Spine Biologics Market Report

Published Date: 31 January 2026 | Report Code: spine-biologics

Spine Biologics Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive market report on Spine Biologics provides detailed insights into market size, growth opportunities, trends, and competitive landscape. Covering the forecast period from 2023 to 2033, the report analyzes various segments, regional markets, and key players driving the industry.

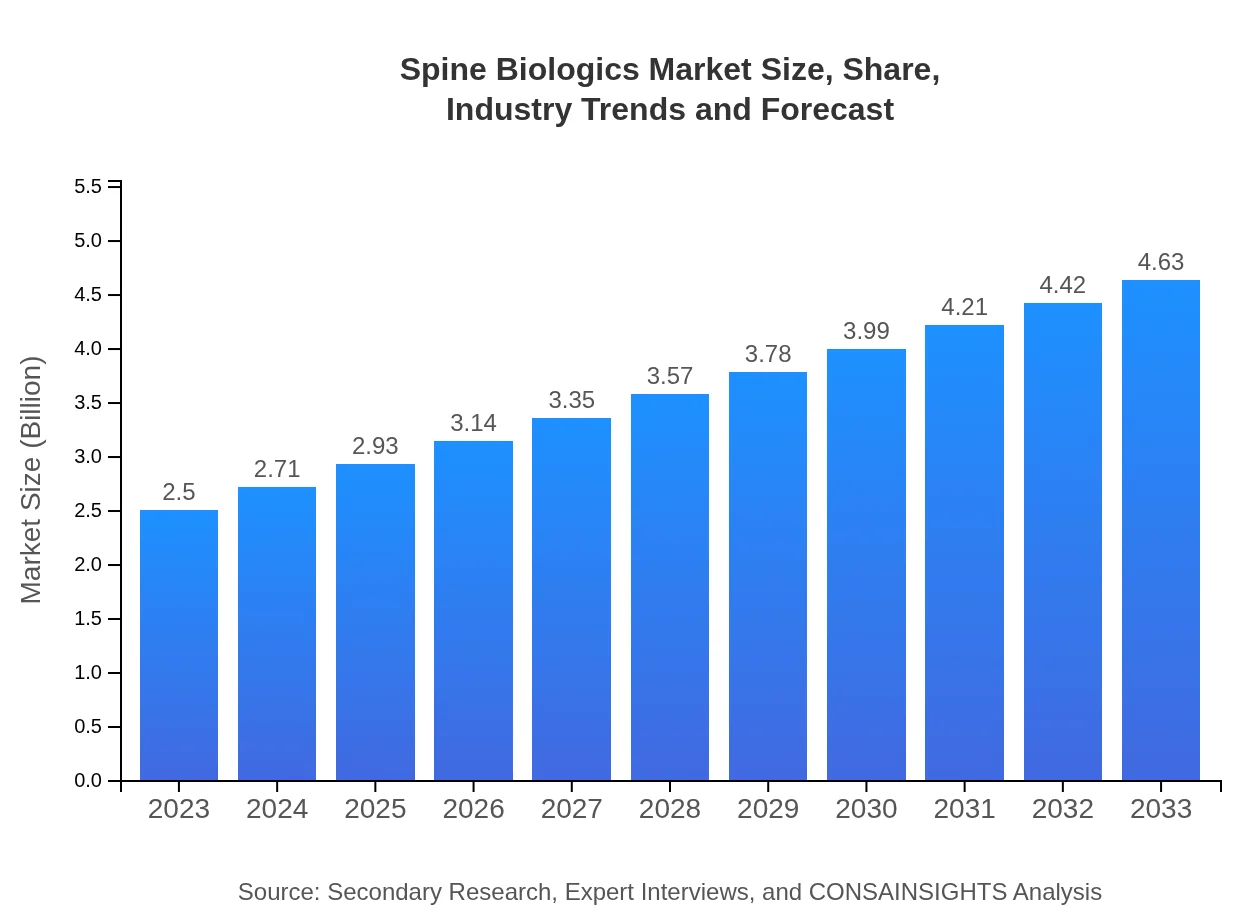

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $4.63 Billion |

| Top Companies | Medtronic , Zimmer Biomet, NuVasive, Stryker Corporation, RTI Surgical |

| Last Modified Date | 31 January 2026 |

Spine Biologics Market Overview

Customize Spine Biologics Market Report market research report

- ✔ Get in-depth analysis of Spine Biologics market size, growth, and forecasts.

- ✔ Understand Spine Biologics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Spine Biologics

What is the Market Size & CAGR of the Spine Biologics market in 2023?

Spine Biologics Industry Analysis

Spine Biologics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Spine Biologics Market Analysis Report by Region

Europe Spine Biologics Market Report:

Europe's Spine Biologics market is set to grow from $0.70 billion in 2023 to $1.30 billion by 2033, fueled by rising incidences of spinal illnesses, technological advancements in surgery, and favorable reimbursement policies that promote biologics.Asia Pacific Spine Biologics Market Report:

In the Asia-Pacific region, the Spine Biologics market is projected to grow from $0.50 billion in 2023 to $0.92 billion in 2033. Factors driving this growth include rising healthcare investments, an increase in the elderly population, and a growing acceptance of advanced treatments. Countries like China and India are leading the way, witnessing heightened demand due to extensive healthcare reforms.North America Spine Biologics Market Report:

In North America, the market is expected to rise significantly from $0.93 billion in 2023 to $1.72 billion in 2033. This growth is driven by the region's advanced healthcare systems, high awareness of spinal health, and robust investments in research and development to innovate spinal biologics.South America Spine Biologics Market Report:

The South American Spine Biologics market is anticipated to expand from $0.10 billion in 2023 to $0.18 billion by 2033. The growth is supported by an increase in spine-related surgeries and the adoption of biologics in clinical practices, although challenges like limited healthcare infrastructure persist.Middle East & Africa Spine Biologics Market Report:

The Middle East and Africa expect moderate growth from $0.28 billion in 2023 to $0.52 billion in 2033. Spending on healthcare is rising, albeit slowly, creating new opportunities for spine biologics as healthcare systems evolve and enhance surgical capabilities.Tell us your focus area and get a customized research report.

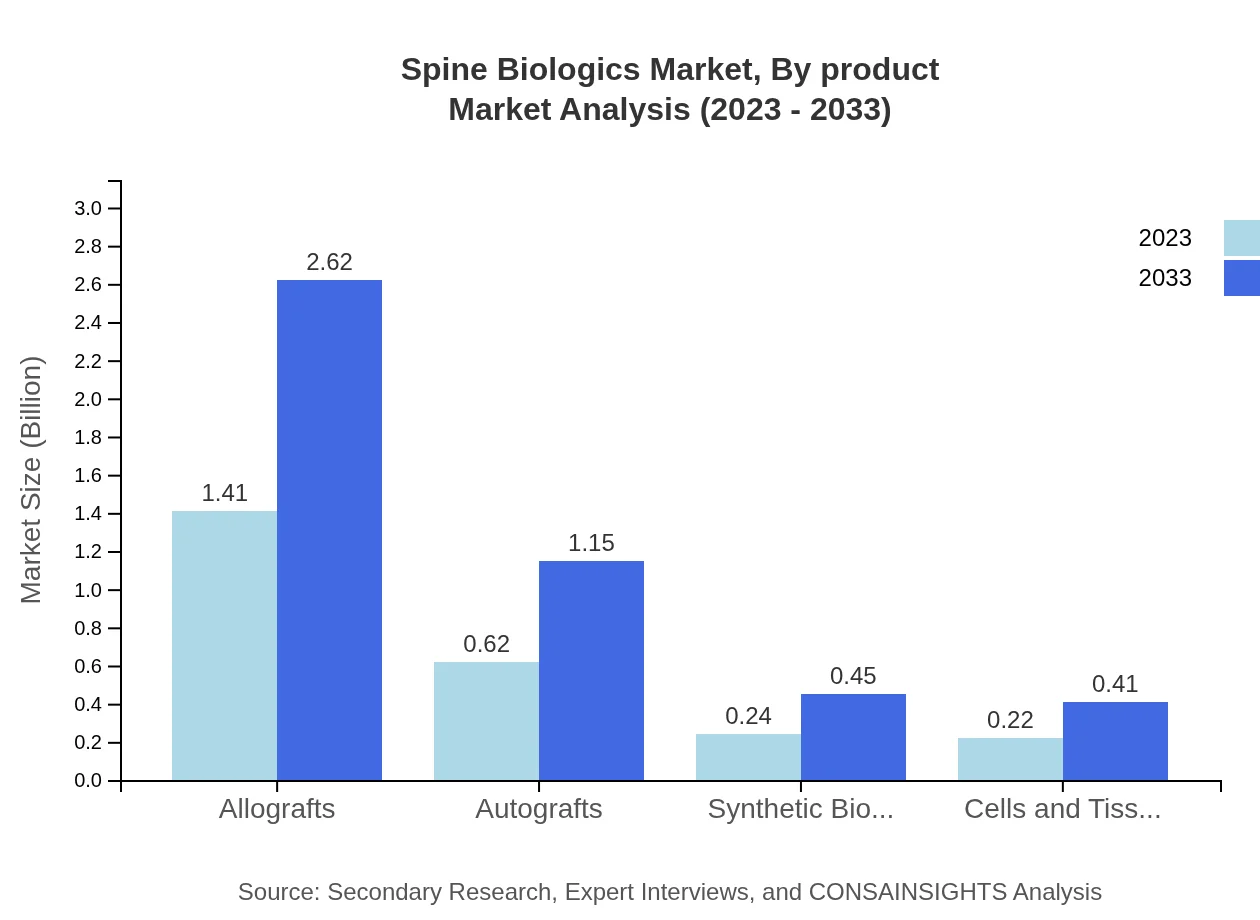

Spine Biologics Market Analysis By Product

The Spine Biologics market is primarily segmented into allografts, autografts, synthetic biomaterials, and cells/tissues. Allografts hold the largest share at 56.51% in 2023, valued at $1.41 billion and projected to reach $2.62 billion by 2033. Autografts follow with a market share of 24.92% in 2023, currently valued at $0.62 billion, expecting to nearly double this value by 2033. Synthetic biomaterials, although smaller in share, show promising growth with a value set to increase from $0.24 billion to $0.45 billion by 2033.

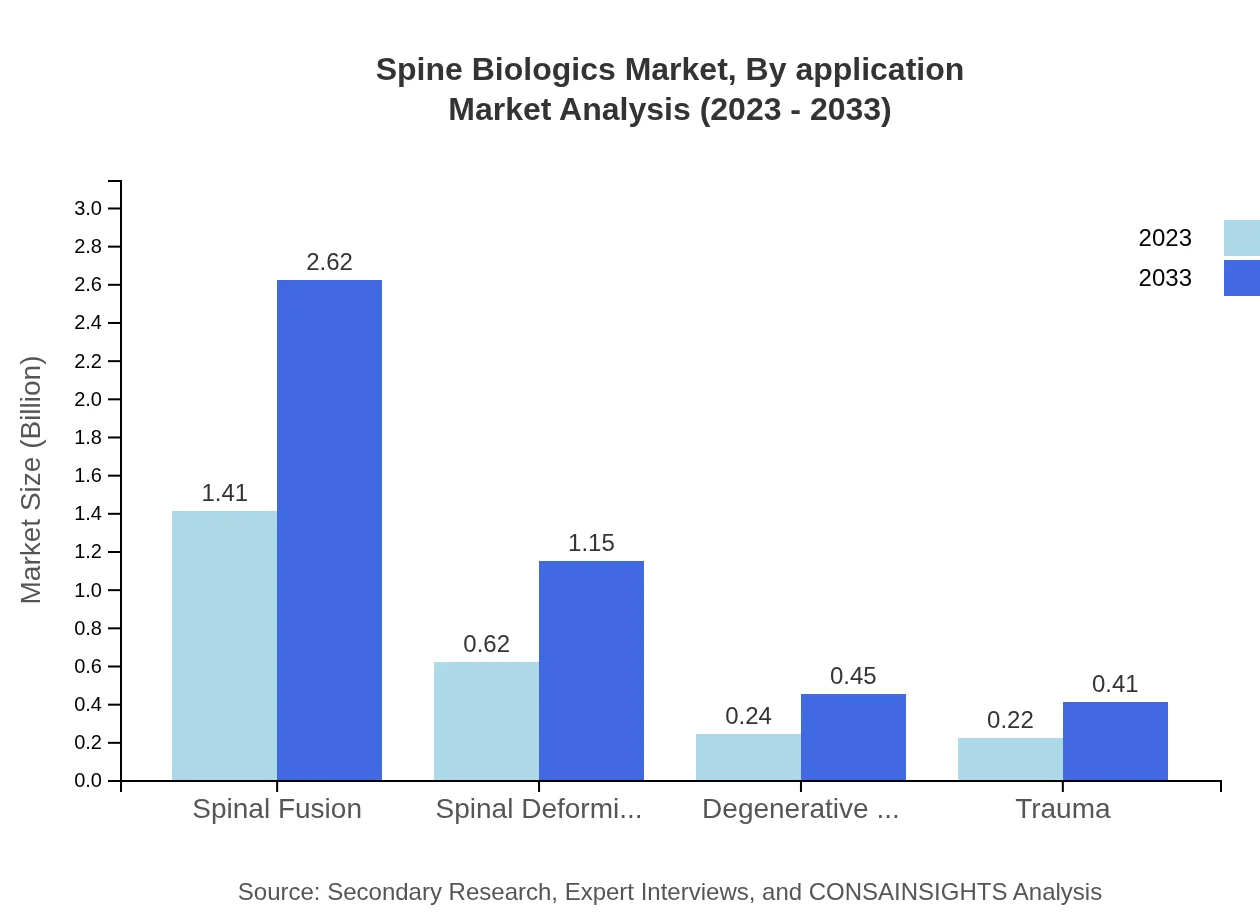

Spine Biologics Market Analysis By Application

Applications in the Spine Biologics market include spinal fusion, spinal deformity correction, treatment of degenerative diseases, and trauma. Spinal fusion remains the dominant application with a market share of 56.51%, valued at $1.41 billion in 2023, expected to grow parallelly with rising surgical procedures. Conversely, spinal deformity correction is gaining traction, expected to increase from $0.62 billion to $1.15 billion by 2033.

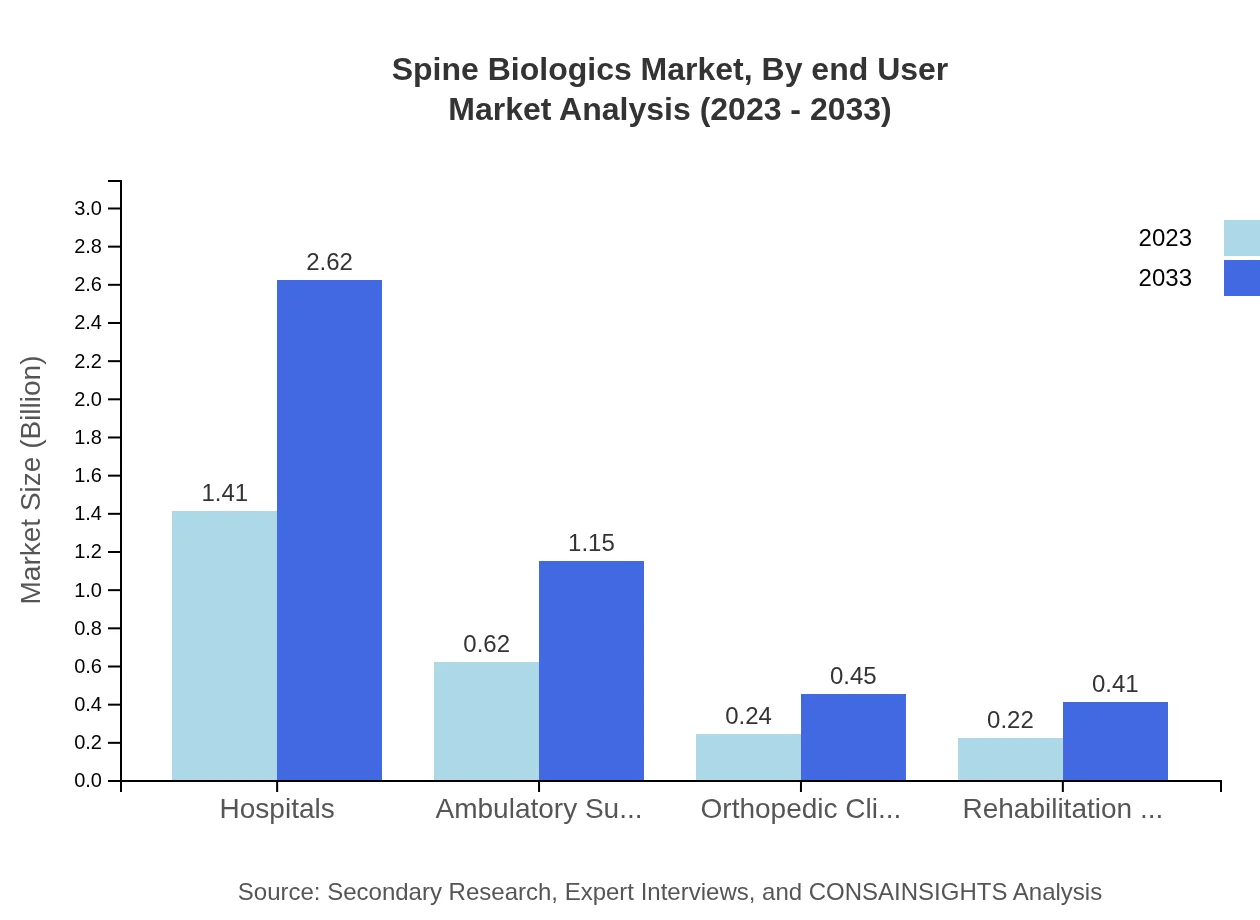

Spine Biologics Market Analysis By End User

End-users of the Spine Biologics market comprise hospitals, ambulatory surgery centers, orthopedic clinics, and rehabilitation centers. Hospitals dominate the segment with a considerable market share of 56.51%. Ambulatory surgery centers are also critical, showing substantial growth potential from $0.62 billion in 2023 to $1.15 billion by 2033, driven by the shift towards outpatient care models.

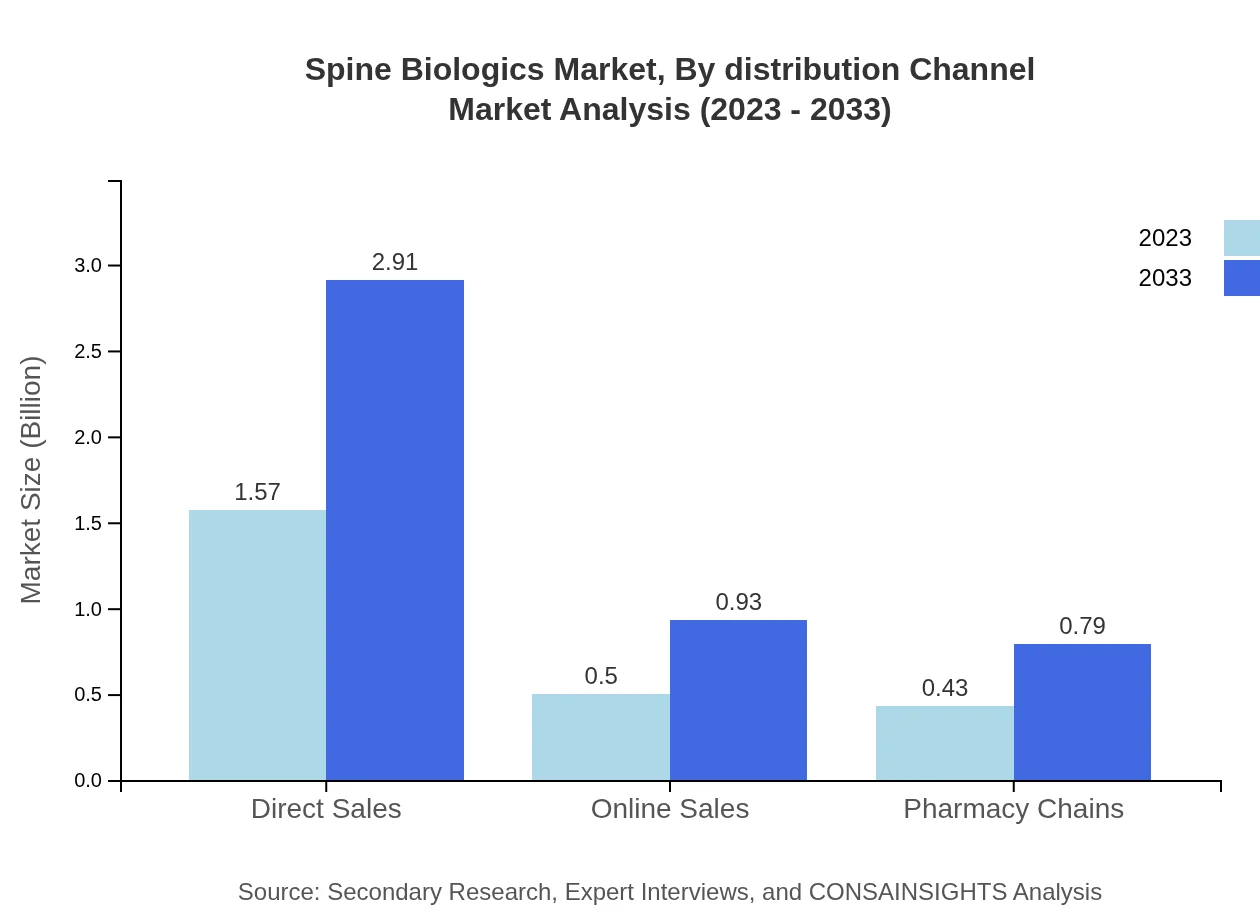

Spine Biologics Market Analysis By Distribution Channel

The distribution channels for the Spine Biologics market include direct sales, online sales, and pharmacy chains. Direct sales continue to lead with a significant share of 62.89%, valued at $1.57 billion in 2023. Online sales are increasingly popular due to changing consumer buying behaviors, growing from $0.50 billion to $0.93 billion by 2033.

Spine Biologics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Spine Biologics Industry

Medtronic :

A worldwide leader in medical technology, Medtronic specializes in spinal implant and biologic technologies, driving significant advancements in the field.Zimmer Biomet:

Zimmer Biomet focuses on musculoskeletal healthcare with a strong portfolio of spinal products and biologics, enhancing surgical techniques and recovery.NuVasive:

NuVasive is renowned for its innovation in minimally invasive spinal surgery, offering advanced biologics that improve patient outcomes.Stryker Corporation:

Stryker is a leading global medical technology company, providing a comprehensive range of spinal biologics and solutions that enhance surgical frameworks.RTI Surgical:

RTI Surgical specializes in surgical implants and regenerative medicine, significantly contributing to the spine biologics market with diverse allograft options.We're grateful to work with incredible clients.

FAQs

What is the market size of spine Biologics?

The spine-biologics market is currently valued at $2.5 billion, with a projected Compound Annual Growth Rate (CAGR) of 6.2%. By 2033, significant growth is expected, driven by advancements in technology and increasing patient needs.

What are the key market players or companies in this spine Biologics industry?

Key players in the spine-biologics market include Medtronic, DePuy Synthes (Johnson & Johnson), NuVasive, and Stryker Corporation. These companies lead through innovative product development and strategic acquisitions, maintaining significant market shares.

What are the primary factors driving the growth in the spine Biologics industry?

The growth in the spine-biologics industry can be attributed to an increasing aging population, rising prevalence of spinal disorders, and advancements in surgical techniques. Additionally, the trend towards minimally invasive surgeries is driving demand for biologic solutions.

Which region is the fastest Growing in the spine Biologics?

North America is the fastest-growing region in the spine-biologics market, projected to grow from $0.93 billion in 2023 to $1.72 billion by 2033. This growth is fueled by robust healthcare infrastructure and rising surgical procedures in this region.

Does ConsaInsights provide customized market report data for the spine Biologics industry?

Yes, ConsaInsights offers tailored market report data for the spine-biologics industry. Clients can receive specific insights based on their unique needs, including competitive analysis, market forecasts, and detailed segmentation.

What deliverables can I expect from this spine Biologics market research project?

From the spine-biologics market research project, you can expect comprehensive reports detailing market size, growth forecasts, competitive landscape analysis, regional breakdowns, and segments overview, including various product types and application categories.

What are the market trends of spine Biologics?

Current trends in the spine-biologics market include increased adoption of allografts, growth of the online sales channel, and a shift towards regenerative medicine. Additionally, notable momentum is observed in synthetic biomaterials, enhancing treatment outcomes for spinal conditions.