Specialty Chemicals Market Report

Published Date: 02 February 2026 | Report Code: specialty-chemicals

Specialty Chemicals Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Specialty Chemicals market from 2023 to 2033, featuring insights on market trends, size, segmentation, and forecasts across various regions and industries.

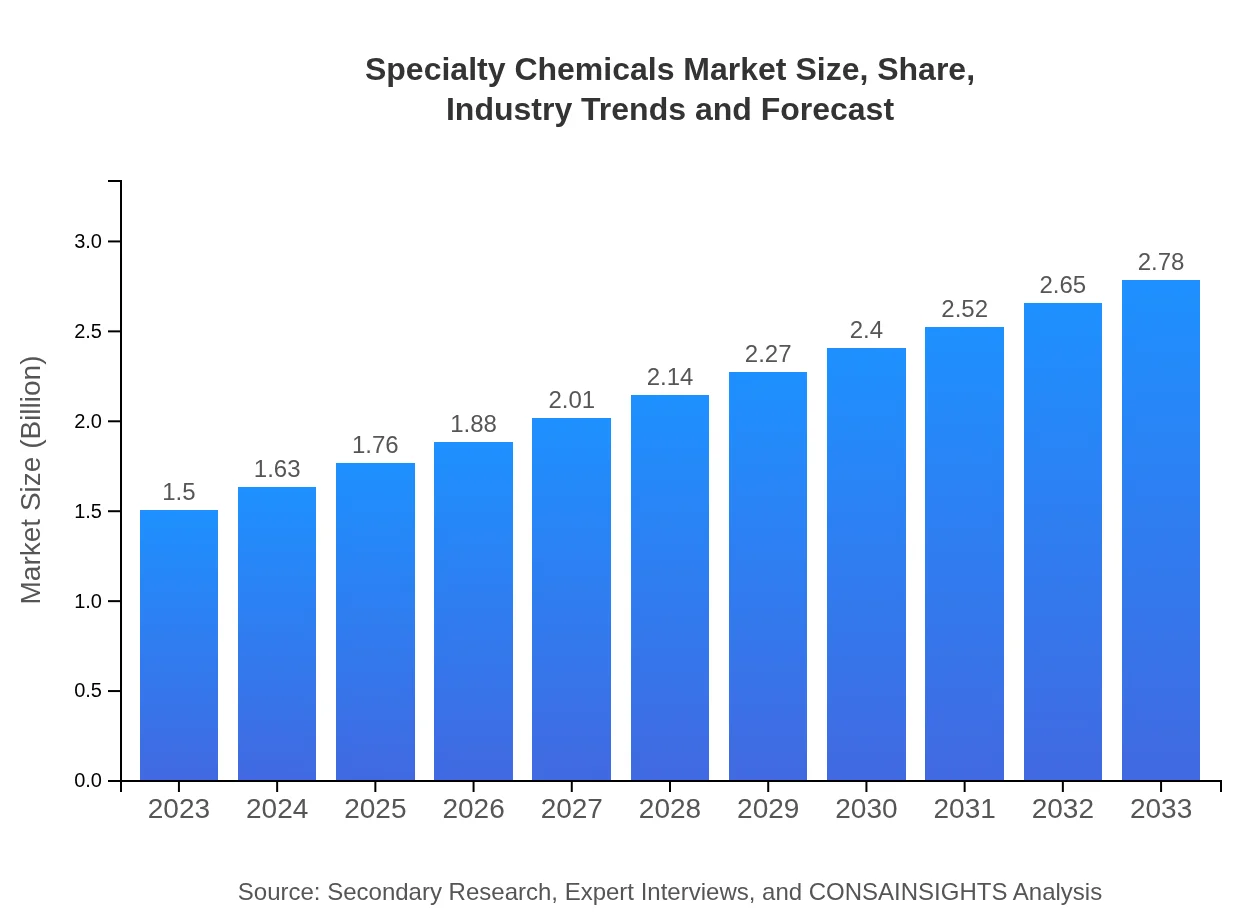

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Trillion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Trillion |

| Top Companies | BASF, Dow Chemical Company, DuPont, SABIC, Evonik Industries |

| Last Modified Date | 02 February 2026 |

Specialty Chemicals Market Overview

Customize Specialty Chemicals Market Report market research report

- ✔ Get in-depth analysis of Specialty Chemicals market size, growth, and forecasts.

- ✔ Understand Specialty Chemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Specialty Chemicals

What is the Market Size & CAGR of Specialty Chemicals market in 2023?

Specialty Chemicals Industry Analysis

Specialty Chemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Specialty Chemicals Market Analysis Report by Region

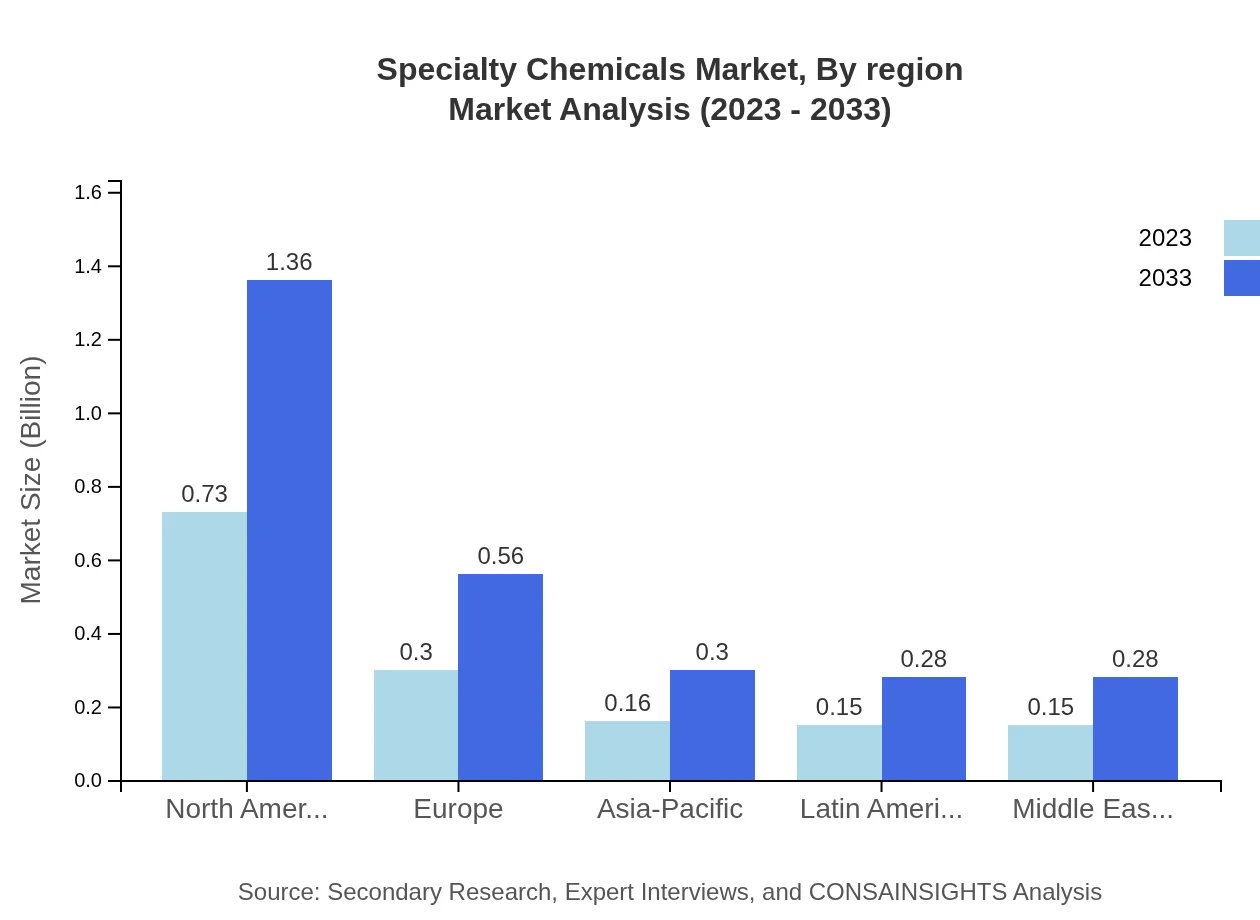

Europe Specialty Chemicals Market Report:

The European Specialty Chemicals market is forecasted to grow from $0.45 trillion in 2023 to $0.83 trillion by 2033. With stringent environmental regulations and a shift towards sustainability, the region is investing heavily in new chemistry technologies that minimize waste and enhance efficiency.Asia Pacific Specialty Chemicals Market Report:

In Asia Pacific, the Specialty Chemicals market is anticipated to grow from $0.28 trillion in 2023 to $0.52 trillion by 2033. The region is a hub for manufacturing and is experiencing rapid industrialization, coupled with rising consumer demand across various sectors, leading to significant growth opportunities for specialty chemicals.North America Specialty Chemicals Market Report:

North America holds a substantial share of the Specialty Chemicals market, growing from $0.55 trillion in 2023 to $1.02 trillion by 2033. This increase can be attributed to demand in construction, automotive, and consumer goods, alongside a strong focus on sustainable practices and innovations in technology.South America Specialty Chemicals Market Report:

South America shows steady growth in the Specialty Chemicals market, with projections indicating an increase from $0.06 trillion in 2023 to $0.11 trillion by 2033. The market's expansion is supported by agricultural advancements and industrial development, despite facing challenges related to investment and market access.Middle East & Africa Specialty Chemicals Market Report:

The Specialty Chemicals market in the Middle East and Africa is expected to rise from $0.17 trillion in 2023 to $0.31 trillion by 2033. Increased industrial activities, along with rising infrastructural projects in this region, are driving the demand for specialty chemicals, particularly in construction and oil sectors.Tell us your focus area and get a customized research report.

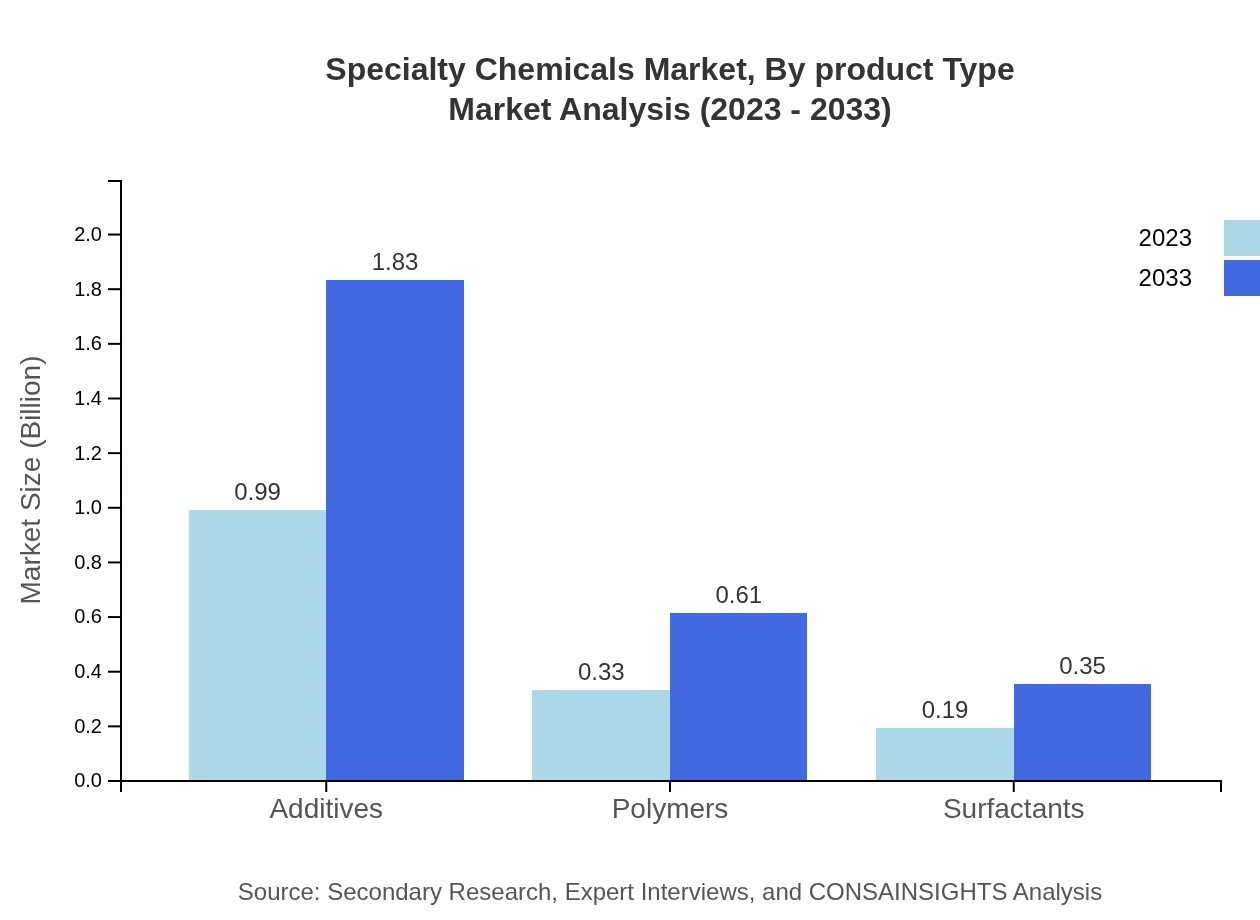

Specialty Chemicals Market Analysis By Product Type

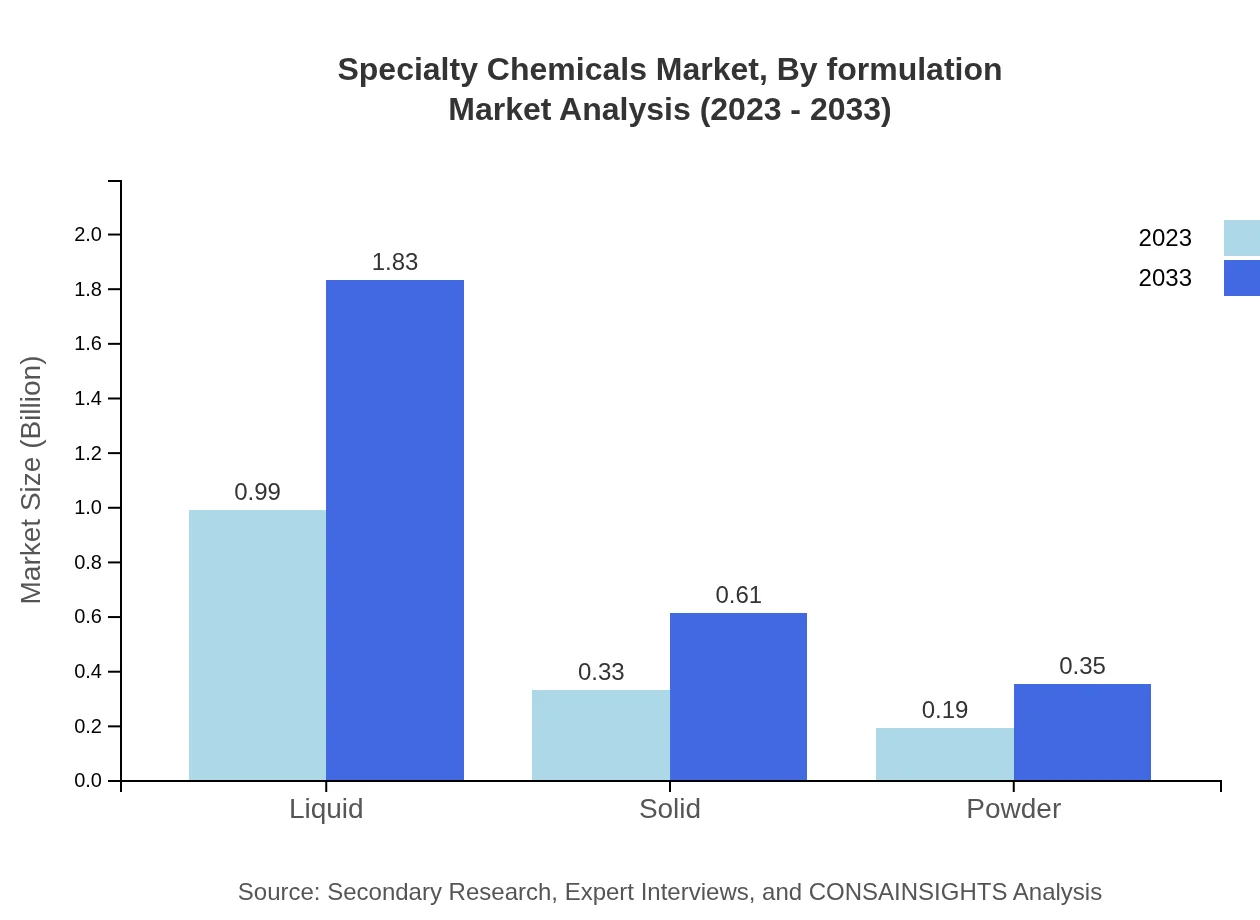

The analysis indicates that liquid specialty chemicals hold the largest market share, valued at $0.99 trillion in 2023 and projected to reach $1.83 trillion by 2033, accounting for approximately 65.7% of the total market. Solid and powder forms also contribute significantly, reflecting diverse applications across industries. The growing demand for additives, particularly, will continue to shape the product landscape.

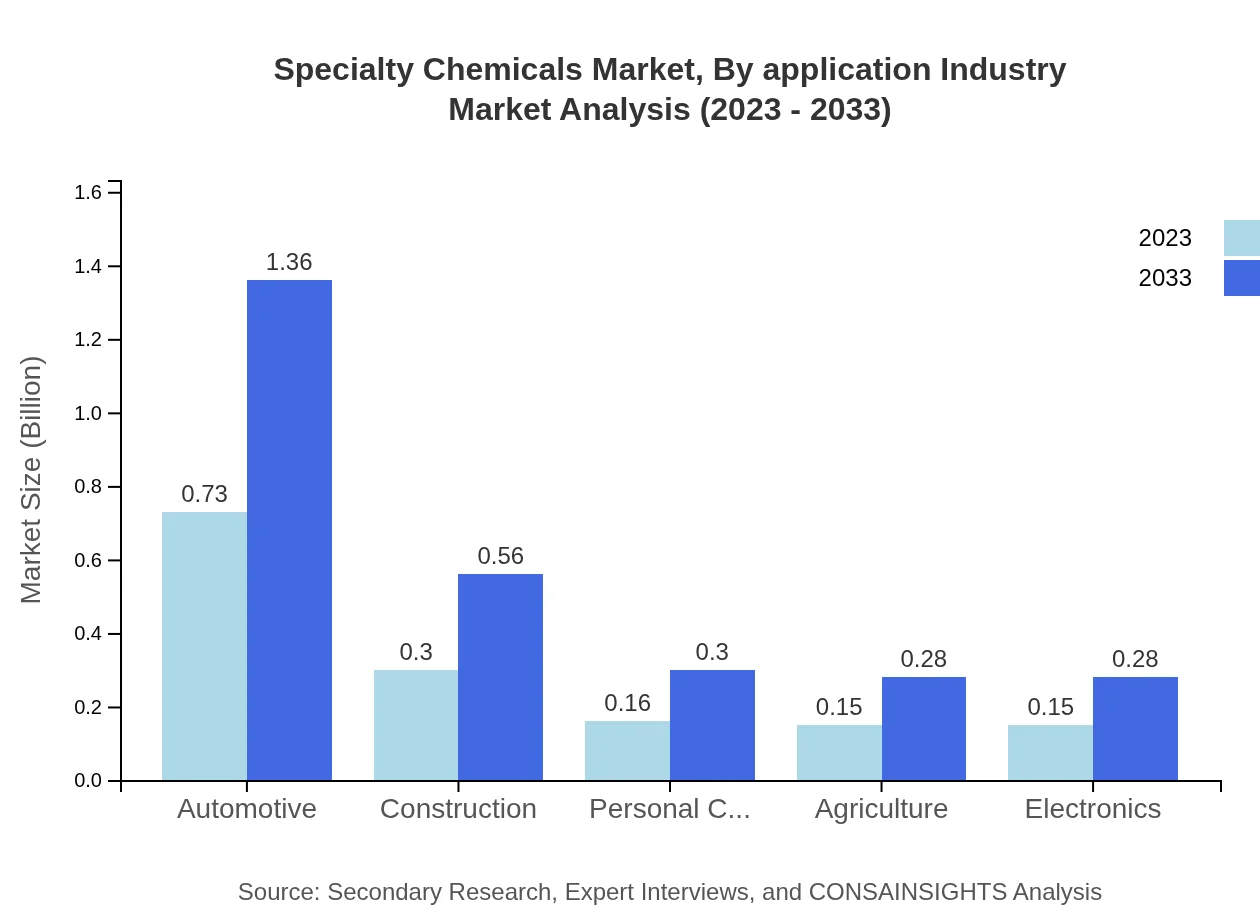

Specialty Chemicals Market Analysis By Application Industry

The automotive industry comprises a dominant share of the Specialty Chemicals market, with revenues of $0.73 trillion in 2023 and a forecasted increase to $1.36 trillion by 2033. Other notable application sectors include construction, healthcare, and personal care, which together highlight the versatility of specialty chemicals across various functional requirements.

Specialty Chemicals Market Analysis By Region

Regional trends reveal that North America and Europe are currently leading in market share and growth potential due to their advanced manufacturing infrastructures. Asia-Pacific's rapid industrialization showcases significant growth potential and is expected to challenge the dominance of these regions in the coming years.

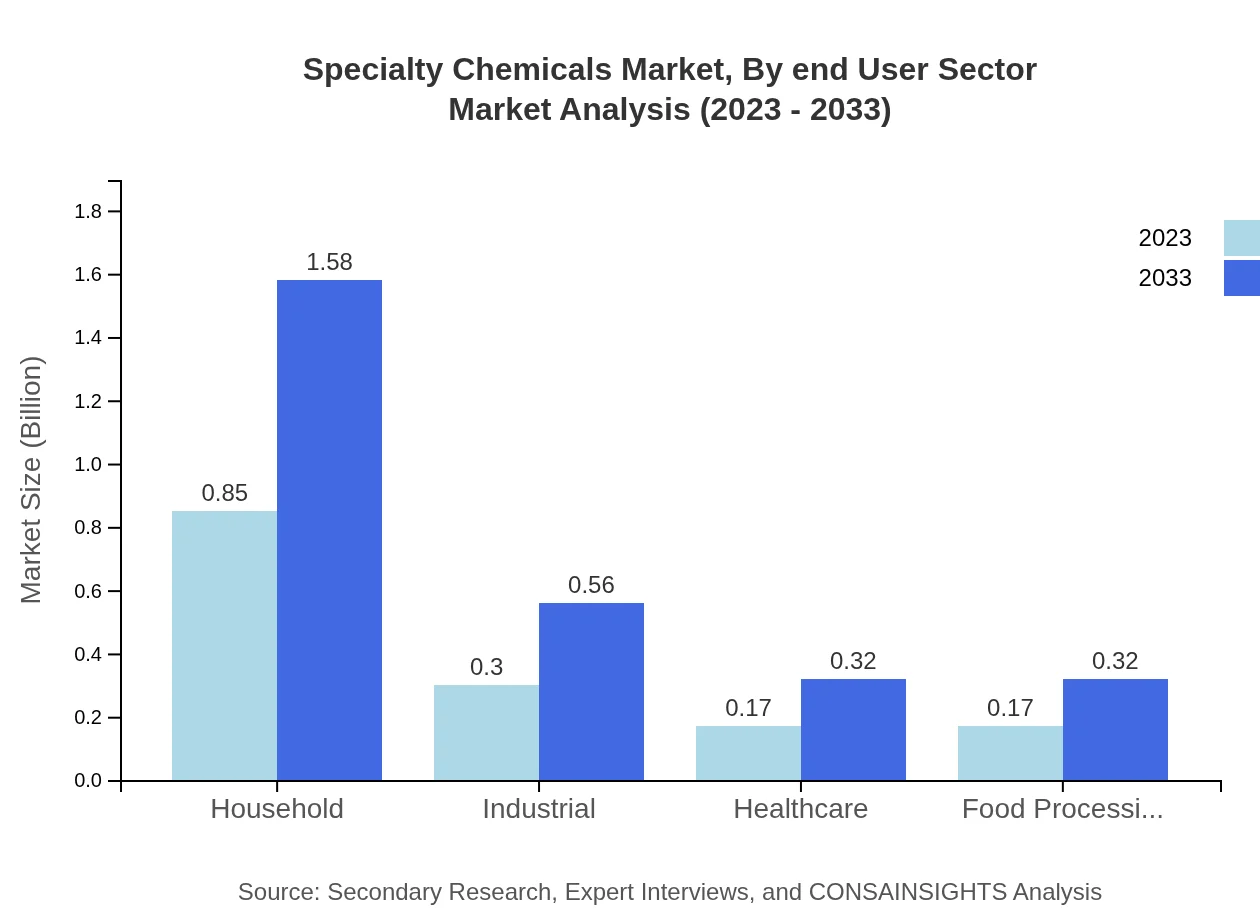

Specialty Chemicals Market Analysis By End User Sector

End-user sectors such as automotive, construction, and personal care are major consumers of specialty chemicals, dominating the market structurally. With an increasing push towards environmentally friendly products, these sectors are expected to drive innovations in formulations and applications.

Specialty Chemicals Market Analysis By Formulation

Formulation types in the Specialty Chemicals market predominantly include liquid and solid states, with liquid formulations commanding majority share due to their application in a wide range of products, from coatings to cleaning agents. The solid formulation segment, while smaller, exhibits steady growth as new applications are explored.

Specialty Chemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Specialty Chemicals Industry

BASF:

BASF is one of the largest chemical producers globally, excelling in a diverse array of specialty chemicals, including performance products and crop protection chemicals.Dow Chemical Company:

Dow is a key player in specialty chemicals, focusing on sustainable solutions and innovative products tailored to consumer and industry needs.DuPont:

DuPont operates in high-performance specialty chemicals, providing advanced materials and solutions for various industries including electronics and healthcare.SABIC:

SABIC is known for its research-driven approach in specialty chemicals, offering innovative applications particularly in polymers and agricultural sectors.Evonik Industries:

Evonik specializes in performance materials and specialty additives, emphasizing sustainability and efficiency in their production processes.We're grateful to work with incredible clients.

FAQs

What is the market size of specialty Chemicals?

The global specialty chemicals market size is estimated at $1.5 trillion in 2023, with a projected CAGR of 6.2% through 2033. This robust market growth highlights the increasing application across various sectors.

What are the key market players or companies in this specialty Chemicals industry?

Key players in the specialty chemicals industry include global leaders such as BASF, Dow Chemical Company, and Evonik Industries, which drive innovation and product development across diverse segments such as coatings, additives, and polymers.

What are the primary factors driving the growth in the specialty Chemicals industry?

Growth in the specialty chemicals sector is driven by increased demand from end-user industries, technological advancements, and a push for sustainable practices, especially in automotive, construction, and personal care products.

Which region is the fastest Growing in the specialty Chemicals market?

The Asia-Pacific region is the fastest-growing market for specialty chemicals, expected to expand from $0.28 trillion in 2023 to $0.52 trillion in 2033, fueled by increasing industrialization and economic growth.

Does ConsaInsights provide customized market report data for the specialty Chemicals industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the specialty chemicals industry, ensuring insights align with unique business strategies and market conditions.

What deliverables can I expect from this specialty Chemicals market research project?

Deliverables from the specialty chemicals market research project include comprehensive reports, data analytics, market forecasts, competitive analysis, and insights into emerging trends across various regions and segments.

What are the market trends of specialty Chemicals?

Current trends in specialty chemicals include a shift towards biodegradable and sustainable products, increasing innovation in formulation chemistry, and a growing emphasis on regulatory compliance and environmental impact reduction.