Speciality Fats And Oils Market Report

Published Date: 31 January 2026 | Report Code: speciality-fats-and-oils

Speciality Fats And Oils Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Speciality Fats and Oils market, examining trends, market size, growth factors, and forecasts from 2023 to 2033. Insights include technological innovations and competitive landscape assessments.

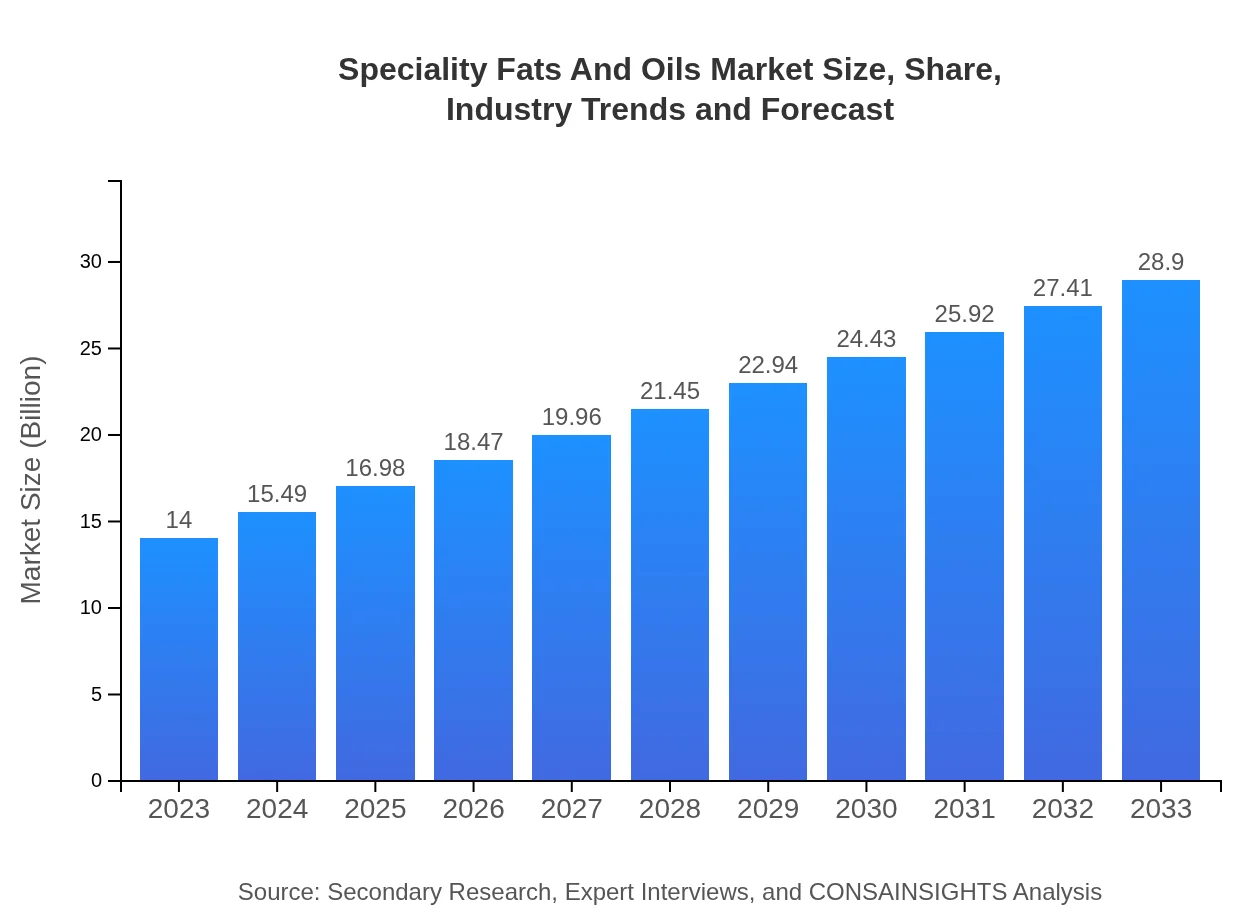

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $14.00 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $28.90 Billion |

| Top Companies | Cargill, Incorporated, Krispy Kreme Doughnut Corporation, Bunge Limited |

| Last Modified Date | 31 January 2026 |

Speciality Fats And Oils Market Overview

Customize Speciality Fats And Oils Market Report market research report

- ✔ Get in-depth analysis of Speciality Fats And Oils market size, growth, and forecasts.

- ✔ Understand Speciality Fats And Oils's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Speciality Fats And Oils

What is the Market Size & CAGR of Speciality Fats And Oils market in 2023?

Speciality Fats And Oils Industry Analysis

Speciality Fats And Oils Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Speciality Fats And Oils Market Analysis Report by Region

Europe Speciality Fats And Oils Market Report:

The European market for speciality fats and oils is set to expand from USD 3.72 billion in 2023 to USD 7.67 billion by 2033. Regulatory support and consumer preferences for sustainable products are significant factors driving this growth.Asia Pacific Speciality Fats And Oils Market Report:

The Asia Pacific region is positioned as one of the fastest-growing markets for speciality fats and oils, expected to grow from USD 2.87 billion in 2023 to USD 5.92 billion in 2033. Factors such as increasing urbanization, a growing middle class, and changing food consumption patterns are contributing to the region's expanding market share.North America Speciality Fats And Oils Market Report:

North America remains a dominant force within the speciality fats and oils domain, with the market projected to rise from USD 4.56 billion in 2023 to USD 9.42 billion by 2033. The increased demand for clean label products in food and beverage, along with a focus on healthy ingredients, is steering market expansion.South America Speciality Fats And Oils Market Report:

In South America, the market for speciality fats and oils is anticipated to escalate from USD 1.14 billion in 2023 to USD 2.36 billion by 2033. Growth is driven by rising health awareness and the adoption of innovative food solutions across several countries.Middle East & Africa Speciality Fats And Oils Market Report:

The Middle East and Africa market is expected to show gradual growth, increasing from USD 1.71 billion in 2023 to USD 3.53 billion by 2033. The rising demand for oils in the food industry, alongside an emphasis on local sourcing, is helping boost market potential.Tell us your focus area and get a customized research report.

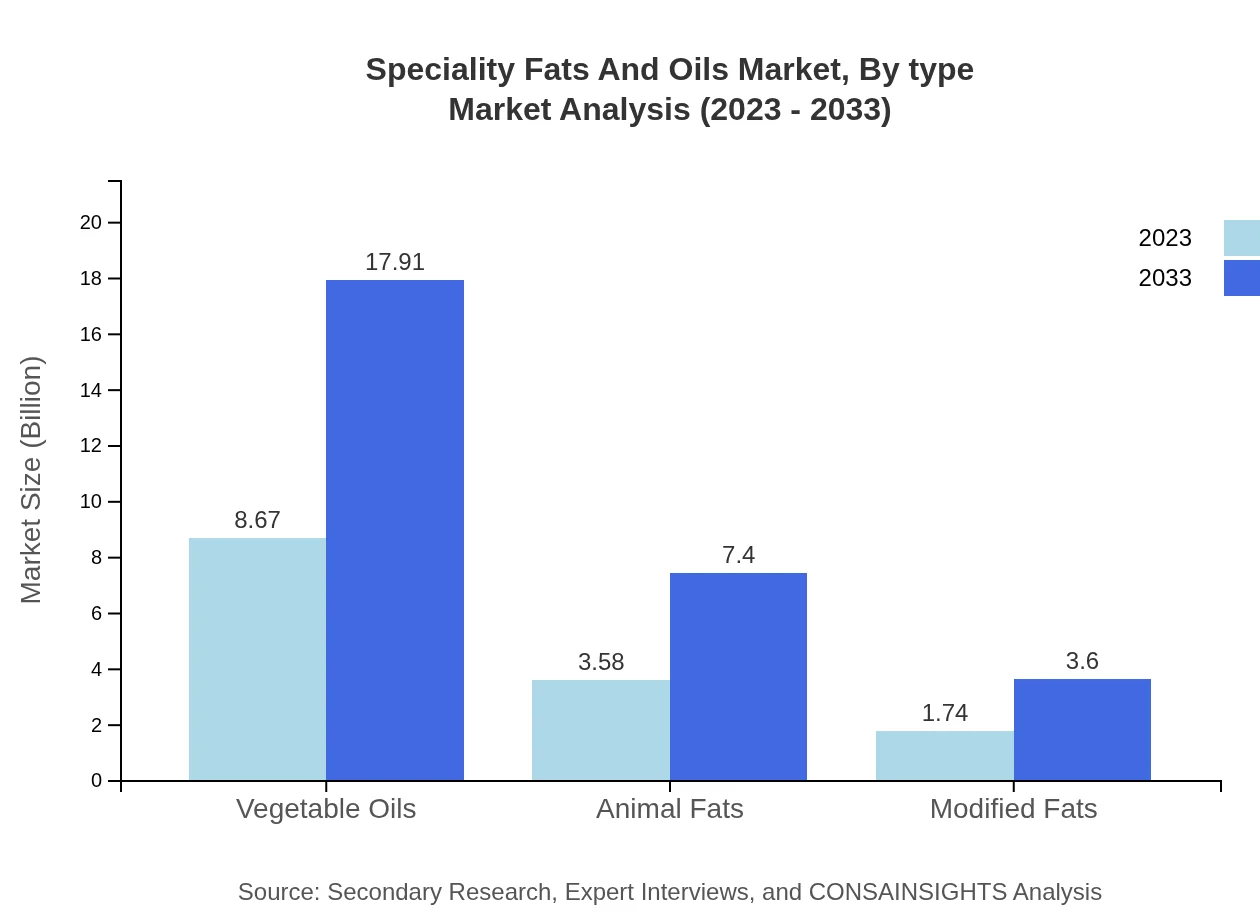

Speciality Fats And Oils Market Analysis By Type

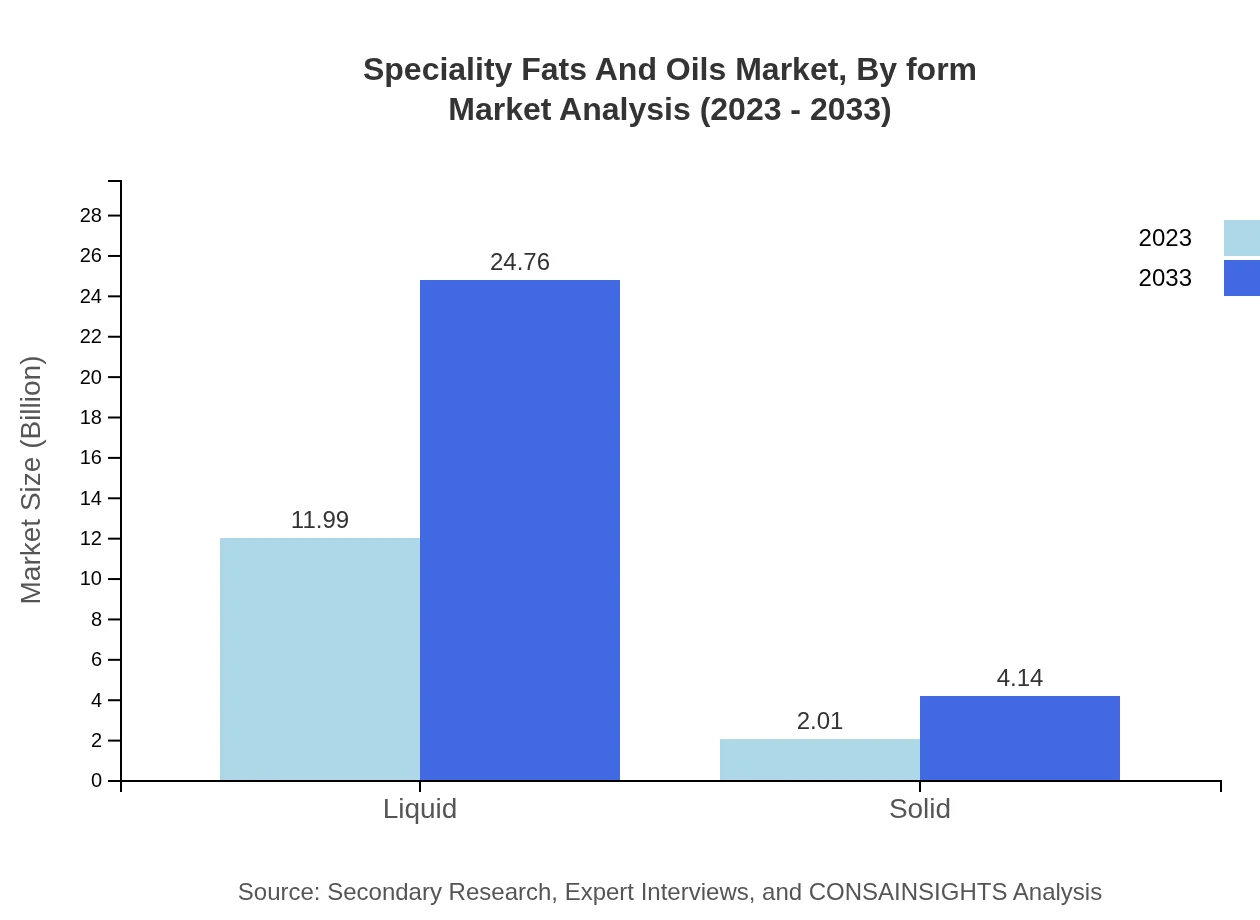

The analysis of the Speciality Fats and Oils market by type illustrates a significant preference for liquid forms, which dominate the market share. In 2023, liquid speciality fats and oils account for a market size of USD 11.99 billion, translating to an 85.67% share. Solid fats showcase a smaller presence with USD 2.01 billion, representing 14.33%. Vegetable oils lead by type with USD 8.67 billion (61.96%), while animal fats and modified fats also play pivotal roles in catering to specific market needs.

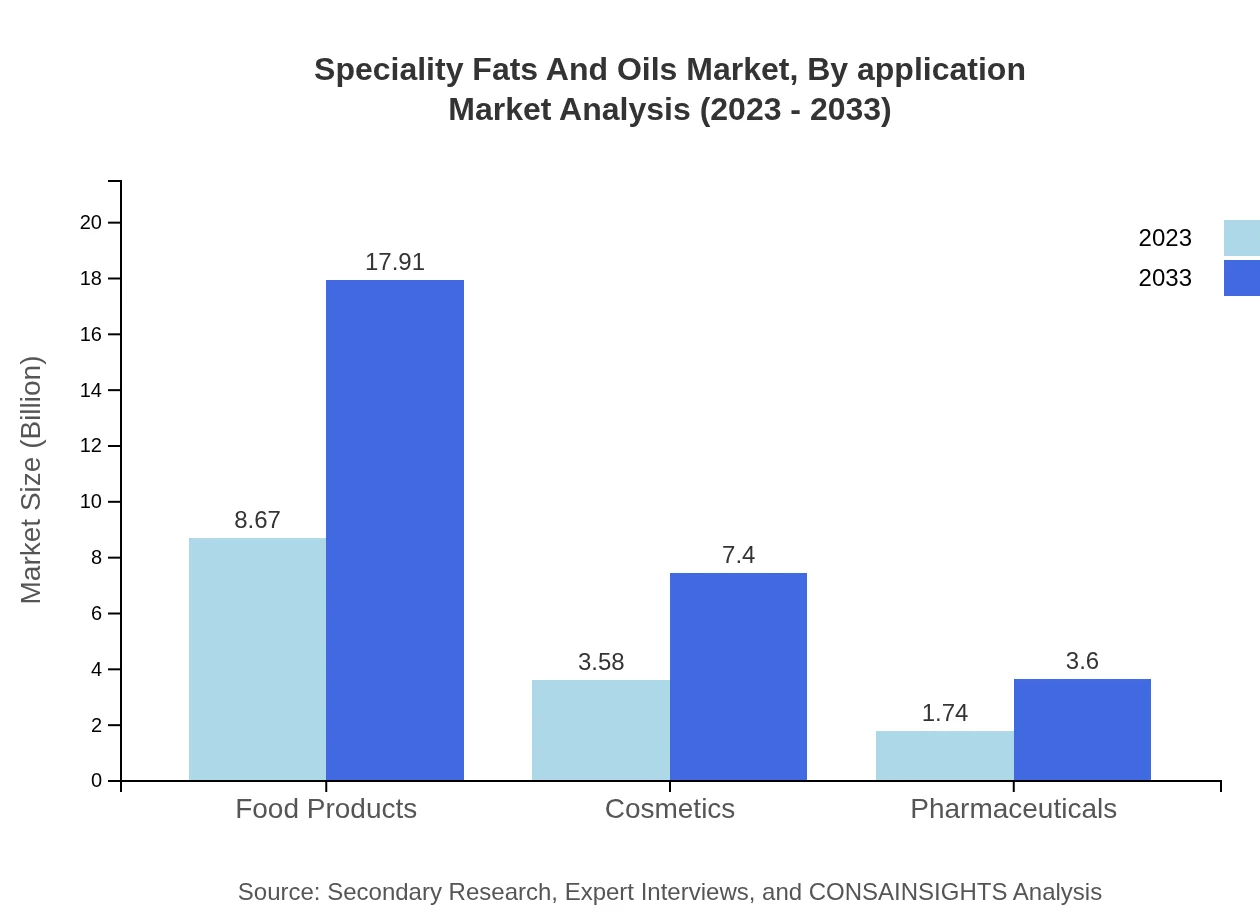

Speciality Fats And Oils Market Analysis By Application

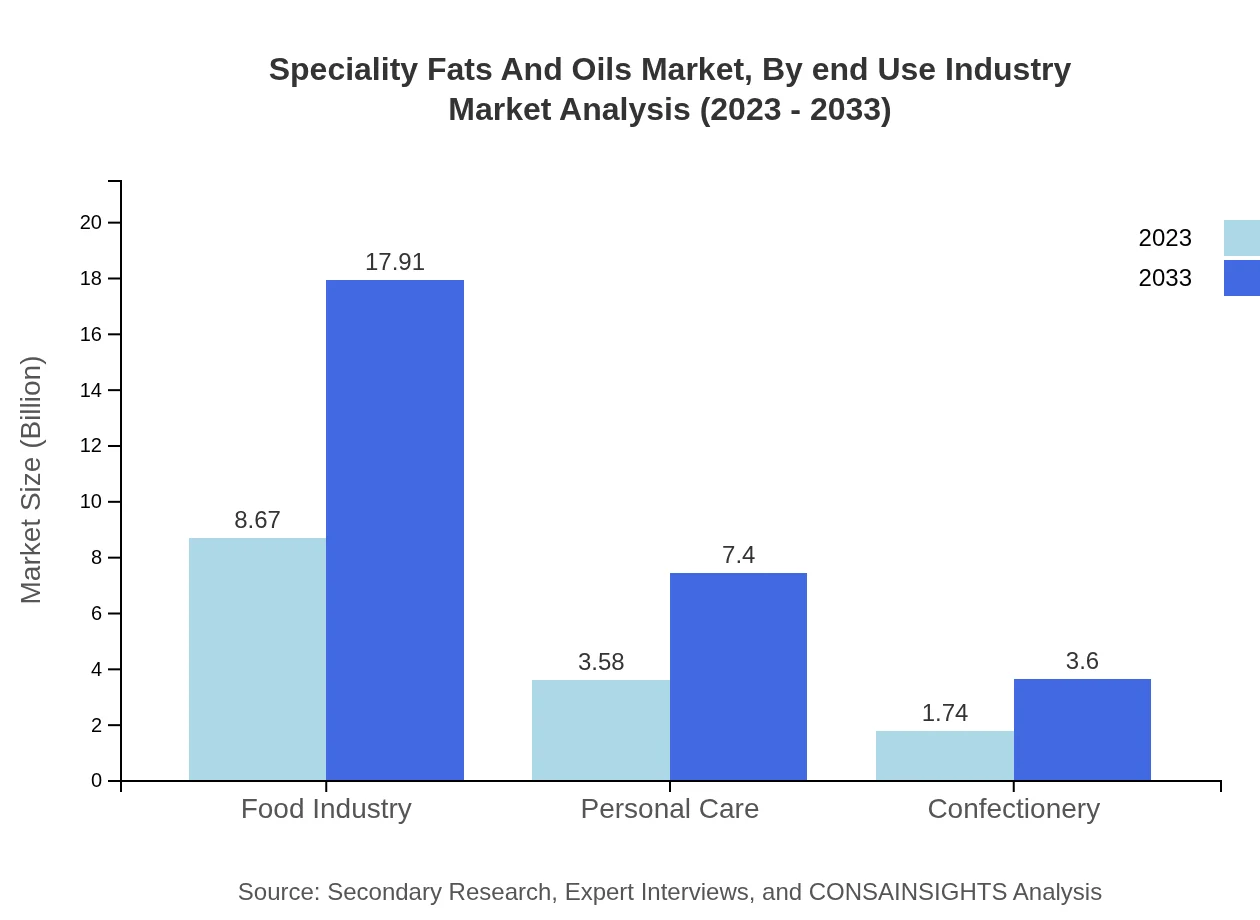

In terms of application, the food industry is the largest consumer segment, valued at USD 8.67 billion in 2023 and maintaining a 61.96% market share. Cosmetics and personal care follow, with significant contributions of USD 3.58 billion and 25.59%, respectively. The pharmaceuticals sector is increasingly absorbing modified fats, representing a growing area of potential within the market.

Speciality Fats And Oils Market Analysis By Form

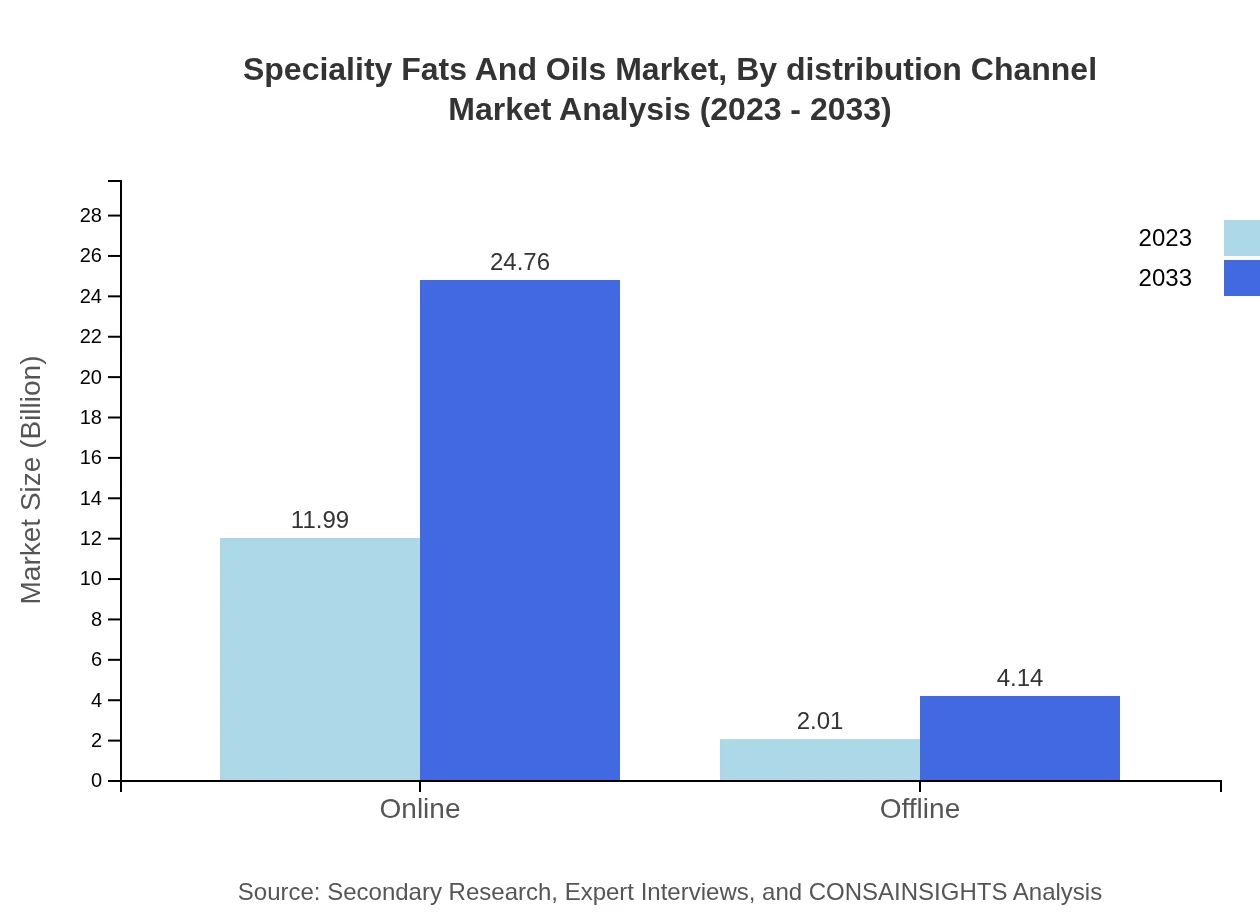

The segment by form is primarily dominated by liquid variants, which showcase robust demand in culinary applications. The liquid form market is projected to reach USD 24.76 billion in 2033, while solid forms are expected to increase to USD 4.14 billion, reflecting evolving consumer preferences and product innovations.

Speciality Fats And Oils Market Analysis By Distribution Channel

With the ongoing digital transformation, the online distribution channel has gained considerable traction, reaching USD 11.99 billion in 2023. The offline segment, though smaller at USD 2.01 billion, still plays an essential role in retail markets, especially in regions with lower internet penetration.

Speciality Fats And Oils Market Analysis By End Use Industry

The Speciality Fats and Oils market, categorized by end-use industries, shows that food manufacturers remain the leading consumers due to the vast range of applications. This segment is set to reach USD 17.91 billion by 2033. The cosmetics sector, while smaller, is projected to grow in significance owing to increased consumer awareness surrounding skincare and natural products.

Speciality Fats And Oils Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Speciality Fats And Oils Industry

Cargill, Incorporated:

A major player in the specialty fats and oils market, Cargill focuses on innovative product solutions that address consumer health and sustainability needs.Krispy Kreme Doughnut Corporation:

Krispy Kreme is known for its high-quality specialty fats used in food production, especially in baking, enhancing the flavor and texture of their products.Bunge Limited:

Bunge has a robust portfolio in oils and fats that combine innovative technology with sustainability, driving their commitment to the Speciality Fats and Oils market.We're grateful to work with incredible clients.

FAQs

What is the market size of speciality Fats And Oils?

The global market size for speciality fats and oils is projected to reach approximately $14 billion by 2033, growing at a CAGR of 7.3% from its current valuation. This growth reflects increasing demand across various sectors.

What are the key market players or companies in the speciality Fats And Oils industry?

Key players in the speciality fats and oils market include major companies recognized for their innovative products and extensive distribution networks. Some prominent names are Cargill, Archer Daniels Midland Company, and Olam International.

What are the primary factors driving the growth in the speciality fats and oils industry?

The growth of the speciality fats and oils industry is primarily driven by rising consumer awareness of health benefits, increased demand in food production, and the expanding cosmetics and pharmaceuticals sectors, which require diverse fat applications.

Which region is the fastest Growing in the speciality fats and oils market?

The Asia Pacific region is noted as the fastest-growing market for speciality fats and oils, projected to grow from $2.87 billion in 2023 to $5.92 billion by 2033, reflecting strong demand in food and cosmetic applications.

Does ConsaInsights provide customized market report data for the speciality Fats And Oils industry?

Yes, ConsaInsights offers customized market report data for the speciality fats and oils industry. This tailored approach allows clients to receive specific insights relevant to their unique market needs and objectives.

What deliverables can I expect from this speciality Fats And Oils market research project?

From the speciality fats and oils market research project, you can expect comprehensive reports including market size analysis, growth trends, competitive landscape details, and regional insights that inform strategic decision-making.

What are the market trends of speciality Fats And Oils?

Current trends in the speciality fats and oils market include a shift towards plant-based oils, increased health consciousness among consumers, and the growing integration of these oils in various food products, cosmetics, and personal care items.