Spirits Packaging Market Report

Published Date: 31 January 2026 | Report Code: spirits-packaging

Spirits Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Spirits Packaging market, encompassing insights on market size, growth forecasts from 2023 to 2033, and emerging trends shaping the industry landscape.

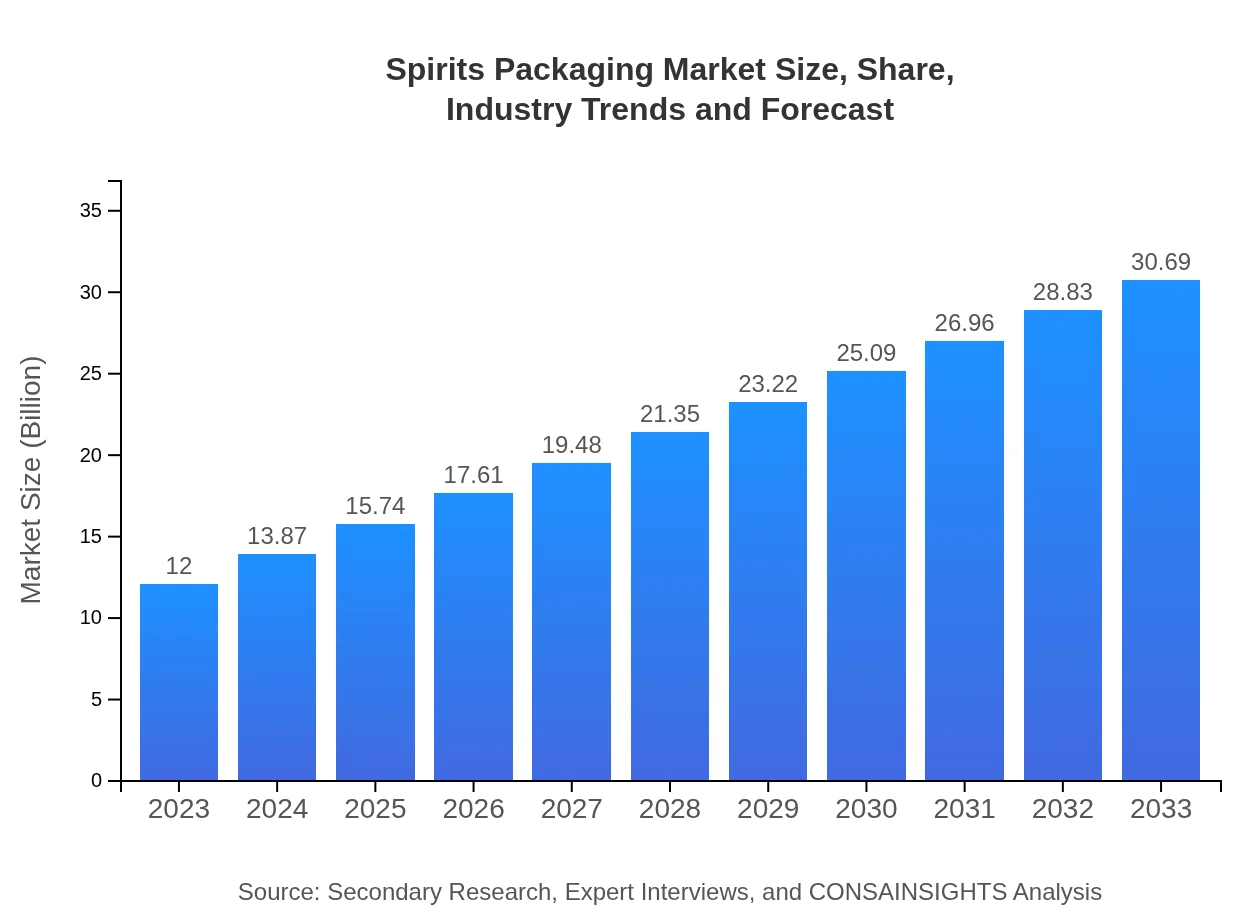

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Amcor plc, O-I Glass, Inc., Ball Corporation, Schneider Packaging Equipment Company, Inc., Crown Holdings, Inc. |

| Last Modified Date | 31 January 2026 |

Spirits Packaging Market Overview

Customize Spirits Packaging Market Report market research report

- ✔ Get in-depth analysis of Spirits Packaging market size, growth, and forecasts.

- ✔ Understand Spirits Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Spirits Packaging

What is the Market Size & CAGR of Spirits Packaging market in 2023?

Spirits Packaging Industry Analysis

Spirits Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Spirits Packaging Market Analysis Report by Region

Europe Spirits Packaging Market Report:

Europe is projected to grow from $3.11 billion in 2023 to $7.97 billion by 2033. This region is known for its established spirits market, with countries like France, Italy, and the UK leading in both production and consumption. The demand for sustainable packaging is high, influencing manufacturers to innovate towards biodegradable and recyclable materials.Asia Pacific Spirits Packaging Market Report:

In the Asia Pacific region, the Spirits Packaging market reached $2.62 billion in 2023 and is projected to grow to $6.69 billion by 2033. The growth is driven by rising disposable incomes, increasing demand for alcoholic beverages, and a young population keen on lifestyle products. Countries like China and India are key markets due to their expanding urban populations and cultural inclinations towards spirits.North America Spirits Packaging Market Report:

North America accounts for a significant share of the Spirits Packaging market, valued at $4.33 billion in 2023, growing to $11.08 billion by 2033. This growth is spurred by the U.S. market's robust spirits consumption, shift towards premium and craft brands, and innovation in packaging design to elevate consumer experience.South America Spirits Packaging Market Report:

In South America, the market size for Spirits Packaging is estimated at $1.02 billion in 2023 and is expected to reach $2.61 billion by 2033. This growth can be attributed to the growing popularity of premium spirits and cocktails, alongside a rise in tourism contributing to the overall demand for local spirits and promotional packaging strategies.Middle East & Africa Spirits Packaging Market Report:

The Middle East and Africa region's Spirits Packaging market is expected to expand from $0.92 billion in 2023 to $2.35 billion by 2033. This growth is driven by increasing modern retail outlets and a gradual shift towards more liberal consumption patterns in certain markets.Tell us your focus area and get a customized research report.

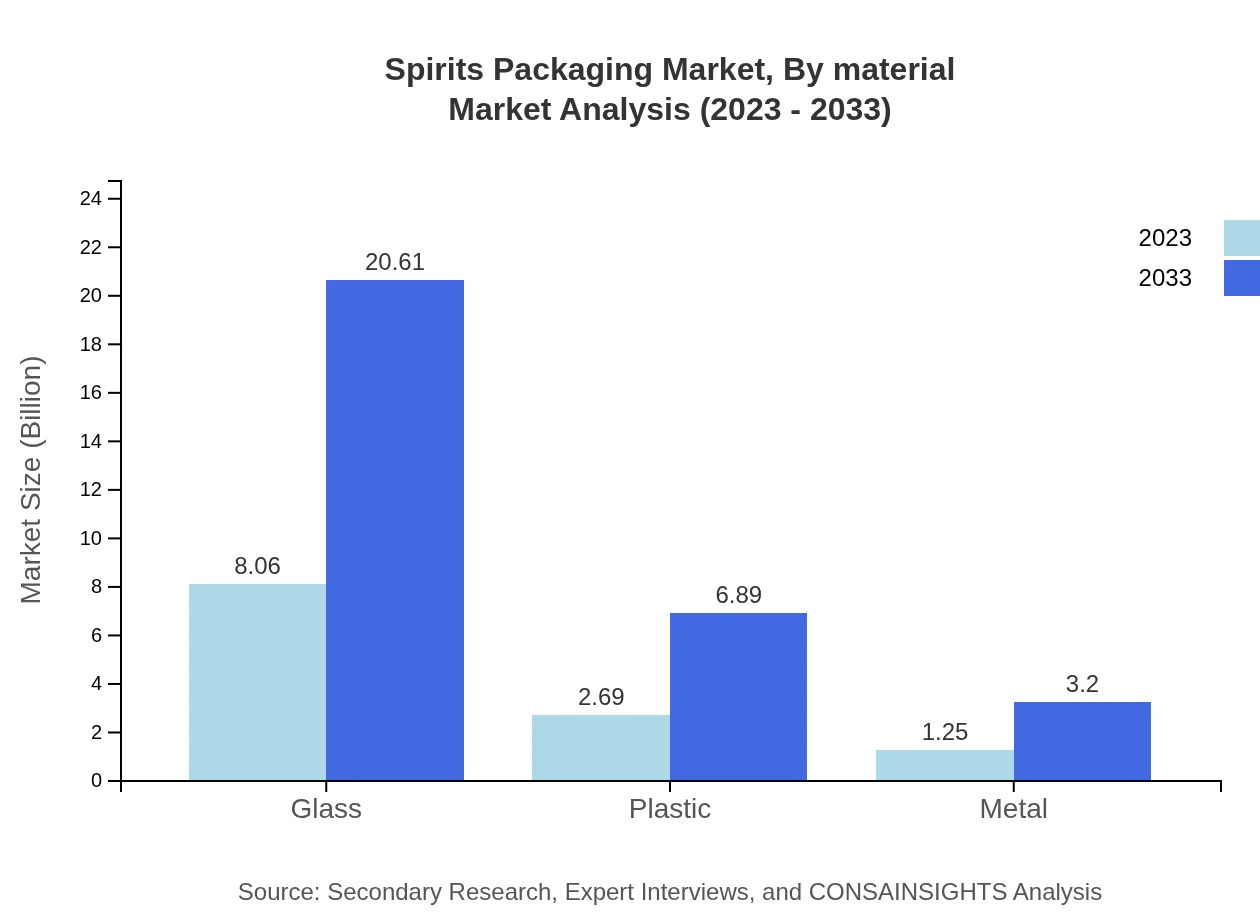

Spirits Packaging Market Analysis By Material

The Spirits Packaging market by material indicates that glass remains the leading choice due to aesthetic appeal and superior preservation qualities. In 2023, glass packaging accounted for $8.06 billion and is expected to rise significantly, while plastic packaging is projected to show growth from $2.69 billion to $6.89 billion during the same period. Metal packaging is also experiencing increased demand, aided by the rising trend of canned spirits.

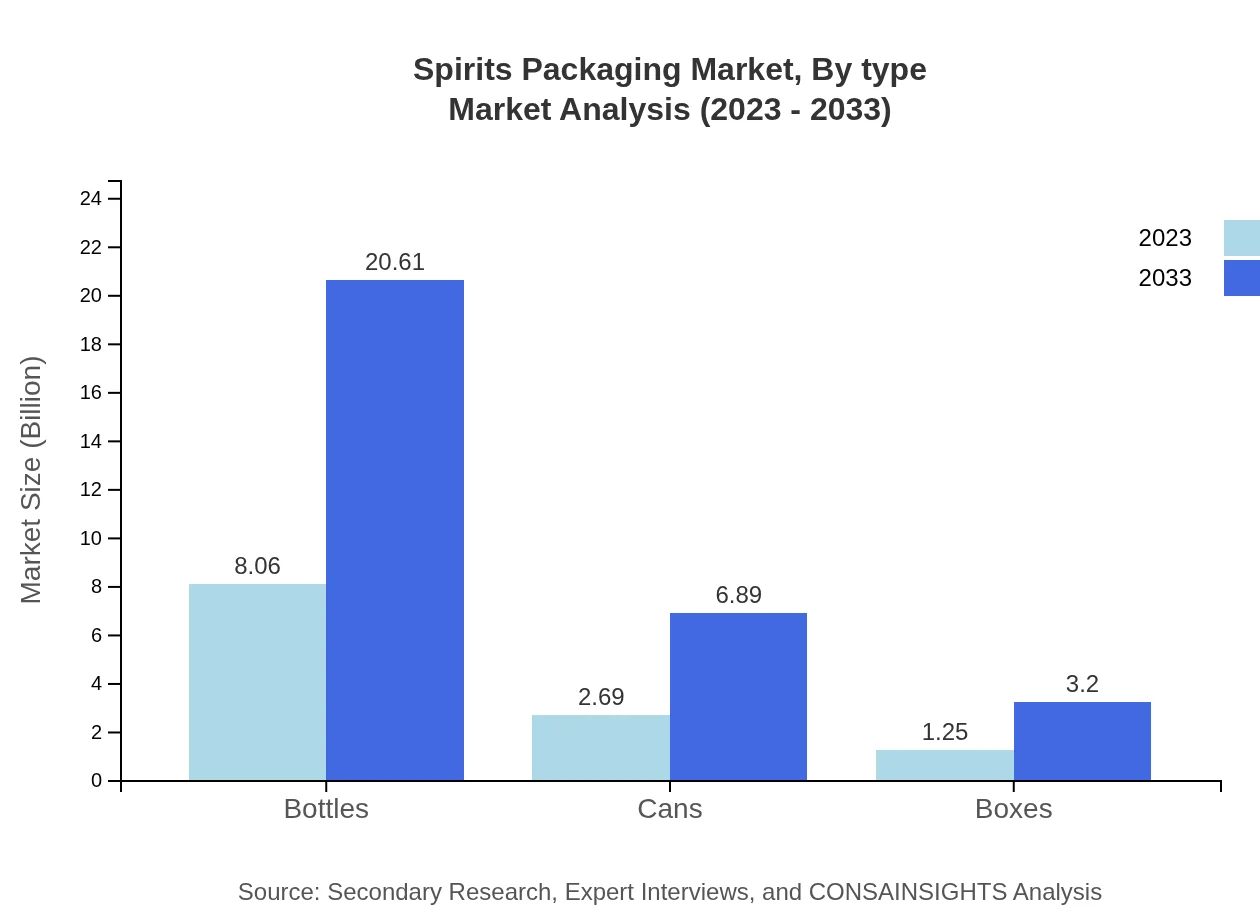

Spirits Packaging Market Analysis By Type

Bottles dominate the market, with a size of $8.06 billion in 2023 and expected growth to $20.61 billion by 2033. Cans and boxes have smaller market sizes but are growing segments, especially among younger consumers seeking convenience and portability, with cans projected to rise from $2.69 billion to $6.89 billion. Overall, the preference for bottles will continue to shape the market landscape.

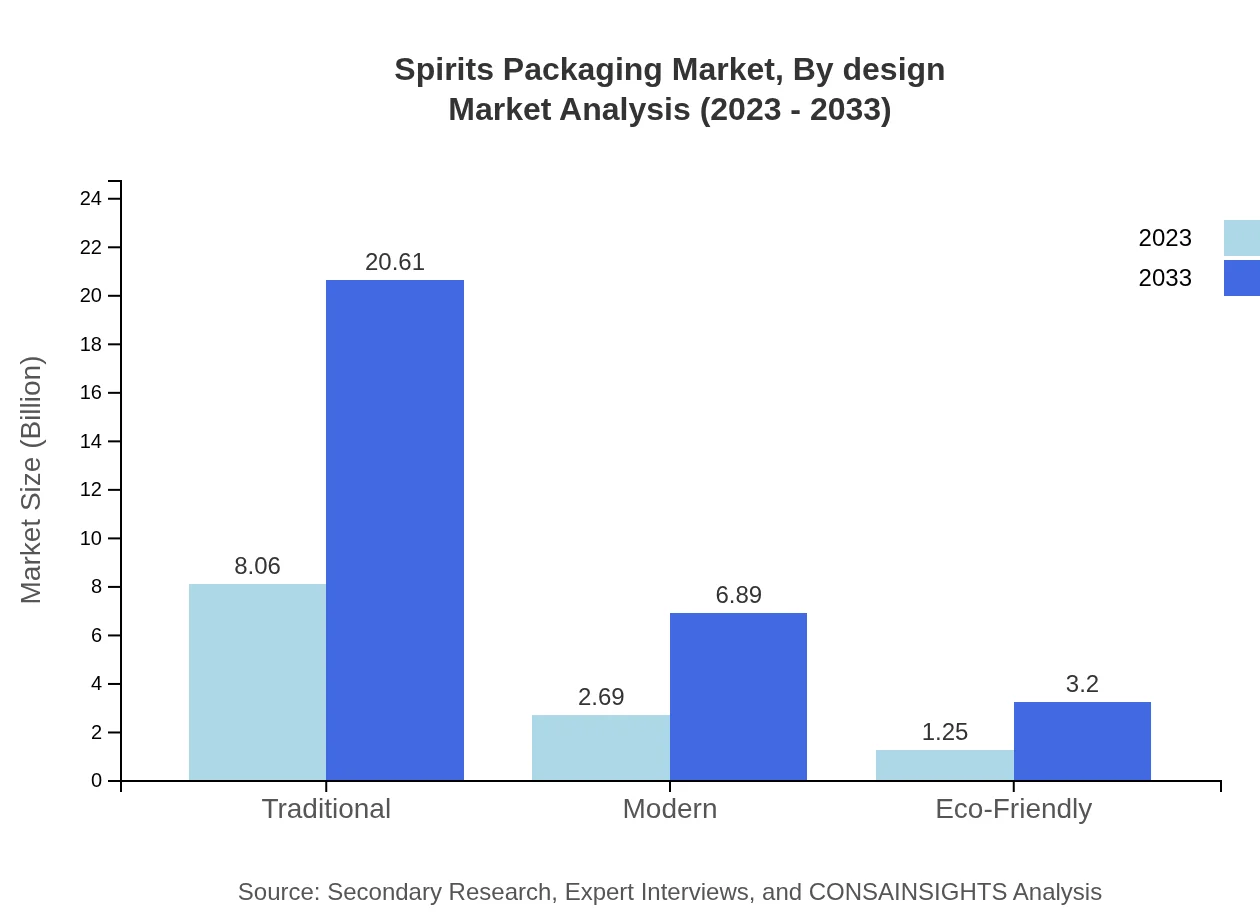

Spirits Packaging Market Analysis By Design

In terms of design, traditional packaging remains prominent, retaining a market size of $8.06 billion in 2023, while modern and eco-friendly designs are gaining traction. Eco-friendly packaging, valued at $1.25 billion in 2023, appeals to environmentally-conscious consumers and is expected to show substantial growth, reflecting the industry's shift towards sustainable solutions.

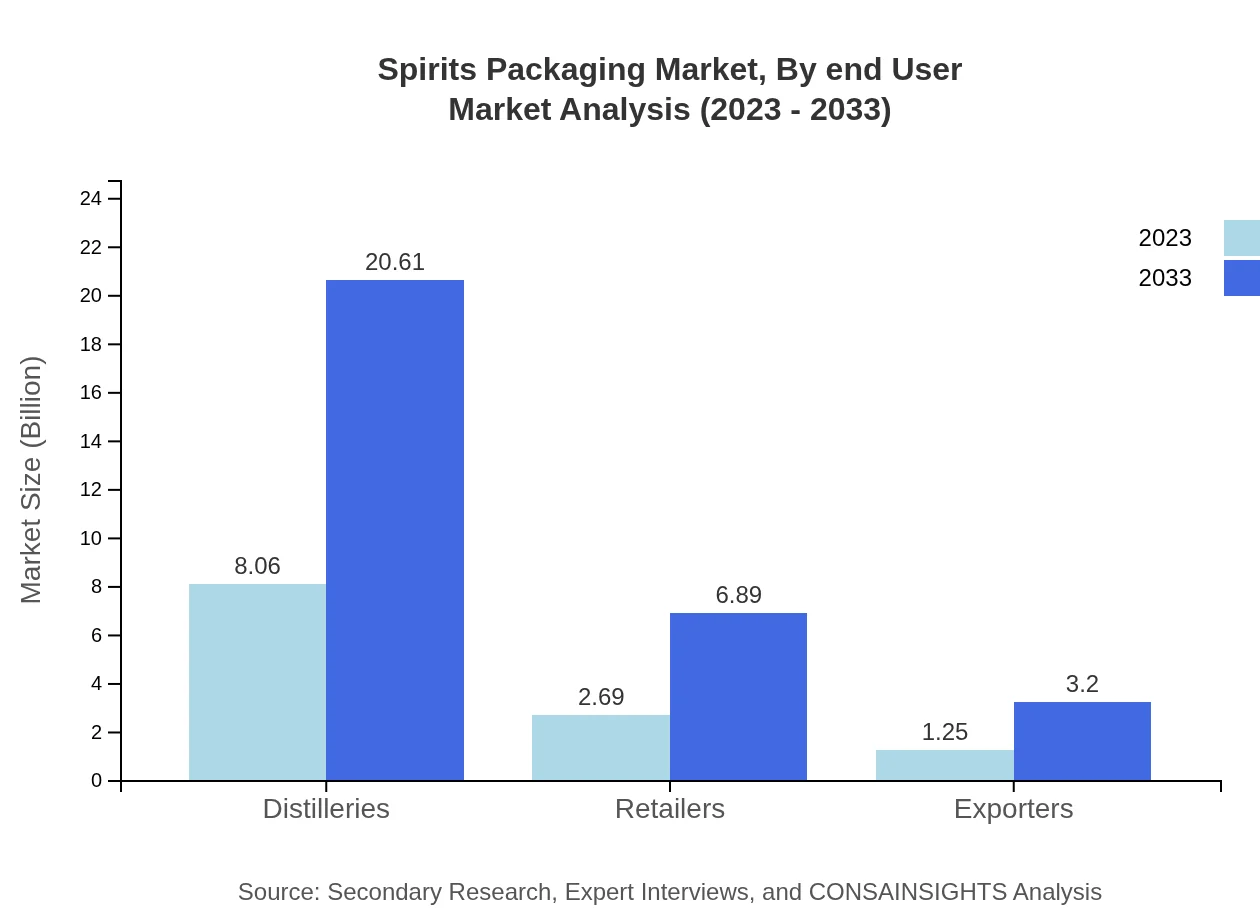

Spirits Packaging Market Analysis By End User

Distilleries are the main end-users, commanding a large share of the market at 67.14% in 2023. Retailers and exporters are also significant contributors, with sizes of $2.69 billion and $1.25 billion respectively. The strength of distilleries lies in their volume production and brand loyalty, while innovative retail packaging strategies are key for retailers to attract consumers.

Spirits Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Spirits Packaging Industry

Amcor plc:

A global leader in responsible packaging solutions, Amcor designs and manufactures flexible and rigid packaging that meets the demanding needs of the spirits industry.O-I Glass, Inc.:

O-I Glass specializes in glass container manufacturing, providing superior quality products that enhance the appeal of spirits brands.Ball Corporation:

Ball Corporation is known for its innovative can designs and sustainable packaging solutions, catering to the expanding market for canned spirits.Schneider Packaging Equipment Company, Inc.:

Specializing in packaging machinery, Schneider provides automated solutions to streamline production for distilleries and beverage companies.Crown Holdings, Inc.:

Crown Holdings offers a wide range of metal packaging solutions designed to provide excellent protection for spirits, along with strong marketing potential.We're grateful to work with incredible clients.

FAQs

What is the market size of spirits Packaging?

The global spirits packaging market is valued at $12 billion in 2023, projected to grow at a CAGR of 9.5%, indicating substantial growth opportunities in the upcoming years.

What are the key market players or companies in this spirits Packaging industry?

Key players in the spirits packaging industry include major manufacturers of glass, plastic, and metal containers. Leading companies often invest in innovative packaging solutions while establishing strong distribution networks.

What are the primary factors driving the growth in the spirits Packaging industry?

Growth in the spirits packaging sector is driven by rising alcohol consumption, increased demand for premium packaging, and innovations in sustainable packaging that cater to eco-conscious consumers.

Which region is the fastest Growing in the spirits Packaging?

North America is the fastest-growing region in the spirits packaging market, with a market size projected to expand from $4.33 billion in 2023 to $11.08 billion by 2033, showcasing significant consumer demand.

Does ConsaInsights provide customized market report data for the spirits Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific business needs within the spirits packaging industry, meeting the unique requirements of clients.

What deliverables can I expect from this spirits Packaging market research project?

Deliverables from the spirits packaging market research project include comprehensive reports, data analytics, market trend assessments, and customized insights tailored to your business objectives.

What are the market trends of spirits Packaging?

Current trends in the spirits packaging market focus on eco-friendly materials, innovative designs, and technology-driven solutions to cater to evolving consumer preferences in the beverage industry.