Specialty Insurance Market Report

Published Date: 24 January 2026 | Report Code: specialty-insurance

Specialty Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Specialty Insurance market, covering trends, growth forecasts, and market dynamics from 2023 to 2033. It includes detailed analyses of market size, segmentation, regional performance, and key players in the industry.

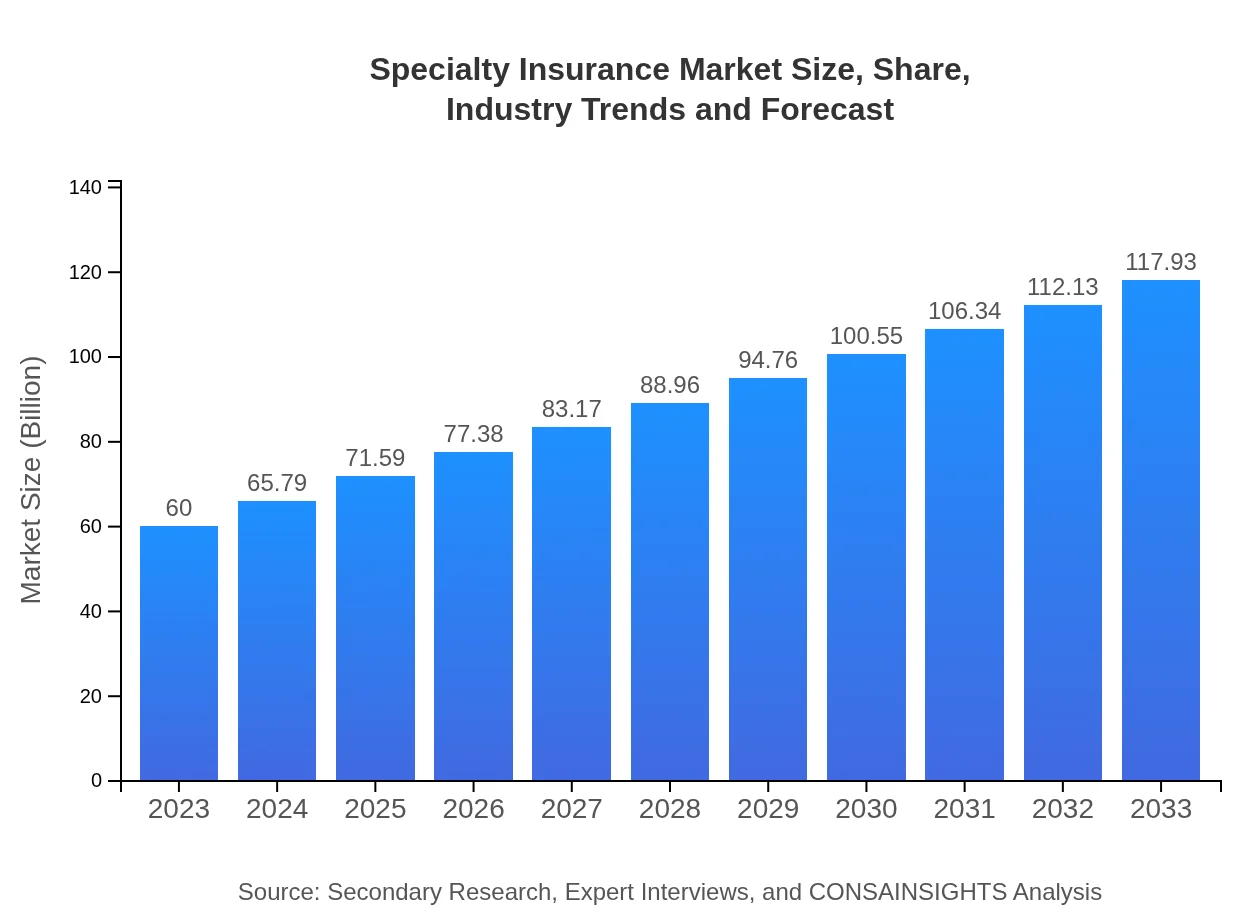

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $60.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $117.93 Billion |

| Top Companies | AIG, Chubb Limited, Lloyd’s, Travelers, Zurich Insurance Group |

| Last Modified Date | 24 January 2026 |

Specialty Insurance Market Overview

Customize Specialty Insurance Market Report market research report

- ✔ Get in-depth analysis of Specialty Insurance market size, growth, and forecasts.

- ✔ Understand Specialty Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Specialty Insurance

What is the Market Size & CAGR of Specialty Insurance market in 2023?

Specialty Insurance Industry Analysis

Specialty Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Specialty Insurance Market Analysis Report by Region

Europe Specialty Insurance Market Report:

In Europe, the market is valued at about $14.92 billion with an expected rise to $29.33 billion by 2033. European countries are increasingly adopting specialty insurance due to regulatory constraints and greater awareness regarding unique risk exposures.Asia Pacific Specialty Insurance Market Report:

In 2023, the Specialty Insurance market in the Asia Pacific region is valued at approximately $13.00 billion with an expected increase to $25.54 billion by 2033. This growth is driven by rapid economic development and increasing awareness among businesses regarding risk management.North America Specialty Insurance Market Report:

North America leads the Specialty Insurance market with a valuation of approximately $19.37 billion in 2023, extending to an anticipated $38.07 billion by 2033. The strong demand can be attributed to the higher prevalence of specialized industries and regulatory requirements.South America Specialty Insurance Market Report:

The South American Specialty Insurance market is currently valued at $4.61 billion and is projected to grow to $9.07 billion by 2033. This growth is fueled by rising investments in infrastructure and the growing middle class seeking comprehensive insurance coverage.Middle East & Africa Specialty Insurance Market Report:

The Specialty Insurance market in the Middle East and Africa is valued at $8.10 billion in 2023 and is projected to reach $15.92 billion by 2033. This region shows growth potential owing to infrastructural investments and a growing entrepreneurial landscape.Tell us your focus area and get a customized research report.

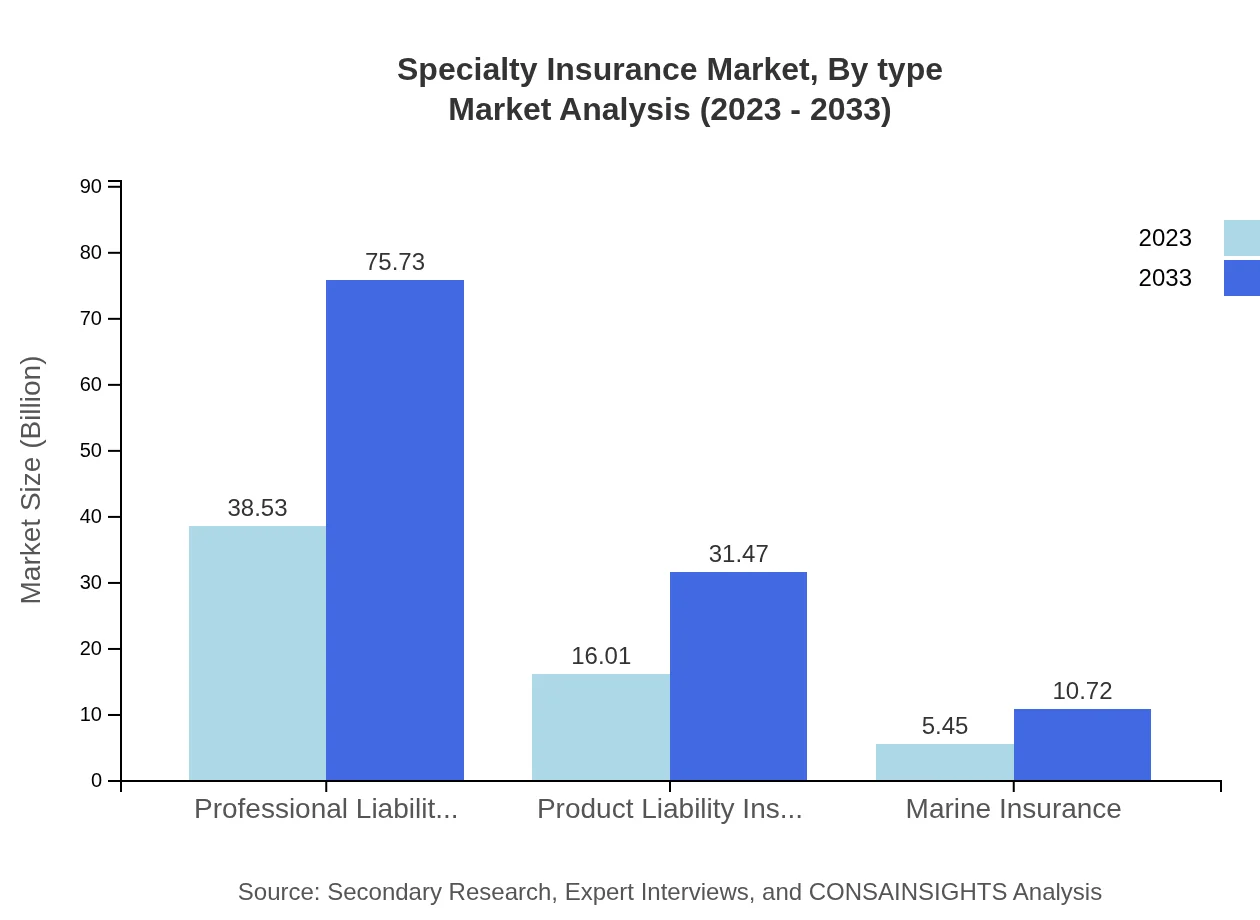

Specialty Insurance Market Analysis By Type

Key segments within the Specialty Insurance market include: 1. **Professional Liability Insurance**: Valued at $38.53 billion in 2023, projected to rise to $75.73 billion by 2033. This segment dominates the market due to its critical need in various services. 2. **Product Liability Insurance**: Estimated at $16.01 billion in 2023 and $31.47 billion by 2033. This growth reflects increased manufacturing and health safety concerns. 3. **Marine Insurance**: A smaller segment worth $5.45 billion in 2023, expected to grow to $10.72 billion, driven by global trade. 4. **Comprehensive Coverage**: Holding similar valuation trends as professional liability insurance, reinforced by diverse client needs.

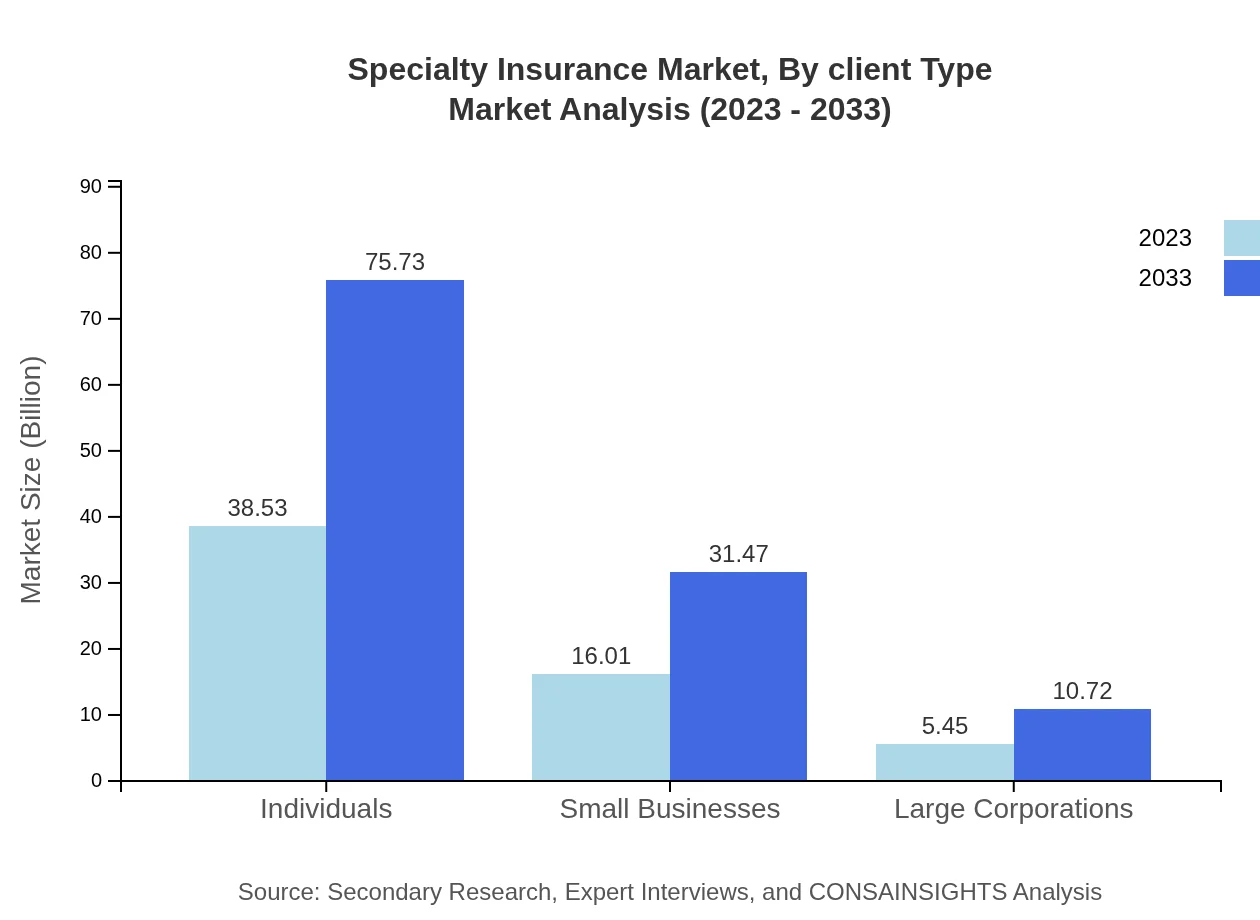

Specialty Insurance Market Analysis By Client Type

The market is divided into three critical client types: 1. **Individuals**: Valued at $38.53 billion in 2023, anticipated to double by 2033. 2. **Small Businesses**: Valued at $16.01 billion in 2023, projected to reach $31.47 billion. 3. **Large Corporations**: Estimated at $5.45 billion with a forecast of $10.72 billion. The rising number of small enterprises is significantly contributing to the increased demand for specialized insurance products.

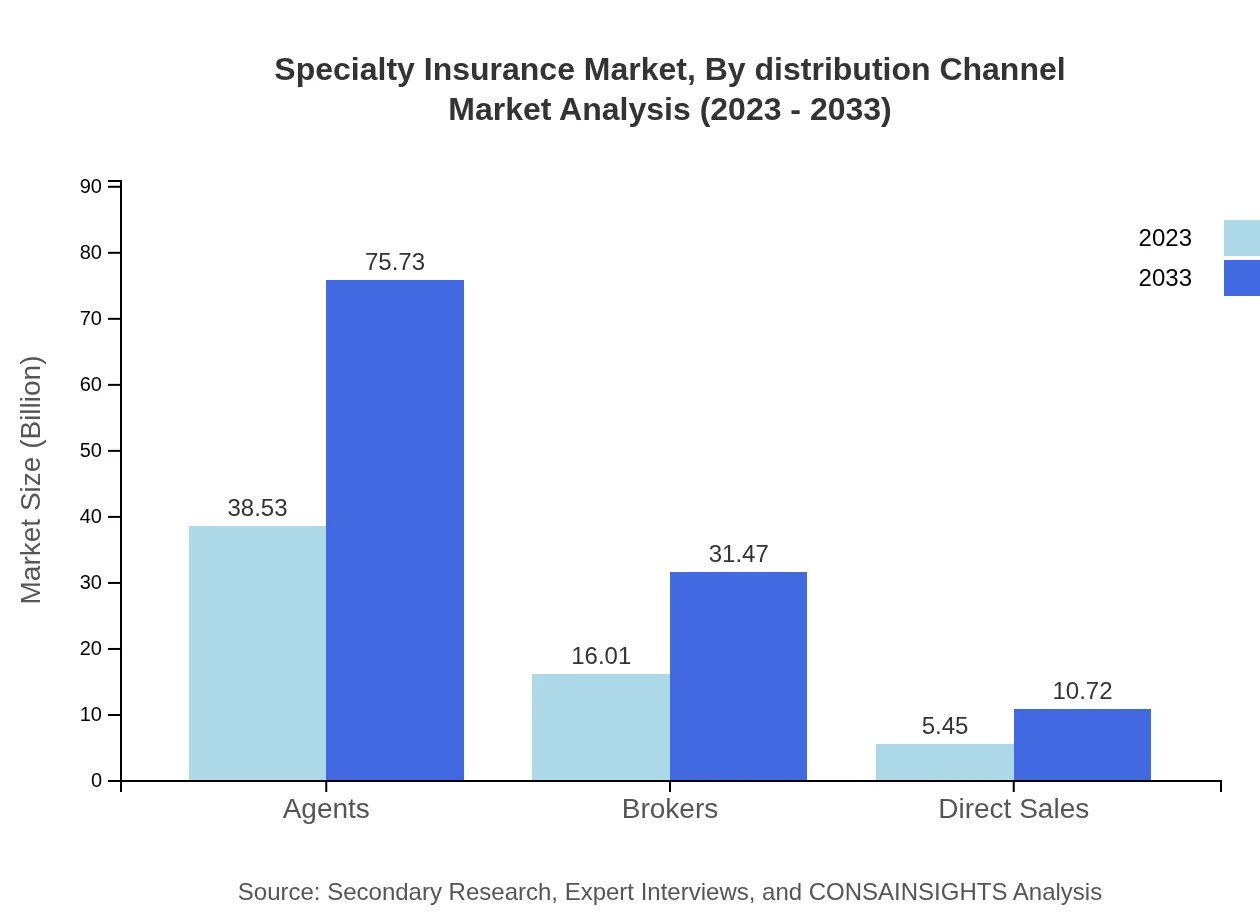

Specialty Insurance Market Analysis By Distribution Channel

Distribution channels in the Specialty Insurance market include: 1. **Agents**: Estimated to hold a significant market share with $38.53 billion in 2023. 2. **Brokers**: Valued at $16.01 billion, increasing steadily. 3. **Direct Sales**: Smaller but growing presence valued at $5.45 billion, reflecting shifts towards online and direct insurance purchases.

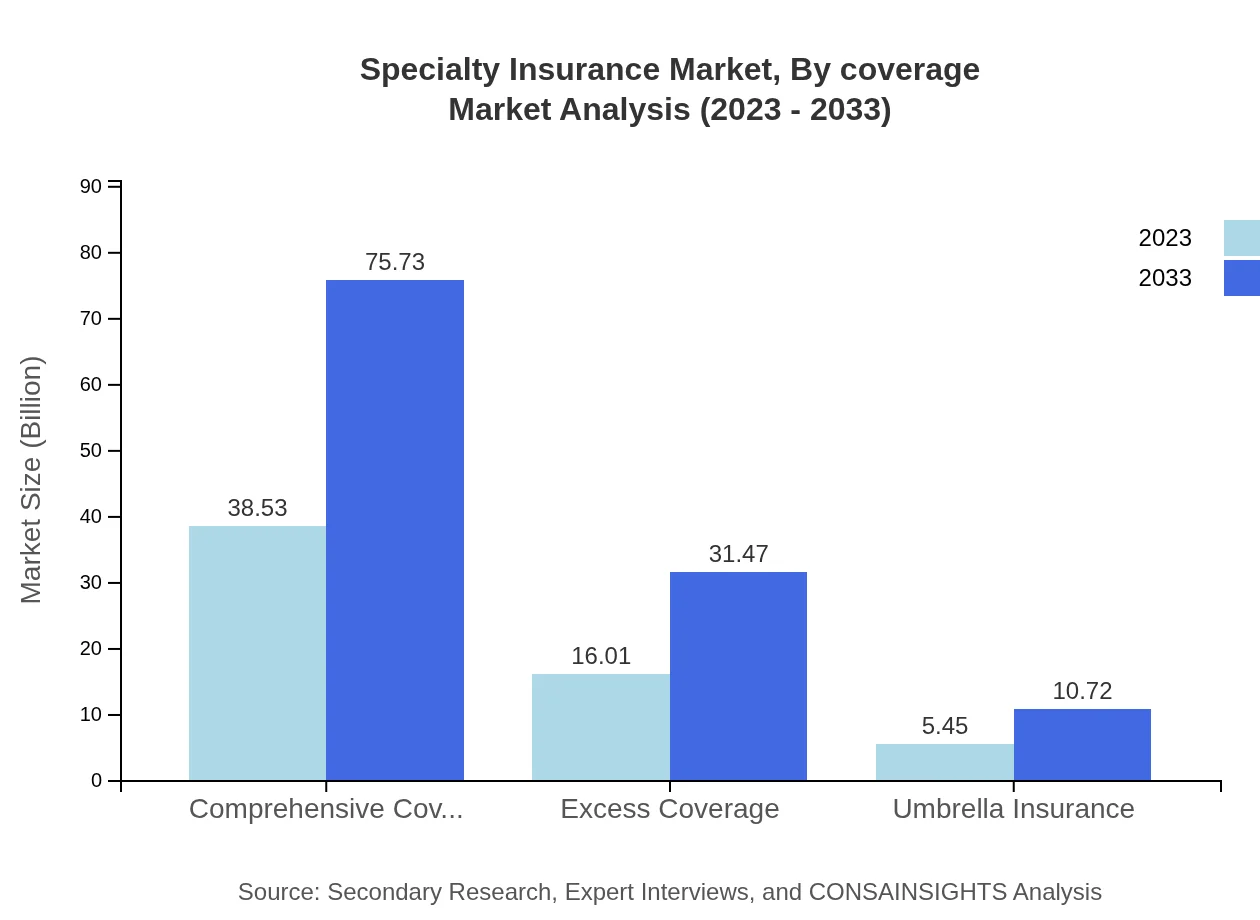

Specialty Insurance Market Analysis By Coverage

Specialty Insurance products vary in coverage, including: 1. **Comprehensive Coverage**: Dominates the market due to its extensive nature, valued at $38.53 billion in 2023. 2. **Excess Coverage**: Valued at $16.01 billion, focuses on additional security beyond standard policies. 3. **Umbrella Insurance**: Accounts for $5.45 billion, gaining a foothold among high-net-worth individuals and businesses.

Specialty Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Specialty Insurance Industry

AIG:

American International Group is a leading global insurance company providing a wide range of property casualty and life insurance products.Chubb Limited:

Chubb is one of the world's largest publicly traded property and casualty insurance companies, known for a wide array of specialty insurance products.Lloyd’s:

Lloyd's is a market of insurance underwriters known for providing specialized insurance and reinsurance coverages.Travelers:

The Travelers Company provides a variety of traditional and specialty insurance products to individuals and businesses, focusing on tailored coverage.Zurich Insurance Group:

Zurich is a leading multi-line insurer that offers general and specialty insurance products, particularly in risk assessment and management.We're grateful to work with incredible clients.

FAQs

What is the market size of specialty Insurance?

The specialty insurance market is valued at approximately $60 billion as of 2023, with a projected CAGR of 6.8% through 2033. This growth reflects expanding demand across various sectors and highlights the robustness of this industry.

What are the key market players or companies in this specialty Insurance industry?

Key players in the specialty insurance market include industry giants such as Berkshire Hathaway, AIG, Chubb Ltd, Lloyd's of London, and Zurich Insurance Group. These companies are recognized for their extensive portfolios and innovative offerings, influencing market dynamics significantly.

What are the primary factors driving the growth in the specialty insurance industry?

Growth in the specialty insurance market is driven by factors such as increasing risk awareness, expansion of niche markets, technological advancements in underwriting, and enhanced regulatory frameworks. The demand for customized insurance solutions is also fueling industry expansion.

Which region is the fastest Growing in the specialty insurance?

North America is the fastest-growing region in the specialty insurance sector, with a market increasing from $19.37 billion in 2023 to $38.07 billion by 2033. This region benefits from robust economic performance and a high demand for specialized insurance products.

Does ConsaInsights provide customized market report data for the specialty insurance industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients in the specialty insurance industry. This includes in-depth analysis of specific segments, competitive landscape, and forecasts to support strategic decision-making.

What deliverables can I expect from this specialty insurance market research project?

Deliverables include comprehensive market reports detailing market size, growth projections, segmentation analysis, competitive landscape, and trends. Clients receive actionable insights and tailored presentations to facilitate informed decision-making.

What are the market trends of specialty insurance?

Current trends in the specialty insurance market include the rise of digital transactions, increased focus on cybersecurity insurances, and the development of specialized products for emerging sectors. Additionally, sustainability considerations are becoming prominent in product offerings.