Specialty Oilfield Chemicals Market Report

Published Date: 02 February 2026 | Report Code: specialty-oilfield-chemicals

Specialty Oilfield Chemicals Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Specialty Oilfield Chemicals market, covering market size, trends, technology impacts, and regional developments from 2023 to 2033. Insights include forecasts, key players, and growth opportunities within the industry.

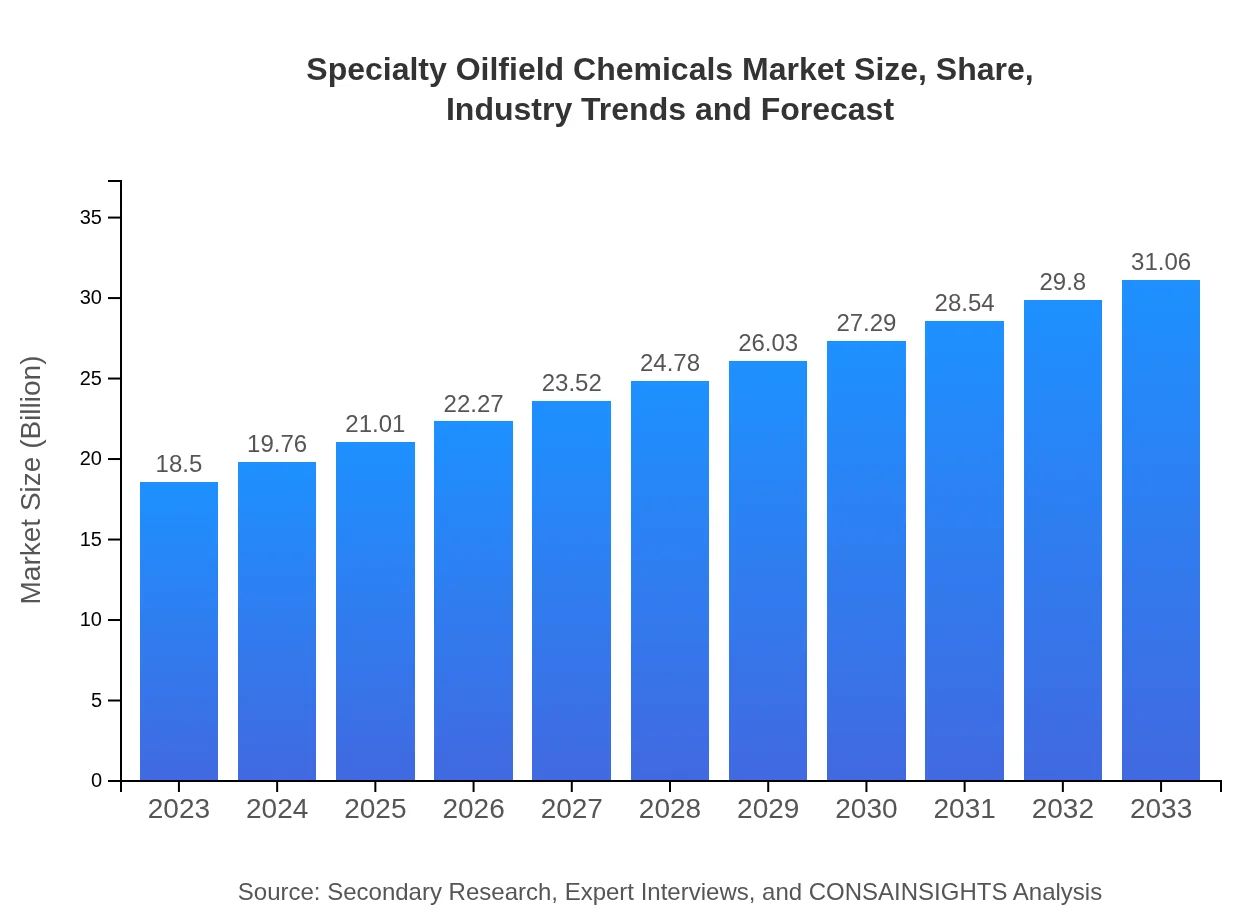

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $18.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $31.06 Billion |

| Top Companies | Halliburton, Schlumberger, Baker Hughes, BASF |

| Last Modified Date | 02 February 2026 |

Specialty Oilfield Chemicals Market Overview

Customize Specialty Oilfield Chemicals Market Report market research report

- ✔ Get in-depth analysis of Specialty Oilfield Chemicals market size, growth, and forecasts.

- ✔ Understand Specialty Oilfield Chemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Specialty Oilfield Chemicals

What is the Market Size & CAGR of Specialty Oilfield Chemicals market in 2023?

Specialty Oilfield Chemicals Industry Analysis

Specialty Oilfield Chemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Specialty Oilfield Chemicals Market Analysis Report by Region

Europe Specialty Oilfield Chemicals Market Report:

Europe's market is expected to grow from USD 5.09 billion in 2023 to USD 8.54 billion by 2033. The heightened focus on sustainable energy solutions and stringent regulations regarding chemical usage in oil and gas activities are influencing the market. Countries like Norway and the UK are leading the adoption of advanced oilfield chemicals.Asia Pacific Specialty Oilfield Chemicals Market Report:

In 2023, the Asia Pacific region holds a market size of USD 3.48 billion, expected to grow to USD 5.84 billion by 2033. Rapid industrialization and increasing oil and gas exploration activities in countries like China and India are driving this growth. The adoption of advanced chemicals and eco-friendly formulations is also notable in this region.North America Specialty Oilfield Chemicals Market Report:

North America, with a market size of USD 7.16 billion in 2023, is anticipated to expand to USD 12.01 billion by 2033. This region's growth is strongly linked to the shale oil boom, along with continuous advancements in refining and completion technologies. Major players are increasingly focusing on innovation and performance enhancement.South America Specialty Oilfield Chemicals Market Report:

The South American market size was USD 1.85 billion in 2023 and is projected to reach USD 3.10 billion by 2033. Growth is supported by ongoing offshore drilling initiatives and investment in natural resource development, particularly in Brazil and Argentina. Environmental regulations are encouraging the shift towards sustainable oilfield chemicals.Middle East & Africa Specialty Oilfield Chemicals Market Report:

In the Middle East and Africa, the market size stood at USD 0.93 billion in 2023 and is expected to reach USD 1.56 billion by 2033. The region continues to be a key player in conventional oil production, with substantial investments in enhancing operational efficiencies and maintaining production levels.Tell us your focus area and get a customized research report.

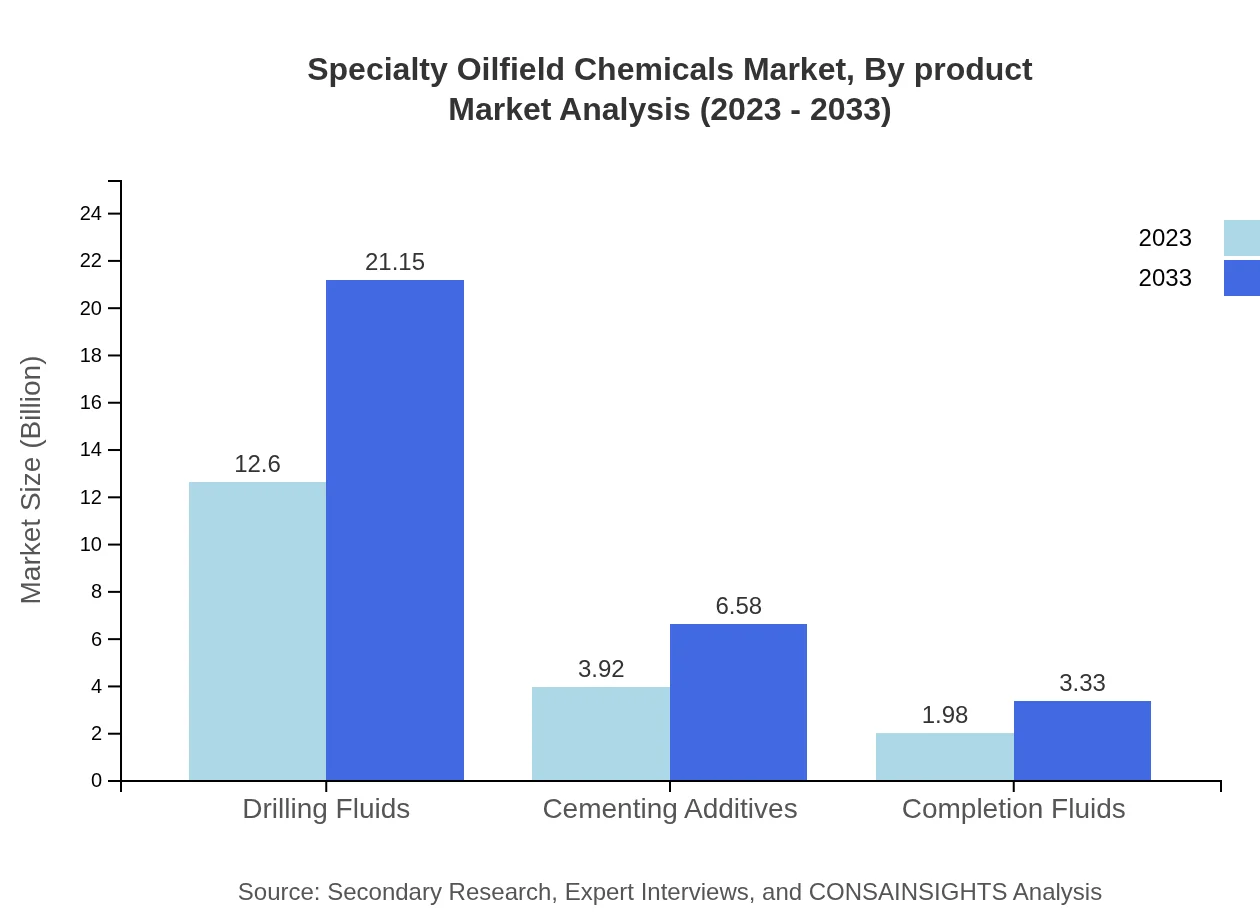

Specialty Oilfield Chemicals Market Analysis By Product

The drilling fluids segment leads the market, valued at USD 12.60 billion in 2023 and projected to grow to USD 21.15 billion by 2033, accounting for approximately 68.09% market share. Cementing additives follow with USD 3.92 billion, expected to increase to USD 6.58 billion. Completion fluids and enhanced oil recovery solutions are also significant contributors, with valuations of USD 1.98 billion and anticipated growth to USD 3.33 billion respectively.

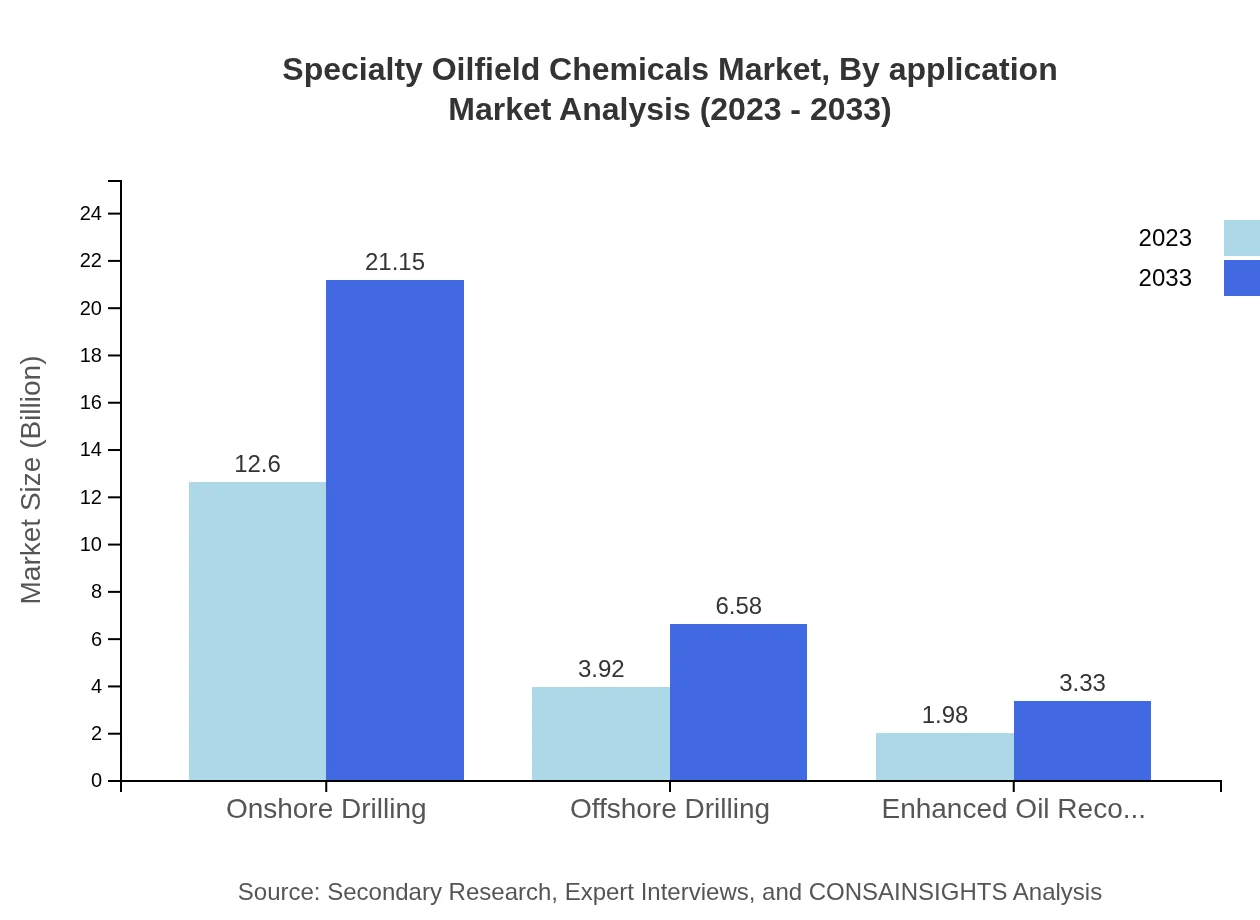

Specialty Oilfield Chemicals Market Analysis By Application

The application segment indicates that oil and gas exploration, comprising 68.09% share, will grow from USD 12.60 billion in 2023 to USD 21.15 billion by 2033. Independent Oil Companies and National Oil Companies share similar growth trajectories, with projected market sizes of USD 3.92 billion and USD 1.98 billion, respectively. This emphasizes the critical reliance on specialty chemicals to support various operational aspects of oil extraction.

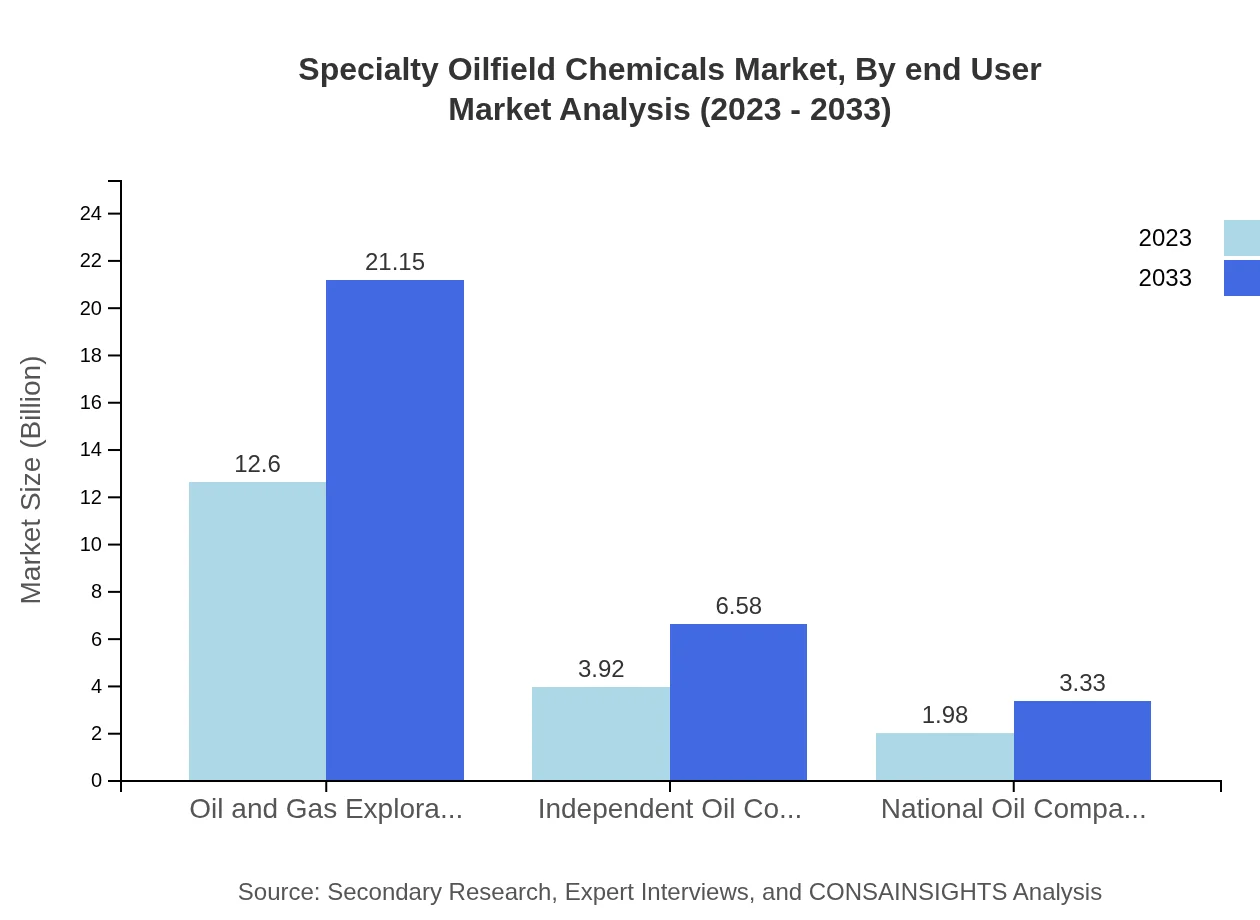

Specialty Oilfield Chemicals Market Analysis By End User

The segmentation by end-user shows a predominant share held by independent and national oil companies, valued at USD 3.92 billion and USD 1.98 billion in 2023, with growth potentials to USD 6.58 billion and USD 3.33 billion by 2033. Onshore and offshore drilling companies also represent significant market shares, driven by increasing investments in exploration activities.

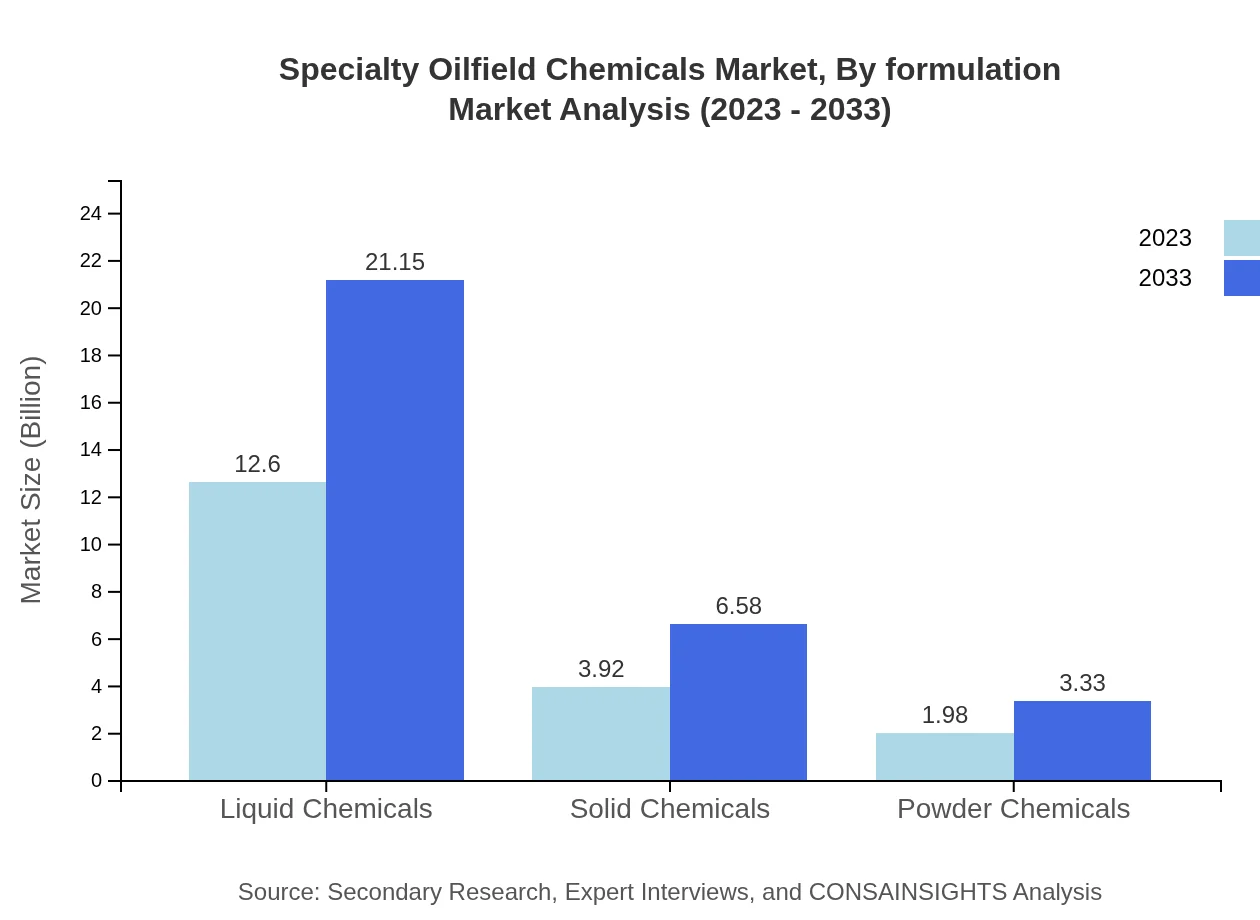

Specialty Oilfield Chemicals Market Analysis By Formulation

Product formulations in plastic materials, liquid chemicals, solid chemicals, and powder chemicals are fundamental to the market. Liquid chemicals represent the leading segment with USD 12.60 billion market size in 2023, followed by solid and powder chemicals at USD 3.92 billion and USD 1.98 billion respectively. The trends indicate a shift towards more sustainable formulation methodologies in response to regulatory pressures.

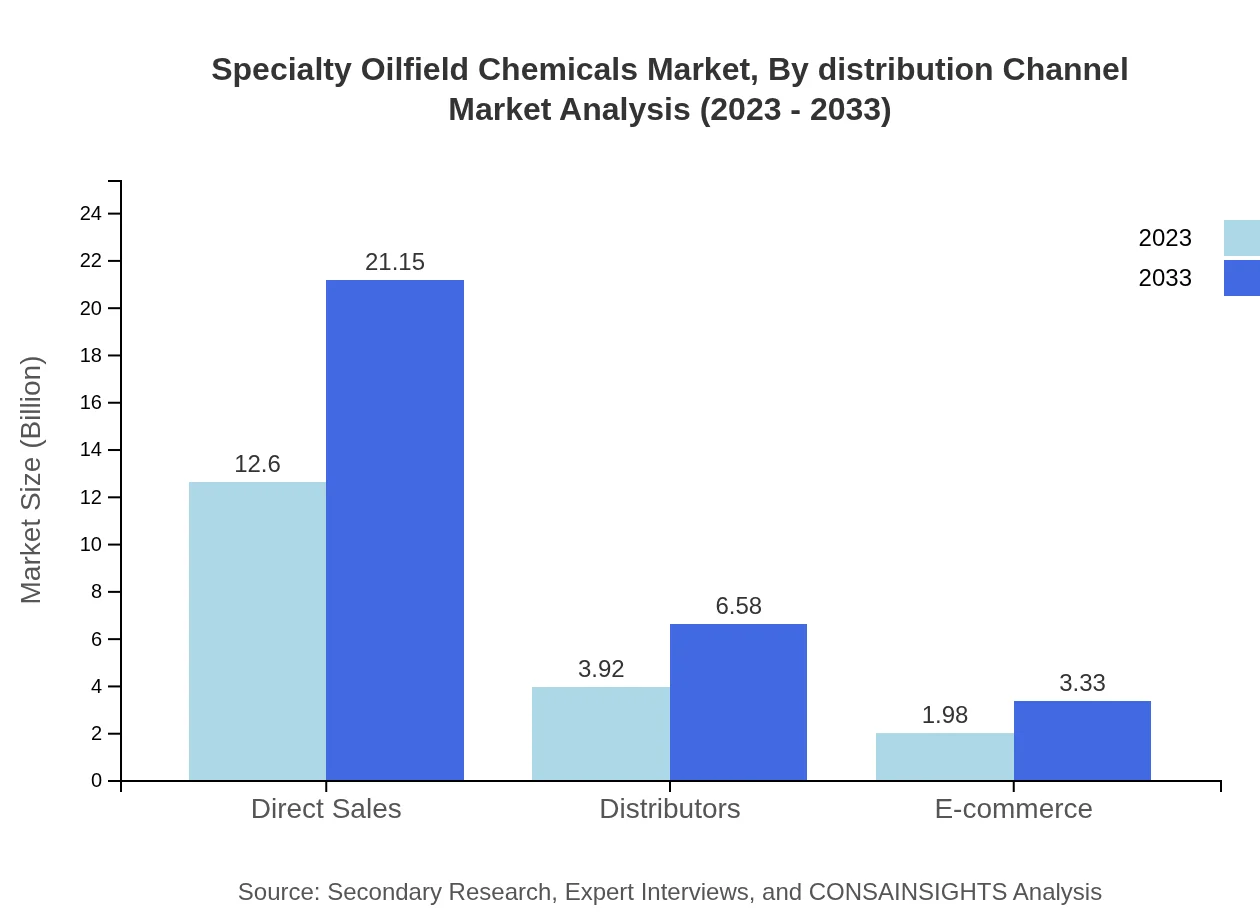

Specialty Oilfield Chemicals Market Analysis By Distribution Channel

Distribution channels are primarily categorized into direct sales (USD 12.60 billion), distributors (USD 3.92 billion), and e-commerce (USD 1.98 billion) as of 2023. Direct sales have maintained dominance, accounting for 68.09% of the overall market share, underscoring the importance of personal relationships and tailored solutions in serving clients across various sectors of the oil and gas industry.

Specialty Oilfield Chemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Specialty Oilfield Chemicals Industry

Halliburton:

A global leader in oilfield services, Halliburton provides comprehensive drilling, evaluation, and completion chemicals aimed at enhancing well performance and operational efficiency.Schlumberger:

Known for its technological innovations, Schlumberger specializes in oilfield chemicals and services that optimize hydrocarbon recovery and maintenance throughout the production lifecycle.Baker Hughes:

Baker Hughes offers a diverse range of specialty chemicals designed for various applications in oil and gas upstream and downstream activities, emphasizing environmental responsibility.BASF:

A key player in the chemical industry, BASF provides specialty oilfield chemicals that enhance productivity while focusing on sustainability and innovative solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of specialty Oilfield Chemicals?

The global specialty oilfield chemicals market is projected to reach $18.5 billion by 2033, growing at a CAGR of 5.2%. This growth reflects increasing demand for efficient oil extraction processes and enhanced oil recovery methods.

What are the key market players or companies in this specialty Oilfield Chemicals industry?

Key players in the specialty oilfield chemicals market include major companies like Halliburton, Schlumberger, Baker Hughes, and BASF, which lead in innovation and sustainable chemical solutions crucial for oilfield operations.

What are the primary factors driving the growth in the specialty Oilfield Chemicals industry?

The growth of the specialty oilfield chemicals industry is driven by rising oil production activities, demand for enhanced oil recovery techniques, and the need for specialty chemicals that improve operational efficiency in challenging environments.

Which region is the fastest Growing in the specialty Oilfield Chemicals?

North America is the fastest-growing region in the specialty oilfield chemicals market, projected to grow from $7.16 billion in 2023 to $12.01 billion in 2033, driven by advanced fracking technologies and increased oil exploration.

Does ConsaInsights provide customized market report data for the specialty Oilfield Chemicals industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the specialty oilfield chemicals industry, allowing for deeper insights and strategic decision-making.

What deliverables can I expect from this specialty Oilfield Chemicals market research project?

Expect comprehensive deliverables including market size analysis, growth forecasts, competitive analysis, key trends, and detailed segment information to support strategic planning and market entry.

What are the market trends of specialty Oilfield Chemicals?

Current trends in the specialty oilfield chemicals market include a shift towards eco-friendly chemicals, increased digitalization in operations, and a rising demand for high-performance chemicals that reduce costs and improve safety during drilling.