Spc Exchange Market Report

Published Date: 31 January 2026 | Report Code: spc-exchange

Spc Exchange Market Size, Share, Industry Trends and Forecast to 2033

This market report offers comprehensive insights into the Spc Exchange, covering current trends, forecasts, and segmented data from 2023 to 2033. The report provides investors and stakeholders with essential metrics, including market size and CAGR, as well as regional and technology-specific analyses.

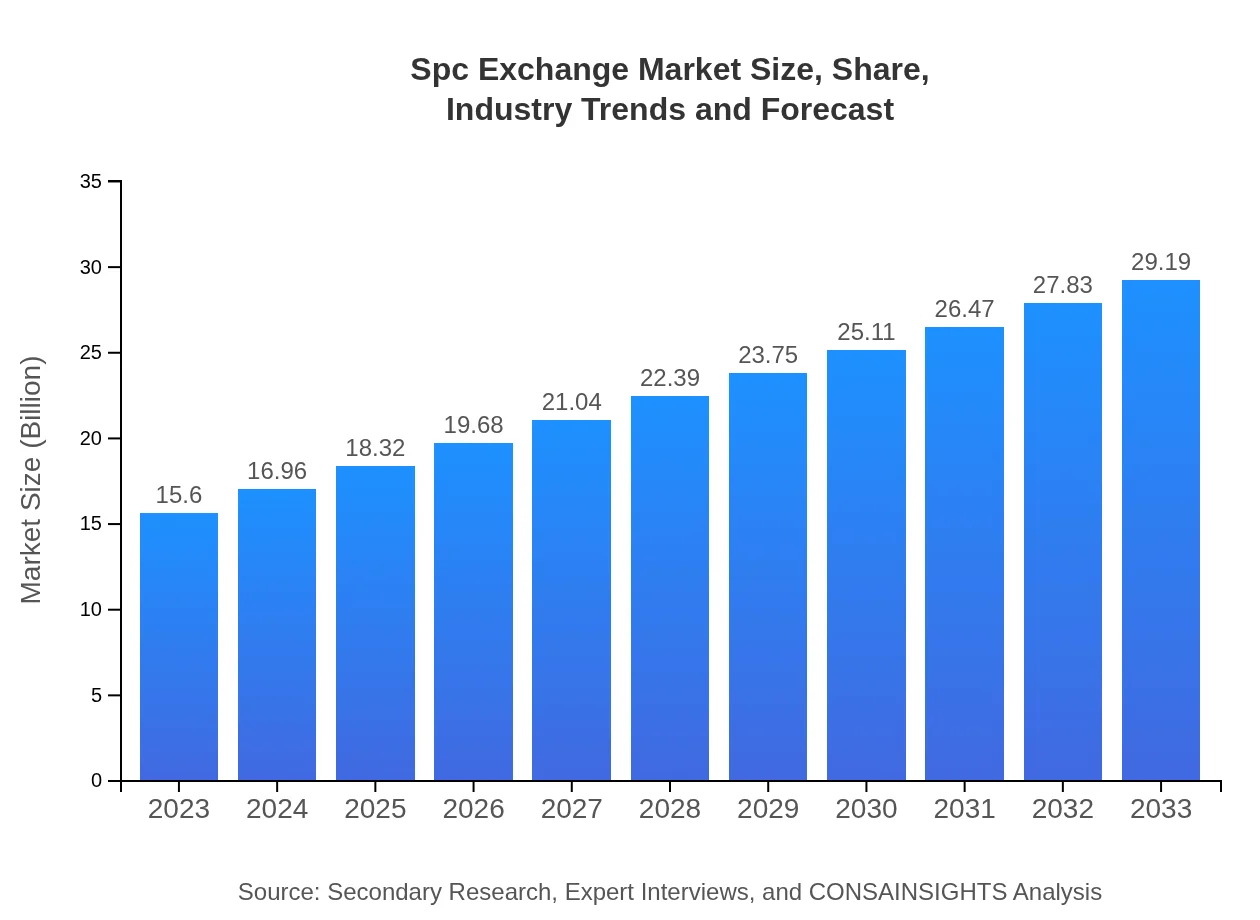

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $29.19 Billion |

| Top Companies | SPC Solutions Inc., Quality Gurus LLC, Statistical Process Controls Ltd. |

| Last Modified Date | 31 January 2026 |

Spc Exchange Market Overview

Customize Spc Exchange Market Report market research report

- ✔ Get in-depth analysis of Spc Exchange market size, growth, and forecasts.

- ✔ Understand Spc Exchange's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Spc Exchange

What is the Market Size & CAGR of Spc Exchange market in 2023?

Spc Exchange Industry Analysis

Spc Exchange Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Spc Exchange Market Analysis Report by Region

Europe Spc Exchange Market Report:

Europe's Spc Exchange market is valued at $4.38 billion in 2023, anticipated to grow to $8.20 billion by 2033. The region's strict quality regulations, combined with the push for digital transformation in industries, drive significant adoption of SPC systems.Asia Pacific Spc Exchange Market Report:

In the Asia-Pacific region, the Spc Exchange market is valued at approximately $3.04 billion in 2023, with projections to reach $5.69 billion by 2033. The growing manufacturing sector and increased scrutiny on quality in emerging economies drive market growth.North America Spc Exchange Market Report:

With a market size of $5.41 billion in 2023, the North American region is set to grow to approximately $10.13 billion by 2033. The extensive adoption of advanced manufacturing processes and rigorous regulatory compliance, particularly in the healthcare sector, support this growth trajectory.South America Spc Exchange Market Report:

The South American market for Spc Exchange is currently valued at $0.79 billion in 2023 and is expected to grow to $1.48 billion by 2033. Challenges such as economic fluctuations may hinder growth; however, sectors like agriculture are increasingly adopting SPC methods.Middle East & Africa Spc Exchange Market Report:

The Middle East and Africa region shows a market size of $1.97 billion in 2023, expected to reach $3.68 billion by 2033. The increasing focus on quality in various sectors and infrastructural improvements in the region contribute positively to the market.Tell us your focus area and get a customized research report.

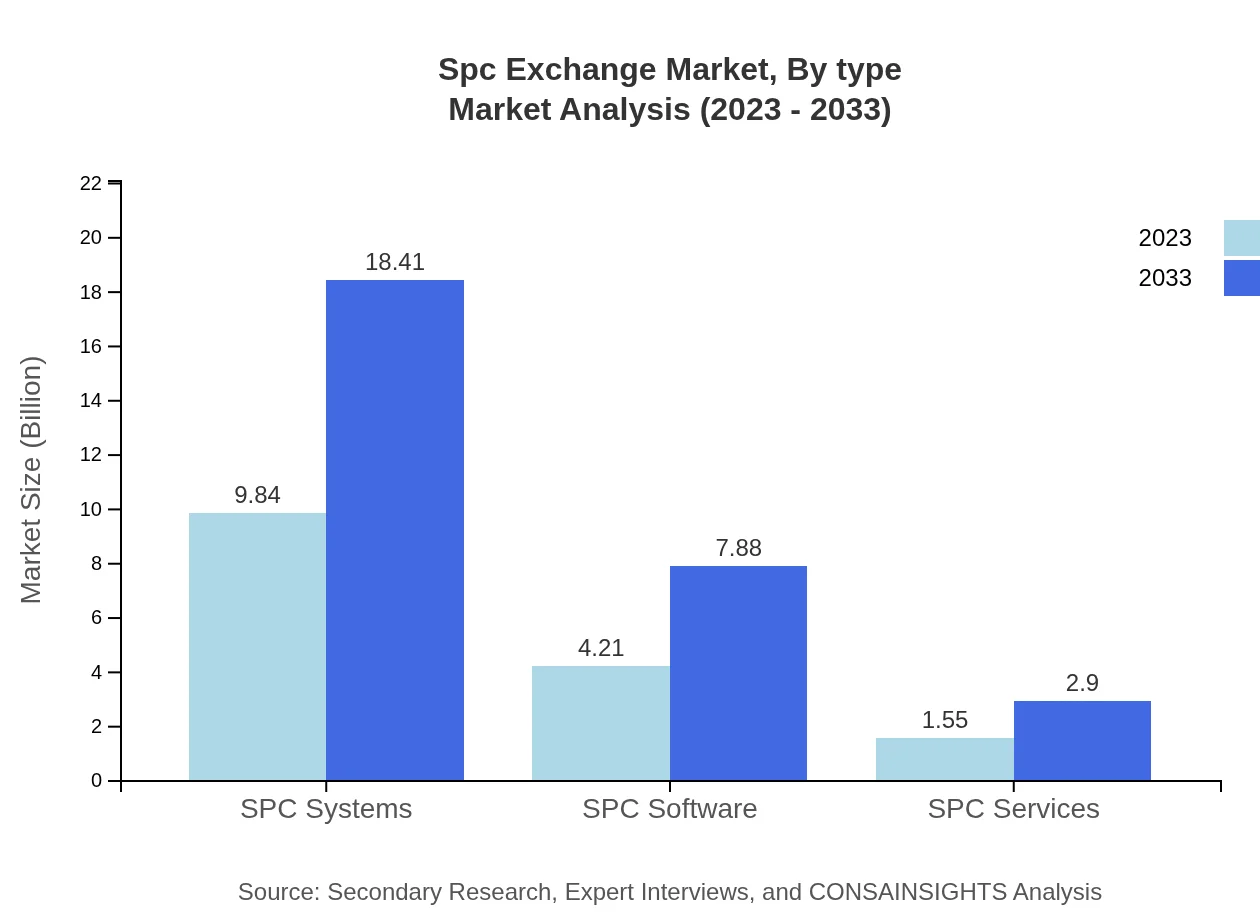

Spc Exchange Market Analysis By Type

The SPC-Exchange market is segmented into various types, including SPC Systems, SPC Software, and SPC Services. In 2023, SPC Systems dominate the market with a size of $9.84 billion and are expected to grow to $18.41 billion by 2033, holding the largest market share of 63.08%.

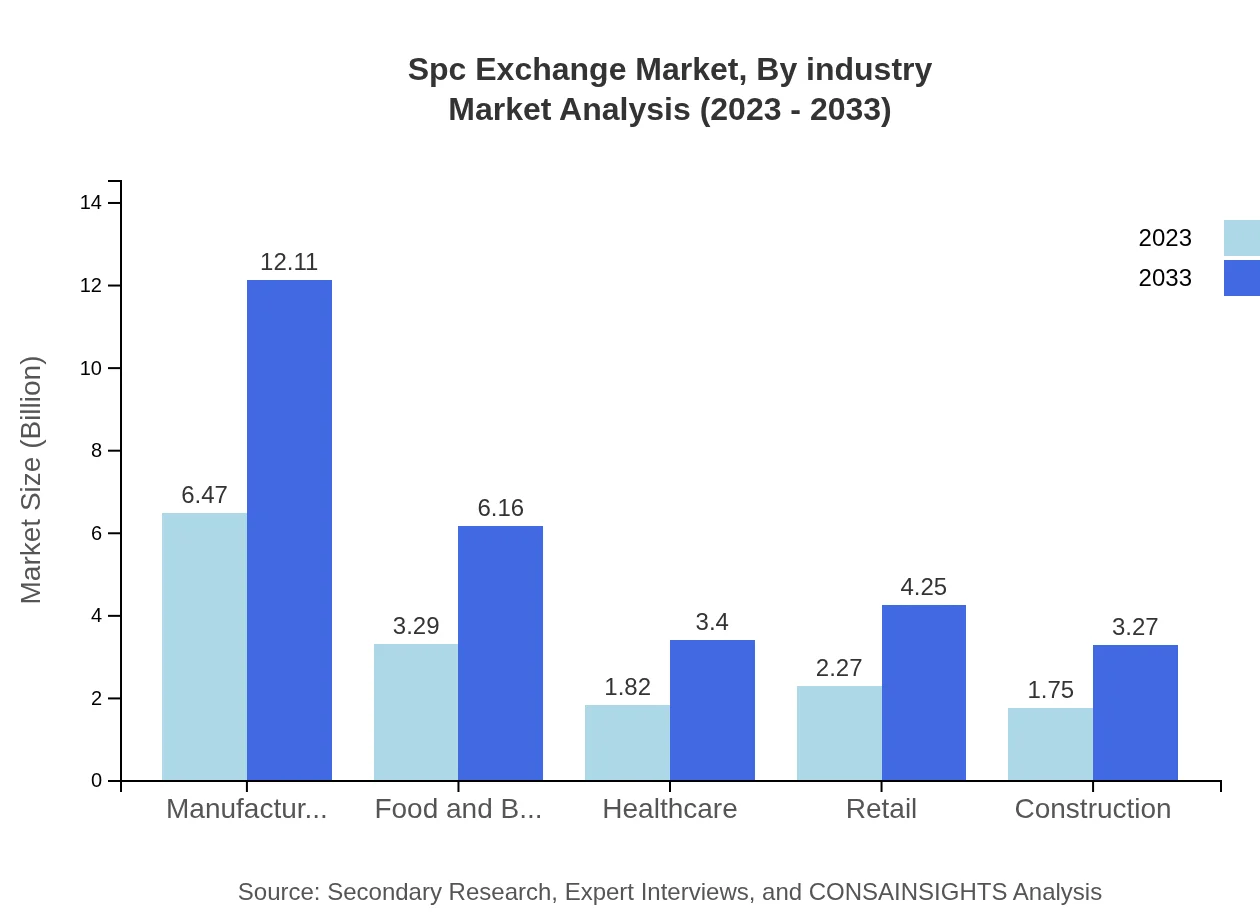

Spc Exchange Market Analysis By Industry

Key industries such as manufacturing lead the market with a size of $6.47 billion in 2023 and projected growth to $12.11 billion by 2033, contributing significantly to the overall market. Other prominent sectors include food and beverage, healthcare, retail, and construction.

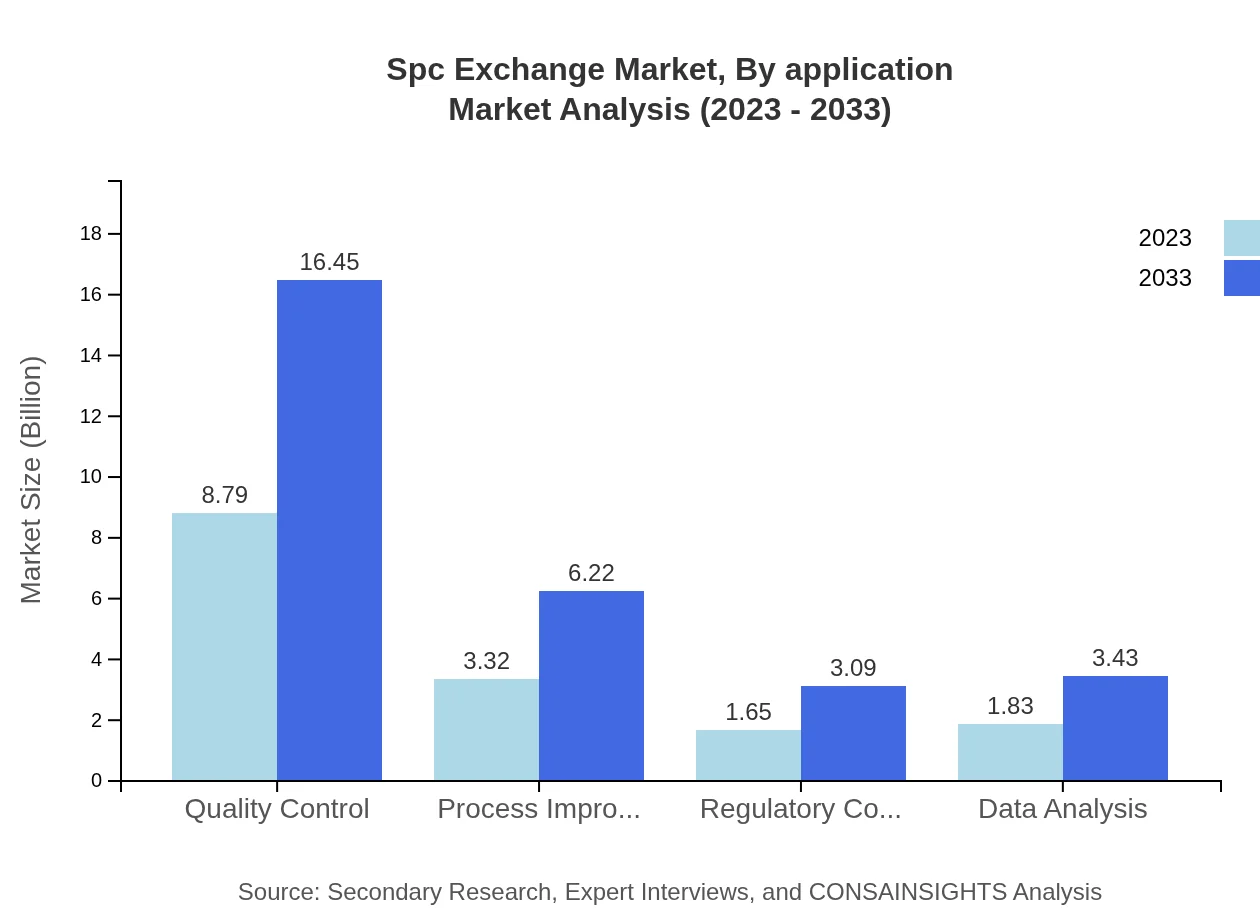

Spc Exchange Market Analysis By Application

Applications of SPC, such as quality control, regulatory compliance, and process improvement, exhibit significant demand. Quality control, alone, stands at $8.79 billion in 2023, expected to double by 2033, showcasing the critical role of SPC in maintaining industry standards.

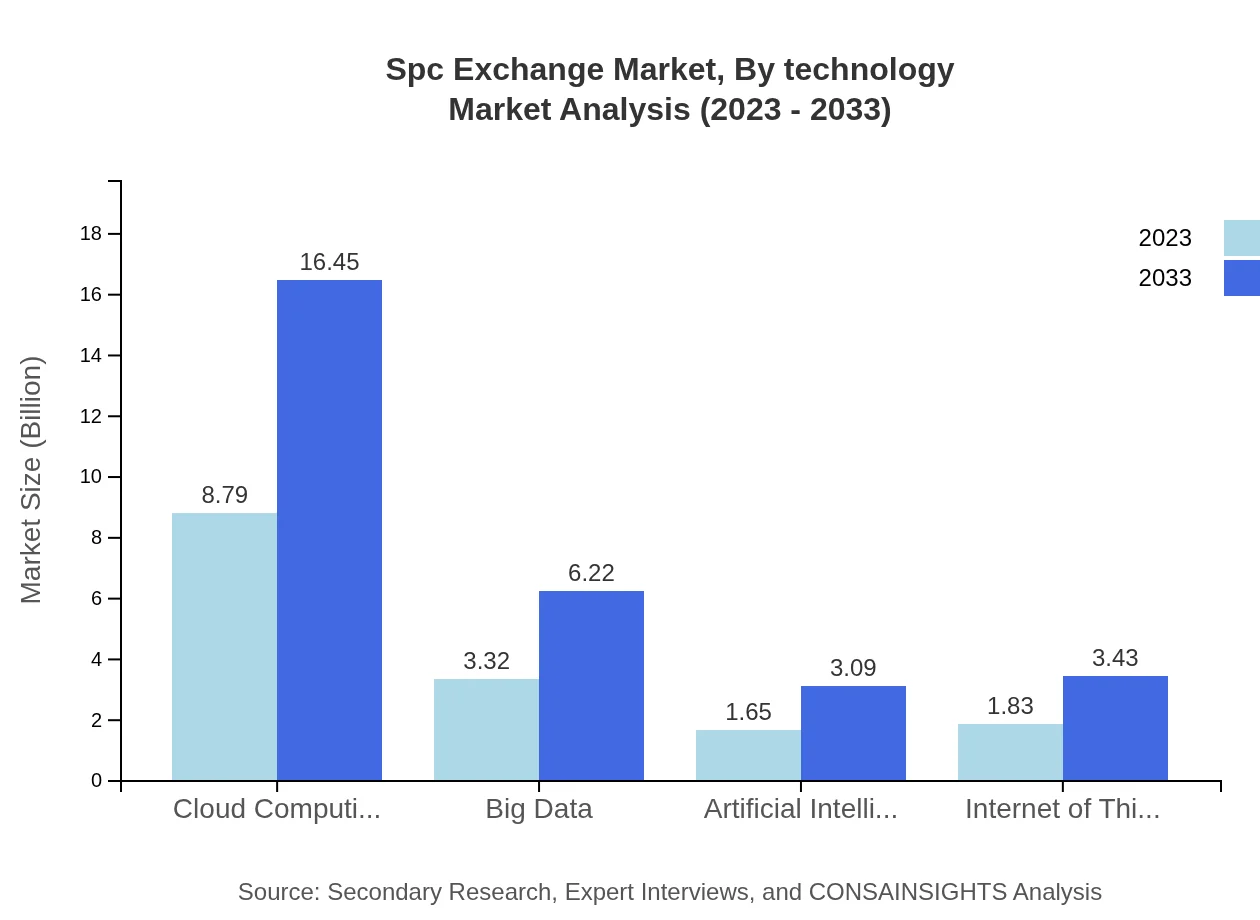

Spc Exchange Market Analysis By Technology

Innovations in technology, particularly in cloud computing, big data analytics, and AI, are transforming the SPC landscape. These technologies enable real-time monitoring, enhanced data collection, and improved decision-making, further propelling the market.

Spc Exchange Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Spc Exchange Industry

SPC Solutions Inc.:

A leading provider of SPC software and services, SPC Solutions Inc. specializes in helping organizations improve process control and quality management across various industries.Quality Gurus LLC:

Quality Gurus LLC offers comprehensive SPC systems and consulting services, focusing on producing high-quality outcomes for their clients in manufacturing and healthcare sectors.Statistical Process Controls Ltd.:

Dedicated to delivering innovative SPC solutions, Statistical Process Controls Ltd. serves a diverse clientele, integrating advanced technologies to streamline operations.We're grateful to work with incredible clients.

FAQs

What is the market size of spc Exchange?

The SPC Exchange market is projected to grow from $15.6 billion in 2023 to an estimated market size reflecting a CAGR of 6.3% over the next decade. This growth indicates a robust demand for SPC solutions across various sectors.

What are the key market players or companies in this spc Exchange industry?

Key players in the SPC Exchange industry include leading software providers and high-tech firms specializing in quality control and process improvement solutions. Their innovative technologies and services play a crucial role in advancing industry standards and meeting growing demands.

What are the primary factors driving the growth in the spc Exchange industry?

Factors fueling growth in the SPC Exchange industry include rising demand for automation, increasing emphasis on quality control, advancements in cloud computing, and the integration of IoT technologies. These elements enhance productivity and ensure compliance with regulatory standards.

Which region is the fastest Growing in the spc Exchange?

The fastest-growing region in the SPC Exchange market is North America, with projected market expansion from $5.41 billion in 2023 to $10.13 billion in 2033. Europe and Asia Pacific are also notable growth regions due to their technological advancements.

Does ConsaInsights provide customized market report data for the spc Exchange industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the SPC Exchange industry. Clients can request detailed insights, market segment analyses, and forecasting to meet their unique strategic needs.

What deliverables can I expect from this spc Exchange market research project?

Deliverables from the SPC Exchange market research project typically include comprehensive reports, market sizing data, segmentation analysis, growth forecasts, competitive landscape assessments, and identified trends crucial for strategic planning.

What are the market trends of spc Exchange?

Current market trends in the SPC Exchange sector include an increasing adoption of AI for data analysis, a shift towards cloud-based solutions, and the integration of big data analytics. These trends are pivotal for enhancing quality control processes.