Specialty Pulp And Paper Chemicals Market Report

Published Date: 02 February 2026 | Report Code: specialty-pulp-and-paper-chemicals

Specialty Pulp And Paper Chemicals Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Specialty Pulp and Paper Chemicals market, covering market trends, size, and forecasts for 2023 to 2033. Key insights into regional dynamics, industry leaders, and market segments are also included to inform stakeholders on future growth opportunities.

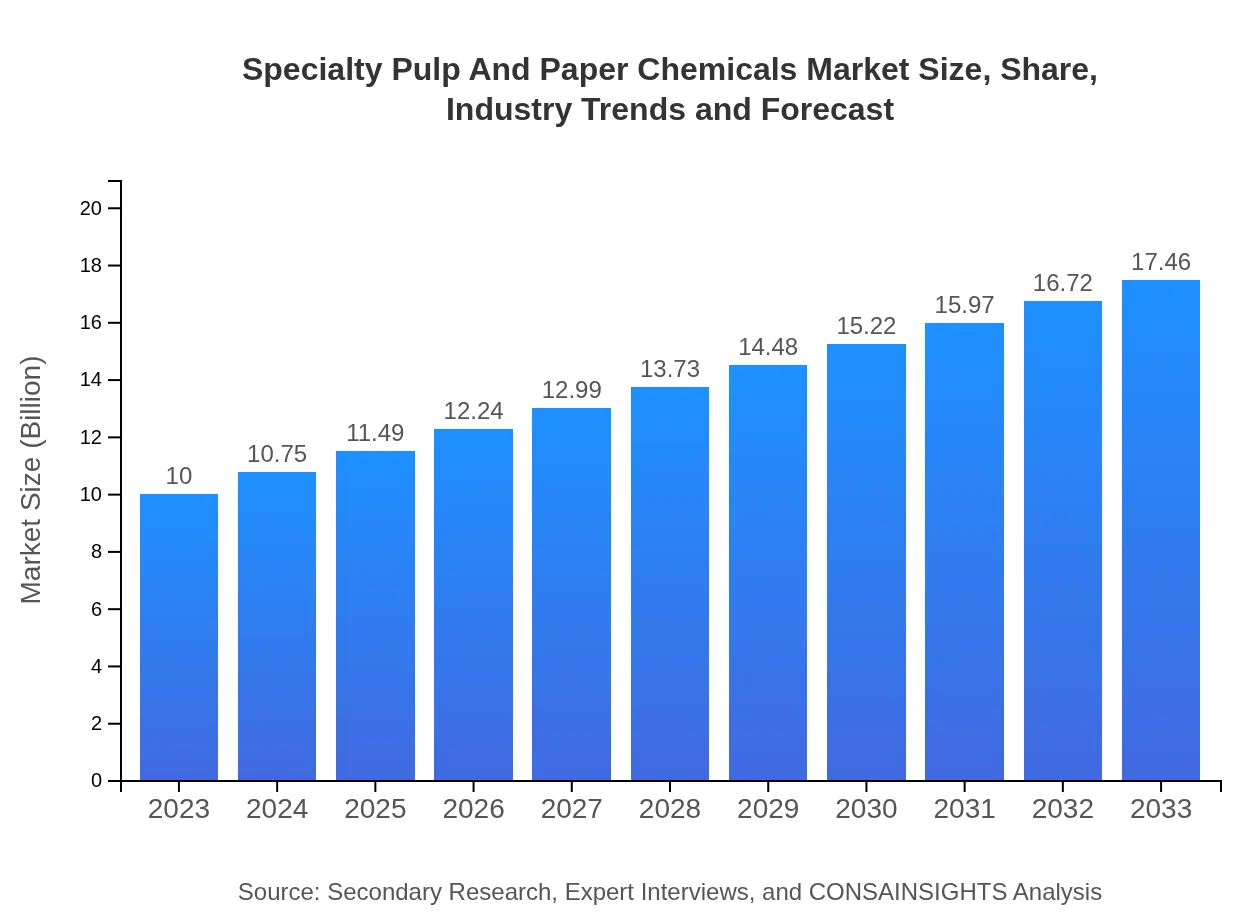

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $17.46 Billion |

| Top Companies | BASF SE, AkzoNobel, Ecolab |

| Last Modified Date | 02 February 2026 |

Specialty Pulp And Paper Chemicals Market Overview

Customize Specialty Pulp And Paper Chemicals Market Report market research report

- ✔ Get in-depth analysis of Specialty Pulp And Paper Chemicals market size, growth, and forecasts.

- ✔ Understand Specialty Pulp And Paper Chemicals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Specialty Pulp And Paper Chemicals

What is the Market Size & CAGR of Specialty Pulp And Paper Chemicals market in 2033?

Specialty Pulp And Paper Chemicals Industry Analysis

Specialty Pulp And Paper Chemicals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Specialty Pulp And Paper Chemicals Market Analysis Report by Region

Europe Specialty Pulp And Paper Chemicals Market Report:

The European market for Specialty Pulp and Paper Chemicals is expected to expand from $3.34 billion in 2023 to $5.83 billion by 2033. This growth is attributed to ongoing sustainability initiatives and a strong emphasis on recycling and using eco-friendly chemicals in pulp and paper production, reflecting the EU's stringent environmental regulations.Asia Pacific Specialty Pulp And Paper Chemicals Market Report:

The Asia Pacific region is anticipated to witness substantial growth, driven by increasing industrialization and demand for paper products. With a market size of approximately $1.85 billion in 2023, it is expected to reach around $3.23 billion by 2033. Countries such as China, India, and Japan are leading this growth, attributing it to booming packaging and publishing sectors.North America Specialty Pulp And Paper Chemicals Market Report:

North America holds a significant portion of the market, with an initial size of about $3.35 billion in 2023 projected to grow to approximately $5.85 billion by 2033. The region is characterized by robust technological advancements and stringent sustainability regulations that drive the adoption of innovative specialty chemical solutions. The U.S. remains a key player in the market.South America Specialty Pulp And Paper Chemicals Market Report:

In South America, the Specialty Pulp and Paper Chemicals market is estimated to grow from $0.78 billion in 2023 to $1.37 billion by 2033. Factors contributing to this growth include developing industrial practices and the growing demand for sustainable paper products in Brazil and Argentina, leading to an increased focus on specialty chemical applications.Middle East & Africa Specialty Pulp And Paper Chemicals Market Report:

The Middle East and Africa region's market is projected to grow from $0.68 billion in 2023 to $1.19 billion by 2033. Growth in this region is primarily driven by increasing investments in the packaging industry, particularly in countries like South Africa and the UAE, where demand for specialty paper products is on the rise.Tell us your focus area and get a customized research report.

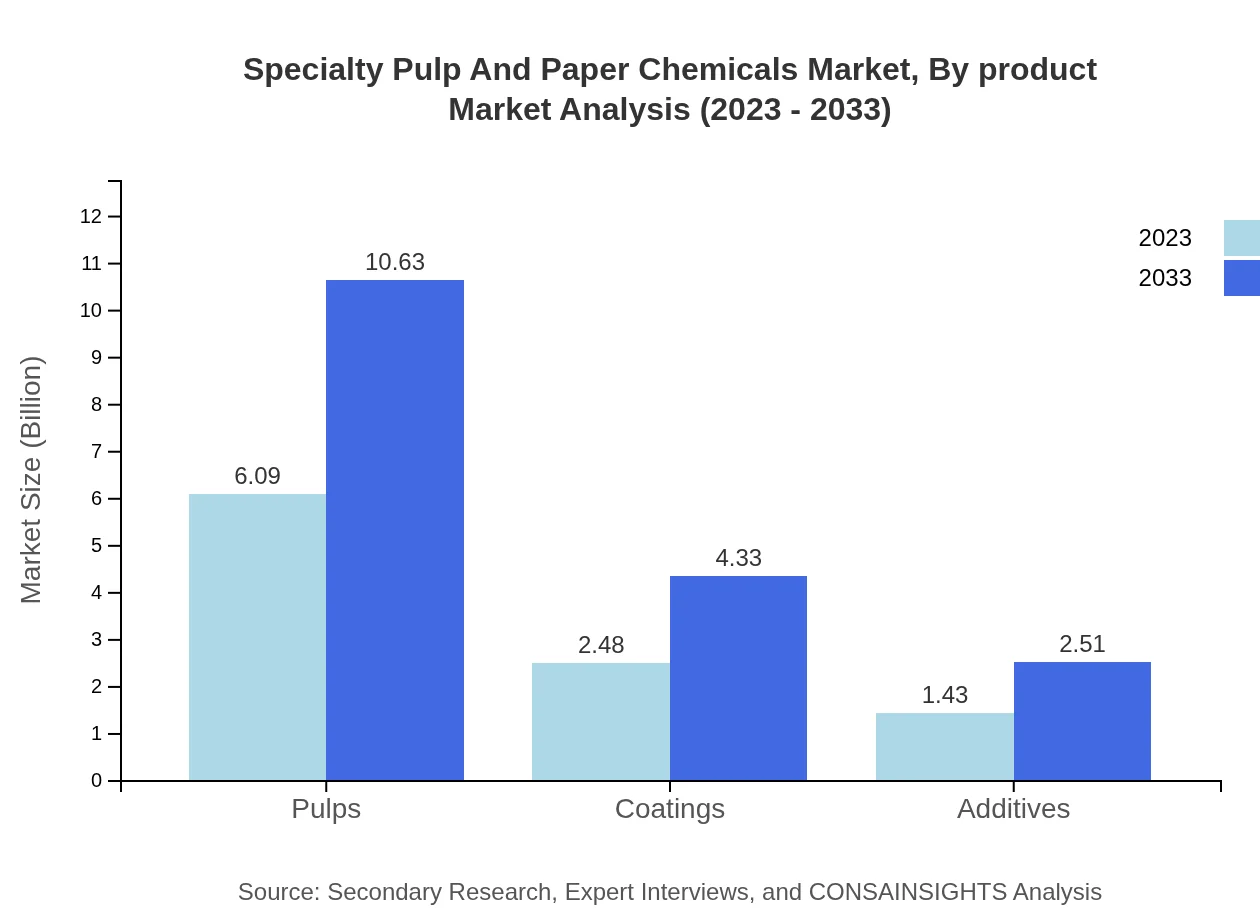

Specialty Pulp And Paper Chemicals Market Analysis By Product

In terms of product type, the Specialty Pulp and Paper Chemicals market is dominated by pulps, which accounted for $6.09 billion in 2023 and is expected to reach $10.63 billion by 2033. Other significant contributors include coatings at $2.48 billion growing to $4.33 billion and additives growing from $1.43 billion to $2.51 billion over the same period, all reflecting the importance of these chemicals in enhancing product quality.

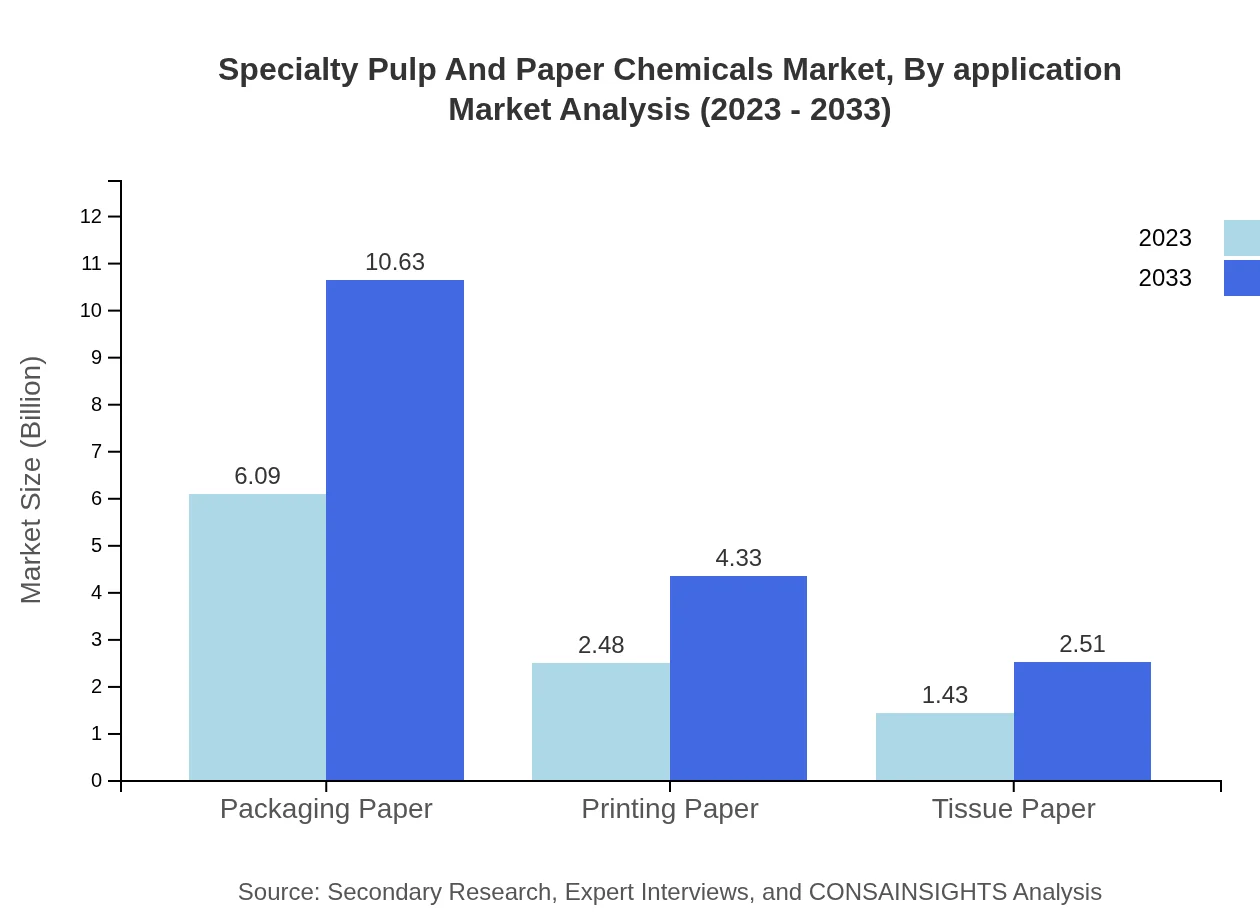

Specialty Pulp And Paper Chemicals Market Analysis By Application

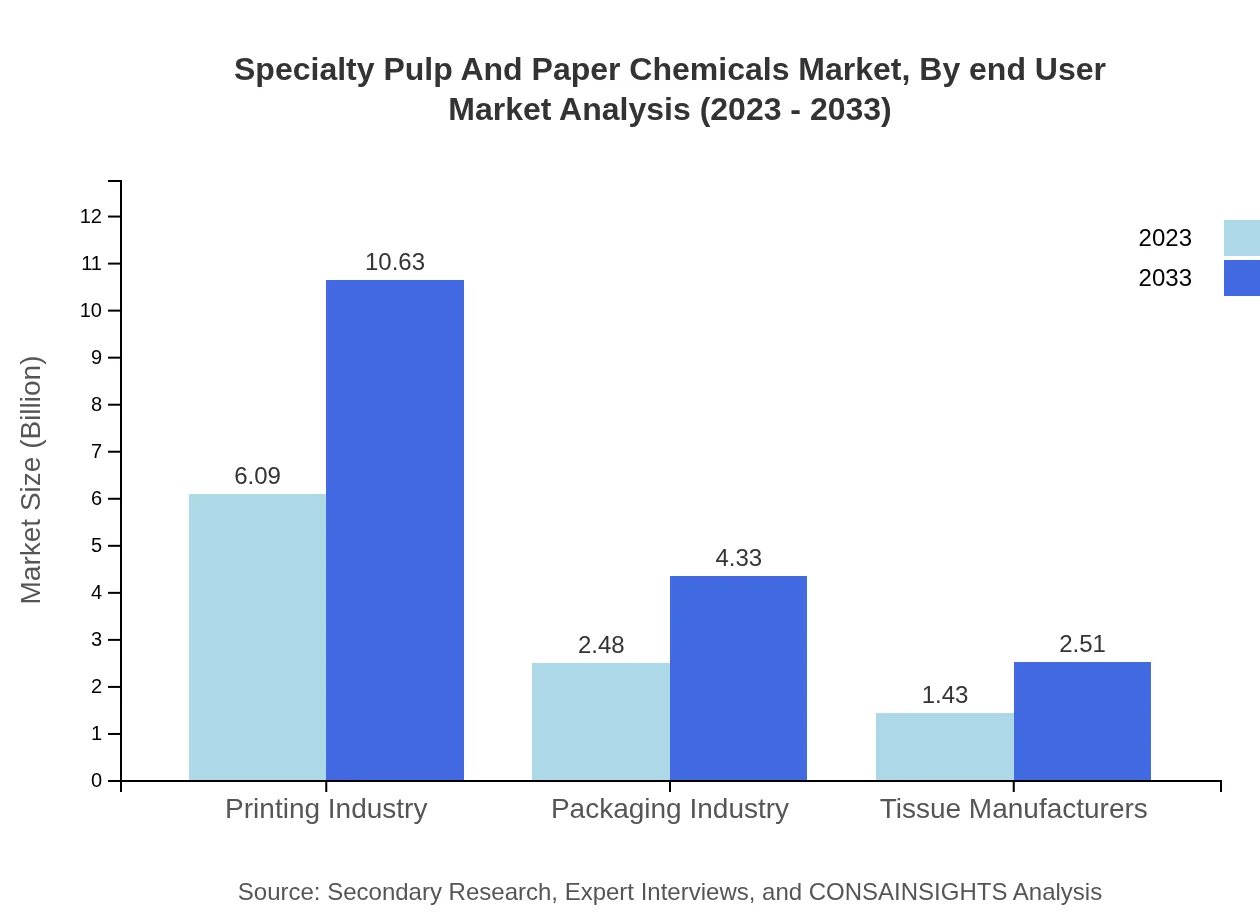

The market shares its composition among various applications, with the printing industry leading at $6.09 billion, projecting $10.63 billion by 2033, followed by packaging industry and tissue manufacturers contributing $2.48 billion and $1.43 billion respectively. This trend indicates a strong preference for specialty chemicals in applications emphasizing quality and performance.

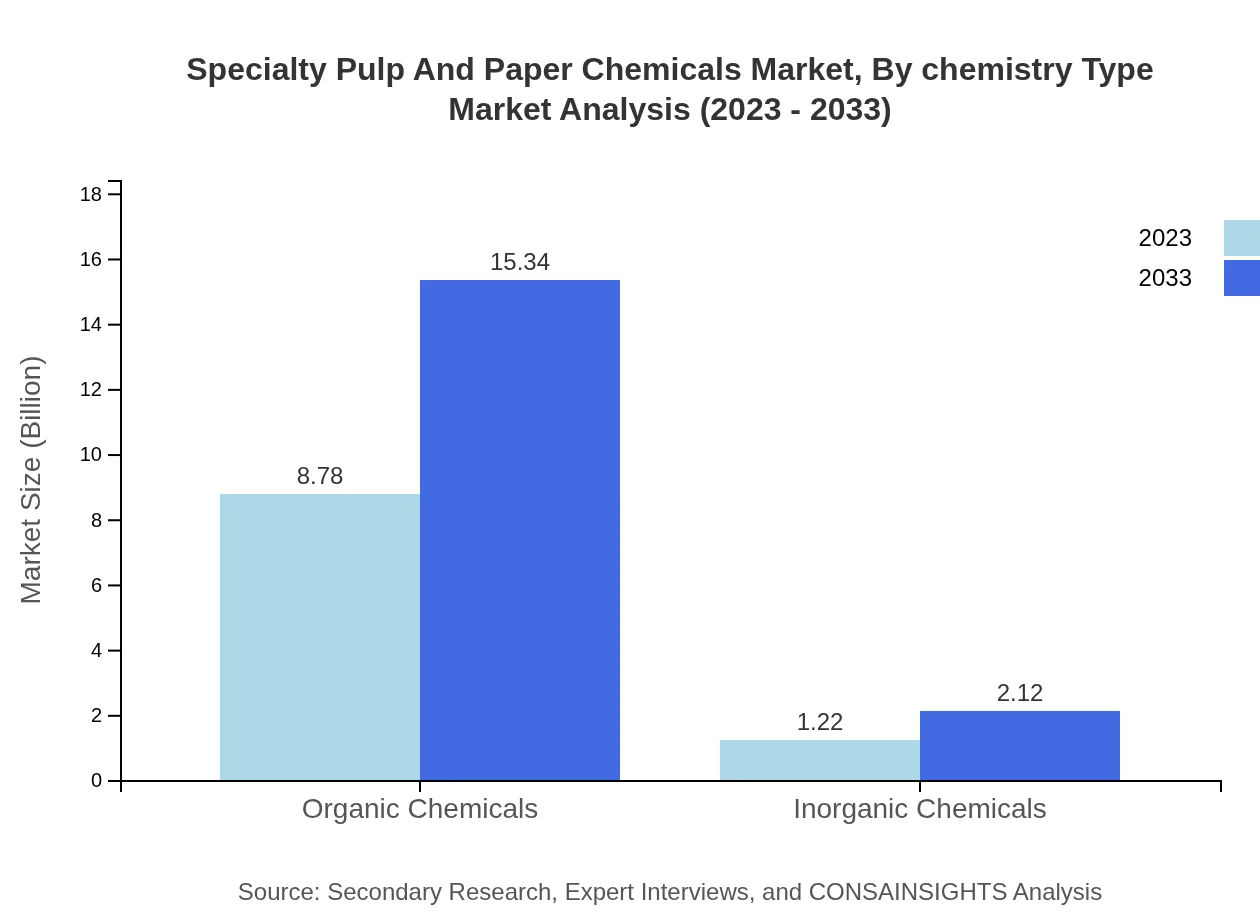

Specialty Pulp And Paper Chemicals Market Analysis By Chemistry Type

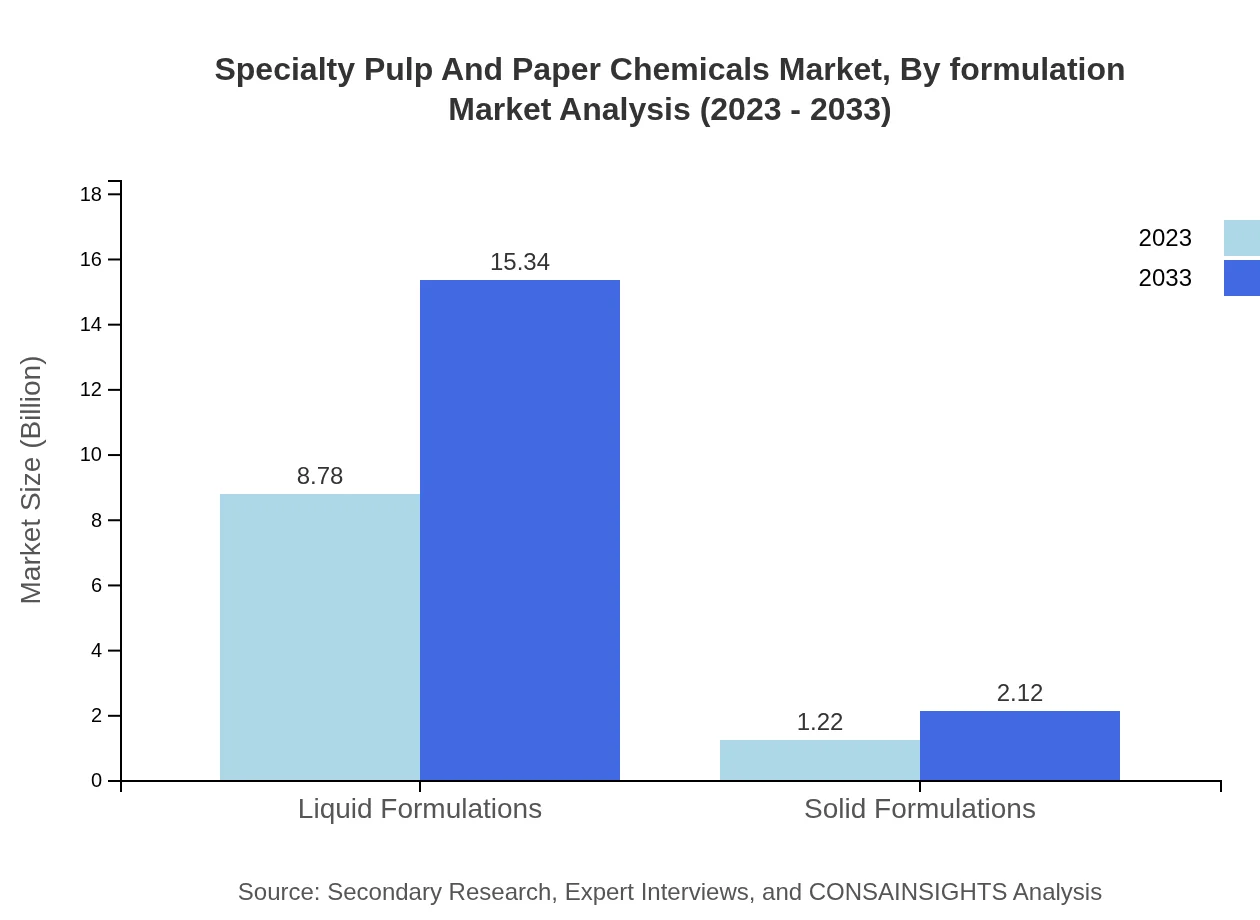

The Specialty Pulp and Paper Chemicals market can be split into organic and inorganic chemistry types. Organic chemicals dominate the market with a size of $8.78 billion in 2023, projected to reach $15.34 billion by 2033, while inorganic chemicals make up smaller segments, anticipating growth from $1.22 billion to $2.12 billion. This reflects both the efficiency and effectiveness of organic compounds in paper manufacturing.

Specialty Pulp And Paper Chemicals Market Analysis By End User

The market is influenced by various end-user industries, with significant contributions from packaging, printing, and tissue paper sectors. The packaging segment represents approximately $60.88% share in 2023, maintaining its importance in terms of sustainable packaging solutions, alongside strong interests in the printing and tissue sectors.

Specialty Pulp And Paper Chemicals Market Analysis By Formulation

Formulation segments reveal a clear preference for liquid formulations, dominating the market with $8.78 billion in 2023, expected to grow to $15.34 billion by 2033. Solid formulations, while smaller, show growth from $1.22 billion to $2.12 billion, indicating their specific applications in certain paper manufacturing processes.

Specialty Pulp And Paper Chemicals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Specialty Pulp And Paper Chemicals Industry

BASF SE:

BASF SE is a global leader in specialty chemicals, including those used in the pulp and paper industry. They focus on developing innovative and sustainable solutions tailored for their clients.AkzoNobel:

AkzoNobel specializes in the production of high-performance specialty chemicals for the paper and pulp sector, emphasizing environmental sustainability as a core aspect of their products.Ecolab:

Ecolab is known for its essential contributions to water treatment and hygiene solutions, playing a significant role in the specialty chemicals market with eco-friendly products for the pulp and paper industry.We're grateful to work with incredible clients.

FAQs

What is the market size of specialty Pulp And Paper Chemicals?

The specialty pulp and paper chemicals market is projected to reach $10 billion by 2033, growing at a CAGR of 5.6% from its 2023 market size of $10 billion. This growth reflects increasing demand for innovative paper products.

What are the key market players or companies in this specialty Pulp And Paper Chemicals industry?

Key market players in the specialty pulp and paper chemicals industry include major companies such as BASF, Solvay SA, and AkzoNobel. These companies lead with innovative product offerings and extensive global reach, influencing market trends significantly.

What are the primary factors driving the growth in the specialty Pulp And Paper Chemicals industry?

Primary factors driving growth in the specialty pulp and paper chemicals industry include rising demand for sustainable paper products, advancements in chemical formulations, and increased consumption of packaging materials, all of which support market expansion strategies.

Which region is the fastest Growing in the specialty Pulp And Paper Chemicals?

The fastest-growing region in the specialty pulp and paper chemicals market is Asia Pacific, anticipated to grow from $1.85 billion in 2023 to $3.23 billion by 2033. This growth is fueled by increasing industrialization and urbanization in the region.

Does ConsaInsights provide customized market report data for the specialty Pulp And Paper Chemicals industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the specialty pulp and paper chemicals industry. Clients can obtain insights that focus on unique segments or geographical markets.

What deliverables can I expect from this specialty Pulp And Paper Chemicals market research project?

Deliverables from the specialty pulp and paper chemicals market research project typically include comprehensive market analysis reports, segment performance data, competitive landscape insights, and trends analysis, tailored for strategic decision-making.

What are the market trends of specialty Pulp And Paper Chemicals?

Current trends in the specialty pulp and paper chemicals market include a shift towards eco-friendly chemical solutions, innovation in product development for enhancing paper quality, and a growing emphasis on automation in chemical applications.