Specialty Polymers Market Report

Published Date: 02 February 2026 | Report Code: specialty-polymers

Specialty Polymers Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Specialty Polymers market, encompassing market size, growth forecasts, key trends, and regional analyses from 2023 to 2033. It is designed for stakeholders seeking in-depth understanding and strategic direction in this dynamic industry.

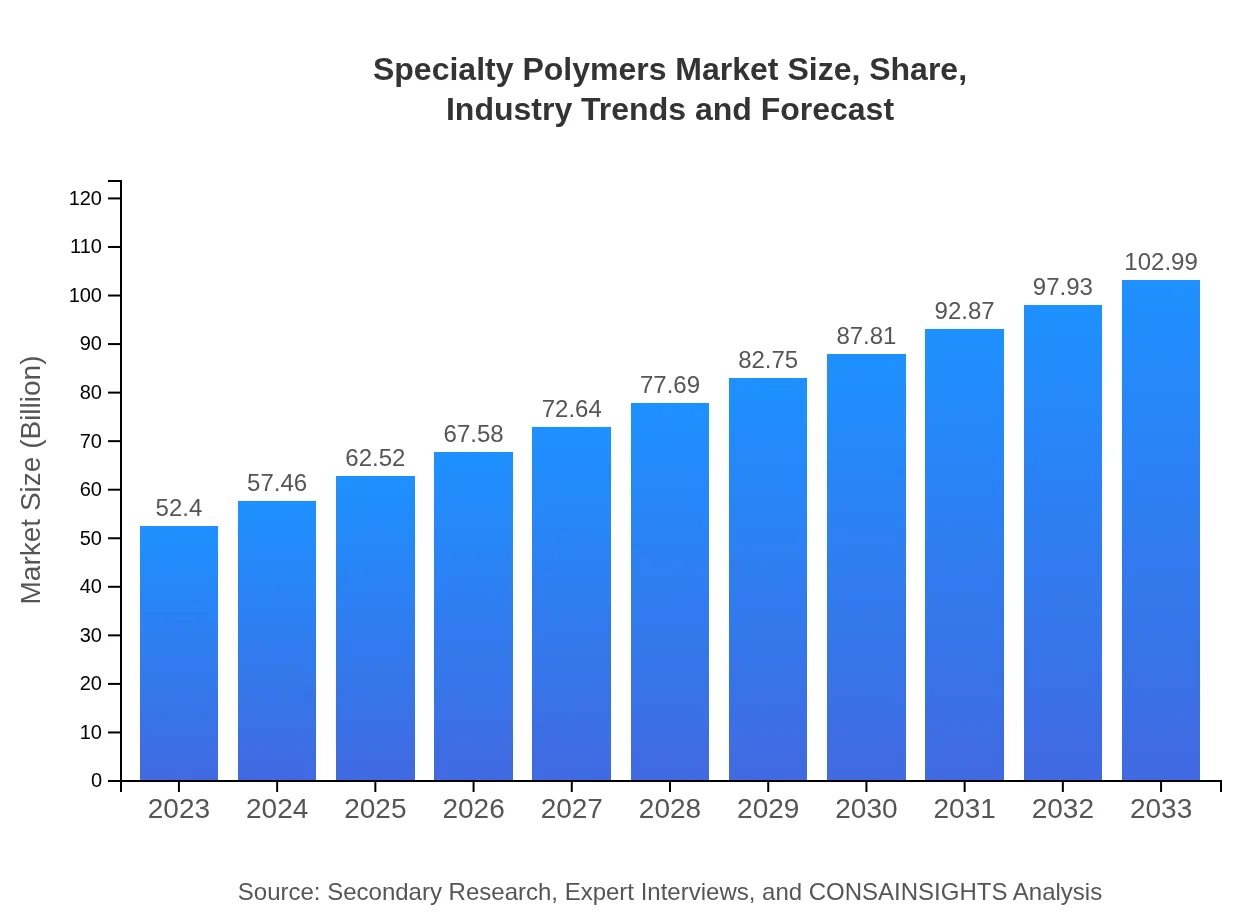

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $52.40 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $102.99 Billion |

| Top Companies | BASF SE, Dow Inc., DuPont de Nemours, Inc., Covestro AG, SABIC |

| Last Modified Date | 02 February 2026 |

Specialty Polymers Market Overview

Customize Specialty Polymers Market Report market research report

- ✔ Get in-depth analysis of Specialty Polymers market size, growth, and forecasts.

- ✔ Understand Specialty Polymers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Specialty Polymers

What is the Market Size & CAGR of Specialty Polymers market in 2023?

Specialty Polymers Industry Analysis

Specialty Polymers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Specialty Polymers Market Analysis Report by Region

Europe Specialty Polymers Market Report:

In Europe, the Specialty Polymers market is expected to grow from $13.47 billion in 2023 to $26.48 billion by 2033. The EU's stringent environmental regulations are pushing manufacturers towards the development of sustainable polymers, thereby accelerating market growth. Countries like Germany and France are pivotal players in this segment.Asia Pacific Specialty Polymers Market Report:

In the Asia Pacific region, the Specialty Polymers market is expected to grow from $10.93 billion in 2023 to $21.48 billion by 2033. This significant growth is driven by robust industrial activities in countries like China and India, coupled with increasing investments in infrastructure and automotive sectors. The region's focus on technology advancement and sustainable practices further strengthens the market outlook.North America Specialty Polymers Market Report:

North America's market is anticipated to expand from $19.50 billion in 2023 to $38.33 billion by 2033. The presence of major market players and advanced technological infrastructure drives growth, particularly in the automotive and electronics sectors. Additionally, a rise in R&D efforts for biopolymers is expected to bolster market expansion.South America Specialty Polymers Market Report:

The South American Specialty Polymers market is projected to grow from $1.78 billion in 2023 to $3.50 billion by 2033. Growth in this region is primarily fuelled by developments in automotive and construction industries, alongside steady demand for innovative packaging solutions. Brazil and Argentina are the key contributors to this growth.Middle East & Africa Specialty Polymers Market Report:

The Specialty Polymers market in the Middle East and Africa is projected to rise from $6.71 billion in 2023 to $13.19 billion by 2033. Increased investments in the region's oil and gas, automotive, and construction sectors are anticipated to support market growth, alongside a growing focus on sustainable manufacturing practices.Tell us your focus area and get a customized research report.

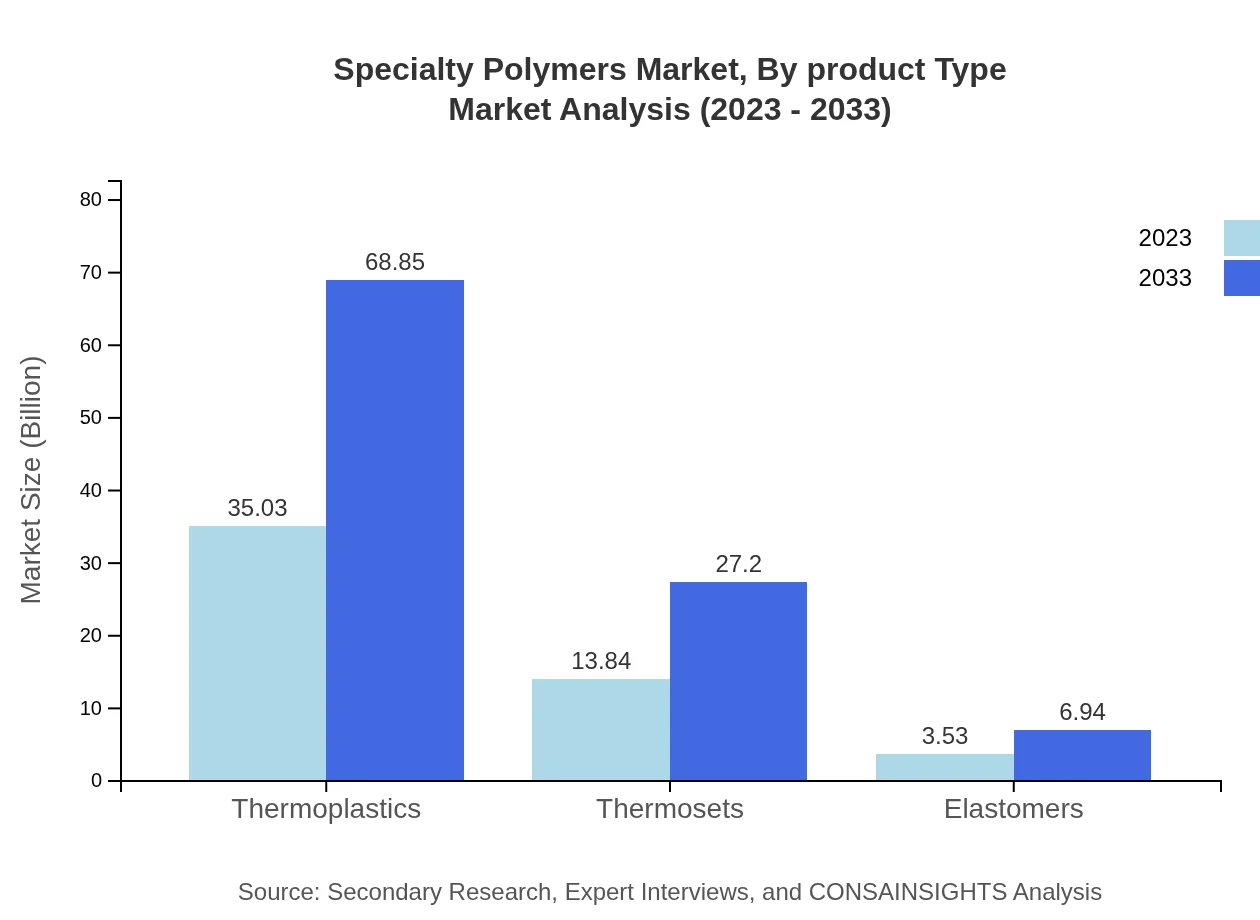

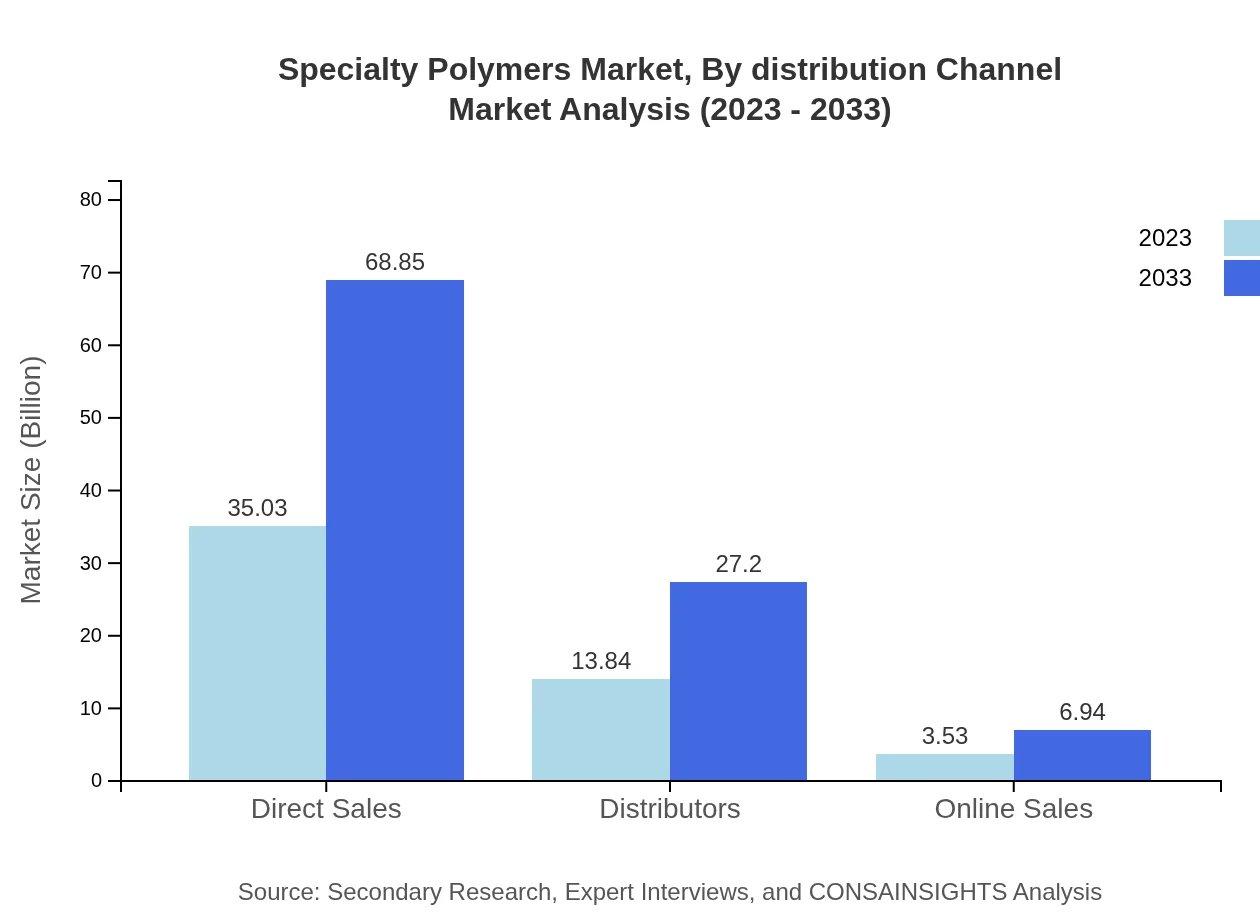

Specialty Polymers Market Analysis By Product Type

Thermoplastics dominate the Specialty Polymers market, capturing a market size of $35.03 billion in 2023, projected to reach $68.85 billion by 2033, comprising 66.85% of the total market share. Thermosets, with an initial size of $13.84 billion expected to grow to $27.20 billion, hold a 26.41% share. Elastomers, although smaller, represent a niche market with $3.53 billion, growing to $6.94 billion.

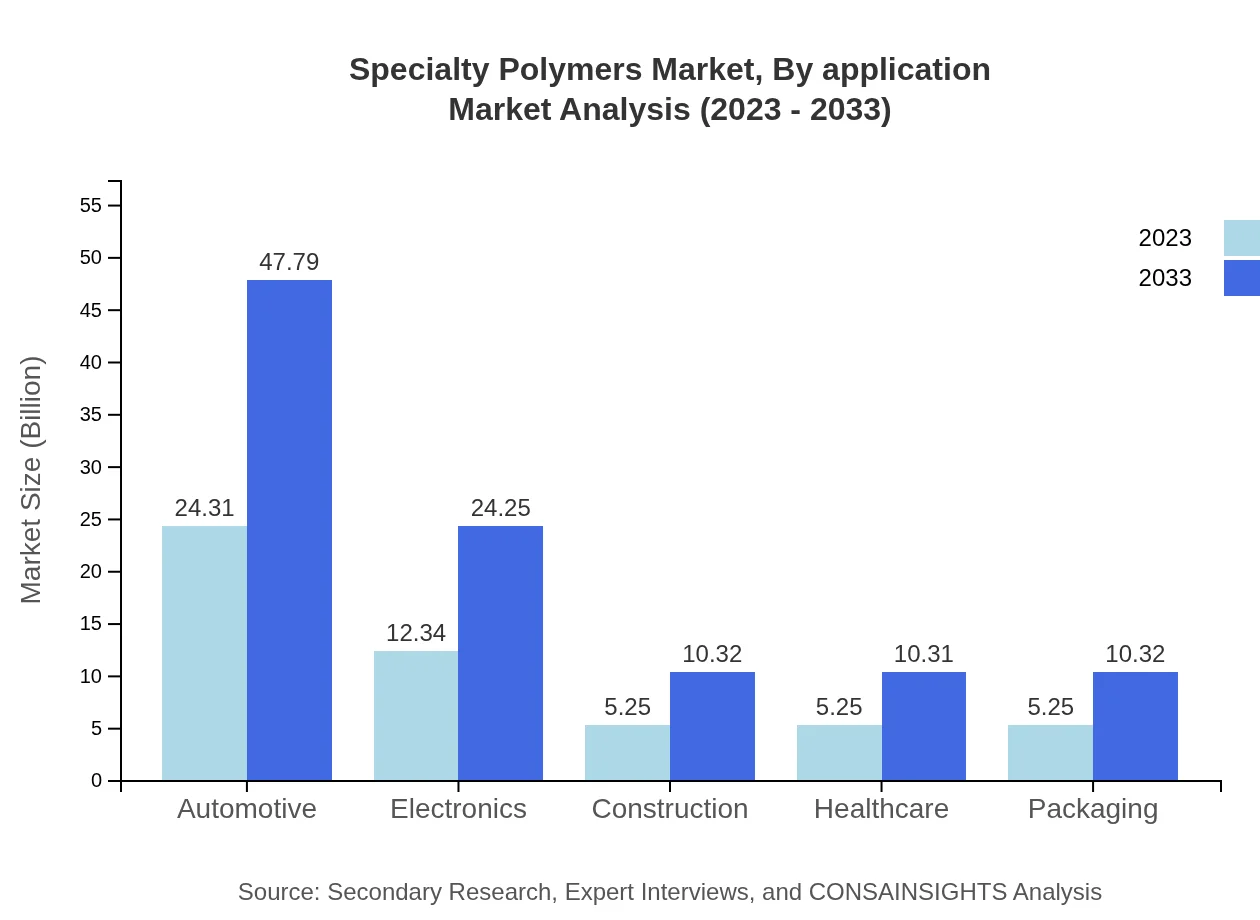

Specialty Polymers Market Analysis By Application

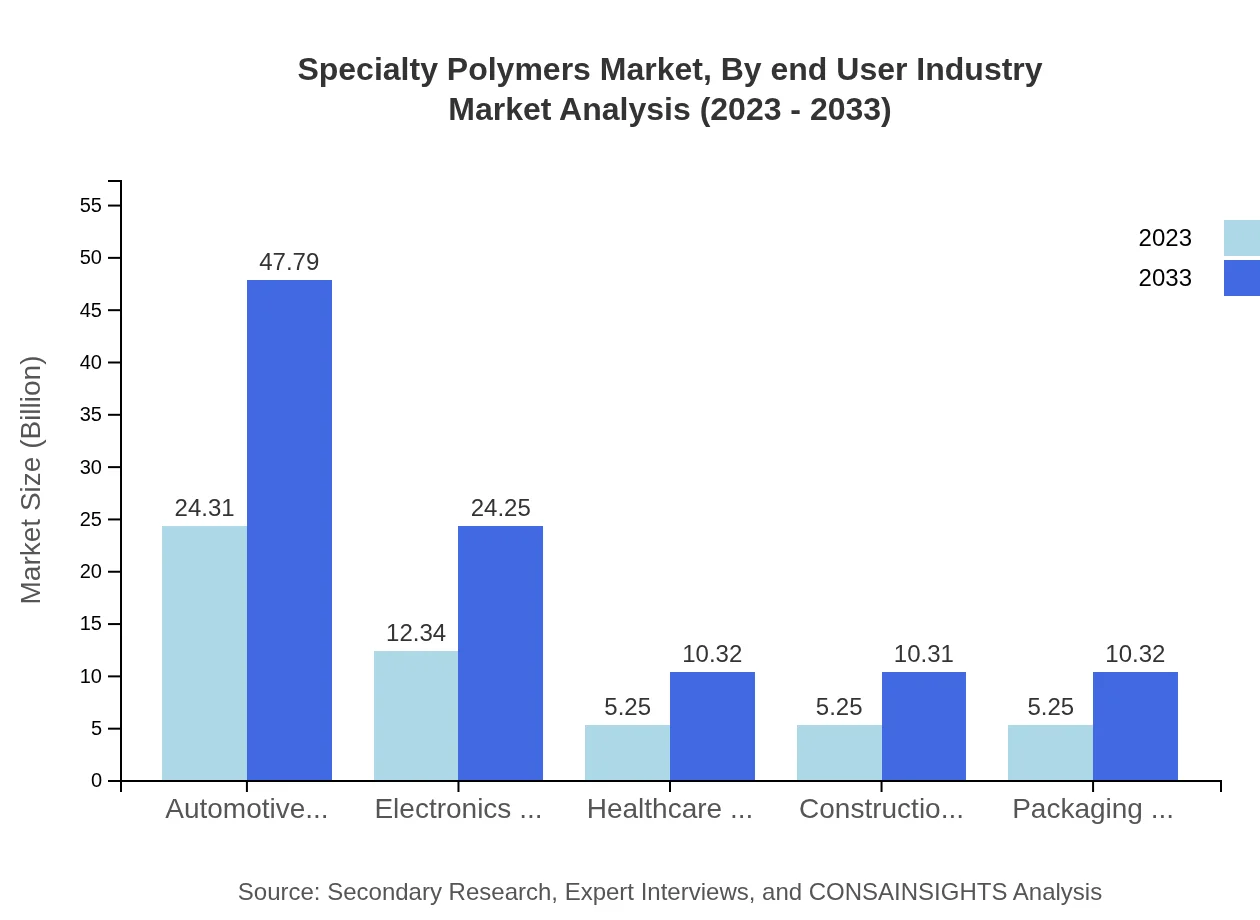

The automotive application leads the Specialty Polymers market share with a size of $24.31 billion in 2023 expected to reach $47.79 billion by 2033, maintaining a share of 46.4%. Electronics follows with a growth from $12.34 billion to $24.25 billion (23.55% share), while healthcare and construction hold $5.25 billion each, anticipated to double by 2033. Packaging also mirrors this trend, indicating a key area of application influence.

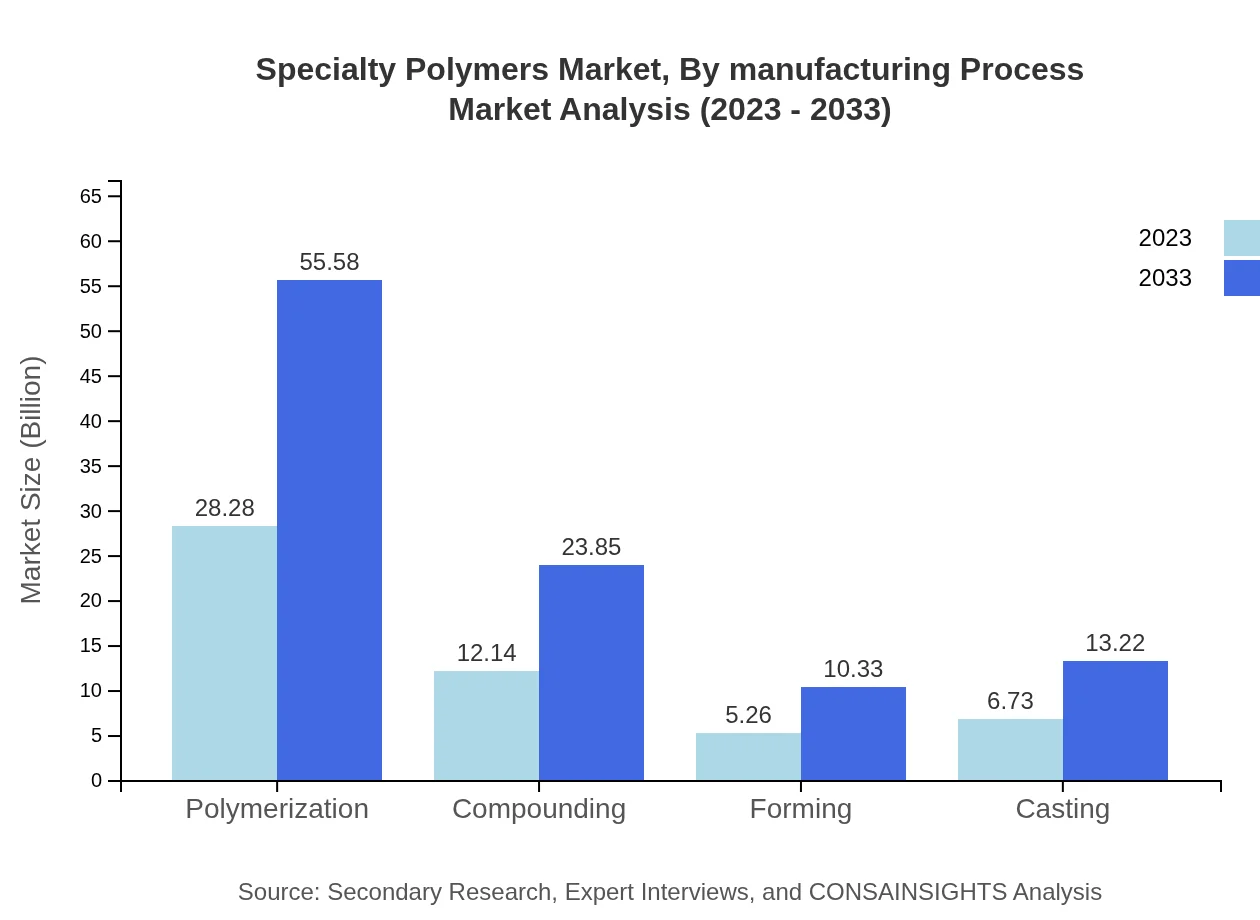

Specialty Polymers Market Analysis By Manufacturing Process

The manufacturing segment is categorized into polymerization, compounding, forming, and casting. Polymerization leads with $28.28 billion, reaching $55.58 billion by 2033, indicating a 53.97% share. Compounding follows with $12.14 billion, projected at $23.85 billion (23.16% share). Forming and casting processes continue to contribute substantively, reinforcing various parts manufacturing.

Specialty Polymers Market Analysis By End User Industry

The automotive industry captures a substantial market share with $24.31 billion expected to grow robustly. Electronics and healthcare also represent significant segments with shares of 23.55% and 10.01%, respectively. The construction and packaging segments, each projected to reach 10.02% in market share, indicate an increasing trend of polymer applications in diverse sectors.

Specialty Polymers Market Analysis By Distribution Channel

The Specialty Polymers market distribution channels include direct sales, distributors, and online sales. Direct sales dominate, with $35.03 billion projected to grow to $68.85 billion (66.85% share). Distributors contribute $13.84 billion and are anticipated to reach $27.20 billion (26.41% share), while online sales, albeit smaller, are growing from $3.53 billion to $6.94 billion (6.74% share).

Specialty Polymers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Specialty Polymers Industry

BASF SE:

BASF SE is a leading global chemical company specializing in producing high-performance specialty polymers that cater to various applications in automotive, construction, and electronics.Dow Inc.:

Dow Inc. offers a broad range of specialty polymers renowned for their durability and versatility, influencing multiple industries and advancing sustainable practices within chemical manufacturing.DuPont de Nemours, Inc.:

DuPont de Nemours, Inc. is a pioneer in high-performance polymers with a strong focus on innovation, providing products tailored to industries such as healthcare and electronics.Covestro AG:

Covestro AG is known for its advanced materials, especially in specialty polymers, focusing heavily on sustainability and environmental responsibility.SABIC:

SABIC operates as a global leader in chemicals and polymers, with a notable presence in the specialty polymers sector, promoting innovation and sustainable solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of specialty Polymers?

The specialty polymers market is valued at approximately $52.4 billion in 2023, with a projected CAGR of 6.8% up until 2033. This growth signifies increasing demand across various sectors such as automotive, electronics, and healthcare.

What are the key market players or companies in the specialty Polymers industry?

The specialty polymers market includes prominent companies like BASF, DuPont, and Covestro, among others. These key players are integral in driving innovation and establishing a competitive foothold in the rapidly evolving market.

What are the primary factors driving the growth in the specialty Polymers industry?

Growth in the specialty polymers industry is primarily driven by technological advancements in materials science, rising demand for lightweight materials in automotive applications, and increased usage in electronics and healthcare industries.

Which region is the fastest Growing in the specialty Polymers market?

The Asia Pacific region is currently the fastest-growing market for specialty polymers, anticipated to expand from $10.93 billion in 2023 to $21.48 billion by 2033, reflecting significant industrial growth and rising consumer demand.

Does ConsaInsights provide customized market report data for the specialty Polymers industry?

Yes, ConsaInsights offers customized market report data for the specialty polymers industry, catering to specific client needs and providing tailored insights based on market dynamics, trends, and growth forecasts.

What deliverables can I expect from this specialty Polymers market research project?

Expect comprehensive market analysis, including market size insights, segment data, regional growth forecasts, competitive landscape evaluations, and tailored recommendations designed to aid strategic decision-making.

What are the market trends of specialty Polymers?

Key trends in the specialty polymers market include increased adoption of sustainable materials, advancements in polymerization technologies, and a growing focus on applications in high-demand sectors like automotive, healthcare, and electronics.