Specialty Gas Market Report

Published Date: 02 February 2026 | Report Code: specialty-gas

Specialty Gas Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Specialty Gas market, focusing on its growth, segmentation, and regional dynamics from 2023 to 2033. It includes market size, trends, and forecasts, as well as an overview of key players and technological advancements in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $18.70 Billion |

| Top Companies | Air Products and Chemicals, Inc., Linde plc, Praxair Technology, Inc., Air Liquide S.A. |

| Last Modified Date | 02 February 2026 |

Specialty Gas Market Overview

Customize Specialty Gas Market Report market research report

- ✔ Get in-depth analysis of Specialty Gas market size, growth, and forecasts.

- ✔ Understand Specialty Gas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Specialty Gas

What is the Market Size & CAGR of Specialty Gas market in 2023?

Specialty Gas Industry Analysis

Specialty Gas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Specialty Gas Market Analysis Report by Region

Europe Specialty Gas Market Report:

The European specialty gas market will grow from $3.46 billion in 2023 to $6.16 billion by 2033. Driven by advances in environmental technologies and an emphasis on renewable gases, Europe leads the market due to well-established industries in healthcare and electronics.Asia Pacific Specialty Gas Market Report:

The Asia Pacific region initiated at a market size of approximately $2.03 billion in 2023 and is expected to grow to $3.62 billion by 2033. Rapid industrialization, growth in automotive and electronics sectors, and increasing healthcare demands drive the market expansion in this region, presenting ample opportunities for specialty gas providers.North America Specialty Gas Market Report:

In North America, the specialty gas market is valued at $3.43 billion in 2023, slated to expand to $6.12 billion by 2033. This region is dominated by stringent regulatory frameworks, enabling greater adoption of specialty gases in pharmaceuticals and research applications, thus spurring significant growth.South America Specialty Gas Market Report:

South America holds a market size of $0.35 billion in 2023, projected to grow to $0.62 billion by 2033. The growth is primarily fueled by the burgeoning food processing industry and governmental investments in health and safety regulations, which drive the demand for specialty gas in laboratory and industrial applications.Middle East & Africa Specialty Gas Market Report:

In the Middle East and Africa, the market size is initially $1.23 billion in 2023 and is expected to reach $2.19 billion by 2033. Growing investments in oil and gas exploration, along with expanding industrial activities, stimulate the demand for specialty gases in this region.Tell us your focus area and get a customized research report.

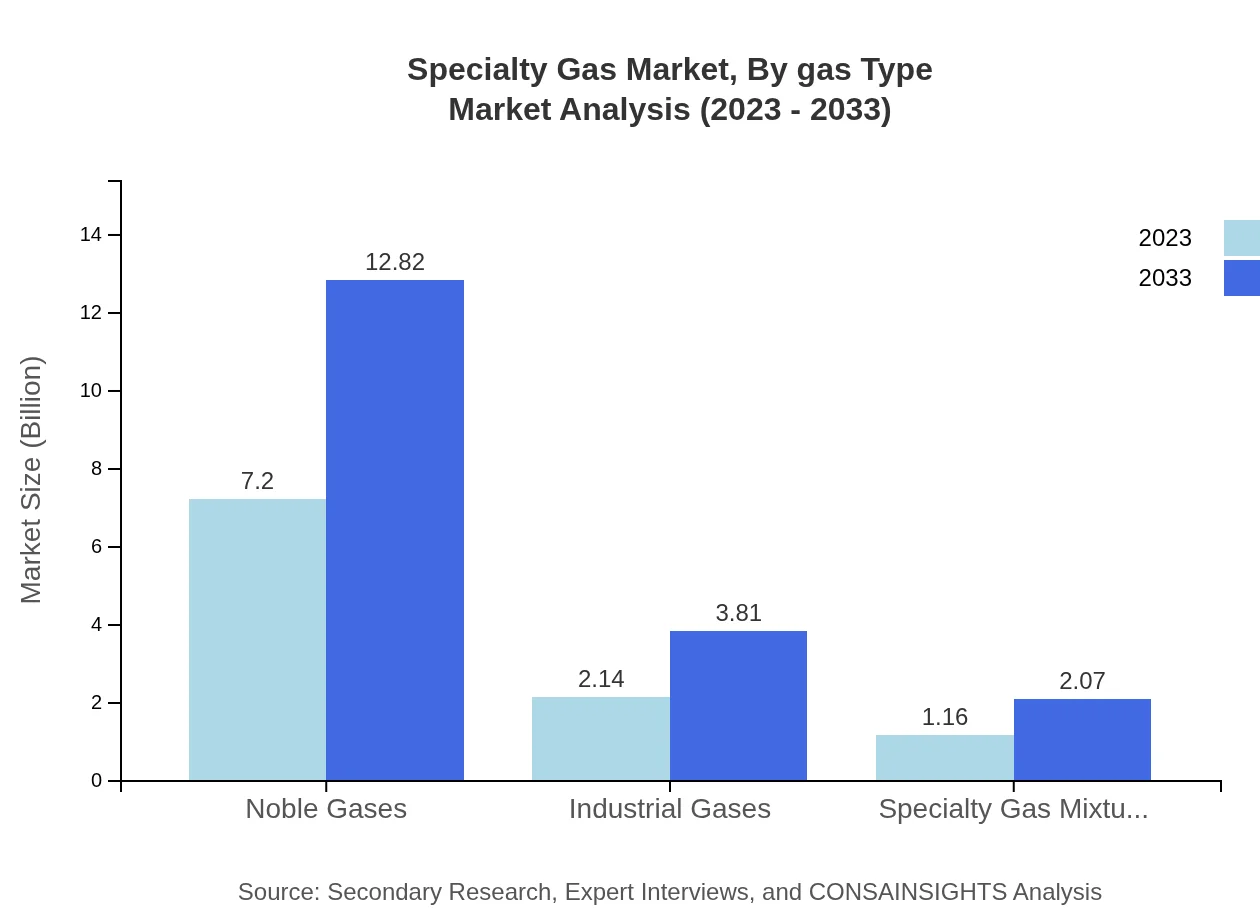

Specialty Gas Market Analysis By Gas Type

The specialty gas market is prominently segmented into noble gases, industrial gases, specialty gas mixtures, and others. Noble gases, valued at $7.20 billion in 2023 and projected to reach $12.82 billion by 2033, dominate the market due to their high applicability across a range of sectors. Industrial gases account for $2.14 billion and are expected to rise significantly. Specialty gas mixtures are showcasing steady growth, holding a market size of $1.16 billion in 2023.

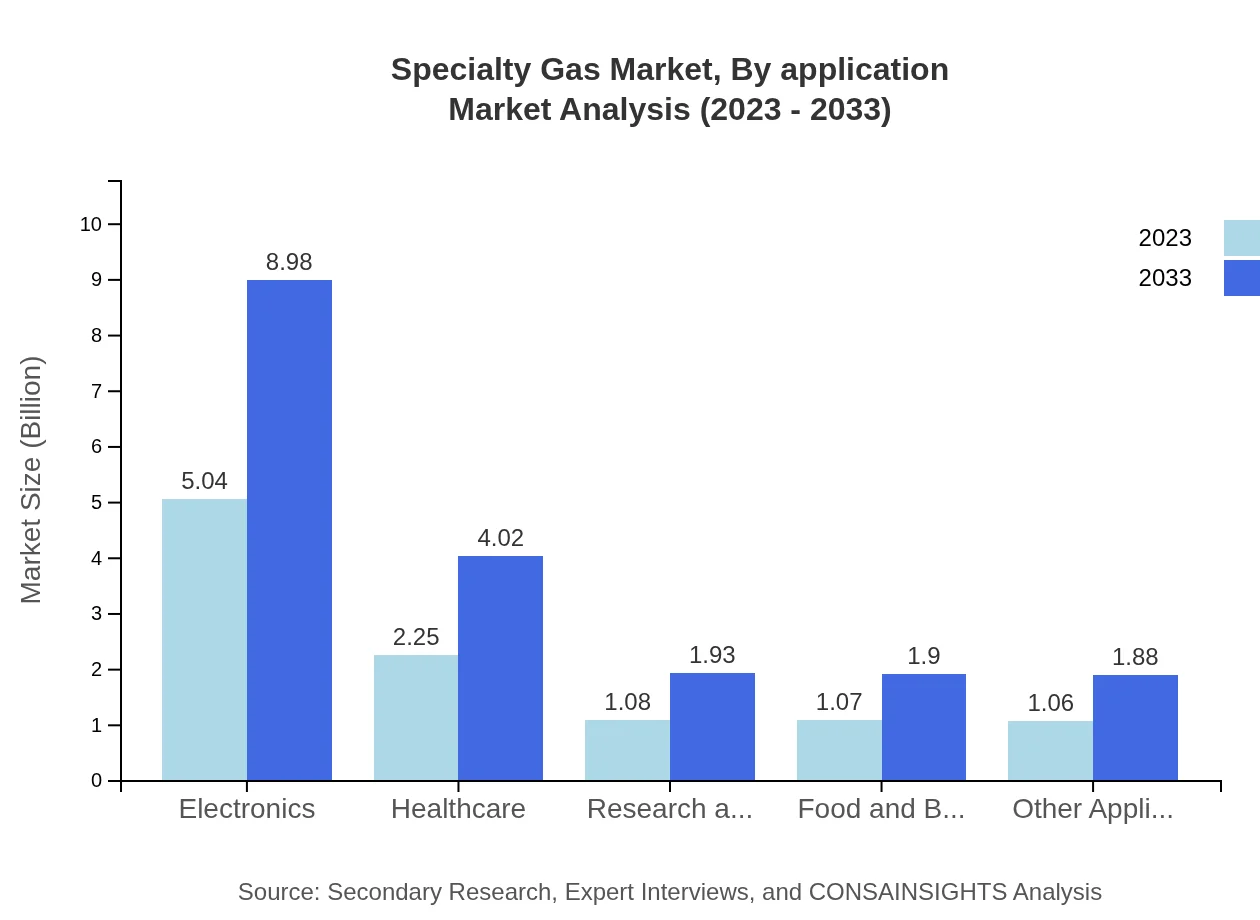

Specialty Gas Market Analysis By Application

Applications of specialty gases span across pharmaceuticals, electronics, aerospace, automotive, research institutes, and food processing. The pharmaceuticals sector holds a substantial market share of 48.02%, set to grow significantly by 2033, with a size projected at $5.04 billion. Other noteworthy applications include electronics and healthcare, which collectively drive a demand surge, leveraging innovations in medical and technology fields.

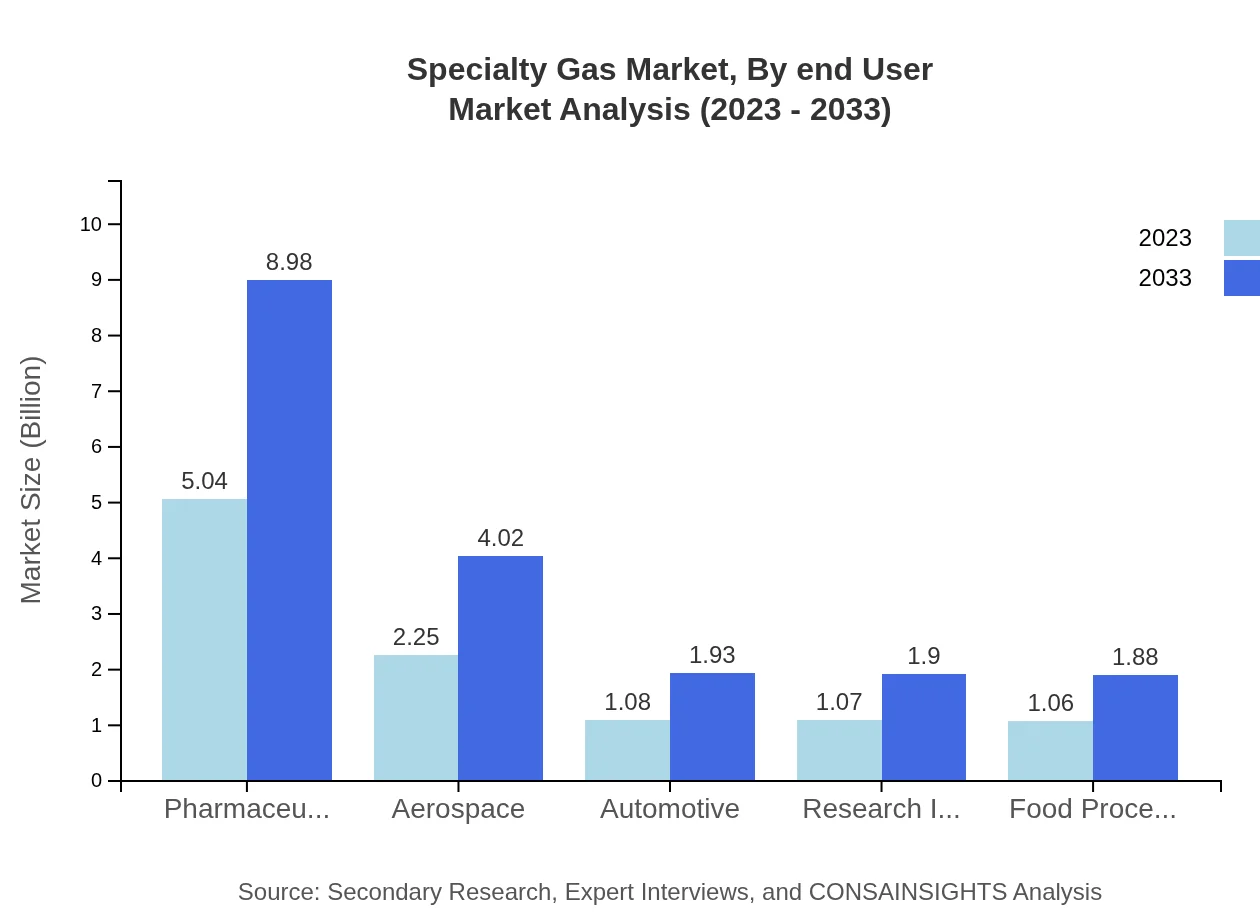

Specialty Gas Market Analysis By End User

The key end-users of specialty gases include manufacturing industries, healthcare facilities, automotive production, and research institutions. Notably, the healthcare and pharmaceuticals sector showcases a growth potential reaching $8.98 billion by 2033, reinforcing the increasing reliance on specialty gases for various applications such as diagnostics and therapeutic practices.

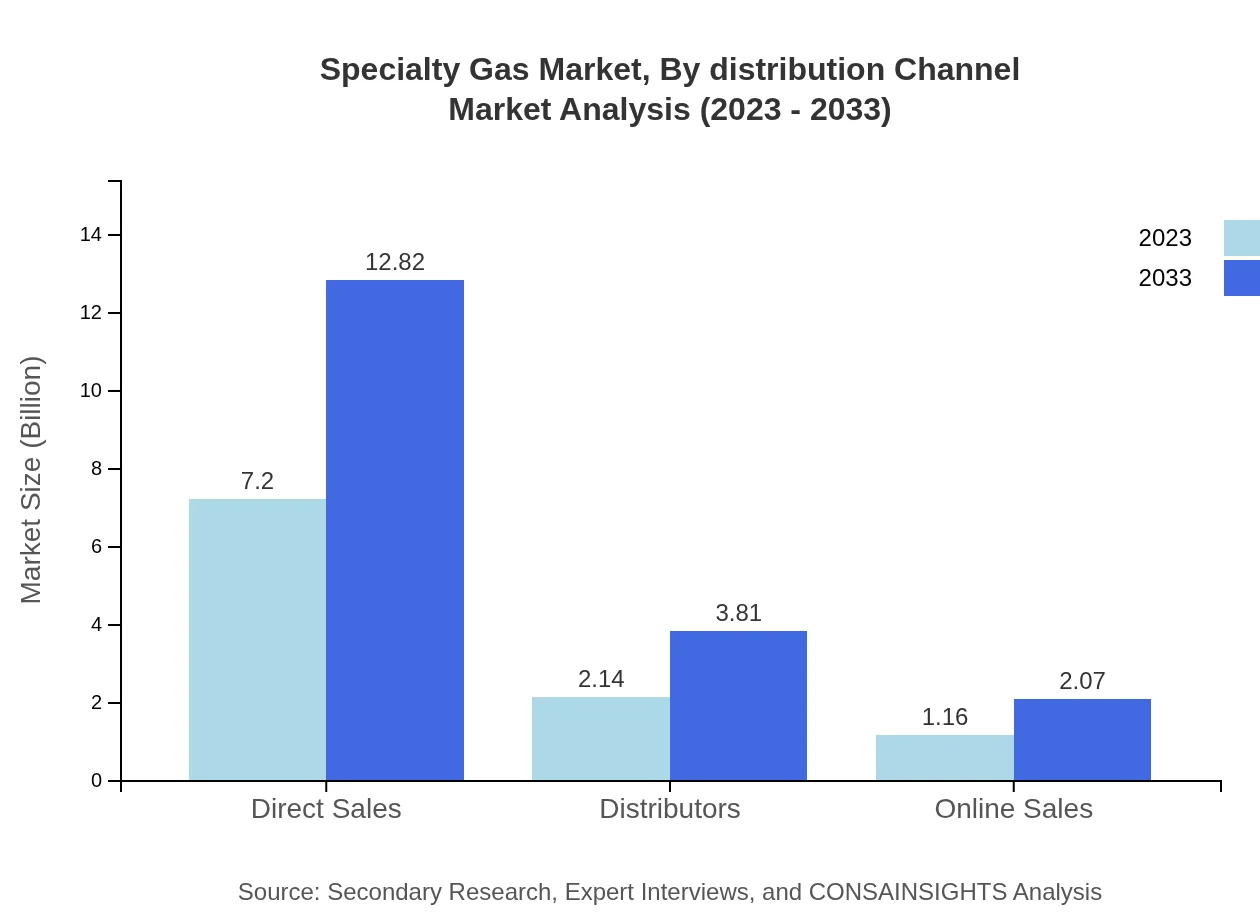

Specialty Gas Market Analysis By Distribution Channel

Distribution channels for specialty gases include direct sales, distributors, and online sales. Direct sales represent a market share of 68.57% in 2023. E-commerce platforms are slowly gaining traction, projected to see increased market share as digitalization becomes more prevalent among consumers and businesses seeking convenience and speed in accessing specialty gas products.

Specialty Gas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Specialty Gas Industry

Air Products and Chemicals, Inc.:

A leading supplier of industrial gases, Air Products offers a comprehensive range of specialty gases critical to various applications, including healthcare and electronics.Linde plc:

Linde is recognized for its innovative gas solutions, playing a prominent role in the specialty gas market with top-tier technologies and extensive distribution networks.Praxair Technology, Inc.:

Praxair provides specialty gases that support numerous sectors, with a commitment to sustainability and reducing environmental impact in its operations.Air Liquide S.A.:

As one of the largest suppliers of gases in the world, Air Liquide specializes in providing advanced gas technologies, serving a diverse clientele across multiple industries.We're grateful to work with incredible clients.

FAQs

What is the market size of specialty Gas?

The specialty gas market is currently valued at approximately $10.5 billion in 2023, with an expected compound annual growth rate (CAGR) of 5.8% projected until 2033.

What are the key market players or companies in this specialty Gas industry?

Key players in the specialty gas industry include major corporations like Air Products and Chemicals, Linde plc, Praxair Technology, and Air Liquide. These companies are known for their extensive portfolios in specialty gases across various sectors.

What are the primary factors driving the growth in the specialty Gas industry?

The growth of the specialty gas industry is primarily driven by increasing demands in pharmaceuticals, electronics, and healthcare sectors. Additionally, advancements in technology and environmental regulations fuel the need for specialty gases.

Which region is the fastest Growing in the specialty gas market?

The fastest-growing region in the specialty gas market is Europe, projected to grow from $3.46 billion in 2023 to $6.16 billion by 2033, indicating a robust growth trajectory.

Does ConsaInsights provide customized market report data for the specialty gas industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the specialty gas industry, ensuring that clients receive relevant insights for their strategic decision-making.

What deliverables can I expect from this specialty Gas market research project?

Clients can expect comprehensive deliverables including detailed market analysis, regional insights, segment data reports, and strategic recommendations tailored to the specialty gas industry, aiding in informed business decisions.

What are the market trends of specialty Gas?

Current trends in the specialty gas market include increasing adoption of noble gases, innovation in gas mixtures, and a shift towards sustainable practices, all contributing to an evolving landscape in the industry.