Spinal Implants And Surgical Devices Market Report

Published Date: 31 January 2026 | Report Code: spinal-implants-and-surgical-devices

Spinal Implants And Surgical Devices Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report delves into the Spinal Implants and Surgical Devices market from 2023 to 2033, presenting critical data, industry insights, growth forecasts, and detailed analysis of market segments and regional dynamics.

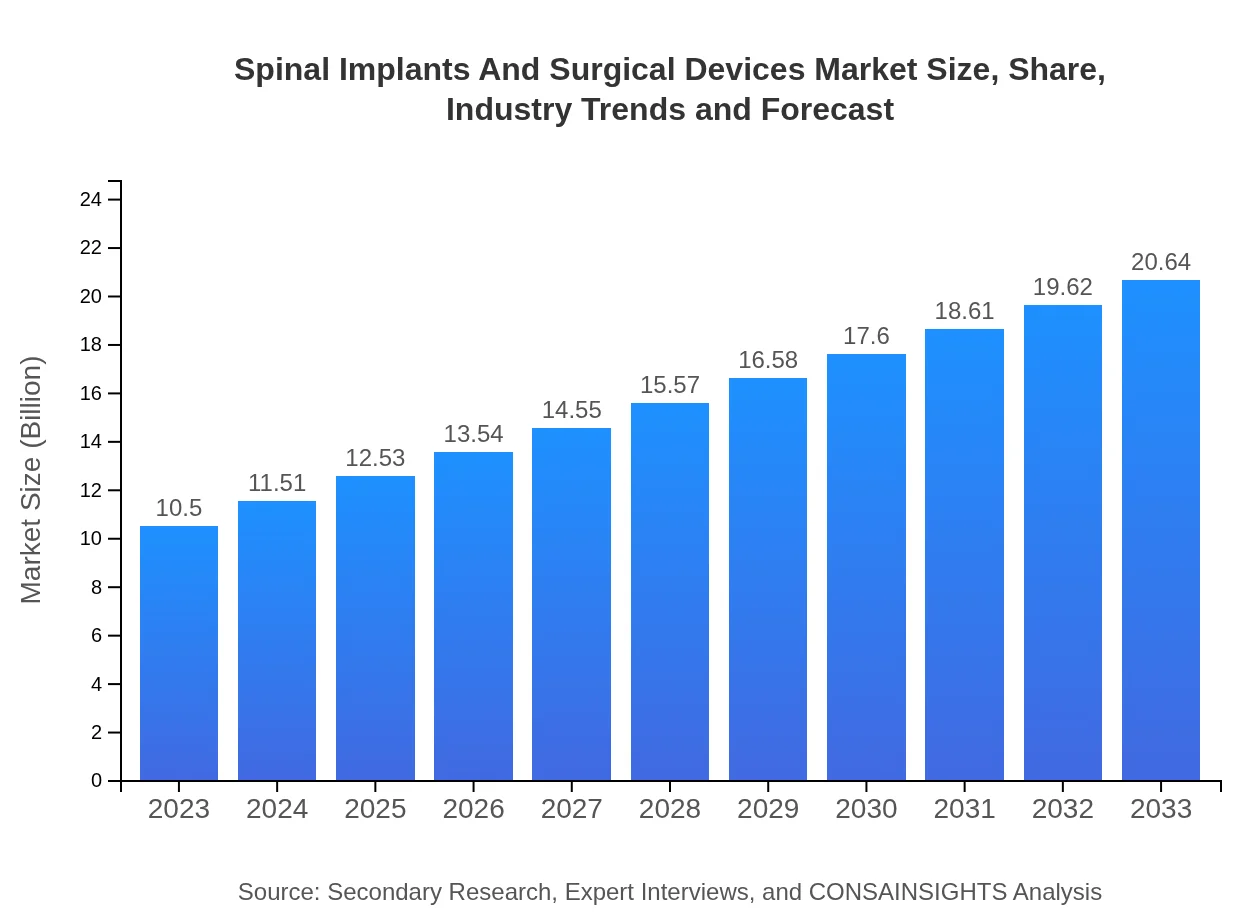

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Medtronic , DePuy Synthes, Stryker |

| Last Modified Date | 31 January 2026 |

Spinal Implants And Surgical Devices Market Overview

Customize Spinal Implants And Surgical Devices Market Report market research report

- ✔ Get in-depth analysis of Spinal Implants And Surgical Devices market size, growth, and forecasts.

- ✔ Understand Spinal Implants And Surgical Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Spinal Implants And Surgical Devices

What is the Market Size & CAGR of Spinal Implants And Surgical Devices market in 2023?

Spinal Implants And Surgical Devices Industry Analysis

Spinal Implants And Surgical Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Spinal Implants And Surgical Devices Market Analysis Report by Region

Europe Spinal Implants And Surgical Devices Market Report:

Europe’s spinal implants market was worth $2.84 billion in 2023 and is projected to increase to $5.58 billion by 2033. The region is witnessing growth due to increasing geriatric populations and advancements in surgical techniques.Asia Pacific Spinal Implants And Surgical Devices Market Report:

In 2023, the Asia Pacific spinal implants market is valued at $2.23 billion, anticipated to grow to $4.38 billion by 2033. Factors such as rising disposable incomes, improved healthcare infrastructure, and increasing awareness of spinal health are propelling this growth.North America Spinal Implants And Surgical Devices Market Report:

North America features a robust spinal implants market valued at $3.41 billion in 2023, with projections of $6.70 billion by 2033. Advanced healthcare systems, high surgical rates, and a strong demand for innovative technologies bolster the market here.South America Spinal Implants And Surgical Devices Market Report:

The Latin America spinal implants market, valued at $0.59 billion in 2023, is expected to reach $1.15 billion by 2033. Growing healthcare investments and an increase in the prevalence of spinal disorders are key drivers in this region.Middle East & Africa Spinal Implants And Surgical Devices Market Report:

The Middle East and Africa spinal implants market, valued at $1.44 billion in 2023, is anticipated to grow to $2.83 billion by 2033. The rising incidence of spinal disorders combined with improving healthcare facilities is stimulating this market.Tell us your focus area and get a customized research report.

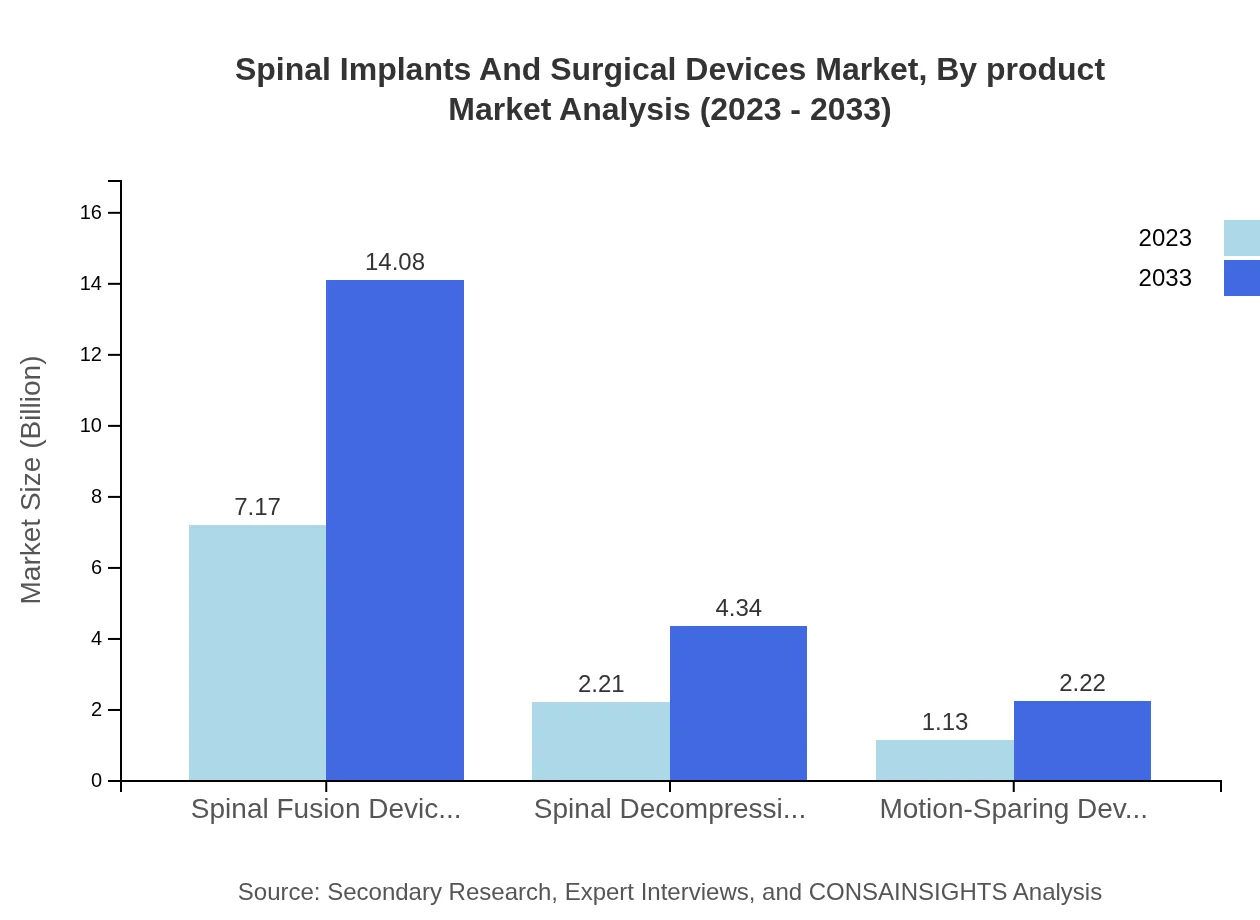

Spinal Implants And Surgical Devices Market Analysis By Product

The Spinal Fusion Devices segment dominates the market, valued at $7.17 billion in 2023 and expected to grow to $14.08 billion by 2033, holding approximately 68.25% market share throughout the forecast period. In addition, Spinal Decompression Devices and Motion-Sparing Devices contribute significantly, with valuations of $2.21 billion and $1.13 billion in 2023, growing to $4.34 billion and $2.22 billion, respectively.

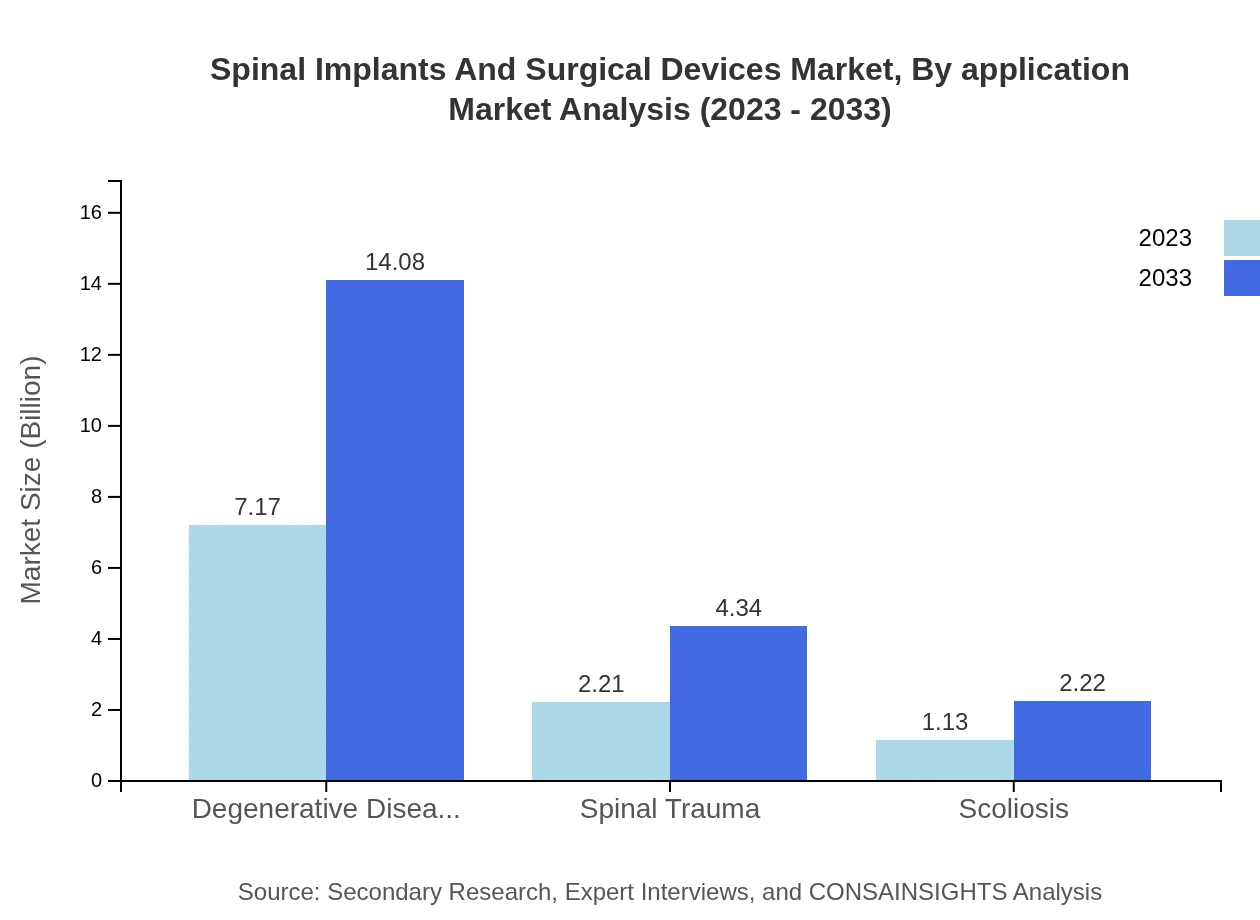

Spinal Implants And Surgical Devices Market Analysis By Application

Key applications include degenerative diseases, spinal trauma, and scoliosis. The degenerative diseases segment is particularly noteworthy, representing a market size of $7.17 billion in 2023 and expected to double by 2033, capturing nearly 68.25% of the market share.

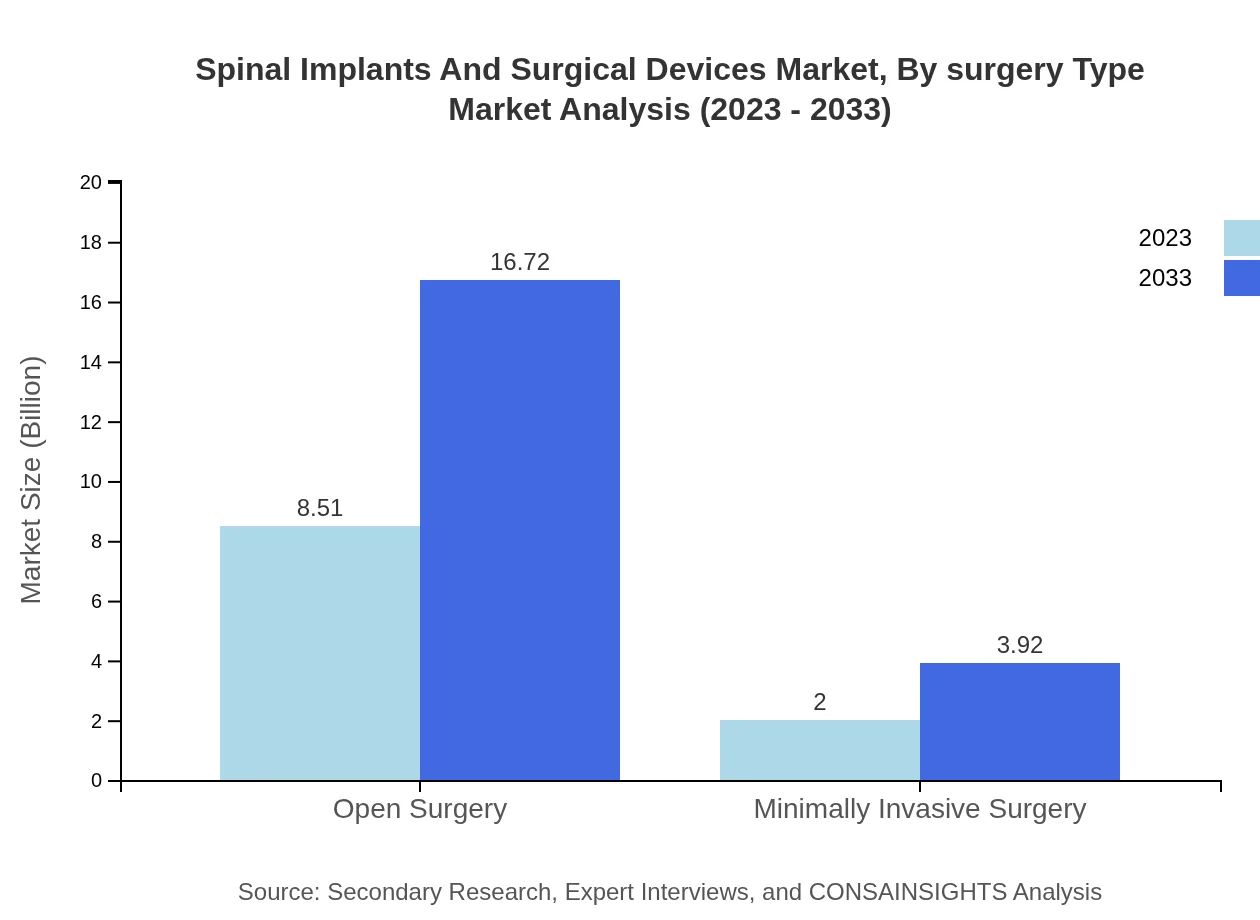

Spinal Implants And Surgical Devices Market Analysis By Surgery Type

Open surgery remains the most prevalent method in spinal procedures, valued at $8.51 billion in 2023 and expected to expand significantly. Conversely, the minimally invasive surgery segment, though smaller at $2.00 billion in 2023, is forecasted to grow rapidly as technology advances.

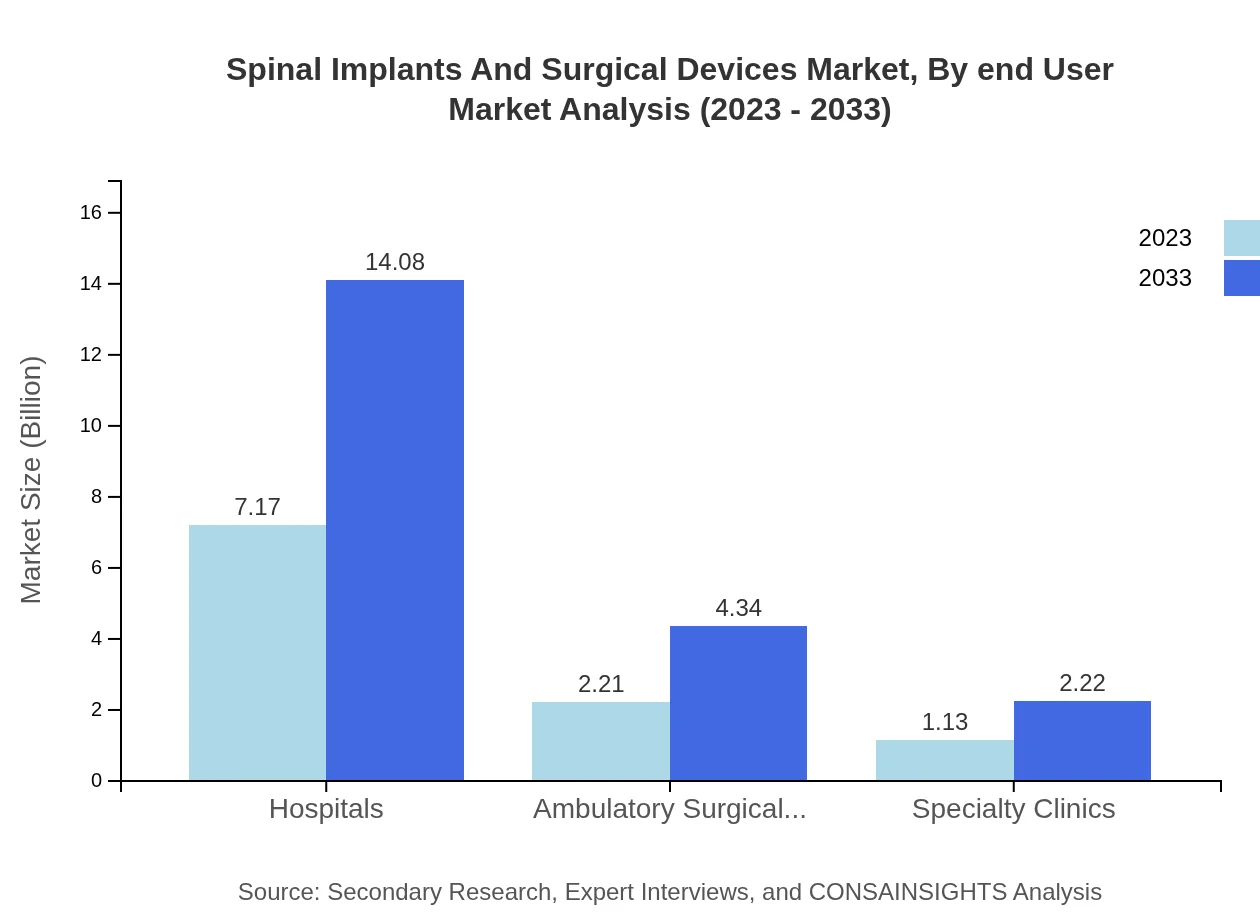

Spinal Implants And Surgical Devices Market Analysis By End User

Hospitals account for the majority of market sales, valued at $7.17 billion in 2023, expected to sustain a 68.25% market share. However, ambulatory surgical centers are gaining traction due to cost-effective and efficient treatment solutions.

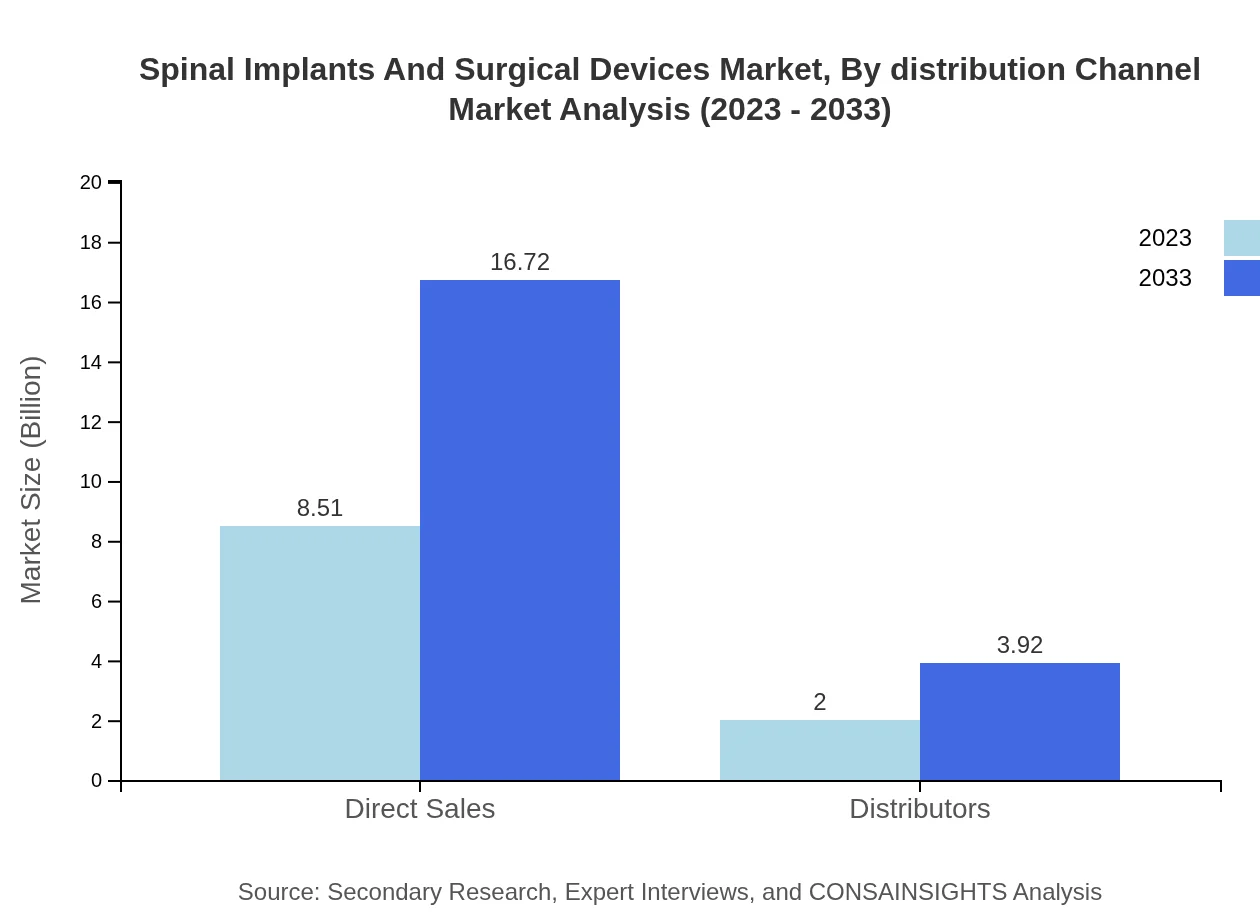

Spinal Implants And Surgical Devices Market Analysis By Distribution Channel

Direct sales strategies remain dominant, representing an 81% share of the market with revenues of $8.51 billion in 2023, reflecting companies’ direct engagement with consumers. Distributors also play a vital role, particularly in regions with emerging healthcare markets.

Spinal Implants And Surgical Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Spinal Implants And Surgical Devices Industry

Medtronic :

A pioneering leader in the spinal implants market, Medtronic is renowned for its innovative technologies and extensive product range in spinal surgery.DePuy Synthes:

Part of Johnson & Johnson, DePuy Synthes specializes in orthopedic and neuro products, contributing significantly to spinal surgery advancements.Stryker :

Stryker's portfolio includes a wide array of spinal devices and technologies, known for their emphasis on research-driven innovations.We're grateful to work with incredible clients.

FAQs

What is the market size of spinal implants and surgical devices?

The spinal implants and surgical devices market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 6.8%, reaching significant growth by 2033.

What are the key market players or companies in the spinal implants and surgical devices industry?

Key players in the spinal implants and surgical devices industry include Medtronic, DePuy Synthes (Johnson & Johnson), Stryker, and Zimmer Biomet, which continuously innovate to address market demands.

What are the primary factors driving the growth in the spinal implants and surgical devices industry?

Growth in the spinal implants market is driven by increasing incidence of spinal disorders, advancements in technology, and rising awareness of minimally invasive procedures that enhance patient recovery.

Which region is the fastest Growing in the spinal implants and surgical devices market?

The Asia Pacific region is the fastest-growing market, projected to grow from $2.23 billion in 2023 to $4.38 billion by 2033, fueled by an expanding healthcare infrastructure and increasing population.

Does ConsaInsights provide customized market report data for the spinal implants and surgical devices industry?

Yes, Consainsights offers customized market reports tailored to specific needs within the spinal implants and surgical devices sector, ensuring actionable insights for stakeholders.

What deliverables can I expect from this spinal implants and surgical devices market research project?

Deliverables include comprehensive market analysis, segmented data by region and device type, competitor analysis, and insights into future trends, catering to various stakeholder needs.

What are the market trends of spinal implants and surgical devices?

Key trends include increasing adoption of minimally invasive surgical techniques and growth in spinal fusion devices, which accounted for 68.25% of market share in 2023.