Speciality Sweeteners Market Report

Published Date: 31 January 2026 | Report Code: speciality-sweeteners

Speciality Sweeteners Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Speciality Sweeteners market, covering market sizes, trends, and forecasts between 2023 and 2033. Key insights include regional performances, segmentation analysis, and projections that help stakeholders understand the evolving landscape of this industry.

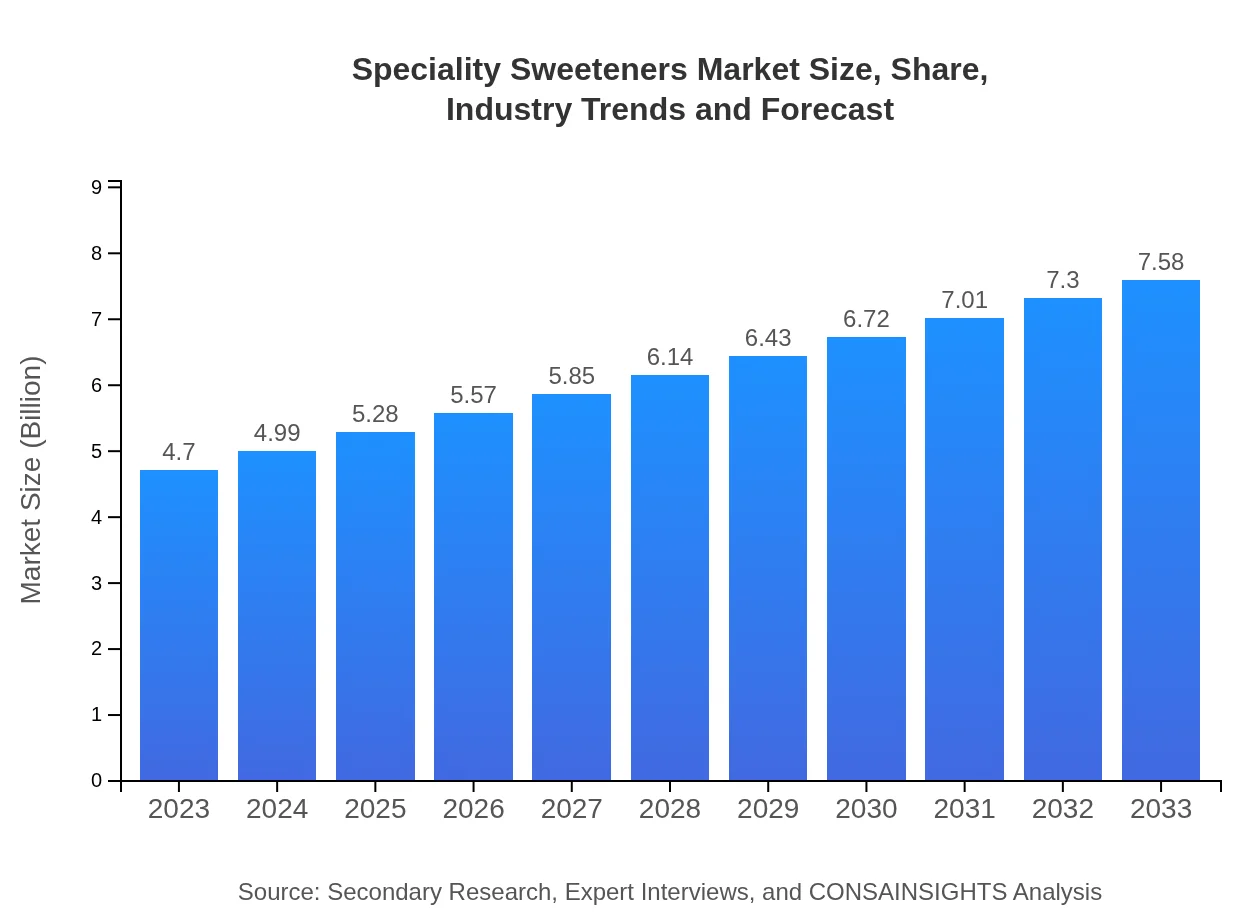

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.70 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $7.58 Billion |

| Top Companies | Cargill Inc., NutraSweet Company, Tate & Lyle, SweetGreen |

| Last Modified Date | 31 January 2026 |

Speciality Sweeteners Market Overview

Customize Speciality Sweeteners Market Report market research report

- ✔ Get in-depth analysis of Speciality Sweeteners market size, growth, and forecasts.

- ✔ Understand Speciality Sweeteners's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Speciality Sweeteners

What is the Market Size & CAGR of Speciality Sweeteners market in 2033?

Speciality Sweeteners Industry Analysis

Speciality Sweeteners Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Speciality Sweeteners Market Analysis Report by Region

Europe Speciality Sweeteners Market Report:

Europe's Speciality Sweeteners market is robust, starting at $1.58 billion in 2023 and anticipated to grow to $2.54 billion by 2033. The market benefits from stringent food regulations favoring healthier food products, along with a mentally segmented market appealing to distinct consumer preferences.Asia Pacific Speciality Sweeteners Market Report:

The Asia-Pacific region's Speciality Sweeteners market size was $0.84 billion in 2023 and is projected to reach $1.35 billion by 2033, driven by increasing urbanization, rising income levels, and the growing health awareness among the population. Countries like China and India show substantial growth potential as they focus on health and wellness trends.North America Speciality Sweeteners Market Report:

The North American market stands strong at $1.67 billion in 2023, expected to reach $2.70 billion by 2033, significantly influenced by rising health concerns and the popularity of sugar substitutes among consumers actively seeking healthier food options. The presence of major sweetener manufacturers also bolsters market growth.South America Speciality Sweeteners Market Report:

In South America, the market for Speciality Sweeteners is smaller, starting at $0.06 billion in 2023, and anticipated to grow to $0.10 billion by 2033. This growth is prompted by an increasing trend toward low-sugar diets and growing accessibility to alternative sweeteners in the region.Middle East & Africa Speciality Sweeteners Market Report:

The Middle East and Africa market, valued at $0.55 billion in 2023, is projected to reach $0.89 billion by 2033. Increased consumer knowledge about health and sugar consumption is fueling demand for speciality sweeteners, particularly in urban areas.Tell us your focus area and get a customized research report.

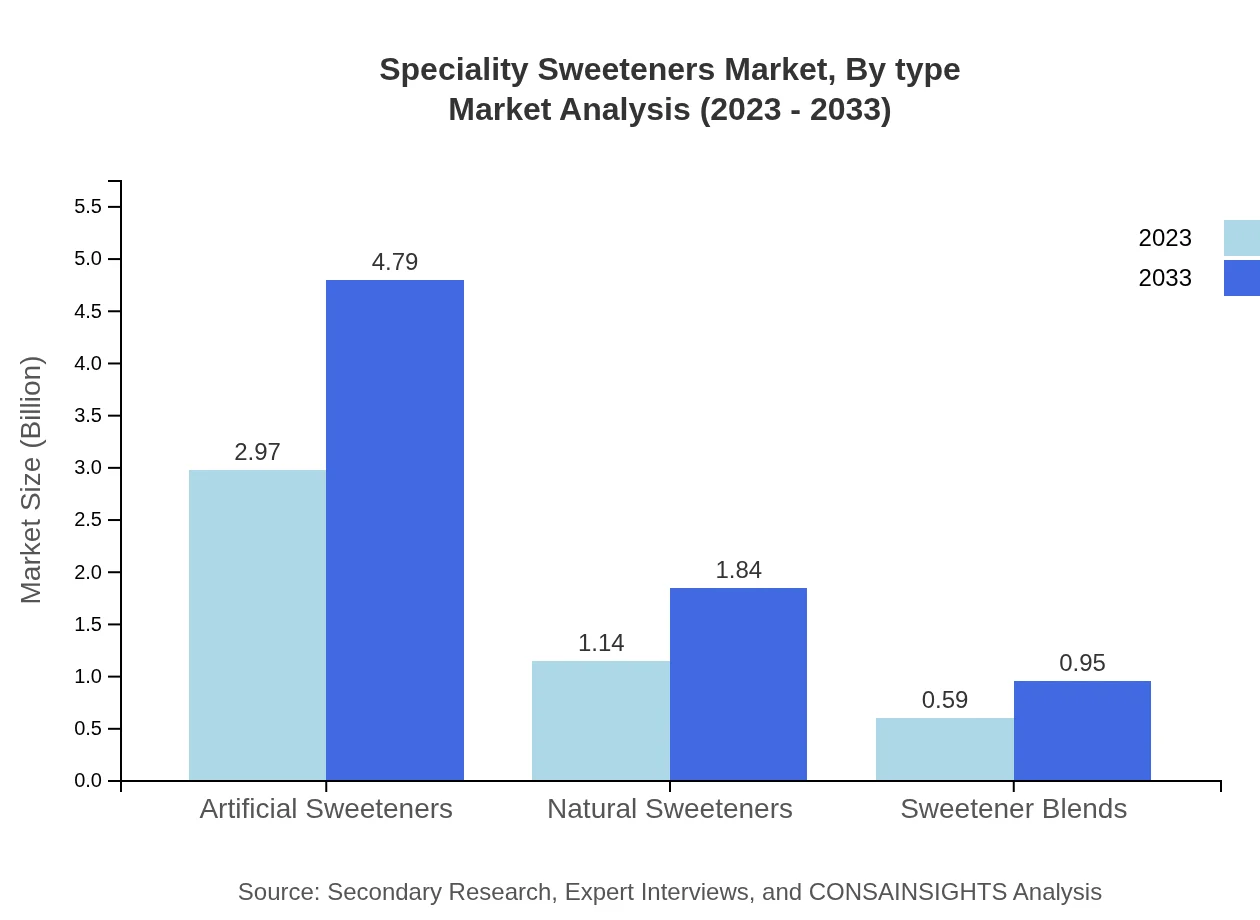

Speciality Sweeteners Market Analysis By Type

The market is primarily divided into two categories: Artificial Sweeteners and Natural Sweeteners. In 2023, Artificial Sweeteners account for a size of $2.97 billion with a market share of 63.16%, projected to grow to $4.79 billion and retain the same share by 2033. Natural Sweeteners start at $1.14 billion with a 24.25% share and are expected to reach $1.84 billion. Sweetener Blends contribute a size of $0.59 billion, growing to $0.95 billion, capturing a share of 12.59% across the forecast period.

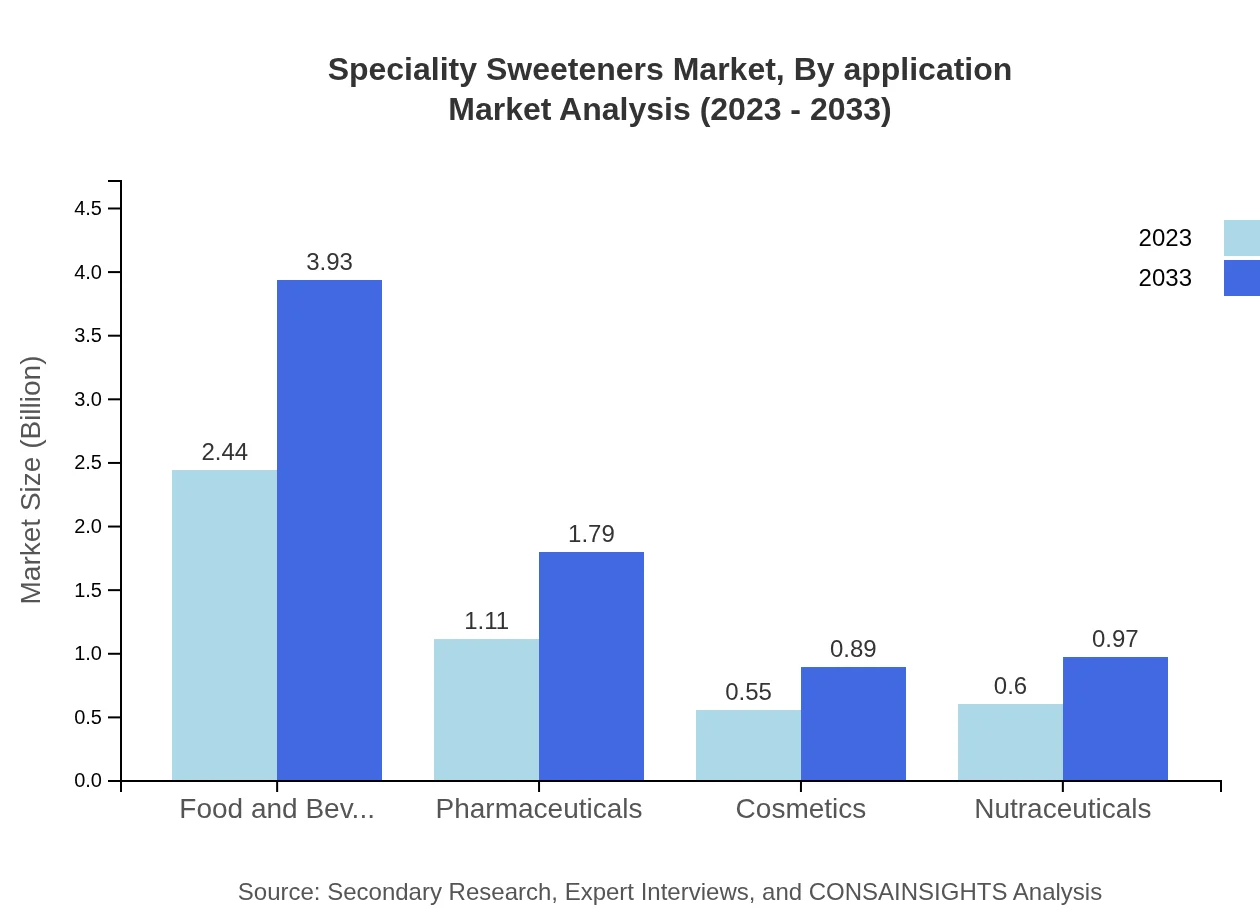

Speciality Sweeteners Market Analysis By Application

The major applications for speciality sweeteners include Food and Beverages, Pharmaceuticals, Cosmetics, and Nutraceuticals. The Food and Beverages segment holds the largest share of the market with a size of $2.44 billion in 2023, projected to rise to $3.93 billion. Pharmaceuticals, valued at $1.11 billion, and growing to $1.79 billion, demonstrate a significant potential for growth focused on health-oriented products. Other segments such as Cosmetics and Nutraceuticals also show favorable growth trajectories.

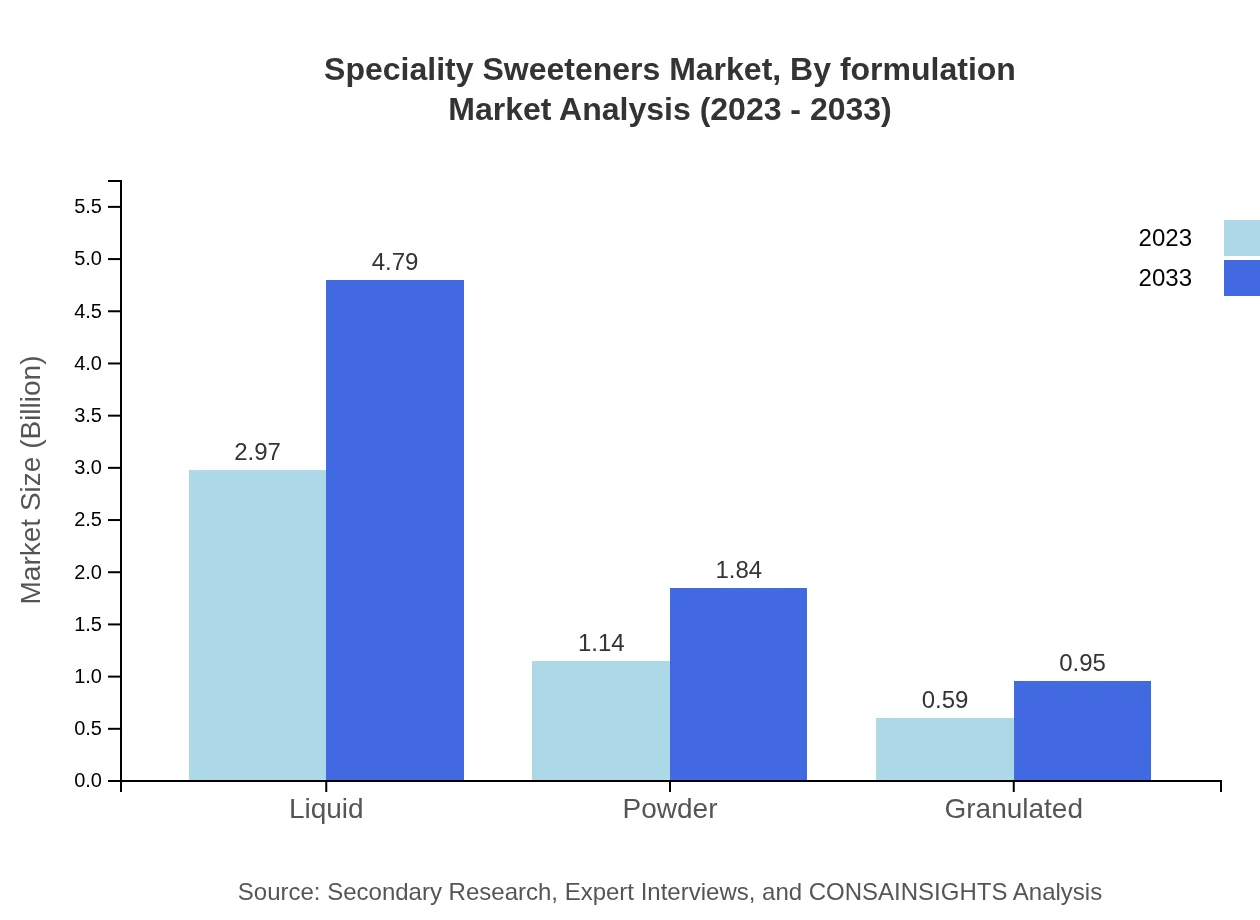

Speciality Sweeteners Market Analysis By Formulation

In terms of formulation, Liquid sweeteners hold a substantial market size of $2.97 billion in 2023, and this is expected to increase to $4.79 billion, representing a dominant market share of 63.16%. Powder formulations occupy a market size of $1.14 billion, which is anticipated to rise to $1.84 billion, while Granulated sweeteners represent a market size of $0.59 billion growing to $0.95 billion by 2033.

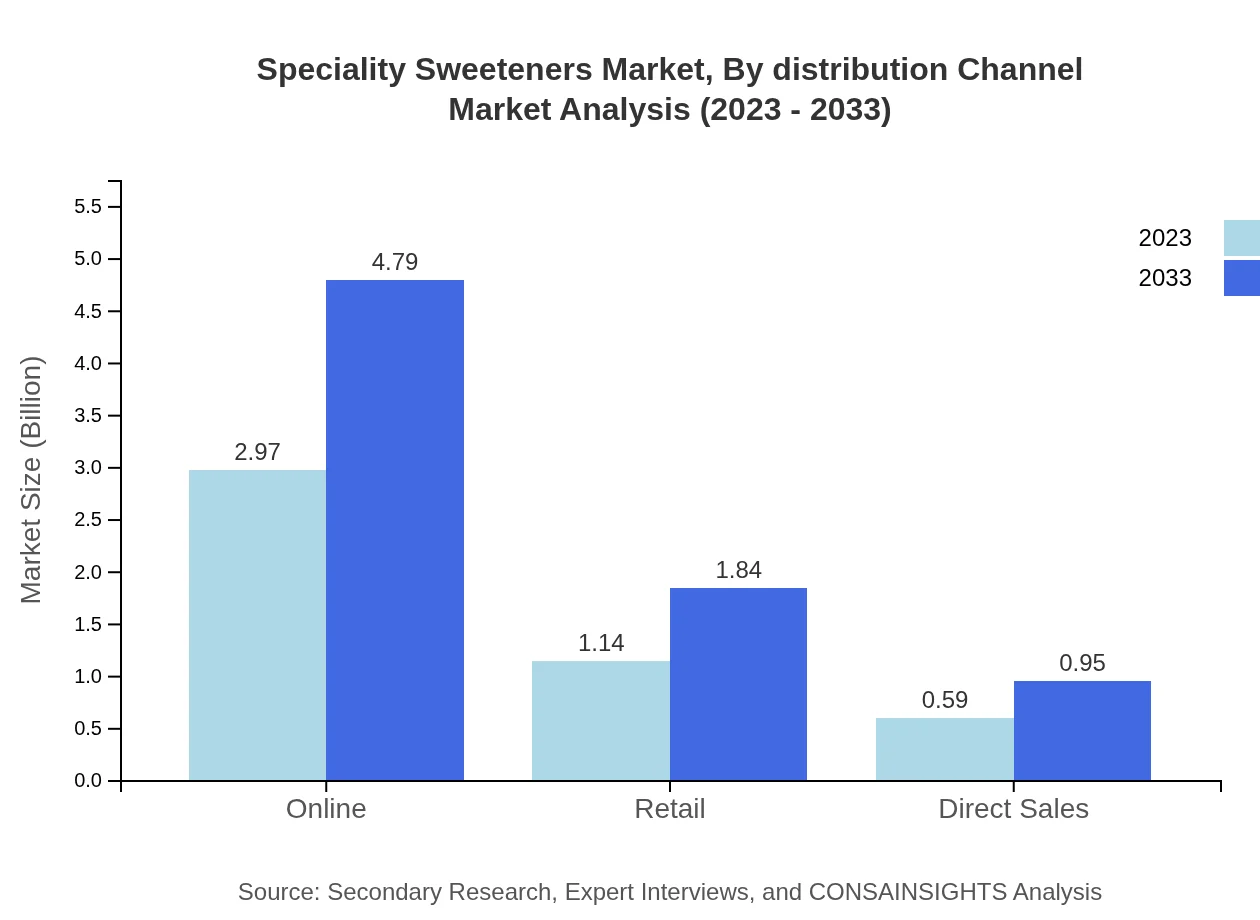

Speciality Sweeteners Market Analysis By Distribution Channel

The market's distribution channels include Online, Retail, and Direct Sales. The Online channel shows substantial growth, starting at $2.97 billion and expected to double to $4.79 billion in 2033. Retail and Direct Sales channels are also significant, starting at $1.14 billion and targeting similar growth trajectories.

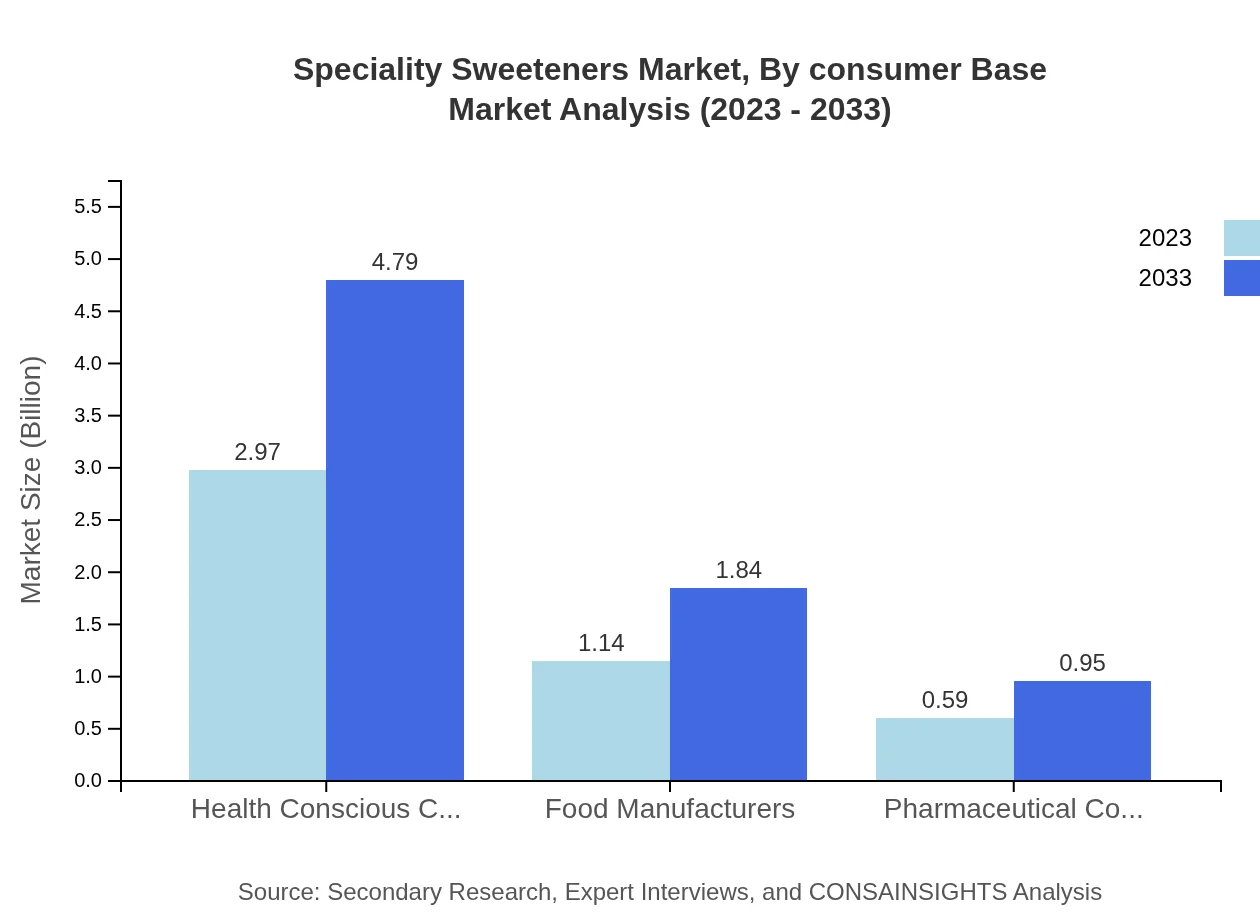

Speciality Sweeteners Market Analysis By Consumer Base

The market caters to several consumer bases, notably Health-Conscious Consumers, Food Manufacturers, and Pharmaceutical Companies. Health-Conscious Consumers lead with a size of $2.97 billion and are expected to mirror growth. Food Manufacturers begin at $1.14 billion with an upward trend projected, while Pharmaceutical Companies hold a market size of $0.59 billion, reflecting a healthy growth outlook.

Speciality Sweeteners Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Speciality Sweeteners Industry

Cargill Inc.:

Cargill is a global leader in food ingredients and a pioneer in developing natural sweeteners, contributing significantly to the growth of the Speciality Sweeteners market.NutraSweet Company:

NutraSweet Company is known for its innovative artificial sweeteners and has been a prominent player in shaping the sweeteners industry, focusing on quality and sustainability.Tate & Lyle:

Tate & Lyle specializes in sweeteners, and they emphasize food safety and consumer health, bringing forth a range of high-quality speciality sweeteners.SweetGreen:

SweetGreen is recognized for its commitment to natural products, highlighting sugar reduction and creating healthier alternatives that cater to modern dietary needs.We're grateful to work with incredible clients.

FAQs

What is the market size of speciality sweeteners?

The global speciality sweeteners market is valued at approximately $4.7 billion in 2023, with a projected CAGR of 4.8% forecasted through 2033, indicating steady growth within this segment during the next decade.

What are the key market players or companies in this speciality sweeteners industry?

Key players in the speciality sweeteners market include leading companies in the food and beverage, pharmaceutical, and nutraceutical sectors that are continuously innovating and expanding their product portfolios to capture a growing health-conscious consumer base.

What are the primary factors driving the growth in the speciality sweeteners industry?

The growth of the speciality sweeteners industry is primarily driven by rising health consciousness, an increasing demand for low-calorie alternatives, and the expanding use of sweeteners in food, beverages, and pharmaceuticals to cater to diverse consumer preferences.

Which region is the fastest Growing in the speciality sweeteners?

The fastest-growing region for speciality sweeteners is North America, projected to grow from $1.67 billion in 2023 to $2.70 billion in 2033, reflecting a notable increase as consumer demand for healthier options continues to rise.

Does ConsaInsights provide customized market report data for the speciality sweeteners industry?

Yes, ConsaInsights offers customized market report data for the speciality sweeteners industry, allowing clients to tailor research and insights based on specific geographic, demographic, or product-focused criteria to meet their unique business needs.

What deliverables can I expect from this speciality sweeteners market research project?

From our speciality sweeteners market research project, you can expect comprehensive reports detailing market size, CAGR estimates, segment data, regional analysis, competitive landscape, and actionable insights to aid strategic decision-making.

What are the market trends of speciality sweeteners?

Current trends in the speciality sweeteners market include a shift towards natural sweeteners, increasing demand for clean-label products, and innovative formulations focusing on sugar reduction and health-enhancing properties among consumers.