Special Steel Market Report

Published Date: 02 February 2026 | Report Code: special-steel

Special Steel Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Special Steel market, detailing insights from 2023 to 2033. It covers market size, growth trends, regional analysis, technology impacts, product performance, key industry leaders, and forecasts, aimed at guiding stakeholders in strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

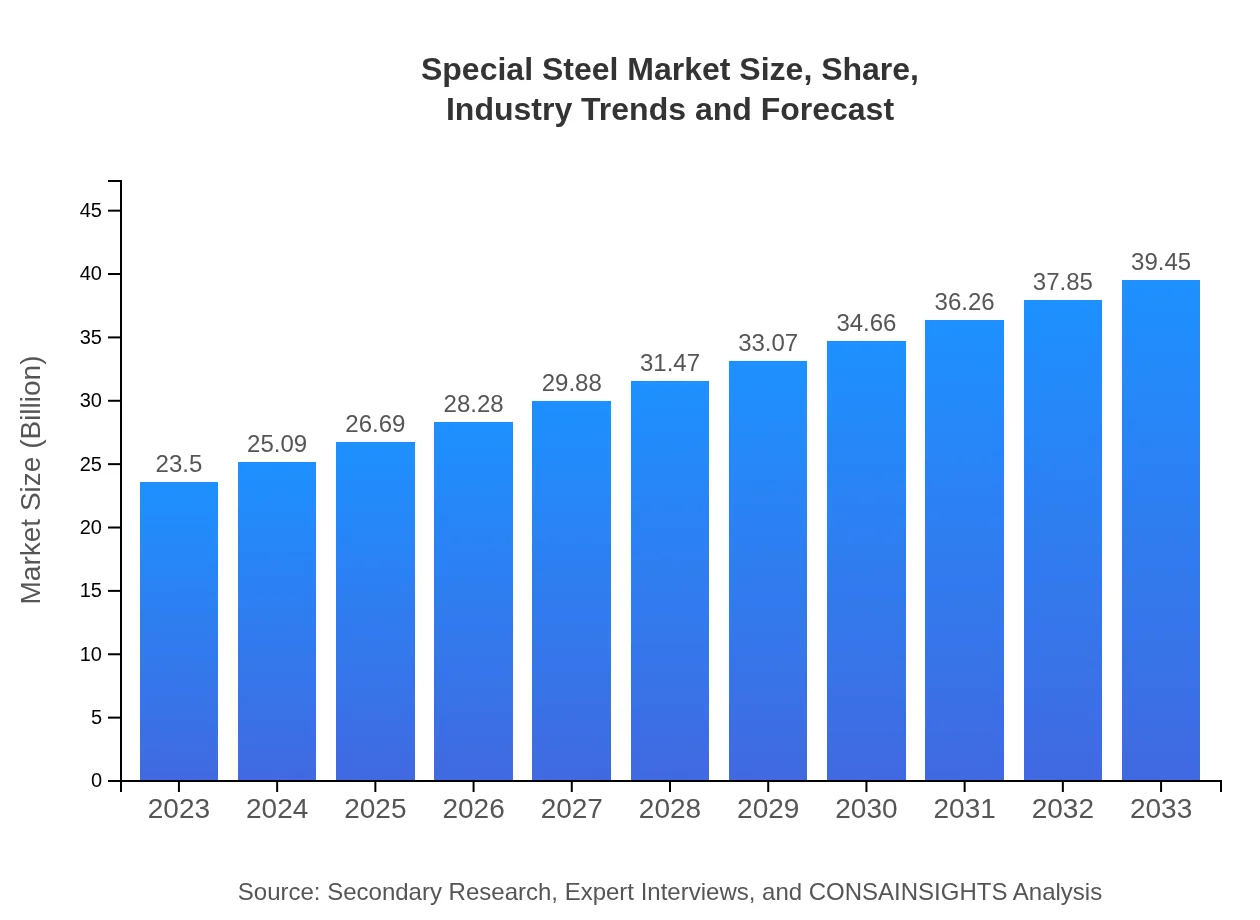

| 2023 Market Size | $23.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $39.45 Billion |

| Top Companies | ArcelorMittal, Nippon Steel Corporation, POSCO |

| Last Modified Date | 02 February 2026 |

Special Steel Market Overview

Customize Special Steel Market Report market research report

- ✔ Get in-depth analysis of Special Steel market size, growth, and forecasts.

- ✔ Understand Special Steel's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Special Steel

What is the Market Size & CAGR of Special Steel market in 2023?

Special Steel Industry Analysis

Special Steel Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Special Steel Market Analysis Report by Region

Europe Special Steel Market Report:

Europe is anticipated to increase from $7.12 billion in 2023 to $11.94 billion by 2033. The focus on renewable energy and advanced manufacturing techniques within the EU is expected to boost demand for special steel, fostering sustainable development practices across the continent.Asia Pacific Special Steel Market Report:

The Asia Pacific region is projected to show strong growth, from $4.10 billion in 2023 to $6.89 billion in 2033. Countries like China and India are leading this growth, spurred by urbanization and industrial expansion, enhancing demand for special steel in construction and manufacturing.North America Special Steel Market Report:

North America holds a significant market presence, with projections from $9.06 billion in 2023 to $15.21 billion in 2033. The growth is fueled by advancements in automotive manufacturing and aerospace technologies, alongside increased infrastructure development initiatives in the region.South America Special Steel Market Report:

The South American market is expected to grow from $2.21 billion in 2023 to $3.72 billion by 2033. The increasing investment in infrastructural development, particularly in Brazil and Argentina, is driving the demand for special steel, particularly in construction applications.Middle East & Africa Special Steel Market Report:

The Middle East and Africa market is projected to grow from $1.01 billion in 2023 to $1.69 billion in 2033. Oil and gas sector developments, along with significant investments in infrastructure, are key growth drivers for special steel in this region.Tell us your focus area and get a customized research report.

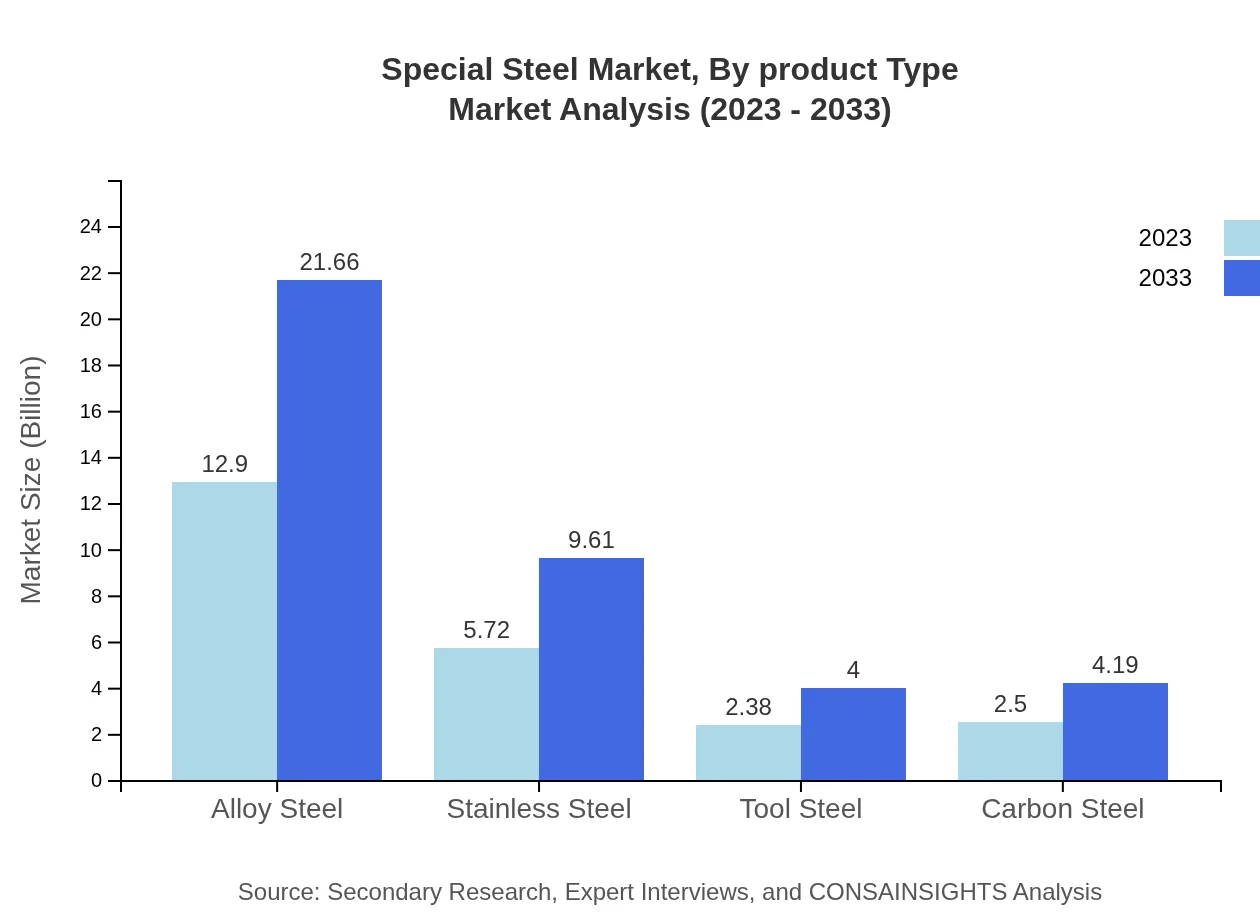

Special Steel Market Analysis By Product Type

In terms of product type, Alloy Steel leads the market, valued at $12.90 billion in 2023 with a projected increase to $21.66 billion by 2033. Stainless Steel follows, currently valued at $5.72 billion, set to grow to $9.61 billion. Tool Steel and Carbon Steel segments are also vital, reflecting the diverse applications and demands in industries.

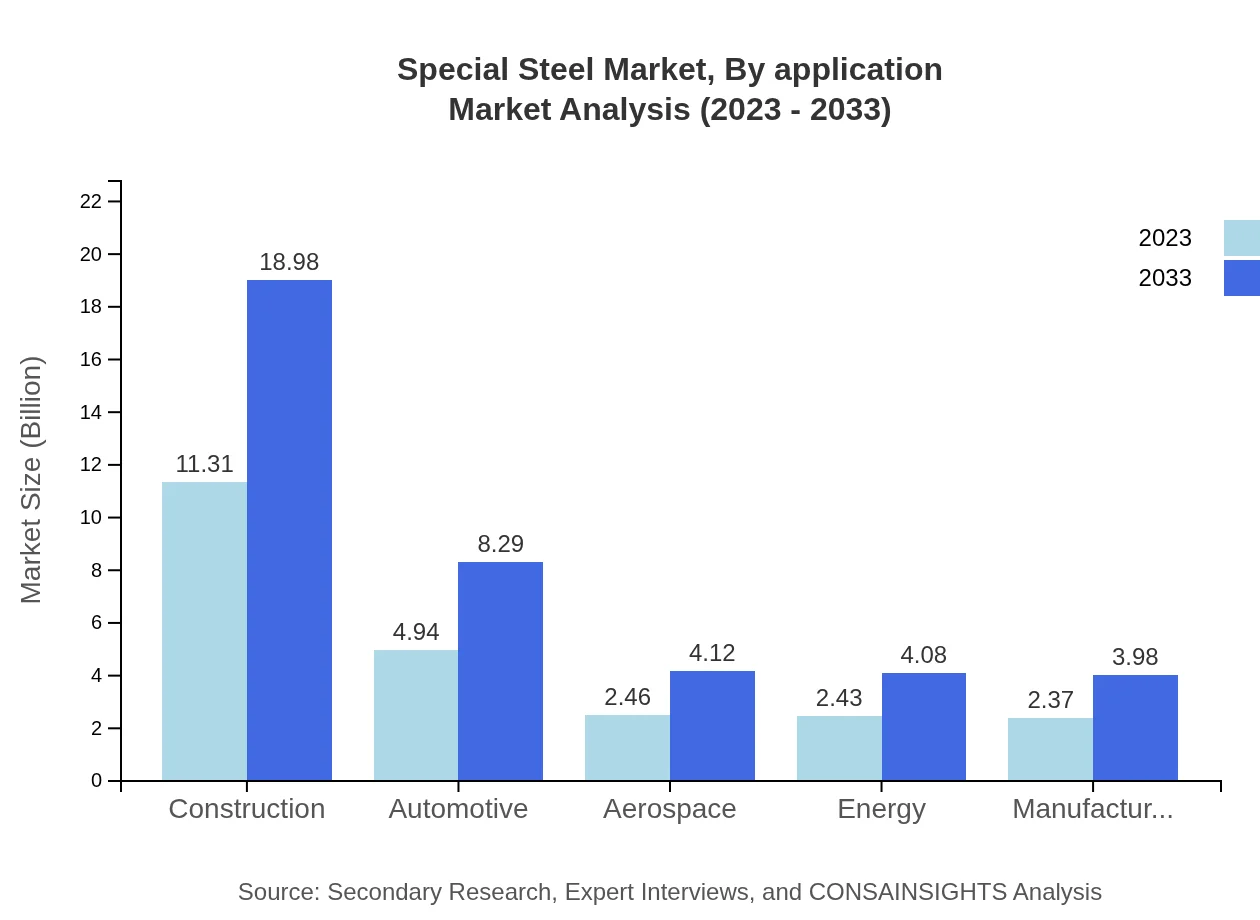

Special Steel Market Analysis By Application

The application-based analysis highlights Construction as the leading segment, commanding $11.31 billion in 2023 and expected to reach $18.98 billion by 2033. The Automotive segment is also significant, currently at $4.94 billion, and projected to grow due to increased vehicle production and technological advancements.

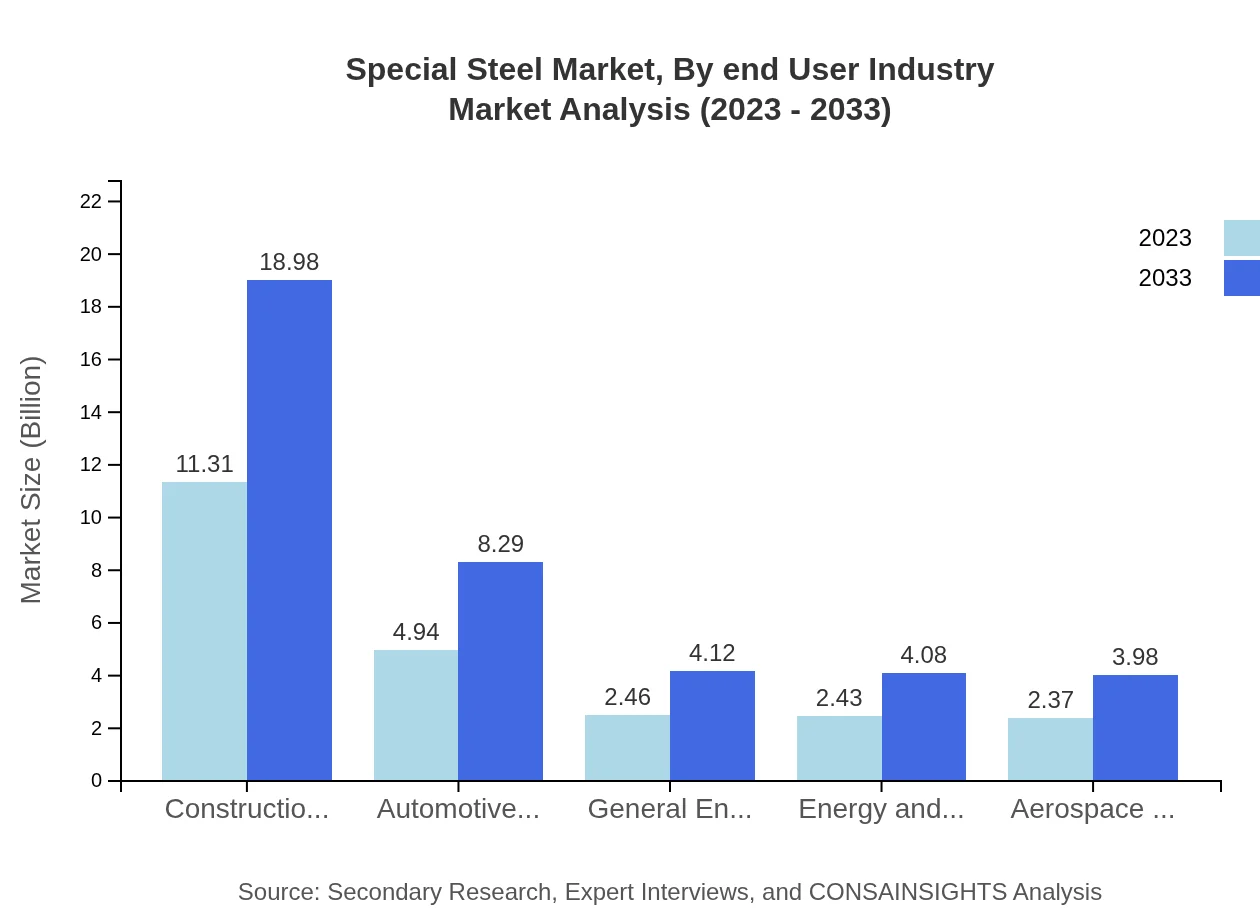

Special Steel Market Analysis By End User Industry

Key end-user industries include construction, automotive, aerospace, energy, and manufacturing, each showing substantial market shares. The construction industry holds a 48.11% market share in 2023, highlighting the critical role of special steel in infrastructure projects.

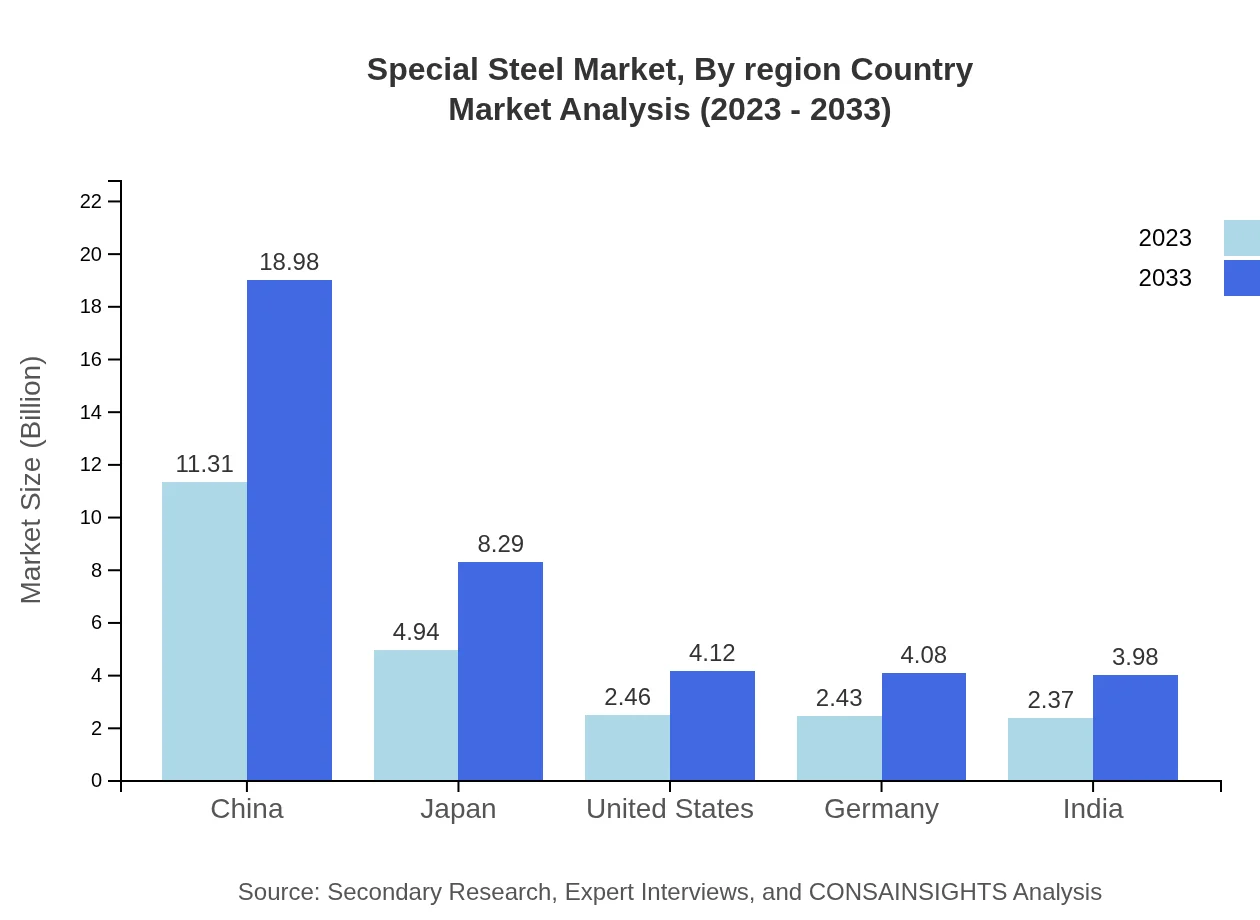

Special Steel Market Analysis By Region Country

Regionally, China dominates the special steel market, accounting for $11.31 billion in 2023. Japan and the United States also contribute significantly, reflecting the matured industrial landscapes that demand high-performance steel solutions.

Special Steel Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Special Steel Industry

ArcelorMittal:

A leading global steel manufacturer, ArcelorMittal operates in over 60 countries, providing a wide range of special steel products known for their quality and reliability.Nippon Steel Corporation:

Japan's largest steel producer, Nippon Steel specializes in high-performance alloy and stainless steels, with a strong focus on advanced manufacturing technologies and sustainability.POSCO:

A South Korean multinational, POSCO is renowned for its innovation in steel-making technologies, producing special steel products for diverse applications across various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of Special Steel?

The global market size for special steel is projected at approximately $23.5 billion in 2023, with a compound annual growth rate (CAGR) of 5.2%. By 2033, this market is expected to see significant growth, reflecting increasing demand across various industries.

What are the key market players or companies in the Special Steel industry?

Key players in the special steel industry include top steel manufacturers and leading automotive parts suppliers. These companies are integral in supplying specialized high-grade steel used for enhanced performance in sectors such as automotive and aerospace.

What are the primary factors driving the growth in the Special Steel industry?

The primary factors driving growth in the special steel industry include increased use in automotive manufacturing, heightened demand for durable construction materials, and advancements in aerospace technology, influencing innovations and competitive dynamics in the market.

Which region is the fastest Growing in the Special Steel market?

The North America region is anticipated to be the fastest-growing, with market size projections increasing from $9.06 billion in 2023 to $15.21 billion by 2033. This growth is spurred by rising construction and automotive needs, alongside technological advancements.

Does ConsaInsights provide customized market report data for the Special Steel industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the special steel industry. This enables organizations to gain targeted insights that align with their strategic objectives and operational requirements.

What deliverables can I expect from this Special Steel market research project?

Deliverables from the special steel market research project typically include comprehensive market analysis reports, trend assessments, competitive landscape evaluations, and tailored data insights, which help drive informed decision-making and strategic planning.

What are the market trends of Special Steel?

Current trends in the special steel market include a shift towards high-performance alloys, increasing focus on sustainable manufacturing processes, and the integration of advanced technologies, such as automation and digitization, within production systems.