Specialty Malt Market Report

Published Date: 31 January 2026 | Report Code: specialty-malt

Specialty Malt Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Specialty Malt market, detailing market dynamics, trends, segmentation, regional insights, and forecasts from 2023 to 2033.

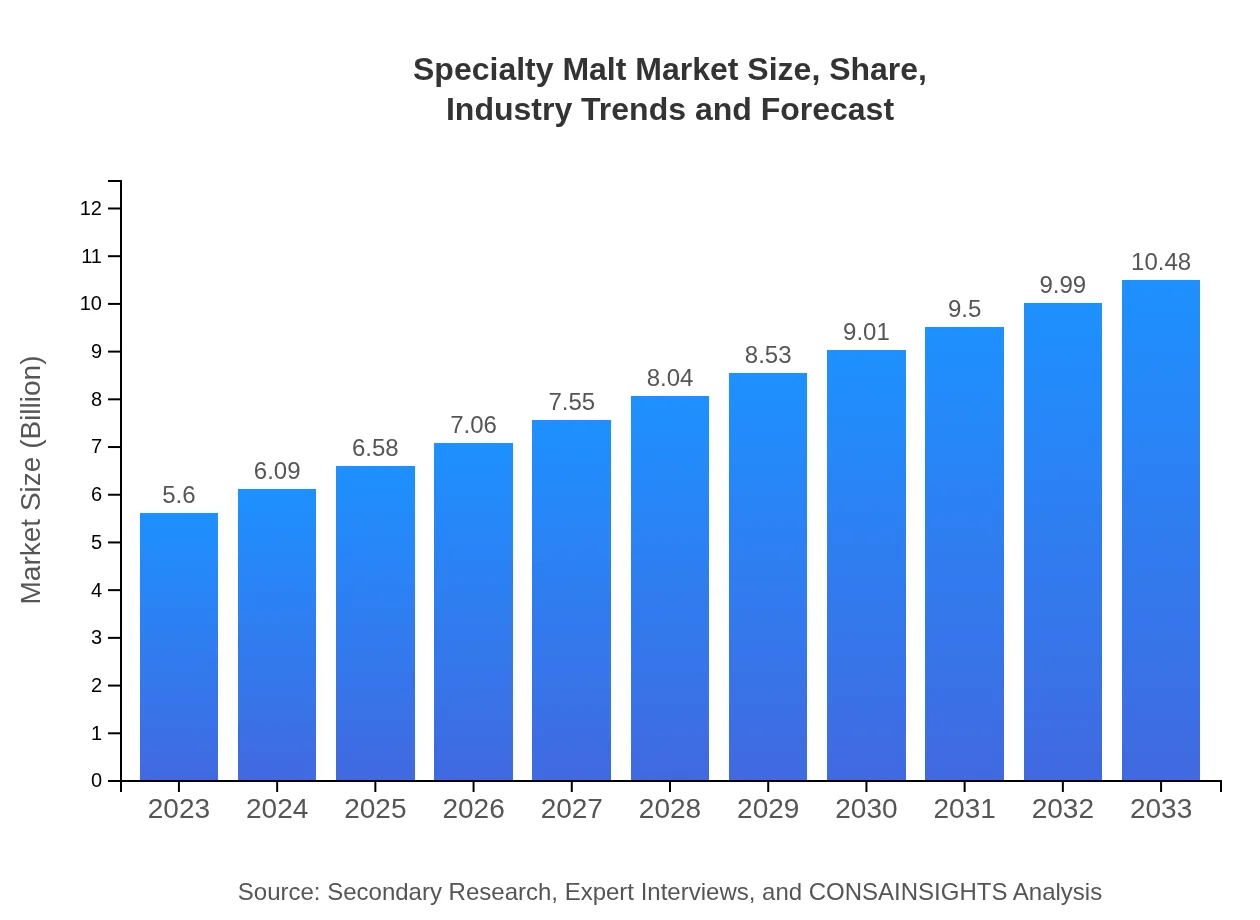

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $10.48 Billion |

| Top Companies | Cargill Inc., MaltEurop, Briess Malt & Ingredients Co., Carlsberg A/S, Muntons Plc. |

| Last Modified Date | 31 January 2026 |

Specialty Malt Market Overview

Customize Specialty Malt Market Report market research report

- ✔ Get in-depth analysis of Specialty Malt market size, growth, and forecasts.

- ✔ Understand Specialty Malt's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Specialty Malt

What is the Market Size & CAGR of Specialty Malt market in 2023?

Specialty Malt Industry Analysis

Specialty Malt Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Specialty Malt Market Analysis Report by Region

Europe Specialty Malt Market Report:

In Europe, the Specialty Malt market is projected to grow from $1.85 billion in 2023 to $3.45 billion by 2033. Europe being home to numerous historical brewing traditions, is witnessing a robust demand for specialty malts, particularly in Germany and Belgium where beer culture is deeply embedded in society.Asia Pacific Specialty Malt Market Report:

In the Asia Pacific region, the Specialty Malt market is projected to grow from $1.06 billion in 2023 to $1.99 billion by 2033, driven by a rising interest in beer consumption, specifically craft and specialty beers. The region has shown a growing trend towards premiumization in alcoholic beverages, leading to an increasing demand for high-quality specialty malts.North America Specialty Malt Market Report:

The North American Specialty Malt market is forecasted to grow from $1.87 billion in 2023 to approximately $3.50 billion by 2033, driven by the booming craft beer movement and increasing consumer preference for artisanal and high-quality beverages. The competition among craft breweries is leading to innovative uses of specialty malts, amplifying demand.South America Specialty Malt Market Report:

The South American market for Specialty Malt is expected to grow from $0.30 billion in 2023 to $0.56 billion by 2033. This growth is stimulated by the flourishing craft beer scene in countries such as Brazil and Argentina, which cultivates local ingredients that enhance the specialty malt segment in the region.Middle East & Africa Specialty Malt Market Report:

The Specialty Malt market in the Middle East and Africa is projected to grow from $0.52 billion in 2023 to $0.97 billion by 2033. Factors contributing to this growth include an increasing trend of beer consumption in the region and emerging craft breweries that are beginning to explore the premium malt segments.Tell us your focus area and get a customized research report.

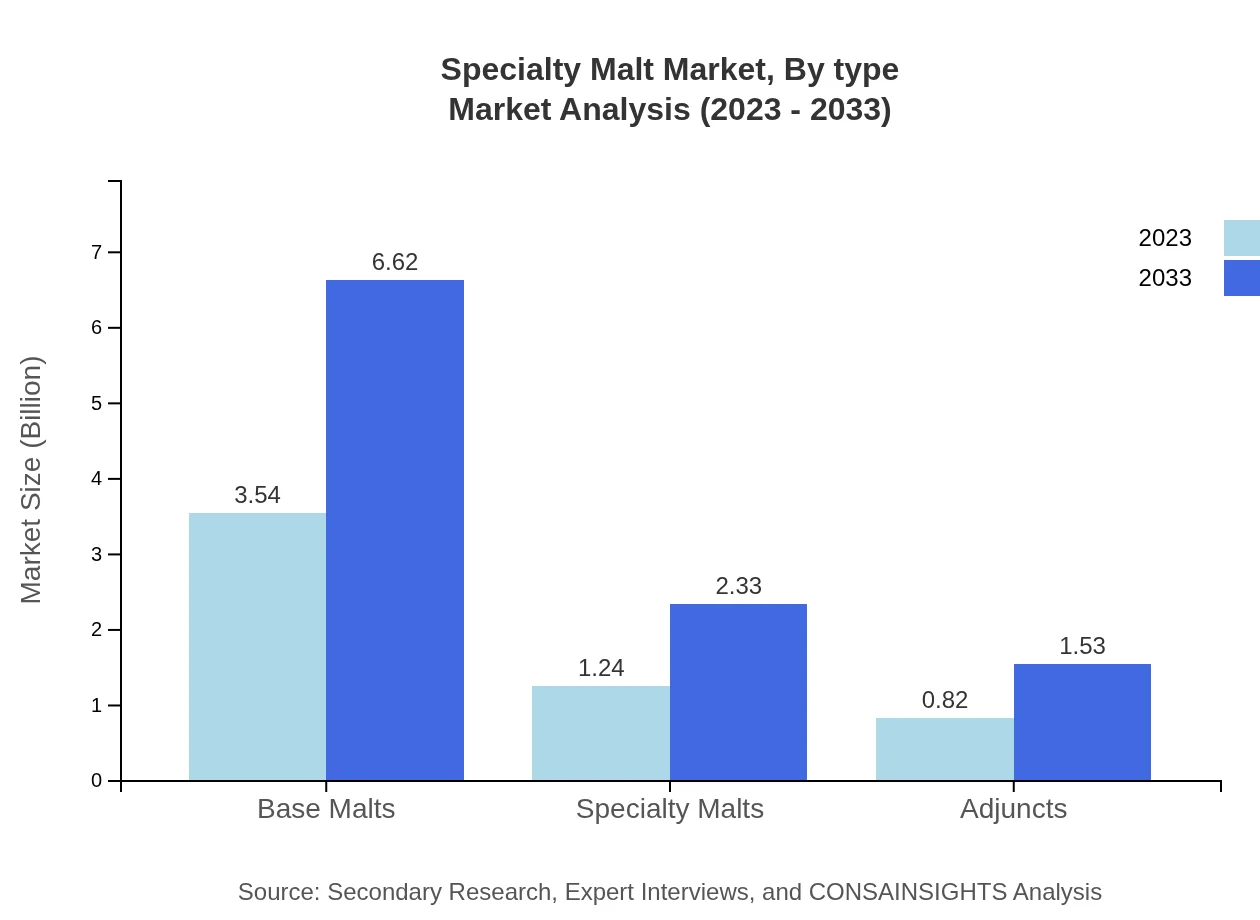

Specialty Malt Market Analysis By Type

Whole Grain malts dominate the market with sizes of $4.73 billion in 2023, projected to reach $8.86 billion by 2033. Milled Malts, though less prevalent, offer substantial returns at $0.87 billion in 2023 improving to $1.62 billion by 2033. Specialty Malts account for $1.24 billion in 2023, growing to $2.33 billion by 2033, while Adjuncts grow from $0.82 billion to $1.53 billion within the same time frame.

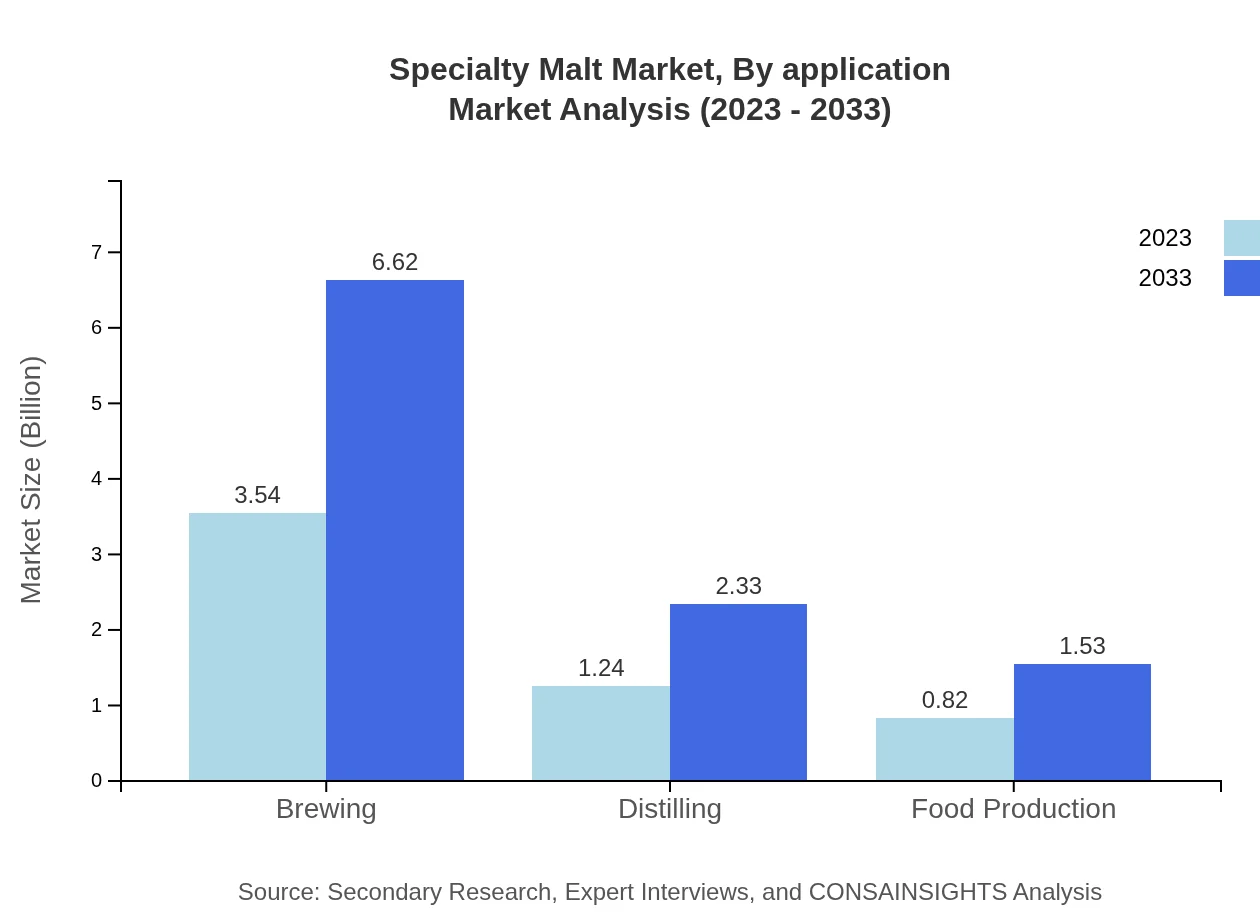

Specialty Malt Market Analysis By Application

The primary applications for Specialty Malt lie within Brewing, which accounts for $3.54 billion in 2023 and is expected to reach $6.62 billion by 2033. Distilling and Food Production also play critical roles, expected to grow from $1.24 billion to $2.33 billion and $0.82 billion to $1.53 billion respectively during the forecast period.

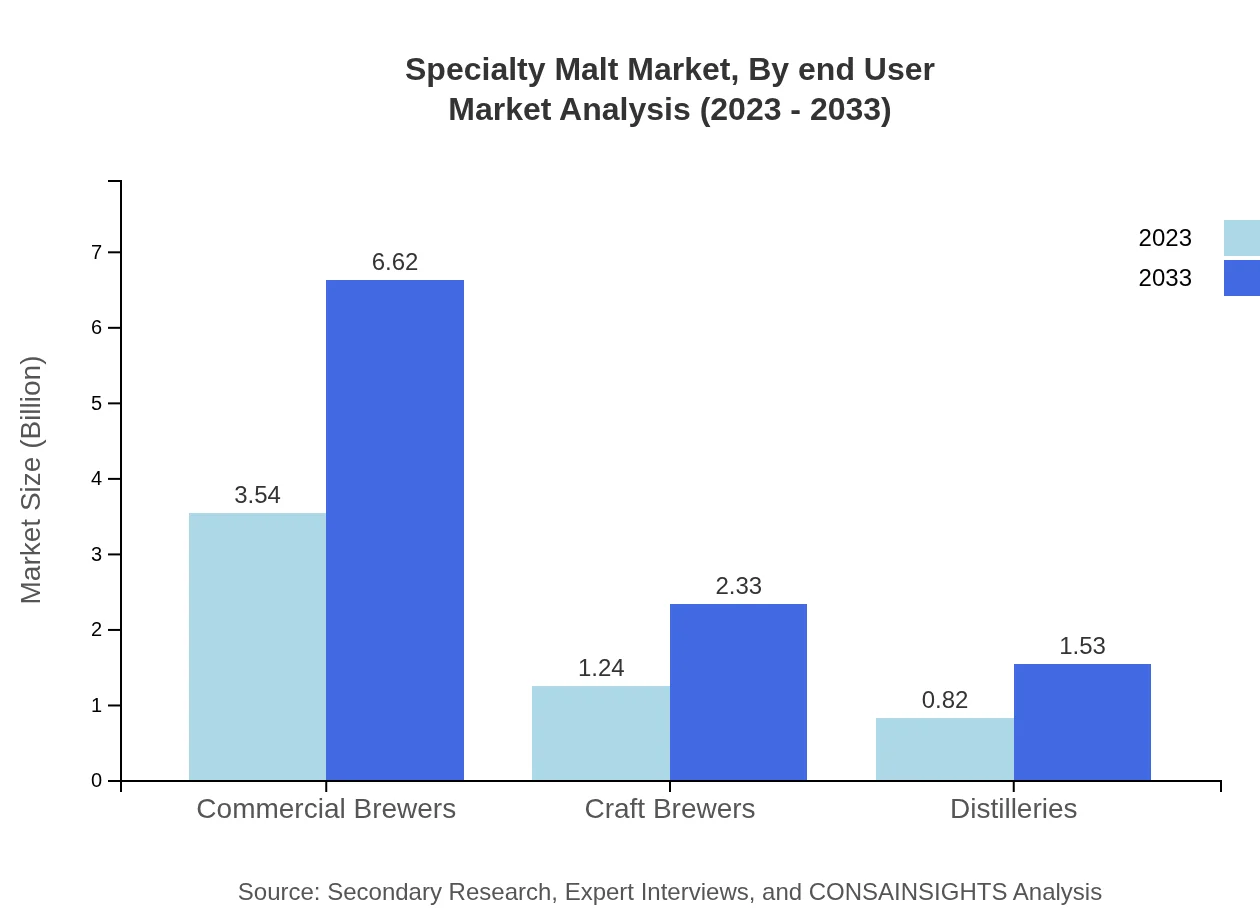

Specialty Malt Market Analysis By End User

The end-user segmentation reveals a focus on Commercial Brewers at $3.54 billion in 2023 to $6.62 billion by 2033, as well as Craft Brewers from $1.24 billion to $2.33 billion. Distilleries and Food Production also feature prominently with expected growth patterns indicative of rising consumer preferences for specialty flavors.

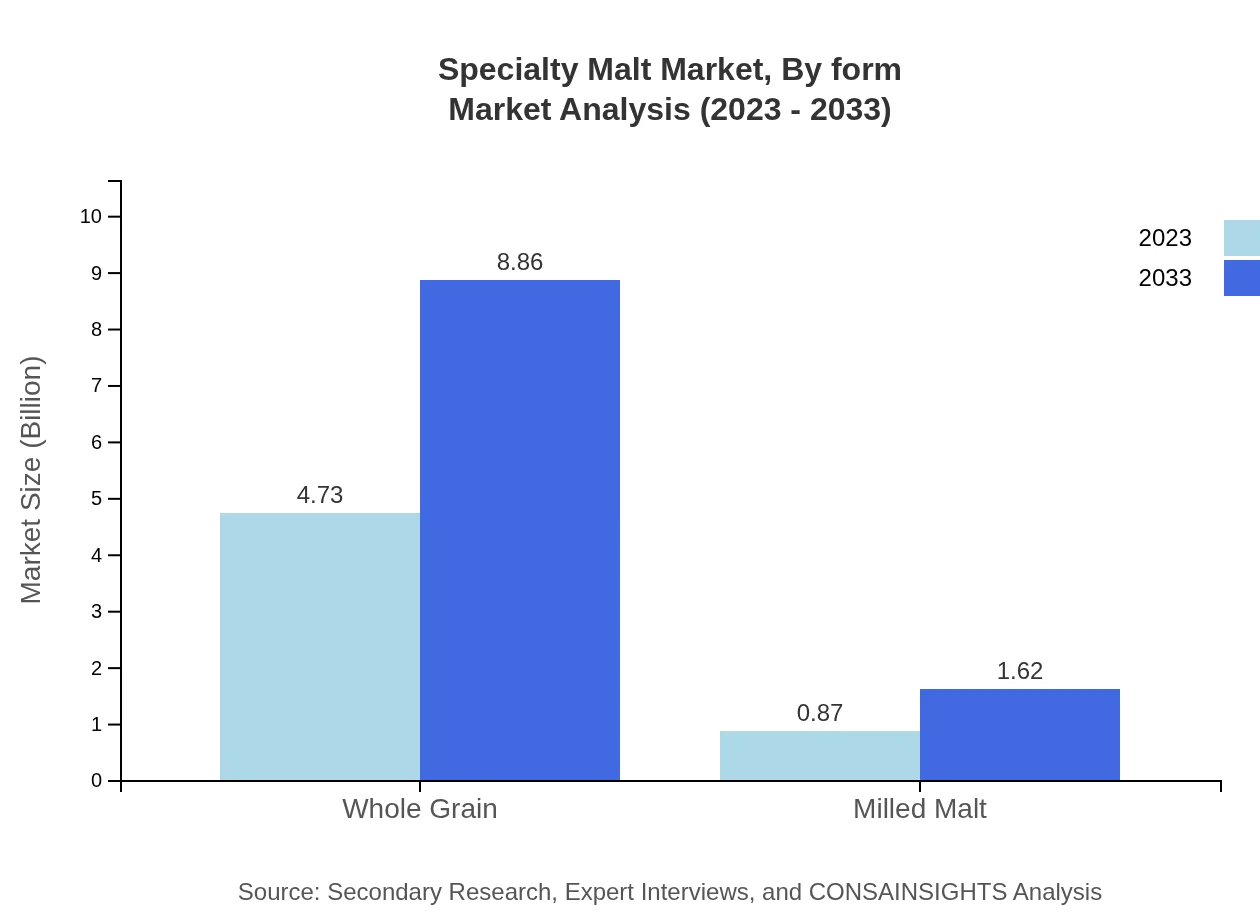

Specialty Malt Market Analysis By Form

Specialty malts exist in various forms, predominantly in whole grain and milled segments. Whole grain malts represent a versatile option for manufacturers, while milled malts cater primarily to the processing ease sought by brewers.

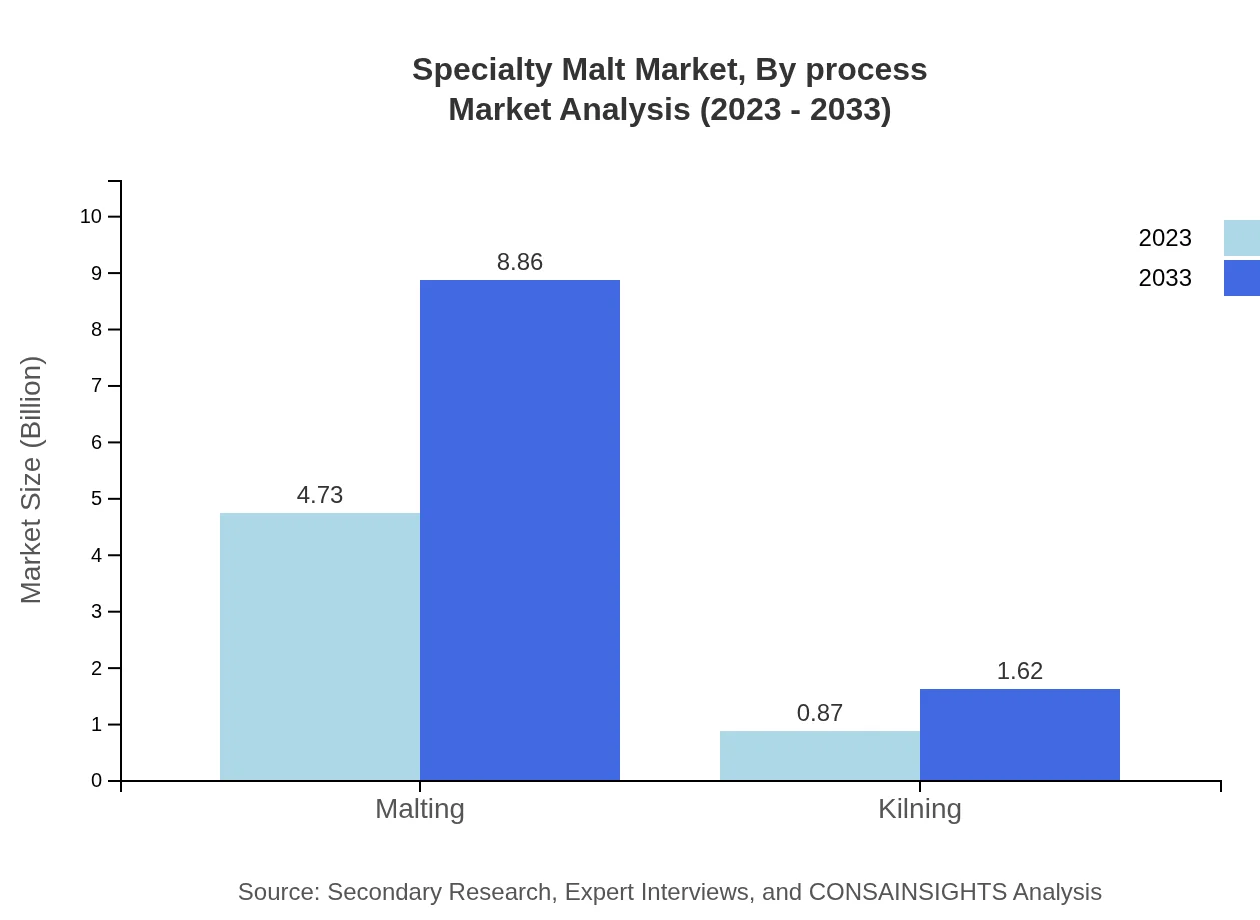

Specialty Malt Market Analysis By Process

The malting process accounts for the most significant market value, valued at approximately $4.73 billion in 2023 and forecasted to grow to $8.86 billion by 2033. Innovations in malting techniques continue to enhance productivity and flavor, while kilning holds a secondary position valued at $0.87 billion in 2023.

Specialty Malt Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Specialty Malt Industry

Cargill Inc.:

Cargill is a key player in the specialty malt market, heavily involved in producing high-quality malting products, emphasizing innovation and sustainability.MaltEurop:

MaltEurop is a leading malt producer known for its commitment to quality and customer satisfaction, providing a range of specialty malts for breweries worldwide.Briess Malt & Ingredients Co.:

Briess is recognized for its diverse selection of specialty and base malts, catering particularly to craft brewers and specialty food producers.Carlsberg A/S:

As part of its comprehensive strategy, Carlsberg operates its malting plants, ensuring high-quality ingredients for its own brewing operations.Muntons Plc.:

Muntons is notable for its innovation in malt production and its extensive range of specialty malts, focusing on sustainability and quality.We're grateful to work with incredible clients.

FAQs

What is the market size of specialty Malt?

The specialty malt market is valued at approximately $5.6 billion in 2023, with an expected CAGR of 6.3% from 2024 to 2033, indicating robust growth and expanding opportunities within the industry.

What are the key market players or companies in this specialty Malt industry?

Key players in the specialty malt market include companies such as Malteurop, Boortmalt, and Rahr Corporation, which lead in production capabilities and market share while driving innovation in malt products.

What are the primary factors driving the growth in the specialty Malt industry?

Growth in the specialty malt industry is driven by rising demand for craft beer, increased use in food applications, and growing awareness of the nutritional benefits of specialty malts.

Which region is the fastest Growing in the specialty Malt?

The fastest-growing region for specialty malt is Europe, projected to grow from $1.85 billion in 2023 to $3.45 billion in 2033, showcasing a significant market expansion over the decade.

Does ConsaInsights provide customized market report data for the specialty Malt industry?

Yes, ConsaInsights offers customized market report data for the specialty malt industry, catering to specific client needs for tailored insights and analysis.

What deliverables can I expect from this specialty Malt market research project?

Deliverables typically include comprehensive market analysis reports, competitive landscape summaries, forecast data, and detailed insights into market segments and regional dynamics.

What are the market trends of specialty Malt?

Market trends in specialty malt include increasing adoption among craft brewers, innovation in malt varieties, and a shift towards sustainable and organic production practices.