Spices And Seasonings Market Report

Published Date: 31 January 2026 | Report Code: spices-and-seasonings

Spices And Seasonings Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Spices and Seasonings market, providing insights into current trends, segmentation, regional performance, and forecasts from 2023 to 2033. The report aims to offer comprehensive data for stakeholders to make informed decisions.

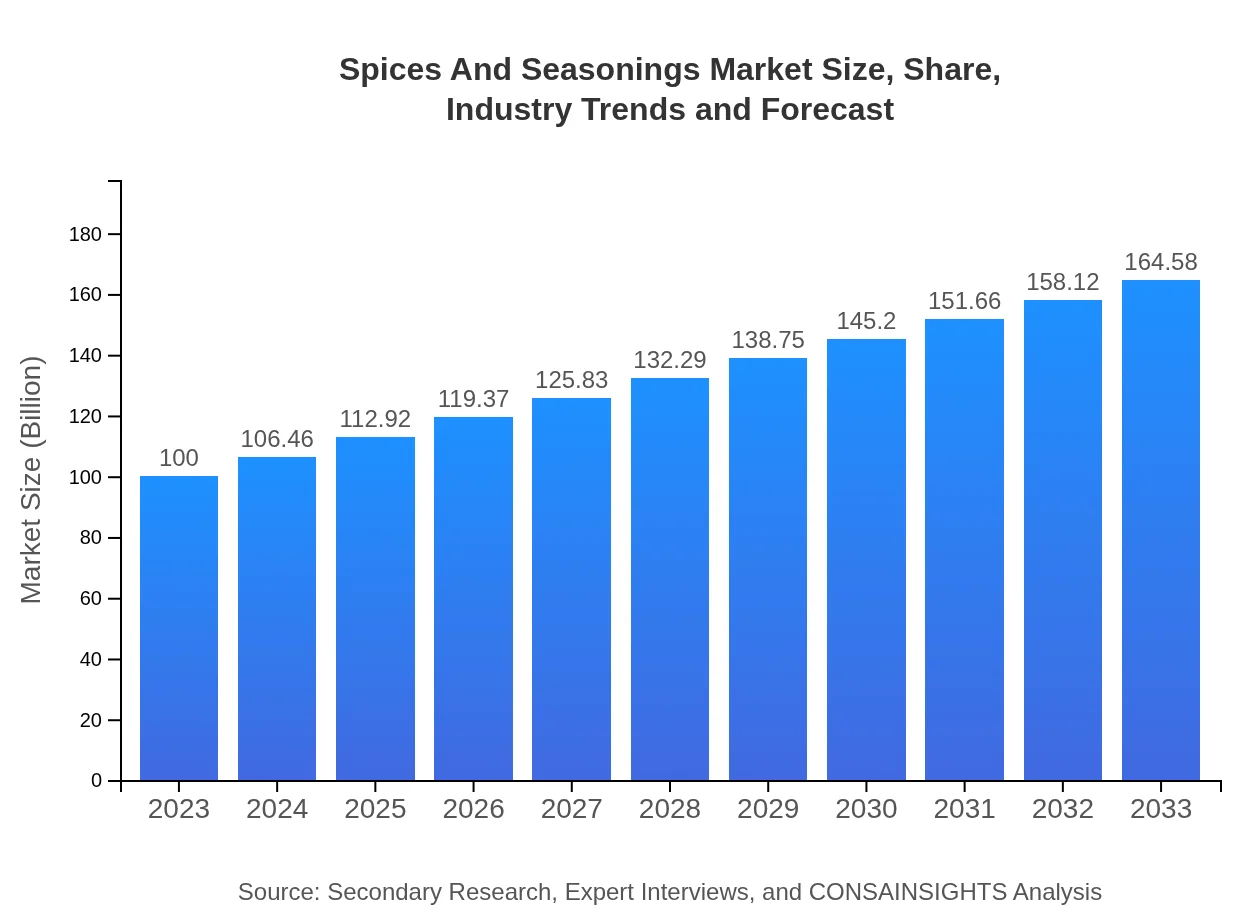

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | McCormick & Company, Olam International, Ajinomoto Co., Inc., Associated British Foods plc |

| Last Modified Date | 31 January 2026 |

Spices And Seasonings Market Overview

Customize Spices And Seasonings Market Report market research report

- ✔ Get in-depth analysis of Spices And Seasonings market size, growth, and forecasts.

- ✔ Understand Spices And Seasonings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Spices And Seasonings

What is the Market Size & CAGR of Spices And Seasonings market in 2023?

Spices And Seasonings Industry Analysis

Spices And Seasonings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Spices And Seasonings Market Analysis Report by Region

Europe Spices And Seasonings Market Report:

The European spices and seasonings market is valued at $36.20 billion in 2023, expected to reach $59.58 billion by 2033. The growth is supported by the regional demand for organic products and the rise in cooking and dining experiences at home.Asia Pacific Spices And Seasonings Market Report:

In 2023, the Asia Pacific region leads the spices and seasonings market with a value of approximately $18.53 billion. By 2033, this market is expected to grow to around $30.50 billion, propelled by rising culinary diversity and health-focused product innovations in countries like India, China, and Japan.North America Spices And Seasonings Market Report:

North America, with a market size of $32.46 billion in 2023, is anticipated to grow to $53.42 billion by 2033. The surge is attributed to the consumer trend towards holistic health, increasing demand for spices in meal preparations, and the popularity of ethnic dishes.South America Spices And Seasonings Market Report:

The South American market, valued at $1.30 billion in 2023, is projected to reach $2.14 billion by 2033. The growth is driven by expanding food service sectors and regional cuisines that embrace bold flavors, particularly in Brazil and Argentina.Middle East & Africa Spices And Seasonings Market Report:

In 2023, the market in the Middle East and Africa stands at approximately $11.51 billion, projected to climb to $18.94 billion by 2033. Increased consumer interest in gourmet cooking and the diversity of spices from the region enhance market expansion.Tell us your focus area and get a customized research report.

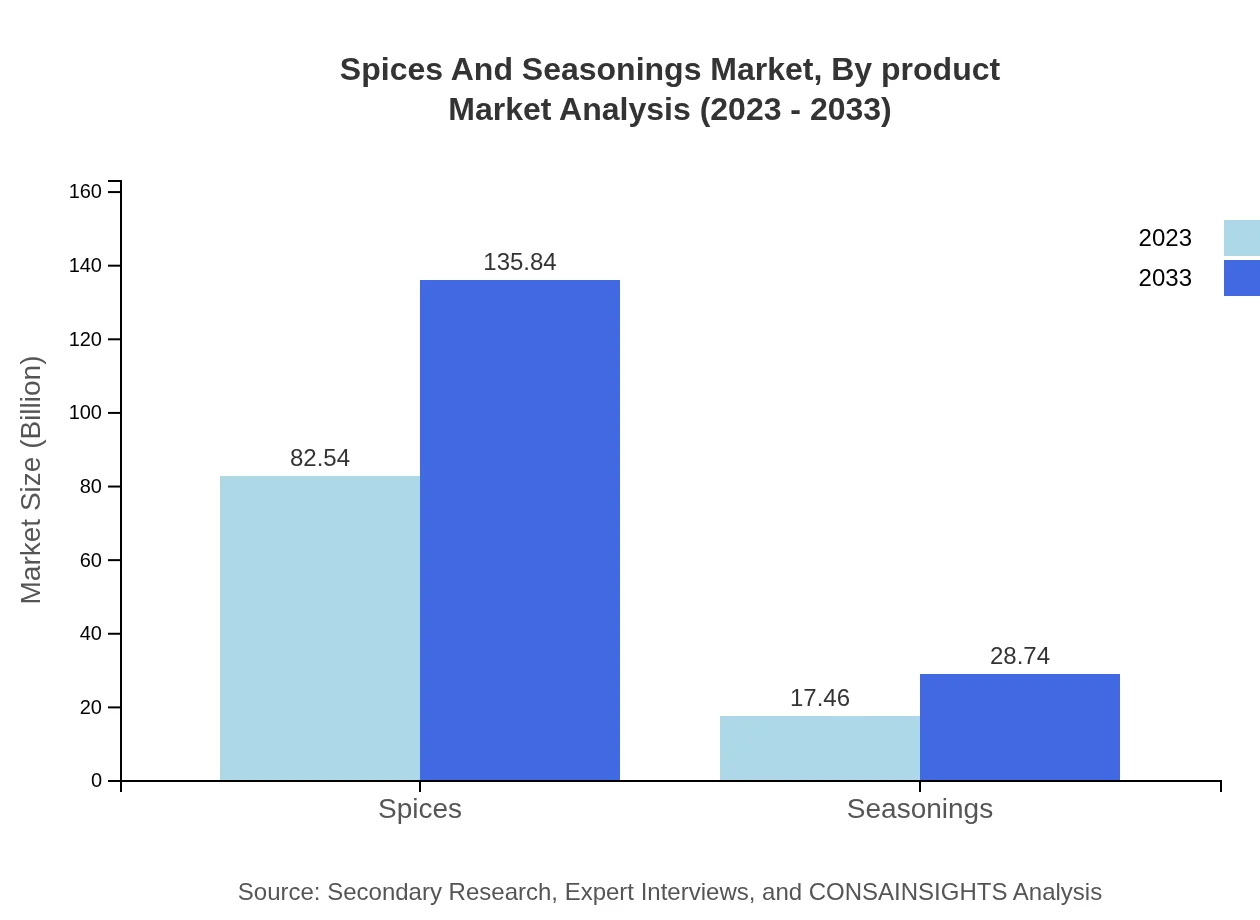

Spices And Seasonings Market Analysis By Product

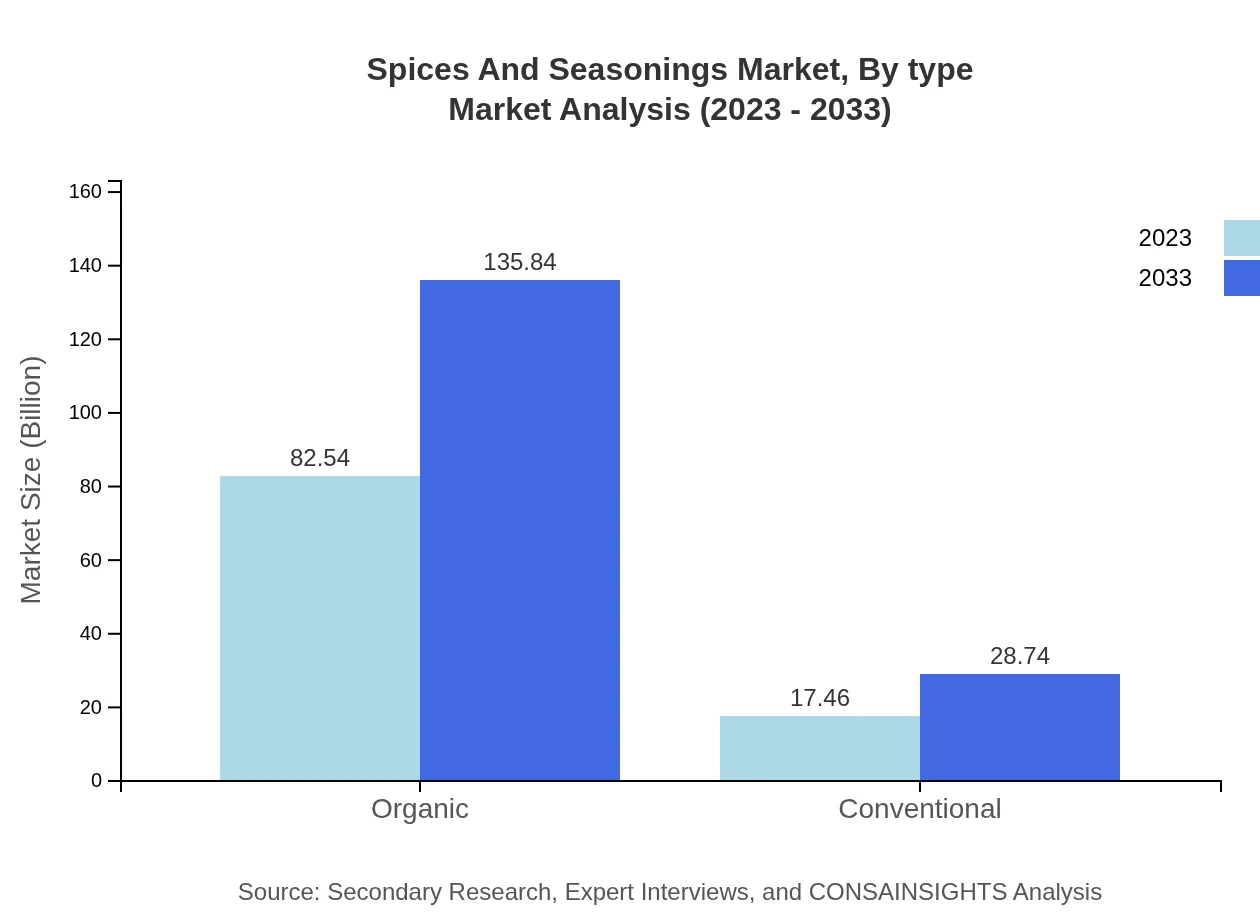

The products in the spices and seasonings market comprise an array of spices and extracts used mainly in food processing, culinary applications, and food service. The organic segment, valued at $82.54 billion in 2023, is forecasted to reach $135.84 billion by 2033, reflecting a strong community preference for natural flavoring agents.

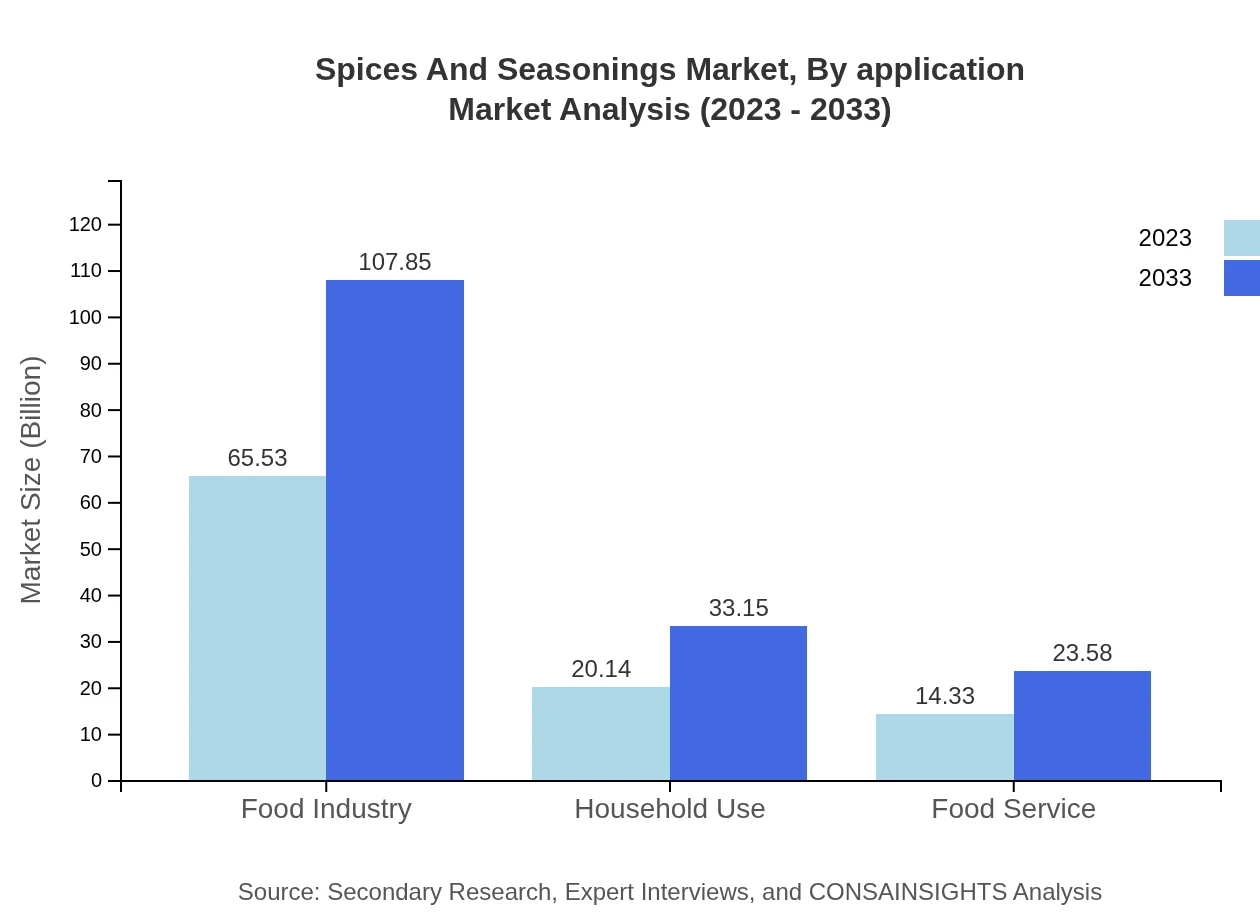

Spices And Seasonings Market Analysis By Application

Applications in the market can be categorized into retail, food service, and food processing. The food processing sector, with a market size estimated at $65.53 billion, is expected to grow to $107.85 billion by 2033 as more consumers lean toward ready-to-eat meals that incorporate rich spices and seasonings.

Spices And Seasonings Market Analysis By Type

The market is bifurcated into spices and seasonings. Spices are anticipated to account for a significant portion of the market value at $82.54 billion by 2023, while seasonings are expected to grow from $17.46 billion to $28.74 billion during the same period, emphasizing their importance in flavor profiles.

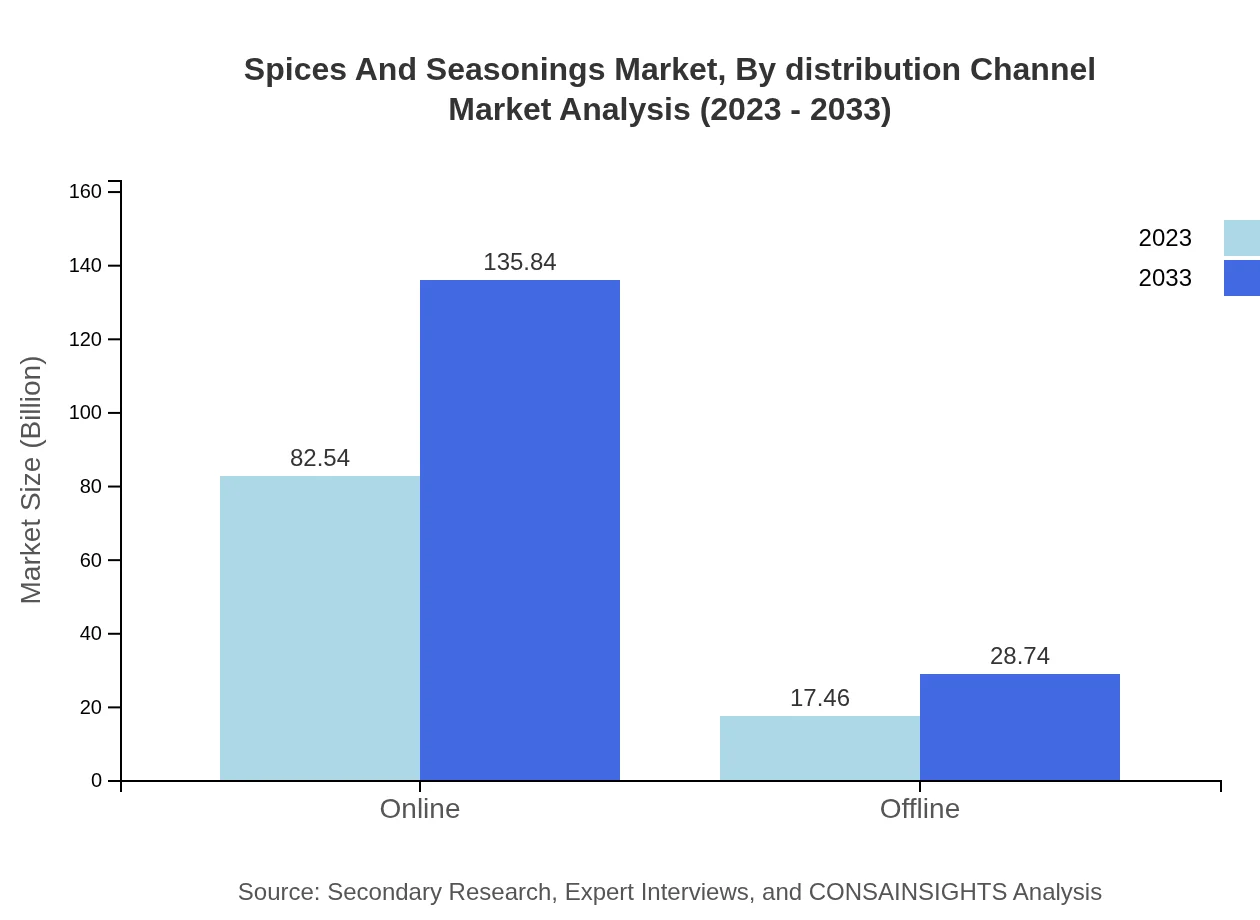

Spices And Seasonings Market Analysis By Distribution Channel

The market's distribution channels consist of online and offline sales, where online sales are projected to hold a substantial lead, from $82.54 billion in 2023 to $135.84 billion in 2033, as consumer purchasing shifts towards e-commerce platforms for convenience.

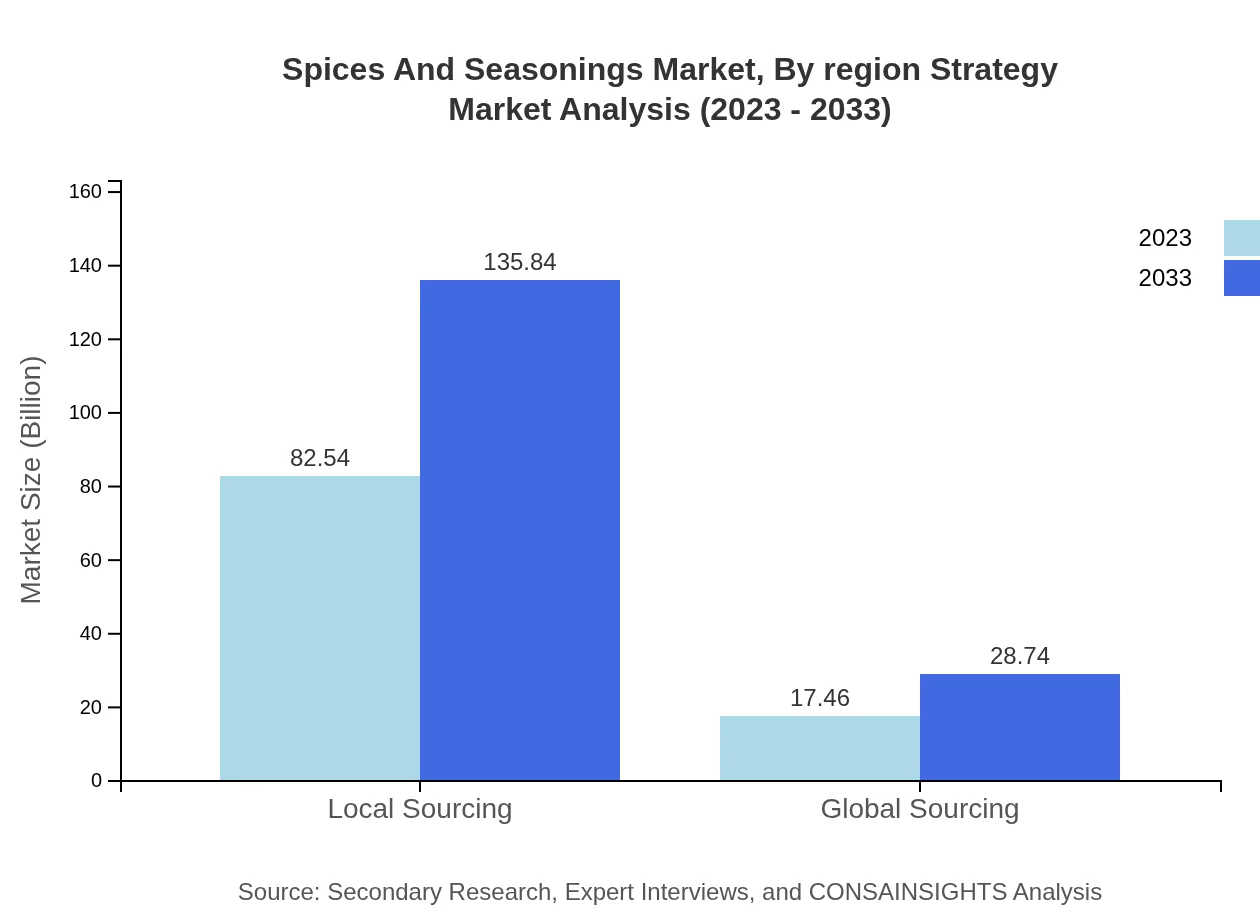

Spices And Seasonings Market Analysis By Region Strategy

Market strategies vary by region, focusing on regional sourcing practices, compliance with local standards, and catering to distinct consumer preferences. Regional strategies will increasingly integrate sustainability and health-based attributes to align with consumer expectations.

Spices And Seasonings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Spices And Seasonings Industry

McCormick & Company:

A global leader in flavor solutions, specializing in spices and seasonings, and known for product innovations and sustainable sourcing practices.Olam International:

An integrated supply chain manager and provider of agri-products, including spices; recognized for its commitment to quality and sustainability.Ajinomoto Co., Inc.:

A multinational food and biotech company, famous for its natural seasonings and flavor enhancers, dedicated to providing nutritious and health-oriented products.Associated British Foods plc:

A diversified group that includes the popular brand 'Silver Spoon', producing and distributing a range of seasonings while emphasizing ethical sourcing.We're grateful to work with incredible clients.

FAQs

What is the market size of spices And Seasonings?

The global spices and seasonings market is currently valued at 100 million, with a projected CAGR of 5% over the next decade, indicating substantial growth. The market size is expected to increase significantly as consumer preferences evolve.

What are the key market players or companies in this spices And Seasonings industry?

Key players in the spices and seasonings market include prominent companies such as McCormick & Company, Olam International, and Spice Islands. These companies lead through innovative products, effective distribution, and strong branding strategies to capture market share.

What are the primary factors driving the growth in the spices And Seasonings industry?

Key factors driving growth in the spices and seasonings market include rising consumer demand for flavorful food, the increasing popularity of ethnic cuisine, and a growing health consciousness leading to the use of natural and organic ingredients.

Which region is the fastest Growing in the spices And Seasonings market?

The Asia Pacific region is the fastest-growing market for spices and seasonings, projected to grow from 18.53 million in 2023 to 30.50 million by 2033. This growth is driven by increasing culinary diversity and higher consumer spending on food.

Does ConsaInsights provide customized market report data for the spices And Seasonings industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the spices and seasonings industry, enabling stakeholders to obtain insights that cater to their business objectives and market strategies.

What deliverables can I expect from this spices And Seasonings market research project?

Expect comprehensive deliverables including detailed market size reports, competitive analysis, consumer insights, trend analysis, and forecasts, along with actionable strategies tailored to the spices and seasonings industry.

What are the market trends of spices And Seasonings?

Market trends in the spices and seasonings industry include a shift towards organic products, increased demand for convenient and ready-to-use spices, and the rise of online shopping channels, enhancing accessibility for consumers.