new Ariane 6 launch vehicle, supporting regional market growth.Asia Pacific Space Launch Services Market Report:

In 2023, the Space Launch Services market in the Asia Pacific region is valued at $1.90 billion, projected to grow to $3.29 billion by 2033. This growth is driven by the expanding space programs in countries like India and Japan, coupled with increasing private sector participation in space-related technologies.North America Space Launch Services Market Report:

North America dominates the Space Launch Services market with a size of $3.39 billion in 2023, projected to reach $5.85 billion by 2033. The presence of established players such as SpaceX and Blue Origin, coupled with government investment in NASA and military space initiatives, fuels this growth.South America Space Launch Services Market Report:

The South American market is relatively nascent but shows promise, with a market size of $0.93 billion in 2023, expected to rise to $1.60 billion by 2033. Brazil leads regional efforts in suborbital and orbital launch services, highlighting potential for expansion.Middle East & Africa Space Launch Services Market Report:

In the Middle East and Africa, the market currently stands at $0.68 billion in 2023 and is projected to reach $1.17 billion by 2033. Investment in space projects, particularly in the UAE, is driving optimism and interest in launching satellite services.Tell us your focus area and get a customized research report.

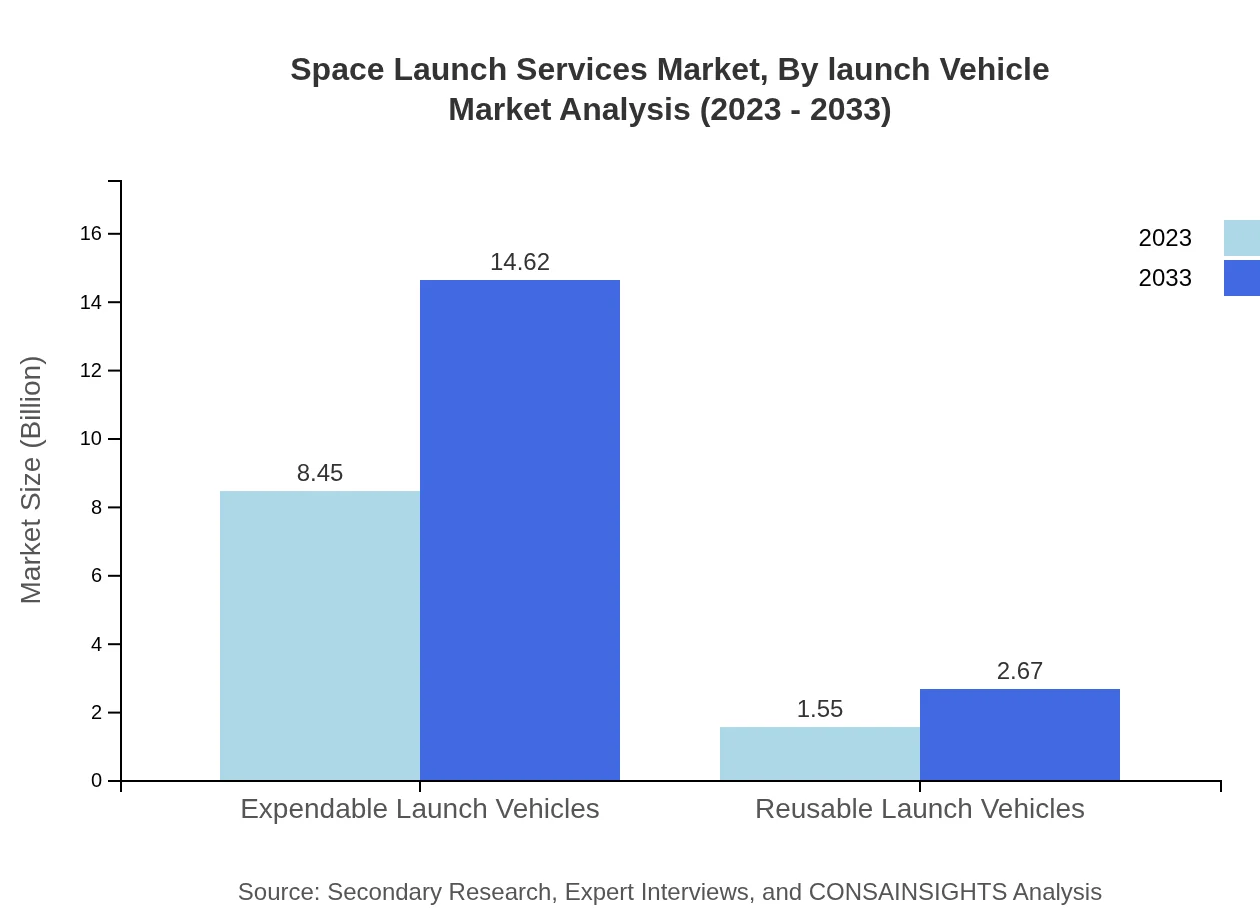

Space Launch Services Market Analysis By Launch Vehicle

The market for launch vehicles in 2023 is led by Expendable Launch Vehicles (ELVs), comprising a substantial 84.54% of the market share. ELVs are crucial for heavier payloads requiring high thrust capabilities. By 2033, it is projected that the ELV segment will continue to dominate. Reusable Launch Vehicles (RLVs), while currently holding a smaller market share of 15.46%, are expected to gain traction, offering cost efficiency and sustainability advantages.

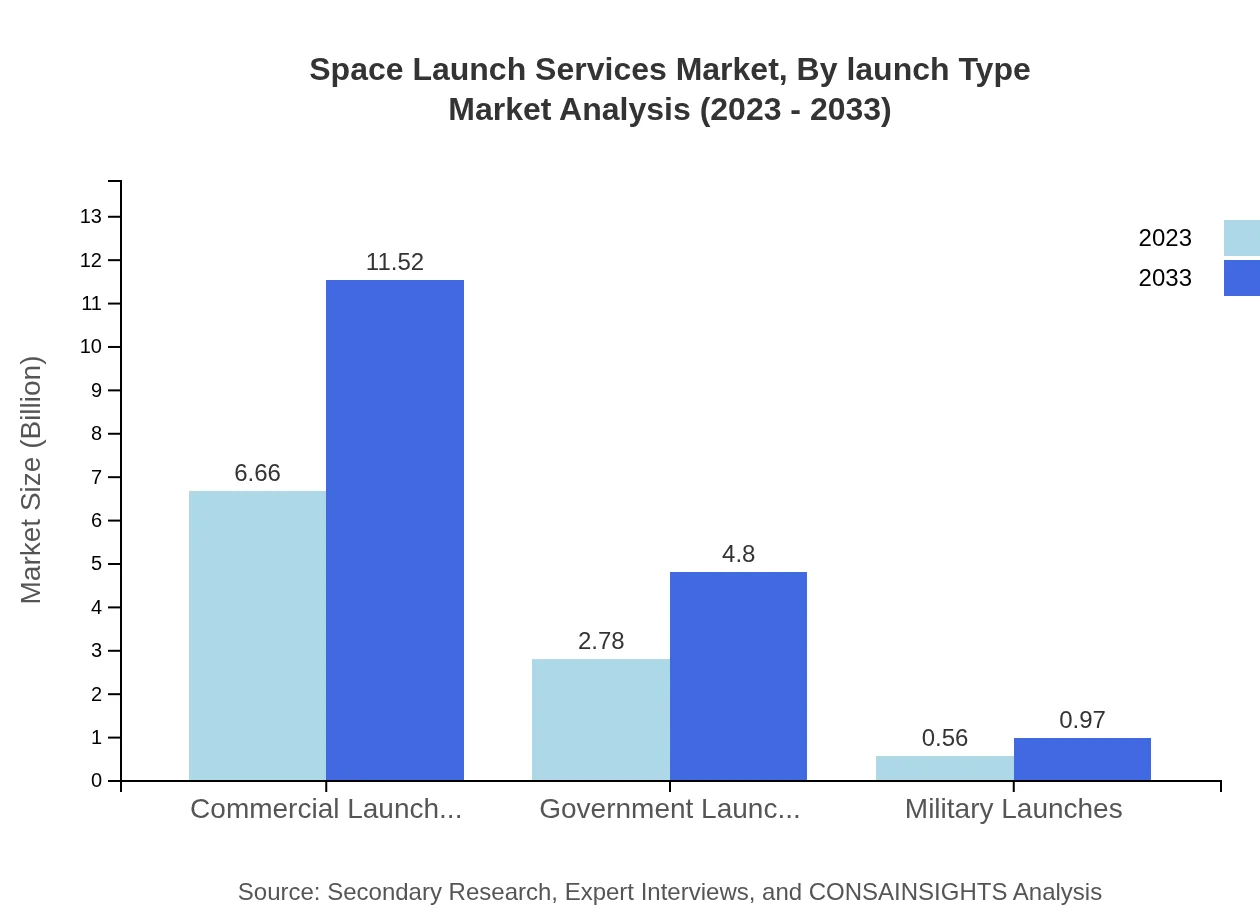

Space Launch Services Market Analysis By Launch Type

Commercial Launches make up 66.61% of the Space Launch Services market in 2023, indicating a strong demand from private enterprises and telecommunications. Government launches account for 27.76%, underscoring their reliance on external commercial services for satellite deployments. Projections indicate that this distribution will remain relatively stable, with commercial launches continuing to drive overall market growth.

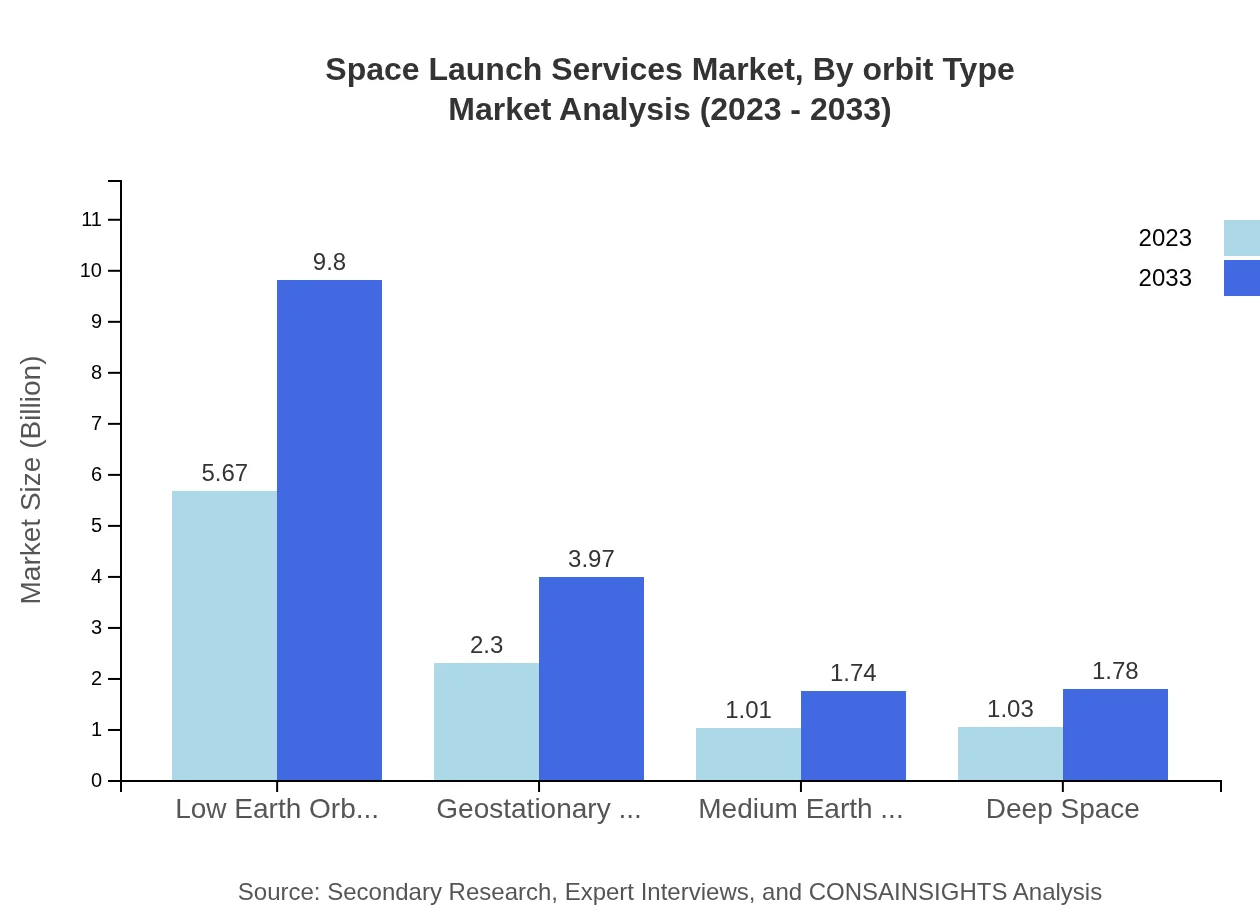

Space Launch Services Market Analysis By Orbit Type

Low Earth Orbit (LEO) represents the largest segment, with a size of $5.67 billion in 2023, and is projected to reach $9.80 billion by 2033. This is driven by the surge in small satellite launches and constellations aimed at global internet coverage. Geostationary Orbit (GEO), now at $2.30 billion, holds significant importance for telecommunications and broadcast services, while Medium Earth Orbit (MEO) and Deep Space segments play critical roles in various applications, including scientific exploration.

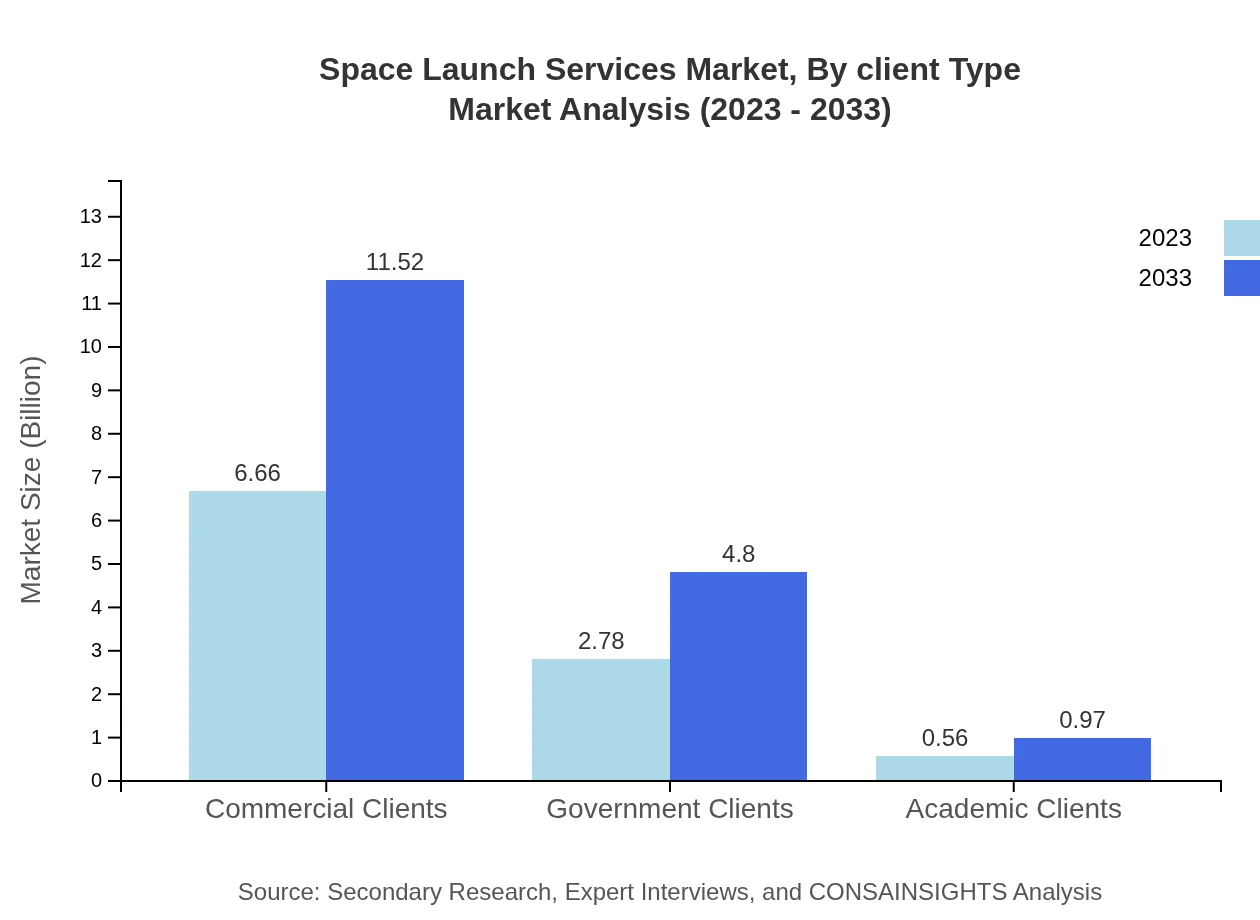

Space Launch Services Market Analysis By Client Type

Commercial Clients dominate the market with a size of $6.66 billion in 2023, showcasing the increasing demand for satellite launches by private enterprises. Government Clients also contribute significantly with $2.78 billion, while Academic Clients, though smaller at $0.56 billion, are crucial for research-based satellite technologies and scientific missions.

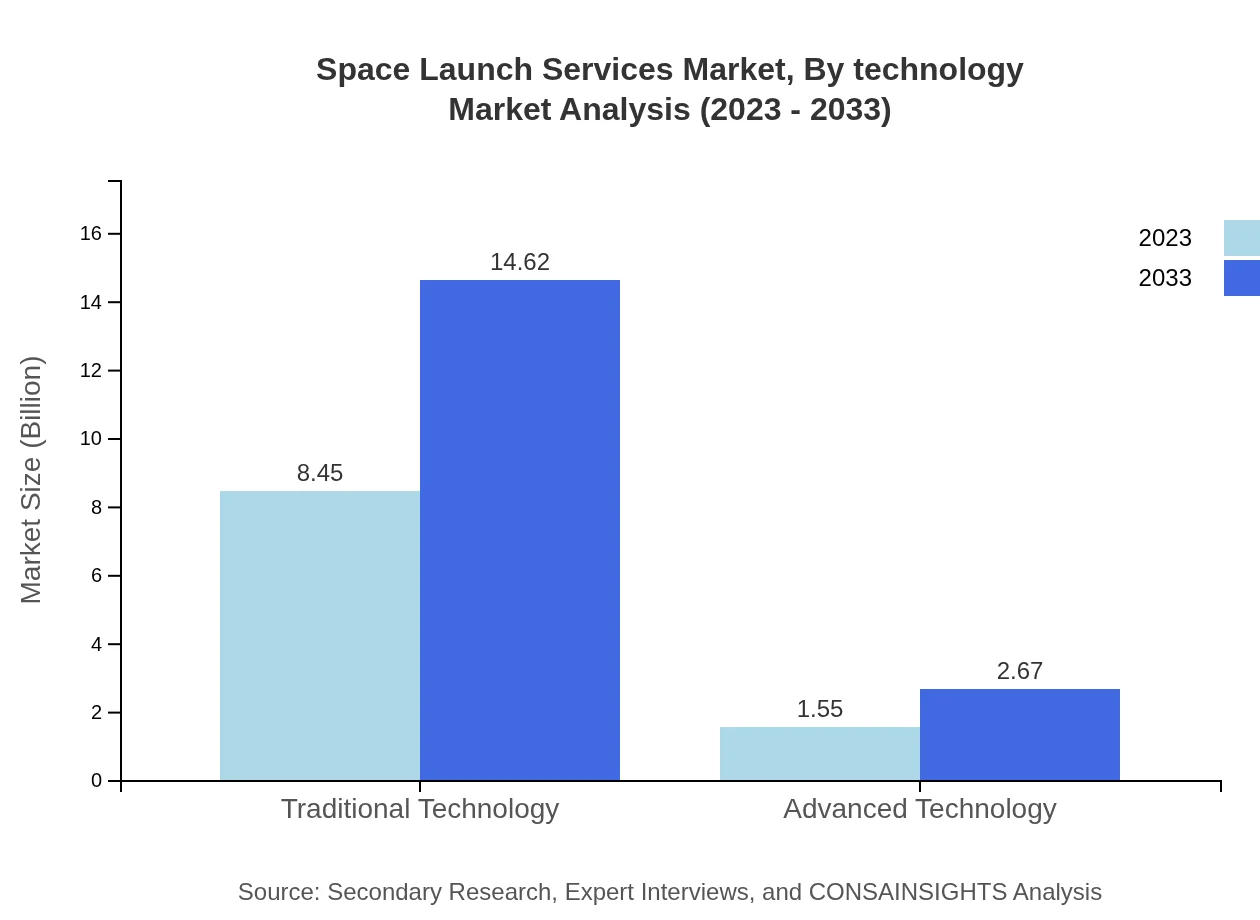

Space Launch Services Market Analysis By Technology

Traditional Technology dominates the market, representing 84.54% in 2023, mainly due to established launch systems. However, Advanced Technology, while currently smaller at 15.46%, is anticipated to grow as innovations in propulsion and reusable launch systems are developed.

Space Launch Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Space Launch Services Industry

SpaceX:

A leader in the private space launch sector, known for its Falcon 9 and Falcon Heavy rockets, introducing reusable technology and significantly reducing launch costs.Arianespace:

European leader in launch services, operating the Ariane 5 and upcoming Ariane 6, focusing on providing reliable launch solutions for satellites.Rocket Lab:

Specializes in small satellite launches with its Electron rocket, emphasizing flexibility and cost-effectiveness for commercial and government clients.Blue Origin:

Innovative aerospace manufacturer focused on RLV and suborbital flights, contributing heavily to commercial space economics.Northrop Grumman:

Provides launch services and spacecraft, notably through its Antares rocket and Cygnus spacecraft for cargo missions to the ISS.We're grateful to work with incredible clients.

FAQs

What is the market size of space Launch Services?

The space launch services market is projected to reach approximately $10 billion by 2033, growing at a CAGR of 5.5%. The market size for 2023 is significant, indicating a robust future for space access technologies.

What are the key market players or companies in the space Launch Services industry?

Key players in the space launch services industry include SpaceX, Arianespace, United Launch Alliance (ULA), and Northrop Grumman, which lead in technology and service offerings across both commercial and government sectors.

What are the primary factors driving the growth in the space Launch Services industry?

Growth in the space launch services industry is driven by increasing satellite deployment, advancements in rocket technology, growing demand from commercial clients, and governmental support for space exploration initiatives.

Which region is the fastest Growing in the space Launch Services?

The fastest-growing region in the space launch services market is Europe, projected to grow from $3.11 billion in 2023 to $5.38 billion by 2033, followed closely by North America, demonstrating significant advancements and investments.

Does ConsaInsights provide customized market report data for the space Launch Services industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the space launch services industry, allowing clients to address their specific research needs and market inquiries comprehensively.

What deliverables can I expect from this space Launch Services market research project?

From this space launch services market research project, you can expect detailed reports on market size, trends, segmentation, competitive landscape, and regional insights to aid in strategic planning and decision-making.

What are the market trends of space Launch Services?

Market trends in space launch services include a shift towards reusable launch systems, increased participation from private companies, and the expansion of satellite constellations, driving demand for effective launch solutions.