Specialty Surfactants Market Report

Published Date: 02 February 2026 | Report Code: specialty-surfactants

Specialty Surfactants Market Size, Share, Industry Trends and Forecast to 2033

This report delivers a comprehensive analysis of the Specialty Surfactants market, covering key insights, regional breakdowns, and forecasts from 2023 to 2033. It aims to inform stakeholders of market dynamics, segments, and growth opportunities in this evolving industry.

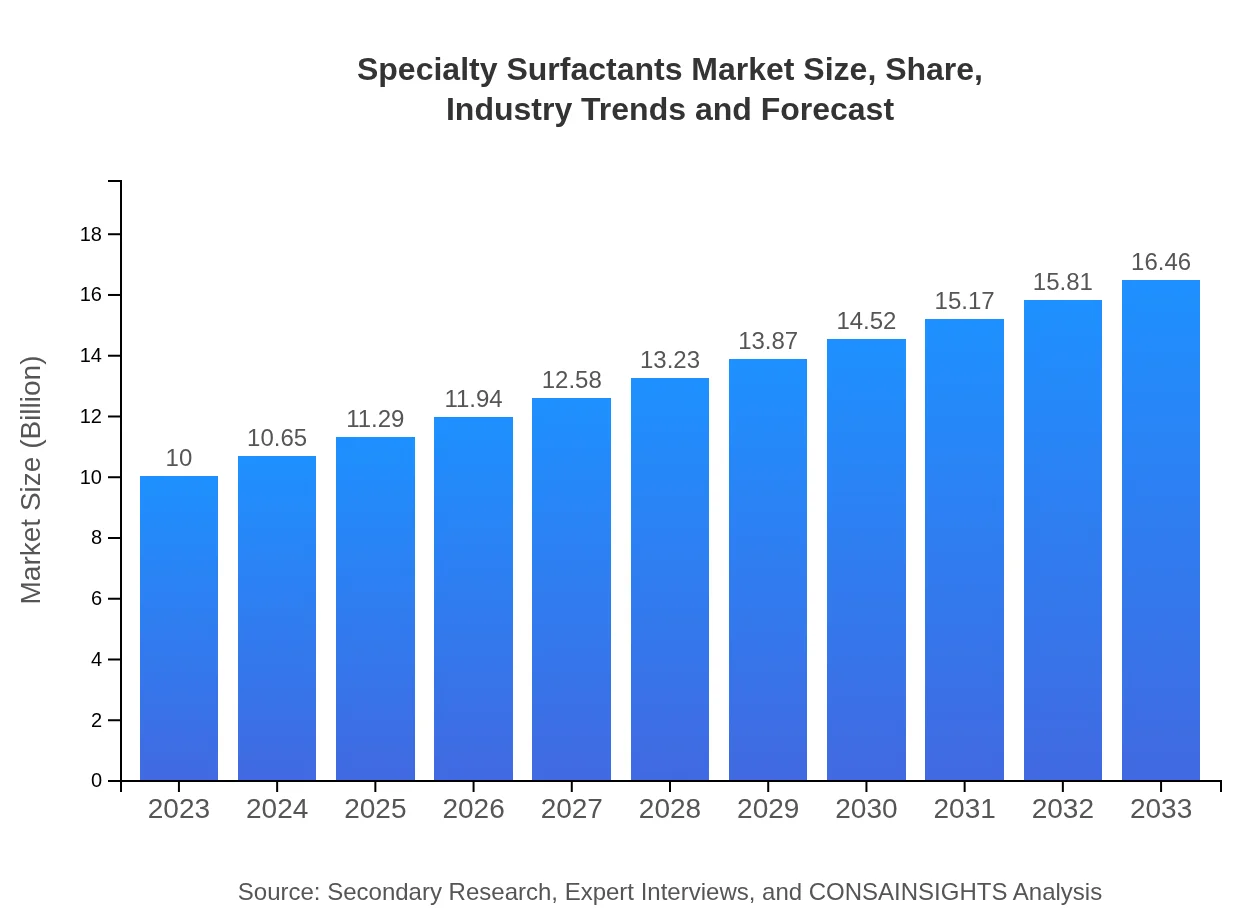

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | BASF SE, Evonik Industries, Dow Chemical Company, Hindustan Unilever Limited, Croda International Plc |

| Last Modified Date | 02 February 2026 |

Specialty Surfactants Market Overview

Customize Specialty Surfactants Market Report market research report

- ✔ Get in-depth analysis of Specialty Surfactants market size, growth, and forecasts.

- ✔ Understand Specialty Surfactants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Specialty Surfactants

What is the Market Size & CAGR of Specialty Surfactants market in 2023?

Specialty Surfactants Industry Analysis

Specialty Surfactants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Specialty Surfactants Market Analysis Report by Region

Europe Specialty Surfactants Market Report:

Europe's Specialty Surfactants market is projected at $2.52 billion in 2023, expanding to $4.15 billion by 2033. The region is witnessing stringent regulations favoring sustainable products, prompting manufacturers to focus on bio-based formulations. Health and safety concerns are also influencing product developments.Asia Pacific Specialty Surfactants Market Report:

In 2023, the Asia Pacific region's Specialty Surfactants market is valued at approximately $2.18 billion, with projections to grow to $3.59 billion by 2033. Rapid industrialization, urbanization, and increasing disposable incomes drive demand for personal care and household products. The trend towards sustainability is prompting manufacturers to invest in bio-based surfactant alternatives to cater to eco-conscious consumer segments.North America Specialty Surfactants Market Report:

North America represents a robust market, estimated at $3.66 billion in 2023, with growth to $6.02 billion by 2033. The region leads in innovation and the adoption of functional surfactants, driven by stringent regulations requiring environmentally friendly products. Major investments in R&D further bolster the market.South America Specialty Surfactants Market Report:

The South American market for Specialty Surfactants is valued at $0.69 billion in 2023, expected to reach $1.14 billion by 2033. Demand for cosmetics and cleaning products is rising, with increased focus on natural ingredients. However, market growth may be hindered by economic instability and varying regulatory frameworks across countries.Middle East & Africa Specialty Surfactants Market Report:

The market in the Middle East and Africa stands at $0.95 billion in 2023, expected to reach $1.56 billion by 2033. Factors contributing to growth include urbanization, increased awareness of personal hygiene, and industrial developments. However, regional challenges like geopolitical tensions and economic fluctuations may impede growth.Tell us your focus area and get a customized research report.

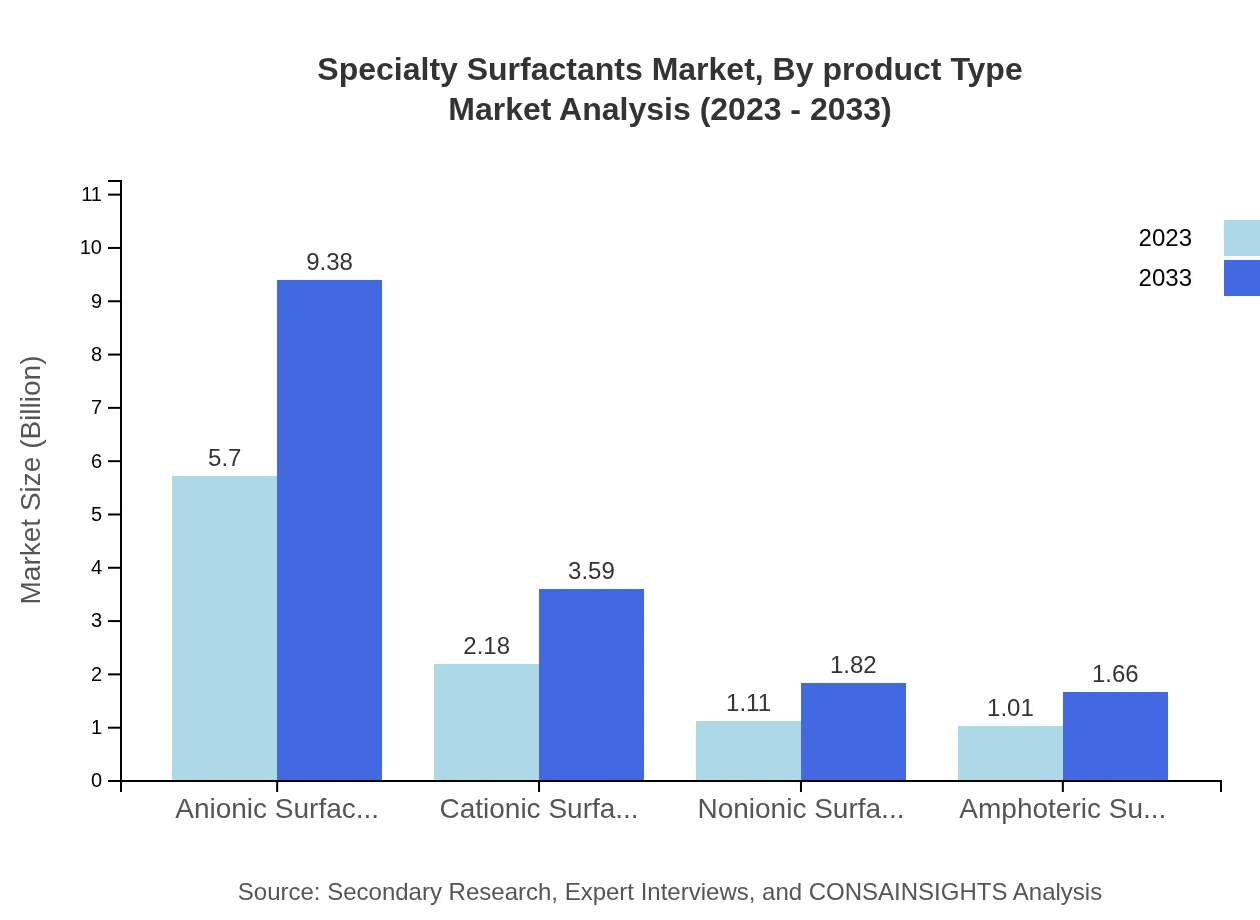

Specialty Surfactants Market Analysis By Product Type

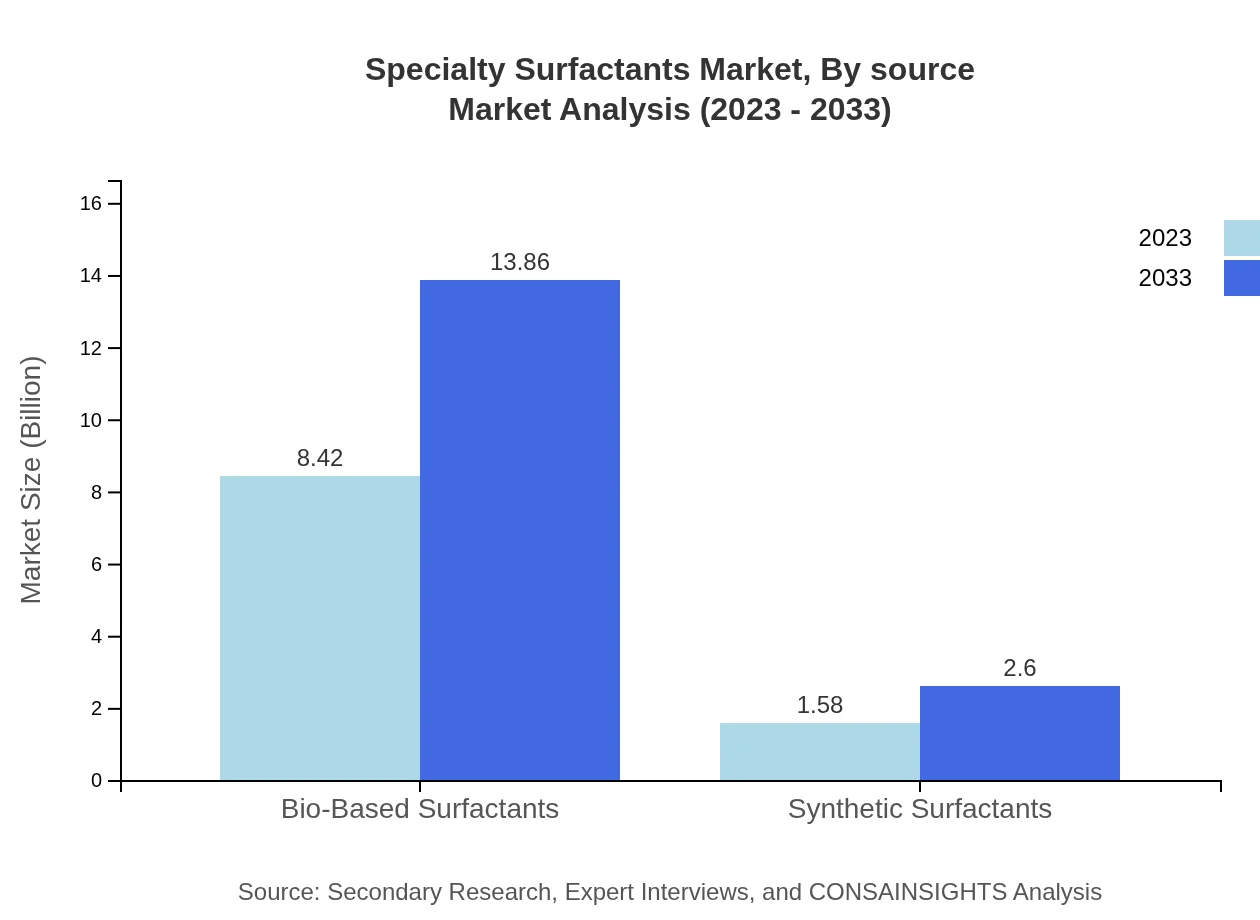

The Specialty Surfactants market is heavily driven by bio-based surfactants, which aim to replace synthetic counterparts. In 2023, bio-based surfactants account for a market size of $8.42 billion and are projected to grow to $13.86 billion by 2033, reflecting a broad market share. In contrast, synthetic surfactants represent a smaller segment with a size of $1.58 billion in 2023, increasing to $2.60 billion by 2033. Each type plays a crucial role in various applications such as cleaning, cosmetics, and industrial uses.

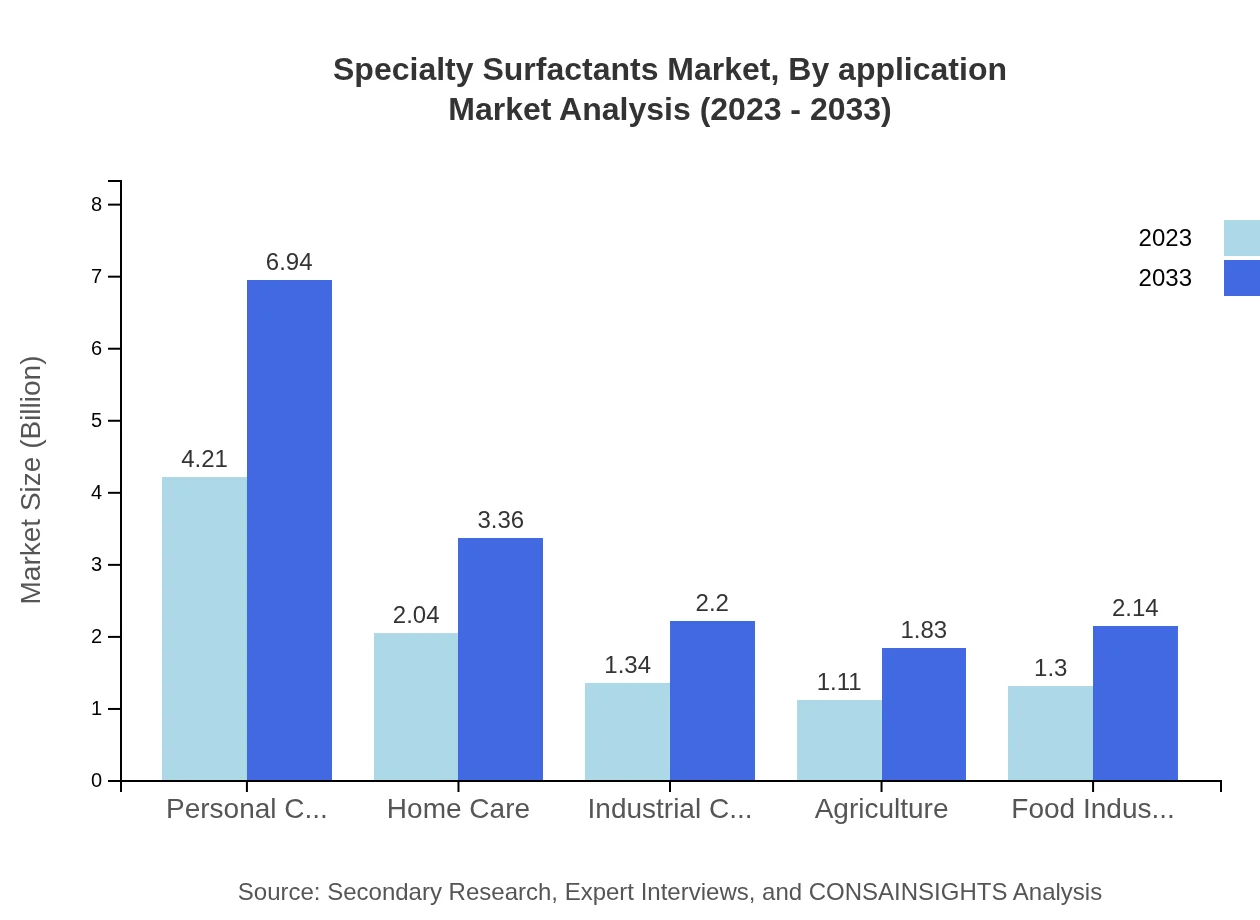

Specialty Surfactants Market Analysis By Application

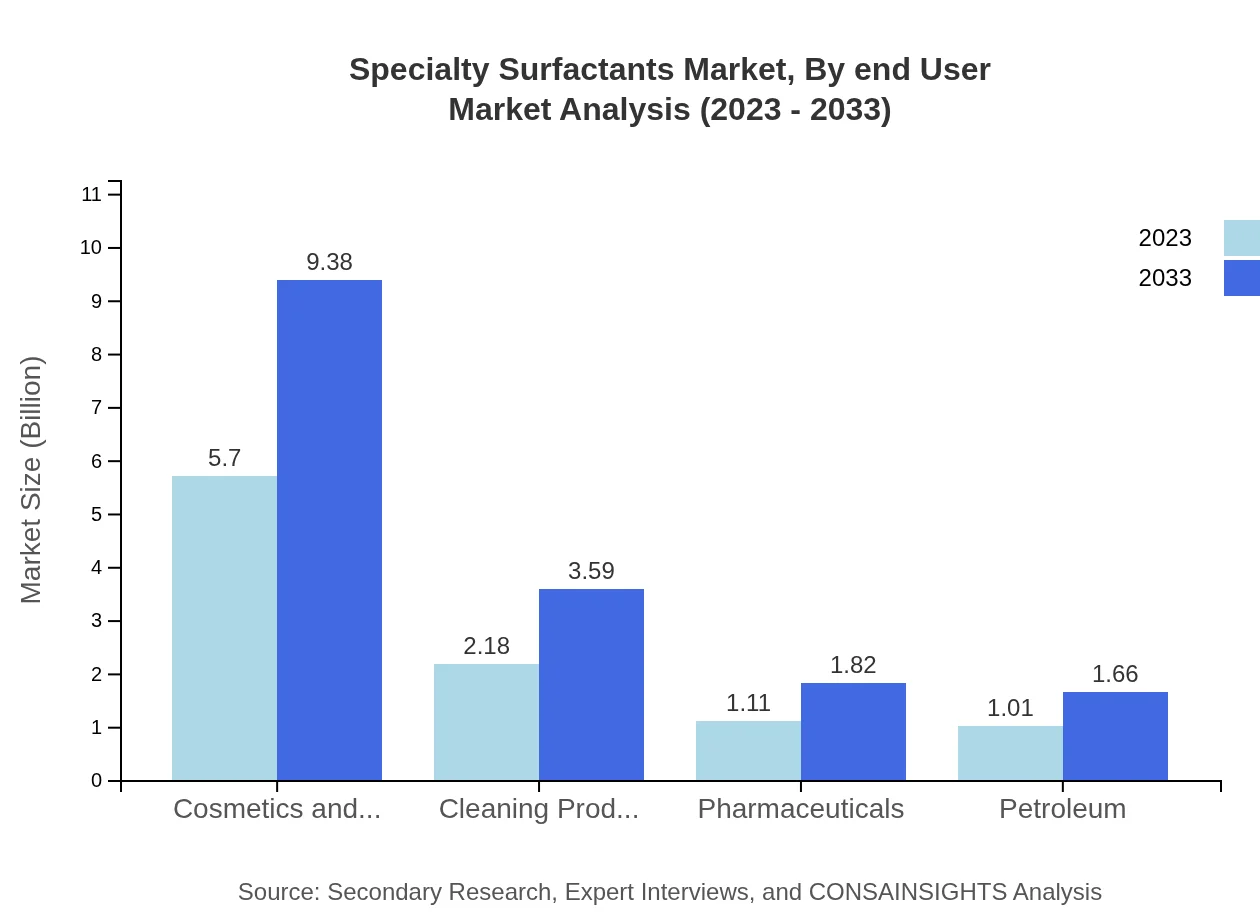

The market is primarily segmented into key applications including cosmetics and personal care, with a share of $5.70 billion in 2023 and projected to grow to $9.38 billion in 2033. Cleaning products account for substantial demand, totaling $2.18 billion and expected to rise to $3.59 billion. Other applications include pharmaceuticals ($1.11 billion), petroleum ($1.01 billion), and food industry ($1.30 billion), each with unique market shares.

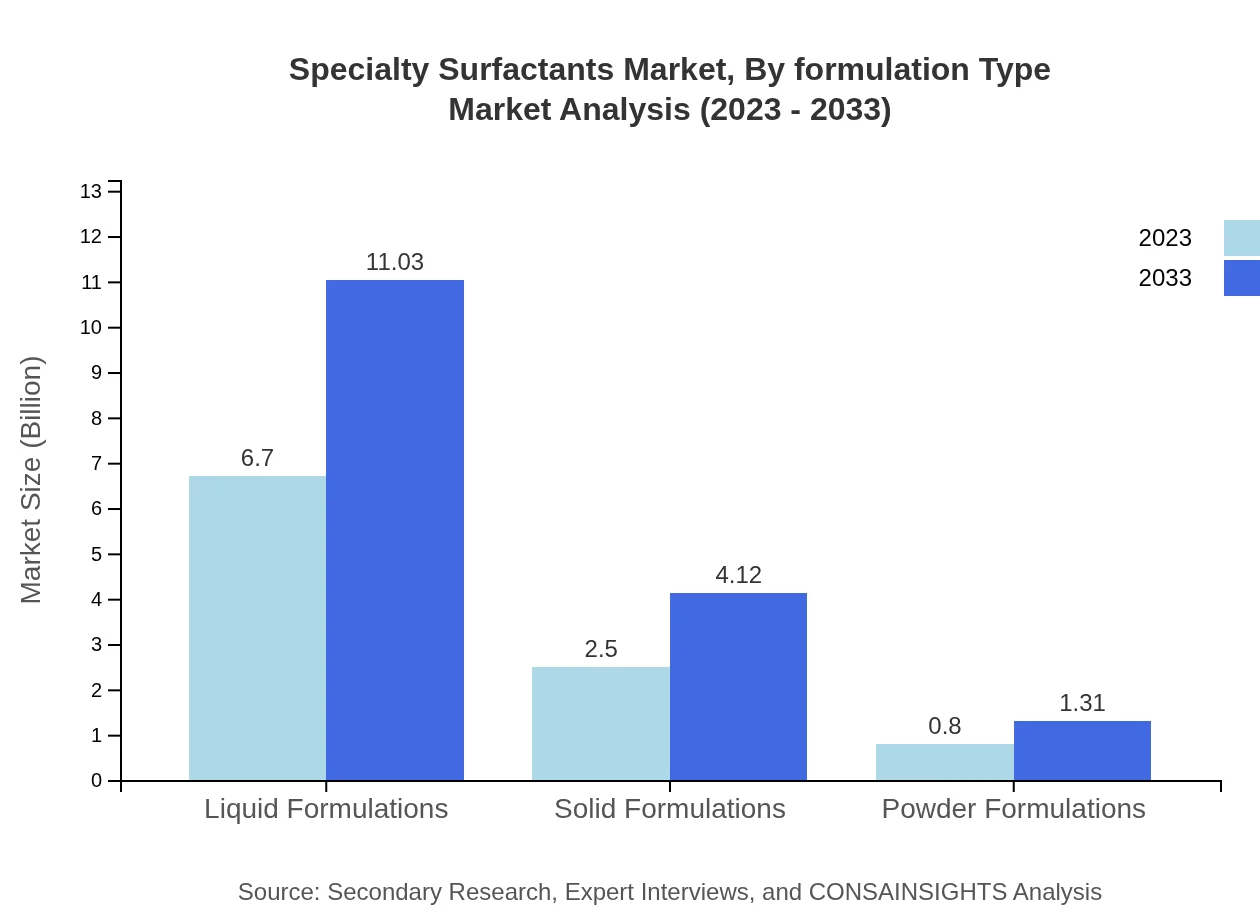

Specialty Surfactants Market Analysis By Formulation Type

Formulation types significantly influence market dynamics. Liquid formulations dominate the segment with a size of $6.70 billion in 2023, expanding to $11.03 billion by 2033. Solid formulations are seeing growth from $2.50 billion to $4.12 billion at the same interval. Powder formulations remain a minor but relevant segment with a forecasted growth from $0.80 billion to $1.31 billion.

Specialty Surfactants Market Analysis By End User

End-user industries for specialty surfactants vary significantly. Personal care and home care sectors are the largest consumers, with shares of 42.15% and 20.39%, respectively. The industrial cleaning sector also holds a notable share with 13.36%. As regulations tighten, end-user industries are focusing more on bio-based alternatives.

Specialty Surfactants Market Analysis By Source

Sources for specialty surfactants are diversifying, with both natural and synthetic options available. Bio-based sources are gaining traction, accounting for significant market share in both production and consumer preference, driven by rising environmental consciousness.

Specialty Surfactants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Specialty Surfactants Industry

BASF SE:

A leading chemical company known for its innovative and sustainable surfactants in various applications from cosmetics to home care.Evonik Industries:

Specializes in specialty chemicals with a strong focus on bio-based surfactants and innovative formulations to meet customer demands.Dow Chemical Company:

A major player in the surfactants market, offering a wide range of products for personal care, industrial, and home care applications.Hindustan Unilever Limited:

Focuses on sustainable product innovations while leading in personal care and home cleaning segment with high-quality surfactants.Croda International Plc:

Emphasizes sustainable sourcing and innovation in surfactants tailored to personal care and industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of specialty Surfactants?

The specialty surfactants market is projected to reach approximately $10 billion by 2033, growing at a CAGR of 5%. This growth reflects the increasing demand for functional surfactants across various applications, supporting sustainable practices in the industry.

What are the key market players or companies in this specialty Surfactants industry?

Key players in the specialty surfactants market include major multinational corporations such as BASF, Dow Chemical, and Huntsman Corporation. These companies actively engage in the development of innovative surfactants to meet diverse customer needs across multiple industries.

What are the primary factors driving the growth in the specialty surfactants industry?

The growth in the specialty surfactants industry is driven by rising consumer demand for eco-friendly and bio-based products. Moreover, the expanding pharmaceutical, personal care, and cleaning product markets contribute to increased surfactant usage, reflecting trends toward sustainability and health.

Which region is the fastest Growing in the specialty Surfactants market?

The Asia Pacific region is the fastest-growing market for specialty surfactants, expected to see growth from $2.18 billion in 2023 to $3.59 billion by 2033. This growth is fueled by rapidly expanding industrial and consumer sectors in emerging economies.

Does ConsaInsights provide customized market report data for the specialty Surfactants industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the specialty surfactants industry. Clients can request insights on particular market segments, regional performance, and competitive landscape analyses.

What deliverables can I expect from this specialty Surfactants market research project?

Deliverables from the specialty surfactants market research project typically include detailed reports, data analytics, market forecasts, competitive assessments, and segment-wise insights, providing comprehensive information for informed decision-making.

What are the market trends of specialty surfactants?

Current trends in the specialty surfactants market include a shift towards bio-based products, increased adoption of green chemistry, and rising demand in emerging markets. Additionally, innovation in formulations and product diversification are key trends shaping the future.